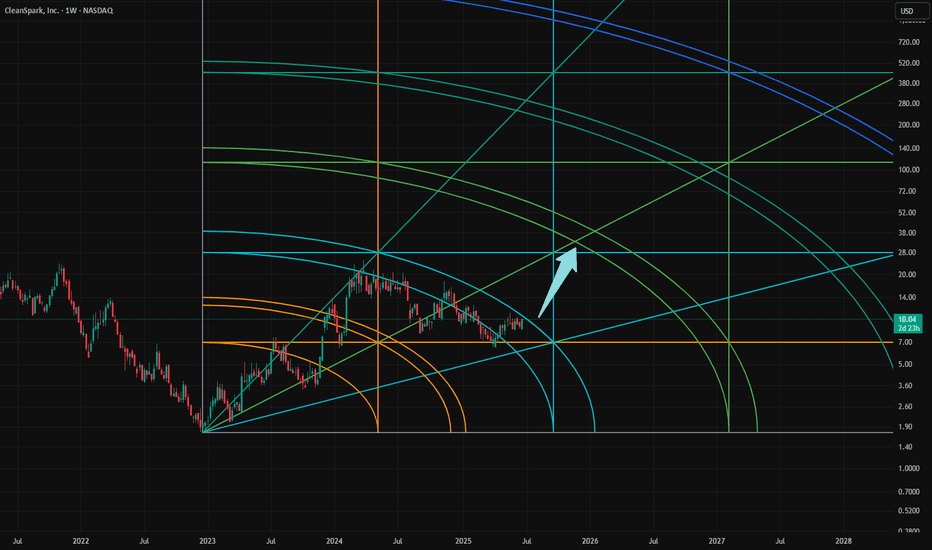

$CLSK Trapped between Critical Resistance and Support?NASDAQ:CLSK Shot through the weekly 200EMA and hit the weekly pivot resistance and was rejected into the High Volume Node (HVN) just below.

If the count is correct we should see price breakthrough in wave 3 after some consolidation and continue up after wave 2 tested the .618 Fibonacci retracement and HVN as support.

Heavy resistance HVN coupled with the R1 pivot at $20.40 will prove another challenge to overcome. Ultimately, if the count is correct AND Bitcoin doesn't tank we can expect a challenge of the all time highs up at $60.

I already closed partial take profit myself at the weekly pivot on a recent trade and will be looking to go long again to the those targets. Make sure to always be taking profits on the way as nobody has a Crystal ball!

RSI is currently printing a bearish divergence on the weekly so we need to see that negated.

Analysis is invalidated below $6.

Safe trading

Miners

$MARA at Resistance!NASDAQ:MARA continues its rally and has come into the High Volume Node resistance target and R2 daily pivot.

Daily 200EMA was tested as support after price smashed through. I expect continuation to the upside $24 target at the R5 daily pivot after some consolidation at this resistance.

Analysis is invalidated way below wave 2 at $13

Safe trading

$RIOT Continues to Follow PathNASDAQ:RIOT Is sticking closely to the plan testing the bottom and top of the channel multiple times.

Price closing above the weekly 200EMA and weekly pivot Friday will be a very bullish signal. As we have over 4 tests of the upper boundary resistance there is a high probability we break through and continue higher in a high degree wave 3.

Initial targets are the weekly R5 pivot at $39 and all time high at range at $79.

Price tested the .618 Fibonnaci retracement in a complex correction for wave 2.

Analysis is invalidated below the channel support.

Safe trading

$WULF Critical Resistance!NASDAQ:WULF has had a great come back but has just hit a triple sword resistance: weekly 200EMA, weekly pivot and High Volume Node where I expect it to struggle for a while!

Are CRYPTOCAP:BTC miners the new altcoins?

Bullish continuation through these resistances will flip them to support and demonstrate fundamental resilience on an improving macro economic background overcoming technical analysis.

Long term tailwind potential can be as high a10x from here but more realistic targets are the R3 weekly pivot $17 and R5 weekly pivot at $25.

Analysis is invalidated below the high degree wave (4) of a leading (or ending) diagonal Elliot Wave pattern.

Safe trading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

IRENs Incredible Surge Continue next wWeek?NASDAQ:IREN has been on a rampage since the April surging 175% and nearing all time high! A great couple of trades for us so far!

Price is likely to hit all time high next week with such a strong trend, where resistance and a pullback is a high probability.

The weekly pivot is $9.77, the most likely area for price to find support just above the 0.382 Fibonacci retracement (which will be dragged up to the weekly pivot once a new high is made).

Price discovery terminal target are the R3 & R5 weekly pivot points at $28 and $40.

Safe trading

$HUT Macro Chart Preparing for Breakout?NASDAQ:HUT looks poised for a strong breakout with a wave 3 long term target of $58 and a short term resistances of $21 and $33

HUT is moving strong almost up 100% from the recent swing low, overcoming its weekly 200EMA with ease. A test of the 200EMA as support is likely before continuation.

Price is consolidating under major resistance High Volume Node (HVN) and the weekly pivot point. Consolidation under resistance often leads to a breakout.

A series of 1-2s appears to be taking place on the Elliot Wave count finding support at the 'BTC-Miners golden pocket' of 78.6 Fibonacci retracement.

Analysis is invalidated below $10.10

Safe trading

Greatness ApproachingClear impulsive bullish move in 2024, followed by 18 or so long months of a triangle correction. The bullish move happened so quickly that this makes sense. The markets needed time to sort out what was going on here.

The breakout from that triangle is a big deal and coincided with silver breaking above major resistance. NYSE:AG is one of the best leveraged silver plays and I am very bullish silver above $35. Momentum and structure have both broken to the upside. We are just getting started.

Based on the way NYSE:AG acts as a leveraged play on silver prices, this count is conservative. It is entirely possible that the next wave 3 we are entering subdivides and we go even higher, but we won't know until we get more structure.

Huge Moves Coming for Silver MinersNYSE:PAAS has some of the best structure I've seen in any of the miners, along with NYSE:AG and $FSM. July 2024 was the beginning of a rising, complex correction. Price could always reject off the top of the channel and pull back to $26, but any dip here is a buying opportunity. We are headed for far higher prices going forward based on this structure.

The impulsive bullish waves in 2024 are clear.

The rising corrective pattern is mega bullish for the next wave.

I believe we are already in the next wave.

If this thing breaks above $30, it will fly.

I am taking no profits until we hit $55-60.

CLSK Going to $27There is always a downside, but I believe Risk vs Reward is here. It's not if, it's when. If we breakout to the downside of the triangle then we will test the support and the bottom of the wedge. If we break to the top of the triangle then we go for the breakout of the wedge and on the way to $27. I am adding at these levels and of course if it goes down, I am adding more.

$IREN has the lowest all-in cost of mining a single coinNASDAQ:IREN is mining a single bitcoin at $40,000 all-in costs. When bitcoin appreciates to $150-200k, the miners with their rigs, land, infrastructure, balance sheet, hardware etc will be repriced higher. Thats the gain I would like to capture with this entry here at $9 a share.

This phenomenon will be seen throughout the entire sector, all miners will appreciate from here.

Gold - Exceptional StrengthGold is clearly in an impulse wave that I feel is the wave five of a larger third wave. Generally, a fifth wave in commodities is often the biggest. While in normal trading vehicle, the third wave is the largest. So either way, momentum remains strong.

GDX however is not as strong but my expectations are for this to change. Recent miner financials have showed that high gold prices along with lower energy costs result in strong positive cash flow. There are too many bargains in the miners sector and as cash levels increase, look for M&A opportunities.

Snow lake resources = life changing moneySnow lake has been developing an admirable portfolio of drill sites to their repertoire. With multiple drill sites containing a slew of significant resources, and the snow lake site appraised with an estimated NPV of 1.7 billion. This company seems like a no brainer. Their drill site results should be published soon this month or in Feburary, and they have done three cash offerings to raise cash on hand and capital. The company is well positioned to drill on their sites. I have estimated that they will be making 150 million a year in revenue just off of the lithium in their snow lake site. They have found Uranium and Gallium at their drill sites as well. Gallium is crucial for semiconductor fabrcation and is considered one of the most valuable resources on this day. Most of Gallium and semicoductor production is found in Taiwan and this discovery raises an eye when it comes to valuation on this company. With Ai needing more power for the data centers Uranium/nuclear power has become a major point when it comes to pwoering these data centers. With a market cap of 100million currently this company is considered seriously undervalued with just the estimated profit from lithium drilling at snow lake. I think you will see this company reach a valuation of around 1billion-5billion and you might see these shares rise up from around 1.00 to 20-40 dollars a share in a few years time.

Thanks,

Ben