Microstrategy

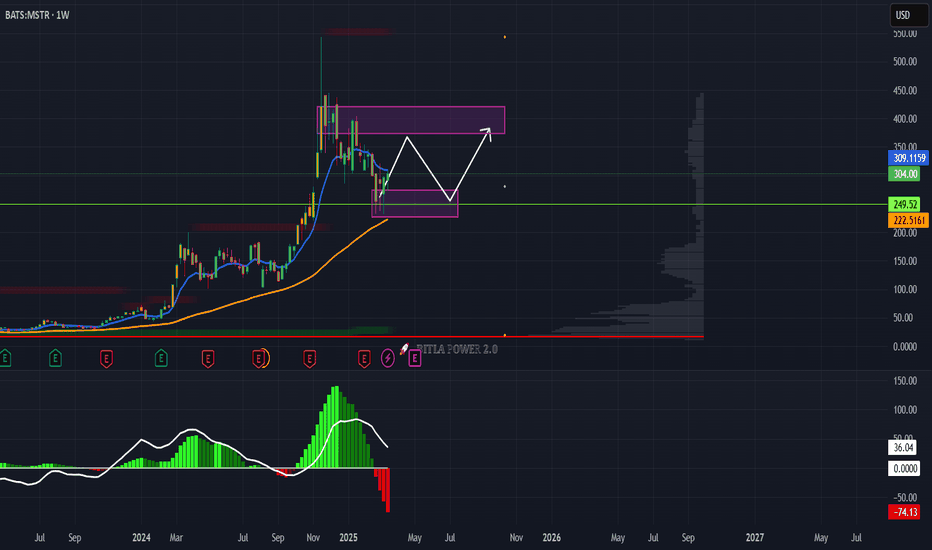

MicroStrategy To $370?Hello friends! I'm back with an analysis of MSTR. As we can see, the price had a significant drop of 57% from November 2024 to March 2025. The price is highly correlated with Bitcoin, and said cryptocurrency is in a wave 4 within an Elliott wave pattern. Therefore, Bitcoin will be returning to test $110,000. Therefore, MSTR, holding 499,096 bitcoins, will see a very significant rise in its price. In the short term, MSTR will be going to test its luck at $370 per share. However, it is highly likely that it could return to $410 per share. MSTR has many technical and fundamental indicators in its favor to be a highly profitable value asset. The best buying zones are below $300 per share.

Disclaimer: This is only an opinion; it should not be used as investment advice or recommendation.

Strategic $MSTR Accumulation: $340 Break for Macro ContinuationDecided to start buying back some $MSTR. I’ve been waiting since late December to begin accumulating, and I initially thought it would stay above $300, forcing me to jump back in.

Now that it's in an optimal buy area with enough confluence on the weekly timeframe, I’m accumulating under $250. I’ll add the last chunk once it breaks above $340.

Just keep in mind there’s a strong weekly downtrend in play, but it’s already hit the first target, so I expect a bounce. If it reclaims the POC at $340, it would invalidate the downtrend. So, I'm taking my chances on a possible invalidation and a continuation of the macro trend.

MicroStrategy - Wave D Since 2002 Just Completed...AriasWave analysis indicates that MicroStrategy, now known as Strategy, is poised for a sharp decline reminiscent of the Dot-Com Bust era.

The anticipated drop in Wave E is expected to coincide with a significant downturn in broader indexes and cryptocurrencies.

Additionally, my latest Bitcoin analysis, set to be released later this week, suggests that Bitcoin has finally peaked, and a price collapse is only a matter of time.

BTC, Fibs, Market Psychology, and You: A Primer The Setup

I've identified a compelling technical setup that suggests BTC could be heading toward the $9,000-$9,850 range. This isn't just another bearish call - it's based on a rare convergence of multiple technical factors that I've rarely seen align so perfectly in my 18 years of trading markets.

Technical Confluence Zone

What makes this setup particularly compelling is the convergence of multiple independent technical factors around the same price zone:

1. Unfilled CME Gap : The Bitcoin futures chart shows a persistent unfilled gap from 2020 between $9,655 and $9,850. This gap has survived multiple market cycles without being filled, making it increasingly significant.

2. Key Fibonacci Level : The 0.382 Fibonacci retracement level sits at $9,024.11, remarkably close to the lower bound of the CME gap when accounting for the typical futures premium over spot.

3. Elliott Wave Structure : The current price action suggests we're in Wave 4 of a larger Elliott Wave pattern. Wave 4 corrections often retrace to previous Wave 1 territory, which aligns with this target zone.

4. Fibonacci Time Cycles : The time component is equally important - Fibonacci time extensions suggest we're approaching a potential inflection point in the current cycle.

Market Context Supports the Technical Picture

The technical setup doesn't exist in a vacuum. Several market conditions increase the probability of this scenario playing out:

1. Market Saturation : The crypto ecosystem has expanded dramatically, with thousands of tokens diluting liquidity that was once concentrated in major cryptocurrencies.

2. Retail Exhaustion : Retail investors who entered during previous hype cycles feel unrewarded despite price recoveries, leading to diminished enthusiasm and buying pressure.

3. Institutional Distribution: Wall Street and institutions have made their presence known, which historically signals they've distributed their high-priced holdings to retail while preparing short positions.

4. Concentrated Leverage Risk : MicroStrategy's position of 499,500 BTC at a $66,000 average purchase price, funded almost entirely by massive debt issuance, creates a significant systemic vulnerability. A move toward our target zone would put extreme pressure on their balance sheet.

Broader Market Context

This analysis also coincides with what looks to be a tired stock market following the 2024 US presidential election. With Donald Trump winning his second term, we have seen significant policy shifts that are actively impacting both traditional and crypto markets. Historically, markets often experience increased volatility during transitions of power, and the confluence of this political shift with our technical setup creates an even more compelling case for caution.

Additionally, price precedes news. The news is created on price. If you're hearing about an event, the trade has already been made. There is too much talk of unprecedented institutional participation. This is another sign that retail is being distributed to for the next meltdown. Bags were already offloaded. It's time to drop the anchor.

Historical Perspective

Having traded through multiple market cycles since 2007 I've seen this pattern before. Large players often target overleveraged positions to acquire assets at distressed prices. Michael Saylor experienced a leveraged meltdown once before during the dot-com crash - history doesn't repeat, but it often rhymes. Saylor is a designated whipping boy. A patsy. He will be rewarded well for his participation in fleecing you, so don't worry about what kind of skin he has in the game.

With that said, I believe an undetermined Black Swan event will be necessary to complete the rug pull. What that is, I cannot know.

Trading Implications

This analysis suggests several potential trading strategies:

1. Risk Management : Reduce exposure to Bitcoin and high-beta altcoins until this technical target is reached or invalidated.

2. Opportunity Preparation : Build dry powder positions to capitalize on what could be an exceptional buying opportunity if BTC reaches the $9,000-$9,850 zone.

3. Watch for Triggers : Monitor for breakdowns below key support levels that could accelerate the move toward our target zone.

4. Time-Based Entries : Use the Fibonacci time cycle extensions to refine entry timing if the price approaches our target zone.

Conclusion

While Bitcoin's long-term prospects remain strong, the confluence of technical factors pointing to the $9,000-$9,850 range suggests a significant correction may occur before the next sustained bull run. The catalysts to reach what should be a $250k range this cycle simply do not exist, and with waning macroeconomic strength, the odds of this cycle being anything other than a massive bulltrap are low. This setup represents one of the strongest technical cases I've seen. I also don't care to share my ideas often, but with everyone expecting a typical crypto market cycle, I feel compelled to offer my take on a public forum--for whatever it may be worth.

I am not shorting this market. I have removed my capital and taken an observant position. While I feel strongly about my idea--Clown World has fully taken hold and I don't dare test its resolve to break me.

Remember that no analysis is guaranteed - always manage risk accordingly and be prepared to adapt as the market evolves.

*Disclaimer: This analysis represents my personal view of the markets based on technical analysis and market observations. It should not be considered financial advice. Always do your own research and trade responsibly.*

Can MicroStrategy Save Bitcoin's Destiny?MicroStrategy’s dramatic stock decline has become a bellwether for the broader digital asset market. As its share price plunges, the company’s deep ties to Bitcoin spotlight a precarious balance between corporate strategy and the volatility inherent in the crypto space. This unfolding scenario challenges investors to reconsider the intertwined fates of traditional finance and digital innovation.

The company’s approach to using Bitcoin as a primary treasury reserve has been revolutionary and risky. Aggressive accumulation strategies, including debt financing and Bitcoin-backed loans, have magnified the impact of market fluctuations. With critical support levels now under threat, the risk of forced asset sales looms large—an event that could cascade through the crypto ecosystem and undermine confidence in digital currencies.

Amid these challenges, MicroStrategy is also pursuing bold financing initiatives to stabilize its operations. Plans to raise $21 billion through a preferred stock offering signal a dual objective: securing necessary capital and further investing in Bitcoin. This move reflects an ongoing commitment to a Bitcoin-centric strategy, even as recent transactions have resulted in significant unrealized losses.

In parallel, the cryptocurrency landscape faces unprecedented headwinds from regulatory pressures, geopolitical tensions, and emerging technological vulnerabilities. Financial professionals are compelled to balance risk with opportunity, rethinking investment strategies amid an environment where innovation meets uncertainty at every turn.

The looming threat of quantum computing adds another layer of complexity. As quantum technologies advance, their potential to break current cryptographic standards—on which Bitcoin’s security fundamentally relies—poses a significant risk. Should quantum computers overcome encryption protocols like SHA-256, the very foundation of blockchain technology could be compromised, forcing the industry to adopt quantum-resistant measures rapidly. This challenge not only underscores the volatility of the digital asset market but also inspires a deeper exploration into safeguarding the future of decentralized finance.

MicroStrategy bouncing off 200 MAWe have also seen S&P 500 bounce off its own 200 day average, while the Nasdaq is coming off earlier lows. Meanwhile Nvidia is now positive on the session after starting the da below $110. So, a bit of a bounce back for stocks- is this the turnaround?

MicroStrategy could start next leg up here, if it again holds the 200-day average support near $235.

By Fawad Razaqzada, market analyst with FOREX.com

MSTR IS JUST GETTING STARTED - ONLY FOOLS SELL NOW!MSTR and Bitcoin are gearing up for the biggest bull run you've ever seen. Its unbelievable how many people are selling now thinking the bear market is starting and the bull run is over. Its crazy how many bears are flooding X and other platforms. It makes me laugh people calling Saylor a top signal and stupid. Saylor is not stupid and to think that you're smarter than him is just dumb. These rich dudes and hedge funds know whats going on, way better than anyone on here or any other platform. They control the markets, they have the money to make the charts do what they want. Dont be fooled.

None of this is financial advice. Just my opinion. Follow me for more charts and updates.

MicroStrategy $MSTR | MicroStrategy’s Bitcoin Bet Sees 20% DropMicroStrategy NASDAQ:MSTR | MicroStrategy’s Bitcoin Bet Sees 20% Drop Feb28'25

With recent downturns in the crypto market, Bitcoin's sharp drop has significantly impacted companies like MicroStrategy NASDAQ:MSTR , which has heavily invested in crypto. I've kept this analysis updated for my students throughout the week and figured I'd post it publicly.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, btc, bitcoin, mstr, micro, microstrategy, strategy, cryptocurrency, cryptodrop, cryptotrend, memecoins, crypto, digitalcurrency, digitalassets, mstrdrop, btcdrop, bitcoinidea, mstridea, mstranalysis, btcanalysis, cryptoanalysis, cryptotrades,

Turning BTC into Revenue: MicroStrategy's Innovative ApproacMicroStrategy's Wild Ride: Navigating Bitcoin's Volatility with a "Yield" Strategy

MicroStrategy (MSTR), the enterprise software company that famously pivoted to a Bitcoin acquisition strategy, has seen its stock price plummet by roughly 16% year-to-date. This downturn mirrors the broader volatility experienced by Bitcoin, which has faced significant headwinds amidst rising interest rates and macroeconomic uncertainty. However, despite the short-term turbulence, a significant portion of stock analysts remain bullish on MicroStrategy's long-term outlook, primarily due to the company's innovative "Bitcoin yield" strategy.

MicroStrategy's bold decision to adopt Bitcoin as its primary treasury reserve asset, spearheaded by former CEO Michael Saylor, has inextricably linked its fortunes to the cryptocurrency's performance. When Bitcoin surges, MSTR typically follows suit, and conversely, downturns in the crypto market exert downward pressure on the stock. This direct correlation has made MSTR a high-beta play on Bitcoin, offering investors amplified exposure to the digital asset's price fluctuations, both positive and negative.

The recent decline in MSTR's stock price can be attributed to several factors. Firstly, the Federal Reserve's aggressive interest rate hikes to combat inflation have dampened investor appetite for riskier assets, including cryptocurrencies. This has led to a significant sell-off in the crypto market, dragging down Bitcoin's price and, consequently, MSTR's valuation.

Secondly, concerns about regulatory scrutiny in the cryptocurrency space have added to the market's unease. Increased regulatory oversight and potential crackdowns on crypto exchanges and projects can create uncertainty and dampen investor confidence.

Lastly, general market sentiment towards growth stocks and technology companies has been bearish, further contributing to MSTR's decline. As a company closely associated with the tech sector and the volatile cryptocurrency market, MicroStrategy has been particularly vulnerable to these broader market trends.

Despite these challenges, the bullish sentiment from stock analysts stems from MicroStrategy's unique approach to generating "Bitcoin yield." This strategy involves utilizing the company's substantial Bitcoin holdings to secure loans and generate revenue through various financial instruments.

One key component of this strategy is the use of Bitcoin-backed loans. MicroStrategy has successfully leveraged its Bitcoin holdings to obtain loans at favorable interest rates, effectively monetizing its digital assets without selling them. This allows the company to generate cash flow while maintaining its long-term Bitcoin position.

Furthermore, MicroStrategy is exploring other avenues to generate Bitcoin yield, such as participating in staking and lending platforms. These activities allow the company to earn interest or rewards on its Bitcoin holdings, further enhancing its revenue streams.

Analysts argue that this "Bitcoin yield" strategy provides MicroStrategy with a sustainable business model, even during periods of Bitcoin price volatility. By generating revenue from its Bitcoin holdings, the company can mitigate the impact of price fluctuations and maintain its financial stability.

Moreover, the company's continued accumulation of Bitcoin, even during price downturns, demonstrates its long-term commitment to the cryptocurrency. This unwavering belief in Bitcoin's future potential is seen by many analysts as a strong signal of confidence.

However, the "Bitcoin yield" strategy is not without its risks. The crypto lending market is still relatively nascent and subject to regulatory uncertainties. Counterparty risk and the potential for loan defaults are also factors that could impact MicroStrategy's financial performance.

Another element that is important to consider is the level of debt Microstrategy has taken on. The company has funded its Bitcoin purchases through debt offerings, and while the "Bitcoin yield" strategy is designed to cover the interest payments, a prolonged bear market could put pressure on the company's balance sheet.

The success of MicroStrategy's strategy hinges on the long-term appreciation of Bitcoin. If Bitcoin's price continues to rise, the company's Bitcoin holdings will increase in value, and its "Bitcoin yield" strategy will become even more profitable. However, if Bitcoin's price stagnates or declines, the company's financial performance could be negatively impacted.

In conclusion, MicroStrategy's stock price has experienced significant volatility in line with Bitcoin's performance. While the recent downturn has raised concerns, stock analysts remain optimistic about the company's long-term prospects, citing its innovative "Bitcoin yield" strategy. This strategy, which involves leveraging Bitcoin holdings to generate revenue, provides MicroStrategy with a unique business model that could potentially mitigate the impact of Bitcoin's volatility.

However, investors should be aware of the risks associated with this strategy, including regulatory uncertainties, counterparty risk, and the potential for loan defaults. The success of MicroStrategy's strategy ultimately depends on the long-term trajectory of Bitcoin's price. As the cryptocurrency market continues to evolve, MicroStrategy's ability to adapt and navigate these challenges will be crucial to its future success.

Microstrategy Enters "The Valley of Risk"A term I have coined, "The Valley of Risk", describes a price chart which has had a prior very strong bullish trend, pulls back to its 50% Retracement Support, and then fails to hold it... entering a long, grinding, bearish deflation which coincides with the heavy negative emotion being felt by those still holding the bag.

Inside the "Valley of Risk" nothing one does is correct:

If you sell... it will bottom and rally

If you buy... it will continue down

If you baghold... it will continue to go down until you cannot stand it and #1

This is just a pattern of human emotion being reflected on a price chart... which is what price charts ultimately are. It is best to avoid going into the Valley of Risk and have strict rules against bagholding. Deploy your capital elsewhere that there is a better potential rate of return.

When I teach about this concept I always look back to Zillow NASDAQ:Z . This was a stock I bought "on a dip" at 111 and made the right decision to sell my position at a loss at 102 when the stock price violated the 50% Support. This allowed me to avoid the horrible Earnings miss gap and the final -74% depreciation. My position still would not have recovered as of writing.

As I published months ago, it became clear to me that the over exuberance and fancy financial buzz words being thrown around about NASDAQ:MSTR were signs of a ponzi about to collapse. Well, the "Bitcoin nuclear reactor" has cooled and the leverage baked into Microstrategy would be its downfall. That has now come to pass. There are some other interesting elements of price action which have been textbook in this decline that I want to talk about in this post.

The 50% Retracement:

The operative level for the last 3 months has been 328. This is the 50% Retracement of the YOLO rally. In the pullback from the ATH 440 became the 50% Retracement Resistance.

The Ichimoku Cloud Breakout Confirmed:

The other textbook setup was when the Ichimoku Cloud Breakout was confirmed by the Lagging Span entering clear bearish space after price had exited the cloud. Interestingly, this happened at the same exact day as Bitcoin; last Friday. You can read more about this strategy and my 14 year study of how effective it is in my recent Ideas:

So what now?

That is the eternal question of "The Valley of Risk". There is never a good answer because the technical supports have been broken.

Personally though I need to answer this question for my bearish positions. The most logical point to look would be the Volume Profile POC at 165. However, Microstrategy is going to move concurrent to Bitcoin itself and knowing the past bearish cycle patterns this week, through brutal, will find a bottom. I do not believe it will be the final bottom only that price may hesitate at some point for perhaps even a month.

My trade management

This week I will be selling premium against my long Puts, which go out to 2027, to offset my Theta while still remaining short Delta.

MicroStrategy - Bitcoin Holdings Chart & Purchase HistoryPrices and volumes of Bitcoin purchases at MicroStrategy

Over 9k BTC at an average price of 58000. 19452 Btc at $52765.

Even these whales are buying at the tops and sitting in the minuses for years

The largest holder of Bitcoin on the planet is not Microstrategy , but the Chinese government, cryptoanalysts found (twitter.com/cryptoquant_com).

In 2019, Chinese authorities confiscated 194 thousand #BTC , 833 thousand #ETH and other coins as a result of an investigation into PlusToken fraud. To this day, the confiscated crypto lies in the wallets of China's national treasury.

In comparison, MicroStrategy has about 130,000 bitcoins .

27 march

MicroStrategy repaid its $205M Silvergate loan at a 22% discount . As of 3/23/23, $MSTR acquired an additional ~6,455 bitcoins for ~$150M at an average of ~$23,238 per #bitcoin & held ~138,955 BTC acquired for ~$4.14B at an average of ~$29,817 per bitcoin .

Best regards EXCAVO

MicroStrategy (MSTR) AnalysisCompany Overview:

MicroStrategy NASDAQ:MSTR combines business intelligence solutions with a Bitcoin-focused investment strategy, holding 471,107 BTC (~$18B) as of now. The company has made significant strides in Bitcoin accumulation, positioning itself as a leveraged play on Bitcoin’s price appreciation.

Key Catalysts:

Aggressive Bitcoin Accumulation 📈

MicroStrategy continues to expand its Bitcoin holdings, raising $563M through an 8% Series A Preferred Stock offering to buy more BTC.

The "21/21" Plan 💡

This plan aims to raise $42B over three years, positioning MSTR as a strategic Bitcoin growth bet.

Indirect Bitcoin Exposure for Institutions 💰

With regulatory uncertainty around Bitcoin ETFs, MSTR offers a secure method for institutional investors to gain exposure to Bitcoin through equity.

Investment Outlook:

Bullish Case: We are bullish on MSTR above $295.00-$300.00, reflecting its Bitcoin-centric strategy and institutional adoption.

Upside Potential: Our price target is $600.00-$620.00, driven by continued Bitcoin accumulation and the growth of institutional interest in crypto exposure.

📢 MicroStrategy—The Bitcoin-Business Intelligence Hybrid. #Bitcoin #CryptoExposure #MSTR

MicroStrategy’s Premium Is Fading – Time to Brace for a Drop?The strong optimism following Trump’s election in November fueled a Bitcoin rally, which in turn led to a massive surge in MicroStrategy’s ( NASDAQ:MSTR ) stock.

However, after reaching an all-time high near $550, MSTR experienced a sharp decline. Interestingly, despite Bitcoin hovering around $100K and even attempting a new ATH recently, this momentum hasn’t been reflected in MSTR’s stock price.

From a technical perspective, the price has broken below its ascending trendline and is now consolidating between $320 and $360.

Given the unjustified premium (at least in my opinion), I expect further downside for the stock.

Additionally, if Bitcoin fails to hold the key $90K confluence support, MSTR could see a sharp plunge below $200.

MicroStrategy’s Make or Break MomentThe chart shows a breakdown from a descending wedge pattern, followed by a retest of the broken support turned resistance. A short position has been placed, anticipating further downside. The price is currently testing the retest zone, and rejection from this level could confirm continuation to the downside.

The stop-loss is strategically placed above 455.10, beyond a key resistance level, to minimize risk in case of a failed breakdown. The take-profit target is set near 224.56, aligning with a significant demand zone. The current price of 335.94 indicates minor volatility, but the structure suggests a potential bearish continuation if the price fails to reclaim the resistance zone.

If the breakdown holds, the next move could accelerate towards lower levels, making this a crucial moment for price confirmation. A reclaim of the resistance zone could invalidate the setup and trigger a short squeeze. The market’s reaction at this level will determine the next directional move.