Medpace Holdings (MEDP): From Molecule to MarketMedpace is a late-stage contract research organization that provides full-service drug-development and clinical trial services to small and midsize biotechnology, pharmaceutical, and medical-device firms. It also offers ancillary services such as bioanalytical laboratory services and imaging capabilities. The company was founded over 30 years ago and has over 5,400 employees across 40 countries. Medpace is headquartered in Cincinnati and its operations are principally based in the US, but it also operates in Europe, Asia, South America, Africa, and Australia.

ClinTrak®: Integrated Clinical Trial Management System.

Electronic Data Capture (EDC), ePRO/eCOA, eConsent: Digital tools for patient-reported outcomes and consent.

Interactive Response Technology (IRT): Randomization and drug supply management.

Wearables & Apps: TrialPACE (patient app), OnPACE (site app), and centralized monitoring tools.

Narrow Moat: Intangible assets, high switching costs.

Differentiation: Speed and precision in trial execution, especially for complex therapies like biologics and gene therapies.

Ranks: Strong

GreenRed: 363 / 3,147

GreenBlue: 258 / 2,500

MEDP

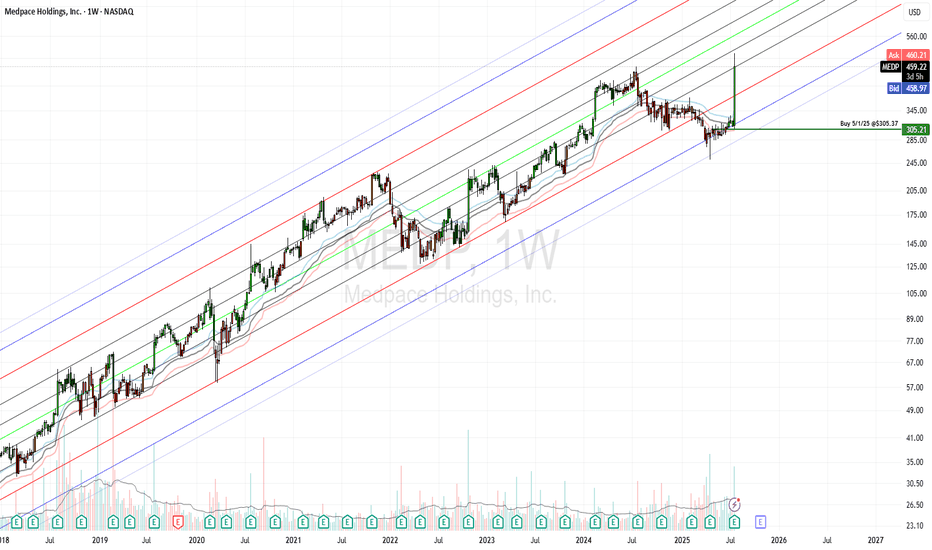

Early entry in small cap health services, $MEDPSince late 2021 NASDAQ:MEDP is being forming a head & shoulders base with pivot buy above $230.

This is the beahvior of a potential leader. It shows when comparing it against the AMEX:IWO as is still in a downtrend.

The play for me would be to buy 1/2 or 1/3 of a position just above yesterday's high with a STOP-LOSS below $196. And then add at the $230 pivot.

Medpace Holdings is ranked #1 in its industry by IBD. I recomend to also check NYSE:VPG which is also setting up.

Its being hard for small caps to get demand as the indices are still in downtrends making the sentiment stay bearish.

But as JC Parets always likes to remember, "is a market of stocks, not a stock market".

MEDP approaching new all-time highMedpace is a scientifically-driven, global, full-service clinical contract research organization (CRO) providing Phase I-IV clinical development services to the biotechnology, pharmaceutical and medical device industries.

They do clinical trials for new drugs, including a recent trial for a neutralizing antibody for SARS-CoV-2 for the treatment and prevention of COV19.

With earnings surprises the last two quarters and a Zacks estimate for a strong Q4, Medpace is on track to make a new all-time high.

As it approaches the all-time high, volatility is decreasing while volume is shrinking. There is not much selling going on, so a little demand will cause this to pop above the all-time high and accelerate from there.

Buy point is at 144.49 with a stop loss of 7.63% based on the 10d ATR (x2.7). Position size of R13.1.

Buy Point: 144.49

Stop Loss: 133.47

Position Size: R13.1

MEDP - Upward channel breakdown short from 60.87 to 33.13MEDP seems running within an upward channel formation. Right now it's getting back from its upper Chanel line. It also has some 100% selles from insider. We think it has good downside potential.

To trade one could consider June $55 or $60 Puts

-------------------

*Trade Idea*

Date First Found- February 11, 2019

Pattern/Why- Upward Channel formation

Entry Criteria- $60.87

Exit Criteria- 1st Target: $50.33, 2nd Target: 33.13

Stop Loss Criteria- $65.73