Metals

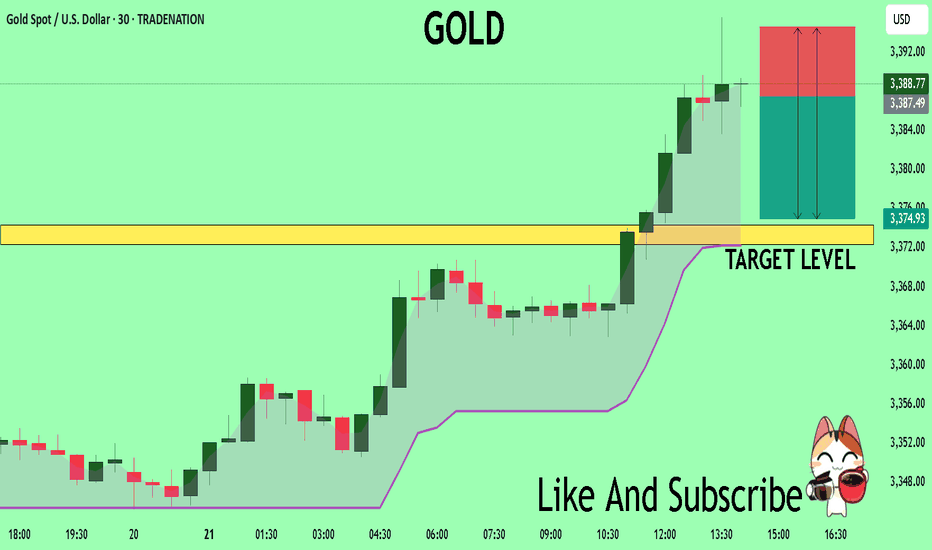

GOLD Technical Analysis! SELL!

My dear subscribers,

This is my opinion on the GOLD next move:

The instrument tests an important psychological level 3387.7

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3374.3

My Stop Loss - 3394.5

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

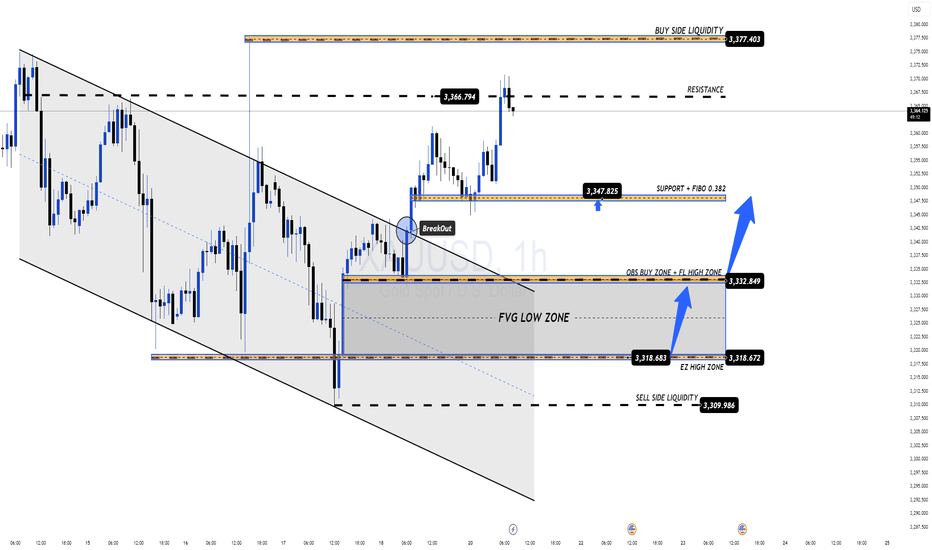

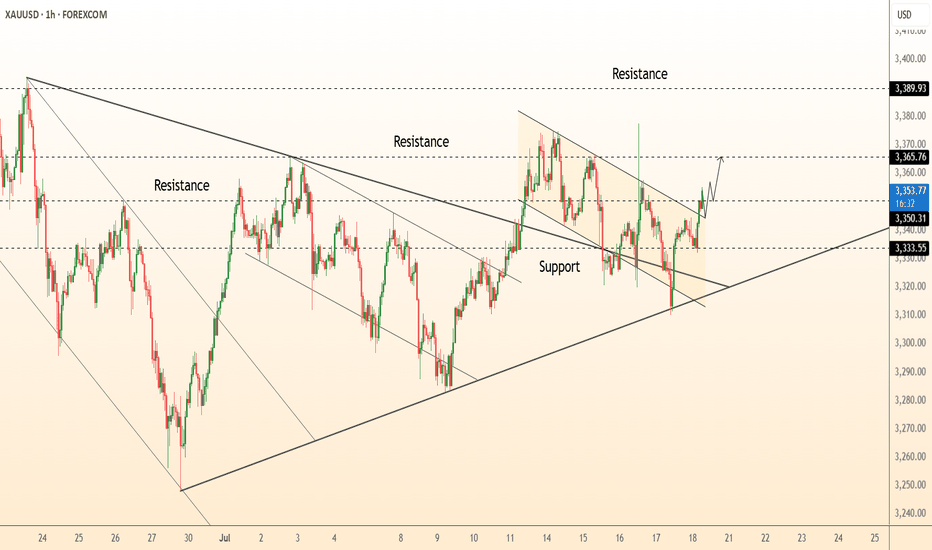

QUIET START TO THE WEEK, WATCH OUT FOR KEY RESISTANCE!🔔 GOLD PLAN 21/07 – QUIET START TO THE WEEK, WATCH OUT FOR KEY RESISTANCE!

🌍 Market Overview

Gold has bounced back strongly following a brief pullback late last week. The move comes as geopolitical tensions and global conflicts continue to escalate.

While this week may not feature high-impact economic data, macroeconomic risks and global uncertainty remain the primary drivers of price action.

📊 Technical Outlook

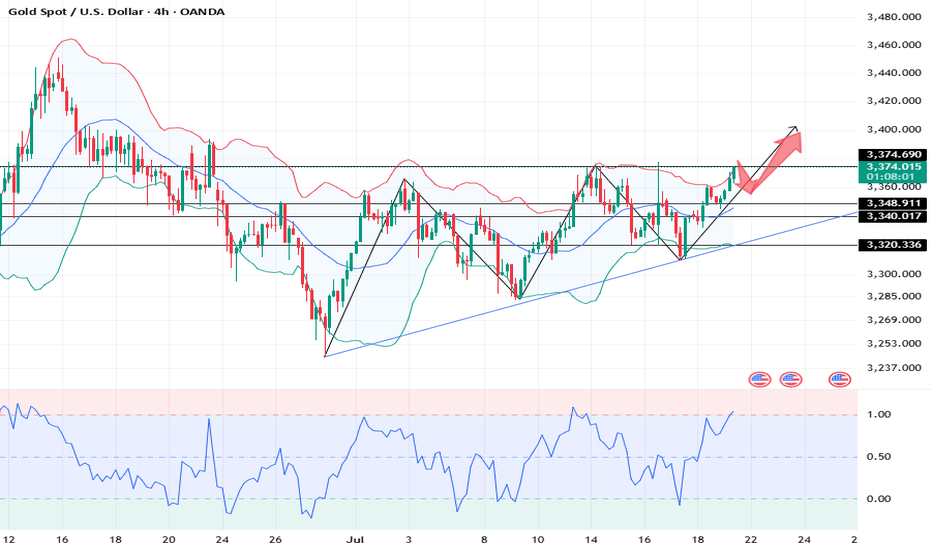

Price is currently approaching a strong resistance zone between 3377–3380, which aligns with a Buy Side Liquidity region.

💡 Sellers may step in here to push the price lower, aiming to fill FVG zones (Fair Value Gaps) left behind during the previous bullish rally.

⚠️ Entering SELL positions at this level is risky — only act upon confirmed reversal signals (candlestick rejection or volume-based confirmation).

🎯 Trade Setup

🟢 BUY ZONE: 3331 – 3329

Stop Loss: 3325

Take Profits:

3335 → 3340 → 3344 → 3348 → 3352 → 3358 → 3364 → 3370

🔴 SELL ZONE (confirmation required): 3377 – 3379

Stop Loss: 3383

Take Profits:

3372 → 3368 → 3364 → 3360 → 3350

📌 Key Notes

The 3347 zone acts as short-term support for bulls. If this level breaks, a move toward lower FVG liquidity zones becomes more likely.

Keep an eye on EU session volume for clearer short-term direction and better trade timing.

✅ Final Thoughts

Discipline is key. Stick to your TP/SL strategy to manage risk effectively during early-week volatility.

🛡️ Wishing everyone a successful start to the week. Stay patient, stay focused.

GOD BLESS ALL!

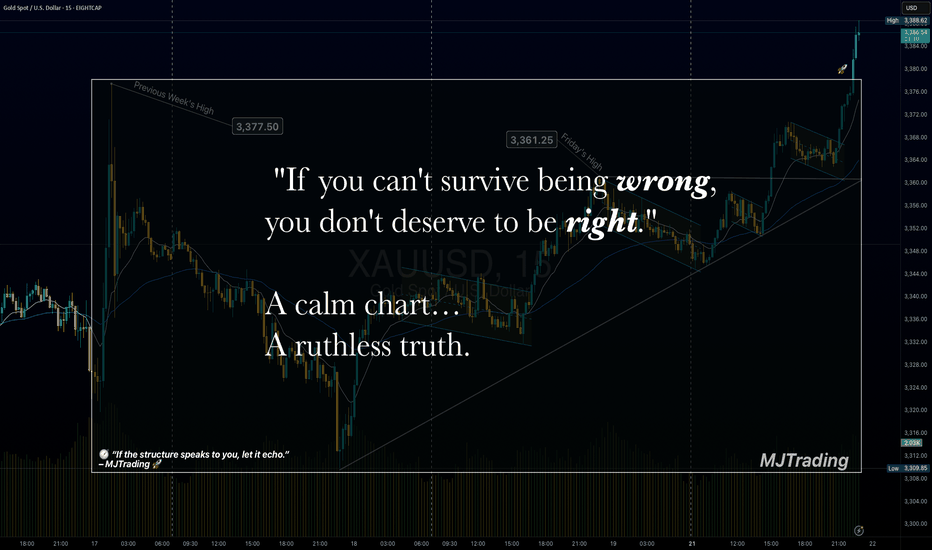

Survive first. Thrive later.🧠 Trading Psychology x Risk Management

"If you can't survive being wrong, you don't deserve to be right."

💬 A calm chart…

A ruthless truth.

Most traders obsess over being right.

But the market only rewards those who manage being wrong.

Risk control isn’t just technical — it’s emotional.

Survive first. Thrive later.

— MJTrading

Psychology Always Matters:

Click on them for notes in the caption...

#MJTrading #ChartDesigner #TradingPsychology #RiskManagement #MindfulTrading #CapitalPreservation #SmartMoney #XAUUSD #ForexDiscipline #15minChart #GoldAnalysis #MentalEdge #Gold

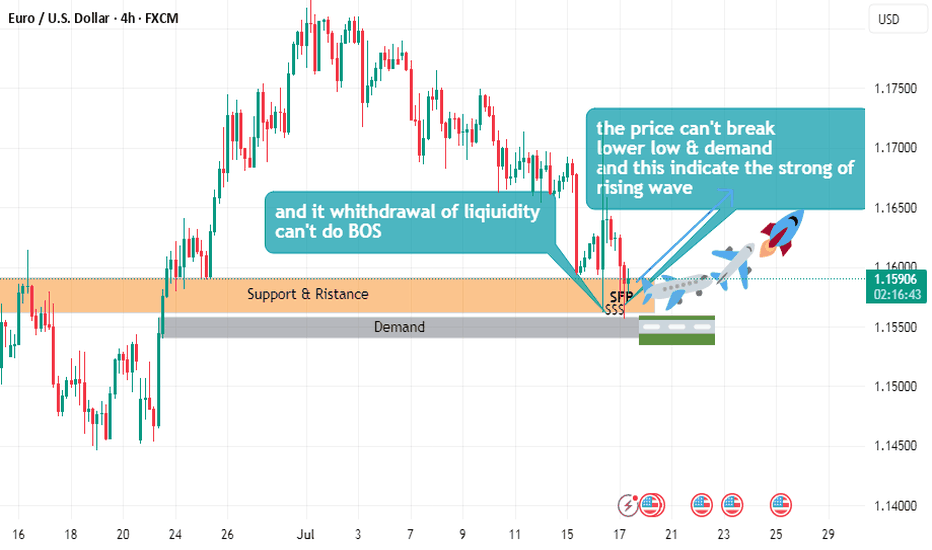

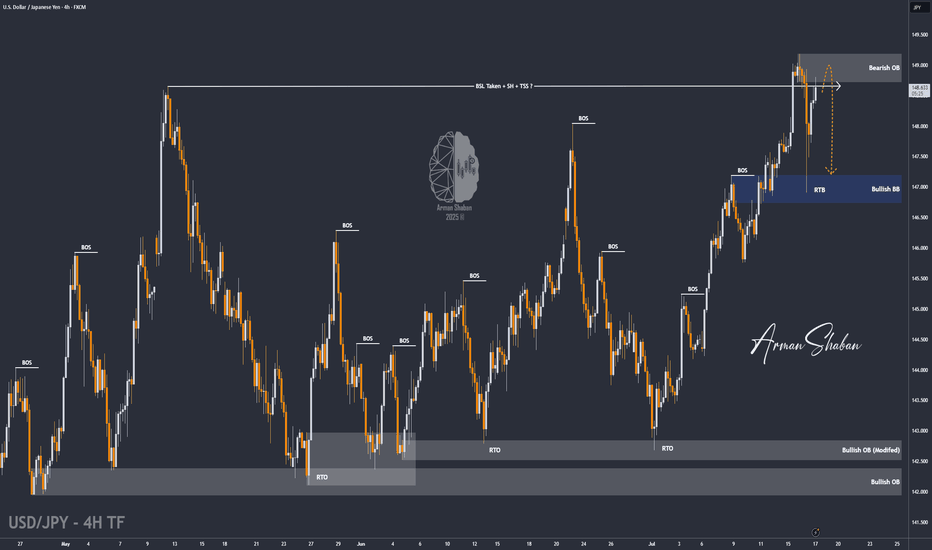

USD/JPY : Get Ready for another Fall ! (READ THE CAPTION)By analyzing the USDJPY chart on the 4-hour timeframe, we can see that after our last daily timeframe analysis, the price started its rally from the 144 zone and, as expected, hit all three targets at 145.5, 147.35, and 148.65, delivering over 500 pips in returns — even reaching as high as 149.2! Once the price broke above 148.65 and swept the liquidity above this level, it faced selling pressure and dropped to 146.9. Currently trading around 148.65, if USDJPY manages to hold below the supply zone between 148.65 and 149.2, we can expect further downside movement. This analysis will be updated with your support!

THE DAILY ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Two Retracement Levels Converge, Creating Strong ResistanceGold is hovering near 3370 amid a wave of tariff-related headlines over the past few days. After Trump’s threats toward Mexico, Canada, and the European Union, gold has been pushing toward higher levels. The latest warning came over the weekend, targeting both the EU and Mexico with a 30% tariff unless an agreement is reached by August 1. The EU trade commissioner described the proposed tariff as “absolutely unacceptable.”

So far, markets remain calm due to ongoing delays in the actual implementation of these tariffs. However, that could change as the August deadline approaches. Trump may view it as politically damaging to issue repeated threats without following through.

Meanwhile, the EU is preparing countermeasures in case the deadline passes without an agreement and the U.S. enforces the 30% tariffs. The EU’s plan targets $84 billion worth of goods, including automobiles, aircraft, wine, bourbon, agricultural and chemical products, plastics, and electrical equipment. The outcome of U.S.-EU negotiations could be a major driver for gold in July.

Another factor to watch is the recent surge in bond yields in Japan. The rising probability that Japan’s ruling coalition may lose its majority is creating uncertainty, especially since opposition parties favor tax cuts and increased government spending. Higher Japanese yields could trigger a reversal in carry trade flows, which might also push up yields in Europe and the U.S.

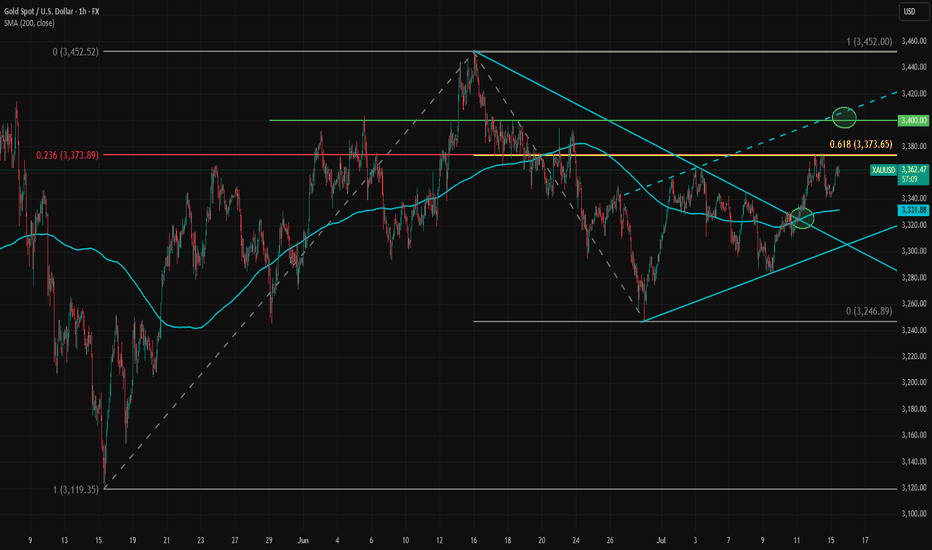

Gold pushed higher, breaking out of the bearish trendline drawn from the July 13 top, and reached the 3370–3375 area. So far, this zone has provided strong short-term resistance. The 3374 is significant, as it marks both the 23.6% Fibonacci retracement level of the May–June rally and the 61.8% retracement of the June 16–30 pullback. This confluence could make it a key pivot point for gold this week.

If this level is broken, gold could gain further momentum and move above 3400. On the downside, 3342 has been acting as a support level for now.

GOLD: Pre-market PrepSo for gold today, I see a lot of confluence around the prior week's high, prior day's high, and the prior value area high. We also had a poor high last Friday that we've clearly broken through.

Right now, we're in balance up above these key levels. My immediate plan is to continue going long up to the prior month's value area high. If we get a pullback to the confluence area, I want to take it up from there.

If the market opens and we accept back into the previous area, I'll be looking to go short from that area and take it down. That's my main analysis for gold today. Let’s trade smart, peace!

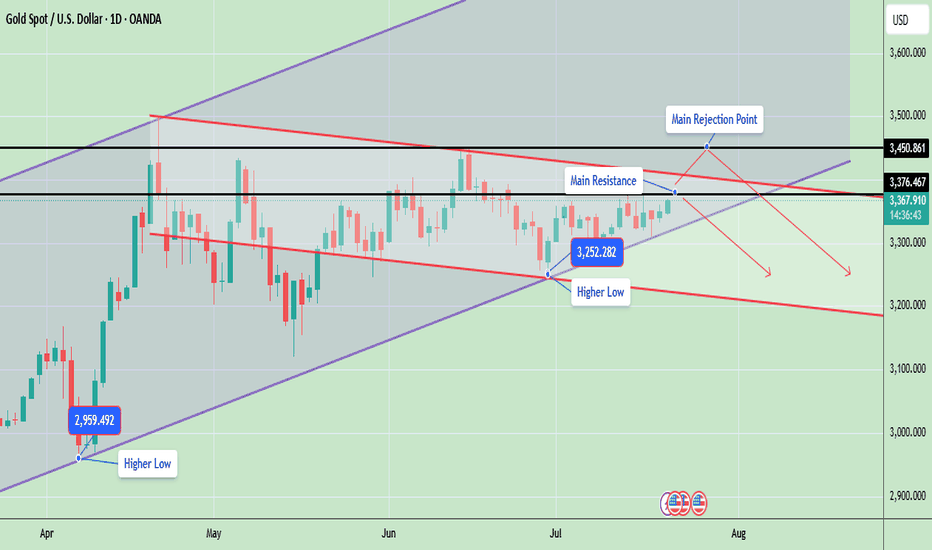

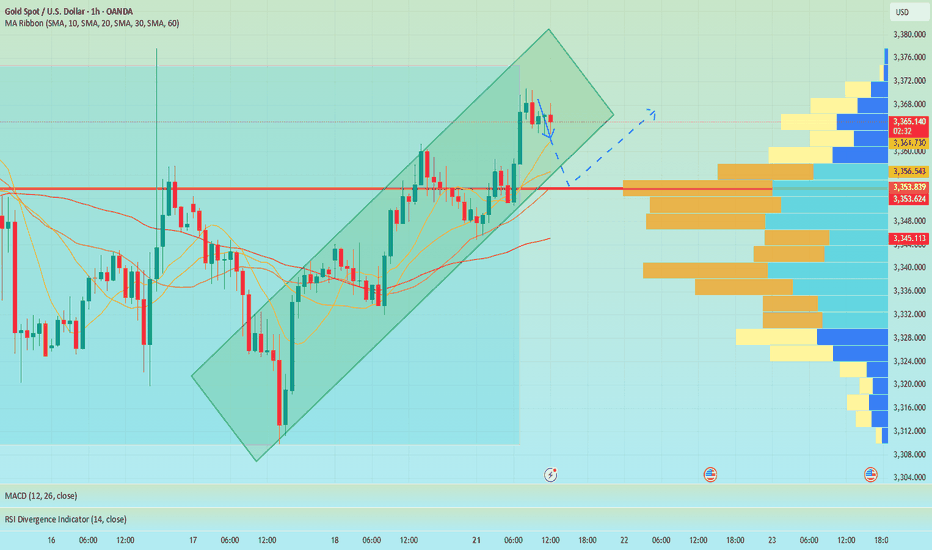

Gold Price Update – Testing Key ResistanceGold is currently trading around 3367, showing strong bullish momentum as it continues to form higher lows, which indicates an ongoing uptrend. The market structure is developing inside a rising wedge pattern, with the price consistently respecting both the ascending support and resistance lines.

Gold is now testing a key resistance zone between 3376 and 3450, an area that previously acted as a major supply zone and caused sharp rejections. A successful breakout and close above 3450 will likely confirm a bullish continuation and may open the door for a rally toward 3500 and possibly 3580. However, if gold fails to break this level, it could retrace back to the 3300 or 3250 support zones, especially if a rejection candle forms in the daily timeframe.

📊 Key Technical Highlights:

- Price has approached the upper resistance boundary of the wedge.

- Daily candle is bullish, indicating strong buying momentum.

- However, unless price closes above 3,376–3,450, there’s still a risk of rejection from the top channel and a pullback toward 3,300–3,250.

🔑 Key levels to watch:

- Gold is currently trading around $3,367, just below a crucial horizontal resistance at $3,376

- A strong breakout above $3,376, and especially above $3,450, could open the door for further bullish movement toward the $3,500–$3,600 range, following the upper trendline of the ascending channel.

- On the downside, if price fails to hold the higher low at $3,252, a drop toward $3,200 or even $3,100 is possible aligning with the downward red trendline.

- The structure remains bullish overall, as price is still making higher lows and staying within the rising channel

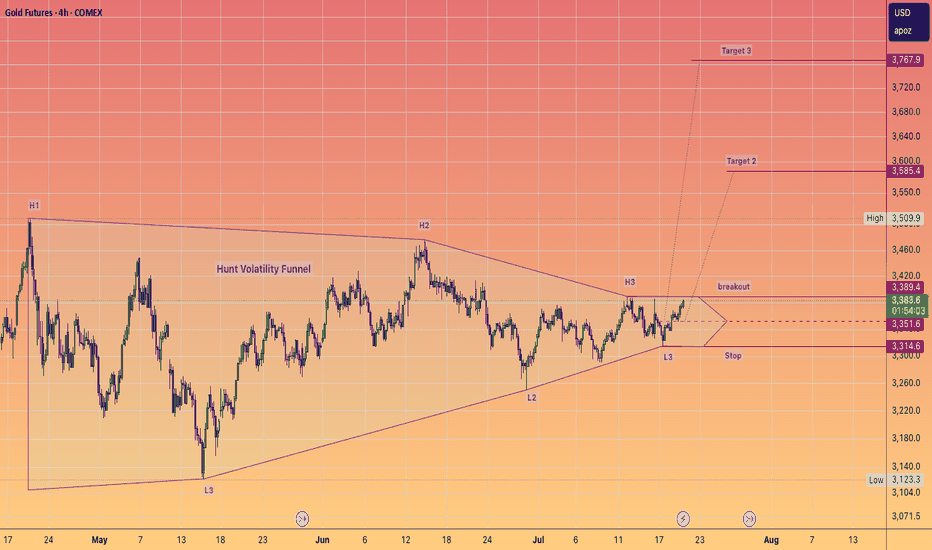

📊 Weekly Gold Chart Analysis

Gold is currently trading around $3,368, forming a symmetrical triangle pattern on the weekly timeframe. This pattern typically indicates a period of consolidation before a potential breakout in either direction. The price is getting squeezed between lower highs and higher lows, which is a sign of decreasing volatility and approaching breakout.

🔑 Key Technical Insights:

- ✅ Current Structure: Price has been consolidating within a triangle since April 2025 after a strong upward move. It is now near the apex of the triangle, suggesting a breakout is imminent—most likely in the next 1–2 weeks.

🔼 Bullish Breakout:

- If gold breaks above the triangle resistance (~$3,385–$3,393), it could trigger a sharp rally.

- Upside targets post-breakout: $3,450, $3,500, $3,600+ (if momentum continues)

🔽 Bearish Breakdown:

- A break below the triangle support (~$3,335–$3,325) may lead to a deeper correction.

- Downside targets post-breakdown: $3,285, $3,200

- Possibly $3,100–$3,050 if bearish sentiment intensifies

📉 Volume Drop:

As typical with triangles, volume has likely decreased, signaling indecision. Once volume returns, it will likely confirm the breakout direction.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Gold 1H - Retest of channel & support zone at 3340After breaking out of the falling channel, gold is currently retesting its upper boundary — now acting as support. The 3340 zone is particularly important as it aligns with the 0.618 Fibonacci level and high volume node on the visible range volume profile. The price action suggests a potential bullish rejection from this area. With both the 50 and 200 EMA below price on the 1H, the short-term trend remains bullish. The 4H trendline further supports this setup. RSI is cooling off near the neutral zone, leaving room for another leg higher toward the 3377 resistance zone. If 3340 fails, 3324 (0.786 Fibo) becomes the next line of defense. Until then, the structure remains bullish following the successful breakout and retest of the channel.

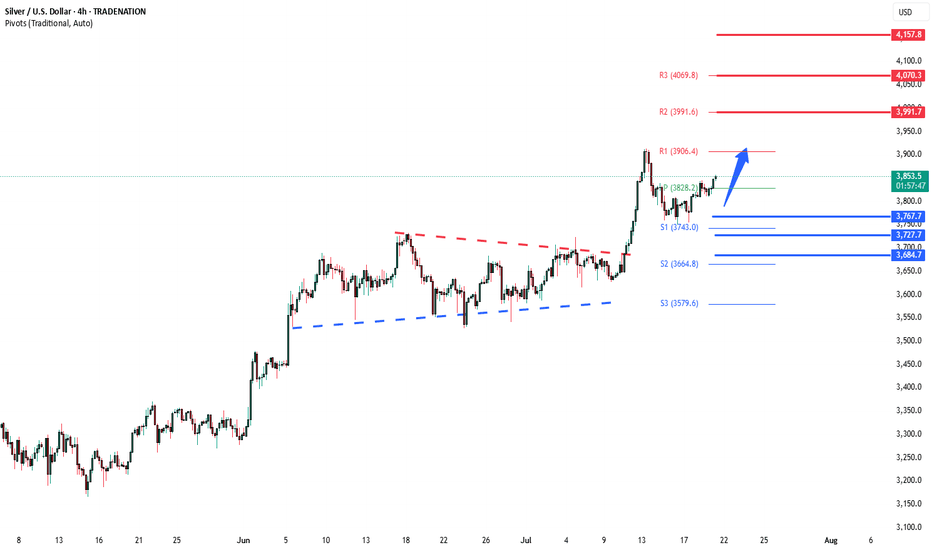

Silver Bullish continuation breakout supported at 3686The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at:

3814 – initial resistance

3865 – psychological and structural level

3920 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3686 would weaken the bullish outlook and suggest deeper downside risk toward:

3645 – minor support

3590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3686. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

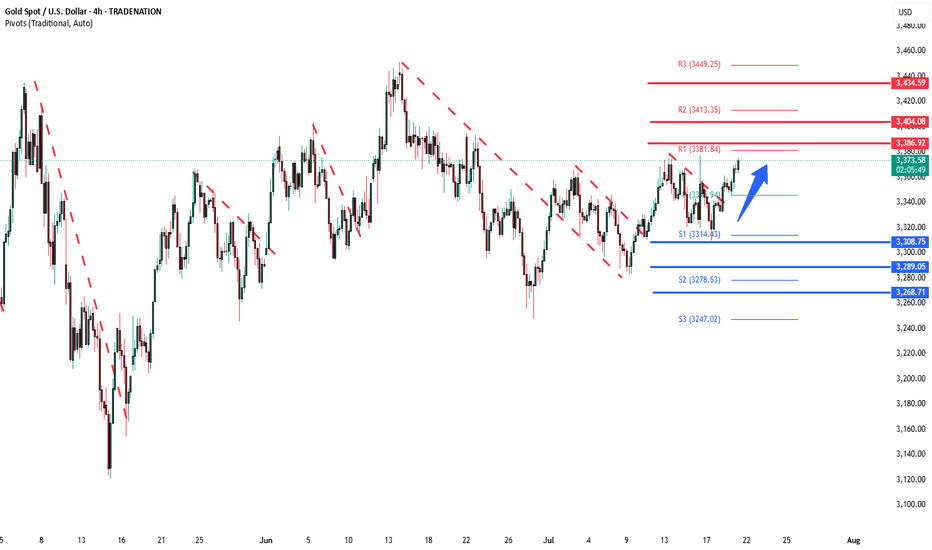

Gold bullish run continuation supported at 3308The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at:

3387 – initial resistance

3400 – psychological and structural level

3435 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3308 would weaken the bullish outlook and suggest deeper downside risk toward:

3290 – minor support

3268 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 3308. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

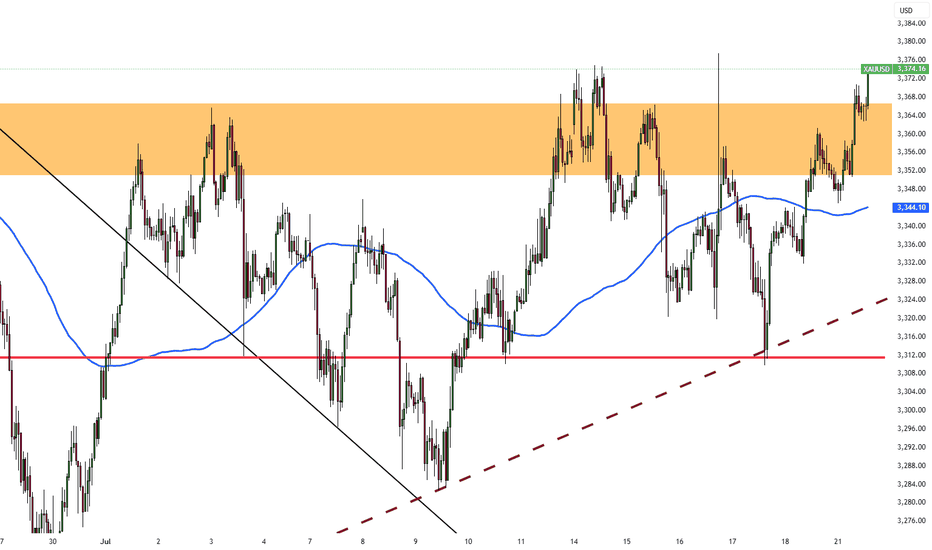

Gold is rising steadily.Gold technical analysis

Daily chart resistance: 3400, support: 3320

Four-hour chart resistance: 3390, support: 3340

One-hour chart resistance: 3375, support: 3348.

After bottoming out last Thursday, gold began to fluctuate upward on Friday, and the 1-hour bottom structure reappeared, which indicates that a new bullish opportunity has appeared again! It is worth noting that after breaking through 3344 on Friday, it continued to rise to around 3360. Today, after retreating to 3444 in the Asian session, it rose again. 3344 has become the top and bottom conversion position, so we can buy on dips based on the support of 3344. The second is the support at 3331.

In terms of intraday operations, the support below is 3344 and 3331, and it may not fall to around 3344. It is probably waiting to buy in the 3350-55 area. Pay attention to the key resistance around 3377 above. After the 15-minute top pattern appears, sell near this area.

Sell: 3375near

Buy: 3355near

Gold Nears $3,350 as Tariff Risks PersistGold rose to around $3,350 per ounce on Monday, extending its gains for a second session amid concerns over Trump’s tariff strategy. Commerce Secretary Howard Lutnick said a deal with the EU is likely but confirmed the August 1 tariff deadline. He also suggested smaller countries could face at least a 10% tariff, with some rates reaching 40%. Strong US data last week reduced expectations for an immediate Fed rate cut, capping gold’s gains. Markets now await comments from Fed Chair Powell and Governor Bowman for policy signals.

Gold faces resistance at 3380, with additional barriers at 3400 and 3430. Support levels are positioned at 3330, followed by 3295 and extending down to 3250.

Gold is waiting for a pullback to break through 3400In the short term, gold is stuck in a sideways trend near 3365. It is not recommended to enter this point regardless of long or short positions. It is expected that there will be certain variables in the NY period. If gold retreats and falls in the short term as we expect, it may first touch around 3361. If it falls below 3361, it is expected to touch around 3353, which is also the point I gave this morning to see support.

Judging from the market, our focus on the upper side is still the 3375-3385 resistance area. If it can be effectively broken through, it is expected to hit the 3400-3420 mark. Although the daily MACD is oscillating near the zero axis, the 4H market shows that the oscillation is strong. Our trading strategy remains unchanged in the short term. The pullback in the NY period provides an opportunity, and we can consider going long. If there is new news during the day that requires adjustment, I will notify you immediately. Bros, please be patient and wait for trading opportunities.

OANDA:XAUUSD

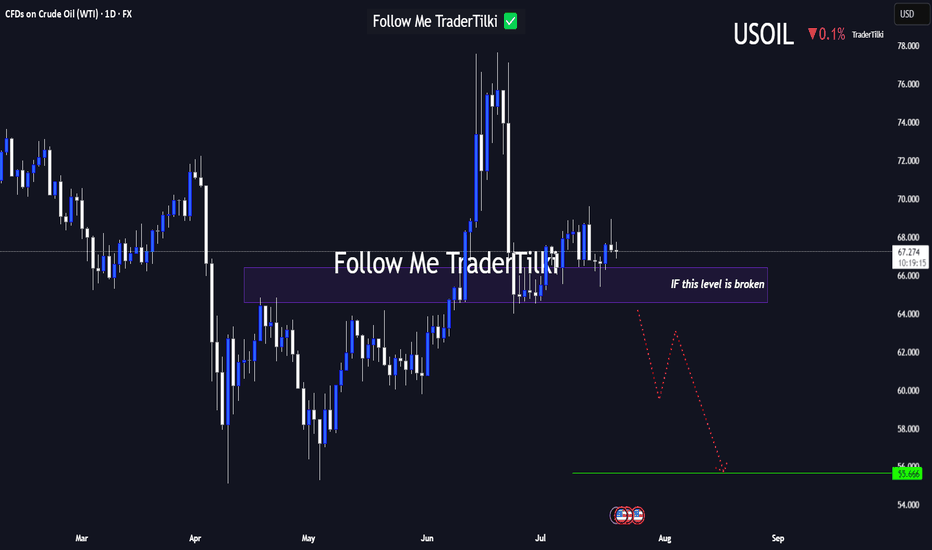

USOIL Under Technical Pressure: 1D Timeframe Breakdown Hey Guys,

The 66.584 level currently stands as the strongest support zone for USOIL. If this level breaks with a candle close, the next major target could drop to 55.666.

This setup is based on the 1-day timeframe. I highly recommend keeping a close watch on that key level.

Every like from you is my biggest motivation to keep sharing these insights. Thanks so much to everyone who’s showing support!

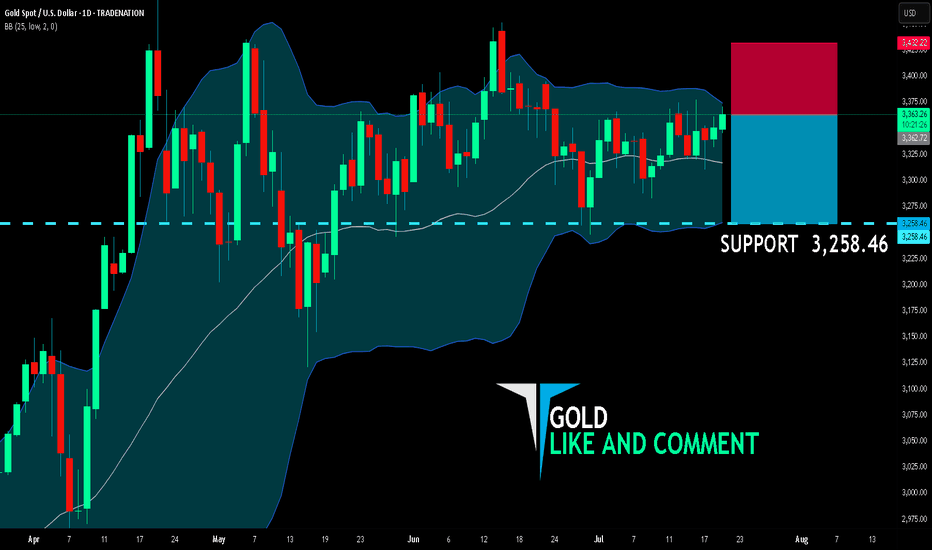

GOLD BEARS ARE GAINING STRENGTH|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,362.72

Target Level: 3,258.46

Stop Loss: 3,432.22

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

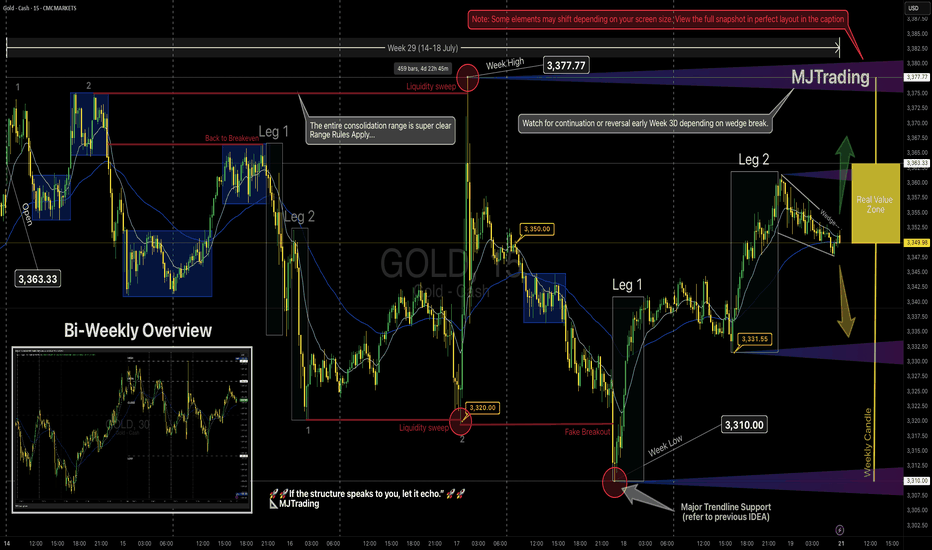

GOLD Weekly Recap (Week 29) – MJTrading View📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

Now that you have got the perfect layout let's dive in...

📈 GOLD Weekly Recap (Week 29) – MJTrading View

🕰 Timeframe: 15min chart with bi-weekly perspective

📅 Period Covered: July 14–18 (Week 29)

🎯 Visual Framework: Leg structure, range boundaries, liquidity sweeps, trendline holds, and Real Value Zone.

🔹 Weekly Summary

Open: 3,363.33

High: 3,377.77 (🔴 sweep: trapped buyers)

Low: 3,310.00 (🔴 sweep into key demand + touching the main ascending trendline )

Close: 3,349.98~3350 (lovely round level)

Structure: Entire week played inside a broad consolidation range, with sharp but failed breakouts on both extremes.

Range rules applied: traps, sweeps, compression — everything aligned for responsive trading.

📌 Key Observations

Early Week:

A double-top structure led to rejection from ~3,375 → slid into 3,350.

Price returned to breakeven but then flushed hard toward 3,320 via a clean 2-leg drop.

Midweek:

After forming a double bottom, price created a tiny liquidity sweep, then exploded to the weekly high.

The move above 3,377.77 was a textbook liquidity grab, immediately rejected.

This led to a slide toward the weekly low, tagging both the trendline and consolidation floor — forming a false breakout + reversal.

Late Week:

The low at 3,310 was swept cleanly (🔴), followed by a leg-based reversal:

Leg 1: Up to 3,331

Leg 2: Extended to ~3,360 before fading back inside the range.

Compression:

Price closed inside the Real Value Zone (weekly candle body) — just under the open, forming a tight wedge, hinting at breakout conditions for Week 30.

🟨 Weekly Candle Body

Open → Close of weekly candle reflects Real Value Zone .

Highs and lows were swept, but real commitment stayed within the body.

🧭 Key Levels to Watch – Week 30

Level Role

3,377.77 Weekly High / Liquidity Sweep (🔴 rejection)

3,363.33 Weekly Open (break & hold = bullish bias) / Previous Weekly High

3,350.00 Micro resistance / Mid-structure cap / Round Level

3,331-3 Leg 2 low & first reaction zone / Round Level

3,320.00 Breakdown support / Flush origin

3,310.00 Weekly Low / Major Demand (🔴 sweep)

3,400.00 Next possible main target

3,282.00 Previous Weekly Low

Dynamics: Both Uptrend and Downtrend Lines...

🧠 MJTrading Notes

Bias remains neutral inside the range.

A break & acceptance above 3,363 could trigger a re-test of the sweep zone (3,377+).

A breakdown below 3,331 puts 3,320 → 3,310 back on the map then 3,282.

Don’t force direction — let expansion confirm itself.

🧭 “If the structure speaks to you, let it echo.”

– MJTrading 🚀

#MJTrading #ChartDesigner #GOLD #LiquiditySweep #PriceAction #StructureTrading #Weekly #Chart #Consolidation #2legs

🧠 Psychology always matters:

SILVER SELLERS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,612.8

Target Level: 3,572.6

Stop Loss: 3,639.3

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

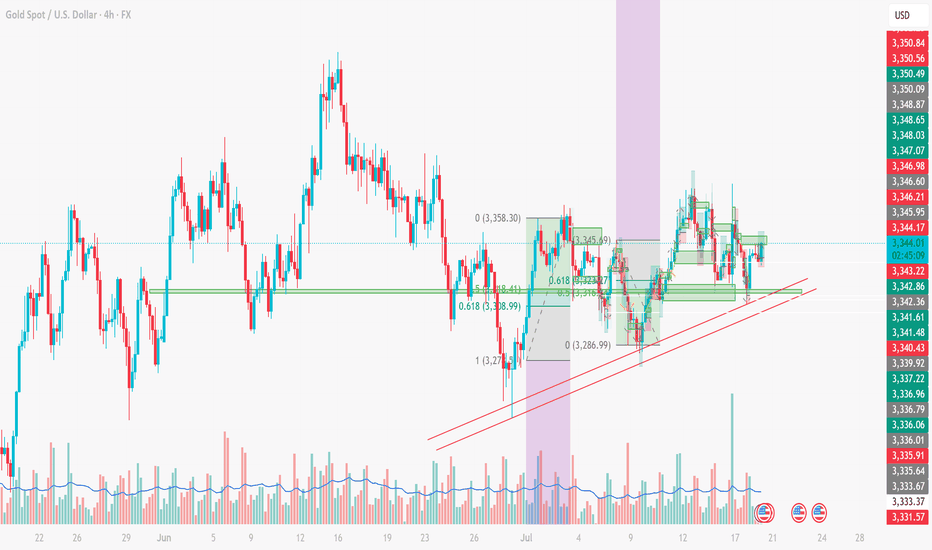

XAUUSD ANALYSIS – JULY 18XAUUSD ANALYSIS – JULY 18: STRATEGY BASED ON FIBONACCI, TRENDLINE & STRUCTURE

1. XAUUSD Technical Overview (4H Chart)

Gold (XAUUSD) is currently trading around 3,343 USD, showing signs of a slight rebound from key support. On the 4H timeframe, the price structure is forming higher lows, maintaining above a short-term rising trendline – a technically bullish signal.

2. Key Support & Resistance Zones

Immediate Supports:

3,338 USD: aligning with the 0.618 Fibonacci retracement – a zone tested multiple times.

3,333 – 3,335 USD: strong support, overlapping with EMA and rising trendline.

3,327 USD: previous swing low – last defense for the bullish structure.

Immediate Resistances:

3,345 – 3,346 USD: frequently rejected zone in recent sessions.

3,350 USD: psychological and technical resistance.

3,358 USD: recent swing high – breakout confirmation level.

3. Price Action & Fibonacci Confluence

Price is currently hovering between Fibo 0.5 (3,343 USD) and Fibo 0.618 (3,338 USD) – a potential bounce zone if bullish momentum holds.

The pullback from 3,358 to 3,286 has respected standard Fibonacci retracement levels, confirming technical price behavior.

4. Trendline Analysis

The ascending trendline from the 3,275 USD low remains intact, providing solid dynamic support.

If the price continues to bounce from this trendline, it may form a bullish continuation pattern (flag/pennant).

5. Suggested Trading Strategies

Long

Entry: 3,338 – 3,340 USD

SL: 3,327 USD

TP: 3,345 – 3,350 – 3,358 USD

Note: Buying the dip near Fib & trendline

Short

Entry: Below 3,327 USD (breakdown)

SL: Above 3,340 USD

TP: 3,310 – 3,298 USD

Notes: Only if price breaks trendline & support

6. Supporting Technical Indicators

EMA20/EMA50 show slight upward momentum – early bullish bias.

RSI (14) hovers near 50 – neutral zone, awaiting breakout confirmation.

Conclusion:

Gold is consolidating around a critical support zone. The short-term bias leans bullish if the 3,338 – 3,333 USD region holds and price breaks above 3,346 – 3,350 USD.

This is a key moment to position early using Fibonacci and trendline confluence.

👉 Follow for more strategies in upcoming sessions. Save this if you find it useful!

Do you have a different view? Share your thoughts in the comments below!

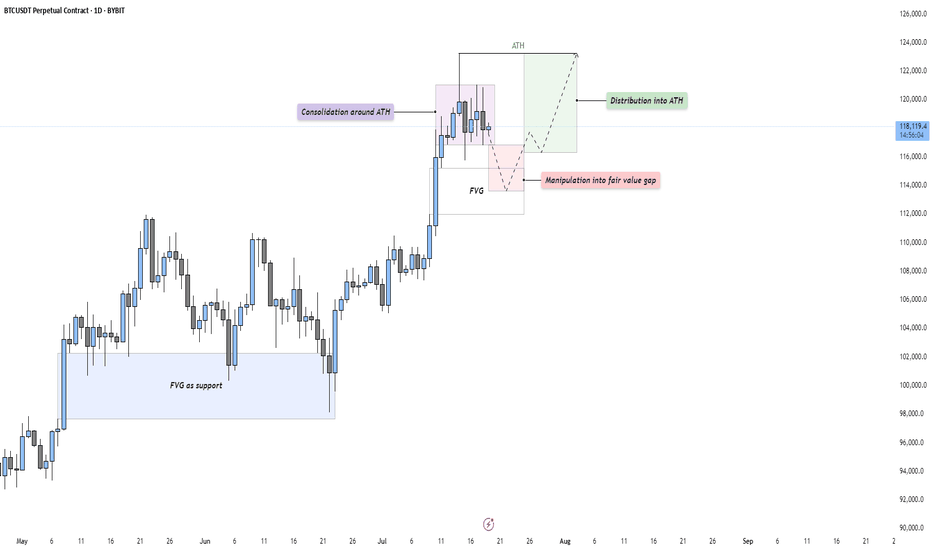

BTC - Consolidation, Manipulation & DistributionMarket Context

After a strong impulsive rally, Bitcoin is currently consolidating just beneath its All-Time High (ATH). This type of consolidation following an extended move higher often indicates indecision in the market — a pause that either leads to continuation or reversal. The current structure suggests that price is building energy for the next leg.

Consolidation and Liquidity Above ATH

The price action is tight and sideways around the ATH, which likely means liquidity is building above. Many stop-losses and breakout orders are sitting just overhead — classic conditions for a Buy Side Liquidity Sweep. This range may serve as a trap for early breakout traders, providing an opportunity for smart money to manipulate price lower before taking it higher.

Fair Value Gap Retest Scenario

Below the current range, we see a Daily Fair Value Gap that aligns with prior bullish imbalances. A move down into this Gap would represent a manipulation phase — shaking out weak longs before rebounding. The Gap also acts as a potential support level where buyers might be waiting. If price reaches into this zone and reacts strongly, it may offer a high-probability long setup.

Distribution or Reaccumulation?

While this could be interpreted as distribution beneath resistance, it’s equally valid to consider it a reaccumulation phase — a temporary markdown into demand before a fresh expansion. If the market dips into the Gap and quickly reclaims the range, it opens the door for a clean breakout above the ATH and continuation toward the 124,000–126,000 region.

Final Thoughts

Price rarely moves in a straight line. It pauses, retraces, and often tricks participants before making the real move. This type of consolidation presents opportunity — but also demands patience and clarity.

If you found this breakdown insightful, a like would be much appreciated! And I’d love to hear your thoughts in the comments — are we about to sweep down into demand, or is the rocket already on the launchpad?

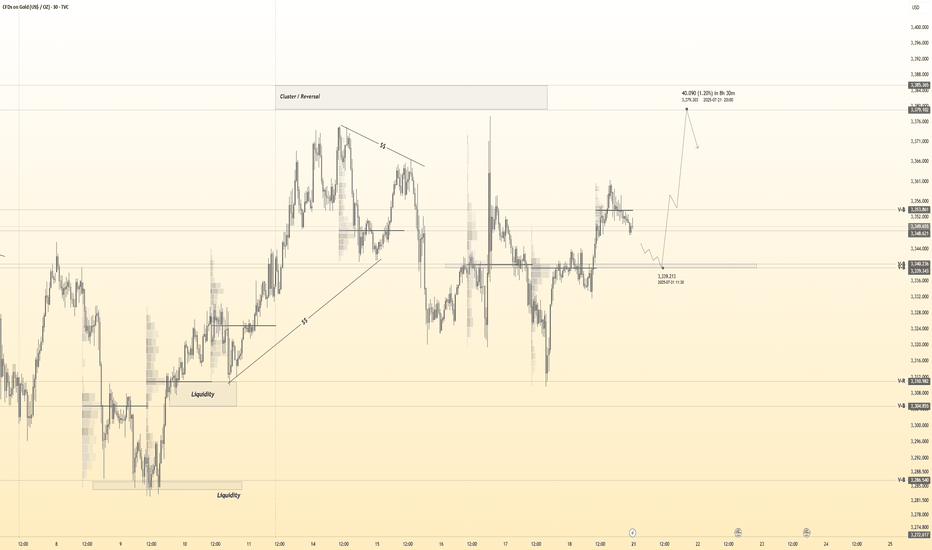

Gold 30Min Engaged ( Bullish Reversal Entry Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Reversal From : 3341.5 Zone

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

DeGRAM | GOLD above the resistance level📊 Technical Analysis

● Bulls defended the channel base at 3 333, snapping the intraday falling wedge and reclaiming the broken trend-line; successive higher-lows since 17 Jul signal fresh upside momentum.

● A clean H1 close over the former pivot 3 355 flips the wedge crest into support and activates the measured-move target at the upper horizontal barrier 3 366, with the March swing cap 3 389 next.

💡 Fundamental Analysis

● Softer US jobless-claims trend and Fed speakers’ hints that “policy is restrictive enough” cooled two-year real yields, while PBoC’s June data showed net gold purchases for a fourth month—both underpinning spot demand.

✨ Summary

Long 3 345-3 355; hold above 3 355 targets 3 366 → 3 389. Bias void on an H1 close beneath 3 333.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!