The powerful perspective that can change your attitude to losseWant to know a secret? You can actually change how you react to losing trades—just by thinking differently. Cool, huh?

🫣 Here’s a hard truth that every trader needs to accept: every trade is a potential loss.

Losses are an inevitable part of the game.

No matter how good your setup is, no matter how much you’ve prepared—there will always be trades that don’t work out.

Trading is already emotionally challenging as it is. But if you get stuck obsessing over one single trade, it becomes so much more emotionally exhausting. You start evaluate yourself after every outcome. And that’s not a sustainable way to trade.

Let’s be honest: the result of one trade doesn’t say much about your actual trading performance.

It’s only over time—after a series of trades—that you can honestly evaluate how you’re doing.

If we want to reduce some of the emotional storms that come with trading, we need a different strategy. A more compassionate one. One that gives us the space to breathe, recover and grow.

So how do we do that? By practicing a shift in perspective.

A shift that’s actually rooted in neuroscience. It’s about broadening your perspective.

👉 Broadening your perspective means reminding yourself:

"This is just one of many trades I’ll take in my trading journey."

That’s it. Simple. No complicated strategy. Just a small shift in thinking that helps you regulate your emotions.

Whether you’ve just taken a loss or feel doubt creeping in before entering a trade—say it to yourself (out loud if you want!): “This is only one of many trades I will experience.”

And here comes the science part:

🧠 When you broaden your perspective like this, the brain responds. It decreases arousal in the amygdala—your brain’s “panic button.”

At the same time, it activates the prefrontal cortex—the part of your brain responsible for rational thinking, impulse control and analysis.

Put simply: you become more emotionally balanced—and more able to view the market objectively.

🤔 Why is that important?

Because when your amygdala calms down, the risk of emotionally driven mistakes decreases.

The fear becomes less intense.

And in trading terms: you’ll be better at cutting losers faster and holding on to winners longer.

🪄 Will this shift magically erase all tough emotions? No. The emotions will still be there—just not as loud.

And isn’t it more motivating to remind yourself that you are not defined by a single trade?

You’re defined by your overall journey. Your effort. Your long-term consistency.

💡Pro Tip:

Next time you feel hesitation—even with a solid setup, or after closing a losing trade

👉 Try this reminder:

“This is only one of many trades I will execute during my career.”

Let it soften the inner storm.

Happy, compassionate trading! 💙

/ Tina the Trading Psychologist

Mindsetmatters

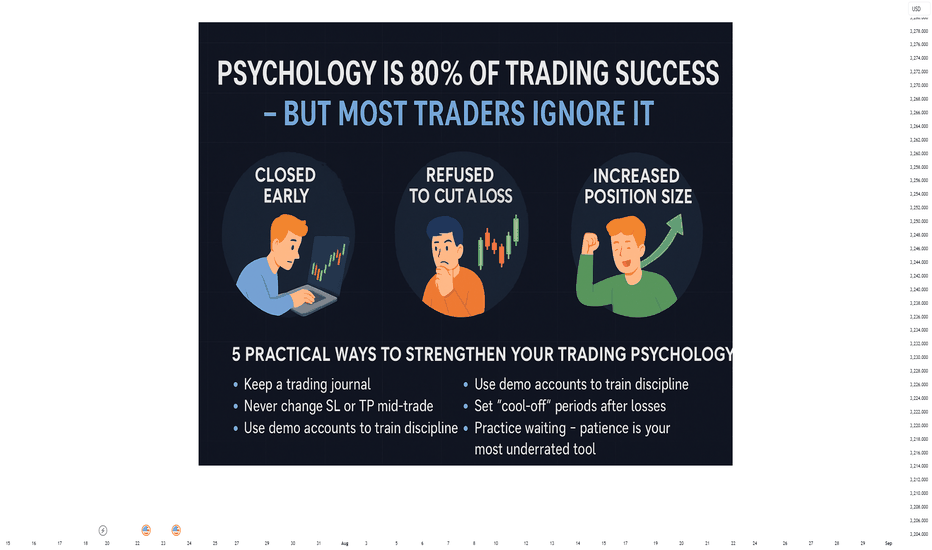

Psychology Is 80% of Trading SuccessPsychology Is 80% of Trading Success – But Most Traders Still Ignore It

Have you ever followed a perfect setup… and still lost money?

You entered at the right level.

The trend was clear.

Confirmation was solid.

But you closed the trade too early.

Or held onto a losing trade far too long.

Or took a revenge trade just to “get it back.”

This isn’t a strategy problem – it’s a psychological one.

💡 Most traders don’t fail due to poor analysis – they fail because they lose control of themselves

Let’s break down three real-world scenarios that almost every trader has experienced at some point:

🎯 1. Closing profitable trades too early – fear of giving it back

Example:

You long XAUUSD from 2360, targeting 2375.

As price hits 2366, you panic and exit early, fearing a reversal.

Later, the price hits 2375 without you.

➡️ This is classic loss aversion — where the fear of losing small gains outweighs the logic of sticking to your plan.

🎯 2. Holding onto losers – hoping the market will turn

Example:

You short EURUSD expecting a pullback, but price breaks resistance and climbs.

Instead of cutting your losses, you widen your stop and hold on.

The loss grows, and you exit in frustration.

➡️ This is denial – refusing to admit you're wrong, letting hope override discipline.

🎯 3. Increasing risk after a winning streak – “I can’t lose” mindset

Example:

After two wins, confidence spikes. You double your position size, despite a weaker setup.

One loss later – your previous gains are wiped out.

➡️ This is overconfidence bias – common after wins and extremely dangerous to consistency.

📊 Technical knowledge accounts for 20% of success – the remaining 80% lies in mindset and behaviour

You can:

Understand market structure

Use advanced indicators

Develop a robust strategy

But if you:

Ignore your stop-loss

Trade out of boredom or revenge

Break rules when under pressure

Then your edge disappears.

Your system becomes irrelevant if your psychology breaks down.

🧠 5 Practical Ways to Strengthen Your Trading Psychology

✅ Keep a trading journal – especially note your emotions

Ask yourself: “Was this trade part of my plan, or based on impulse?”

✅ Never adjust SL or TP mid-trade

Stick to your original parameters. Trust your plan, not your feelings.

✅ Use demo accounts to practise discipline, not just execution

Treat them like live accounts. Emotions will surface if you're honest.

✅ Pause trading after consecutive losses

Two losses in a row? Step away for 24 hours. Protect your decision-making clarity.

✅ Learn to wait – no trade is often the best trade

Patience is a trader’s secret weapon. Pros trade less, but with precision.

🔁 Trading isn’t about predicting the market – it’s about managing yourself within it

A 55% win-rate system can make you consistent profits

If you’re disciplined, calm, and structured.

But…

A 70% win-rate system can still blow your account

If your emotions are calling the shots.

🎯 Final Thought:

Financial markets don’t reward traders with the best strategy.

They reward those who stay rational under pressure.

You don’t need to be the smartest person in the room.

You don’t need a complex system.

But you do need emotional control, patience, and trust in your process.

Knowledge helps you spot the trade. Psychology helps you survive it.

🔔 If you found value in this, follow me for more content on trading mindset, discipline, and long-term consistency – because true success begins in the mind.

Location, Location, Location!!!Knowledge is Power!

But how deeply do most people really understand this?

The average mind thinks power comes from possessing knowledge. But here’s a deeper truth — simply imagining yourself with mastery can trigger powerful feelings. Why? Because as Terence McKenna once described, the human brain is a chemical factory. An inspired thought — a glimpse of future achievement — can activate a cocktail of serotonin and dopamine, giving us a real sensation of power. And yet… did anything really change?

This is where ancient voices — shamans, philosophers, and modern mentors — whisper:

“You are already there…”

But are you really?

The answer is Yes… and No.

You feel the outcome, but you haven’t earned it yet. You’re not truly there until you’ve gone through the effort — the hours and hours of disciplined study, reflection, and ignoring the mental traps like “take a break,” “you have time,” or “scroll a bit.” Power, in this case, is the Knowledge itself — and to approach Power, you must become Power. Or else, it will crush you — like a boot crushes an ant. (Yes, that’s borrowed from the Avengers… we all need a laugh too.)

To actually reach that imagined reality, you must prove yourself to the knowledge itself. You have to earn it — through discipline, sacrifice, and unbroken focus. That means hours of study, observation, application, and repetition — no matter how many distractions your mind throws at you.

Focus on one subject until it bends for you.

Focus like your life depends on it.

Because in a way… it does.

🧠 Opportunity Cost = Power Equation

This focused, intentional work is what economists call Opportunity Cost. It’s the measure of how productively you spend your time. Every marked level, every reaction, every shift in volume is either:

• A step closer to mastery, or

• A missed opportunity, depending on what you choose to focus on.

TradingView becomes your journal.

A sacred workspace in the chaos.

A tool to track your evolution — mentally and technically.

🔍 The SHIBA/USDT 4H Breakdown

On the 4H chart of Shiba Inu, key swing levels are marked — targets that can serve as entry/exit decisions depending on your strategy.

But the magic is not in the lines.

It’s in how volume reacts to those levels.

🔺 Volume — The King

Currently, the 4H Volume shows signs of a bearish continuation. But lower timeframes are beginning to show the initial signs of accumulation — strength where weakness used to live.

This is the beginning of Effort vs Result analysis:

• Are we seeing strong volume but no progress? (Demand absorption?)

• Are we seeing low-effort pushes into supply that fail to break key levels?

That’s how Smart Money behaves. Quietly, strategically, and always one step ahead.

And all this happens near key demand/supply zones — where Location meets Volume.

🔄 Timeframe Psychology: Past–Present–Future

Lower timeframes = The Past (they push).

Higher timeframes = The Future (they pull).

Your active timeframe = The Now — where you make your move.

A shift on the 3M chart might hint, but until it aligns with the 1H or 4H, nothing is confirmed. That’s why true traders are observers first, executors second.

🎯 Alignment: Levels, Volume, Effort

• 📍 Levels: They are not just technical — they are psychological battlegrounds.

• 🔊 Volume: It shows us where energy is being spent and whether it’s paying off.

• 🧱 Effort vs Result: The ultimate measure of Smart Money’s hidden hand.

When everything aligns, you don’t guess — you act.

🧭 Final Thoughts

At the time of this writing — 17:26 IST on June 18, 2025 — the 4H chart remains bearish in tone. But markets shift fast, and for all I know, a power transition could be unfolding on a micro timeframe as I type. That’s the nature of this game.

TA is not rigid. It is an art.

And once mastered, it becomes a part of how you think — not just how you trade.

Use your time wisely.

Let your focus become your fortress, and that fortress will guard you through every storm.

Work Smart. Think Deep. Act with Purpose.

Study the Bitcoin and Bitcoin Dominance cycle to understand altcoin flow.

Explore previous posts — I’ve shared them to help you grow.

The market is a breathing organism, I’ve pointed this in previous ideas. If you’re in sync with it—you’ll feel it.

And for those who believe there’s more to learn—but are struggling to find answers—there’s no shame in asking questions. But remember, nothing in the market is free.

Work Smart, and you’ll earn the right to follow — and even think like — Smart Money.

Till next time, take care—and trade wisely.

Click…Click…Boom : What’s Your Count?Hello Traders and welcome to Crypto Aera.

The inspiration for today’s episode comes from a conversation I had recently.

Someone asked me, "I’m moving up in my position size, and there’s this knot in my stomach. I’m numb to smaller figures, but now I’m stressed." That stayed with me.

A few days later, I stood on a beach, watching the waves lap against a shore covered in endless pebbles.

As I began stacking them, I noticed a pattern. The higher the stack climbed, the more precise I had to be. I spent longer searching for flat, perfectly matched pebbles.

You see, you can’t throw a large pebble on top of a small one, followed by another large one, and expect stability. The tower will hesitate, teeter for a moment, and then collapse under the weight of imbalance.

Trading is no different. It’s physics, it’s art, it’s strategy. Your foundation—your portfolio—can only carry so much unless each decision is deliberate, consistent, aligned.

A misplaced pebble, much like a poorly timed trade, and you’re staring at the rubble of a once-promising stack, left with barely 8%—if you’re fortunate.

Similar-sized, flat pebbles stack because consistency breeds strength. The higher you go, the more thoughtful you must become. The rules of pebble stacking and trading are inseparable.

Now, let’s address that knot in your stomach.

How do you conquer it?

You embrace the crash.

You let the tower burn—not on its own terms, but on yours.

You take control.

Cut the trade, close it yourself.

It may seem like a minor act, but it’s not.

Holding on for hours, days, endlessly hoping, is how you wear yourself down, tumble-dry your psyche into exhaustion.

But here’s the alchemy of transformation: you choose the moment.

Pick the time, pick the place, and sever the cord.

Because waiting for the market to punish you, to bring your tower down, is surrender.

Hope is a subtle assassin, and hesitation will chain you to stagnation.

Don’t allow it.

Let the tower fall, let it crash.

That moment—the collapse—is not an end.

It’s a doorway.

It’s the reset button, the gateway to moving forward.

Guilt?

Leave it behind.

Regret?

That’s weight you can’t afford.

Be nimble, be decisive.

Don’t get swept away by the explosion; walk yourself out of that burning tower with precision and strength.

Scars are avoidable if you leave on your terms.

Every trade is a deliberate action, a piece of a larger construction.

Each choice builds your tower, step by step, click by click.

The market’s tide can shift in an instant, but you can decide whether you stand still, hesitating, or take action to preserve what you can.

So I’ll ask you:

What’s your count?

How many pebbles have you stacked?

How many missteps have you learned from?

Each toppled stack is not failure—it’s a masterclass in rebuilding, stronger and sharper.

Balance risk and reward, ambition and patience.

Understand that every pebble plays a role. Yes, at the bottom of the stack it's not a heavy burden... it's when you see growth... that's where things tend to get wobbly.

And next time you feel that knot in your stomach, remember this: you are the architect of your stack. You are the one who decides when to burn the tower and when to build it higher.

Don’t hesitate.

Act.

Thank you for tuning in to Crypto Aera's Mental Analysis Navigation.

Until next time: keep stacking, keep counting, and keep mastering.

PS: Split your stacks.

Over and Out,

Craft

Mark Douglas’ Guide to Trading Without EmotionDue to the critical role psychology plays in trading success, I’d like to share a summary of The Disciplined Trader by Mark Douglas. This book dives into the mental and emotional skills required for consistent and profitable trading, revealing the mindset needed to stay calm, disciplined, and focused in the markets. Here’s a brief overview of its key insights.

1. Importance of Trader Psychology

Douglas believes that success in financial markets depends more on mindset than on complex strategies. Emotional control and mental discipline are key to avoiding losses.

2. Embracing Risk and Market Rules

The book emphasizes risk acceptance. Traders must understand each trade is uncertain and only one possible outcome in a probability field. Douglas advises establishing clear rules and following them without exception.

3. Taking Full Responsibility

Douglas insists that traders are fully responsible for their market outcomes. Avoiding blame and excuses, traders should own every decision they make.

4. Building a Success-Oriented Mindset

Douglas explains how to create a mental framework that enables traders to make unbiased, emotion-free decisions based on market trends and signals, avoiding fear and greed.

5. Stress Management and Maintaining Calm

The book highlights managing stress and staying calm under pressure. Douglas suggests using mindfulness and focus techniques to stay composed and make sound decisions.

Mastering the "IF-THEN" Mindset: The Key to Stress-Free TradingIn this video, I’ll share how using IF-THEN statements helps me stay balanced in my trading. It’s simple: IF the price does this, THEN I’ll do that. Having a plan like this keeps me from getting caught up in emotions and helps me react to what’s actually happening in the market – not what I wish would happen.

This mindset keeps things smooth, makes trade management easier, and keeps me consistent. It’s all about staying ready for whatever the market throws your way.

If this vibe clicks with you, drop a comment, like, or follow – I’ve got plenty more insights to share!

Mindbloome Trading

Trade What You See

e-Learning with the TradingMasteryHub - Growth is "simple"🚀 Welcome to the TradingMasteryHub Education Series! 📚

Looking to unlock consistent growth in your trading? Today, we’re diving into a powerful yet straightforward formula that many overlook. Growth isn’t magic; it’s a process that involves discipline, patience, and following a few key principles. Let’s explore seven strategies that can lead you to consistent success.

1. Get Rid of the Idea that You Can Calculate Profit

It’s time to rethink profit calculation. Many traders rely on risk/reward (R/R) ratios to estimate their potential profits, but the truth is, you can’t predict how far the market will go or how volatile it’ll be on the way. Setting a profit target can actually work against you. Your brain becomes fixated on that goal, which can cause you to make irrational decisions, like holding on too long when the market is telling you to exit. It’s more likely that you’ll lose out by not taking profits before reaching your target than by missing an extended move.

Instead of trying to calculate profit, focus on managing your trades as they unfold. No one knows where the market will go, but you can follow the price action and let it lead you to bigger gains than you initially expected.

2. Always Use a Stop Loss

The stop-loss order is your best friend in trading because it’s the only thing you can control. A stop loss does more than protect your capital—it measures your discipline and ability to stick to a plan. It helps you stay aligned with your risk tolerance (what I like to call your “bud meter”).

Set your stop loss at significant areas in the market. The best place to put it? Where you’d place the opposite trade. For example, if you’re buying, put the stop loss where a sell order would make sense in the current market context. This prevents you from being stopped out prematurely and ensures you stay on the right side of the momentum.

3. Add to Your Winners, Cut the Losers

Adding to winners is a game-changer. Most traders fade out of winning trades too quickly because they fear giving back profits. But by adding to positions that are moving in your favor, you’re compounding your success. Don’t worry about getting in at a higher price—if the market is showing strength, it’s a sign to follow.

Let’s look at how most traders handle a winning trade:

- They take small profits at 1:1 R/R ratio, move their stop loss, and try to let the rest run.

- But in doing so, they lock in limited gains and miss out on the bigger move.

Now, here’s what the top 10% of traders do:

- Instead of scaling out, they add to their winners at each significant level.

- By adding small positions as the market runs, they compound their gains, allowing the trade to grow much larger than initially estimated.

This approach not only maximizes your gains but also lowers your risk on each successive entry.

4. Only Trade in Trend Direction

Trading with the trend is like surfing—catching the wave takes you much farther than paddling against it. In bull markets, overhead resistance zones are often broken, just like support levels in bear markets. These trends are driven by large institutional players, like hedge funds and banks. Retail traders only make up a small fraction of the market, so swimming against these currents is a losing game.

About 20% of trading days in major indices are strong trending days where the market moves in one direction all day long. To take full advantage of these days, you need to add to your winning trades as the trend progresses.

5. Seek the "Brain Pain"—It’s a Sign of Growth

Your brain is wired to avoid pain at all costs, and this can be detrimental to your trading. Most traders scale out of winning positions too soon because their subconscious is trying to protect them from the fear of losing profits. On the flip side, they’ll add to losing positions, convincing themselves that they’re getting a “discount,” even when the market shows otherwise.

To become a winning trader, you need to train yourself to embrace discomfort. This means adding to your winning trades, using stop losses that you can stomach, and cutting losses as soon as your brain starts to rationalize bad decisions. Losing should never bother you—it’s part of the game. What matters is your overall growth and consistency, not avoiding pain in individual trades.

6. Don’t Do What 90% of Traders Do—Be the 10%

Want to be in the top 10%? It’s simple: avoid the mistakes of the 90%. Here’s how:

- Always set a stop loss.

- Add to your winners, don’t fade out.

- Cut losses before they snowball.

- Trade the market, not your account—don’t take revenge trades to “get even.” Focus on what the market is showing you, not what your account balance says.

The market doesn’t care about your profit target. It only cares about price movement, so align yourself with it.

7. Analyze Your Trades, Not Just Your Results

The best way to grow as a trader is through post-trade analysis. Screenshot your charts, mark your entries, stop losses, and exits, and review them daily. This helps you identify both technical and psychological weaknesses in your trading.

Think of it this way: if you had a business partner who consistently made poor decisions, you’d fire them eventually. Be your own business partner, and change your behavior if it’s not delivering results.

🔚 Conclusion and Recommendation

Growth in trading is a simple formula: get rid of fixed profit targets, control your risk with stop losses, add to winners, and cut your losers. Follow the trend, embrace discomfort, and don’t fall into the traps that 90% of traders do. Analyze your trades with an honest eye, and over time, you’ll see steady growth.

Success in trading isn’t about perfection—it’s about discipline, consistency, and continual learning.

---

🔥 Can’t Get Enough? Don’t Miss Out!

Subscribe, share, and engage with us in the comments. This is the start of a supportive trading community—built by traders, for traders! 🚀 Join us on the journey to market mastery, where we grow, learn, and succeed together. 💪

💡 What You'll Learn:

- Essential growth strategies in trading

- The psychological edge to outperform others

- Practical tools for trading success

- And much more!...

Best wishes,

TradingMasteryHub

Is the Dollar (DXY) About to Shock the Markets? Take a look NOW!DXY Analysis: Potential Bullish and Bearish Scenarios

Overview:

This analysis of the U.S. Dollar Index (DXY) on a 4-hour timeframe outlines potential bullish and bearish scenarios based on price movements and key levels.

Bullish Scenario:

For a bullish continuation, we need to see:

Corrective price movement in the area of the blue box.

An impulsive move above the last short-term high, forming a liquidity zone (LQZ) on a lower timeframe, or a bullish pattern such as a bull flag on the 1-hour or 15-minute chart.

Bearish Scenario:

For a bearish continuation, the following conditions should be met:

A clear impulsive move underneath the blue transparent box structure.

Confirmation of the break below, either through the formation of a LQZ or a bearish pattern, indicating a continued push lower.

Possible False Breakout:

There is also the possibility of a false breakout, where the price briefly breaks a level but fails to sustain the movement, reversing direction instead.

Mindset Lesson: Handling Uncertainty and False Breakouts:

Stay disciplined and stick to your trading plan.

Embrace flexibility and be ready to adjust your approach.

Manage risk effectively.

Be patient and wait for the right setups.

Learn from each trade to continuously improve.

Revealing My Top Gold Trading Secrets for Huge Profits!In this video, I reveal my top trading secrets for making huge profits in gold trading (XAU/USD). This educational content will cover key technical analysis techniques and strategies that I frequently use in my charts, as well as valuable insights into trading mindset and proper risk management. Let's unlock the potential of your trading skills together!

Technical Approach:

In this educational segment, we'll focus on the core technical analysis principles that I use to make informed trading decisions. Here's a detailed breakdown of my approach:

Identifying the Trend:

Uptrends and Downtrends: Learn how to recognize market trends using higher highs and higher lows for uptrends, and lower highs and lower lows for downtrends.

Trendlines: Use trendlines to connect the highs and lows of price movements, helping to identify the direction of the trend and potential reversal points.

Support and Resistance Levels:

Support Levels: Identify areas where the price tends to find support as it falls, acting as a floor preventing further decline.

Resistance Levels: Identify areas where the price tends to find resistance as it rises, acting as a ceiling preventing further ascent.

Historical Price Action: Use past price movements to pinpoint key support and resistance levels that the market respects.

Liquidity Zones (LQZ):

Definition: Liquidity zones are areas on the chart where there is a high concentration of trading activity, often leading to significant price movements.

Identification: Learn how to spot these zones using volume profiles, order flow analysis, and historical price action.

Trading Strategy: Use liquidity zones to identify potential entry and exit points, as they often precede major price moves.

Volume Analysis:

Volume Spikes: Understand how volume spikes can indicate strong buying or selling interest, confirming the validity of price movements.

Volume Trends: Analyze volume trends to gauge the strength of a price trend and anticipate potential reversals.

Entry and Stop Loss Strategies:

Breakouts and Pullbacks: Enter trades on confirmed breakouts above resistance or below support, or on pullbacks to key levels within a trend.

Trailing Stop Loss: Implement a trailing stop loss to lock in profits as the trade moves in your favor, adjusting the stop loss level as the price progresses.

Mini Lessons: Mindset:

Patience and Discipline:

Patience: Wait for the right trading setups that meet your criteria, avoiding impulsive decisions.

Discipline: Stick to your trading plan and rules, even when the market becomes volatile or unpredictable.

Emotional Control:

Stay Calm: Keep your emotions in check to avoid making irrational decisions based on fear or greed.

Mindfulness: Practice mindfulness techniques to remain focused and calm, especially during stressful trading situations.

Proper Risk Management:

Position Sizing:

Risk Per Trade: Limit the amount of capital you risk on any single trade, typically 1-2% of your trading account.

Position Size Calculation: Calculate your position size based on the distance to your stop loss and your risk tolerance.

Risk-Reward Ratio:

Target Ratio: Aim for a risk-reward ratio of at least 2:1, meaning your potential profit should be at least twice your potential loss.

Trade Evaluation: Evaluate each trade based on its risk-reward ratio before entering, ensuring it aligns with your trading strategy.

By incorporating these technical strategies and mindset principles, you can enhance your trading performance and increase your chances of success in the gold market. Stay tuned for more educational content and trading insights!

Control of EmotionsTrading in the cryptocurrency market often resembles a marathon where everyone aims to be the first. Unlike running, where there's only one winner, multiple traders can succeed in the crypto marathon. However, success in trading involves serious psychological work, which we'll discuss today.

Everyone aspires to achieve their goals and be successful. Beginners in any field need to go through a learning curve, gradually honing their skills. The crypto market is not about luck; it requires constant self-improvement, learning from mistakes, and analyzing actions. The psychology of crypto trading involves a set of rules, methods, and actions to ensure successful trading, profit-making, and minimizing unavoidable failures.

A professional trader approaches trading with a focus on results and a realistic assessment of risky situations. Financial success, in the form of net profit, is the ultimate goal.

Let's explore the basic psychological tools used by professionals for successful trading:

Always at Hand

The whole world of cryptocurrencies is in your pocket.

Don't Think About Defeat

When starting a trade, don't focus on potential losses. Such thoughts set you up for failure from the outset. Be confident and avoid dwelling on the fear of making mistakes. While mistakes will happen, treat them as valuable lessons and continue improving your trading skills.

Visualize

Although not a scientific method, psychologists emphasize the importance of visualization. By visualizing success, you can block out fears of making mistakes and focus on achieving your goals effectively. Visualize yourself executing your strategy professionally and accurately, then act accordingly.

Be a Recluse

Cryptocurrency trading is a solitary activity. Ignore other people's opinions and avoid external interference. Your forecast accuracy will improve when you analyze market situations independently, without relying on others' advice.

Self-Realization Comes First

While trading in the crypto market is finance-related, view it as a creative process that should bring you satisfaction. Be confident in yourself and your success, and see trading as a means of self-fulfillment. This mindset will help you navigate the chaotic and unpredictable market as a tool for success.

Think About the Risks

Never risk funds you aren't prepared to lose. Consider potential losses when creating your strategy. Stick to your loss limits, even if the temptation for larger trades is high. Sometimes, multiple small trades can be more profitable than one big trade.

Discipline

Avoid reacting to sudden emotions or news. Trade according to your pre-developed plan without deviation. In trading, discipline is synonymous with success. This is particularly crucial for novice traders, as the volatile market often puts psychological pressure on them.

Control of Emotions

Monitor your emotional state and avoid trading when influenced by certain news or events. Emotional trading leads to losses. If you notice impulsive decision-making, take a break to calm down.

Vacation

Everyone needs breaks. If emotions and feelings drive you, take a break and avoid thinking about trading, assets, or cryptocurrencies. Engage in activities you enjoy and spend time with loved ones to recharge.

Statistics

Keep detailed statistics. This advice is valuable for both beginners and experienced traders. Record the number of transactions per day, profit and loss balance, positions, and other indicators. Analyze this information weekly. Statistics are a great way to create an effective strategy.

By incorporating these psychological tools, traders can navigate the cryptocurrency market more effectively, enhancing their chances of success and minimizing losses.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Finding Balance as a Forex Trader and Nurturing Your FamilyDo you ever feel like your life is a constant juggling act? As a 33-year-old female, I understand the challenges of maintaining balance between trading forex and taking care of a family. It's a question I often get asked:

"How do you create balance in your life while pursuing your passion for forex trading?"

Today, I want to share some insights that may resonate with you and help you find that much-needed equilibrium.

You may already live a well-balanced life more than you know. Think about your daily routine: waking up, preparing for work, spending time with your loved ones, and getting some well-deserved "me" time. These tasks may seem simple, but they contribute to the overall balance of your life.

The key is to recognize that this balance is not set in stone and can be adapted to accommodate new endeavors.

However, when you decided to become a forex trader, your life may have shifted from being balanced to unbalanced, causing confusion and chaos. There are three primary reasons for this shift:

Learning a new skill: Forex trading is a skill that requires time and dedication to master. It's natural to feel overwhelmed when you're navigating unfamiliar territory.

No guaranteed income: Unlike a traditional job, forex trading doesn't come with a fixed paycheck. The uncertainty surrounding your earnings can add stress to your life.

The need for guidance: When you had a boss, coworkers, teachers, or family members supporting you, you had clear instructions and a sense of direction. Without this guidance, you might feel lost and uncertain about your trading journey.

The secret to restoring balance lies in seeking help, asking for guidance, and implementing the knowledge you gain. By doing so, you create a path towards balance that supports your growth as a trader and as an individual.

So, what does balance as a trader look like?

It's about integrating trading into your daily or weekly routine in a way that aligns with your energy levels and priorities. Find your passion peak hours, the times of the day when you feel most aware and energized. This is when you should dedicate time to learning and trading. On the other hand, avoid trading or learning during your low energy times, as it can throw off your balance and hinder your performance.

Remember, trading should become a simple addition to your life, not a burdensome chore. It's crucial to find a pace that suits you. For some traders, placing 1-3 trades a week is sufficient. And it's perfectly okay if there are weeks when you don't make any trades at all. Embrace the concept of making money doing the bare minimum in trading. We're fortunate to have technology that allows us to achieve significant results without the need for countless trades.

Imagine the satisfaction of making substantial profits with just a few minutes of work. This is the kind of mindset that can make trading an invaluable addition to your life. It's worth the effort to learn and master this skill.

To integrate trading into your already balanced life, follow these steps:

Visualize the addition: Imagine how trading will fit into your routine and how it will complement your current lifestyle.

Determine your trading frequency: Decide on the number of trades you want to place and visualize yourself executing those trades confidently.

Embrace the highs and lows: Picture yourself experiencing the emotions that come with making or losing money. Reflect on how often you want to feel those emotions.

Take action: Now that you have a clear vision, it's time to take concrete steps towards making it a reality. Implement your plan and adapt as necessary.

Finding balance takes time, and it's important to be patient with yourself. Give trading at least 1-3 years to see true growth.

The first year is for learning and establishing a foundation.

The second year is about building repetition and consistency.

By the third year, you'll be ready to implement and evolve your trading strategy further. Throughout each year, document your journey through notes and videos, and share your experiences with others. Your story can inspire and encourage those who are on a similar path.

Remember, blessings come to those who persist and inspire others. Share your journey, even when you're not yet where you want to be. Your insights and encouragement can make a significant impact on someone else's life.

Wishing you many blessings on your journey,

SHAQUAN

Overcoming Regret: How To Move Forward and SucceedRegret is a common emotion experienced by traders when they miss out on opportunities or a trade they took doesn't go the way they believed it would. It is a feeling of disappointment or dissatisfaction with a decision that has been made or not made. In trading, the fear of missing out (FOMO) can often lead to irrational decision-making, which leads to missed opportunities or poorly timed entries. Today we will explore the psychology of regret in trading and provide tips for dealing with missed opportunities.

The psychology of regret:

Regret is a complex emotion that can be triggered by many factors when trading. In trading, regret is frequently stirred up by missed opportunities. When an opportunity slips past a trader, they may experience disappointment, frustration, and anger. These emotions can lead to irrational decision-making, often resulting in further missed opportunities or poorly executed trades.

One of the reasons why traders experience regret is due to the phenomenon of counterfactual thinking. Counterfactual thinking is the process of imagining alternative outcomes to past events. When traders miss out on an opportunity, they may engage in counterfactual thinking by imagining what could have been if they had made a different decision. This can lead to feelings of regret and disappointment.

Another reason why traders experience regret is due to cognitive dissonance. Cognitive dissonance is the discomfort that arises when one feels a conflict between beliefs and actions. When traders miss out on an opportunity, they may experience cognitive dissonance because their faith in what they see in the market may conflict with their actions.

How do we deal with missed opportunities?

Dealing with missed opportunities is a principal aspect of trading psychology and maintaining a positive mindset. Your trading strategy and plan may have a strong foundation, but our own mind is often the biggest obstacle we face in trading. Here are some tips for dealing with missed opportunities.

Accept that missed opportunities are a part of trading:

Missed opportunities are a part of trading. No trader can catch every opportunity that arises in the market. Accepting this fact can help traders cope with the disappointment and frustration that can manifest when opportunities are missed. If we do not recognize this we may start to make brash decisions, which can lead to over-trading. Overtrading can lead to losses that may impact your trading mindset, more negatively than simply missing an opportunity.

Learn from missed opportunities:

Missed opportunities can be a valuable learning experience for traders. By analyzing the reasons why an opportunity was missed, traders can learn from their mistakes and improve their decision-making in the future. However, it is important to be careful with this, one or two missed opportunities do not mean you need to question your entire strategy. It is important to take a step back and objectively look at what happened and analyze if there were possible opportunities for improvement.

Focus on the present moment:

Focusing on the present moment can help traders avoid counterfactual thinking. Do not get sucked into making FOMO decisions and entering trades at poorly executed times. Instead of dwelling on missed opportunities, traders should focus on the current market conditions. As traders, we need to be forward-looking to explore new opportunities that can be confirmed by a robust yet simple trading system.

Talk it out with other traders or a trading community:

Talking to other traders or a trading community can help traders deal with missed opportunities and regret. Other traders can provide support, advice, and a fresh perspective on the given situation. You might be surprised to find out you are not alone in how you feel about missed opportunities. A trading community can also offer a sense of belonging and understanding, which can be helpful in managing other difficult emotions when trading.

Conclusion

Regret is a complex emotion that can be triggered by a variety of factors when trading, and if you have felt it, you are definitely not alone. Dealing with missed opportunities is a critical part of trading psychology as it happens to everyone at every skill level. By accepting that missed opportunities are a part of trading, learning from missed opportunities, focusing on the present moment, and talking to others, traders can cope with the disappointment and frustration that comes with missed opportunities and improve their decision-making in the future.

Higher Rewards For Less RiskI've changed my reward-to-risk ratio from 1:1 to 2:1.

You heard me right! They have changed.

I wasn't a stickler about my ratios, but I am now. I want to make more money and do less trading. How is this possible, you may be asking?

It's simple when you look into the details. So let's take a look at the losses first.

What do my losses look like?

Each time I lose a trade, I recently exited a previous winner or wasn't in a trade on that currency pair before I lost. Let me explain because these are two different things.

When I win a trade, I give back my profits on losing trades and may not enter the next trade due to my emotions being everywhere.

I noticed that I was stopped out, and the price flowed my way. But, honestly, I can do nothing to prevent this from happening.

You may say, "well, can't you change your stop loss?"

I could, but to what? I never know when I'll be stopped out or how big the wicks will be to get me out of the trade. This means every trade is unique, and I'm making a mistake if I don't follow my rules.

Being stopped out isn't the problem. Trading my system too much with almost the same reward to risk is the problem.

Question to myself, what if you could hold the trade longer(I'm a swing trader, so this fits) and increase your reward significantly, so you don't have to keep entering multiple trades unless the reward was worth it? So now, if I am stopped, my winning trades will make up for my losses and more.

What do my winning trades look like?

My winning trades look more significant than my losses. My focus is and will always be higher timeframes. I like to trade when markets are trending. So per the daily, weekly, or monthly timeframe, I'm trading if my currency pairs are trending.

My goal is to get the best entry that fits my rules and hold to my long-term targets, and any trade under a 2:1 reward-to-risk ratio will not be traded.

I'm also ok with not being triggered into trades set by my pending orders. I'm also ok with losing trades. That's part of the business.

In Summary

I seek to hold trades longer to receive bigger rewards and let the small losses be small. I've not changed my trading strategy. It works, and I am working on it. We go well together.

My belief is as long as the market is trending, I can hold my trade.

I pray this blessed you,

Shaquan

Remember, you don't trade the markets. You trade what you believe about the markets. "Van Tharp"

🧊The Iceberg Illusion In TradingThe iceberg illusion in trading refers to the perception gap between what people think trading is and what it actually means. Many people see trading as a simple way to make quick profits and accumulate wealth, with the idea that all one has to do is buy low and sell high. However, the reality is far more complex. Under the surface of what appears to be a straightforward process lies a world of risk, stress, and uncertainty. Trading is not just about making money, it requires discipline, patience, and a deep understanding of the markets. Those who don't understand the true nature of trading may face financial loss, depression and failure, much like the hidden dangers beneath the surface of an iceberg. Success in trading often requires much more than just a basic understanding of market trends and patterns, and those who dive in without being fully prepared may face dire consequences.

🔷 Above the Iceberg

Above the iceberg, people often see the glamorous and attractive side of trading, characterized by success, wealth, and financial independence. They imagine traders as confident and knowledgeable individuals, making smart decisions and reaping the rewards of their investments. The image of traders making large profits in a short amount of time is one that is often perpetuated by media and popular culture. People often see the stock market as a fast-paced, exciting place where opportunities for financial gain are abundant, and the idea of being able to control one's financial future through trading is alluring. This perception of trading often creates a rosy and idealized image of what it entails, leading many to believe that success in the markets is easy to achieve.

🔶 Bellow the Iceberg

Below the iceberg, lies the reality of the challenges and difficulties that traders face on a daily basis. There are many hidden risks and uncertainties that are not immediately apparent to those who are new to the world of trading. Some of the things that people don't know that lie beneath the surface of the iceberg include:

🔸 Market volatility:

The stock market is a highly volatile environment, and prices can fluctuate rapidly and unpredictably. This can make it difficult for traders to manage their positions and minimize their losses.

🔸 Emotional stress:

Trading can be a highly emotional experience, and the pressure to make the right decisions can be immense. Many traders struggle with anxiety, fear, and depression, particularly when faced with losing trades.

🔸 Lack of understanding:

The stock market is complex, and it can be difficult for traders to understand all of the factors that influence market trends and prices. This can lead to costly mistakes and an increased risk of financial loss.

🔸 Competition:

The stock market is a highly competitive environment, and traders must be able to keep up with fast-moving markets and make quick decisions based on complex data and information.

🔸 Long-term success:

Many traders are focused on short-term profits and may not consider the long-term impact of their trading decisions. Achieving lasting success in the markets requires a well-thought-out strategy and a strong understanding of the markets and the risks involved.

🔸 Timing:

Successful trading often requires precise timing, as markets can change rapidly and prices can fluctuate. Traders must have a deep understanding of market trends and be able to make quick decisions to take advantage of opportunities.

🔸 Risk management:

Trading involves risk, and traders must be able to manage their positions and minimize their losses. This requires a well-planned and executed risk management strategy, including setting stop-losses and taking profits at appropriate levels.

🔸 Knowledge and experience:

Trading is not just about buying low and selling high. It requires a deep understanding of market trends, economics, and financial analysis, as well as years of experience to develop a successful trading strategy.

🔸 Discipline:

Trading requires discipline and patience, as well as the ability to stick to a well-thought-out strategy. Many traders make impulsive decisions based on emotions or market rumors, which can lead to financial losses.

Welcome to the hardest game in the world.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

🧠 The Mind Of A Smart TraderTrading psychology is influenced by emotions like greed and fear, which can drive irrational behavior in markets. Greed causes excessive risk-taking and speculation, while fear causes traders to exit positions prematurely or avoid risk. Regret can also cause traders to violate discipline and make trades at peak prices, leading to losses. These emotions can be particularly prominent in bull or bear markets and can have a significant impact on market outcomes. Trading psychology is a crucial factor in determining success in trading securities. It includes aspects of an individual's character and behavior that affect their trading decisions. Discipline and risk-taking are critical components of trading psychology, as is the impact of emotions like fear, greed, hope, and regret. It can be as important as knowledge, experience, and skill in determining trading success.

🧠10 Trading mindset tips:

🔹 Stay informed: Stay updated with the latest market news, trends, and developments, as well as your preferred assets.

🔹 Create a trading plan: This should include a clear set of rules for entry, exit, and risk management. Stick to your plan.

🔹 Manage your emotions: Avoid making impulsive decisions, especially during volatile market conditions. Keep a clear head and stick to your plan.

🔹 Continuously educate yourself: Enhance your knowledge and skills by reading books, attending seminars, and practicing with demo accounts.

🔹 Diversify your portfolio: Spread your risk across different assets and markets to reduce your exposure to any one particular market.

🔹 Stay disciplined: Follow your plan and stick to your rules, even if your emotions are telling you otherwise.

🔹 Set realistic expectations: Be mindful of your limitations and don’t overreach. Accept small losses and focus on long-term success.

🔹 Stay focused: Avoid distractions and keep your mind on your trading activities.

🔹 Keep a trading journal: Record your trades, track your progress, and reflect on what you could have done differently.

🔹 Take breaks: Avoid overtrading, which can lead to burnout. Take time to recharge and come back fresh.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

The Biggest Mistake Novice Traders Make When Learning To TradeI wasted a lot of time from years one to four in my trading career.

Being scammed led me to decide to create my unique trading strategy. I used the course material I bought and google to do so. It worked but after years of pain and suffering. If I had continued searching for a legit trading coach, I would've succeeded much quicker.

But I'm grateful because I learned a valuable lesson, which is to always...

Start By Mastering An Existing Trading Strategy Before Creating A Brand New One.

Ignoring this advice, especially as a novice trader, will stop you from succeeding on time.

For that reason, trying to create something new that you don't have experience with is useless. Because it will waste the mental energy and time you need to master what you already have to move forward. Thus committing to grasp the details of a trading strategy will save you from mental battles that hinder your growth. You'll also free up time to develop the following key ingredients for trading success:

1. Trading and Risk Management (Business) Plan.

2. Risk Management edge.

3. Psychological edge.

4. Journalling Habit.

With that said, let me show you how to flourish as a novice trader, below.

Find a legitimate trading coach with a proven track record.

Having a professional trader coaching you through your journey will make it a bit easier and more fun.

But there aren't many legitimate professionals who will make that possible. The industry has a lot of scammers who only make money from selling courses. That's not a problem though as there are traders who live off trading. Your job is to find them.

How?

Do research before buying a course:

1. Pick 2-3 traders you perceive as legitimate.

2. Check if their course will help you develop the 4 ingredients for trading success.

3. Check the coach's Trustpilot for course/community reviews.

4. Do research by contacting people who have bought it.

5. Ask for the coach's trading (Myfxbook) statistics.

6. Join their free communities to ask questions.

Once you’ve found your perfect match, focus on studying and mastering his/her course material till you become a profitable trader.

And while doing that teach other people your skill for free. This will quicken the process of learning, understanding, and mastering. After that form new trading strategies to maximize your gains and sell to other people for extra cash.

Following the advice above, will save you years of pain and suffering in exchange for fun years of rapid growth and success.

So trust the process and you’ll make it.

3 Ways Traders Can Prepare For SuccessComing into trading with only the desire to make money, often results in not making any.

I didn't make a dime for 4 years till my lucky day came.

Before it, like most traders, I gambled my way into the game with little to no knowledge. I started off with free information. (Youtube and Babypips were my buddies.)

After gathering data from them for 2 weeks, I felt I'm ready, then funded my first trading account. Luckily, I doubled the account on my first day but blew it the next. It was awful but I repeated the process for 3 months till I gave up.

However, I got back a month later. Because I was still hooked by the idea of making money wherever I am. Though at the same time feeling stressed, anxious, and depressed to see my hopes and dreams out of reach, I had faith.

That I carried with me throughout the years, until one day, I found out what was holding me back: a short-term mindset.

Which is what I'll show you how to escape from before it's too late.

**Thus Begin By Thinking In Years Than Months**

Ignoring this advice will be costly. It will cost you your time, money, and mental health. You don't want that.

But you get that by being a short-term thinker. Which is a person who focuses on the now, with little regard for the future. Someone who focuses on short-term results at the expense of long-term interests. A trader who focuses on making money instead of focusing on the 3 stages of becoming a trader:

1. Learning to trade.

2. Becoming a trader.

3. Full-time (profitable) trader.

It's almost impossible to reach stage 3. Yet it is possible when you begin the journey like a long-term thinker. Which is a trader who envisions, plans, and works toward the future. While ignoring the monetary side to focus on the skill (that will serve you till you meet bro, Jesus).

Like what all medical students do.

From the get-go, they know it will take them 6-7 years to become professional doctors. Being aware of this allows them to focus on the stages of becoming doctors. (But lucky for them, they make money along the way through student loans.)

So, coming into trading with an idea that it will likely take you 5 years to become a consistently profitable trader, will assure that. Because it will keep you grounded, focused, consistent, and patient with the process. And that will allow you to enjoy it while growing fast.

With that said, let me show you how you to prepare for trading success below:

1. Create a long-term vision.

A clear vision with a plan will save you from falling into traps that will delay your progress. It will allow you to navigate through the dark cave till you reach the light. But that's only possible when you have a torch and a compass.

Powerful questions and a plan of action.

Questions help you to discover the path. A plan helps you walk the path. Thus to find out if trading is the right path, ask yourself:

- Why do I want to become a trader?

I know you are in it for the money (like I used to be), but that mindset will prevent you from getting it. So take your time answering this question. Don't rush because whatever answer you get will determine your success or failure!

Once you're satisfied with your answer, start planning out your journey by...

2. Setting Objectives

In simple terms, an objective is a measurable step you take to achieve a vision.

For a trader who's in the first stage of "learning to trade" while working a 9-5 job, the vision could be to become a full time professional trader. And the objective could be to buy a trading course from a mentor you perceive as legit, then study and practice till you reach the 3rd level.

To discover that objective, the reason behind it, and how to achieve it, you need to ask yourself:

- What do you need to do?

- Why do you need to do it?

- How you’re going to do it?

After figuring out all that, move on to the next step, which is...

3. Keeping your job

Do not quit your job before becoming a profitable trader. It will save you from unnecessary mental and emotional pain that are caused by forcing profitable trades to pay bills.

That’s a bad approach to trading. It always delivers opposite results that will definitely make you stressed, anxious, depressed, and unsuccessful.

You need not worry about money along your journey, so you can focus on the process of becoming an elite trader.

I’ve made that mistake and it cost me too damn much. So, keep your job to save up at least 2 years of monthly expenses that will get covered once you’ve decided to become a full time trader, and save for a 6 to 7-figure prop firm trading account to manage once you’ve resigned from your job.

Follow the above steps and witness the fruits of being a long-term thinker who focuses on the processes instead of results.

The Shop Model - Trading Mindset This is a look into the way I see markets and how I see my trading using the Wyckoff Method and comparing it to standard business models. More of a mindset video but I feel is very useful when trading and seeing your trading as a business.

Let me know what you think,

Cheers for watching

Current move in US30 - bear week <3Shared another idea ft. Nas100, but US30's price action has been smooth, lots of reentries, tight mitigations, low volume distributions and huge volumes at breakouts... loved this week and I'll seek to push those moves lowers through the start of this week.

Has a lot of drawings, but overall everything I detailed this week in my charts, even after ZOOM trainings. Left my thought process because it's a rare picture perfect week, grateful this happens, hope everybody understands than this is attainable for anybody. I'm not special, I'm not better than anyone, because through hard work and experience you can match my results and exceed them. So just keep trying, I'm not at my highest level yet, so let's grind this mf'r out ;)

3 Stages of Trading 🚨Every trader goes through these stages.

I remember starting out on demo thinking this would be the easiest way to make money quickly.

Oh, how I was wrong.

It seems like sunshine and rainbows on a demo account but when you move onto a live account, the real problems begin.

Your expectations of quick money quickly vanish due to the psychological aspects of trading.

This usually results in big losses.

Excitement is followed by pain, this is where most traders quit.

If you make it past the pain and develop, you will reach your trading goals.

Do these stages seem similar to your trading? 💬

Visualization and Trading Manifestation 💆♂️Visualization

Why is it important?

You may have noticed that whatever you choose is always manifested. What you choose is what you get. Whatever you choose to believe in gets reflected in your worldview.

So why are you not choosing to be a successful trader?

Thoughts not only provide the motivation for human action, they also have a direct influence on our reality.

Thought energy transforms into physical reality.

Thinking positively going into a trade and thinking positively in general as a trader is a sure path to success.

Do you practice positivity and visualization when trading? 💆♂️