Miningstocks

Largo ResourcesLGORF

Vanadium Flake and high grade source to V2O5 for making high strength steel. 0.5% V2O5 will double the strength of steel. Above this it can improve corrosion protection and harden metals like in aircraft engines. It is also offering a new battery technology that is more reliable than Lithium-Cobalt-Manganese batteries. The stock has already jumped 148.5% since July and climbing back to Oct. 30 high of 3.48 from current 3.33.

Who will make Vanadium reflux batteries is my next question, anyone?

Watching from 786fibretracement and nearing Oct. 30 high.

REMX - CCI at point where upward movement occurs historicallyVan Eck Precious Metals is showing a CCI entry point for potential short-term to medium hold. I remain neutral and await more volume or price confirmation.

VanEck Vectors Rare Earth/Strategic Metals ETF (NYSEMKT:REMX), a tiny ETF with only $57 million in net assets, which emulates the holdings and performance of the MVIS Global Rare Earth/Strategic Metals Index.

Vanadium One Energy Corp. VONE

Vanadium One Energy Corp, formerly Vendome Resources Corp, is a Canada-based mineral exploration company. The Company focuses to acquire near-term production exploration mining projects and existing producers. It operates through the business segment of exploration for mineral resource properties. Primary targets are Vanadium and Magnesium. Titanium and Gold are other opportunites on their lands found. 2 lb. V2O5 to every ton of steel = 2x its strength, aka high strength steel. So the opportunity is still yet to be mined, but in a mining community as land mine leases. 29M shares and 2.9M Mkt Cap.

Note: The Company has not generated any revenues. Check out their website vanadiumone.com/presentation to know facts as anyone viewing and buyer beware.

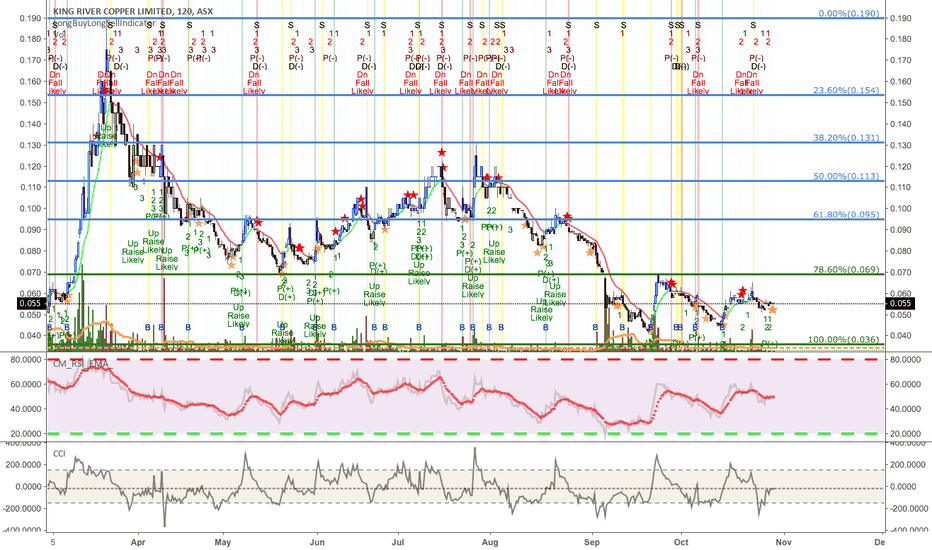

King River Copper - ready to go up as Cu/V2O5 ready to go upKing River Copper: KRC HG1!

Copper is showing key crossing of 20/50/100 day MAv and this Australian miner also produces Vanadium Pentoxide used for High Strength Steel, Aerospace engines, and rebar for concrete reinforcement. Currently below 786 Fibonacci Retracement and low bid entry 0.05 area.

YRI - Yamana Gold Rally Coming?Given the relationship to the one-day crash we will have, I think that the mining sector will spark up a nice new bull run into 2019.

CCJ - Cameco Corp. Mining - domestically sourced energy sourceNYSE:CCJ

Recent changes to using domestic sources of Ur (Uranium symbol) for nuclear power.

Cameco Corp. is also at an extreme low due to the 2011 psunami that hit Japan that

had back-up power failure causing a melt down and Japan shuttering 32 Nuclear

Power Plants until they had full double fault protection to prevent such from ever

occuring again. They are now getting ready to start back up, which will drive up the

prices of Ur futures (UX) and thus profits for domestic suppliers, as no new power

plants are being built these days. CCJ pricing in near break-out of 9.75-9.81 resistance

level.

View the 1w, 1d, 1h, 1m chart and look for pricing to go past 9.80-9.81 range for entry

upward and simply know prices are going up. Lower Fib retracement is 9.50 which it

quickly bounced off today. Below this 9.13 is the low and not likely with current

dynamics.

Cobalt prospecting for EV play breaking out on wedgeCBBWF

Cobalt and Silver prospector and formerly Global Copper Group...Cobalt sexier asset.

NAFTA sourcing for Co/Ag play. Has assets with cobalt for EV, electroplating, electronics, metal alloys.

Trend in electric batteries to solid state batteries, which Cobalt will remain sexy for next decade despite Elon Musk hope in Lithium and threat to keep prices down. Not sure his comments are working for him.

Lithium EV Battery Growth - Chilean to US$ plusSQM NYSE:SQM is a chilean Lithium mining stock for

EV Batteries and takes advantage of US$ to Chilean value as well. EV Truck manuf.

just starting and will require more and more lithium.

Another big news story that hit the market in the second quarter was worries that Tesla

might not be able to deliver its Model 3 on time due to a battery shortfall. This is

another sign of supply and demand will drive up prices and profits.

Here is 4hr. chart showing solid entry, which already in below $44 and buying up to $50.

RIO Mining set to jump 15%Rio Tinto ( RIO ) is showing entry signal in buying, MACD, and CCI.

Supplier of iron oxide, bauxite for AL, titanium dioxide for paints, coatings, copper, diamonds, and uranium as large-cap mining stock.

Metal prices have been bottomed and starting to climb, along with domestic sourcing needs for steel and uranium will send this one

to $60. Currently $51.48 and target is $60 by Pedro (Martinez) Lynch.

COMEX:HG1! COMEX:ZA1!

Cobalt mining stock set for entry off weak volumeTSX: LUN LUN

NYSE:LUNMF LUNMF

Lundin Mining is a mid-cap mining company that will benefit from rising cobalt prices and demand.

Waiting for bounce off likely 4.55 for entry, or 4.35-4.40 range, and not likely lower $4.06-4.10

Fib retracement. RSI going above 50 with 1w chart shows good entry with lots of scribble correlation.

Sorry for the business, I mean busyness here.

Cobalt value is strong and demand for electric batteries also very strong. Recovery as major player

in this area is prominent.

For own use. Put to use idea, comment or like, but review on Friday Sept. 14th.

longbuylongsell chart with blue-black courtesy of @MarxBabu.

A Larger Correction Might Be Underway for VALEThe Cycle Wave 5 top (and Supercycle Wave 1 top) was most probably on the week of the 14th of May 2018 (please reffer to related idea).

NYSE:VALE now seems to be on an Intermediate Wave C which is part of the Cycle Wave A down.

If this count is correct we should still expect Intermediate waves B and C.

Only after Cycle Wave C, the last part of Supercycle Wave 2, should we see the hallowed Supercycle Wave 3. \o/

Best idea for now is to step aside from the stock and wait for signs Supercycle Wave 3 is around the corner...

Long TAC Picked up a position today at 0.075. Their last NR did it for me. Could have a potential multi bagger here with such a low market cap and tight float. No debt on the company, solid balance sheet.

Potential of Breaking Resistance, should reach at least 3.30Kept it simple with this analysis.

Last few candles for AZ were bullish, and we saw it pop up on Friday.

I am confident it will at least get to 3.30, its resistance level. RSI indicates bulls gaining momentum.

However, I also feel like it might break past its resistance level this time as it has reversed at its lower bollinger band with a strong bullish signal twice now.

$LFR Potential Symmetrical Triangle Continuation LFR have ongoing Zinc developments and recently announced a high grade cobalt and copper project. Awaiting top side break before considering entry

OSCI ready to mine gold?It has been a long road and you can see part of that under the $PYHH idea I previously published. $OSCI has filed a large number of financials in the past 2 days and I'm expecting them to go current on OTCMarkets.com followed by some news and hopefully production ramping up. We've seen a lot of activity over the past few months on the property, mostly posted to www.facebook.com