META’s Best Correction in a Long Time – A Prime Buying Opportuni🔹 Current Price: $583.39

✅ TP1: $620 – Short-Term Rebound to Mid-Channel Resistance

✅ TP2: $720 – Retesting Previous Highs

✅ TP3: $765+ – Analyst Average Target, Aligning with Recovery Patterns

🔥 Why Are We Bullish?

1️⃣ Analyst Ratings & Price Targets

Strong Buy Consensus: Major institutions maintain bullish ratings on META.

Average Price Target: $765 → +29% upside from current levels.

Price Target Range: $580 (low) to $935 (high).

JPMorgan Calls META a Top Pick: Meta and Spotify named as two of the best investment opportunities currently.

2️⃣ Market Correction Presents a Strong Entry Point

Biggest pullback since September 2023 – The last time META corrected 23% in two months, it fully recovered within two months and resumed its uptrend.

META is now at major trendline support , historically a strong accumulation zone.

RSI indicates potential reversal , aligning with previous rebounds.

3️⃣ AI Expansion & Business Growth

Meta’s Llama AI Model Hits 1 Billion Downloads , reinforcing the company’s dominance in AI innovation.

Heavy investments in AI & machine learning strengthen long-term growth prospects.

4️⃣ Strategic Growth & Revenue Expansion

Strong Ad Revenue Growth: Despite market volatility, Meta’s ad business remains a cash machine.

Metaverse & Reality Labs: Long-term investments positioning Meta as a leader in next-gen digital experiences.

New Revenue Streams from AI & Cloud-Based Services: Expected to drive earnings in 2025 and beyond.

📌 Conclusion

META’s 23% correction is presenting a rare discounted entry opportunity in an otherwise strong bullish trend. With AI growth, ad revenue expansion, and a rebound pattern that historically favors a recovery, META remains one of the best opportunities in the tech sector right now.

Meta

Meta’s Wild Ride: Skyrocketing to $866 or Crashing to $374 Get ready, traders—Meta’s at a crossroads! If we smash past $64.70, buckle up for a thrilling climb to $866 as AI hype and Metaverse dreams fuel the fire. But if the bears take over, we could tumble hard to $442—or even skid down to $374. This isn’t just numbers; it’s a rollercoaster of hope, greed, and nail-biting suspense. Which way will it break?

Kris/Mindbloome Exchange

Trade Smarter Live Better

META: Key support! Watch out for a possible opportunity!For a few weeks now we have been experiencing PANIC in the markets due to Trump's AGGRESSION with tariffs. The question we all have to ask ourselves is whether the USA will enter a RECESSION and ALL COMPANIES will continue to fall sharply, or on the contrary, if Trump will negotiate and therefore the markets will RECOVER.

From my point of view, TRUMP has become too aggressive and IS ALREADY STARTING TO WORRY ABOUT SOME COMMENTS OF THE LAST FEW DAYS, and HE WILL NEGOTIATE!! Regardless of this, there are companies that despite the great fall suffered, REMAIN BULLISH AND POSITIVE in the year, as is the case of META, which has risen by +2% in 2025.

The graph above SHOWS YEAR BY YEAR the trend and WHEN a CHANGE IN TREND occurs, in this way we will see more clearly the current situation of the company this year. In the graph below with H4 time frame we see a ZOOM of the current situation to know more precisely when a floor is formed and the retreat phase in which it is immersed ends.

If we look at this year 2025, its TREND is still BULLISH in a RECOIL PHASE and at this moment it is in A VERY IMPORTANT SUPPORT that it should respect (zone 580) in order NOT TO START A CHANGE IN TREND.

If the zone respects it and a BOTTOM is formed, the price will quickly rise towards its first resistance at 641, which if it is surpassed WE WILL SEE NEW MAXIMUMS in the value.

---> What do we do?

1) If our PROFILE is AGGRESSIVE, we enter LONG IN THE CURRENT ZONE.

2) If our PROFILE is CONSERVATIVE, WE WAIT for a floor to form or for the price to surpass the 641 zone.

-------------------------------------

Strategy to follow IF OUR PROFILE IS AGGRESSIVE:

ENTRY: We will open 2 long positions in the current zone of 610

POSITION 1 (TP1): We close the first position in the 640 zone (+5.5%)

--> Stop Loss at 568 (-6%).

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-6%) (coinciding with the 568 of position 1).

---We modify the dynamic Stop Loss to (-1%) when the price reaches TP1 (640).

-------------------------------------------

SET UP EXPLANATIONS

*** How do we know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the dynamic Stop Loss.

-->Example: If the dynamic Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% during increases, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very solid and stable price trends can be taken advantage of.

+405% day from $0.35 to $1.77 for $PSTV WOW 🔥 +405% from $0.35 to $1.75 NASDAQ:PSTV 🚀 What market sell off 🤷🏻♂️ we don't know anything about that, our strategy is getting us paid no matter the overall market circumstances 💪 It's been like this for over a decade

P.S. AMEX:SPY is at 200 moving average, if it cracks below it we could see NASDAQ:TSLA NASDAQ:NVDA NASDAQ:AMZN NASDAQ:GOOG NASDAQ:META and many others go way lower.

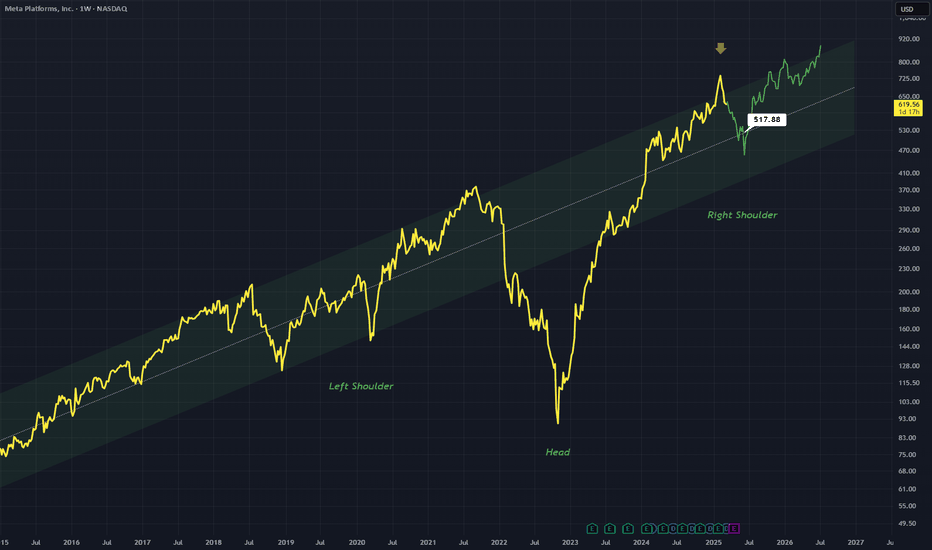

Meta - The Breakout Is About To Be Confirmed!Meta ( NASDAQ:META ) is attempting the breakout:

Click chart above to see the detailed analysis👆🏻

Over the past couple of months, we have been witnessing an incredible rally of about +750% on Meta. Looking at the long term reverse triangle pattern, this rally was not unexpected and such is the breakout. We still need to see confirmation, but then Meta will target the four digit level.

Levels to watch: $700, $1.000

Keep your long term vision,

Philip (BasicTrading)

Whole market drops but our strategy makes profitWhile the rest of the market drops our strategy delivers profitable day once again 👏

Buy Alerts were on NASDAQ:BCG NASDAQ:ESGL NASDAQ:MLGO

❌ No holding and hoping

✅ In and out at safest spots, exiting after pre-planned prices are reached 🎯

Nicely profitable day while NASDAQ:NVDA NASDAQ:TSLA NASDAQ:PLTR NASDAQ:META and even MARKETSCOM:BITCOIN end in deep red 🔻

META priced the new Channel Up bottom. Eyes $800 next.Meta Platforms (META) hit yesterday its 1D MA50 (blue trend-line) for the first time since January 02, while reaching the bottom of the short-term (dashed) Channel Up and the 1D RSI the November 15 2024 Low.

Since the 2-year pattern is also a Channel Up, this pull-back is a natural technical correction before the next Bullish Leg. Both previous rallies that started after long-term Accumulation Phases, then rallied by at least +45.10%.

As a result, we treat this correction as the most optimal medium-term buy opportunity to target $800 (top of dashed Channel Up and +45.10% from the Accumulation Phase bottom).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

META Technical Analysis: Potential Buy OpportunityMETA is currently exhibiting a bullish trend, trading above both its 100-day SMA and a key weekly trendline. The stock is currently retracing, having recently tested the 0.5 Fib retracement level, a common area of support. The RSI is also synced with the price action, further supporting the bullish outlook. This pullback could present a favorable buying opportunity.

Trading Recommendations:

Buy 1 (CMP): 669

Buy 2: 642

Stop-Loss: Closing below 575

Take Profit 1: 738

Take Profit 2: Open

A stop-loss order placed below the last higher low, which is also positioned below the trendline, is recommended on a closing basis. A laddered buy approach is suggested to take advantage of potential further price dips. Happy trading!

META I Potential Long Opportunity Welcome back! Let me know your thoughts in the comments!

** META Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

$SPY $SPX OLD CHART BAR PATTERN COVID CRASH NOW!!!!Holy crap.... I just came across an old chart and literally in the nick of timeI tell you. All I'm going to say is... I'm a pattern chart trader and this is the COVID bar pattern attached to our daily from like a year ago almost and I loaded up an old layout to do work and boom... here we are... Good LUCK ... Not sure what the trigger will be but we are here.

META: 2nd Expansion Era targets $900 by the end of the year.Meta may have only now turne bullish on its 1D technical outlook (RSI = 56.480, MACD = 20.520, ADX = 63.183) but on 1W it has been on an exceptionally healthy bullish tech (RSI = 66274) since the October 2022 bottom. Ever since that was formed, Meta entered its 2nd Expansion era with similarities in price and RSI terms obvious with the 1st Expansion era of 2012-2018. As long as the 1W MA50 supports, we can see a similar Channel Up targeting $900 by the end of 2025.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

META’S Q4 2024—$META RIDES AI AND ADS TO VICTORYMETA’S Q4 2024— NASDAQ:META RIDES AI AND ADS TO VICTORY

(1/9)

Good evening, Tradingview! Meta’s Q4 2024 earnings landed—$48.4B revenue, up 21% YoY, topping estimates 📈🔥. A 16.5% stock rally seals the deal. Let’s unravel NASDAQ:META ’s big win! 🚀

(2/9) – AD & AI POWER

• Q4 Revenue: $48.4B, 21% jump from last year 💥

• Profits: Nearly $21B—up 49%—efficiency shines 📊

• Ad Surge: Biggest driver, fueling the cash flow

AI’s humming, ads are king—Meta’s on fire!

(3/9) – KEY WINS

• AI Spend: $60B+ lined up for ‘25 🌍

• Users: 3.35B daily logins—record crowd 🚗

• Meta AI: 700M monthly fans—AI’s buzzing 🌟

Stock’s tearing up the charts—hot streak alert!

(4/9) – SECTOR SMACKDOWN

• Forward P/E: ~28x, leaner than Amazon’s 33x

• Ad Game: 21% growth beats Google’s 12% 📈

• User Pull: Social king—rivals can’t touch it

NASDAQ:META ’s a growth beast—hidden value or hype? 🌍

(5/9) – RISKS ON THE HORIZON

• Regs: EU and U.S. eyeing fines—trouble brews? 🏛️

• AI Bet: $60B spend—payoff’s a question ⚠️

• Saturation: 3.35B users tough to top 📉

High stakes in this tech showdown!

(6/9) – SWOT: STRENGTHS

• Ad Muscle: $46.8B in Q4—ad king rules 🌟

• AI Edge: 700M Meta AI users—future’s here 🔍

• Cash Pile: $52B free flow in ‘24 🚦

NASDAQ:META ’s flexing serious firepower!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Metaverse burns SEED_TVCODER77_ETHBTCDATA:5B , AI costs stack 💸

• Opportunities: Threads hits 100M+, AI ads shine 🌍

Can NASDAQ:META spin risks into wins?

(8/9) – NASDAQ:META ’s Q4 rocks—what’s the vibe?

1️⃣ Bullish—AI and ads keep it roaring.

2️⃣ Neutral—Growth’s cool, risks hover.

3️⃣ Bearish—Big spends clip its wings.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

Meta’s Q4 dazzles—$48.4B revenue, $21B profit, AI soaring 🌍🪙. 28x P/E vs. peers, but growth’s electric. Regs and AI costs loom—gem or gamble?

Riding Wave 5: Is $700 Just Around the Corner?Hey Realistic Traders, Will META Bullish Bias Continue ? Let’s Dive In....

In the Daily timeframe, META rebounded above the 38.2% Fibonacci level, marking the completion of wave 4. Within this wave, a Descending broadening wedge pattern was formed. Recently the price has broken out of the pattern. This breakout was further confirmed by a bullish MACD crossover, signaling increasing momentum and strengthening the case for a continued upward move.

Based on these technical signals, I foresee a potential upward movement toward the first target at $638. After reaching this level, a minor pullback is likely before the rally continues toward a new high at $700.

This outlook remains valid as long as the price holds above the stop-loss level at 550.00.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on META.

Why booze stocks are so cheap (part 1002)This analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

Now, I do not think Brown Forman will return to 32x earnings anytime soon — if ever — but if you even half the implied return from multiple expansion you still have plenty of upside.

Ditto Remy — I do not love Remy because Cognac, for lack of a better term, is screwed. But there’s still obviously value there and it trades on a very depressed multiple — what’s to say the family has had enough and finds a buyer?

Finally, Diageo. Less upside but more certainty — Guinness sells very well among Gen Z while their spirits portfolio continues to ebb along, if only growth in the low single digits.

Valuations always tend to normalise, especially for companies which make staples. Paying 30x earnings was always too much — I used to look at Brown-Forman enviously, and wish it were cheaper. Well, now it is! And nobody likes it. On chart is a couple of headlines from Barron’s.

I love to go counter-consensus to the media, because usually that’s a sign of peak pessimism. On chart are some headlines about Meta when everyone hated the stock in 2022/2023.

Obviously, the booze stocks are not Meta — Meta is a cash flow machine! Zuck wears a gold chain! Zuck would like us to know he is a Cool Guy!

But still — price drives narrative. Everyone was dissing Meta in 2022 (and I felt like an idiot buying it), now they love it. Ditto booze stocks. People aren’t going to stop drinking. That’s it. That’s the thesis.

New highs area +$1,000/share unlocked for NasdaqSeems like 2 months of sideways downtrending (since mid December) is over for Nasdaq.

Unless any surprise political shock news come out (we all know that can be a challenge with Trump) we could see Nasdaq reach $23,000 per share area in drawn upcoming green period.

This would also reflect directly on upward momentum for several bluechip stocks:

Apple Inc. NASDAQ:AAPL

Microsoft Corporation NASDAQ:MSFT

Amazon.com Inc. NASDAQ:AMZN

Alphabet Inc. NASDAQ:GOOGL

Meta Platforms Inc. NASDAQ:META

NVIDIA Corporation NASDAQ:NVDA

Tesla Inc. NASDAQ:TSLA

Intel Corporation NASDAQ:INTC

$Meta and U.S equity Bull Run Almost Finished? Was just having a little fun before bed and brainstorming on the NASDAQ:META chart. Our darling as of late. I love trying to find similarities and patterns between macro swings and cycles. Human psychology and business cycles have a way of repeating themselves pretty often. As they say, history doesn't repeat, but it rhymes.

This recent melt up reminds a lot of the price action NASDAQ:META saw in 2021-2022. RSI overbought both times, currently approaching the 2.618 fib when connecting them to major high and low points. Decreasing volume on the moves up.

There's a lot of other data to support a bear market may be on the horizon:

Weak housing data/stocks (I do see some outlier stocks in the housing sector).

The yield curve un-inversion which typically precedes major bear markets 6-12 months after un-inversion.

The dollar seems to want to keep going higher. However it has shown a lot of weakness here lately which could help fuel the rest of the bull market.

The unwinding of the Japanese Yen carry trade has seemed to play a big factor in U.S equities as of late. Every time the BOJ hikes interest rates, a lot of U.S. equities see pretty sizable bearish volatility shortly after.

Being the darling that NASDAQ:META has become, once this trend line breaks it will be a signal that everyone should be taking note of in my opinion. I think the risk of a bear market increases dramatically. Maybe we get a shallow or 2022 style bear market next year and continue to make one last lag into new highs in 2027.

Here are some ideas that could support that theory:

China seems to be coming out of a depression-style bear market and is beginning to inject liquidity into their economy. This could help give U.S. equities a little more juice to run higher for longer

chips could make a major comeback and fuel SPY/QQQ higher for longer.

Names like Google, Tesla and Amazon can continue to show strength and we could see a rotation into them.

Maybe we get some more significant quantum breakthroughs with the help of AI.

These are things to keep in mind, but I think the probabilities of this this bull market we've enjoyed since 2008 is A LOT closer to the end than the beginning.

I base most of my sentiment off the 18.6 year real estate/land cycle theory that I have been following since 2022. I also give a lot of credibility to U.S. yield curve un-inversions sending shockwaves through the global economic system.

What do you guys and gals think?