Day 4 — Trading Only S&P Futures — +$207, Patience Pays OffWelcome to Day 4 of Trading Only S&P Futures!

After two tough losing days, I took a morning yoga session to clear my mind and approach the market calmly. I started trading late but found a strong A+ setup near 6355, aligned with a major gamma zone and RSI signals, which led to a $200+ profit.

📈 What you’ll learn

The importance of mindset and mental clarity in trading

How to identify strong setups using market structure and gamma zones

Reading RSI on multiple timeframes for confirmation

Managing risk and knowing when to call it a day

⏰ Timestamps

0:00 — Intro & Day 4 Overview

0:30 — Mindset Reset & Trade Recap

1:30 — VX Algo Signal Recap & Setup Breakdown

3:00 — Market News & Impact

3:30 — Key Levels for Tomorrow

4:00 — Closing Thoughts & Next Steps

🔔 VX Algo Signals (9:30am – 2pm EST)

9:39 AM Market Structure flipped bullish on VX Algo X3!

11:20 AM VXAlgo ES X1 Buy signal (triple buy)

11:52 AM VXAlgo ES X1 Buy signal

12:40 PM VXAlgo ES X1 Sell signal

📰 News Highlights

U.S. jobless claims rose to 226,000 vs. estimate 221,000, signaling increased layoffs.

🔑 Key Levels for Tomorrow

Above 6332 = Remain Bullish

Below 6315 = Bearish

MES1!

Day 3 — Trading Only S&P 500 FuturesDay 3 — Trading Only S&P Futures

Daily P/L: -142.87

Sleep: 7 hours

Emotions: Headache & stress from the morning

:thought_balloon: Today’s Trade thoughts:

I made a typo when i was putting some orders in from last night that triggered and started the day -300 so I spent most of today just grinding it back again.

I think going forward, I am going to make a rule to limit myself of only doing 2 MES MAX during night time if i plan to put orders in because it really sadden the mood when you start the day negative.

Overall, today's trading day wasn't that bad, we had bullish structure and AAPL event that carried the market up. I took some shorts at 6355 that didn't work out but eventually made money at the end of the day as i shorted 6375 zones. I have noticed that** max Gamma levels don't truly settle until 11am. **

:bell:News Highlights:

*TRUMP TO IMPOSE ADDITIONAL 25% TARIFF ON GOODS FROM INDIA

:bar_chart: VX Algo Signals (9:30am – 2pm EST):

9:30 AM Market Structure flipped bullish on VX Algo X3! @everyone*

10:20 AM VXAlgo NQ X1 Sell Signal

11:00 AM Market Structure flipped bullish on VX Algo X3!

11:40 AM VXAlgo ES X1 Sell Signal

12:20 PM VXAlgo ES X1 Sell Signal (double sell)

1:40 PM VXAlgo NQ X1DD Buy Signal (double buy)

:chart_with_upwards_trend: Key Levels for Tomorrow:

Above 6332 = Remain Bullish

Below 6315 = Bearish

Day 2 — Trading Only S&P Futures — -$100, Grinding Back from Los Day 2 — Trading Only S&P Futures

Daily P/L: -100

Sleep: 8 hours

Emotions: Good

:thought_balloon: Today’s Trade thoughts:

I rushed into a trade thinking 6330 was going to be a good area of support to buy and oversized my position going 5 mes deep in my first trade and adding 5 more at the 48 min MOB at 6325 and got stopped out at the bottom down -400 and pretty much spent the rest of the day grinding back up.

Overall market seem to have rejected the higher timeframe resistance and deciding which direction to go.

:bell:News Highlights:

U.S. STOCKS END LOWER, VIX JUMPS AFTER WEAK ISM SERVICES DATA

:bar_chart: VX Algo Signals (9:30am – 2pm EST):

— 9:30 AM VXAlgo ES X1 Buy signal

— 9:40 AM VXAlgo NQ X1 Buy Signal

— 9:48 AM Market Structure flipped bullish on VX Algo X3!

— 11:00 AM VXAlgo ES X1 Buy signal (triple buy signal)

— 12:50 PM VXAlgo NQ X1DD Sell Signal

— 1:00 PM Market Structure flipped bullish on VX Algo X3!

— 1:30 PM VXAlgo NQ X1DD Buy Signal**

:chart_with_upwards_trend: Key Levels for Tomorrow:

Above 6332 = Bullish

Below 6310 = Bearish

**07/31/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: +

Sleep: 5.5 hours

Overall health: Good

** VX Algo System Signals from (9:30am to 2pm) **

— 9:00 AM Market Structure flipped bullish on VX Algo X3

— 9:30 AM VXAlgo ES X7 Sell signal

— 9:32 AM Bullish market structure got cancelled

— 11:40 AM VXAlgo NQ X1 Buy Signal

— 12:40 PM VXAlgo NQ X1 Sell Signal

— 1:00 PM Market Structure flipped bullish on VX Algo X3!

— 1:22 PM if we lose 6415 and stayy under it . Bullish Market structure is cancelled.

— 1:55 PM VXAlgo NQ X1 Buy Signal

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today marked the 4th day of the structure signals being iffy as they try to tip the volumes bullish just to cancel it right afterwards.

I was starting to get a bit tilted today as I had a bunch of orders at area that didn't get filled and eventually just gave up trying to have a green day and walked away.

looking at some of the other charts, i also we are getting a doji on the longer time frames and it is starting to look like bear's wet dream.

However, Mag 7 stock earnings were really great, the only downside was rate cut isn't happening.

News

*U.S. STOCKS END LOWER, VIX JUMPS AS S&P 500, NASDAQ RETREAT FROM RECORDS DESPITE MONSTER META AND MICROSOFT EARNINGS

What are the critical support levels to watch?

--> Above 6415= Bullish, Under 6403= Bearish

07/30/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +960

Sleep: 5 hours

Overall health: still struggling with sleep due to heat waves

VX Algo System Signals from (9:30am to 2pm)

— 8:30 AM Market Structure flipped bearish on VX Algo X3!✅

— 9:45 AM Market Structure flipped bullish on VX Algo X3! ✅

— 10:30 AM Market Structure flipped bullish on VX Algo X3!❌

— 11:30 AM Market Structure flipped bearish on VX Algo X3!❌

— 12:00 PM VXAlgo NQ X1DD Buy Signal, ✅

— 12:30 PM Market Structure flipped bullish on VX Algo X3!✅

What’s are some news or takeaway from today? and What major news or event impacted the market today?

I have started to noticed that the last 3 days, we have been getting false triggers on market structure signals and it almost feels MM are trying to do it to break people's algo that trade on that.

This is a good reminder that no matter how successful the signal has been for the last 30 days, you still need to have risk management. additionally, it's also a good way to test people's faith and trick new traders in going back to doing random things because it makes them think market can behave randomly and nothing works.

this is why i always tell people to religiously test out a system for 30 days before giving up.

News

*FEDERAL RESERVE SKIPS RATE CUT, KEEPS FED FUNDS RATE AT 4.50%

What are the critical support levels to watch?

--> Above 6410= Bullish, Under 6400= Bearish

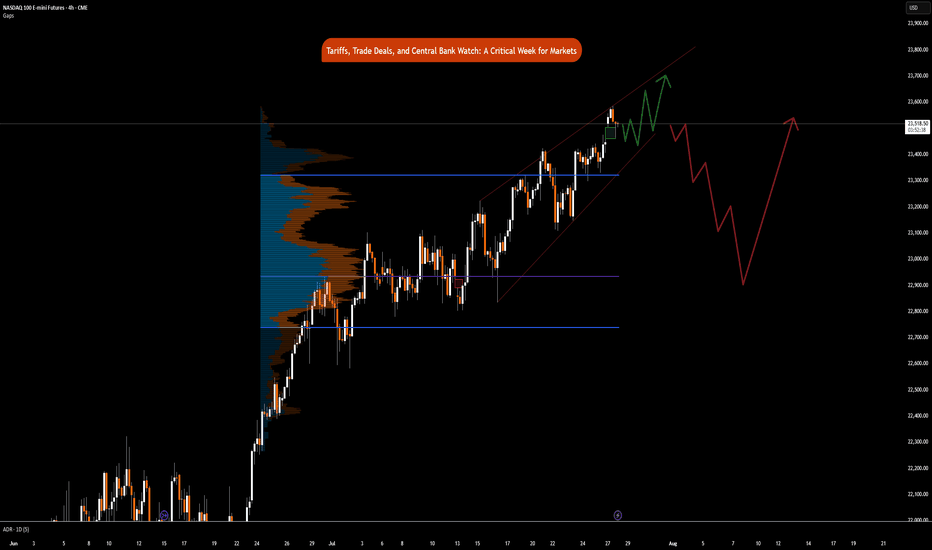

Tariffs, Trade Deals, & Central Bank Watch: Key Week in MarketsCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! CME_MINI:MES1! NYMEX:CL1!

This is a significant week in terms of macroeconomic headlines, key data releases, central bank decisions, and major trade policy developments. We get numbers for growth, inflation and decision and insights into monetary policy. Combining this with ongoing trade policy developments, we have a key week which may shape how the rest of the year unfolds.

Below is a consolidated summary of the latest trade negotiations, scheduled economic releases, and policy outlooks.

US - EU Trade Deal:

• US–EU Tariffs: The US will impose a 15% tariff on most EU goods, including cars, semiconductors, and pharmaceuticals, but retain a 50% tariff on steel and aluminium with a new quota system.

• Exemptions: Zero-for-zero tariffs agreed for agriculture, aircraft parts, and chemicals; aircraft exports are temporarily exempt.

• EU Commitments: The EU will invest $600 billion in the US and purchase $750 billion in US energy, mainly LNG.

• Agriculture: The EU will lower tariffs on many US agricultural goods, though not comprehensively.

• Political Reactions: EU leaders are mixed, Germany and the Netherlands praised the deal, France called it unbalanced, and Hungary viewed it unfavorably.

• The deal is not final until it is ratified by all EU national parliaments and the EU Parliament.

China Talks: US and China expected to extend their trade truce by 90 days. US-China meeting expected in Stockholm on Monday and Tuesday. Trump to freeze export controls to secure a deal. A group of US executives will visit China for trade discussions, organized by the US-China Business Council.

South Korea Trade Talks: Korea proposes a shipbuilding partnership with the US and is preparing a trade package.

UK–US Relations: PM Starmer and Trump to meet in Scotland to discuss the UK–US trade deal implementation, Middle East ceasefire, and pressure on Russia.

Thus far, the US has announced trade deals with the UK, Vietnam, Philippines, Indonesia, Japan and The EU. Trade delegations are working to finalize deals with China, Mexico, Canada

Key Economic Data Releases:

Monday: Treasury refunding financing estimates.

Supply: 2-Year and 5-Year Note Auction, 3 & 6-Month Bill Auction

Tuesday: US Advance Goods Trade Balance, Wholesale Inventories Advance, CB Consumer Confidence, JOLTS Job Opening (Jun), Atlanta Fed GDPNow, Australian CPI Q2

Supply: 7-Year Note Auction

Wednesday: German GDP Q2, EUR GDP Q2, US ADP Non-farm Employment, US GDP Q2, Crude Oil Inventories, Chinese Manufacturing PMI

Canada: BoC Interest Rate Decision, Rate Statement, Monterey Policy Report, BoC Press Conference

US: Fed Interest Rate Decision,FOMC Statement, Fed Press Conference.

Japan: BoJ Interest Rate Decision, Monetary Policy Statement

Thursday: EU Unemployment (Jun), US PCE & Core PCE Price Index (Jun)

Japan: BoJ Press Conference

Friday: EU CPI, US NFP, Unemployment Rate, Average Hourly Earnings, ISM Manufacturing PMI, Michigan 1-Year & 5-Year Inflation Expectations.

It is also a busy earnings week. See here for a complete earnings schedule .

Markets are interpreting trade deals as positive news thus far. The dollar is strengthening.

As we previously mentioned, we anticipate no rate cuts this year as economic data proves to be resilient and inflation largely under control. WSJ also posted an article stating that most tariffs costs are being absorbed by companies due to weaker pricing power. We previously wrote about this on our blog: “ In our analysis, the inflation impact of tariffs may not show up until Q4 2025 or early 2026, as tariff threats are mostly used as a lever to negotiate deals. While effective tariff rates have increased, as Trump reshapes how tariffs are viewed, cost pass-through to consumers will be limited in Q3 2025, as companies’ front-loaded inventory helps mitigate the risks of increased tariff exposure.

So, what we have is an interesting development shaping up where, while inflation may rise and remain sticky, it is yet to be seen whether slowing consumer spending will weaken enough to the point where companies must start offering discounts, which would nullify the tariff risk to the end consumer and result in companies absorbing all tariffs. This scenario will see reduced earnings margins leading into the last quarter and early 2026. However, it will materially reduce risks of higher inflation.”

In our view, the US dollar has a higher probability to rally in the short-term i.e., Q3 as markets re-align FX rate differentials. Bond yields stabilize, Equities continue pushing higher, while Gold retraces as previously mentioned. This in our view, is what investors and participants refer to as the Goldilocks scenario. If this plays out as expected we anticipate continued strength with AI, tech, energy and defense sectors outperforming into mid- 2026.

Institutional View: Morgan Stanley

Morgan Stanley also sees no rate cuts in 2025, despite market pricing for two 25 bps cuts. They forecast more aggressive cuts in 2026 due to:

• Tariff-related inflation emerging before labor market deterioration

• Slowing US growth, as fiscal support fades

• Impact of tighter immigration policy and global trade realignment

That said, MS continues to cite longer-term risks to the dollar, including:

• Twin deficits (fiscal + current account)

• Ongoing debate around USD’s safe haven status

• USD hedging activity picking up by international investors

• Strained credibility of the Fed due to tension between Fed Chair and the US Administration

How Fed policy evolves in Q4 2025 and Q1 2026 will depend heavily on the incoming Fed Chair nominee, who is expected to replace Jerome Powell in May 2026. This nomination could significantly influence future policy direction around growth and inflation targets.

Mid-Week Outlook Update: US CPI- Trade TalksCPI day today. Scheduled to be released at 7:30 AM CT.

CME:6E1! CME_MINI:ES1! CME_MINI:NQ1! CME_MINI:MNQ1! CME_MINI:MES1! COMEX:GC1! CBOT:ZN1!

ES futures edged slightly higher after positive commentary from US-China trade talks. The delegations from both sides agreed on a framework to move forward with negotiations.

It is important to note that Trade War 1.0 took about two years to formalize and finalize. However, given the previous experience and the current agreement on the framework, our opinion (which is not the consensus) is that the trade deal between China and the US may be closer than what most analysts and investors might otherwise predict.

Like any negotiations, China and the US have previously discussed these difficult issues and have found a way to resolve them. Although the concerns have shifted towards niche sectors, we still view baseline tariffs with some sectors seeing increased tariffs as likely.

TACO (Trump Always Chickens Out) acronym traders will see a tougher stance from Trump to resolve the overarching trade deficit issue with China, particularly the dumping of Chinese goods.

AI, defense technology, chips, and rare earth minerals are at the center of these discussions. There will be targeted controls on exports of chips from the US and exports of rare earth minerals on the Chinese side, despite the current framework and deals agreed. In our view, these controls will be phased out until agreements are finalized, to maintain leverage and show TACO acronym backers that Trump is not “chickening out,” but rather maintaining a strong stance while negotiating trade deals with China and other countries.

In our analysis, despite positive headlines, the overhanging uncertainty has not dissipated. In fact, there is clarity that President Trump is willing to take the difficult road to negotiate from an apparent position of strength. Would this result in extension of trade deadlines or temporary increase in tariffs followed by an extension of deadlines? This remains to be seen!

If May CPI comes in lower than expectations, this will be a nudge in the direction that tariffs are not translating into higher inflation. We may see a rally in index futures.

On the contrary, any increase in CPI above the previous 2.3% YoY increase will be seen as tariff-induced inflation.

In our analysis, given lower energy prices, rent inflation stabilizing at levels last seen in late 2021, and services inflation in the US trending lower from the peak in January 2023, we are seeing embedded inflation in the prior two months and this may remain sticky in today’s release. However, any stability with lower energy prices seen in the prior month will point to a lower inflation print overall.

Comment with your favorite trade idea from our past trade ideas and what you would like to see more of.

ES Trade Idea and Upcoming NFP ReportCME_MINI:ES1!

• What has the market done?

ES futures are lagging compared to tech heavy index NQ futures. ES futures are still below yearly open. Yearly open has been a strong area of resistance since the rally of April 6th Lows in futures complex.

• What is it trying to do?

ES futures are in consolidation mode, building value higher. VPOC has shifted higher since the gap up from May 11th open. VPOC and 0.786 fib level provide a base for a continuation higher.

• How good of a job is it doing?

Markets seem to be slowing its rally. After such a strong rebound, participants are wary of any pull-backs. Although a strong trend higher, consolidation or a pullback is not illogical at these levels.

• What is more likely to happen from here?

o Scenario 1: Hold steady and NFP provides needed boost for markets to get across yearly open resistance and climb higher.

o Scenario 2: A mixed NFP report may point towards further consolidation. Key level 5873 as support on move lower before reverting higher.

o Scenario 3: A hawkish NFP report that signals higher for longer rates, may be interpreted by market participants as less monetary stimulus and dwindling rate cut bets for this year. We anticipate a sell-off towards 0.618 fib level in this scenario, moving to the lower edge of micro composite volume profile.

In all the above scenarios, there is a clear LIS at yearly open. Other key levels are defined cleanly on the higher time frame. Important thing for traders to note here is to trade what you see and not what you think. Having an alignment between fundamentals and technicals is sound but the markets do what they do, and price moves where it should. Painting narrative to any move may sound fancy but it gets less important at intraday time frames in our opinion. Hence why we view all this considering auction markets and volume profile.

Glossary:

ES - emini-S&P 500 Futures

NQ - emini-NASDAQ 100 Futures

VPOC - Volume Point of Control: The most traded price by volume in a given range. Represents acceptance or consensus

NFP - Non-Farm Payroll: Released by the US Department of Labor around the 1st Friday of every month. It reports on Unemployment, Productivity and other key metrics. Key economic release

LIS - Line In the Sand: A key zone that might tip buyers or sellers to act to cover risk and might change the overall bias of our analysis

MES1!/ES1! Day Trade Plan for 05/06/2025MES1!/ES1! Day Trade Plan for 05/06/2025

📈 5625 5638 5650

📉 5614 5602 5590

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

SPY Day Trade Plan for 05/06/2025SPY Day Trade Plan for 05/06/2025

📈 560.55 562.50

📉 556.64 554.69

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

SPY Day Trade Plan for 05/01/2025SPY Day Trade Plan for 05/01/2025

📈 562.70 565.60

📉 557 554.30

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

MNQ1!/NQ1! Day Trade Plan for 04/29/2025MNQ1!/NQ1! Day Trade Plan for 04/29/2025

📈 19560 19685

📉 19185 19060

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

MES1!/ES1! Day Trade Plan for 05/01/2025MES1!/ES1! Day Trade Plan for 05/01/2025

📈 5670 5695

📉 5613 5600

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

MES!/ES1! Day Trade Plan for 04/29/2025MES!/ES1! Day Trade Plan for 04/29/2025

📈 5555 5580

📉 5500 5475

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

MES!/ES1! Day Trade Plan for 04/25/2025MES!/ES1! Day Trade Plan for 04/25/2025

📈 5530 5560

📉 5475 5445

Thanks to all my followers! Truly appreciate the support!

Please like and share for more NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

MES1!/ES1! Day Trade Plan for 04/23/2025MES1!/ES1! Day Trade Plan for 04/23/2025

📈 5512

📉 5440

Thanks to all my followers! Truly appreciate the support!

Please like and share for more NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

MES!/ES1! Day Trade Plan for 03/18/2025MES!/ES1! Day Trade Plan for 03/18/2025

📈5740. 5760

📉5680. 5660

Like and share for more daily ES levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

ES Morning Update March 18thYesterday, the plan for ES was straightforward: rally to ~5755 (adjusted for the June contract, previously 5703 on March) to back-test the 3-month megaphone breakdown from last Monday. The market followed through with an 88-point rally to that level before selling off.

As of now:

• 5720 (reclaimed) and 5698 are key supports

• Holding above keeps 5739 and a second test of 5754 in play

• If 5698 fails, look for selling pressure toward 5668

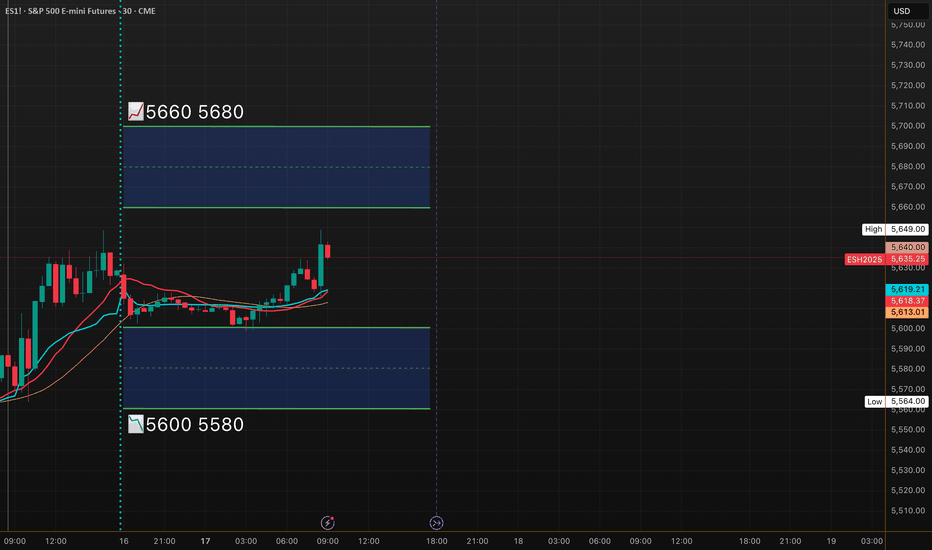

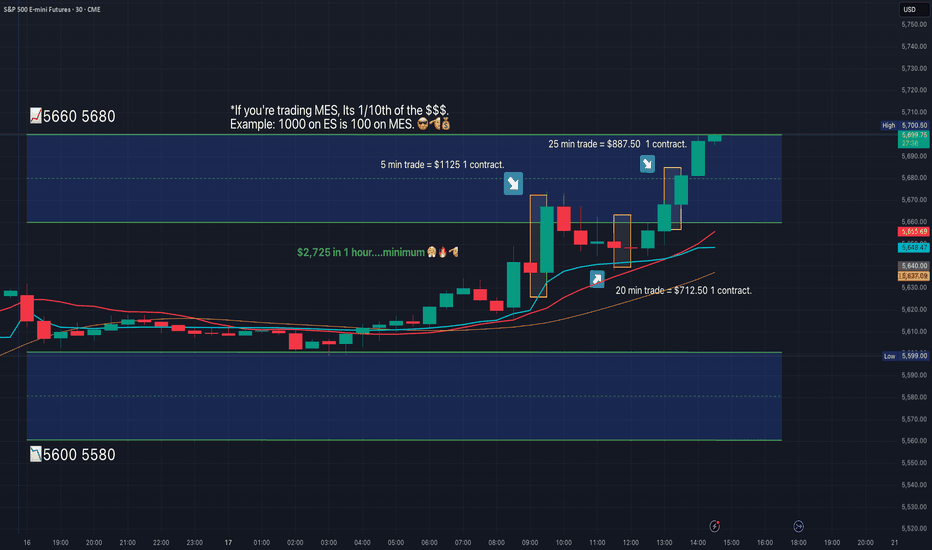

MES!/ES1! Day Trade Plan for 03/17/2025MES!/ES1! Day Trade Plan for 03/17/2025

📈5660. 5680

📉5600. 5580

Like and share for more daily ES levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

MES!/ES1! Day Trade Plan for 03/14/2025MES!/ES1! Day Trade Plan for 03/14/2025

📈5600 5640

📉5560 5520

Like and share for more daily ES levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

ES Morning Update March 14thYesterday was all about 5558 in ES. After a drop to 5512 support, bulls needed to reclaim 5558 for upside. That level was tested twice before a sell-off, but once it cleared at 8:30 PM, buyers stepped in, pushing the market +20 points higher.

As of now:

• 5598, 5615 are the next upside levels as long as 5558 (now weaker) holds

• A break below 5558 opens the door for a drop to 5548, then 5533