Integra LifeSciences Holdings | IART | Long at $12.39Integra LifeSciences Holdings Corp NASDAQ:IART manufactures and sells surgical instruments, neurosurgical products, and wound care solutions for neurosurgery, neurocritical care, otolaryngology, orthopedics, and general surgery. The stock has fallen over the past few years due to earnings misses / lowered earnings per share guidance, slow revenue growth, and operational challenges / recalls. But the company has been around since 1989 (endured many ups and downs during that time), has over 4,000 employees, a book value near $20 (undervalued), a forward price-to-earnings between 6x-9x (depending on the source), and revenue growth beyond 2025 and into 2028. Debt is slightly high with a debt-to-equity ratio of 1.2x and a quick ratio near 0.8x (company may have difficulty meeting its short-term obligations with its most liquid assets), it is thus a risky play. But the valuation and potential turnaround should get some attention.

From a technical analysis perspective, the stock price has entered and exited my "crash" simple moving average area 3 times now (see green lines). While I think $10 is likely in the near-term, it appears the stock *may* be forming a bottom - especially given the book value is more than 60% from the current price. But, as always, medical device stocks are always a major investment risk, so due diligence is needed.

Thus, at $12.39, NASDAQ:IART is in a buy zone with a note regarding the potential for a dip near $10 before a move up. Targets will be kept low for a swing trade.

Targets:

$15.00 (+21.0%)

$16.50 (+33.2%)

Medicaldevices

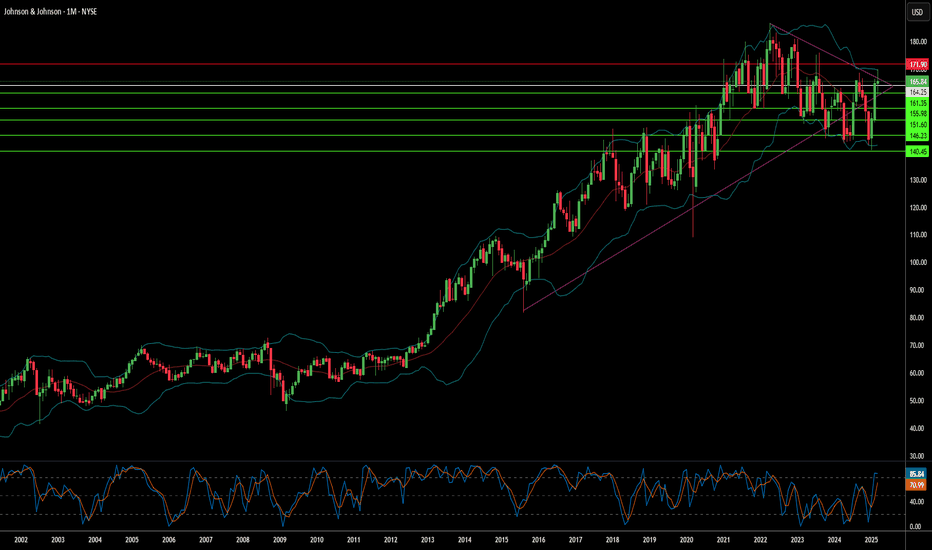

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With tens of thousands of lawsuits alleging links to cancer, the company's strategy to manage this liability via bankruptcy has been repeatedly struck down by courts, most recently rejecting a $10 billion settlement proposal. This forces J&J to potentially face over 60,000 individual claims in court, introducing immense financial uncertainty and the prospect of staggering legal costs and damages.

Compounding these concerns is mounting scrutiny over the company's historical and recent marketing practices. A federal judge recently imposed a $1.64 billion penalty against J&J's pharmaceutical arm for misleading marketing of HIV medications, citing a "deliberate and calculated scheme." This follows earlier multi-million dollar settlements related to alleged improper financial inducements paid to surgeons for orthopaedic implants by its DePuy subsidiary, and tax disputes in India over questionable "professional sponsorship" expenses tied to similar activities. These incidents depict recurring legal and ethical entanglements with significant financial penalties and reputational harm.

Taken together, the unresolved talc litigation, substantial financial penalties from marketing violations, and persistent questions regarding ethical conduct create considerable headwinds for Johnson & Johnson. The cumulative impact of ongoing legal battles, potential future liabilities, and damage to its corporate image threatens to drain resources, divert management focus from core operations, and erode investor confidence. These converging factors present tangible risks that could exert significant downward pressure on the company's stock price moving forward.

Baxter International | BAX | Long at $35.00Baxter International NYSE:BAX , a company that primarily focuses on products to treat kidney disease and other chronic and acute medical conditions, is another name that had a very rough time through 2022 and into 2024. However, the company's projected earnings and cash flow are expected to grow from 2024 through 2027 and it currently has a 3.35% dividend. Interest rates being lowered soon will help these projections. From a technical analysis perspective, my selected simple moving average is working its way down to recapture the price for a likely reversal in the next year or two (unless company fundamentals change). The recent low in June 2024 was higher than the previous low in October 2023 (higher lows) indicating a high chance of future price improvement - but nothing is guaranteed. At $35.00, it is currently in a personal buy zone.

Target #1 - $40.00

Target #2 - $48.00

Target #3 - $51.50

Target #4 - $65.00

Target #5 - $77.00 (very long-term...)

AHCO | Good Long Entry | LONGAdaptHealth Corp., together with its subsidiaries, provides home medical equipment (HME), medical supplies, and home and related services in the United States. The company provides sleep therapy equipment, supplies, and related services, including CPAP and bi-PAP services to individuals suffering from obstructive sleep apnea; medical devices and supplies, including continuous glucose monitors and insulin pumps to patients for the treatment of diabetes; HME to patients discharged from acute care and other facilities; oxygen and related chronic therapy services in the home; and other HME devices and supplies on behalf of chronically ill patients with wound care, urological, incontinence, ostomy, and nutritional supply needs. It serves beneficiaries of Medicare, Medicaid, and commercial insurance payors. The company is headquartered in Plymouth Meeting, Pennsylvania.

BAX | Catch the Falling Knife | LONGBaxter International Inc., through its subsidiaries, develops and provides a portfolio of healthcare products worldwide. The company offers peritoneal dialysis and hemodialysis, and additional dialysis therapies and services; intravenous therapies, infusion pumps, administration sets, and drug reconstitution devices; remixed and oncology drug platforms, inhaled anesthesia and critical care products and pharmacy compounding services; parenteral nutrition therapies and related products; biological products and medical devices used in surgical procedures for hemostasis, tissue sealing and adhesion prevention; and continuous renal replacement therapies and other organ support therapies focused in the intensive care unit. It also provides connected care solutions, including devices, software, communications, and integration technologies; integrated patient monitoring and diagnostic technologies to help diagnose, treat, and manage a various illness and diseases, including respiratory therapy, cardiology, vision screening, and physical assessment; surgical video technologies, tables, lights, pendants, precision positioning devices and other accessories. In addition, the company offers contracted services to various pharmaceutical and biopharmaceutical companies. Its products are used in hospitals, kidney dialysis centers, nursing homes, rehabilitation centers, doctors' offices, and patients at home under physician supervision. The company sells its products through direct sales force, as well as through independent distributors, drug wholesalers, and specialty pharmacy or other alternate site providers in approximately 100 countries. It has an agreement with Celerity Pharmaceutical, LLC to develop acute care generic injectable premix and oncolytic molecules. Baxter International Inc. was incorporated in 1931 and is headquartered in Deerfield, Illinois.

OWLT | A Good Entry Point | LONGOwlet, Inc. operates as a digital parenting platform in the United States. The company's platform focuses on giving real-time data and insights to parents. Its products include Smart Sock, a baby monitor to track an infant's oxygen levels, heart rates, and sleep trends; Dream Sock, an app to assist children for better sleep; Cam, a video streaming app to hear and see baby from anywhere; and Dream Lab, an interactive online platform that assists families in building healthy sleep habits. The company also offers Dream Duo, a monitoring system for baby's sleeping habits and includes wearable sock monitor, HD video, and digital sleep coach. Owlet, Inc. was founded in 2012 and is based in Lehi, Utah.

ZBH longZimmer Biomet Holdings Inc. designs, develops, manufactures, and markets medical equipment.The Company offers orthopedic, dental, and spinal reconstructive implants, as well as bone cement and related surgical products.

My trade levels

Entry: $112.05

Take profit: $118.05

Stop loss: $109.59

Risk/reward: 2.44

AVGR | Incoming Rally | SqueezeAvinger, Inc., a commercial-stage medical device company, designs, manufactures, and sells a suite of image-guided and catheter-based systems used by physicians to treat patients with peripheral arterial disease (PAD) in the United States and internationally. It develops lumivascular platform that integrates optical coherence tomography visualization with interventional catheters to provide real-time intravascular imaging during the treatment portion of PAD procedures. The company's lumivascular products comprise Lightbox imaging consoles, as well as the Ocelot family of catheters, which are designed to allow physicians to penetrate a total blockage in an artery; and Pantheris, an image-guided atherectomy device that allows physicians to precisely remove arterial plaque in PAD patients. In addition, its first-generation chronic total occlusion (CTO)-crossing catheters, Wildcat and Kittycat 2, which employs a proprietary design that uses a rotational spinning technique allowing the physician to switch between passive and active modes when navigating across a CTO. Further, the company develops IMAGE-BTK for the treatment of PAD lesions below-the-knee. It markets and sells its products to interventional cardiologists, vascular surgeons, and interventional radiologists. Avinger, Inc. was incorporated in 2007 and is headquartered in Redwood City, California.

MYO | Medical Devices Need Love | LONGMyomo, Inc., a wearable medical robotics company, designs, develops, and produces myoelectric orthotics for people with neuromuscular disorders in the United States. The company offers MyoPro, a myoelectric-controlled upper limb brace or orthosis product used for supporting a patient's weak or paralyzed arm to enable and improve functional activities of daily living. Its products are designed to help improve function in adults and adolescents with neuromuscular conditions due to brachial plexus injury, stroke, traumatic brain injury, spinal cord injury, and other neurological disorders. The company sells its products to orthotics and prosthetics providers, the Veterans Health Administration, and rehabilitation hospitals, as well as through distributors. Myomo, Inc. was incorporated in 2004 and is headquartered in Boston, Massachusetts.

BIO | Medical Device Co | Good EntryBio-Rad Laboratories, Inc. manufactures, and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America. The company operates through Life Science and Clinical Diagnostics segments. The Life Science segment develops, manufactures, and markets a range of reagents, apparatus, and laboratory instruments that are used in research techniques, biopharmaceutical production processes, and food testing regimes. It focuses on selected segments of the life sciences market in proteomics, genomics, biopharmaceutical production, cellular biology, and food safety. This segment serves universities and medical schools, industrial research organizations, government agencies, pharmaceutical manufacturers, biotechnology researchers, food producers, and food testing laboratories. The Clinical Diagnostics segment designs, manufactures, sells, and supports test systems, informatics systems, test kits, and specialized quality controls for clinical laboratories in the diagnostics market. This segment offers reagents, instruments, and software, which address specific niches within the in vitro diagnostics test market. It sells its products to reference laboratories, hospital laboratories, state newborn screening facilities, physicians' office laboratories, and transfusion laboratories. In addition, the company offers products and systems to separate complex chemical and biological materials, as well as to identify, analyze, and purify components. The company offers its products through its direct sales force, as well as through distributors, agents, brokers, and resellers. Bio-Rad Laboratories, Inc. was founded in 1952 and is headquartered in Hercules, California.

8/31/22 MCKMcKesson Corporation ( NYSE:MCK )

Sector: Distribution Services (Medical Distributors)

Market Capitalization: $52.319B

Current Price: $367.00

Breakout price: $369.40

Buy Zone (Top/Bottom Range): $355.55-$334.35

Price Target: $403.40-$407.60

Estimated Duration to Target: 37-40d

Contract of Interest: $MCK 10/21/22 370c

Trade price as of publish date: $13.90/contract

JNJ bullish scenario:The technical figure Pennant can be found in the US company Johnson & Johnson (JNJ) at daily chart. Johnson & Johnson is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. Johnson & Johnson is one of the world's most valuable companies, and is one of only two U.S.-based companies that has a prime credit rating of AAA, higher than that of the United States government. The Pennant has broken through the resistance line on 23/05/2022, if the price holds above this level you can have a possible bullish price movement with a forecast for the next 6 days towards 184.37 USD. Your stop loss order according to experts should be placed at 172.71 USD if you decide to enter this position.

Johnson & Johnson is now working to spin off its consumer health division and after the company entered a series of settlements for its part in the opioid crisis. First-quarter metrics were mixed, but the company's medical devices business had few declines.

Now, the Dow index stalwart expects $94.8 billion to $95.8 billion in 2022 sales. That no longer includes prior expectations for $3 billion to $3.5 billion in Covid vaccine sales.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Quiet accumulation and pro traders in a bottom: SILKThis is a young public company that is forming a bottom with some quiet accumulation, well hidden in price, by the Dark Pools during the bottom formation. The accumulation may include ETF Developers as many medical devices are in accumulation mode. Pro traders are in the mix as well. Candlestick patterns, improving volume and Accum/Dist indicators confirm--see blue arrows. When the bottom completes and sustains above the red line, there will be strong support for an uptrend. This company has pioneered TCAR.

NVCR ready to go on an extended run Initial Target by Apr 14 = 99

Target Range by 5/20/2022 = 108-116

Upcoming earnings as a catalyst. Bullish Momentum for pre-earnings run up.

Kept the chart simple but a lot of bullish aspects at play here, to name a few:

- ready for markup coming off an accumulation phase

- completes wave 5 correction apprx. .786 off the highs last June

- if you look at the bigger structure it just completed a running flat beginning Aug 2019

Great Company!

NVCR primed for an extended runKept the chart simple but there are a lot of bullish aspects at play here:

- ready for markup after an accumulation phase

- coming off a wave 5 correction apprx. 0.786 off the highs last June

- looking at weekly chart you’ll see a larger running flat structure

- earnings as a catalyst and overall great company!

*Initial Target by Apr 14 = 99

** Target range by 5/20/2022 = 108-116

Would love to hear your thoughts on this.

ISRG consolidation then new highs or retest support?Just did a basic fib retracement on ISRG using that last low. Looks like the 50 fib line presents a consistent area of traffic and previous support. It tested the 236 fib area weeks ago and after managing to break through and hold, the stock made new highs. After failing to retest those highs at the end of the week, it settled back at the recent levels just shy of 950. That area has also been a short-term area of support. But does it hold these levels and bounce to retest ATH or is the retracement in effect heading back down closer to the 236 fib line?

Have to see what comes with ISRG earnings during this next round. That 71.22% surprise last quarter didn't hurt but can it maintain the same pace now that things are beginning to normalize to some extent?

Ontrak seems not to want to forget the prices of the pastThe company Ontrak has always proved to be an excellent partner for care centers, unfortunately in recent months one of their major customers has decided to abandon the contract with the company Ontrak.

This has led to a rapid decline in prices, but the company is proving to have a good basis to start again, the technology they produce is essentially unique and at the top of the category.

Currently Ontrak comes defined 'heavy undervalued' in the sites of reference that I use for the fundamental analysis that is the price of the action turns out to be 85.4% under to the just value.

Maybe that’s why many big investors are coming back to invest in Ontrak, I find the indicator Miracle Viewer that detects the flows of money categorizing them by type of players.

And that’s why the Market miracle advisor gave an input signal on Ontrak at the price of 31.19 usd and a target of 35.98 usd or with a possible profit of 15.37%

Analyzing the diagram is clear as it is drawing a reversal to U slightly in climb that testifies the strong pressure of purchase on the Stock.

Looking at the cyclical nature of the big players I expect that in the coming weeks or at most within the next month the purchase pressure increases further, so I venture to make a further forecast for a second possible target.

This idea is based on the signal generated by the Marketmiracle advisor whose link you can find by scrolling at the bottom of this page.

INMD Good Entry... INMD Inmode Ltd is an Israel-based company. It designs, develops, manufactures and commercializes energy-based, minimally-invasive surgical aesthetic and medical treatment solutions. The Company’s proprietary technologies are used by physicians to remodel subdermal adipose, or fatty, tissue in a variety of procedures including fat reduction with simultaneous skin tightening, face and body contouring and ablative skin rejuvenation treatments...

Tech that might help with those Covid lbs...

Medical Devices group looking good ...

Only concern is the lack of volume but some leaders have been breaking out on less than average volume for example, check out my NET Cloudflare entry.

IBD #1 in its group

Composite Rating 99

EPS Rating 98

RS Rating 96

Group RS Rating A-

SMR Rating A

Acc/Dis Rating A-

Entry: 93.6 Stop 85.73 1R 7.61 Target 3R 116.43

Earnings due 8/5/21 Good space to run up to earnings report.

1R 7.61

Not trading advice. Educational purposes. Do your own due diligence.

SENS potential trendsBuddy and I found these potential trends in SENS. It's lower due to the recents news around the FDA approval. But I could see both potential trends happening based on the past. Who knows.

This stock is definitely on my watchlist to test it out depending on what further info comes out.

HJLI Potential set upHeart Surgery Innovators HJLI are seeing their In-human testing with their CoreoGraft product go well.

Basically they have a new product doc's can use for heart surgery.

More so it looks like a bottom has been found at $8 and sentiment is turning positive.

Currently range bound and has been testing the 200EMA a few times.

Good low risk set up with a Stop Loss below $8

Good luck.