Miners' Capitulation into Bitcoin Halving - Macro AnalysisMiners' Capitulate into Bitcoin Halving

On a macro level the Empire is currently building the 3rd Super Star Destroyer with Death Star capabilities to jump even further through hyperspace. There are 3 scenarios:

1. blue (most likely)

2. green

3. red

Miners Capitulation

In a nutshell - undercapitalized miners panic sell because difficulty is too high and mining is no longer profitable, price dumps, longs get squeezed, stop losses cascade, more miners sell.

The capitulation is signaled by a bearish MA crossover on the Hash Ribbons indicator. Last time a Hash Ribbon inversion took place in Nov 2018, when Bitcoin crashed from $6000 to $3000.

The inversion of the Hash Ribbons can lead to a 30-50% drop in the following days, with weeks and months of consolidation prior to an eventual breakout.

If capitulation occurs, subsequent positive momentum (bullish MA crossover) could be taken as a BTC buy signal.

formal cause of the dump: major inflow of 1st spend BTC from some unknown miner's wallet.

_______________________________

Basics of Bitcoin Mining:

- Bitcoin has cycles/epochs. Halving affects miners' revenue in each cycle and therefore the price. This is by design. Hash rate and difficulty adjustments ensure system operation and stability during a cycle. Price converges to a median of a triangle before each halving. It's like having a built in gyroscope. Difficulty adjusts both up and down automatically to counter the Hash Rate increase/decrease.

- Miner's goal is to sell bitcoins at max price and buy new equipment at low price to stay in the game. Therefore miners are incentivized to gather in large pools to be able to control hash power and the market by increasing/slowing down supply production. Built-in scarcity or artificially limited supply production causes the price to go up and attracts new investors - basics of supply/demand. Miners can halt all operations and cause the price to collapse. They can also dump 1 mil coins and crash the market at any given time or kill other coins with compatible protocol using 51% attack. They lobby for changes in the bitcoin protocol.

- Bitcoin is essentially a math formula, it's a sort of self-propelled pyramid scheme that is propagated by miners using investors' money as fuel. It will likely converge and stabilize around a single value or collapse in the long run. You can use it while it works.

- It's a pyramid because to be able to cash out your coins you must have a counter party - someone with fiat to buy bitcoins from you. You won't be able to sell if there's no buyer. Only the first few will. The rest will become bagholders. Or you will sell at 10% of the value. You don't notice this when there's enough liquidity in the market and price goes up which attracts occasional buyers. It's much harder to cash out when price goes down and no one wants to buy and people have to wait for weeks. Those always in profit are service providers that charge fees and control liquidity pools. People with lots of coins usually just donate them or try to run their own exchanges - this is the only way to get cash for coins and fees from trading/listings.

- that's why HODLing is pointless in the long run. Whales need lots of bitcoins only as leverage to be able to trade large positions, shake out the market and cash out occasionally. They can grow capital because they are hedged.

- miners need to sell bitcoins to upgrade the equipment and pay for electricity to be able to continue working. Their profit margin is very small, it reduces exponentially and at certain difficulty levels they go bankrupt like most traders. In the long run 1-2 mining pools will control the whole market. It will become a centralized monopoly. And you don't want to become the market because no one will buy from you. Everyone will just switch to a new coin. Check US history of oil prices. The only miners that are always in profit are mining equipment manufacturers. They get cash from sales and they know that their machines will become obsolete.

- 1 BTC = 1000000 USDT price is possible but no one will be able to cash it out, because there will be no liquidity at such price levels and no sane banks to process it. It is possible because USDT will cost a fraction of USD. Attempting to withdraw at 100% value will cause exchanges and tether to collapse. And there's 2x more tether now with ERC tokens.

- Mining manufacturers, exchanges and corrupt governments will pay large fees to shady banks for coin to USD processing to maintain the vicious cycle and attract new investors. This will work while not everyone wants to withdraw.

- in the future all exchanges will list BTC price in satoshis because common man will be able to buy only a small fraction of BTC such as 10^-8 decimals

- in the future miners will rise fees, fee = 1 BTC or 50% of transaction value could become the new norm. People won't be able to move coins for many reasons.

- The price of any commodity tends to gravitate toward the production cost. If the price is below cost, then production slows down. If the price is above cost, profit can be made by generating and selling more - Satoshi Nakamoto

Check out links:

Stock to Flow model:

digitalik.net

www.lookintobitcoin.com

https://bytetree.com, featured charts, generation 1 on-chain miners 1st spend chart

Bitcoin Log Regression:

www.youtube.com

How The Economic Machine Works:

www.youtube.com

USDT supply

www.tokenanalyst.io

QUANDL is huge database that stores a lot of statistical and economical data from all over the world. Free quotes from QUANDL are available on TradingView:

QUANDL:BCHAIN/DIFF - bitcoin difficulty

QUANDL:BCHAIN/MIREV - miners' daily revenue

QUANDL:BCHAIN/NADDU - unique bitcoin addresses

QUANDL:BCHAIN/TOTBC - total bitcoins in circulation

QUANDL:BCHAIN/BLCHS - api.blockchain size

P. S.

Gabening intensifies. Alyx is here. It's been only 12 years but feels like yesterday.

Miners

We Are Skirting on the Edges of a Bitcoin Miner CapitulationBitcoin Hash Ribbons are extremely close to a potential Miner Capitulation.

Should a Capitulation occur (crossover of the ribbons), it is not the time to be buying Bitcoin.

The best times to buy Bitcoin is on Hash Rate recovery, as identified by this indicator.

For now, we are "still in the green", and Bitcoin's price may have already bottomed.

However, until we see continued Hash Rate growth, and separation of these Ribbons, we cannot be sure.

This is one of the most important indicators to be watching right now regarding Bitcoin's health… as when miners hurt, the market will hurt too.

Miner Confusion? An Unusual State in Hash Rate GrowthThe current plateau in Hash Rate growth is most unusual for Bitcoin.

The Hash Ribbons 1 month and 2 month moving averages have never been this close - for so long - except during a capitulation event.

We can measure the relative "growth" of the current month Hash Rate (HR) to the prior 2 months as: Growth = (1m HR - 2m HR)/(1m HR)

In November 2019, "Growth" has been below 0.5% for over 7 days now, without a cross-over (capitulation event) occurring.

However, it appears as though miners are moving cautiously, and may be struggling between two tough choices:

1) To commit more resources to Hashing (and trying to accumulate more Bitcoin) ... OR...

2) To cut back Hashing power and risk missing a major Bitcoin Bull Run.

In attempt to plot some "similar" historic scenarios, I have flagged in red where "growth" was historically less than 2% for at least 1 week:

OCCURRENCE: DAYS TO CAPITULATION

Apr 2012: 2

Dec 2012: 2

Dec 2014: 2

Apr 2015: 21

Nov 2016: No Capitulation*

Oct 2018: 5

Mar 2019: No Capitulation*

May 2019: No Capitulation*

Result: in 5/8 cases a capitulation occurred within 1 month.

This suggests there is roughly a 60% chance of a capitulation occurring in the next month.

However, this result should be taken as a GUIDE ONLY.

10 years of data, and 8 similar data points, is FAR from an exact science. We only have 10 years of Bitcoin history to work with, it is imprecise, but that doesn't mean it should be ignored.

Notes:

* Capitulation occurred >> 2 months away

** I excluded any occurrences within 2 months after a capitulation

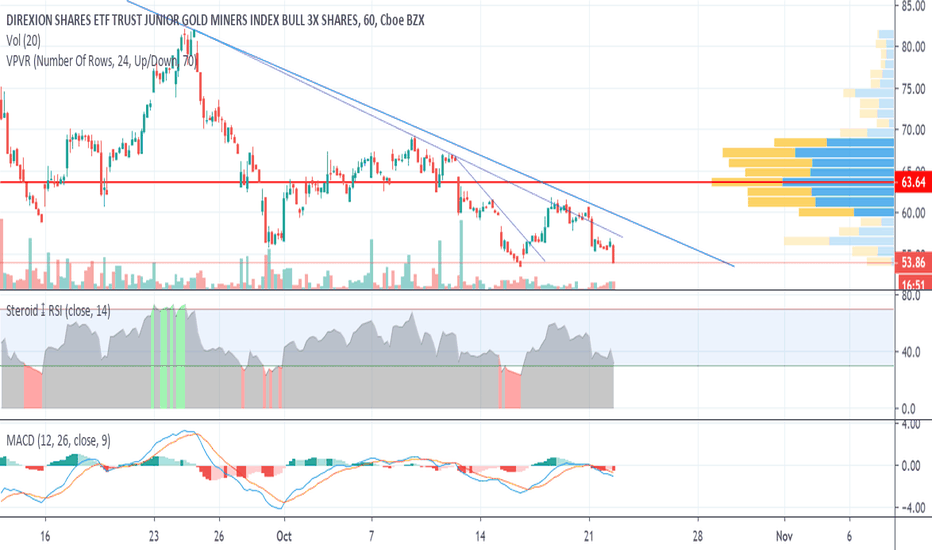

Watch JNUG for a trend line breakThe junior gold miners' leverage ETF has been making a long-term downward trend line since September as the dollar showed strength and gold showed weakness. Surprisingly, gold and JNUG have stayed in their downtrends despite dollar weakness throughout the month of October.

That's presumably because the dollar index, now at 97.48, has a support trend line around 96.86. Gold and JNUG will break upward out of their downtrends if the dollar breaks downward through that support.

It probably won't happen before the Fed meeting, although conceivably it could. Futures traders are pricing the probability of a Fed rate cut at 94%, and yesterday's headlines included "The Fed Just Printed More Money Than Bitcoin’s Entire Market Cap." The dollar is up today, but only because it's making a technical pullback from oversold territory. I expect it to touch its support line soon.

Assuming the futures markets aren't completely out to lunch, we should get a rate cut next Wednesday and then our breakout should come.

Time to Accumulate Gold and Silver Miners on Metals Pullback It is always important to keep one’s mind open and to consider all possibilities.

At this point I am expecting a pullback correction in Gold, between $1416 and $1434. If this pullback comes, this will be an opportunity to accumulate undervalued junior miners who will play “catch-up” to the large cap miners. Additionally, with the gold-silver ratio finally breaking lower, silver looks poised to outperform on this next leg up. I am not actively shorting the metals, merely patiently waiting for this opportunity to accumulate even more shares in my list of miners.

However, given the current state of affairs around the world, it is entirely possible this pullback never comes and that we move higher from here. I am hedged against that possibility by being presently invested and continuously adding to my investments in junior & small cap miners. In my opinion, if this scenario plays out where gold does not correct first, it will ultimately not be ideal for gold long-term and will likely result in a painful crash in the metals.

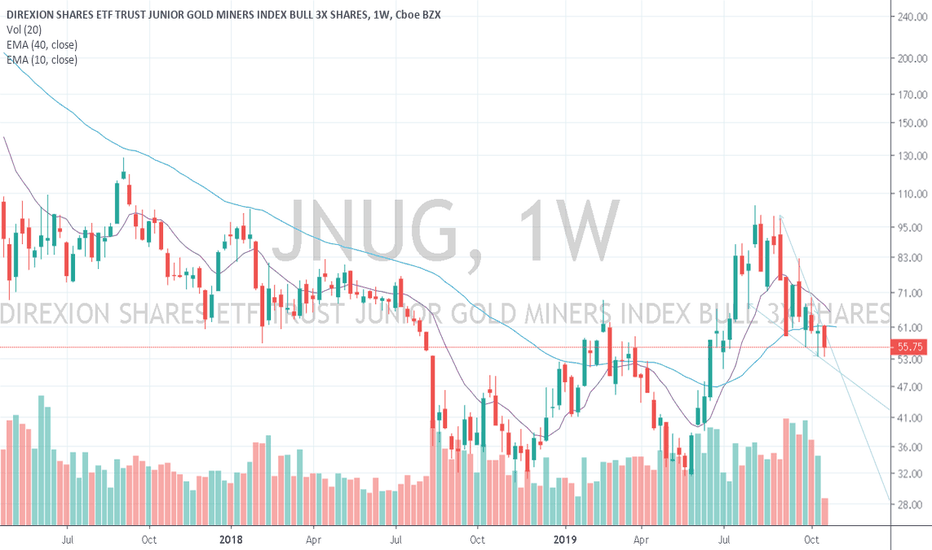

Gold-Short model GLL low @ 09/2021 - JNUG Bullish next 24 monthsKeep studying & tweaking GLL (Gold Short Model) to try to understand maximum peak in Gold/Miners.

Continue to see 3 hour brschultz model place optimal peak in gold miners in Sept 2021.

Bottom in S&P, Dow, Nasdaq, & Real Estate in Late 2021 as well.

brschultz