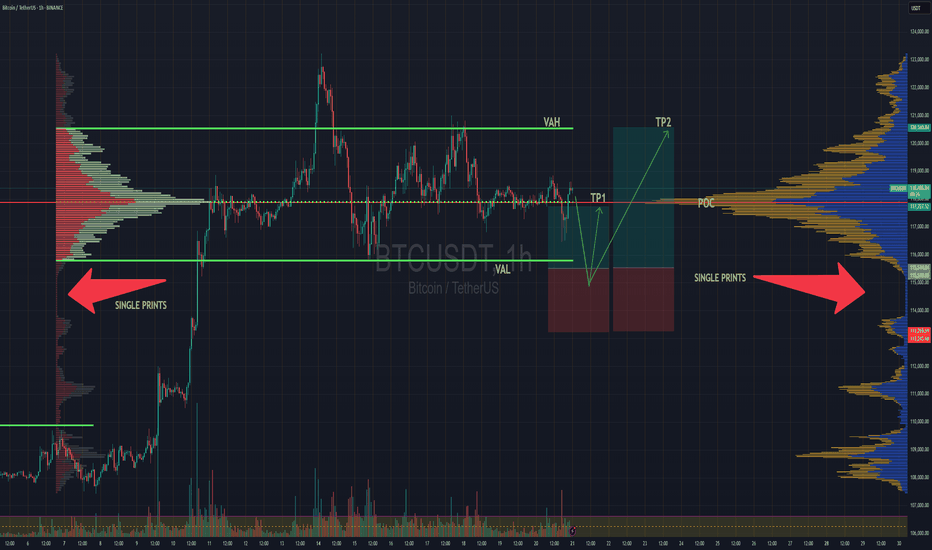

BTC Balanced Volume Profile BTC is now trading in a textbook D-Shape Volume Profile. In english - Buyers & Sellers are happy to transact here and will stay inside the value area & consolidating sideways until further notice.

Consolidation at POC is a signature of this profile, and one of the easiest and least stressful trade setups because now, your mission, should you chose to accept. Is to fade the Highs (VAH) and Lows (VAL) and avoid the middle unless you love donating money to the market.

I'll have buy limit orders waiting right below the VAL where we have the single prints. It doesn't get any easier than this.

Doesn't mean price cant rip through, but this is always the best entry with less risk, especially when the single prints have not been tested yet..

BINANCE:BTCUSD CME:MBT1!

MBT1!

Strategy H2 2025. BTC Airless Plot Near $100'000 Choking PointOver the past 6 months, Bitcoin (BTC) has demonstrated a very mixed up/down performance, marked by significant price fluctuations, appreciation and volatility.

From late December 2024 to June 2025, BTC's price rose from approximately $92,000 to around $108,000, representing a gain of about 17.26% over this period.

On the other hand. the price fluctuated between last price in 2024 $92,000 and BTC' low near $74,491 achieved in early April 2025, posting the similar, nearly 20 percent year-to-date decline.

Bitcoin's price trajectory during this time was influenced by several factors. Early in 2025, BTC reached a new all-time high near $109,000 but faced a pullback triggered by profit-taking and macroeconomic uncertainties, dropping nearly 30% to about $74,000 by April. This decline was short-lived, as Bitcoin quickly rebounded by roughly 24%, climbing back to mid-$90,000 levels and eventually surpassing $100,000 again by June, signaling wide range fluctuations are getting for longer.

The technical setup suggests that Bitcoin is poised for further swings around $100'000 choking point.

In summary, Bitcoin’s performance over the last six months has been characterized by sharp correction, mixed technical buy and sell signals, with no any solid fundamental support from institutional investors.

These factors collectively indicate a mixed outlook for BTC, with further price fluctuations in wide range, as a mid-term pricе action perspective for H2 2025 and for longer.

Similar like a year ago 52-week SMA could be considered as major support level.

--

Best wishes,

@PandorraResearch Team 😎

Check support near 106775

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(MBT1! 1D chart)

The prerequisite for the previous ATH to rise above is that the OBV must rise above the High Line and remain there.

Accordingly, the key is whether it can be supported and rise near 106775.

If it fails to rise, it is likely to fall to the 96600-101495 area.

The 96600-101495 area is an important support and resistance area for continuing the uptrend.

Therefore, if it falls in the 96600-101495 area, it is likely to fall sharply.

If it falls,

1st: Around 89745

2nd: M-Signal indicator on the 1M chart or 74105-79025

You should check for support near the 1st and 2nd areas above.

Therefore, the 96600-101495 area can be seen as an important support and resistance area.

-

(30m chart)

It played the role of support and resistance by touching the area around 105385 several times.

It is expected to determine the trend again when it meets the M-Signal indicator on the 1D chart.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

Fading Risk Sentiment Supports Solana Amid Crypto SlumpLast week, Mint Finance published a comparison of Solana with other blockchain networks, focusing on speed, transaction costs, network size, and valuation. We emphasized Solana’s unique position in the decentralized application (dApp) space—particularly in NFTs and meme coin trading—where it has cultivated a loyal user base by offering low fees and fast transaction speeds.

While Solana’s network growth has been notable, its token performance tells a more nuanced story. The token generally trades with a high correlation to broader crypto markets, though it has experienced periods of divergence that have presented attractive spread opportunities.

Solana sits further out on the risk curve compared to BTC and ETH, exhibiting higher volatility. It tends to outperform in risk-on environments, delivering stronger returns during market rallies. However, during risk-off periods, it typically underperforms as investors favor more established and resilient assets like BTC.

Amid the current turbulence in crypto markets, this paper examines Solana’s relative outlook versus BTC and ETH, and outlines how investors can position accordingly using CME Solana and Micro Solana futures.

Recap of Solana Performance and Volatility

After a strong recovery from its 2022 lows following the FTX collapse, Solana began trading closely in line with BTC throughout 2024. Both were among the top-performing crypto assets last year. However, since January, this trend has reversed, with Solana surrendering most of its year-to-date gains.

Data Source: TradingView

Historical volatility across SOL, ETH, and BTC follows a similar trend but varies in magnitude. SOL consistently exhibits the highest volatility, followed by ETH, with BTC being the least volatile. These differences become more pronounced during volatility spikes, while during calmer periods, their volatility levels tend to converge.

The trend in implied volatility (IV) mirrors that of historical volatility, with SOL showing the highest IV and BTC the lowest. Recently, IV has begun to moderate, driven in part by the tariff rollback.

Relative Performance During Risk-On/Risk-Off Periods

During periods of risk-off sentiment—indicated by spikes in the VIX index—Solana typically underperforms, often experiencing the steepest declines among major crypto assets.

Conversely, during market rallies, Solana tends to outperform, often posting the strongest gains by a significant margin.

Technicals Sentiment

Technical indicators suggest a weakening bearish trend for Solana. Although prices have been declining since January, a rising RSI and MACD are signaling that the downtrend may be approaching a turning point. While the broader macro environment remains challenging, the postponement of U.S. tariffs has offered some short-term relief. Nonetheless, continued macro stress may weigh further on prices. The USD 100 level could serve as a potential support, offering psychological significance for the market.

A review of near-term technical indicators reflects a similar outlook, with multiple signals aligning toward a Buy summary. However, the 1D timeframe still shows a Sell signal, indicating that further downside may be possible before a definitive bottom is established.

In contrast, the near-term outlook for ETH remains bearish, with a Sell signal across most timeframes. Any sentiment improvement has yet to materialize for ETH.

Hypothetical Trade Setup

Solana sits further out on the risk curve compared to assets like ETH and BTC, as reflected in its higher implied and historical volatility, as well as its more extreme price movements. It typically experiences the steepest declines during market corrections but also leads gains during bullish periods.

Since the start of the year, Solana’s price has been in steady decline. However, early technical signals suggest the downtrend may be approaching a turning point, though some near-term weakness could persist.

BTC continues to serve as the crypto market’s safe haven. Despite a 20% correction since January, it has significantly outperformed both SOL and ETH. While Solana has been the weakest performer among the three for most of the downturn, it has recently begun to close the gap with ETH as the correction appears to be nearing its end.

With the performance gap between ETH and SOL narrowing as the correction approaches its end, a tactical long SOL / short ETH position may be attractive. If prices continue to rise or consolidate, SOL is likely to outperform ETH due to its higher beta.

Alternatively, for investors expecting further downside in crypto markets, a long BTC / short SOL position could be compelling. This setup aims to capture relative strength in BTC, which tends to benefit from safe haven flows during periods of market stress.

In order to express these views, investors can deploy CME futures which offer compelling margin offsets for inter-market spreads involving cryptocurrencies which can enhance capital efficiency.

Long Micro SOL, Short Micro ETH

Long 1 x Micro SOL April futures: 117.2 x 25 SOL/contract = notional of USD 2,931

Short 19 x Micro ETH April futures: 1554 x 0.1 ETH/contract x 19 = notional of USD 2,952

This trade requires margin of USD 2,185 as of 11/April (USD 1,255 for 1 x MSL and USD 931 for 19 x MET (49/contract)

CME offers 40% margin offset for this trade as of 11/April reducing margin requirements to USD 1,311

A hypothetical trade setup with a 2x reward to risk ratio is described below:

Long Micro BTC, Short Micro SOL

Long 1 x Micro BTC April futures: 81,250 x 0.1 BTC/contract = notional of USD 8,125

Short 3 x Micro SOL April futures: 117.2 x 25 SOL/contract x 3 = notional of USD 8,793

This trade requires margin of USD 5,678 as of 11/April (USD 1,913 for 1 x MBT and USD 3,765 for 3 x MSL (1,255/contract)

CME offers ~25% margin offset for this trade as of 11/April reducing margin requirements to USD 4,261

A hypothetical trade setup with a reward to risk ratio of 1.6x is described below:

To access the standard size contract spreads, investors can use the ratios of 1 x BTC to 6 x SOL and 2 x ETH to 3 x SOL.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Bitcoin Goes "Red Days Again" since "Relief Rally" Has Been NullBitcoin's price has experienced significant fluctuations over last "Intl Women's Day" weekend, reflecting the volatile nature of the cryptocurrency market. To understand these movements, it's essential to consider both the broader economic context and specific events that have influenced investor sentiment.

Background: Economic and Political Factors

In recent weeks, Bitcoin's price has been heavily influenced by economic indicators and political announcements. The U.S. Federal Reserve's stance on interest rates, particularly comments from Jerome Powell, has been closely watched by investors.

Political factors have also played a crucial role. For instance, Donald Trump's re-election and his proposals related to cryptocurrency, including the creation of a "Strategic Bitcoin Reserve," have contributed to market optimism and price increases. However, these developments also introduce uncertainty, as regulatory environments and geopolitical tensions can quickly shift investor confidence.

Recent Price Movements

As of the last weekend, Bitcoin's price has shown a decline of nearly 5%. This decrease is part of a larger trend where Bitcoin's price has struggled to maintain consistent gains, often experiencing sharp drops followed by rebounds. For example, on March 9, 2025, Bitcoin's price was noted to be choppy, trading around $81,500.

Bitcoin's price initially dropped but then rebounded slightly. This rebound was likely driven by renewed optimism in the altcoin market and strategic purchases by entities like Metaplanet, which has been actively buying Bitcoin. However, the overall sentiment remains cautious due to ongoing economic uncertainties and the potential for further interest rate hikes.

Key Events Influencing Price

Mt. Gox Bitcoin Movement: The recent transfer of over $1 billion worth of Bitcoin from Mt. Gox to an unmarked address has raised concerns about potential market impact. Such large movements can lead to increased volatility as investors speculate about the intentions behind these transactions.

Regulatory and ETF Developments: The ongoing efforts to establish a U.S. spot Bitcoin ETF have seen mixed results, with periods of significant outflows followed by brief moments of positive inflows. These developments can influence investor confidence and, consequently, Bitcoin's price.

Global Economic Conditions: Trade tensions and economic stimulus measures, particularly those involving China, have also played a role in shaping Bitcoin's price. As investors seek safe-haven assets, Bitcoin's performance relative to traditional assets like gold can impact its value.

Technical challenge

The fluctuations in Bitcoin's price over the last weekend reflect the complex interplay of economic, political, and market-specific factors. As investors continue to navigate these uncertainties, Bitcoin's price is likely to remain volatile. The influence of major economic data releases, political announcements, and strategic investments will continue to shape the cryptocurrency's trajectory in the coming days and weeks.

The main technical 1-day resolution graph indicates that Bitcoin Goes "Red Days Again" since recent "relief rally" has been Null.

Ahead of upcoing week our "super-duper" @PandorraResearch Team is Bearishly calling to numbers between $30 000 to $50 000 per Bitcoin, that is correspond to major current support of 200-week SMA.

Conclusion

In summary, Bitcoin's price movements are a testament to the dynamic and speculative nature of the cryptocurrency market, where sentiment can shift rapidly based on a wide array of factors. As the market continues to evolve, understanding these influences will be crucial for investors seeking to navigate the volatile landscape of Bitcoin and other cryptocurrencies.

--

Best 'Jojoba oil' wishes,

@PandorraResearch Team 😎

MBT1 BULISH (THE LEAP BITCOIN)MBT1, the Bitcoin leaps asset, is showing a slight bullish movement. The targets, danger zone, and stop loss levels are marked on the chart. The zigzag movement indicates that if MBT1 breaks through this area, it could reach upper targets up to 100K.

Please pay close attention to the danger zone and stop loss.

Note: My ideas are not intended for any type of scalping or scalpers!

You can find the full list of my ideas here: www.tradingview.com

Here are some of my ideas:

The key is whether it can be supported near 98105

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(MBT1! 1D chart)

There are many indicators formed over the 96600-102095 section.

Therefore, the key is whether it can break through this section upward.

In particular, we need to look at whether it can be supported and rise in the 98105-100700 section.

-

In order to turn into an uptrend, the price must rise above the Trend Cloud indicator and maintain it.

The Trend Cloud indicator is a combination of the existing 5EMA+StErr indicator and the MS-Signal indicator to increase intuitiveness.

Since it is currently below the Trend Cloud indicator, if it fails to rise above 98105, there is a possibility that the downtrend will continue, so caution is required.

If the downtrend continues, the key is whether there is support near 91435, which was the previous low point.

Therefore, in order to trade with a long position, it is recommended to check that the price is maintained above the Trend Cloud indicator and proceed.

-

(30m chart)

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------