IOTA. how it relevancy with 5G tech

great thing to know about this crypto.

IOTA is different with others crypto in term of it is technologies

there’s no blockchain, there are no miners, and because there are no miners, there are no fees. Many established networks see costs balloon when congestion intensifies, but IOTA aims to provide limitless throughput at minimal expense.

the marking price for today to date.

Rank #46

Coin

On 226,540 watchlists

IOTA Price (MIOTA)

$0.847

1.31%

0.00002029 BTC3.98%

0.0003441 ETH1.75%

Mining

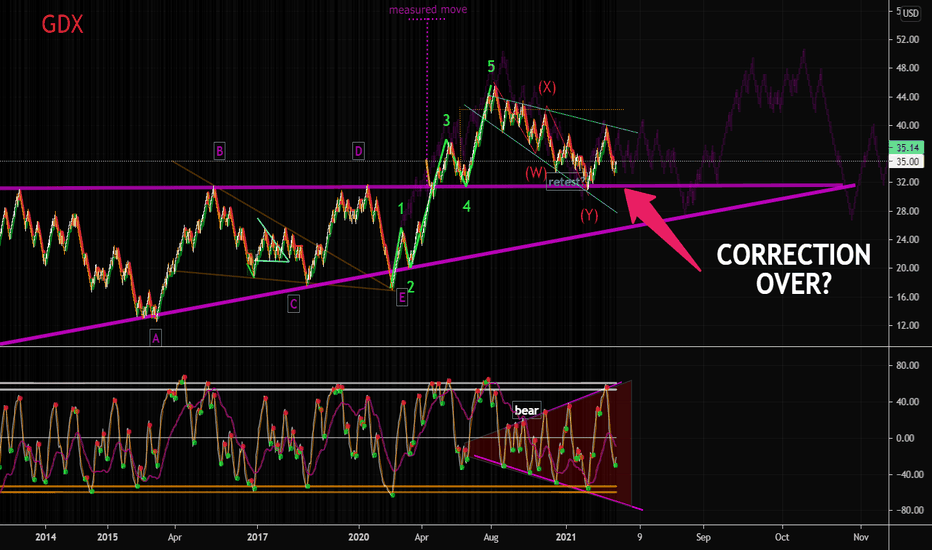

GDX HAS COILED ENERGYThe metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden bearish pattern that will eventually break. When it breaks, GDX is likely to move up incredibly strong. Perhaps one more push lower? I don't know... But I'll be ready if it drops again.

For me, I have some medium-longer term targets over 55-60.

Vox Royalty Just Doubled 2021 GuidanceFor those of you who haven't been following along, this is what was said in May at the end of Q1 2021.

GEORGE TOWN, CAYMAN ISLANDS – May 25, 2021 – Vox Royalty Corp. (TSXV: VOX) (“Vox” or the “Company”) is

pleased to announce its operating and financial results for the first quarter ended March 31, 2021. All amounts are in U.S. dollars

unless otherwise indicated.

Kyle Floyd, Chief Executive Officer stated: “The first quarter of 2021 marked another milestone for Vox as it reported record

revenues. The Company is well on track to achieve its previously announced 2021 royalty revenue guidance of C$1.7M to C$2.5M.

The embedded organic growth in our portfolio of 50 royalty assets continues to build. Every month our shareholders are benefiting

from exploration successes, fast-tracking of development and production increases on our royalty properties. The coming quarters

have strong potential to be the most productive in Vox’s seven year history.”

This is where they are end of Q2 2021

VOX ANNOUNCES RECORD REVENUE IN Q2 2021 AND INCREASES 2021 REVENUE GUIDANCE BY +100%

TORONTO, CANADA – July 27, 2021 – Vox Royalty Corp. (TSXV: VOX) (“Vox” or the “Company”), a high growth precious

metals focused royalty company, is pleased to announce that it has realized record preliminary quarterly royalty revenue of

C$1,628,600 (US$1,314,000)

for the three-month period ended June 30, 2021. During the quarter, the Company recognized inaugural royalty revenue from its Janet Ivy gold royalty, acquired on March 29, 2021, which is an uncapped A$0.50 per tonne royalty.

Quarterly revenue benefitted from increased royalty-linked production by Mineral Resources Limited (ASX: MIN) at Koolyanobbing, increased production by Karora Resources Inc. (TSX: KRR) from the Hidden Secret deposit at Higginsville covered by the Dry Creek royalty, inaugural royalty revenues earned from the Janet Ivy royalty, and increased production by the operator of the Brauna royalty.

Vox has successfully grown quarterly revenue figures exponentially since Q3 2020, which is summarized in the below chart:

Three months ended June 30, 2021

Royalty revenue (C$) == $1,628,600

Royalty revenue (US$) == $1,314,000

Royalty revenue % growth == 143%

# of producing assets == 4

Kyle Floyd, Chief Executive Officer stated: “This is the continuation of an exciting period in Vox’s growth as revenue and

profitability metrics start to reflect the true earnings power of the Vox royalty portfolio. We have consistently updated the market

with operator updates concerning our royalty assets and noted that our portfolio continues to grow ahead of expectations. The

coming quarters and years should continue to reflect a robust increase in revenues from both in production assets and development

stage projects we expect to come online.”

Vox receives money$VOX.CA is pleased to announce that it has executed binding agreements with Titan Minerals Limited to acquire four Peruvian gold, silver, and copper royalties for total cash consideration of US$1,000,000. In addition, Titan will pay Vox US$1,000,000 in cash pursuant to the terms of an agreement between Vox’s subsidiary, SilverStream SEZC, and a subsidiary of Titan, Mantle Mining Peru S.A.C. (together with the acquisition of the Royalty Portfolio, the “Transaction”). Spencer Cole, Chief Investment Officer stated: “We are pleased to close out this legacy receivable from Titan and to add four highly prospective Peruvian exploration royalties to our portfolio. #preciousmetals #gold #royalty #miners $GDX $WPM $RGLD $FNV

This company is on the move

Short term bearish, long term bullishBased on Elliott Waves and Fib levels. The targets for waves 2 and 3 are shown; the other waves should be updated later.

This stock follows BTC price movements. Currently BTC analysis shows a similar behaviour.

I am not a financial advisor and this is not financial advice. It is a potential scenario or opinion. Invest at your own risk and do your own research.

Love The Upside! - Fortuna Silver Mines Inc <FSM>Going into the Earnings report on August 11th, I think we will have a great bullish swing with tons of upside, ex. going from 4.10-ish to the 5.90 level at a minimum, and potentially even higher depending on the news.

The company has been struggling in the last few years yet now is dishing out a ton of positive news about their ventures and the scale of their operations. Quarterly financials show that they are looking to have stronger financials than they have in the last 3 years... I think this offers a lot of growth for an otherwise currently undervalued player in the space!

If the results however are much more negative than expected, I could imagine a lowering down to $2.85-ish at the lowest, before we will hopefully get a lot more support for another bullish move back to current levels and beyond, perhaps around $5.00.

Either way, if you are looking for a nice little swing play with the potential for a 20-50%-ish upside depending on the outcome of the next earnings report, and also don't mind holding for a few months to see where we go, then this opportunity is likely to be for you!

$FCC perfect bounce on the edge of the Arc.First Cobalt just proved the validity of the arc with a nice bounce out of a bullish pennant. We could be looking at a quick 3 bagger here.

$NLC.V Thoughts and Limit Buy OppIn looking to add to my Long Position in Neo Lithium Corp $NLC.V / $NTTHF I have approached this TA from a bearish perspective over the short term. As detailed on the chart, You can see price make relatively weaker advances: The first move up in early June was stopped at +3SD channel, the next at +2SD channel (note volume). Price always travels back to the mean and $NLC as a miner is not above choppy action in SP. To be clear, I don't see massive downside risk here, but rather some selling pressure channel trading back to the $2.70-$2.75 range.

On top of Linear Regression Analysis, the 21 ema is currently acting as support and the 9 ema (I applied it to see where it was but can only keep 3 indicators) is acting as resistance. I think the clearest conclusion to draw currently is that NLC is trying to figure out which way it is going to go.

One could make the argument that if the market holds here for the most part and small caps participate in a further advancement that $NLC could maintain the mean and advance back up through the positive side of the channel. $NLC is not without near-term catalysts in this Quarter like an off-take agreement and/or financing to finish capitalizing the 3Q Project + release of its DFS. I am taking the approach that these catalysts are a month + away and the above TA in the short-term may come to fruition. I have placed a LB for shares at $2.71.

In sharing this post I think its worth noting that at the Annual and Special Meeting held on June 25th the company set forth a vote to allow the board the discretion at a future date to consider a consolidation of the common shares of the company on a 1 for 2 ratio to list on a Senior US Exchange. Not a guarantee this R/S will occur, but its a possibility and something to be mindful of. When pre-revenue companies R/S, their SP can crater. Granted 1 for 2 is as good as you can get when it comes to R/Ss. I am keeping some cash for a buy further down the road to cover off this risk that may exist and take advantage of a downturn. I have emailed Mr. Vicens the company's CFO and contact person on SEDAR kindly asking for an update on the AGM vote as its been some time since the meeting. I will share any update given on ye olde twitter.

As always Please follow your own trading rules and do DD first.

Cheers,

Luke

$CLSK vs $BTC*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

Recap: My team has been analyzing sustainable energy tyrant $CLSK for the past few weeks. $CLSK converts waste materials into SynGas. $CLSK uses its SynGas as clean and renewable fuel for power plants and motor vehicles. My team entered $CLSK on 6/21/21 at $17.19 per share.

My team has been doing some critical thinking on how to approach crypto. Public enemy number one for $BTC is fossil fuel energy consumption for coin mining and transactions. If $BTC were to ever reach previous all time highs $CLSK share price would correlate and perform astronomically well. My team has reallocated previous funds that were used in our $BTC trade earlier this week and are using those funds to double down on $CLSK today.

My team has averaged down on $CLSK today at $15.60 per share.

If you want to see more, please like and follow us @SimplyShowMeTheMoney

Vox Royalty - GDX,FNV,RGLD & WPMComparing 3 large precious metals royalty companies and the VanEck Vectors Gold Miners UCITS ETF (GDX), shows how the Gold miners and large-cap royalty firms have a similar relationship within the market.

Recently the price action in Vox Royalty has started to find that it too can benefit from a rising market and good news flow. In the past VOX Royalty has been a more volatile ride but steady progress towards their goal of building a portfolio and bringing value to their shareholders.

A few months ago news of Letters of Intent and Public Offerings was announced. The raising of capital was to purchase royalties and assuming completion of the transactions under LOI and a midpoint of 25 royalties acquired, the Company’s portfolio will consist of seven producing assets (an increase of 75% compared to its four producing or construction-stage assets in 2020). In addition, six of the royalty assets subject to LOIs are currently in a development stage and the remaining 16 royalty assets are in the exploration stage (based on an assumed acquisition of 25 royalties). Assuming 25 of the royalties under LOI are purchased, the Company projects that the underlying royalties are expected to generate between C$3 million and C$7 million of incremental revenue in 2023.

$EEGI Readies Itself As it Gets Close to Acquiring OTCIQ PT .25+$EEGI's CEO recently tweeted that the company was very close now to acquiring OTCIQ Access and uploading documents. The process has been slowed down tremendously by FINRA's new regulations that will take effect in September.

The CEO is actively engaged and seems to have formulated a game plan for when the company is pink current.

It's sister company $DKMR is also in the same process, and both are some of the few OTC companies actively engaged in ensuring their stock is pink current or higher before the deadline.

The surge of money flow from non pink current to pink current should start around Mid August and the stock with the most potential will go the highest.

I still anticipate a PPS target of .25 or higher here.

$DKMR Finishes Consolidating and Releases Press Release PT $1+$DKMR Possibly the First OTC Company to have a televised broadcast in national households: xfcmma.net

XFC 45 In Grand Rapids Michigan: The Detroit Superstar Daron Cruickshank takes on XFC legend Guilherme Faria

The upcoming fight on August 6th is to be televised on XFC TV, Fox Sports 2, Roku TV and several others.

The CEO recently tweeted and also released a Press Release giving some guidance on the potential for OTCQB and further updates once Pink Current has been established.

www.prnewswire.com

“Xtreme Fighting Championships, Inc. ("XFC") (OTC:DKMR) has filed to move up to OTCQB and will complete its OTCQB filing once it has become current by filing its Form 10K for 2020 and its Form 10Q for the first quarter for the year 2021.”

“We have a significant update that we will release once we are current with OTC Markets."

For more DD see attached post. PT still stands at $1+

Bitcoin might drop by 93%The luck of electro power in China forced the government to start closing Bitcoin mining farms. In the long run, this should result in a substantial price decline for the BTC, before and if the price will manage to produce a new all-time high.

What do you think of the long-term Bitcoin price perspective, are we still in a bull market?

Crypto Mining Companies are Better InvestmentsBitcoin mining companies are likely the best investments for the next bull run. One aspect that benefits crypto mining companies is that the asset that they generate is expected to increase in value in the future.

This is not the case with most other companies. Take a car company for example. The cars that the company creates will depreciate without question. If the car company produces cars and holds them, the company will go bankrupt.

For crypto mining companies, like MARA and RIOT, they can hold the assets that they produce and the value is expected to increase in the future. Many of the mining companies raised funds in a way that allows them to hold the bitcoin they produce for several years. As MARA and RIOT invest in more mining infrastructure, they will generate and hold more bitcoin.

Why not invest in alts? MARA and RIOT are involved in Bitcoin, which is the most secure and trustworthy crypto. Investing in altcoins can yield higher returns but with much greater risk of going to zero. We all know the risks of altcoins. To name a few: theft/scams by founders, shorter track record and more prone to bugs, infighting by founders, CTOs leaving the project, etc. ADA and BNB performed spectacularly, but I'd still rather hold MARA and RIOT because I feel they are a safer investment in the long term.

Long term, I am bullish on crypto. I think that holding bitcoin mining companies will outperform bitcoin itself for the next 3+ years. Also, I think that the risk of holding companies involved with the Bitcoin network is far less than holding altcoins and results in a much better risk-reward ratio.

Short term, I am waiting for the crypto markets to drop a bit; BTC at $23k or $20k. If that occurs, I will likely switch to bullish and buy crypto mining companies. Until then, I will wait on the sidelines... and tactically short MARA until I am ready to buy it.

BYRG Platinum & Rhodium Mining RevivalOTC:BYRG Buyer Group International, Inc.

Rhodium Price 2013: $1,000

Rhodium Price 2021: $29,000

Revival and funding of BYRG has been taking place for the past couple months. Back in 2013 they're claims had a $1.3 BILLION valuation when Rhodium was only $1,000 per ounce. Currently today Rhodium is worth $29,000 per ounce and has become one of the most sought after precious metals. They also have Uranium and Platinum assets in the same location. There is only 1 other company successfully mining and producing Platinum in the USA and that company is Sibanye Stillwater (SBSW) out of Colorado. NYSE:SBSW is currently trading at $16.83.

Updates have been appearing on OTCM which means the CEO is getting the company on the correct direction. I have reached out to the CEO David Bryant many times and he is aware of the current changes going on in the OTC marketplace and he is working on getting BYRG pink current by the deadlines. He is doing everything by the book and taking the appropriate steps to become PINK CURRENT.

Updates:

5/13/2021 - OTCM updated the share structure with a TA verified signature

5/14/2021 - New officers updated:

David A. Bryant - CEO

Nancy Bryant - Secretary

5/16/2021 - BYRG Authorized Shares Reduction: Reduced from "unlimited" to "50 Billion"

(seeing these updates, share structure reductions, shows they are cleaning up for a great future)

6/17/2021 - Company profile changed on OTCM: "Buyer Group International Inc is a development stage company targeting acquisition opportunities in the commodities space with recurring revenue streams to maximize share holder value"

All the steps have been taken to achieve a "verified profile" and to start seeing filings for BYRG.

As you can see from the daily chart, BYRG has been trading at very low volume but still following a strong trend upward. Between volume and the accumulation you can tell this is locked and people know what they are holding. In my opinion I think this will still look cheap when it hits multi pennies. We should see further updates and filing VERY soon.

Analysis on JSE:ANGThis is an analysis on AngloGold Ashanti. From an inflation point of view I think this is a good stock to invest in as gold is also now turning the trend more upward, ANG could also have a big swing up.

Disclaimer: This is just my opinion on the stock. Tread carefully and best of luck to all the other investors out there!

$ANY super nice, massive wedgeIf you are familiar with wedges, you will see where this is going. If you are not, well, it is likely going up. Breakout coming soon. Accumulating where I can. I like to hope (hope is not a winning trading strategy) that this is going to be like the next $MARA or $RIOT. Renewable to boot. Two hot up and coming (or already here) sectors in one. Not trying to sound like an advertisement but I anticipate a 4x return on this. It has a decent shot to get near $20 as well. Will have to double check the chart after that, but anything is possible. With enough momentum and positive social sentiment, this could rally huge. Low float also. Really like this setup. Ask me if you have any questions and I can provide more detail, possibly.

Bitcoin Digest all Fud, now what next - HindiJune23 :#Bitcoin: $btc beautiful jump from Long term Support belt. MACD also turn bullish in 4 hr time frame. One Day RSI also showing bullish divergence. Quick bounce is showing that bulls actively accumulate picked support.. Upper side many small resistance with major resistance at 50 day and 200 day moving average.

China Mining status: Next 15 days will be crucial, Nearly 70% mining firm will be offline by end of this month. Chinese minors already start shifting to other part of world. Some Minors are using 2nd hand machine too for quick start. BTC and eth both hashrate are decline with china mining crackdown. Its still hard to find actual position. But if btc handle 30k support for next 15-20 days, than it will be very bullish once again.