Dow Jones Industrial Average Index (DJI) Analysis 05/03/2021as we can the there is a bearish divergence between Price and MACD, which is the sign of trend reversal and we can predict the 61.8% of Fibonacci retracement as one of our TPs

so soon we shall face an other recession

how big this time. we shall see.

if 61.8% Fibonacci retracement stands then we may go for a bullish rally and if not and braked down then a huge recession and history will be repeated again...

Milo

Silver (XAGUSD) Analysis 04/03/2021this is a 2 Day Candle Chart

as we can see the Price is up Ranging in a Yellow Ascending Parallel Channel where currently it is trying to break the lower bond.

there exist a Fibonacci golden zone of the smaller impulsive wave, which can show Support and if the price bounces from it then we can target the 1TP, which is Fibonacci Expansion -27% level of the main Bullish Wave.

the Red Box (Fib Confluences Level IMPORTANT) is the confluences of the 76.4% Fib Retracement of Smaller Impulsive wave and 38.2% Fib Retracement of the main bullish wave, where if the price falls and it stands as a support and bounces the price, then we can target the 2TP, which is the -61.8% Fibonacci Expansion Level of the main Bullish Wave.

there are 2 Vertical Lines which Shows the Speculated Dates for Achieving the Specified Targets, they are specified by Trend-Base Fibonacci Time,

there are total of 2 TPs Specified

1TP=35$

2TP=41$

please comment your Opinions...

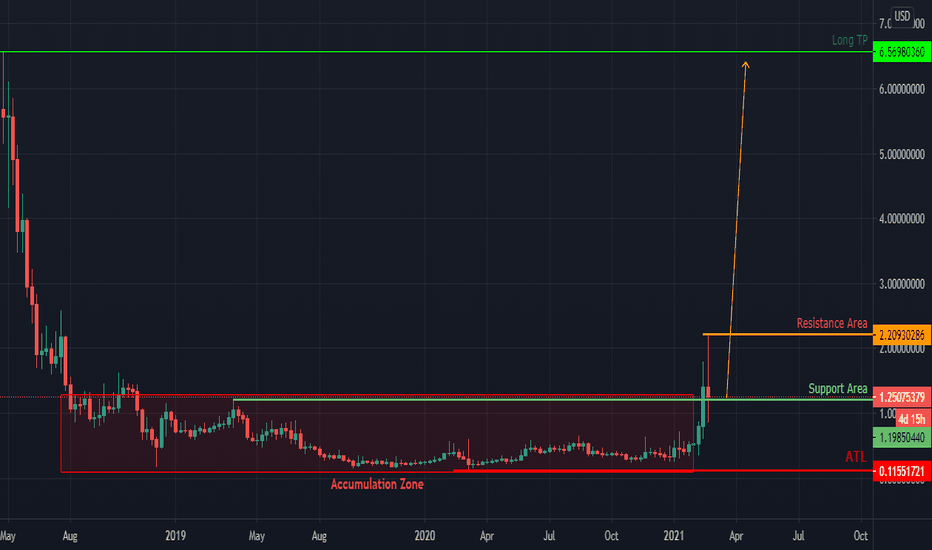

Bitcoin Diamond (BCDUSDT) Analysis 04/03/2021as we can see the coin has done its accumulation phase and started its Rally where as we can predict 3 TPs by Fibonacci projection.

the 1 TP is the immediate Target if the current Resistance area breaks and turns to Support,

if on the same impulsive wave after the 1 TP, we Triger the 2TP which is the extension level i.e. 161.8%, then we can be optimistic about the 3 TP which is the 261.8% of the same

AMBUJA CEMENTS LTD Analysis 04/03/2021as we can see the price is renege Bounding in an ascending Paralleled Chanel where as the Fibonacci Projection shows some confluences with the Top Red Trendline which is the long term trend line and can be used as a resistance area.

we can be optimistic about 1 TP , which is 161.8% i.e Extension Level of the same Fibonacci projection and if triggered and show some candle pattern and the resistance turned to Support, then we can target the 261.8% of the same which is 3TP

Celer Network Analysis 04/03/2021as we can see the price has already done its accumulation and established its initial journey,

we can target the parallels legs of Fibonacci projection and if on the same impulsive wave we triggered the extension zone of 161.8% which is our 2 TP then we can be more confirm about the 3TP which is the 261.8% of the same Fibonacci projection.

there are total of 1 TPs and 1 Ultimate Target we have specified here where as the 1 TP is very close to achieve and rest may take some time but alternatively all will be triggered

GBPJPY 3D Analysis 03/03/2021the price has broken the Top Boundary of the Ascending Channel and can continue its rally up to the provided TPs

as we can see the price has confirmed its rally by touching Fibonacci projection extension level 161.8% so we can target the 261.8% of the same Fibonacci projection level

EURJPY analysis with 2 TPs 03/03/2021as we can see this instrument was up trending in an ascending Parallels channel and there are no majeure resistances on its way,

so we can speculate 2 TPs where we may have some Resistance so we can capitalize our positions there.

one of the most important confirmations are that the price has touched the Fibonacci projection 161.8% extension level and there is a convention that, once the price touches this level there are over 85% of chances that the price will continue its rally to 261.8% of the same Fibonacci projection, where it has confluences with our Price Action defined 1 TP.

Reliance Industries Analysis 24/02/2021the price seem to be retracing from its long term rally and now it is falling up to 61.8% of the Fibonacci retracement

if the price started to rally from the place where it is now we can target 3290 directly but if it retraces to lower supports then we can target 1 TP after the retracement

Ripple is Rallying, worth of Longing Now 24/02/2021we may have some retracement to the support areas but yet this Coin is doomed to be bulled

we have specified total of 3 TPs

1TP is the parallels leg of the Fibonacci projection and

2TP is the extension level of the same Fibonacci projection and if the 2 TP triggered then we can expect the 3 TP to be followed

please comment your opinon

PIVX is Very Good to HODLed 24/02/2021PIVX is a decentralized autonomous organization (DAO) that is self-funded and community-driven. It is a third-generation privacy coin and uses a modified version of Dash’s masternode architecture. It also uses Zcoin’s Zerocoin privacy protocol. Its transaction capacity can reach up to 1000 transactions per second through the usage of the SwiftxX payment protocol.

PIVX also uses a proof-of-stake consensus mechanism that involves two parties: the masternodes and the validators.

Masternodes are responsible for voting on development proposals that are put forward by the PIVX community and validating the transactions on the blockchain with a single confirmation. 10,000 PIVX is the minimum requirement to run a masternode. Each masternode gets 1 vote and is not involved in the mining of new tokens.

Validators are responsible for mining PIVX. They have a chance of generating a block proportional to the number of PIVX they have staked. 500 PIVX can generate a single block, which is completed within a 60 second time period. When a block is generated, it brings a reward of 6 PIVX coins, two of which go to the validator and three to the masternode, while one is allocated to the PIVX treasury.

If a user wants to store PIVX, they can do so in three ways: on the Ledger hardware wallet, the PIVX desktop and mobile wallets, or the Coinomi desktop and mobile wallets.

PIVX was announced on November 25, 2015. PIVX is short for Private Instant Verified Transaction Cryptocurrency and is a privacy-centric proof-of-stake cryptocurrency that was forked from DASH. It focuses on community governance and decentralization.

PIVX is building a digital means of exchange with the main focus on minimizing the transaction times and fees while maintaining privacy and security. PIVX was launched on January 31, 2016, by James Burden.

PIVX did not have an initial coin offering and instead, 60,000 PIVX were pre-mined to allow for 6 masternodes to operate on the initial network. After the initial setup, these coins were burned as soon as the PIVX community grew to the point where it became self-sustainable.

ames Burden is the founder of PIVX. Aside from this project, he is also the founder of VEIL. Burden used to be a senior technician at IBEW 357. He graduated from the College of Southern Nevada.

Burden has over 20 years of experience working as a hardware technician and has been an active cryptocurrency developer since as early as 2012. He stepped away from PIVX in April 2019.

Cartesi is now Worth to be Longed 24/02/2021Cartesi is taking smart contracts to the next level. It is solving the urgent problem of scalability and high fees on blockchains by implementing a variant of optimistic roll-ups. Most notably, Cartesi is revolutionizing smart contract programming by allowing developers to code with mainstream software stacks. Noether is Cartesi's side-chain that’s optimized for ephemeral data, providing low-cost data availability to DApps.

What gives Cartesi a competitive edge as a layer-2 and optimistic rollups solution is that it allows developers to code their smart contracts and DApps directly with mainstream software components and Linux OS resources. That represents more than an incremental improvement to decentralized applications. It is a necessary step toward the maturity of the whole blockchain ecosystem. Allowing mainstream programmability means that DApp developers have an entirely new expressive power to create from simple to rather complex smart contracts. It also means opening the doors for extensive adoption of regular developers who have never programmed for blockchain, as they will create decentralized applications with a coding experience similar to desktop or web.

Cartesi is a layer-2 infrastructure for blockchains that allows developers to code highly scalable smart contracts with mainstream software stacks on a Linux VM. Cartesi uses a combination of rollups and side-chains.

Mainstream programmability: Developers create smart contracts with mainstream software stacks, taking a productive leap from the limited programmability of blockchain-specific VM's to coding with software components supported by Linux.

Scalability: Cartesi enables million-fold computational scalability, data availability of large files and low transaction costs. All while preserving the strong security guarantees of the underlying blockchain.

Privacy guarantees: Cartesi allows for decentralized games where players conceal their data and Enterprise applications that run on sensitive data, preserving privacy on DApps.

Portability: Cartesi is blockchain-agnostic and will run on top of the most important chains. The current implementations already support Ethereum, Binance Smart Chain, Matic (Polygon), with Elrond coming soon.

CTSI is a utility token that works as a crypto-fuel for Noether.

Stakers receive CTSI rewards by staking their tokens and participating in the network. Node runners are selected randomly according to a PoS system and gain the right to create the next block. Users of the network pay CTSI fees to insert data on the side-chain.

CTSI also plays a role with Descartes Rollups.

CTSI will be used by DApps to outsource the execution of verifiable and enforceable computation to entities running Descartes nodes.

there are totally 3TPs which you can capitalize one and if the 2 TP got triggered you ca be sure about the 3 TP too

GasToken.io will shows Beautiful Performance, Long IT 23/02/2021GasToken is a new, cutting-edge Ethereum contract that allows users to tokenize gas on the Ethereum network, storing gas when it is cheap and using / deploying this gas when it is expensive. Using GasToken can subsidize high gas prices on transactions to do everything from arbitraging decentralized exchanges to buying into ICOs early. GasToken is also the first contract on the Ethereum network that allows users to buy and sell gas directly, enabling long-term "banking" of gas that can help shield users from rising gas prices.

Gas is a fundamental resource in the Ethereum network. Every transaction on the network must include some gas, and the fee paid to miners for each transaction is directly proportional to the gas consumed by a transaction. GasToken allows a transaction to do the same amount of work and pay for less gas, saving on miner fees and costs and allowing users to bid higher gas prices without paying correspondingly higher fees. Using GasToken on an eligible transaction, you can save money on the Ethereum network today.

Gas prices on Ethereum are hard to predict; they can be as cheap as 1 gwei or less at off-peak hours, while some transactions pay into the hundreds of gwei to buy into that juicy ICO or hit an order on EtherDelta before any other players. Users who need to be mined quickly or first often engage in fierce bidding wars, bidding wars in which using GasToken provides an enormous advantage by letting you perform the same transactions while spending less gas.

Compounding this effect, Ethereum blocks are starting to fill up, making block space ever more coveted.

GasToken price today is $234.51 with a 24-hour trading volume of $1,769,926. GST2 price is up 45.7% in the last 24 hours. It has a circulating supply of 14 Thousand GST2 coins and a max supply of 13.7 Thousand. Bilaxy is the current most active market trading it.

Bridge Mutual/Wrapped Ether seems to be undervalued 23/02/2021Bridge Mutual is a decentralized, discretionary p2p/p2b insurance platform that provides coverage for stable coins, centralized exchanges, and smart contracts. Its platform allows users to provide insurance coverage, decide on insurance payouts, and get compensated for taking part in the ecosystem.

The live Bridge Mutual price today is $2.83 USD with a 24-hour trading volume of $1,177,069 USD. Bridge Mutual is down 27.51% in the last 24 hours. with a live market cap of $21,142,527 USD. It has a circulating supply of 7,463,923 BMI coins and a max. supply of 160,000,000 BMI coins.

this instrument seems to be very under valued and truly worth of longing for long

MahaDAO/Wrapped Ether seems undervalued 22/02/2021MahaDAO, which is releasing ARTH, a decentralized non-depreciating algorithmic token, which derives its value from a basket of uncorrelated assets, the relative weights of which are automatically adjusted by automatic buying and selling in response to changes in the price of each individual asset relative to the others.

MAHA is a governance and utility token that will regulate ARTH value coins — the world’s first non-depreciating crypto token.

some of the key fundamentals that make the $MAHA unique from other projects and showcase why we’re here for the long run. 1. $MAHA is used to fuel the liquidity for $ARTH The MahaDAO stablecoin platform is amongst the first of it’s kind to have liquidity farming built directly into the protocol, creating the world’s first incentivized stablecoin. Those providing liquidity to create $ARTH will be earning $MAHA tokens as rewards. 2. $MAHA is used to pay the stability fees for $ARTH As more and more collateral is deposited into a vault to mint $ARTH; A fee is paid by the vault owner if he/she wishes to. 3. $MAHA is used to make key decisions to the direction of $ARTH As a governance token, $MAHA token holders will get the ability to vote on various parameters that’ll govern $ARTH such as the stability fee, risk parameters of various collaterals, reward distributions, etc. 4. $MAHA is bought-back and burnt as $ARTH adoption grows As the adoption of $ARTH grows more and more, $MAHA is bought back and burnt off to reduce the supply of $MAHA tokens and pay an indirect dividend to all existing $MAHA token holders.

The live MahaDAO price today is $9.57 USD with a 24-hour trading volume of $2,912,617 USD. MahaDAO is down 3.33% in the last 24 hours. live market cap of $5,861,850 USD. It has a circulating supply of 612,451 MAHA coins and a max. supply of 10,000,000 MAHA coins.

The top exchanges for trading in MahaDAO are currently BKEX, Uniswap (V2), Hoo, Gate.io, and Bilaxy.

technical:

as we can see there are 2 TPs above the ATH which we have defined them with Fibonacci expansions.

KeeperDAO Token is Worth of Investment Now 22/02/2021What Is KeeperDao (ROOK)?

KeeperDAO is a decentralized organization that provides liquidity to markets of smart-contract-based solutions, by providing the underwriting of contracts. These underwriting contracts are created in order to give an incentive for participation in the KeeperDAO.

KeeperDAO will provide an on-chain liquidity mechanism using derivatives. Token holders will be able to collateralize their balances, from which they can either liquidate and regain access to their collateral or lock the collateral for a set period in order to draw earnings.

Who Are the Founders ?

KeeperDAO is founded by a team with experience working at publicly traded companies, running hedge funds and managing private investment vehicles. The team consists of people who have managed large pools of liquidity for some of the biggest institutional investors in the world.

The project is a joint venture between Amber Group and Talon Systems: a crypto trading firm run by Tiantian Kullander and a blockchain research firm run by Taiyand Zhang, respectively.

What Makes KeeperDao (ROOK) Unique?

KeeperDAO is a decentralized autonomous organization that stands between users and the critical components of decentralized finance: risk, reputation, and liquidity. The role of KeeperDAO is to create a secure environment for the most important events in the life of a decentralized borrowing or lending transaction. These events are not limited to funding a loan, but also include making margin calls, collecting on collateral, and adding new members to the platform.

The live KeeperDAO price today is $556.25 USD with a 24-hour trading volume of $8,625,873 USD. KeeperDAO is down 12.23% in the last 24 hours. It has a circulating supply of 36,430 ROOK coins and a max. supply of 1,070,000 ROOK coins.

The top exchanges for trading in KeeperDAO are currently HitBTC, Hoo, Gate.io, Bilaxy, and Poloniex.

Technical:

we have 4 TPs to achieve as Fibonacci projection is projection some Fibots to target.

Multiplier Token is Good to HODL for Long Time 22/02/2021MXX tokens are designed to balance liquidity for depositors and lenders through algorithmic derived interest rates and yield. These are based on the collateralization and loans conducted on the Multiplier cryptocurrency platform. The minting of MXX tokens will start from 0 tokens, with a total supply of 9 billion, which can be accumulated through minting only.

Essentially, liquidity mining is when a yield farmer mints new tokens in exchange for their liquidity on the platform. This creates a positive loop; whereby users are incentivized with minted tokens to conduct transactions on the platform, which in turn increases the value of the same token, and attracts more users to join.

MXX Token and Community Governance:

A maximum of 18 million MXX tokens are issued daily, shared among users in proportion of their contribution to the platform through lending, borrowing and making referrals. The currently accepted currencies on the Multiplier platform are BTC, USDT and USDC. MXX tokens are also currently listed on the trading platform Bilaxy.com.

MXX tokens will gradually allow the protocol to transit towards being entirely governed by the community. The number of votes is proportional to their amount of MXX tokens and can be used to make decisions on the protocol. The move towards a decentralized governance process will protect investor interests, reduce systemic risk and increase long term utility of the Multiplier protocol.

The simple-to-use Multiplier platform aims to attract holders looking to optimize their idle cryptocurrency assets, as well as attract experienced yield farmers looking for more ways to maximize their harvests.

About Multiplier:

Multiplier crypto lender began in 2019 with regulated financial licenses obtained (SRO Switzerland VQF 10075 and Hong Kong Money Lenders License 1702/2019), and formed strong collaborations with reputable industry leaders such as Coinbase Custody and JUMIO KYC/AML.

Multiplier believes in operating within the legal framework of jurisdictions, and having the relevant licenses to adhere to regulations.

The company continues to establish strong relationships, between regulatory authorities, communities and leading institutions around the globe, merging the scale and familiarity of traditional finance, into a secured, advanced and simplified global financial blockchain system.

Multiplier has been developing DeFi protocols with user feedback from its centralized crypto lending entity since 2019, and launches MXX governance tokens which give the community voting rights that will gradually allow the protocol to be entirely governed by the community and stakeholders.

Technical:

A simple Fibonacci projection is projecting 3 Targets for us where we can capitalize on any if them or who missed the opportunity of investing on them can use these TPs for benchmarks.

please comment your opinion or any news you got about it and willing to share and discus...

yAxis Seems to be Very Good for Investment 22/02/2021What is yAxis?

yAxis markets itself as a meta yield farming aggregator that is able to switch the underlying assets when deploying strategies. Yield farming strategies are governed by a DAO, where token holders vote regularly to implement the best strategy out of a selection of strategies provided by multiple yield aggregators.

yAxis price today is $33.70 with a 24-hour trading volume of $3,473,514. YAX price is up 0.2% in the last 24 hours. It has a circulating supply of 800 Thousand YAX coins and a max supply of 938 Thousand. Uniswap (v2) is the current most active market trading it.

What are YAX tokens?

The YAX token is yAxis’s native governance token. As the platform is developed further, YAX tokens will be used to shape the direction of its future.

Among the proposals that the DAO may choose to execute is to alter the emission of YAX or to reward early users of the protocol. Governance may also vote for the protocol’s fees to be distributed to YAX holders.

10% of YAX tokens is saved into a community treasury which could be deployed via a governance vote.

How does yAxis work?

The goal of yAxis is to create a meta yield aggregator which can obtain the best yield by taking advantage of other existing yield aggregating platforms such as yearn.finance or Pickle Finance. In other words, it operates above these platforms and can switch between platforms that offer better yields.

Currently, the product can be divided into MetaVault and governance.

Multi-Asset MetaVault

The multi-asset MetaVault allows users to deposit different types of stablecoins such as USDC or DAI. Users who deposit stablecoins will receive MetaVault tokens (MLVT) to represent their share of the vault. MLVT tokens will accrue value as the deposited funds are deployed to the best yield-aggregating strategy. Depositors will get to save on gas fees as the fees are distributed to all depositors.

Whenever there is a better strategy available, MetaVault will convert the underlying deposits into the appropriate asset to begin yield-farming using the more profitable strategy. Users can choose to withdraw their funds anytime by returning their MLVT tokens for any stablecoin of their choice and interest.

yaxis metavault page

Governance

Strategies are decided by the community by staking YAX tokens on the governance platform. YAX holders can choose from a preselected list of yield farming aggregators, and stake their tokens in the contract which they believe will provide the best return.

Strategy risk, fees, and the overall DeFi market sentiment will be displayed on the governance user interface. In return for voting, the community will reward voters with a share of the MetaVault’s performance fee.

How do I get YAX tokens?

You can obtain YAX by purchasing them from cryptocurrency exchanges such as Uniswap or Bilaxy.

Besides that, you can also earn YAX through the staking section on the yAxis platform. Users can stake their existing YAX to earn a share of farming rewards which are sold to YAX and redistributed back to stakers.

Users may also provide liquidity for the YAX-ETH pair on Uniswap and stake the liquidity provider tokens to earn YAX in the LP section. To know more about this and other yield farming programs, you may head over to our Yield Farming page.

there are total of 3TPs i have mentioned where easily we can achieve them. i have mentioned these levels for those who did not invest on time so you can understand where to jump in the market in case you where interested

Option Room Token is Initiating, Long it Fast 22/02/2021OptionRoom is a user governed oracle and forecast protocol built on Polkadot.

this token is now ready to be longed,

now it is a very good time to invest on it and it seems to have a very good future.

there are total of 3 Targets but it is even worth of keeping it for long time even

DGB is at a very Good Price to be Purchased 20/02/2021as we can see the asset has moved up from its accumulation zone and we can see the up trend is at a very good pace with long bullish candles,

we can simply Target the 161.8% and 261.8% of the Fibonacci projection as they are the most prone points to be targeted

please comment your opinion