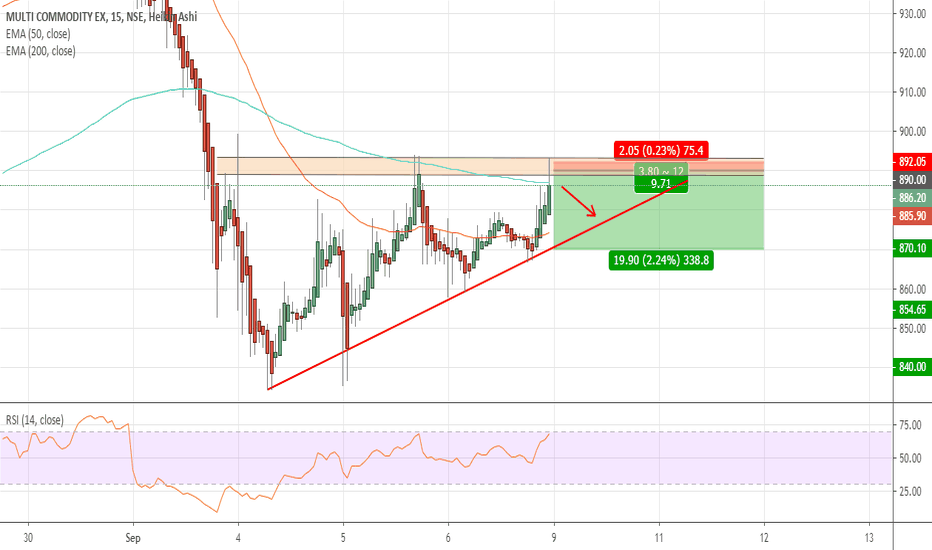

MCX

Expertcrudeoil - intraday trading in crude oil?Indicators play a major as well as significant role in intraday traders particularly for the beginners for trading.

All markets, but especially crude oil are only based on supply and demand. Supply and demand are what makes price in any market move from one value area to another, nothing else.

My best indicator is MACD & Bollinger band

Moving Average Convergence Divergence - MACD

The MACD is calculated by subtracting the 26-period EMA from the 12-period EMA.

The MACD triggers technical signals when it crosses above (to buy) or below (to sell) its signal line.

The speed of crossovers is also taken as a signal of a market being overbought or oversold.

The MACD helps investors understand whether bullish or bearish movement in the price is strengthening or weakening.

Bollinger band

Bollinger Bands are a dynamic indicator which means that they adapt to changing market conditions and, thus, have benefits over other standard indicators which are often perceived as ‘lagging’.

There are just a few things you need to pay attention to when it comes to using Bollinger Bands to analyse trend strength :

During strong trends, price stays close to the outer band

If price pulls away from the outer band as the trend continues, it shows fading momentum

Repeated pushes into the outer bands that don’t actually reach the band show a lack of power

A break of the moving average is often the signal that a trend is ending

Visit here : Expertcrudeoil

GOLD SELL ON RISE TG 1186 (100%) SL 1336GOLD SELL ON RISE TG 1186 (100%) SL 1336

MINI SL - MINI LOSS

BIGG TG - BIGG PROFIT

Reasons : Fundamental Vs. Technical Analysis

1- GOLD UP SUPPORT 1336 LAST YEAR LOW

2- LAST DOWN SUPPORT 1186/82 (100%)

3- DXY ALREADY BREAKED 95.53

4- XAUAUD LAST DOWN SUPPORT 1602 (100%)

5- INDIAN MCX GOLD TRADING EXP 03/AUG/2018

6- Jul/Aug31-1 FED MEETING

7- PM ME FOR MORE INFO

Like & Comments if you follow this idea

MAKE MONEY IN TONS

THANKS

CrudeOil Elliottwave View: Buy the dipStrategy: Buy the dip

------------------------------

CrudeOil is in correction phase and looking for W-X-Y correction on weekly chart where target for Y is above 55. On Short term, we are waiting for good opportunity to go long. After breakout of bullish inner channel, we are on sideline and looking to see support on outer bullish channel.

EURINR Elliottwave: Looking for break of monthly trendlineTalking Points:

Technical Strategy: Bearish

Elliottwave Count: Either wave (C) continuation or B wave of (B).

HTG Note:

Larger outlook on weekly chart is showing weakness on long and short term. EURO vs Indian Rupee price is testing weekly trend line. Last time this line was tested on September, 2015 and post that we seen nice pullback towards 77.80 levels. We in HTG consider that was correction and marking as a wave (B). From 77.80, we were seen bear continuation and currently price is testing same weekly trenline. Break of this weekly trendline will be very bearish outlook for Euro. On alternate, if price is start trading higher, we are expecting to see price can go and above 82 levels before it's turn bearish again.

Lower time frame, we are seen reaction near trend line support, however current price is trading in just correction and testing horizontal resistance on 70.15. We are expecting this zigzag correction should be over. To confirm, bear trend is back in force, we need to have channel breakout here @ 70 area. Post this breakout, we are able to mark correction over and can trade for lower target below 68

Action

We initiated short position @ 1.77 with limited stoploss