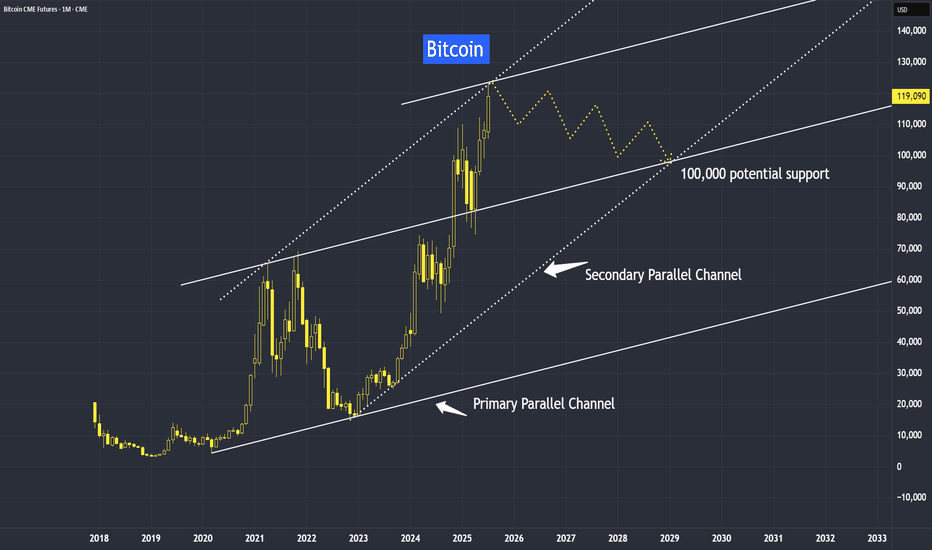

Bitcoin and Upcoming TrendBitcoin’s trend has been growing from strength to strength — and it’s likely to stay that way. Why?

This trend isn’t driven purely by speculation; it’s supported by strong fundamental reasons.

One of the most widely debated topics in finance today is the comparison between Bitcoin and gold. While both are viewed as stores of value, their long-term roles may diverge significantly.

Yet, they’ve been moving in near-perfect synchronization, with potential resistance ahead, but their trend still remain intact — and here’s why.

Mirco Bitcoin Futures and Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Microbitcoin

Bitcoin Forecast After 2024 - Why support at 82,000?Bitcoin's price at the close of December, marked by this inverted hammer, clearly indicates that a correction is imminent. However, the overall trend remains upward.

We will discuss the fundamental reasons why Bitcoin may have temporarily peaked in December 2024, as well as the potential support level around 82,000 this year. Let’s explore how we can manage Bitcoin following its peak above 100,000 as we move into 2025.

Micro Bitcoin Futures & Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Bitcoin Reacted Well to InflationBitcoin serves as an inflation hedge, going beyond its role as a decentralized digital currency that facilitates peer-to-peer transactions without intermediaries like banks or governments.

When inflation peaked at 9% in 2022, both Bitcoin and gold exhibited upward trends—a pattern that has continued to the present day.

Although the latest inflation figure stands at 2.6%, the current levels of gold and Bitcoin, driven by market demand, indicate that inflationary concerns persist.

Today, we’ll explore how to buy Bitcoin during market dips.

Mirco Bitcoin Futures & Options

Ticker: MBTX4

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

BTIC: $1.00 per bitcoin = $0.10 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Will NVDA Gap Hold for ES?E-mini S&P (June) / E-mini NQ (June)

S&P, yesterday’s close: Settled at 5062.25, down 30.25

NQ, yesterday’s close: Settled at 17,658.50, down 222.25

E-mini S&P and E-mini NQ futures finished lower for the fourth session in a row. Most crucially, the S&P tested our rare major four-star support at 5044-5055, this pocket aligns multiple indicators as well as the gap close on February 21st, ahead of NVDA’s earnings release. Given the relentless move down, failed bounce attempts and this critical area of support, it is imperative the bulls show up today.

Bias: Neutral/Bullish

Resistance: 5078-5082**, 5094-5097***, 5110*, 5119-5123.25***, 5127-5131.75***, 5147.25-5153.75***, 5162.75-5167.25***, 5182-5185.50**, 5207.75-5213***

Pivot: 5069.50-5075

Support: 5062.25***, 5044-5055****, 5026-5027.25**, 5018**, 4983.50-4994.25****

NQ (June)

Resistance: 17,767-17,796***, 17,850-17,874**, 17,959-17,988***, 18,051-18,072****, 18,131-18,167***, 18,226-18,254***, 18,326-18,343***

Pivot: 17,719

Support: 17,604-17,638***, 17,463-17,493***, 17323-17,372***, 17,106***

Micro Bitcoin (April)

Yesterday’s close: Settled at 61,130, down 1,790

Bias: Neutral/Bullish

Resistance: 63,350-63,700**, 64,660-64,937****, 66,555-67,595***, 68,172-68,590*, 70,410-70,800**, 71,795-71,815**, 72,110-72,530**, 73,410-73,600***

Pivot: 62,535

Support: 61,632-61,680***, 59,700-60,830***, 57,410-58.250***

Check out CME Group real-time data plans available on TradingView here: www.tradingview.com

Disclaimers:

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Stocks Slammed, Is a Reprieve In Order?E-mini S&P (June) / E-mini NQ (June)

S&P, yesterday’s close: Settled at 5104.00, down 63.50

NQ, yesterday’s close: Settled at 17,876.25, down 303.00

E-mini S&P and E-mini NQ futures finished sharply lower for the second day in a row as both geopolitics and rising rates act as major headwinds to investors’ risk appetite. We are viewing this pullback as healthy and timely with price action in both testing into the aftermath of NVDA’s February 21st earnings report, which was a pivotal catalyst in the market’s next leg higher. While we do not view the driving narratives (geopolitics and rates) to be stale, we do believe a reprieve in prices is in order? Major three-star resistance in the E-mini S&P comes in at 5127-5131.75, and this is a modest first target upon an attempted rebound, with 5147.25-5153.75 marking a 50% back into the week’s range. To the downside, a failure to hold first key support at 5094 would erode this thesis and encourage another wave of selling. As for the E-mini NQ, the February 21st settlement comes in at 17,767 and stands as a line in the sand that has so far withstood an overnight test, but a break below here would also encourage added selling.

Bias: Neutral/Bullish

Resistance: 5120-5123**, 5127-5131.75***, 5147.25-5153.75***, 5162.75-5167.25***, 5182-5185.50**, 5207.75-5213***

Pivot: 5104-5112.25

Support: 5094**, 5081.25**, 5069.50-5075***, 5044-5055****, 5026-5027.25**, 5018**, 4983.50-4994.25****

NQ (June)

Resistance: 17,938**, 18,005-18,072****, 18,131-18,167***, 18,226-18,254***, 18,326-18,343***

Pivot: 17,881

Support: 17,841-17,867**, 17,767-17,792****

Micro Bitcoin (April)

Yesterday’s close: Settled at 63,560, down 3,610

Bias: Neutral/Bullish

Resistance: 64,660-64,890***, 67,170-67,595***, 68,590*, 70,410-70,800**, 71,795-71,815**, 72,110-72,530**, 73,410-73,600***

Pivot: 63,700

Support: 62,535**, 61,632-61,680***, 60,830**, 57,410-58.250***

Check out CME Group real-time data plans available on TradingView here: www.tradingview.com

Disclaimers:

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

The Local Line in the Sand for ESE-mini S&P (June) / E-mini NQ (June)

S&P, yesterday’s close: Settled at 5207.75, down 52.50

NQ, yesterday’s close: Settled at 18,196.75, down 163.00

E-mini S&P and E-mini NQ futures finished lower after a barrage of negative news. CPI for March was a touch warmer than expected, coming in roughly one-tenth higher across the board before a poor 10-year Note auction lifted yields further. The U.S. 10-year Note yield rose by 20bps from 4.36 to 4.56, and according to the CME Group’s FedWatch Tool, the odds for a rate cut in June fell to 16.9%, while July shows a 43.7% probability. Now, we brace for an ECB policy decision, PPI data at 7:30 am CT, producer prices are a leading indicator of consumer prices and a 30-year Bond auction at noon CT.

This has certainly put stock index futures on their back foot. Still, on a positive note, the low in each of the E-mini S&P and E-mini NQ that traded in the immediate aftermath of the CPI release was never taken out during the intraday session. For the E-mini S&P this low aligns to create a critical line in the sand with the 50% retracement back to the February 13th low at 5163.75-5176.50. We will look for construction above here to help shift tides more positively as the rest of the week unfolds.

Bias: Neutral

Resistance: 5203.75-5208.25***, 5214.75-5217**, 5223-5226.50***, 5030.75**, 5241-5244.25***, 5260.25***, 5272-5274.25***, 5280.75-5285**, 5295.25-5300.75***, 5207-5208.50***

Pivot: 5191.50-5196.75

Support: 5185-5188.25**, 5163.75-5176.50***, 5145-5147.25***, 5123.75-5124.25***, 5112.25***

NQ (June)

Resistance: 18,215-18,224***, 18,264**, 18,313-18,350**, 18,405-18,414***, 18,474-18,498**, 18,568-18,607***, 18,691-18,709***

Pivot: 18,185

Support: 18,102-18,118*** 18,051-18,070***, 18,006-18,029***, 17,767-17,881****

Crude Oil (May)

Yesterday’s close: Settled at 86.21, up 0.98

Crude Oil futures slipped early yesterday due to the broader risk-off sentiment, and saw further selling on larger builds within the weekly EIA inventory data. However, price action held major three-star support (newly adjusted to 84.55-84.69 and 84.90-85.10) before geopolitical premium brought a fresh bid as news flow called an Iranian strike on Israel imminent.

Price action is again slipping into the onset of U.S. hours and with support well-defined, we will look to a pivot and point of balance at 86.02.

Bias: Bullish/Neutral

Resistance: 85.29**, 86.58-86.71**, 86.91-87.10***, 87.07-87.22**, 88.37-88.64***

Pivot: 86.02

Support: 84.90-85.10***, 84.55-84.69***, 84.04-84.09**, 83.71***, 83.12-83.25***

Micro Bitcoin (April)

Yesterday’s close: Settled at 70,410, up 1,055

Bias: Neutral/Bullish

Resistance: 71,355**, 72,110-72,530**, 73,410-73,600***, 74,800-75,300***, 80,503***, 82,110***

Pivot: 70,355-70,410

Support: 69,990-70,005**, 68,540-68,785**, 67,75-68,034***, 66,330-66,500***, 64,715-65,260***, 62,955-63,435**, 60,830-61,680***

Check out CME Group real-time data plans available on TradingView here: www.tradingview.com

Disclaimers:

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Helping you map out your gameplanE-mini S&P (June) / E-mini NQ (June)

S&P, yesterday’s close: Settled at 5253.25, up 0.25

NQ, yesterday’s close: Settled at 18,295.00, down 5.75

E-mini S&P and E-mini NQ futures were little changed to start the week as traders and investors await tomorrow’s CPI slate. Given last Thursday's fallout and Friday's stronger-than-expected headline job creation, one could perceive the consolidation as healthy. While there was some construction within the Treasury complex yesterday, we must also keep a close eye on rates as we move through the data-heavy middle of the week.

Price action in E-mini S&P futures held an early low yesterday after the opening bell, creating first key support at 5245.25-5246.50, while E-mini NQ futures have a similar mark with major three-star support at 18,228-18,249. The bears must test and violate these levels in order to potentially break the consolidation ahead of CPI. To the upside, a move out above second key resistance aligning with Friday’s high at 5268.75-5272.50 in the E-mini S&P and 18,406-18,446 in the E-mini NQ could begin to spark a pre-CPI melt, back into the thick of the damage, where indices began rolling over Thursday.

Bias: Neutral

Resistance: 5264.25*, 5268.75-5272.50**, 5279.25-5282**, 5295.25-5300.75***, 5207-5208.50***

Pivot: 5252.50-5253.25

Support: 5245.25-5246.50**, 5231.25-5237***, 5224.50**, 5212.75-5215.50**, 5203.75-5206.75***, 5191.50-5196.75***, 5163.75**, 5145-5147.25***, 5123.75-5124.25***, 5112.25***

Micro Bitcoin (April)

Yesterday’s close: Settled at 72,110, up 4,355

Bias: Neutral/Bullish

Resistance: 72,110-72,530**, 73,410-73,600***, 74,800-75,300***, 80,503***, 82,110***

Pivot: 71,800

Support: 69,610-69,900**, 68,650-68,900**, 67,755***, 66,330-66,500***, 64,715-65,260***, 62,955-63,435**, 60,830-61,680***

NQ (June)

Resistance: 18,370-18,376**, 18,406-18,446**, 18,475-18,498**, 18,568-18,607***, 18,691-18,709***

Pivot: 18,300-18,310

Support: 18,228-18,249***, 18,173-18,191**, 18,102*** 18,051-18,070***, 18,006-18,029***, 17,767-17,881****

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Bitcoin Broke New High – The Real Reasons Behind ItThe relationship between inflation and Bitcoin - they moves in tandem together, in the same direction.

We saw Bitcoin has broken above its 2021 high, and it is likely to continue this trend.

Many attribute the reason behind this rally to the approval of Bitcoin ETF by SEC in January of this year. While this approval serves an incentive, the core reason for this rally is the resilience of US inflation, meaning the inflation is still pretty stubborn, not coming down to the 2% target.

Micro Bitcoin Futures & Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50

BTIC: $1.00 per bitcoin = $0.10

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

IN A BITCOIN FRENZY; LONG BTC MINERS & SHORT BTCBitcoin ("BTC") prices are on a tear. It has rallied +57% since the start of September and is on course to clock fourth sequential month of rising prices. Four forces are driving a blistering rally. Euphoria linked to BTC spot ETF. Bullishness in all “Risk On” assets. Regulatory clarity. BTC halving.

In a BTC rally, portfolio managers can gain exposure to the sector in multiple ways. These include a long position in (a) BTC, (b) BTC Futures, (c) Listed BTC miners’ stocks, (d) Crypto Exchanges, or (e) ETF on Listed BTC Miners (“Miners ETF”).

Each of these presents its own benefits and challenges. This paper summarises the forces driving the bull run and analyses the price behaviour of Miners ETF (represented by Valkyrie Bitcoin Miners ETF “WGMI”) vis-a-vis BTC.

Since June when market caught on to the excitement of a BTC Spot ETF, BTC prices have rallied relative to WGMI.

In the near term, will the ETF catch up with the bull rally in BTC? Has the BTC price rally run ahead of itself?

UNPACKING WGMI ETF

WGMI is an actively managed ETF that invests in listed BTC miners. It is issued by Valkyrie Funds LLC.

The ETF objective is to invest >80% of its net assets in firms that derive >50% of their revenue or profits from BTC mining operations and/or from providing specialized chips, hardware and software or other services supporting BTC mining.

The Fund will not directly invest in BTC. Neither will it indirectly participate in BTC using derivatives or through investments in funds or trusts that hold BTC.

Source: ETFDB and data last updated 7th/December 2023

WGMI was launched in Feb 2022, it has net assets of USD 33 million and an expense ratio of 75 basis points.

In June, when regulatory approval discussions became louder, WGMI rallied relative to BTC. Net fund flows have been positive for much of the year with rising inflows since start of October.

However, since mid-July, while BTC remained resilient, WGMI came off precipitously. WGMI price meltdown stopped in early Oct and has since started rising. Meanwhile, BTC prices have rallied sharply resulting in a WGMI underperforming BTC by 30%.

BTC BULLS IN FULL FORCE

Four forces are driving BTC frenzy.

1. BTC Spot ETF Euphoria

ETF applications were delayed by the SEC and remain pending. Previously anticipated timeline of between 5th and 10th January 2024 remains the expected approval date.

Source: James Seyffart

2. Risk-on Asset Bull Run

When money flows, it flows everywhere. Equity markets have been on an upward trajectory over the past three months on Fed rate cut hopes. BTC is seen as the risk asset of choice rallying the most.

3. Regulatory Clarity

Recently, Sam Bankman-Fried (SBF), former CEO of FTX, and Binance, the world’s largest crypto exchange were both prosecuted. SBF was convicted of fraud and jailed.

Meanwhile, Binance was imposed USD 4.3 billion in penalties on criminal charges related to money laundering and breach of financial sanctions.

In reaction to these developments, JP Morgan's Nikolais Panigirtzoglou said that "We see the prospect of settlement as positive as uncertainty around Binance itself would subside and its trading and BNB Smart Chain business would benefit.

"For crypto investors the prospect of settlement would see the elimination of a potential systemic risk emanating from a hypothetical Binance collapse.", he added.

4. BTC Halving

BTC derives value from its limited supply. Every four years, the number of BTCs minted as a mining reward, halves and will eventually halt, leading to a fixed supply.

BTC halving occurs every 210,000 blocks. As the average block time is ~10 minutes this gives a ballpark range of four years. Next BTC halving is expected on 19th April 2024, with tiny likelihood that it could take place in March or May.

HYPOTHETICAL TRADE SET UP

BTC appreciation due to halving is well known but its effects on miners is counter intuitive. With halving, the block reward for mining BTC i.e. miner revenues are essentially slashed in half.

Although BTC price appreciation helps offset to some degree, it may not be enough if elevated prices cannot be sustained. Macro conditions have shifted. Energy prices are lower positively impacting the miners. Miner margins are likely to be wider.

Large miners are expanding their hash rate at record clip. This is supported by expansion of hash rate as well as consolidation.

Given the frenzied euphoric run up in BTC prices, BTC price may have run ahead of itself. In order to protect long position in Bitcoin miners against downside moves in volatile cryptocurrency prices, investors can hedge a long position in WGMI with a short position in CME Micro BTC futures.

This Relative Value trade captures the alpha from rising stock prices of miners, while remaining agnostic to the price action on BTC itself.

This paper argues for a hypothetical long position in WGMI ETF hedged by a short position using CME Micro Bitcoin Futures expiring in January 2024 (MBTF2024).

A long-short spread requires the notional of each trade leg to be identical. Each lot of Micro Bitcoin Futures provides exposure to 0.10 bitcoin equating to a notional value of USD 4,544. Given WGMI prices as of market close on 8th December was at USD 14.75 per ETF, 308 ETF units are required.

The hypothetical relative value trade then comprises of 308 WGMI units of ETF hedged by one lot of short position in CME Micro Bitcoin Futures with the following hypothetical trade set up:

• Entry: 0.03246% (USD 14.75 divided by USD 45,440)

• Target: 0.045%

• Stop Loss: 0.027%

• Profit at Target: USD 1,755

• Loss at Stop: USD 676

• Reward/Risk: 2.6x

Please note that the above hypothetical P&L doesn’t include transaction and capital costs.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Bitcoin Bull Run Precedes Ethereum RallyDays of triple digit volatility and rampant amateur speculation are gone. Unlike the overblown enthusiasm which defined the peak of 2021, investors now are more measured and discerning.

2023 has been defined by (a) discrete and information fuelled rallies followed by unprecedented low volatility, and (b) rise of traditional finance entrants in digital assets.

Bitcoin (BTC) has rallied sharply relative to Ethereum (“ETH”), pushing BTC-ETH ratio to its highest level since 2021. Several factors point to a potential reversal in the ratio. Investors can deploy CME Micro BTC and Micro ETH Futures to harness gains from eventual reversion.

BTC surged 20% during the past week driven by excitement over the anticipated approval of a BTC Spot ETF. Large liquidations triggered as BTC prices rose on its re-emergence as a haven asset as discussed in a previous paper .

BITCOIN IS A HAVEN (AGAIN)

In October, BTC’s correlation with gold rose while correlation with Nasdaq-100 has inverted suggesting that investors consider BTC as a haven rather than a risk-on asset.

The case for BTC as a haven derives from its limited supply. Every four years, the number of BTCs minted as a mining reward, halves and will eventually halt, leading to a fixed supply.

BTC has played its role as a haven previously. In March this year, during the US regional banking crisis, BTC surged 40%. BTC also rallied 20% at the start of Russia-Ukraine conflict but soon pared those gains. Given the repeated pullback in its prices, question around BTC’s ability to deliver as a safe haven remains.

Assigning BTC a haven status could be a tad bit too early. It is a new asset. It faces regulatory ambiguity. It remains under-invested relative to traditional safe havens like gold and treasuries.

Notwithstanding that BTC is new, it is the most popular and widely tested cryptocurrency. Flow of assets from riskier crypto to the safety of BTC during rising uncertainty partly contributes to haven flows into BTC.

SHORT SQUEEZE ACCENTUATED BITCOIN’S RALLY

Recent rally was punctuated by heavy deleveraging in BTC derivatives. During the long squeeze in August, 64,000 BTCs were liquidated. In the following period, only half of these long positions returned.

These positions were not spared either as large liquidations occurred on October 17th and 23rd leading to unwinding of more than 60,000 BTC.

Source: Glassnode

The size of liquidation was like those in Jan 2023 when prices definitively broke above the $20k range, suggesting that this washout may be adequate to cement a major psychological price level.

AWAITING A BTC SPOT ETF

The latest development in the BTC spot ETF saga comes as an appeals court upheld the ruling against SEC’s rejection of Grayscale’s spot ETF application based on concerns that market manipulation is not addressed sufficiently.

The court held that SEC’s decision was arbitrary, capricious, and unenforceable. This time around, the SEC stated it will not be appealing any further.

The SEC’s easing stance is also echoed in the modest feedback response to other spot ETF applications. Many now believe that all spot BTC ETFs will be approved together and probably before the deadline of January 10th.

Approval of spot BTC ETFs is expected to make the asset available to a wider audience in a familiar Tradfi product structure making BTC go “mainstream.”

Spot ETFs will spur greater demand for spot BTC from ETF manufacturers. When gold ETF was first listed, incremental fund flows translated into higher demand for physical gold.

ETF listing and BTC price run is not a given as regulatory concerns remain. Prices have struggled to sustain ETF excitement driven rallies not once but thrice in 2023 due to slow developments compounded by a harsh macro backdrop.

The risk that the current rally will pullback persists. Earlier this week, price action was significantly influenced by investors speculating on the approval of Blackrock spot ETF (IBTC). The rumours have been spurred by the listing, delisting, and relisting of the ticker on Depository Trust and Clearing Corporation (DTCC) website.

BITCOIN BULL RUN PRECEDE ALTCOIN RALLIES

In stark contrast to BTC’s rally, other major cryptocurrencies have lagged pushing BTC dominance to its highest since 2021.

ETH has rallied 15% over the past week. ETH underperformance relative to BTC has pushed the ratio between them to levels unseen since 2021.

Altcoin underperformance is unusual. During past BTC rallies, ETH price tops lagged BTC tops by a month. This is a consequence of capital rotation within crypto.

In past rallies, asset rotation can be seen in three distinct waves starting with (1) increase in BTC capital, (2) ETH rotation, followed by (3) increasing stablecoin flows.

MARKET METRICS AND ON-CHAIN SIGNALS

A raft of market metrics points to bullish sentiment in crypto markets due to resilient Long-Term Holders (LTH), limited profits at current levels, and strained supply which is expected to be exacerbated by demand from spot ETFs.

More importantly, market metrics indicate a higher bullish sentiment for ETH.

FUTURES AND OPTIONS POSITIONING

Leveraged funds have built up net short positioning over the last few weeks in BTC futures. Contrastingly asset managers have setup net long positioning. In options, BTC full size options have a bullish P/C ratio of 0.51 and Micro BTC options have a P/C ratio of 0.76.

In contrast, leveraged funds bullish on ETH have switched from net short to net long positioning last week. Full size ETH options have bullish P/C ratio of 0.38 and Micro ETH options have P/C ratio of 0.38.

Overall, leveraged funds and option markets are more bullish on ETH compared to BTC.

TRADE SETUP

BTC prices may pullback relative to ETH in the short term given price divergence. CME’s suite of crypto futures can be deployed to harness gains from this trend reversal.

The hypothetical spread posited in this paper consists of two legs: (1) long position in Micro ETH futures expiring on November 24th ( METX3 ) and, (2) short position in Micro BTC futures expiring on the same date ( MBTX3 ).

Each lot of Micro ETH futures provide exposure to 0.1 ETH while each lot of Micro BTC futures provides exposure to 0.1 BTC. To balance notional values, nineteen lots of METX3 are required for each lot of MBTX3 at current prices

● Entry: 19.090

● Target: 17.58

● Stop Loss: 20.000

● Profit at Target: USD 276

● Loss at Stop: USD 169

● Reward to Risk: 1.6x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Still Waters Run Deep - Bitcoin Set To Go Bullish?BACKGROUND

Bitcoin (BTC) price has been in decline for the past year with price crashing as much as 20% on a single day in June. Still, the low set of $17,750 on 18 June (Saturday & hence unseen on CME chart) has turned out to be a resilient support level.

BITCOIN PRICES RESILIENT RELATIVE TO S&P500 (SPX) and NASDAQ-100 (NDX)

NDX and SPX with which BTC is generally correlated have both set new lows since June while BTC has been traded within the same range (of $18k - $20k). This again shows remarkable price resilience. Analysis from market experts points to significant deleveraging within the crypto industry and hence the perception that crypto prices might have bottomed out.

SHRINKING IMPLIED VOLATILITY

Thirty-day forward implied volatility is at record low. Low premiums to acquire call options to secure outsized gains from price break-out is seen on non-traditional crypto derivatives exchanges. Call-put ratio of 2.09 on Deribit points to 2.09 calls for every 1 put, underscoring the bullishness in BTC. However, call-put ratio on CME is 0.362 at the time of this writing.

BULLISH ONCHAIN SIGNALS

Turning our attention to on-chain analysis, we notice that Long Term Holders GLASSNODE:BTC_ACTIVE1Y (those who held BTC for at least 12 months) now represent nearly two-thirds of total BTC supply. This again points to further selling pressure being limited.

BULLISH TECHNICAL INDICATORS

Talking of technicals, BTC/USD is showing a falling wedge formation, suggesting the possibility of a breakout.

BTC has retested its June support at DXY local maximum. As the USD is the primary base currency against which BTC is traded, the value of the Dollar strongly impacts BTC price. The DXY has been rallying all year with an unprecedented rate hiking cycle. However, the DXY has started to show a broadening ascending wedge formation, signaling the softening of rate hiking cycle. The CME FedWatch tool currently suggests three more rate hikes are likely by 22nd March 2023. Anticipation is that each of these upcoming hikes will be incrementally lower relative to the last four outsized rate rises.

TRADE SET-UP

CME’s Bitcoin futures for December are currently discounted relative to spot at the time of this writing, offering investors an opportunity for a long position - amid a macroeconomic backdrop which poses a significant threat to risk assets such as BTC. With that backdrop, an entry around $20,770 with a stop loss at $17.7k (the June low) might provide a compelling trade set-up. Profit could be taken at previous bear market rally highs of $22.7k and $25k delivering a risk reward ratio of 1.38 and 0.63, respectively.

CASE STUDY WITH 1 LOT OF CME Micro Bitcoin Futures

One lot CME Micro Bitcoin Futures provides exposure to 0.10 BTC. CME Micro Bitcoin Futures expiring January 2023 requires a maintenance margin of USD 528 per lot.

Entry at $20,770 and take profit at $22,700 would result in $193 in profits with a return on capital of 36.5%. However, if the trade turns sour triggering a stop-loss at $17,700, it would lead to a loss of $307 amounting to a loss of 58%.

Investors must take note that when prices plunge sharply, stop-losses might be triggered at levels way below the set levels inflating realised losses.

CME Real-time Market Data help identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

This material has been published for general education and circulation only. It does not offer or solicit to buy or sell and does not address specific investment or risk management objectives, financial situation or particular needs of any person.

Advice should be sought from a financial advisor regarding the suitability of any investment or risk management product before investing or adopting any investment or hedging strategies. Past performance is not indicative of the future performance.

All examples used in this workshop are hypothetical and are used for explanation purposes only. Contents in this material is not investment advice and/or may or may not be the results of actual market experience.

Mint Finance does not endorse or shall not be liable for the content of information provided by third parties. Use of and/or reliance on such information is entirely at the reader’s own risk.

These materials are not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject Mint Finance to any registration or licensing requirement.

Micro Bitcoin Futures Will Increase the Addressable Market

Each event lifted Bitcoin to new highs

Next up- Micro futures

Expanding the addressable market through lower margin requirements- Real Estate is about location; other markets are all about liquidity

The market cap is still low and has room to rise

The next event will be the ETFs- It could take time

I remember a commercial that aired in New York for the lottery. The memorable slogan was “All you need is a dollar and a dream.” The odds of hitting the six lotto numbers along with the Powerball number were infinitesimal. At a recent Powerball drawing in Tennessee was one in 292.2 million. People have a one in 2.32 million chance of being killed in a lightning strike, to put the odds in perspective.

Meanwhile, a $1 investment in Bitcoin eleven short years ago bought 166.67 tokens at six cents per coin. At the April 14 high at $65,520, the $1 invested was worth over $1.09 million, a jackpot. The incredible return continues to fuel widespread speculation in the digital currency arena. Each day new tokens come to market. While Bitcoin and Ethereum are the leaders, there were another over 9,500 tokens, and rising, at the end of last week.

While Bitcoin’s value has risen steadily over the past eleven years, it has been a bumpy road. The Mount Gox debacle in 2014 shook confidence in the digital currency market and sent Bitcoin’s price substantially lower. High-profit critics over the past years have called Bitcoin and the other cryptocurrencies everything from a scam to a Ponzi scheme. JP Morgan Chase’s Jamie Dimon called it a “fraud” in 2017. Warren Buffet said it was financial “rat poison squared.” They were wrong as the digital currencies continue to challenge the status quo.

The CME rolled out its first futures contract in December 2017. The move pushed Bitcoin’s value over the $20,000 level. Monday, the CME will introduce a micro Bitcoin futures contract, which is likely to add liquidity to the market and help in the maturation process.

Each event lifted Bitcoin to new highs

Bitcoin has been around for a little over a decade. From humble beginnings where those with the foresight to mine the tokens found a treasure if they held it, the price of the leading cryptocurrency has vaulted to new highs each time acceptance grew.

In late 2017, the Chicago Mercantile Exchange rolled out futures contracts that sent the price to the first record high at over $20,000 per token.

The chart highlights the peak at $20,650 in December 2017.

This picture shows the incredible rise from price levels before the CME’s futures contract, which provided liquidity and expanded the addressable market. The CME rolled out Ethereum futures on February 8 with the same impact on the price of the second-leading digital currency.

Ether’s price rose in anticipation of the futures contract, but the February 8 rollout turbocharged the gains. Ethereum hit an all-time high at $2803.75 on April 29 as the bullish party continues to push the price to higher highs.

Meanwhile, other events have fostered a rising acceptance for the asset class, which has come a long way from Jamie Dimon’s classification as a “fraud” and Warren Buffett’s characterization as “financial rat poison squared.” Last September, Jack Dorsey’s Square (SQ), a payments technology company, bought $50 million worth of Bitcoin. They added another $170 million in purchases in early 2021. Meanwhile, Elon Musk’s Tesla (TSLA) swooped in and bought $1.5 billion of Bitcoin early this year and said it would accept the cryptocurrency for its EVs. Tesla is not the only company accepting cryptos these days. I've included a link to the growing number of companies and businesses accepting Bitcoins in the full article.

The bottom line is that the more companies accept Bitcoin, the more investment capital pours into the market. At the end of last week, Bitcoin’s market cap stood at roughly the $1.082 trillion level.

The Coinbase listing on NASDAQ was the last significant event. On April 14, the listing date, Bitcoin reached its latest record high at $65,520 per token.

Next up- Micro futures

The five-token Bitcoin contract had a nominal value of $327,600 when the price reached its April 14 high. Original or initial margin requirements or the good-faith deposit required to trade a Bitcoin future was roughly $160,000 per contract, precluding many market participants from trading the product. The extreme volatility in Bitcoin’s price requires a high margin level.

This week, on May 3, the CME rolled out the Micro Bitcoin future, a pint-sized product that makes Bitcoin futures trading and investing available to a broader audience. The contract is 1/50th of the size of the original futures (0.1 Bitcoin per micro contract), meaning margin requirements will be around the $2,500 level.

Micro futures will allow for hedging, speculation, and trading at a more manageable risk level for many.

Expanding the addressable market through lower margin requirements- Real Estate is about location; other markets are all about liquidity

In the real estate market, the mantra is location-location-location. In financial products, it’s liquidity-liquidity-liquidity.

Mature markets offer buyers and sellers the ability to execute purchases or sales on tight bid-offer spreads. Tight spreads are only possible when there is enough critical mass or trading volume created by a substantial number of market participants with interest at all price levels.

The CME’s micro product for Bitcoin that lowers nominal margin requirements could have an explosive impact on liquidity. The bottom line is that lower capital requirements make the market available to a growing addressable market, translating to increased liquidity. Liquidity measures include volume and open interest, the total number of open long and short positions in the futures contract.

Moreover, increasing liquidity often causes price volatility to decline. We witnessed this in the natural gas futures ( NG1! ) arena, which began trading in 1990 on the CME’s NYMEX division. The price ranged from 1990 through 2005 was from $1.02 to $15.65 per MMBtu, and the price action was wild at times. Over the first fifteen years of trading, the highest-level open interest ever reached was below 600,000 contracts. As the market matured and liquidity grew, open interest rose to over 1.6 million contracts. Over the past twelve years, increased liquidity led to a significant decline in price variance.

Please continue reading the full article using the link below.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This post does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.