Micron Technology - Another +50% rally will follow!Micron Technology - NASDAQ:MU - will rally another +50%:

(click chart above to see the in depth analysis👆🏻)

About two months ago Micron Technology perfectly retested a confluence of support. This retest was followed by bullish confirmation, nicely indicating a reversal. So far we saw a rally of +100%, but looking at the channel pattern and previous cycles, another +50% will follow.

Levels to watch: $200

Philip (BasicTrading)

#LONGTERMVISION

Microntechnology

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 128usd strike price Calls with

an expiration date of 2025-6-27,

for a premium of approximately $5.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Micron Technology - Starting the next +80% move!Micron Technology - NASDAQ:MU - perfectly respects structure:

(click chart above to see the in depth analysis👆🏻)

Starting back in mid 2024, Micron Technology created the expected long term top formation. We witnessed a correction of about -60%, which ultimately resulted in a retest of a confluence of support. So far, Micron Technology rallied about +60%, with another +80% to follow soon.

Levels to watch: $150, $180

Keep your long term vision!

Philip (BasicTrading)

MU Options Insight: Bulls Eyeing $123Fundamental Overview

Micron Technology's $200 billion expansion plan aligns with the broader push for domestic semiconductor manufacturing. The company is investing $150 billion in fabrication plants across Idaho, New York, and Virginia, while $50 billion is allocated for high-bandwidth memory packaging and R&D. This move strengthens Micron’s position in AI-driven demand and supply chain resilience.

The CHIPS and Science Act funding of $6.4 billion and eligibility for the Advanced Manufacturing Investment Credit further bolster Micron’s financial outlook. CEO Sanjay Mehrotra emphasized that this expansion will create tens of thousands of jobs and reinforce U.S. tech leadership.

Technical Analysis

Micron’s stock is currently near a 12-month high, up 37% year to date. The momentum remains strong, with institutional activity suggesting bullish sentiment.

- Options Flow Insight: A vertical bull spread was spotted in Times & Sales, with 118 strike contracts executed on the ask and 123 strike contracts executed on the bid simultaneously. This suggests a bullish stance, as traders anticipate further upside.

- Expiration Consideration: The June 20 expiration (4 days away) indicates a short-term bullish outlook, likely targeting a breakout above $123.

- Institutional Positioning: The 500 additional contracts at 118 reinforce the bullish bias. If MU moves beyond $123, traders holding the spread still profit, confirming strong conviction in upside potential.

Micron Technology - The Chart Is Still Perfect!Micron Technology ( NASDAQ:MU ) will reverse right here:

Click chart above to see the detailed analysis👆🏻

If you actually want to explain technical analysis to somebody, just show them the chart of Micron Technology. Almost every structure makes perfect sense, with this stock respecting all major trendlines and horizontal levels and with the current support area, the bottom is now in.

Levels to watch: $70, $210

Keep your long term vision,

Philip (BasicTrading)

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

Micron Technology (MU): AI Powerhouse Trading at a 40% Discount!1️⃣ AI Boom: Micron’s advanced DRAM and NAND solutions are fueling growth in AI and cloud computing, with Nvidia’s ecosystem showcasing its critical role.

2️⃣ Analyst Targets: With 42 ratings averaging $131.47 and highs of $150, Micron offers over 50% upside from current levels.

3️⃣ Automotive Growth: As the top memory supplier for autonomous vehicles, Micron dominates a market set to grow at a 27% CAGR.

4️⃣ Technical Momentum: Breaking $75 resistance, a golden cross and rising volume confirm strong bullish signals.

💹 Trade Setup:

TP1: $100

TP2: $110

TP3: $120

SL: $80

Micron is a top-tier AI play at a deep discount. With massive growth catalysts, it’s primed to soar! 🚀

Micron Technology - Fully Resisting The Stock Market Crash!Micron Technology ( NASDAQ:MU ) is one of the few bullish stocks:

Click chart above to see the detailed analysis👆🏻

Despite the stock market kind of "crashing" lately, Micron Technology is one of the few stocks which remains in a rather bullish environment. Following the uptrend, the bullish break and retest and the beautiful cycles on Micron Technology, this strength will soon become reality.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

MU, bound for more significant RISE ahead this 2025! from 100.Micron Technology, Inc. is an American producer of computer memory and computer data storage including dynamic random-access memory, flash memory, and solid-state drives. It is headquartered in Boise, Idaho.

Based on latest metrics, MU is now at basing zone finally after experiencing heavy downtrend since last years peak at 153 on June 2024.

The stock is currently on a massive SHIFT in trend hinting of a weighty reversal to the upside. It already bounced more than 20% from its lows at 80 levels since late last year.

Fridays' closing price of +6% is already conveying its directional context for the rest of the year -- more RISE ahead.

Also factoring its last QTR Results which are all in greens.

(USD) Nov 2024 Y/Y

Revenue 8.71B 84.28%

Net income 1.87B 251.54%

Diluted EPS 1.67 249.11%

Net profit margin 21.47% 182.23%

Operating income 2.17B 292.73%

Net change in cash -355M 30.39%

Cash on hand - -

Cost of revenue 5.36B 12.6%

----------------------------------

Spotted price at 100.

Interim target at 150

Mid at 200.

TAYOR. Trade safely.

Micron Technology - The Textbook Chart!Micron Technology ( NASDAQ:MU ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

For the past seven year, Micron Technology has been respecting a pretty clear rising channel pattern. With the recent all time high breakout, it is very likely that this level is now holding as support and we will eventually see a rejection and new all time highs.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

Micron (MU) Stock Update: Correction or Collapse?Morning Trading Family

Here's what's up with Micron (MU): If it bounces back at 92, cool. But if it keeps going down, it might hit 89-90 before it stops. If it drops past that, we might see it go to 84 or even 80. This could be a big moment for MU, so keep watching!

Kris/Mindbloome Exchange

Trade What You See

Micron's Next Move: Will $102 Trigger a Drop to $98?Micron (MU) is showing a head and shoulders pattern, and it’s at a critical level. If it breaks below $102, I think we could see it drop to $99.50 or even $98.

This could be a big move, so keep an eye on it!

If this helps, I’d love to hear your thoughts—drop a comment, like, or share. Let’s trade smarter and live better! 💡

Kris/Mindbloome Exchange

Trade What You See

Micron Technology's Journey to the 136 PeakGood morning, trading family! Here's the lowdown on Micron Technology (MU):

Picture MU climbing "136 Peak" with hurdles at $104, $111, and $114. Each is like a mountain bump where we might see a slip or a leap forward. With AI and memory chips in high demand, Micron's equipped for this climb, but expect some corrections like pit stops. Keep an eye on tech trends and the economy; they'll tell us if MU makes it to the top!

If you found this useful: boost, share, like, and comment. I appreciate all the support! If you're struggling as a trader to be sustainable, I get it - I've been there myself. Jump in, send me a DM or head to my profile; I'm more than happy to help.

Kris/Mindbloome Exchange

Trade What You See

Micron Technology: Bearish or Ready to Break Out?Good morning, trading family!

Micron (MU) is at an important spot right now:

If we move lower, I’m watching $97 and $96 as key levels, with potential for more downside.

If we hold above $100, there’s room to climb to $102, $103, and $104. A break above $104 could mean a smoother ride higher.

I’m also hosting a Master Your Mind Traders Class this Sunday to help you refine your skills and mindset. Want to join? Send me a message for details.

Kris/ Mindbloome Exchange

Trade What You See

Semiconductor Stocks Blast Off as Foxconn's Revenue Takes FlightA perfect storm of positive factors sent semiconductor stocks soaring, with major players experiencing significant gains. Here are the key drivers behind this surge:

1. Foxconn's Record-Breaking Revenue: A 15% year-over-year revenue increase and a 42% rise in December sales ignited investor optimism in the sector.

2. AI Demand Anticipation: Foxconn's strong results underscored ongoing demand for AI technologies, fueling expectations for future growth in the semiconductor space.

3. Microsoft's $80 Billion AI Investment: The tech giant's commitment to AI-enabled data centers further boosted expectations for increased demand for specialized chips, particularly from Nvidia.

The impact on leading semiconductor companies was substantial:

● Nvidia Corporation NASDAQ:NVDA : Up +3.4%

● Advanced Micro Devices NASDAQ:AMD : Up +3.3%

● Micron Technology NASDAQ:MU : Up +10.5%

As the demand for AI technologies continues to grow, semiconductor companies are well-positioned to capitalize on this trend, driving growth and innovation in the sector.

Micron Technology - The perfect chart!NASDAQ:MU is one of these stocks, which just respects every level, cycle and structure.

If I would give each chart an individual rating, the chart of Micron Technology would be 10 out of 10. Micron Technology is actually respecting every structure level and providing textbook trading opportunities. If we get a retest of the previous all time high, which is now turned support and perfectly lining up with the support of the rising channel, I will certainly look for longs.

Levels to watch: $90

Keep your long term vision,

Philip - BasicTrading

Micron Technology (MU): Is a Big Move Just Around the Corner?Good morning, trading family!

Micron’s price has been moving between $92.90 resistance and $84.26 support, and it looks like a big move could be coming soon. Will we see a breakout to higher levels, or a pullback to retest support?

This is one of those setups where being patient and watching how the price reacts at these levels can really pay off. Stay ready, and let’s tackle this opportunity together!

Comment, like, follow, or send me a DM if you want a deeper analysis or more insights!

Kris/Mindbloome Exchange

Trade What You See

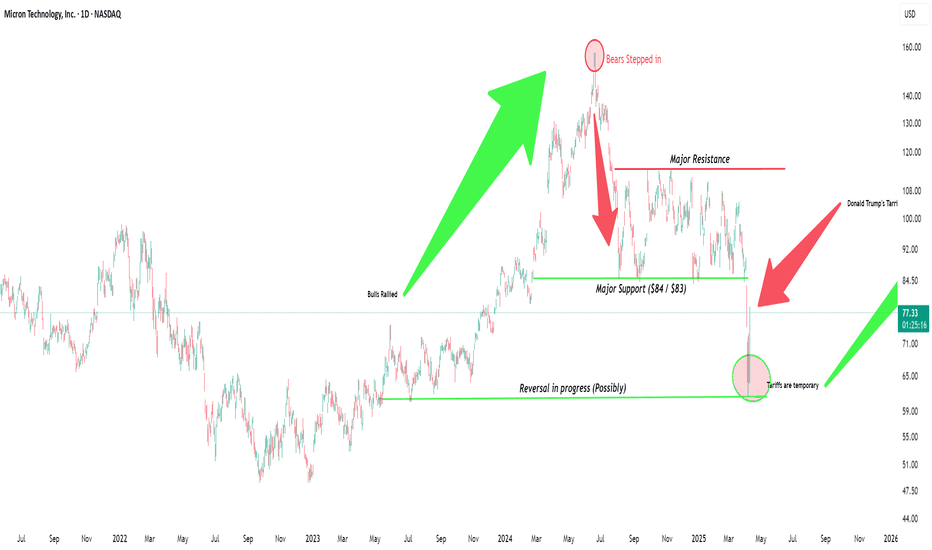

Micron ($MU) is Poised for Action – Here’s What’s ComingMicron is sitting at a major decision point, and the next move could be big. Here’s the game plan:

If we drop below $84: Things could get bumpy, with possible corrections to $74, $70, or even $63–$64.

If we break above $93: The sky’s the limit, with targets at $100, $110, and maybe even $138 on the horizon.

This is one to watch closely. Big moves are coming, so stay sharp and ready to ride the wave!

Kris/Mindbloome Exchange

Trade What You See

Micron Technology (MU) Stock Drops 16%Micron Technology (MU) Stock Drops 16%

On Wednesday, Micron Technology released its quarterly earnings report after the main trading session closed. The results aligned closely with analysts' expectations: earnings per share came in at $1.79, slightly above the forecast of $1.76, while revenue met projections at $8.71 billion.

Despite meeting estimates, the chipmaker issued a disappointing forecast for the next quarter, citing weak demand for personal computers (PCs) and smartphones. This overshadowed positive projections for the growth of the artificial intelligence (AI) chip market. Morningstar analyst William Kerwin warned of a potential "significant decline" in revenue from chips used in smartphones and PCs in 2025, driven by challenging market conditions.

As a result, Micron Technology's stock opened Thursday's session with a significant bearish gap and continued to slide throughout the day, closing 16% lower than Wednesday's closing price.

The chart of Micron Technology shares reveals bearish signals, as the price has broken below the support line of the long-term upward channel defined by key reversal points.

Currently, the stock is hovering around the $85.50 support level, which successfully halted the bearish momentum in August and September. However, with market sentiment dampened by Jerome Powell’s cautious comments about the pace of rate cuts in 2025, MU shares may face further downside. If this happens, the downward channel (highlighted in red) could become the dominant trend.

Analysts remain optimistic despite recent developments. According to TipRanks:

→ 23 out of 24 analysts recommend buying MU stock.

→ The average 12-month price target is $153.05.

That said, if the stock continues to deviate from the blue upward channel, analysts may adjust their price targets downwards to reflect the changing outlook.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Micron Technology - This Stock Will Double Soon!Micron Technology ( NASDAQ:MU ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

After we saw a test of the resistance trendline on Micron Technology a couple of months ago, it was quite likely that we will eventually retest the previous all time high. This structure is now acting as massive support and together with the rising trendline, we will see a bullish rejection.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

Micron (MU) is Heating Up! Breakout at $114.52 and Soar UP Key Levels to Watch:

Breakout Level: $114.52

Retracement Target: $122

Major Resistance Levels:

First Target: $140

Final Target: $170

What to Expect:

If MU can break and close above $114.52, we could see a retracement to $122, creating a solid base for the next leg up. Once it clears $140, the path to $170 becomes much clearer. This level will be critical for the bulls, and if it’s breached, MU could be in for an exciting run!

Kris/ Mindbloome Exchange

Trade What You See

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the previous earnings:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 105usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $4.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.