Could Microstrategy be a 1 Trillion dollar mcap company?!Microstrategy and Michael Saylor evoke a spectrum of opinions, with analysts offering a diverse range of potential future valuations.

High risk, high reward!

The destiny of Microstrategy’s market capitalization is clearly linked to Bitcoin’s performance. The company has been utilizing debt to acquire the cryptocurrency, aiming to create significant spreads. This leverage is the reason why the stock has significantly outperformed Bitcoin throughout 2024.

I am confident that Bitcoin can indeed reach $200k, with a potential upper price target of $250K for this cycle, indicating a potentially explosive Q3 and Q4.

The lingering question is how much additional FOMO and premium Saylor can cultivate for his leveraged vehicle in such an environment?

That's why charting is such a key component to any personal investing strategy IMHO, as we navigate these markets.

Michaelsaylor

Bitcoin Whales Going On Summer Vacation🚨 Wake Up, Crypto World! 🚨

🔹 Bernstein calls $200K 🔹 CNBC eyes $130K 🔹 BlackRock boasts IBIT is the fastest-growing ETF 🔹 Saylor claims $1M BTC 🔹 Thiel-backed crypto exchange Bullish - has confidentially filed for a US IPO …

Does this sound like "Institutions secretly acquiring Bitcoin"?

NO. This sounds like a desperate call for exit liquidity.

The real accumulation already happened, behind closed doors, away from the headlines. Now they need buyers. Retail FOMO is their exit strategy.

Don't be fooled enjoy the Summer Vacation. 🌴

#Bitcoin #Crypto #ExitLiquidity #MarketCycles #TakeProfits

CRYPTO:BTCUSD INDEX:BTCUSD TVC:GOLD TVC:SILVER NASDAQ:COIN NASDAQ:MSTR

MicroStrategy: The Dumbest Bet on WallStreetMicroStrategy: The Bitcoin Bet Masquerading as a Tech Company

Introduction: A Software Company Turned Crypto Casino

Once upon a time, MicroStrategy was a business intelligence firm. Today, it’s a Bitcoin holding company disguised as a software business.

Its market cap has ballooned to over $100 billion, not because of its software, but because of its aggressive Bitcoin purchases. Investors aren’t buying a company—they’re buying a leveraged bet on Bitcoin.

And that bet? It’s built on debt, dilution, and dangerous financial engineering.

The Math Problem: MicroStrategy’s Obscene Valuation

MicroStrategy is worth three times the value of its Bitcoin holdings. Let that sink in.

If you buy MicroStrategy stock, you’re effectively paying three times the price of Bitcoin. It’s like buying Bitcoin at $245,000 per coin when the actual market price is far lower.

This isn’t investing, it’s financial insanity.

The Debt Trap: How MicroStrategy Keeps the Illusion Alive

MicroStrategy’s entire strategy revolves around issuing debt to buy more Bitcoin. It has borrowed $7.27 billion through convertible bonds.

Here’s how the cycle works:

MicroStrategy issues debt at low interest rates.

It uses the money to buy Bitcoin.

The stock price rises because investors think it’s a genius move.

The company issues more shares to raise more money.

It buys more Bitcoin—and the cycle repeats.

This is not a sustainable business model. It’s a Ponzi-like structure that depends entirely on Bitcoin’s price continuing to rise.

The Accounting Trick: Hiding the Losses

MicroStrategy has been misleading investors with custom financial metrics. It created terms like BTC Yield and BTC $ Gain to make its Bitcoin strategy look profitable.

But in reality? It recently disclosed a $5.91 billion unrealized loss on its Bitcoin holdings. And when that news broke, its stock dropped 8.67% in a single day.

This isn’t a company, it’s a high-stakes gamble.

The Risk: What Happens When the Bubble Bursts?

MicroStrategy’s survival depends on Bitcoin’s price never crashing. If Bitcoin falls, MicroStrategy’s stock collapses.

And here’s the worst part:

If Bitcoin crashes, MicroStrategy might have to sell its holdings, triggering a death spiral.

If investors lose confidence, the company can’t issue more debt, and the illusion falls apart.

If regulators step in, MicroStrategy’s entire strategy could be dismantled.

This isn’t a safe investment. It’s a ticking time bomb.

Conclusion: The Dumbest Bet on Wall Street

MicroStrategy isn’t a tech company. It’s a leveraged Bitcoin casino.

Investors aren’t buying innovation, they’re buying hype, debt, and financial engineering. And when the illusion fades, reality will come crashing down.

So ask yourself: Are you investing in a business? Or are you just buying the dream—before it bursts?

MSTR–Institutional Bitcoin Proxy with Conviction and Leverage ₿Company Snapshot:

MicroStrategy NASDAQ:MSTR remains the largest corporate holder of Bitcoin, positioning itself as a leveraged equity proxy for BTC exposure—while still operating a profitable enterprise software business.

Key Catalysts:

Massive Bitcoin Treasury Strategy 💰

Recently acquired $1.42 billion in BTC, reinforcing commitment

Total holdings exceed 200,000 BTC, making it the most visible and transparent institutional crypto holder

Acts as a high-beta vehicle for Bitcoin bulls, especially as ETF flows drive demand

Financial Engineering = Firepower for More BTC 🚀

$722 million in refinanced fixed-income notes, lowering costs and extending maturity

Provides capital flexibility to accumulate BTC at opportunistic levels

Reflects strong capital market access and investor confidence

BTC ETF Tailwind + Institutional Validation ✅

Bitcoin ETFs provide broader adoption and liquidity, indirectly benefiting MSTR

MSTR offers a regulated, equity-based alternative to direct BTC ownership

Ideal for funds restricted from holding digital assets directly

Dual Business Model Stability ⚙️

Core enterprise software business contributes revenue and operational stability

Reduces perceived risk relative to pure-play crypto companies

Investment Outlook:

✅ Bullish Above: $325.00–$326.00

🚀 Upside Target: $490.00–$500.00

🔑 Thesis: High-conviction BTC accumulation + balance sheet optimization = leveraged upside for Bitcoin-focused investors

📢 MSTR: The go-to equity for institutional Bitcoin exposure—with built-in leverage and transparency.

#Bitcoin #MSTR #CryptoStocks #DigitalAssets #MichaelSaylor #InstitutionalCrypto

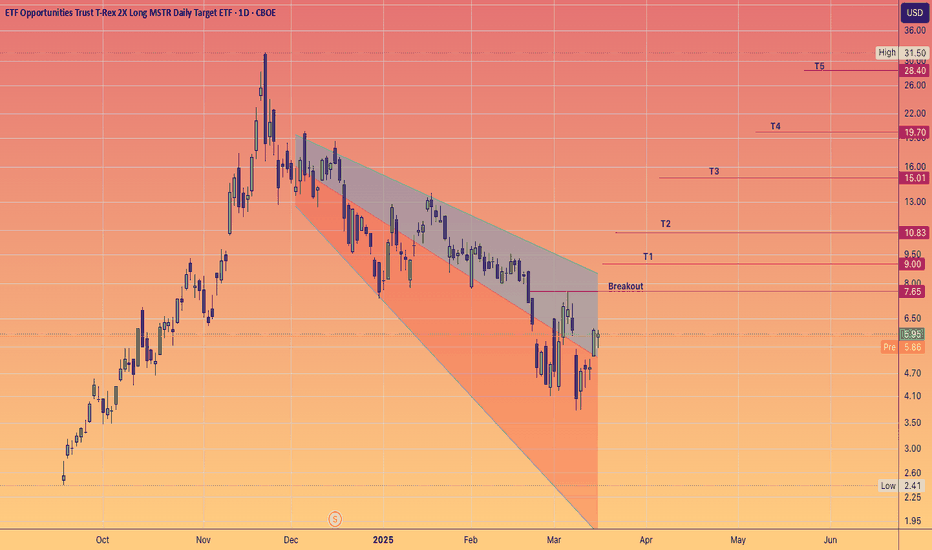

Double down like Michael Chad Saylor - MSTR ----> MSTU 2X"Are you convicted?"

Of Bitcoin achieving a new All time high if so Saylor will greatly rewarded and lauded.

MicroStrategy's unwavering focus on acquiring Bitcoin through unconventional financing methods, rather than building a sustainable revenue-generating business, carries significant risks, especially if a major bear market were to hit the cryptocurrency sector again. This exposure to Bitcoin offers a distinctive investment opportunity for those looking to gain leverage in the crypto space without direct participation.

While MicroStrategy's inherent volatility may deter more traditional investors, it also provides a platform for those eager to engage with market dynamics. The MSTU adds an additional layer of volatility, but unlike options, it does not have an expiration date.

Investors should closely monitor Bitcoin's market fluctuations, as these directly influence MSTR's stock price, potentially creating advantageous entry points for savvy traders.

Can MicroStrategy Save Bitcoin's Destiny?MicroStrategy’s dramatic stock decline has become a bellwether for the broader digital asset market. As its share price plunges, the company’s deep ties to Bitcoin spotlight a precarious balance between corporate strategy and the volatility inherent in the crypto space. This unfolding scenario challenges investors to reconsider the intertwined fates of traditional finance and digital innovation.

The company’s approach to using Bitcoin as a primary treasury reserve has been revolutionary and risky. Aggressive accumulation strategies, including debt financing and Bitcoin-backed loans, have magnified the impact of market fluctuations. With critical support levels now under threat, the risk of forced asset sales looms large—an event that could cascade through the crypto ecosystem and undermine confidence in digital currencies.

Amid these challenges, MicroStrategy is also pursuing bold financing initiatives to stabilize its operations. Plans to raise $21 billion through a preferred stock offering signal a dual objective: securing necessary capital and further investing in Bitcoin. This move reflects an ongoing commitment to a Bitcoin-centric strategy, even as recent transactions have resulted in significant unrealized losses.

In parallel, the cryptocurrency landscape faces unprecedented headwinds from regulatory pressures, geopolitical tensions, and emerging technological vulnerabilities. Financial professionals are compelled to balance risk with opportunity, rethinking investment strategies amid an environment where innovation meets uncertainty at every turn.

The looming threat of quantum computing adds another layer of complexity. As quantum technologies advance, their potential to break current cryptographic standards—on which Bitcoin’s security fundamentally relies—poses a significant risk. Should quantum computers overcome encryption protocols like SHA-256, the very foundation of blockchain technology could be compromised, forcing the industry to adopt quantum-resistant measures rapidly. This challenge not only underscores the volatility of the digital asset market but also inspires a deeper exploration into safeguarding the future of decentralized finance.

Bitcoin back to $75,000 from here?Seems like that guy Michael Saylor, the CEO of Strategy just wasted hundreds of millions of dollars by buying $1.99 billion worth of Bitcoin at an average price of $97,514 per bitcoin, right before the drop down below $80k to probable $75k area.

Rushing to buy at highs like that instead of being smart about it and loading much more at the dips is hard to understand.

MicroStrategy’s Premium Is Fading – Time to Brace for a Drop?The strong optimism following Trump’s election in November fueled a Bitcoin rally, which in turn led to a massive surge in MicroStrategy’s ( NASDAQ:MSTR ) stock.

However, after reaching an all-time high near $550, MSTR experienced a sharp decline. Interestingly, despite Bitcoin hovering around $100K and even attempting a new ATH recently, this momentum hasn’t been reflected in MSTR’s stock price.

From a technical perspective, the price has broken below its ascending trendline and is now consolidating between $320 and $360.

Given the unjustified premium (at least in my opinion), I expect further downside for the stock.

Additionally, if Bitcoin fails to hold the key $90K confluence support, MSTR could see a sharp plunge below $200.

Should You Follow Michael Saylor’s BTC Moves? Let’s Think TwiceIn the crypto world, Michael Saylor is a household name. The co-founder of MicroStrategy has become one of Bitcoin’s most vocal advocates, with his company accumulating a massive Bitcoin treasury. Many view his purchases as a signal of confidence, believing that if someone with his track record is buying, it must be the right move.

But is it wise to follow his lead without question?

Let’s take a closer look at the full story and consider why doing your homework is essential before jumping in headfirst.

The Rise of Michael Saylor: Bitcoin’s Biggest Cheerleader

Saylor didn’t become a prominent figure in the crypto space until 2020, when MicroStrategy announced its first Bitcoin purchase.

Since then, he has positioned himself as a thought leader in the industry, frequently championing Bitcoin as the ultimate store of value.

However, Saylor’s newfound reputation as a financial visionary often overshadows his earlier history—a history that’s worth examining.

A Look Back: The Dot-Com Bubble and MicroStrategy’s Decline

In the late 1990s, MicroStrategy rode the wave of the dot-com boom, with its stock soaring to impressive heights. But like many other tech companies of the era, it faced a harsh reality check when the bubble burst.

MicroStrategy’s stock plummeted, and for the better part of two decades, it languished near its lows.

During this period, Michael Saylor’s reputation as a business genius took a backseat. It wasn’t until Bitcoin’s meteoric rise—and MicroStrategy’s pivot to buying and holding Bitcoin—that Saylor regained the spotlight.

Is It Genius or Just Timing?

Here’s the question we need to ask: Is Michael Saylor’s success in Bitcoin a result of brilliant foresight, or was he simply in the right place at the right time?

Bitcoin’s Performance: The timing of MicroStrategy’s Bitcoin purchases coincided with a strong bull run in the market. This rise in Bitcoin’s value undoubtedly contributed to Saylor’s renewed status as a financial savant.

Reputation Rebound: It’s easy to appear “smart” when your investments are soaring. But how much of that success is due to skill, and how much is due to external factors like market trends?

The Danger of Blindly Following Big Names

While it’s tempting to follow someone like Michael Saylor, assuming he has insider knowledge or an unbeatable strategy, history teaches us a valuable lesson:

Even Experts Can Be Wrong: Many celebrated investors have made costly mistakes, especially when riding trends. The dot-com bubble is a prime example of how quickly fortunes can change.

Market Conditions Are Key: What worked for Saylor may not work for everyone, especially as market conditions evolve. Bitcoin’s past performance is no guarantee of future results.

The Importance of Doing Your Own Homework

Instead of blindly following big names, take the time to develop your own understanding of the market. Consider:

Risk Tolerance: Are you prepared for the volatility that comes with Bitcoin and other cryptocurrencies?

Market Fundamentals: Do you understand the underlying factors driving the asset’s value?

Your Strategy: Does buying Bitcoin (or any other asset) align with your financial goals and investment timeline?

Final Thoughts

Michael Saylor’s success with Bitcoin is undeniably impressive, but it’s essential to view his story in context. His rise to prominence as a Bitcoin advocate came after years of MicroStrategy’s struggles, and much of his newfound fame coincided with Bitcoin’s broader bull market.

Rather than simply mimicking his moves, take a step back and assess your own strategy. Remember, the smartest investors aren’t those who blindly follow the crowd—they’re the ones who do their research, weigh the risks, and make informed decisions.

In trading and investing, doing your homework is the real key to success. Don’t let someone else’s narrative cloud your judgment.

MICROSTRATEGY a pyramid ponzi.Understanding the situation with MSTR can be quite complex.

Many people recognize that MicroStrategy has been issuing convertible bonds at a 0% interest rate to purchase Bitcoin. This strategy tends to drive up both Bitcoin's price and the value of MSTR shares.

As a result, the scheme appears to inflate continuously, placing the risk on bondholders. The only way for MSTR's stock price to keep rising is through the issuance of increasingly larger amounts of convertible debt; otherwise, the entire pyramid would collapse.

It's understandable why Michael Saylor seems to be focusing more on shilling MSTR bonds instead of Bitcoin itself.

Why would institutions invest in MSTR's convertible bonds at 0%?

Many believe it's because they anticipate being able to convert these bonds into MSTR stock in five years at a predetermined price, potentially around $675, effectively giving them a premium-free call option. However, there is a hidden cost to this strategy: inflation. At first glance, this might seem like a poor investment choice—if one expects MSTR's value to rise, it would make more sense to buy the shares now rather than commit funds to a higher price in the future.

Why would anyone engage in such a massive financial manoeuvre involving BILLIONS?

The truth is, those purchasing the bonds are ACTUALLY indifferent to the rising stock value! Their primary interest lies in capitalizing on price fluctuations. Ultimately, a convertible bond functions as a CALL OPTION; thus, as the MSTR stock price experiences greater volatility, the premium on the call increases. Recently the value of these convertible bonds has surged by 170%. This is precisely why investors are unconcerned about interest rates or the actual conversion of the bonds—they have ZERO desire to convert! The reason? Issuing new shares would only dilute their holdings!

All the rewards with none of the risks!

But what happens if MSTR collapses? Bondholders will seize all the Bitcoin MSTR possesses, leaving shareholders with nothing but scraps!

Can you fathom how deep this MSTR Ponzi scheme really is?

The more you explore, the more mental acrobatics you need to perform to grasp the situation!

Many believe that bond buyers are naive, but in reality, they are the sharpest players in the game, reaping the benefits without facing the risks! In the current climate, that’s the nature of volatility! It doesn’t matter if MSTR’s stock price fluctuates; they’re insulated from the fallout. Who do you think is betting against MSTR? It’s the bondholders, and their positions are secure!

Ultimately, for someone to profit, someone else must incur a loss, and it won’t be the bondholders. This means that regular shareholders are poised for significant losses, as the primary force driving MSTR’s stock price is its own volatility. Once that volatility dissipates, we could see MSTR plummet below $100 a share! All those crypto enthusiasts will be left reeling, wondering how MSTR could possibly decline while Bitcoin’s value rises!!!

What’s the main effect of these convertible bonds?

They create volatility in the stock price, leading to wild swings up and down, just as we’re currently witnessing.

What occurs when the volatility subsides?

The stock price will plummet!

Many people are misdirecting their focus on metrics, technical analysis, and listening to Michael Saylor's commentary on CNBC. Instead, they should be paying attention to the volatility of MSTR's stock price, as its decline will directly impact the stock's value.

Don't be misled; even if MSTR falls below $300, it will still be overpriced and could potentially drop to under $100 per share due to the convertible bonds scheme. Claims from MSTR valuation sites that each share is backed by a certain amount of Bitcoin are misleading; the reality is that the shares are not backed by anything.

The BONDHOLDERS are the ones who possess all the Bitcoin.

There’s no such thing as a free lunch—someone has to bear the costs, and in MSTR's case, that burden will fall on the shareholders. You certainly don’t want to be left holding the bag when the music stops.

It is important to maintain a clear perspective regarding cryptocurrencies; they should not be viewed as traditional investments, but rather as something more comparable to gambling.

While you may have the advantage of being an expert poker player, the only way to truly win is to cash out your profits.

Otherwise, you risk losing on MSTR and in the crypto market.

MicroStrategy Buys the Dip Amidst $BTC Crash to $92KThe cryptocurrency market witnessed another headline-grabbing move by MicroStrategy as the firm added 2,138 BTC to its holdings for $209 million. While Bitcoin’s price experiences a significant dip, this acquisition reflects a continued belief in its long-term potential. Let’s dive into the technical and fundamental aspects of Bitcoin’s current state.

MicroStrategy’s Strategic Buy

On Monday, MicroStrategy announced its latest Bitcoin purchase, acquiring 2,138 BTC at an average price of $97,837. This marks yet another chapter in the company’s aggressive Bitcoin accumulation strategy. However, critics like Peter Schiff were quick to note that these purchases are involving less capital, and the acquisition price consistently overshoots the market rate.

Despite such criticism, MicroStrategy’s move underscores institutional confidence in Bitcoin’s long-term trajectory. The company’s continued investment is seen as a vote of confidence amidst bearish market sentiment, reinforcing Bitcoin’s role as a digital store of value.

Technical Analysis

Bitcoin’s price action is currently confined within a horizontal channel, with support at $92,200–$94,200 and resistance at $98,700–$101,000. As of now, CRYPTOCAP:BTC is testing the lower boundary of this channel. A decisive move in either direction could dictate the asset’s next major trend.

Bullish Scenario

Should buyers step in with strength, Bitcoin could rebound and retest the $98,700–$101,000 resistance zone. A breakout above this level may act as a catalyst for further gains, potentially marking the start of a sustained uptrend. Historically, Bitcoin has shown a tendency to gain momentum after the New Year’s pause, making January 8, 2024, a key date to watch for heightened volatility and potential upside movement.

Bearish Scenario

Conversely, a breakdown below the $92,200 support could trigger a retest of the $90,800 level. A more severe downturn might lead to Bitcoin revisiting its major support at $85,000. This psychological level will play a pivotal role in determining whether BTC can stage a trend reversal or face further downside as sellers shake out weak hands.

Market Sentiment and Outlook

The broader market sentiment remains cautious as Bitcoin’s price consolidates within its current range. MicroStrategy’s recent purchase has injected some optimism, but the market awaits stronger signals of a directional move. Traders are closely monitoring the $101,000 resistance level, which could act as a springboard for greater gains if breached.

Conclusion

Bitcoin’s price is at a critical juncture, with key support and resistance levels in focus. MicroStrategy’s continued investment highlights institutional confidence, while technical indicators suggest potential for both recovery and further downside. As the market navigates this pivotal phase, all eyes are on Bitcoin’s next move, which could shape its trajectory for the months ahead.

Bitcoin price Must surpass $100KBitcoin's price is seeing increased volatility around GETTEX:97K , and some crypto experts believe it’s on track to surpass $101K in the near term. Renowned analyst *PlanB* recently highlighted that Bitcoin’s current trajectory aligns with historical post-halving trends, suggesting significant upside potential. Similarly, a prominent advocate for Bitcoin, emphasized that growing institutional interest and adoption could fuel BTC’s rise past $101K. Our forecast anticipates Bitcoin reaching $100K by the end of 2024, driven by strong market sentiment following the halving event, with a potential to touch $270,593 by 2030 as institutional investments gain momentum.

The Power of Bitcoin: How MicroStrategy’s $MSTR Soared 1,620%MicroStrategy Inc. (NASDAQ: NASDAQ:MSTR ) has experienced a massive surge in its stock price, climbing 15.9% on Friday's market trading and an additional 5% during Monday's premarket session. The stock broke out of a rectangular chart pattern, signaling a bullish move that could potentially lead to new all-time highs. This explosive growth is underpinned by the company’s strategic bet on Bitcoin ( CRYPTOCAP:BTC ), which has not only outpaced the cryptocurrency itself but also the broader market, including tech giants like Microsoft ( NASDAQ:MSFT ), Nvidia ( NASDAQ:NVDA ), and the S&P 500. Let's dive into both the technical and fundamental factors driving this remarkable surge.

MicroStrategy's Bitcoin Bet

MicroStrategy (NASDAQ: NASDAQ:MSTR ) adopted a Bitcoin-centered strategy in August 2020 under the leadership of its executive chairman, Michael Saylor. This strategic pivot has yielded extraordinary results, with the stock gaining 1,620% since then. In comparison, Bitcoin itself has gained 426% during the same period, while the S&P 500 and the “Magnificent 7” tech giants, including Microsoft, Apple, and Nvidia, have lagged with gains of 73% and 243%, respectively.

As of September 2024, MicroStrategy (NASDAQ: NASDAQ:MSTR ) holds 252,220 bitcoins, making it the largest corporate holder of the cryptocurrency. In a recent acquisition, the company purchased 7,420 BTC for $458.2 million at an average price of $61,750 per coin, further solidifying its bullish stance on Bitcoin.

Michael Saylor has made it clear that he believes Bitcoin is the ultimate asset for long-term wealth generation. His famous quote, “The only thing better than bitcoin is more bitcoin,” encapsulates the company’s philosophy. This bold strategy has clearly paid off, as NASDAQ:MSTR has consistently outperformed both the broader market and even some of the most successful tech companies.

Bitcoin Outperformance & the Broader Market

What makes MicroStrategy's performance particularly notable is its stark outperformance compared to Bitcoin and other major stocks. For example, while Bitcoin’s price has increased 426% since 2020, MicroStrategy’s stock price has skyrocketed 1,620%, leveraging the company's heavy exposure to Bitcoin as a strategic asset. This outperformance can also be attributed to the broader market sentiment toward Bitcoin, which has attracted institutional investors and long-term holders like MicroStrategy. As the company continues to acquire more BTC, it positions itself as a de facto Bitcoin ETF in the eyes of traditional market participants.

In addition, NASDAQ:MSTR has far outpaced Nvidia’s impressive 1,107% increase and Arista Networks' 650% rise over the same period. These gains have positioned MicroStrategy as one of the most successful stocks in the past three years.

Technical Analysis

From a technical standpoint, MicroStrategy (NASDAQ: NASDAQ:MSTR ) has just broken out of a rectangular chart pattern, a significant bullish signal. A rectangle formation is characterized by a period of price consolidation between clearly defined horizontal support and resistance levels. In this case, NASDAQ:MSTR had been trading within a range, reflecting indecision among traders.

However, Friday’s surge confirmed a breakout above the ceiling of the rectangular pattern, signaling that the bulls have regained control. This breakout is particularly significant because it often precedes further upward movement, potentially setting the stage for a new high.

The Bullish Rectangle Pattern Explained

A rectangle formation typically occurs after an asset experiences an uptrend, which then consolidates as traders weigh the next move. In the case of NASDAQ:MSTR , the stock has been consolidating within a tight range as investors digested the company’s continued Bitcoin purchases and broader market conditions. With the breakout above the rectangle, it suggests that traders are once again optimistic, and the stock may be heading toward further gains.

As of Monday morning’s premarket session, NASDAQ:MSTR is up 5%, reinforcing the bullish sentiment.

Another key technical indicator supporting NASDAQ:MSTR ’s bullish outlook is the Relative Strength Index (RSI), which is currently at 76.76. Typically, an RSI above 70 indicates that an asset is overbought, and caution is advised. However, during periods of strong momentum, stocks can remain overbought for extended periods, particularly during significant bullish trends.

Moreover, the stock is exhibiting a gap-up pattern in the price chart, which is a strong indicator of momentum. Gap-ups occur when the price of an asset opens significantly higher than its previous close, often indicating a shift in sentiment or the release of market-moving news. In NASDAQ:MSTR 's case, the gap-up is driven by its breakout from the rectangle pattern, as well as renewed enthusiasm for Bitcoin.

Whale Accumulation and Bitcoin’s Influence

MicroStrategy’s stock is not just benefiting from technical patterns; the underlying Bitcoin market is also providing fundamental support. Recent data shows that whale activity has intensified around Bitcoin, with large holders accumulating 2.07 billion DOGE in a single week. While this specific data pertains to Dogecoin, it underscores a broader trend of renewed interest in cryptocurrencies by large investors, which often correlates with upward price movements in both the crypto market and crypto-exposed stocks like MicroStrategy.

Conclusion:

MicroStrategy’s breakout from the rectangular pattern, combined with its solid fundamental footing in Bitcoin, suggests that the stock could be setting a course for new highs. The company’s Bitcoin strategy has proven to be a game-changer, with the stock significantly outperforming both Bitcoin and the broader market since 2020.

As Bitcoin continues to grow in institutional acceptance and more companies adopt digital assets as part of their strategies, MicroStrategy’s long-term bullish outlook remains intact. Investors will be keenly watching for the next moves in both Bitcoin and NASDAQ:MSTR , as the stock could continue to serve as a leading indicator of market sentiment around the world’s largest cryptocurrency.

MicroStrategy’s Bold Bitcoin Play: $700 Mln in BTC AcquisitionIn a move that highlights its unwavering commitment to Bitcoin, MicroStrategy, led by its CEO Michael Saylor, has announced a fresh $700 million debt offering to acquire more Bitcoin ( CRYPTOCAP:BTC ). This marks the second such offering in just one month as the company aggressively expands its Bitcoin holdings. Known for its bullish stance on Bitcoin, MicroStrategy has now accumulated a staggering 244,800 BTC as part of its Treasury Reserve Asset (TRA) strategy.

The Latest Debt Offering

The newly proposed $700 million debt offering comes in the form of Convertible Senior Notes, which will be available only to qualified institutional investors. MicroStrategy plans to use the proceeds from this offering to redeem $500 million of its 6.125% Senior Secured Notes due 2028. After settling these debts, the remaining funds will be directed toward acquiring additional Bitcoin and other general corporate purposes.

This is not MicroStrategy's first foray into issuing convertible notes to fund its Bitcoin strategy. The company has previously conducted similar offerings, raising billions of dollars to support its growing Bitcoin portfolio. In June of this year, it made an $800 million offering, followed by a $1.1 billion Bitcoin purchase, which added 18,300 BTC to its reserves.

MicroStrategy’s Unstoppable Bitcoin Streak

MicroStrategy began its Bitcoin ( CRYPTOCAP:BTC ) acquisition spree in August 2020, becoming one of the first publicly traded companies to adopt Bitcoin ( CRYPTOCAP:BTC ) as a primary reserve asset. Over the years, the company has consistently used debt to bolster its Bitcoin reserves, reinforcing its belief in Bitcoin as a long-term store of value.

This strategy has often paid off for the company, especially in times of Bitcoin price appreciation. Most notably, MicroStrategy’s stock (MSTR) has soared as a direct result of its Bitcoin investments. After recent acquisitions, MSTR’s stock price surged by 18.74%, outpacing the broader market and gaining value even when other stocks faced volatility.

Bitcoin’s Current Market Dynamics

Despite MicroStrategy's massive Bitcoin purchase plans, the cryptocurrency itself has experienced some downward pressure. At the time of writing, Bitcoin ( CRYPTOCAP:BTC ) is down 2% after showing strength in previous weeks. This pullback is intriguing as it comes amid positive sentiment surrounding Bitcoin's recent performance and broader adoption.

From a technical perspective, Bitcoin’s Relative Strength Index (RSI) currently stands at 48, indicating a potential for a bullish reversal. The key pivot point for Bitcoin remains at $70,000, a level that traders and analysts are closely watching. If Bitcoin can break through this resistance, it could set off another significant rally, supported by the increasing institutional interest exemplified by companies like MicroStrategy.

Institutional Impact and MSTR Stock

MicroStrategy’s continued commitment to Bitcoin reflects a growing trend of institutional adoption of the cryptocurrency. With its relentless accumulation of Bitcoin ( CRYPTOCAP:BTC ), MicroStrategy is making a bold bet on the long-term potential of the digital asset. As more institutions and corporations follow suit, Bitcoin could further cement its status as a mainstream financial asset.

For MicroStrategy, its aggressive Bitcoin strategy has not only bolstered its stock but also differentiated the company from its peers. MSTR has consistently outperformed other tech stocks, thanks in large part to its Bitcoin holdings. As the company continues to issue convertible debt and acquire more Bitcoin, investors will keep a close eye on both the price of Bitcoin and the value of MSTR stock.

Conclusion

MicroStrategy's latest $700 million debt offering underscores its confidence in Bitcoin’s future. With 244,800 CRYPTOCAP:BTC already in its reserves and plans to accumulate more, the company is betting on Bitcoin ( CRYPTOCAP:BTC ) as a core part of its corporate strategy. While Bitcoin faces near-term volatility, the long-term outlook remains promising, especially with institutional players like MicroStrategy continuing to lead the charge. If Bitcoin ( CRYPTOCAP:BTC ) can breach the $70,000 pivot, MicroStrategy’s bullish strategy could prove even more lucrative for both the company and its investors.

MSTR MicroStrategy Incorporated Options Ahead of EarningsIf you haven`t sold MSTR on this potential fair value retracement:

Then analyzing the options chain and the chart patterns of MSTR MicroStrategy Incorporated prior to the earnings report this week,

I would consider purchasing the 1250usd strike price Puts with

an expiration date of 2024-5-17,

for a premium of approximately $120.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Insider Sell-off Sends MicroStrategy (MSTR) Stock TumblingMicroStrategy Inc (NASDAQ: NASDAQ:MSTR ) recently experienced a significant downturn in its stock price, plummeting by 6% following news of insider sell-offs. Michael Saylor, the Executive Chairman and 10% Owner of MicroStrategy, sold 1,140 shares at an average price of $1,951.33 per share, totaling over $2.2 million. This sale is part of a broader trend, with insiders offloading a substantial number of shares over the past year. As investors grapple with this development, it's crucial to analyze the implications for NASDAQ:MSTR 's future prospects and investor sentiment.

Insider Sell-off and Market Reaction:

The insider sell-off, particularly by key figures like Michael Saylor, has triggered concerns among investors. The lack of insider purchases over the past year, coupled with numerous insider sells, paints a worrisome picture. On the day of the sale, NASDAQ:MSTR shares were trading at $1,951.33, contributing to a market capitalization of $28.923 billion. However, the sell-off has raised questions about the company's valuation and its long-term growth prospects.

Overvaluation Concerns and Analyst Ratings:

MicroStrategy ( NASDAQ:MSTR ) may be significantly overvalued. Analysts have voiced mixed opinions on the stock, with some maintaining buy ratings while others have lowered their target prices. The consensus among analysts underscores the uncertainty surrounding NASDAQ:MSTR 's future trajectory and underscores the importance of thorough due diligence for investors.

Institutional Investors' Stance:

Institutional investors and hedge funds have also made moves in response to recent developments. While some have increased their stakes in MicroStrategy, others have reduced their positions or remained cautious. These actions reflect the diverse perspectives within the investor community regarding the company's outlook and its ability to deliver sustained value in the highly competitive software market.

Conclusion:

The insider sell-off at MicroStrategy has undoubtedly rattled investors and cast a shadow over the company's near-term prospects. With valuation concerns, mixed analyst ratings, and varying reactions from institutional investors, navigating MSTR's stock requires careful consideration of both risks and opportunities. As the company continues to navigate the evolving landscape of enterprise analytics and mobility software, investors must remain vigilant and stay informed to make sound investment decisions.

MSTR MicroStrategy Incorporated Fair Value | Potential Sell-OffAchieving a scenario where MSTR trades at parity with its Bitcoin reserves would necessitate a remarkable surge in BTC price to $157,000, marking a staggering 130% increase from current levels!

At today's BTC price, MSTR's ideal settlement range would hover around $775-$800, representing its fair value!

Adding a slight premium, my adjusted price target for MSTR would be $960!

The growing popularity of Bitcoin ETFs presents a challenge to MSTR's relevance, making it useless to hold MSTR at such a high premium to its BTC holdings!

It's worth noting that CEO Michael Saylor sold 1,508 shares of the company on March 14, 2024.

MicroStrategy's $800 Mil Notes Offering Fuels BTC AcquisitionMicroStrategy Incorporated (NASDAQ: NASDAQ:MSTR ) has once again made waves in the financial world with its recent completion of an $800 million offering of 0.625% convertible senior notes due 2030. The move, which saw significant interest from qualified institutional buyers, marks a strategic play by the company to bolster its Bitcoin acquisition strategy and further solidify its position as a pioneer in the cryptocurrency space.

The offering, completed on March 8, 2024, garnered widespread attention as MicroStrategy ( NASDAQ:MSTR ) signaled its commitment to expanding its Bitcoin holdings. The notes, which are unsecured senior obligations of the company, offer investors an opportunity to participate in MicroStrategy's ( NASDAQ:MSTR ) ambitious vision of utilizing Bitcoin as its primary treasury reserve asset.

With a nominal interest rate of 0.625% per annum, payable semi-annually, and a maturity date set for March 15, 2030, the notes provide investors with a unique avenue to engage with MicroStrategy's ( NASDAQ:MSTR ) long-term growth trajectory. Additionally, the convertible nature of the notes allows holders the flexibility to convert them into cash, shares of MicroStrategy's class A common stock, or a combination of both, at the company's discretion.

What sets this offering apart is MicroStrategy's ( NASDAQ:MSTR ) explicit intention to utilize the net proceeds from the sale of the notes to acquire additional Bitcoin. This strategic maneuver underscores MicroStrategy's unwavering confidence in Bitcoin as a store of value and highlights its proactive approach to capitalizing on the burgeoning cryptocurrency market.

MicroStrategy's CEO, Michael Saylor, has been vocal about the company's Bitcoin-centric strategy, viewing the cryptocurrency as a hedge against inflation and a long-term store of wealth. By leveraging its operating structure and cashflows, MicroStrategy ( NASDAQ:MSTR ) has amassed a substantial Bitcoin reserve, positioning itself as a trailblazer in corporate Bitcoin adoption.

The timing of the notes offering coincides with MicroStrategy's ( NASDAQ:MSTR ) ongoing efforts to enhance its position in the cryptocurrency market amidst increasing competition and regulatory scrutiny. With the conversion rate set at a premium over the current market price of MicroStrategy's class A common stock, investors stand to benefit from potential upside opportunities as the company's Bitcoin holdings appreciate in value.

However, the move is not without its risks. The volatile nature of the cryptocurrency market coupled with regulatory uncertainties presents inherent challenges for MicroStrategy ( NASDAQ:MSTR ). Moreover, the company's heavy reliance on Bitcoin as its primary treasury reserve asset exposes it to fluctuations in the cryptocurrency's price, which could impact its financial stability in the long run.

Nevertheless, MicroStrategy (MSTR) remains undeterred in its pursuit of pioneering Bitcoin adoption among corporations and institutional investors. Through its strategic initiatives and relentless focus on technology innovation, MicroStrategy ( NASDAQ:MSTR ) aims to redefine the traditional financial landscape and usher in a new era of digital asset management.

Technical Analysis

NASDAQ:MSTR is trading above its 200-day Moving Average. With a Relative Strength Index (RSI) of 74, NASDAQ:MSTR has seen an increase of 9.66% in Premarket Trading on Monday morning.

As MicroStrategy ( NASDAQ:MSTR ) continues to chart new territory in the cryptocurrency space, its $800 million notes offering serves as a testament to its unwavering commitment to Bitcoin and its vision of Intelligence Everywhere.

In a world where digital assets are reshaping the future of finance, MicroStrategy ( NASDAQ:MSTR ) stands at the forefront of innovation, poised to shape the course of history with its bold and visionary approach.

MSTR Bitcoin Boom: Saylor's Bold Moves Yield 46% Surge in a WeekMicroStrategy ( NASDAQ:MSTR ) has emerged as a beacon of innovation and foresight, led by the visionary Michael Saylor. As the clamor for cryptocurrency reaches a fever pitch, Saylor's strategic maneuvers have positioned MicroStrategy ( NASDAQ:MSTR ) at the forefront of the Bitcoin revolution, yielding a remarkable 46% surge in stock value within a single week.

Saylor's Revelations: Unveiling the Demand for Bitcoin ETFs

At the heart of MicroStrategy's meteoric rise lies Michael Saylor's keen insight into the burgeoning demand for Bitcoin Exchange-Traded Funds (ETFs). With investors clamoring for traditional avenues to access the digital currency, Saylor's bold assertion of a tenfold increase in ETF demand underscores MicroStrategy's ( NASDAQ:MSTR ) astute alignment with market dynamics.

MicroStrategy's Strategic Shift: From Software Titan to Cryptocurrency Leader

Gone are the days when MicroStrategy ( NASDAQ:MSTR ) was solely synonymous with software solutions. Under Saylor's guidance, the company has undergone a seismic strategic shift, rebranding itself as a vanguard in the realm of cryptocurrency. By amassing substantial holdings of Bitcoin, MicroStrategy ( NASDAQ:MSTR ) has not only embraced the digital currency but has also cemented its status as a trailblazer in the field.

Despite this pivot, MicroStrategy ( NASDAQ:MSTR ) remains steadfast in its commitment to its core software and business intelligence offerings, which continue to serve as linchpins of revenue generation and client satisfaction. This delicate balance between tradition and innovation underscores MicroStrategy's versatility and resilience in a rapidly evolving market landscape.

Future Growth Strategies: Pioneering Financial Planning for the Digital Age

Looking ahead, Michael Saylor has outlined a vision for MicroStrategy ( NASDAQ:MSTR ) that transcends mere adaptation; it encapsulates a proactive pursuit of growth and value creation. By leveraging capital markets and exploring strategic initiatives such as stock splits and capital restructuring, MicroStrategy ( NASDAQ:MSTR ) aims to optimize its financial resources to fuel expansion and innovation.

Conclusion

In conclusion, MicroStrategy's ( NASDAQ:MSTR ) meteoric ascent amid the Bitcoin boom epitomizes the power of visionary leadership and strategic foresight. Under Michael Saylor's stewardship, the company has not only embraced the winds of change but has also harnessed them to soar to new heights of success and prosperity. As the cryptocurrency revolution continues to unfold, MicroStrategy ( NASDAQ:MSTR ) stands poised at the vanguard, a beacon of innovation illuminating the path forward for investors and industry titans alike.

Michael Saylor Sells 5,000 $MSTR Stocks For Investing Into $BTCBetween January 2 and January 10, Saylor sold 3,882 to 5,000 NASDAQ:MSTR shares in accordance with the SEC's announcement.

Leading up to the recent approval by the U.S. Securities and Exchange Commission (SEC) of exchange-traded funds directly investing in Bitcoin, Michael Saylor, the co-founder of MicroStrategy Inc., participated in a series of share sales.

MicroStrategy Sells NASDAQ:MSTR Just Before ETF Approval

According to data compiled by Bloomberg, Saylor sold between 3,882 and 5,000 shares on specific days from January 2 to January 10, coinciding with the SEC’s announcement. The transactions are estimated to have yielded Saylor over $20 million, marking the first instance of him selling company shares in nearly 12 years. This development comes as the company already sold $216 million worth of NASDAQ:MSTR stock last week.

A spokesperson for MicroStrategy has verified the recent share sales by Michael Saylor, clarifying that these transactions are part of a pre-existing plan disclosed in a filing last year. The spokesperson emphasized that these sales are unrelated to the recent approvals of Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission. The planned sales, involving up to 5,000 shares daily, are scheduled between January 2, 2024, and April 26, 2024, with the intention of selling a total of as much as 400,000 shares during this period.

MicroStrategy, a leading business intelligence firm with substantial Bitcoin holdings, weathered significant losses during the previous crypto winter. The company had to undertake substantial write-offs due to the market downturn at that time.

However, in a remarkable turn of events, MicroStrategy’s current Bitcoin holdings have surged in value to approximately $8.3 billion. This represents a notable paper gain of around 40%, underscoring the company’s resilience and recovery in the crypto market.

NASDAQ:MSTR Stock Under Pressure

MicroStrategy, a prominent player in the business intelligence sector, has witnessed a 23% decline in its stock since the beginning of the year. The drop is attributed, in part, to concerns arising from the debut of exchange-traded funds (ETFs) that could potentially diminish the appeal of the company’s shares as investments.

MicroStrategy, headquartered in Tysons Corner, Va., has long been regarded as a proxy for Bitcoin, given its substantial holdings of the cryptocurrency on its balance sheet for several years. Prior to the recent approval of a dozen spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC), MicroStrategy was a primary avenue for investors seeking indirect exposure to Bitcoin. The emergence of alternative options through ETFs has introduced new dynamics to the market.

However, MicroStrategy chief Michael Saylor stated that the spot Bitcoin ETF launch won’t negatively impact the MicroStrategy stock price.

💾 MicroStrategy Set To Grow Like There's No TomorrowI love the "Community trends" on the front page... TradingView is great.

With this new feature I can see stocks/assets that I would never think of looking at otherwise.

Here we have MicroStrategy, MSTR.

I know about Mr. Michael Saylor as he is a huge Bitcoin fan like most of us.

He also wrote the foreword for the best selling Bitcoin book ever and it was nice to see his opinion about this game we now have been playing for so long.

MicroStrategy is set to grow like there is no tomorrow...

At least that's the message that I am getting from this chart.

I am using the weekly timeframe because long-term gives you a better perspective, short-term there is always too much "noise".

The first thing to look at is the broader cycle and that's the All-Time High, February 2021, almost two years have gone by since this level was hit.

The first thing that caught my attention is the current consolidation pattern and how the bulls are already showing up and strong.

This weekly candle is already trading above EMA21 and EMA10... There is a strong bullish divergence on the RSI since May 2022.

Also, the low in December 2022 came in higher than May, a higher low...

These signals put together make a strong case for bullish growth.

I write these signals for you... But what catches my attention from the go is this sort of "M" pattern, bullish bat, gartley, etc. too many names it has...

This pattern is like a falling wedge in the sense that it has a very high level of accuracy.

It is a bullish pattern of course and once it shows up... The chart tends to shoot up.

You can find the resistance levels marked on the chart (light green) and blue for support.

Namaste.