Natural Gas Cooling Near Support Zone – Bounce Ahead!Natural Gas Technical Overview (2-Chart Analysis):

Chart 1 – Parallel Channel Formation:

Natural Gas is moving within a well-defined parallel channel.

The lower support boundary of this channel is observed near 250, indicating a potential bounce zone.

Chart 2 – EMA-Based Support Structure:

Price is currently sustaining above key EMAs, reflecting short-term strength.

The last EMA support lies around 252, acting as an additional support confluence.

If this level is sustain then we may see higher prices in Natural gas futures.

Thank you !!

MCX

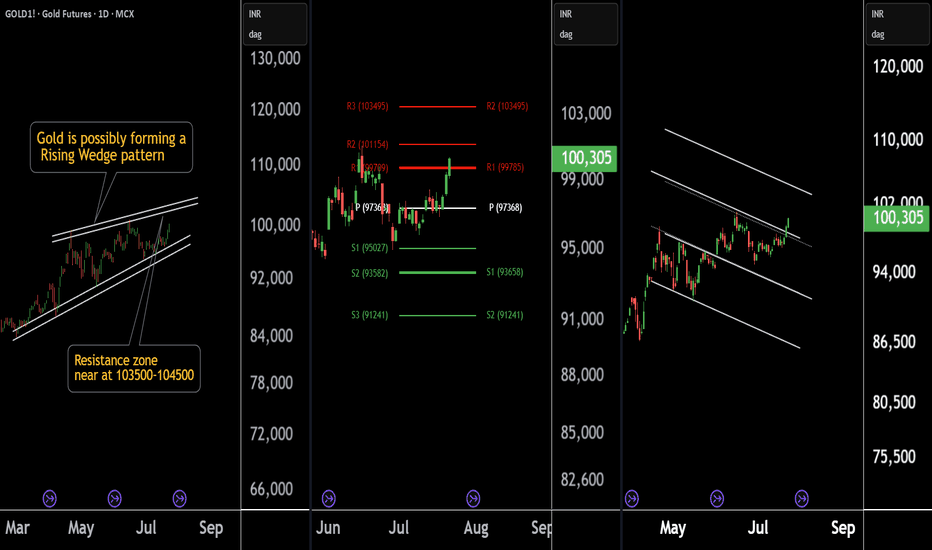

Gold at a Crossroad: Long or Short? Key Levels in FocusThere are three chart of Gold .

Gold1! is forming a Rising Wedge pattern, with resistance positioned between 103500-104000 levels.

Gold1! is facing Pivot Point resistance around the 103500 level, indicating potential supply pressure.

Gold1! is approaching the parallel channel resistance, and the upside move is nearly complete in percentage terms, with resistance around 103800-104000.

if this level sustain then we may see first of all higher prices then again fall in gold1!

Thank You !!

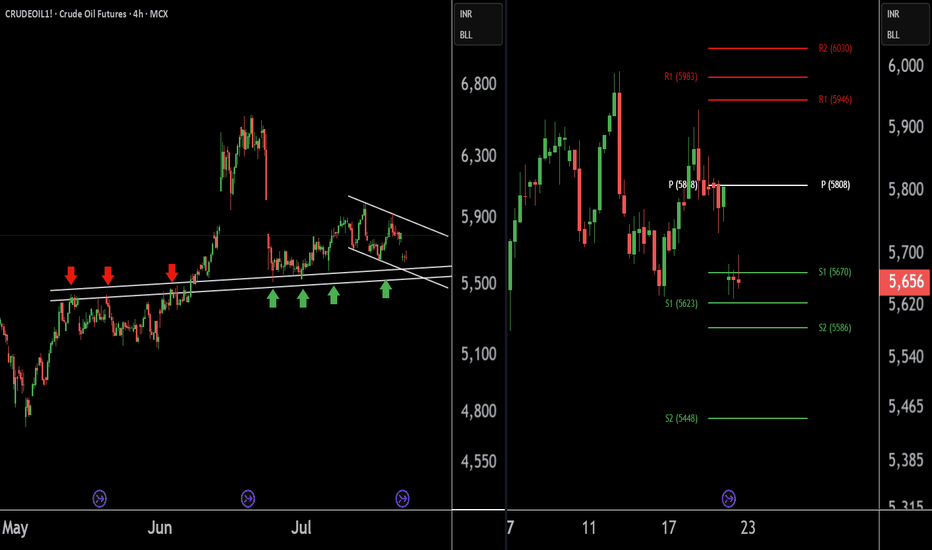

Crude Oil Buying Alert: Strategic Entry Point IdentifiedThere are two charts of Crude Oil on the 4-hour timeframe.

In the first chart, Crude Oil is sustaining near its lower point (LOP), with a support range of 5540-5580.

A-VWAP is also providing support to Crude Oil around the 5580 level.

The Pivot Point is also supporting Crude Oil around the 5580-5620 level.

If this level is sustain then we may see higher prices in Crude Oil.

Thank you !!

CRUDEOIL1! at Best Support Zone !!This is the Daily Chart of CRUDEOIL1!.

CRUDEOIL1! having a good law of polarity at 5500-5600 level .

CRUDEOIL1! is currently trading between its quarterly pivot 5603 level and monthly pivot 5805 levels , indicating a range-bound movement."

Once the Crudeoil1! sustains above the monthly pivot, it may trigger a potential upside rally."

If this lop is sustain , then we may see higher prices in CRUDEOIL1!

Thank You !!

Gold Future MCXThe Gold Future Price is Stuck in A Triangle Trend Lines.

There is Good Action Seen from Both Buyers and Sellers. Lets se who wins it.

If the price breaks DOWN the Support Trend Line with Good Volume "THE PRICE CAN TRAVEL DOWN TILL 90000 Levels."

If the Price Breks UP the Resistance Trend Line with Good Volume " THE PRICE CAN TRAVEL UP TILL 95500 Levels."

NOTE: (In My View)

Price Going Down till 90000 is More Likely.....

MCX - Multi Commodity Exchange (45 minutes chart, NSE) - LongMCX - Multi Commodity Exchange (45 minutes chart, NSE) - Long Position; short-term research idea.

Risk assessment: Medium {volume structure integrity risk}

Risk/Reward ratio ~ 1.35

Current Market Price (CMP) ~ 6490

Entry limit ~ 6400 on May 16, 2025

Target limit ~ 6680 (+4.38%; +280 points)

Stop order limit ~ 6192 (-3.25%; -208 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

GOLDM ANALYSISTechnical view on Goldm(mcx).

Disclaimer: This does not construe to be an investment advice. Investments/trading are subject to market risks.

All information is a point of view, and is for educational and informational use only.

The author accepts no liability for

any interpretation of articles or comments on this platform being

used for actual investments.

MCX - Multi Commodity Exchange (Daily chart, NSE) - LongMCX - Multi Commodity Exchange (Daily chart, NSE) - Long Position; short-term research idea.

Risk assessment: Medium {volume structure integrity & volatility risk}

Risk/Reward ratio ~ 4.25

Current Market Price (CMP) ~ 5930

Entry limit ~ 5925 to 5775 (Avg. - 5850) on April 25, 2025

1. Target limit ~ 6201 (+6%; +351 points)

2. Target limit ~ 6700 (+14.53%; +850 points)

Stop order limit ~ 5650 (-3.42%; -200 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

Natural Gas Futures (4H) - ABCD Pattern Analysis and PRZ Levels"In this analysis of Natural Gas Futures (4H timeframe), we identify a bullish ABCD pattern that projects a Potential Reversal Zone (PRZ) around 394.5-395. Key highlights include:

ABCD Pattern: The 1.618 Fibonacci extension from the BC leg aligns with the PRZ.

Current Price Action: Natural Gas is trading around 368.6, indicating a strong upward momentum.

Key Levels:

Resistance at 394.5 (PRZ zone).

Support levels marked at 365.2, 364.3, and 361.5.

Strategy Insight:

Traders may look for potential shorting opportunities at the PRZ (394.5) with confirmations.

Alternatively, breakouts above 394.5 could indicate further bullish movement toward 400+ levels.

This setup is ideal for monitoring reversal or continuation scenarios. Keep an eye on volume and momentum indicators for better confirmation."

CRUDEOIL MCX - OCTOBER SERIES INVERTED HEAD AND SHOULDERCrudeoil is making inverted head and shoulder on 1 hour time frame

Weekly time frame is downtrend

Crudeoil trading at weekly strong demand zone

Target we may see 6072 and above that 6279

This chart is only for educational purpose. Do your own analysis before taking any trades

GREAVESCOT LONGGREAVESCOT is the growth stock but its in IT sector we found Rs.800 is a under value Rs.1700 is a over value based on up-to this year company result....

so this value(under and over value) will change year to year

but now this stock will reach RS.800+(under value) like a growth stock after that it will act like a value stock up-to Rs.1700+(over value)

long-term doesn't want perfect entry

my entry was 163

company wont go ZERO

ITS A INVESTING PURPOSES>>SEPUCLATION IS RISK... WE ARE NOT RESPONSIBLE FOR YOUR SEPUCLATION PROFIT AND LOSS>>>BUT WE ARE RESPONSIBLE FOR YOUR INVESTING PROFIT AND LOSS