Scenario: buyback at the bottom of the long trend channel @ MGMI'm waiting for a pullback, so I've set a buy limit order at the bottom of the long trend channel @ MGM. Technical support: 36.6 + arriving MA(200). Fundamental support: The governor of Nevada said the casinos and hotels are gonna open on 1th June. Target price is 44.5 USD.

MGM

MGM Down Goes Frazier!Price broke out the downtrend flag. Price then broke the previous resistance. Looking for some type of pullback!

All praise be to the market gawds!

Continue the flow of great measures!

This week been a helluva rollercoaster and I don't plan on leaving this theme park anytime soon!

My mask has been found. I got something to wear for market open Friday....Let's grind!

MGM Rising Wedge + Bear Divergence on RSI, MACD and MomentumMGM has had an impressive rally last month with the rotation into value. We have a rising wedge formed and despite making higher highs, our indicators are making lower highs, indicating a disconnect and thus a bear divergence. When we break the rising wedge, I expect a decline, entering short and an additional short in the case of a retest of the lower boundary following the breakdown. The stock is also overbought in 1D.

$MGM Potential Short OpportunityJust as fast as the news of COVID vaccine may have rallied the market this past week, the effects may be short lived as they were in the past when the realization that we still are a minimum of 6-12 months away from anything remotely resembling a normal society. With that said, companies like MGM will likely see another dump of their stock when investors realize that lockdown may inevitably have to happen again in order to slow the burden of the hospital systems this winter. Oddly enough, coinciding this news is the major pivot point for the S&P500 along with a major uptick in COVID lockdown news. This week will give us a good idea of what will happen next.

Note: This document is for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation

THE WEEK AHEAD: TWTR, MGM, AMD EARNINGS; JETS, XOP, GDXJEARNINGS:

If you like to play earnings for volatility contraction, there are a ton this coming week. Here are the ones that made my cut for volatility contraction plays based on options liquidity and bang for your buck as a function of stock price:

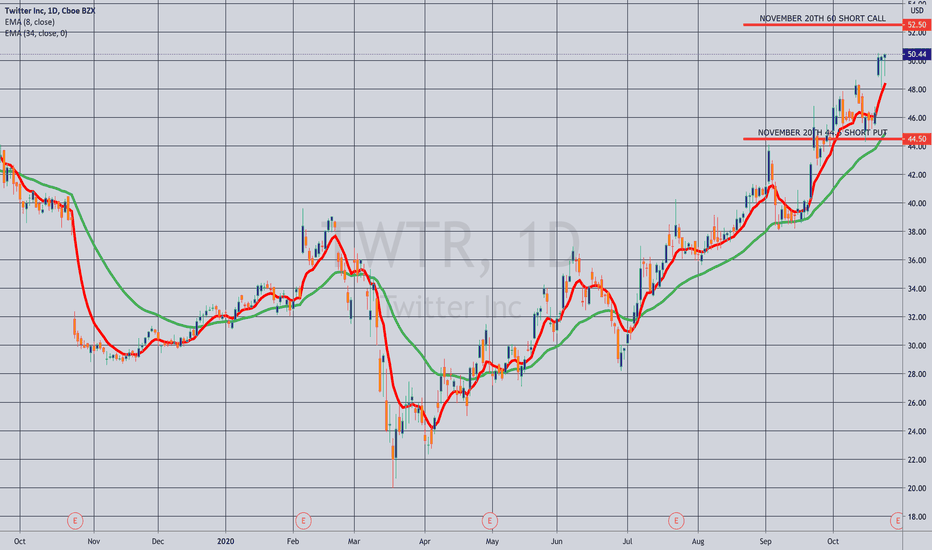

TWTR (49/73/15.9%),* announcing Thursday after market close.

MGM (16/69/15.2%), announcing Thursday before market open.

JBLU (22/73/14.6%), announcing Tuesday before market open.

TECK (20/64/14.1%), announcing Tuesday before market open.

AMD (30/62/14.0%), announcing Tuesday after market close.

BA (19/59/12.4%), announcing Wednesday after market close.

FB (47/52/11.1%), announcing Thursday after market closes.

Honorable Mentions:

AMZN (63/51/11.2%), announces Thursday after market close. (Option illiquid).

AAPL (36/47/9.8%), announces Thursday after market close. (November 20th short straddle paying less than 10% of stock price).

GOOG/GOOGL (40/40/8.6%), announce Thursday after market close. (Options illiquid).

MSFT (32/40/8.2%), announces Tuesday after market close. (November 20th short straddle paying less than 10% of stock price).

Pictured here is a TWTR short strangle in the November 20th expiry (26 days) with the short options camped out at the 22 delta. Paying 2.72 at the mid price as of Friday close, it has -.55/10.56 delta/theta metrics and break evens wide of 2 times the expected move on the call side, between the expected and 2x on the put.

For those of a defined risk bent, the uneven winged** November 20th 40/44.5/60/65 iron condor pays 1.50, has delta/theta metrics of 2.53/3.43, and has a 2x expected move break even on the call side and an expected move break even on the put.

MGM: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

JBLU: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

TECK: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

AMD: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

BA: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

FB: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK AND SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

JETS (12/50/16.1%)

XOP (15/56/16.0%)

GDXJ (17/49/15.1%)

SLV (36/48/13.9%)

EWZ (17/43/13.3%)

XLE (26/44/12.6%)

GDX (16/40/12.6%)

XBI (30/41/11.6%)

SMH (21/35/10.3%)

EWW (23/35/10.0%)

I threw JETS in here due to continued high implied volatility in airlines which is sticking in there even for names that have already announced "earnings" (or lack thereof) (e.g., DAL (63.5%), UAL (80.7%), AAL (106.6%)).

BROAD MARKET:

QQQ (30/34.9.7%)

IWM (29/33/9.0%)

SPY (23/27/7.6%)

EFA (23/24/6.3%)

IRA DIVIDEND-PAYERS SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

KRE (25/45/13.3%)

XLE (26/44/12.6%)

EWZ (17/43/13.3%)

* -- The first metric is the implied volatility rank (where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, implied volatility in expiry nearest 30 days until expiry; and the third -- for earnings: what the November at-the=money short straddle is paying as a function of stock price; for exchange-traded funds, broad market, and IRA dividend-payers, what the December at-the-money short straddle is paying as a function of stock price. For lack of a better term, I've dubbed this last metric as the "bang for your buck".

** -- Only 5-wides are available on the call side.

MGM Clearly Bullish, Get In Before Labor Day!MGM's growth has been fenominal through the past month as it climbed to new record highs. We seem to be hitting a respectful resistance, but now we have a even more respectul consolidation. I cant see MGM retesting another other supply levels in the future, as these next few days will look good for vegas, and especially the ballagio! People from all across the west are booking rooms for labor day as they are confirmed "Travel safe during COVID-19" (Trip Advisor). This is an extremely undervalued stock and I have high expectation for the upcoming week.

MGM Resorts International 100% upside potentialGreat news!

Aug 11 Reuters:

BRIEF-NASCAR And BetMGM Announce Multi-Year Sports Betting Partnership

BETMGM TO OFFER LIVE, IN-RACE BETTING BEGINNING IN 2021

Aug 10 (Reuters) - Barry Diller's IAC/InterActive Corp IAC said on Monday it has bought a 12% stake in MGM Resorts International MGM for about $1 billion, sending the casino operator's shares soaring 14%.

"MGM presented a "once in a decade" opportunity for IAC to own a meaningful piece of a preeminent brand in a large category with great potential to move online."

Market Capitalization $10.42 billion

Net Income $2.05 billion

small 5.56 P/E ratio

If you are interested to test some amazing BUY and SELL INDICATORS, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

THE WEEK AHEAD: LYFT, UAL, MGM, DAL, CNX, SLV, GDXJEARNINGS:

LYFT (20/82/19.8%) announces earnings on Wednesday after the close, so look to put on a play in the waning hours of Wednesday's New York session if you want to play the volatility contraction.

Pictured here is a directionally neutral 29/38 short strangle camped out at the 20 delta in the September monthly. Paying 1.26 as of Friday close, it has 27.74/39.26 break evens, which are wide of 2 times the expected move on the call side, but somewhat short of 2 times on the put side due to skew; delta/theta .25/3.58.

You'll have to go somewhat tighter (the 25 delta) to get one-third the width out of an iron condor, with the 27/30/37/40 iron condor paying .97; 29.03/37.97 break evens, which are at the expected move on both sides; delta/theta 2/1.31.

I've stuck on an UBER line just to show how LYFT's competitor did with its earnings in the coronavirus environment ... .

CSCO (28/36/8.4%) also announces, but has less than ideal metrics for a volatility contraction play.

EARNINGS AFTERGLOW:

There are a number of underlyings with earnings in the rear view that still have sufficient implied to potentially make them worthwhile just as pure premium selling plays. Here are a number of them, ranked by the percentage that the September at-the-money short straddle is paying relative to stock price and screened for those paying greater than 15%:

UAL: 20.8%

MGM: 17.7%

DAL: 17.7%

CNX: 17.6%

WYNN: 16.9%

PINS: 16.1%

ROKU: 16.0%

BYND: 15.8%

SNAP: 15.7%

BA: 15.3%

SQ: 15.2%

AMD: 15.1%

LUV: 15.1%

I may pick one or more of these if I have nothing better to do, keeping in mind correlations here (i.e., UAL, DAL, and LUV are all airlines; BA is airline-related).

EXCHANGE-TRADED FUNDS, RANKED BY SEPTEMBER AT-THE-MONEY SHORT STRADDLE PRICE/STOCK PRICE RATIO AND SCREENED FOR >35% 30-DAY IMPLIED:

SLV (70/81/19.9%)

GDXJ (24/62/15.6%)

GDX (24/43/12.8%)

XOP (11/48/12.7%)

EWZ (18/43/11.2%)

Here, I've screened out those paying <10%. I'm in an August GDXJ play, but may re-up with a SLV, even though there is going to be some correlation with miners. The September 18th 20 delta 22/36 short strangle was paying 1.45 as of Friday close, with the 25 delta 20/23/33.5/36 iron condor paying .99. There is some massive call side skew to potentially accommodate here, so could see going "double double" (double the contracts on the put side, but double the width on the call).

Two Examples: September 18th 2 x 18/2 x 20.5/33/38 "double double" iron condor, paying .98 or September 18th 2 x 15.5/2 x 25.5/33.5/44 "double double", paying 1.30, the latter of which approaches the metrics of the naked short strangle.

BROAD MARKET EXCHANGE-TRADED FUNDS:

Most of the fun has bled out ... :

IWM (25/30/7.3%)

QQQ (25/28/7.2%)

EFA (17/21/4.8%)

SPY (15/22/5.1%)

MGM ✅ Why Go To Vegas When You Can Speculate On MGM From Home!💬 MGM International Resorts (MGM) is rolling out its new 'Viva Las Office' campaign to get people to work from Vegas. That could help drive business to MGM properties, which could be why the market is showing us some bullish options flow and decent price action. While we are skeptical this single event makes a giant impact, we think all these factors together (along with the recent earnings beat) are enough for a conservative swing play. Let's see if we can find a setup that works.

Hit that 👍 button to show support for the content!

Help the community grow by giving us a follow 🐣

-----

Support:

S1: Our entry is going to be off the minor price pivot point, a current S/R flip, and previous orderblock cluster range. The logic is that we retest this level before moving up. Meanwhile, we are placing our stop below the S/R flip to give us a solid 1:5 Risk-to-Reward that keeps us well away from any short term downside volatility that might be seen as the price is finding support.

Resistance:

R1: Our target is the orderblock at the previous swing high as highlighted on the chart.

-----

Summary:

We have a pretty straightforward setup here. Retest the S/R filp, and then go long until the next resistance level is hit while keeping a comfortably placed stop well below support to mitigate risk... its a gamble with good odds, and we didn't even have to leave the office to do it.

Resources:

finance.yahoo.com

www.marketbeat.com

✨ Drop a comment asking for an update, we do NEW setups every day! ✨

MGM - MGM Resorts International BUY investment opportunityHello traders,

Description of the analysis:

MGM Resorts International investment opportunity. I already invest to this stock with big potencial. I bought 462 pcs of shares. Trade what you understand, trade carefully and sparingly according to the business plan. This is not investment recommendation.

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund ($4.000.000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob

Trucking Along The SPY - 06/12/20 RECAPHi traders,

After an indecisive start of Friday's trading and one false breakout later, I managed to both enter and exit pretty nicely in MGM, making it probably the nices trade of the month. Ending up slightly down for the week though.

Trades:

1) MRO - LONG @6.81, -0.70%

2) MGM - SHORT @19.09, +2%

*In my ID trades, I risk 1% of the account per trade and go for 2% (2:1 RRR ). Sometimes I adapt a little bit as you can see in the trades' description.*

Total PnL for the day: +1.30%

Total PnL for the week: -2.04%

Good trades,

Tom | FINEIGHT

MGM uptrend ? 14 June 2020 MGM is making a higher high higher low structure. Healthy volume can be seen with the uptrend. Price was supported at 50 EMA with the Thursday retracement. I expect more potential downside this coming week with the last week bearish engulfing close. 6-17 is a good low risk long entry. Have patience and trade well.

MGM Resorts Technical AnalysisThe idea is to go long.

MGM Resorts (MGM) – MGM will reopen more Las Vegas casinos, following strong performances for the Bellagio, MGM Grand, and New York New York following their reopenings. The Excalibur will open Thursday, followed by ARIA, Mandalay Bay and Four Seasons Las Vegas on July 1.

Bullish Weekly ChartDaily & Weekly charts look great, especially the weekly chart.

Volume is Bullish

PMO is Bullish

MACD is Bullish

Stochastic is Bullish

Sector is Bullish

Long!

DISCLAIMER

The Content herein is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Possible MGM Long IdeaI am thinking this thing is poised to breakout with states reopening, and their casinos already being sold out for the month. It is already breaking resistance and I think it could hit one of these targets and possibly re visit all time highs.

This is mainly based off momentum, elliot waves, and fibonacci targets and retracements. What do you think of this? I am fairly new to this so any advice is appreciated.