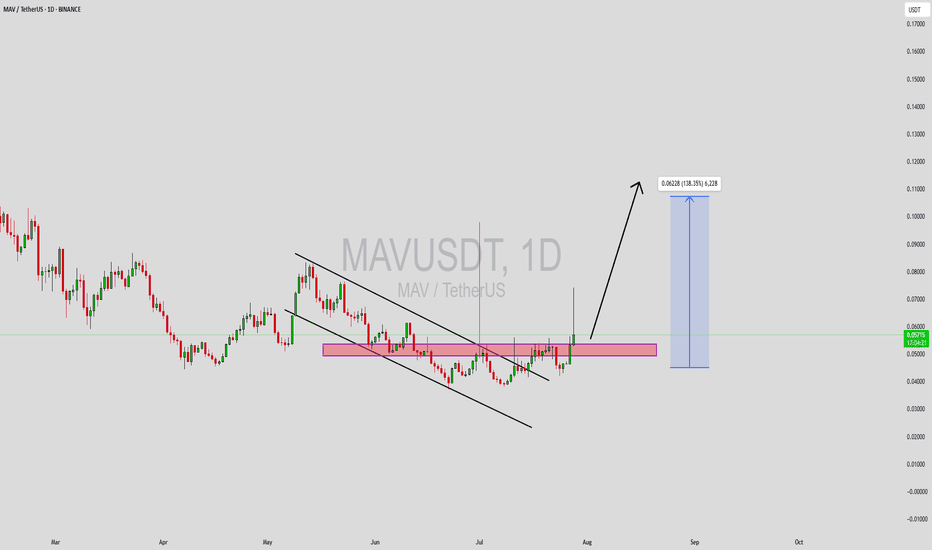

MAVUSDT Forming Falling ChannelMAVUSDT has recently broken out of a falling channel pattern, signaling a potential trend reversal from its prolonged downtrend. This breakout is supported by a noticeable surge in trading volume, adding strength to the bullish momentum. The chart shows that price has successfully retested the previous resistance zone, now acting as strong support. This structural shift provides a compelling setup for an explosive upward move, especially as momentum builds across the altcoin market.

Traders are closely watching MAV due to its technical setup, as well as the broader interest in decentralized finance (DeFi) protocols. The current price action hints at a high-probability bullish continuation, with a projected gain of 90% to 100%+ if bullish sentiment remains intact. The combination of solid support formation, high-volume breakout, and clear upside potential makes this a high-conviction play among smart money participants.

Maverick Protocol (MAV) is gaining attention for its unique approach to liquidity provisioning in DeFi. As the ecosystem matures and more investors look for efficient capital deployment strategies, protocols like MAV stand to benefit. The fundamentals, combined with the technical picture, suggest that the current levels may represent a key accumulation zone before a major breakout.

This setup could offer significant upside for early movers. Watching for follow-through candles and sustained volume above breakout zones will be key to validating the strength of this breakout move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MAVUSDT

MAVUSDT Forming Bullish ReversalMAVUSDT is currently showing strong technical signs that have caught the attention of traders who are searching for the next breakout altcoin. This crypto pair is moving within a clear downward channel, which often sets the stage for a significant bullish reversal once the price breaks out convincingly. Combined with good volume, this indicates healthy market participation and interest, a key factor for sustainable upward momentum.

Many investors are eyeing MAVUSDT because the expected gain is projected between 40% to 50%+, a realistic target considering its price structure and historical volatility. The recent price action shows that buyers are stepping in near key support levels, which adds to the conviction that a breakout could push prices higher. The confluence of a well-defined pattern, solid volume, and growing investor sentiment makes MAVUSDT an attractive setup for swing traders and medium-term investors.

Additionally, MAVUSDT aligns well with the broader crypto market recovery trend, which has seen altcoins reclaiming lost ground. As traders hunt for high-potential coins with clear technical setups, MAVUSDT stands out for its ability to deliver consistent price swings. Watching the breakout levels and monitoring daily closes will be crucial to confirm the move and manage risk properly.

In summary, MAVUSDT is worth keeping on your radar for its clear technical pattern, solid volume profile, and potential to deliver a strong upside move in the coming sessions. Stay alert for a confirmed breakout to capture the best part of this anticipated run.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MAVUSDT – Critical Resistance Zone AheadThe blue box is a key resistance area where smart money could be looking to sell. This is not a place to FOMO in blindly. If price rejects here with volume-backed selling pressure and LTF breakdowns, it could be an ideal short opportunity.

📌 How to Trade This Like a Pro?

✅ Patience Wins – Let the market show its hand. If we see a rejection, we execute.

✅ No Confirmation = No Trade – CDV weakness, low-timeframe breaks, and volume shifts are our green light.

✅ Breakout & Retest? Flip the Bias – If price smashes through with volume and retests, we adapt and look for longs.

Discipline = Profits. The difference between professionals and amateurs is knowing when to strike and when to wait. Follow the plan, or follow the crowd, your choice.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

MAV ROADMAP (1D)It appears that MAV is forming a large triangle, currently in wave D of this triangle.

Wave D within the triangle seems to be a diametric pattern, and the price is currently in wave d of this diametric.

We are looking for buy/long positions in the green zone.

The red line or range can act as a target.

If a daily candle closes below the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

$MAV DeFi for Tier-1 fundsGreat Project with TOP-1 Funds, Obvious Manipulation and Distribution in 2026-2027!

The project might aim for broader distribution and market adoption by 2026-2027, potentially through partnerships, new product launches, or integration into larger DeFi ecosystems. However, without careful management, this could be seen as an attempt to manipulate market perception or liquidity.

Horban Brothers!

#MAV (SPOT) entry range( 0.1830- 0.2330) T.(0.5790) SL(0.1706)BINANCE:MAVUSDT

entry range ( 0.1830- 0.2330)

Target1 (0.3649) - Target2 (0.5790)

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (0.1706)

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #CLV #RIF ENJ #ZIL #APT #MAV ****

MAV Looks bullishMAV is bearish in the larger structure but has recently formed an iCH on the chart which is a bullish sign.

We have a big bullish QM on the chart.

The demand range is a suitable place for buy/long positions.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#Mav 1D chartNYSE:MAV 1D chart;

First of all, there are notes of all the necessary data on the chart, which you can easily understand as soon as you look at it.

* The first bullish signal came with a positive mismatch at the bottom (RSI)

* Breakout required for uptrend has arrived (MSS)

* Although it lost after gaining the 50EMA level, the spread is very narrow due to its horizontal process (positive)

* The lack of volume in the weekly candlestick view shows that it has been flat all week, so there is a high probability that there will be no deep decline (positive)

* If there is a close below the +OB level below, only then will it look for a new bottom.

When it starts to rise, the levels that it can hang out can be considered for the short term.

#mav #maverick

#MAVUSDT Ready for a Bullish Breakout or Deeper Correction? Yello Paradisers! Are you ready to catch the next big move in #MAV? Let's look at the latest analysis of the #MaverickProtocol:

💎We've been closely watching #MAVUSDT within a descending channel for some time, and it's now flashing signs of a bullish breakout. Currently, we are seeing a bullish continuation from a key demand zone at $0.159.

💎If NYSE:MAV maintains support at the current demand zone, we could witness a significant bullish rally reminiscent of past trends. A breakout above the resistance at $0.411 might pave the way for a move toward higher resistance levels.

💎If the momentum fails to sustain, the next bullish rebound could occur around the lower support range of $0.116-$0.128.

💎But remember, Paradisers, stay vigilant! A daily close below the demand area could negate this bullish outlook and potentially trigger a deeper correction.

Trade smart, stay disciplined, and be patient—this is how we stay ahead

MyCryptoParadise

iFeel the success🌴

There is a possibility for the price to rebound upwardsIn the daily timeframe, the overall trend of MAV is bearish, and the price is sharply declining. As you can see on the chart, the price has broken its support level, which now has the potential to turn into resistance. If the price returns to the broken level and the breakdown proves to be false, there is a possibility for the price to rebound upwards.

Maverick Protocol (MAV) completed a setup for upto 26% pumpHi dear friends, hope you are well and welcome to the new trade setup of Maverick Protocol (MAV) with US Dollar pair.

Recently we caught almost 27% pump of MAV as below:

Now on a 4-hr time frame, MAV has formed a bullish BAT move for the next price reversal move.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

MAV/USDT IDEA Mav/Usdt has recently shown signs of breaking out above the trendline resistance, indicating a potential bullish rally ahead. This breakout could potentially lead to a significant upward movement in the price, with a target towards the $1 level. However, it is important to note that this information is not financial advice, and individuals should conduct their own research (DYOR) before making any investment decisions.

The breakout above the trendline resistance suggests a shift in market sentiment towards a more bullish outlook for Mav/Usdt. If the breakout proves to be successful, we could see a strong momentum driving the price higher towards the $1 mark. Traders and investors may find this development as an opportunity to capitalize on the potential price appreciation.

It is crucial to consider various factors such as market conditions, trading volume, and overall market sentiment before making any trading decisions. Additionally, risk management strategies should be in place to mitigate potential losses in case the breakout does not sustain its momentum.

In conclusion, while the breakout in Mav/Usdt looks promising for a bullish rally towards $1, it is essential to conduct thorough research and analysis to make informed investment decisions. Stay updated with the latest market developments and be prepared for various possible outcomes as the situation evolves.

MAV after the pullback will continue to go downMAV after the pullback will continue to go down

🔵Entry Zone 0.6428 - 0.6190

🔴SL 0.6646

🟢TP1 0.5491

🟢TP2 0.5036

🟢TP3 0.4341

Risk Warning

Trading Forex, CFDs, Crypto, Futures, and Stocks involve a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results.

If you liked our ideas, please support us with your likes 👍 and comments.

MAV looks bearishConsidering the bearish CH and liquidity pools at the bottom of the chart, it seems that MAV intends to move towards the specified demand.

Also, the trend line is lost.

supply is a good place for sell/short positions

By maintaining the supply range, it can drop the demand side.

Closing a daily candle above the invalidation level will violate this analysis

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks