Up In Smoke - MJ burning downA great 2x inverse ETN for this recession is MJIN, which is opposite of MJXL. By early morning of June 8, SMG reported less expected FY22 earnings, sales & profits. This largely affects weed ETFs due to heavy use of their products for growing, as we can see the spike here shortly after the news broke. In this case, due to rising inflation across the economy, most cannabis users will likely go underground to unregulated markets to find somewhat cheaper MJ. So take this ETN & get high.

Medicalmarijuana

Triple Bottom & Inverse Head & Shoulders. Has Aleafia stuck in a bottom recently, it appears as though on the RSI there is a staircase creation of higher lows & higher highs, and now a Inverse Head & Shoulders is forming & may break-out bullishly to the upside in the near term.

It also seems like a bull flag is breaking out to the upside right now.

LONG CGCExpecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

LONG CGC

Expecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

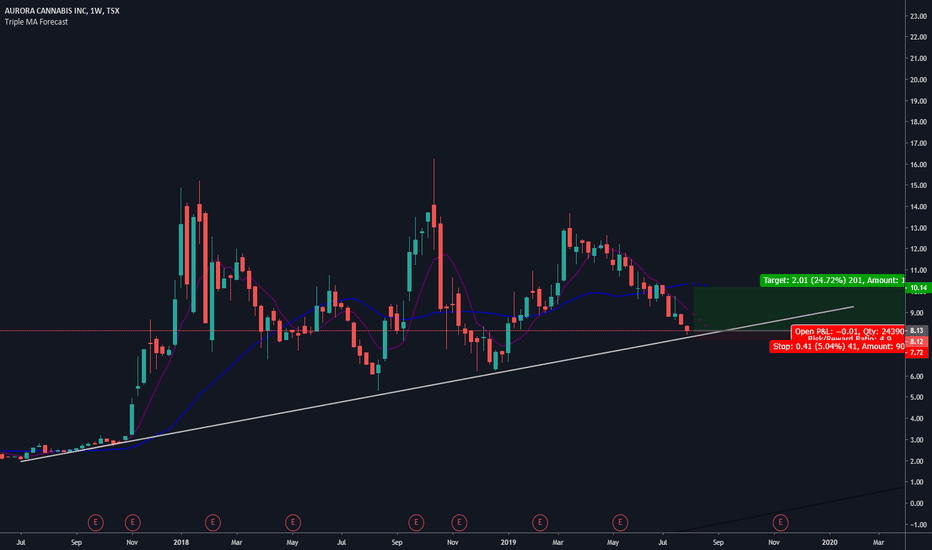

ACB Trendline Bounce TradeACB appears to be in a good buy spot here- This stock along with many of the marijuana names have been beaten up in the last few weeks/months.

The price is on/near the diagonal bullish trendline it has respected for a long period. Although it is not the strongest of trendlines with only 3 real bounces. I do think the risk meets tbe reward here.

Im looking at a trade just under 5:1.

Close any weekly candle close below the trendline. Take profit at the moving average. If it breaks the moving average in a strong way I will update my price targets.

Happy Trading :)

Long CGCExpecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

From YOLO to POT, from 0 to 100

I told you about Sunniva and my lucky entry at around 3 canadian dollar. Like Sunniva I also see a long up move in weekend unlimited.

First traded under the symbol YOLO (you only live once) they were absolutely lucky to win the symbol lottery when it was about who will trade under the ticker POT. There are only two big ticker symbols that really stand out for the companies business. Thats WEED and POT. WEED is canopy growth like most of you might know and now there is POT wich belongs to weekend unlimited. They state their selves as a lifestyle cannabis company. Its about Canna Candy, Champ and Verve Beverages, Glas blowing, Organic bio canna farming and events with majority canna consumers. On the day they announced the ticker winning they went from around 0,13 CAD to 0,30s CAD and I saw the gap they made and was patient enough to wait for the almost gap close wich happened on friday at 0,135 CAD. So my first entry was at 0,14 CAD and I will take the second part at around 0,10 CAD if it will ever see it. I really believe in the strategy to acquire other companies in the sector but taking the second route. Not the cannabis only production but the everything around that.

My plan is to really stick to these two SUNNIVA and WEEKEND UNLIMITED for a long time and let them develop them selves. To many of the major players are absolutely overvalued in my opinion and here we get the uncut diamonds. And they both also operate in California, the biggest market when it comes to POT

Just my opinion so make your own research

And like always

May the markets be with you

For more please follow me here and on twitter

Tilray nearing full retracement - daily MACD - CCI watch Tilray is currently $71.74/share and falling in this weeks sell off and good chance to drop near full retracement to $65-66 range. Great time to buy half and have standing order 8% below this for full retracement, or just wait.

$65.50 target with MACD cross-over on 12/26 and CCI about to cross positive.

MEDICAL MARIJUANA SHORT (MJNA)Okay so this is uncharted territory for me. The pot-head market seems very bearish but it has gone through its fair share of market cycles. Prices might just edge a bit higher in order for them to test the upper channel resistance, but i would advise traders to open a short position at the break of the short-term bullish trendline which i drew in the descending channel.

APHRIA correction plus - over bad acquisitionAphria acquired a bad asset and is reported to be a shell company now. Down to pre-2017 prices and shown here compared to Canapy Growth, Tilray, Cronos (Aphria trying to acquire) and Aurora.

Watching for high $2 entry. Like watching GE go below $7. Bottom feeding.

RED Light - GREEN Light, sorry GREEN Light - RED LightCRONOS Group likely going full retracement to low $6's.

Oversupply, VIX, profitability, recent losses and await when larger institutional buying allowed Federally. November review watch. Few others here.

CRON

CGC

ACB

APHQF

CVSI

CBDS

Pick'n shovel stocks:

SMG

BLOZF

KSHB

IIPR

OTC:MNTR

NASDAQ:MSFT

NYSE:BE

ACB - UpdateA ACB TSX:ACB

Down 17½% from opening price on NYSE and down 27.7% from high.

Watch list.