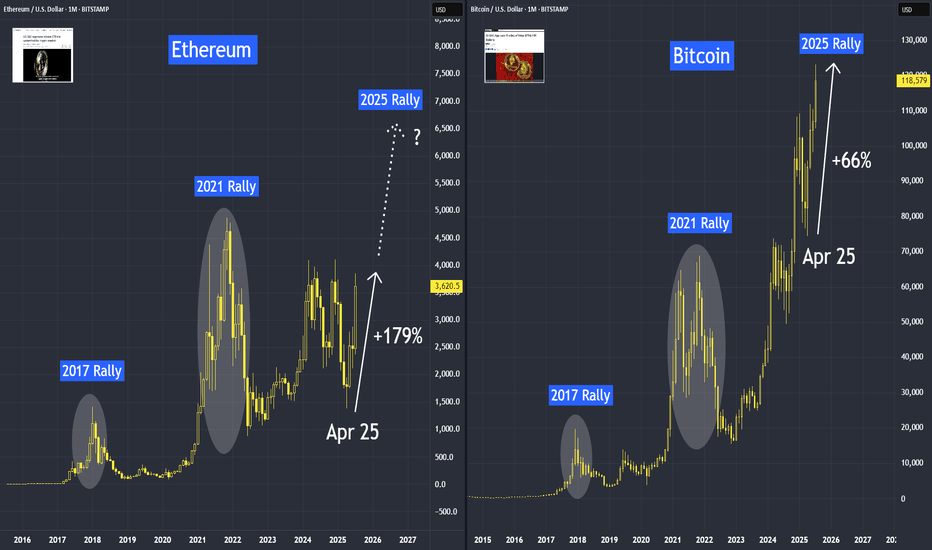

Cup and Handle Setup in Ethereum Since April trough, Ethereum has risen by 179%, delivering a higher rate of return than Bitcoin at 66%.

But most of our attention is on Bitcoin, breaking above the 120,000 level.

Why is Ethereum quietly gaining ground —and what does the future hold for Ethereum?

It's video version on its trading strategies:

Mirco Bitcoin Futures and Options

Ticker: MET

Minimum fluctuation:

$0.50 per ether = $0.05 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

MET

Ethereum is Trending HigherSince April trough, Ethereum has risen by 179%, delivering a higher rate of return than Bitcoin at 66%. But most of our attention is on Bitcoin, breaking above the 120,000 level.

Why is Ethereum quietly gaining ground —and what does the future hold for Ethereum?

Mirco Bitcoin Futures and Options

Ticker: MET

Minimum fluctuation:

$0.50 per ether = $0.05 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

GEHC topped out in an ascending channel SHORTGEHC is a new spinoff from General Electric. It has great success thus far with good earnings

reports and no dependency on debt and interest rates. It has been on an uptrend since

the November earnings. At present it is correcting. I will play this going short on shares while

hedging with a long term call options. I am in GE calls out into 2026. A long term call option

will yield a lower capital gains tax if closed beyond 12 months. Accordingly, I will go out 15-16

months as I typically want to close early to avoid the effects of time decay. I have high

expectations for GEHC. I do not think it will disappoint. When price reaches the running mean

anchored VWAP I will close the shares and run only the options.

FB Potential For Bullish Bounce | 21st April 2022Price is near to the key pivot level. We can see a potential for bullish bounce from buy entry level of 198.49 which lines up with 78.6% Fibonacci retracement towards the take profit level of 212.11 which lines up with 38.2% Fibonacci retracement and 100% Fibonacci projection . Otherwise, price might break through key pivot structure and head towards the stop loss level of 190.42 which is a previous horizontal swing low support.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Every. Target. Met...in less than 24 hours. Not much to say other than refer to my previous analysis on this coin less than 24 hours ago.

Some of you may be thinking..."well, a broken clock is right twice a day, what does 1 successful trade mean?"

My response?

Stay tuned to find out if I am a broken clock or not ;)

Happy trading! More trade ideas to come.

METLIFE - DAILY CHART Hi, today we are going to talk about MetLife and its current landscape.

MetLife is poised to receive increasing attention from the market as relevant events are taking place. The Metropolitan Life Insurance Company agreed to pay a $10 million SEC fine for had broken federal securities laws related to books, records, and internal accounting controls. The company mistake resulted in the insurer's failure to pay thousands of workers their monthly pension benefits. Damages to MetLife credibility weren't felt by their shares that are having a good year so far.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

$MET METRONOME: Promising LOW CAP Coin Ready To Break OutMetronome is a VERY promising coin that is under the radar.

Total Supply ONLY 9,058,676 MET

Current Market Cap: $10M

Grab a bag and HODL!

MET analysis, Elliott Wave, Fib, wedgeMET seems to be going through a solid breakout from a downwards channel. This retracement has also occurred at 38.2%, allowing for decent upwards movement. There has also been an increase in volume in the past 2 days, allowing for the change in the direction of the price action. According to my Elliott Wave analysis, the stock is going through it's own middle of a 3rd wave that is part of a large new 3rd wave taking place (after a complete 1-2-3-4-5, A-B-C). There is also a rising wedge, or a triangle tilted upwards, in technical analysis, this indicates that the price will move lower. However, the stock is attempting to breakout towards the upper part of the triangle, rather than remaining on the lower area where it could continue to further downside. According to GuruFocus, there are issues with the stock's fundamentals, as revenue declines, debt increases, income decline, and other signs that the stock is approaching major resistance levels while dividends are at lows. The company has growth issues, along with problems in their financials. There are numerous large investors with high amount of shares in this company, however the majority of recent trades have been sales of their shares in the company. There are some buyers and investors increasing their amount of shares, but these trades can possibly be the necessary change in the share price to allow prices to continue on higher rather than falling too far to dangerous levels.

This analysis comes after Trading View user, 'pardis' has identified a breakout. I have not yet entered long, however I plan to attempt an entry which can lock in profits, while adding to the position later on. This may be considered 'picking tops and bottoms,' however with a day trading position rather than an 'investor outlook' on the company it isn't irrational to try an entry which may or may not work out.

Bears are out For MetLifeOn April 28, 2017, the MetLife 20 day moving average (DMA) crossed below its 150 day moving average (DMA). Historically this has occurred 24 times and the stock drops a minimum of 1.184%. The median drop is 3.894% and maximum drop is 10.709 % over the next 12 trading days.

When we take a look at other technical indicators, the relative strength index (RSI) is at 48.2268. RSI tends to determine trends, overbought and oversold levels as well as likelihood of price swings. I personally use anything above 75 as overbought and anything under 25 as oversold. The current reading declares the stock has been neutral but also trending down since the election last November.

The true strength index (TSI) is currently -9.0016. The TSI determines overbought/oversold levels and/or current trend. I solely use this as an indicator of trend as overbought and oversold levels vary. The TSI is double smoothed in its calculation and is a great indicator of upward and downward movement. The current reading declares the stock has been moving down for most of 2017.

The positive vortex indicator (VI) is at 0.8072 and the negative is at 0.9669. When the positive level is higher than 1 and higher than the negative indicator, the overall price action is moving upward. When the negative level is higher than 1 and higher than the positive indicator, the overall price action is moving downward. The current reading declares the stock has been moving down but with both indicators below 1, anything can happen.

The stochastic oscillator K value is 53.4444 and D value is 54.8659. This is a cyclical oscillator that is highly accurate and can be used to identify overbought/oversold levels as well as pending reversals and short-term activity. I personally use anything above 80 as overbought and below 20 as oversold. When the K value is higher than the D value, the stock is trending up. When the D value is higher that the K value the stock is trending down. The current reading declares the stock did not make it to overbought territory before recently reversing downward. The highs reached for the stochastic have been trending lower since the election, so a reversal at the current level is very possible.

Considering the moving average crossover, RSI, TSI, VI and stochastic levels, the overall direction appears to be pointing down. Based on historical movement compared to current levels and the current position, the stock could drop another 2.23% if not more over the next 12 trading days.