TLRY 50? ESCAPING THE INELASTIC CHOKE FUTURE OF CANNABISGood evening Trading viewers,

I present to you my second analysis on weed stocks. Is it a voodoo or a complex set of modelers in background or a mystic play of my mind.

The infinity governance of time and space has played in part lower single digits.

The axiom quantification of price says tlry $50, is it possible?!!!

Stop loss 1$. We will see, maybe i am right or maybe i am wrong.

Three years from now we will see and ponder about magnification of the ideas.

Let the game begin

Mj

Trading Edge 2020 Portoflio -Trade #1 - MJ - Under loved Pot ETFTrading Edge 2020 Portfolio trade #1

Ticker: MJ

Position:

- Looking at long dated call options (Jan 15th 2021)

- $15 strike (ITM, gives some degree of protection against theta decay)

- Cost (approximately $460/ contract, at current mid bid and ask, willing to go as high as $5.00)

- 0.72 Delta (ITM)

- Running 2x contracts (allows us to sell one on the way up, also makes a more meaningful position size)

Profit Target/ Exit:

- looking for mean reversion to allow us to sell half to have a riskless trade, this would require a move to around the $22.50 - $23.00 range

- Given the fact the position is a long-dated option, we will not run a technical stop, instead we will let the position run and check to see if it performers or not (i.e. no point running a 50% stop and getting stopped out, 1 month into a 12 month contract).

Rationale:

- Speculative counter trend play on MJ, given the overwhelming negative sentiment

- Simple position to manage, the long-dated nature means that we have 12 months for this ETF to regain it's legs, also means that if we get a market correction, we have the time to ride it out

- Despite the price action, MJ has been a high beta performer, if we are going through a 'melt up' phase, then MJ is likely to be swept up in the euphoria

- Both MACD and RSI signaling a possible bullish reversal (or even just a potential bear rally)

- Moving averages signaling a possible bounce is due, not necessarily a total trend reversal

- TradingEdge

Portfolio spreadsheet available to view here >>> docs.google.com

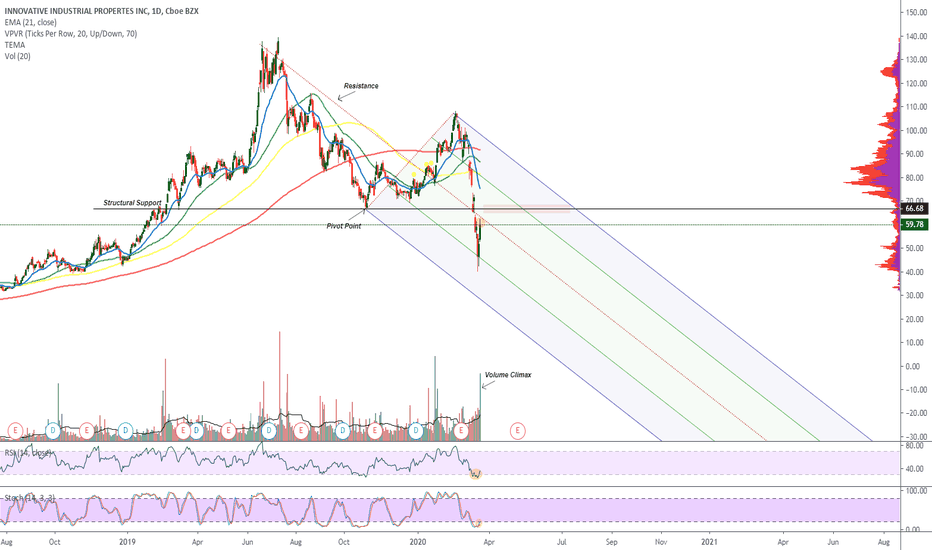

IIPR Pivot Points |Oversold Bounce| Structural Support Evening Traders,

Today’s analysis will be on IIPR, breaching structural support and currently is testing pitchforks median line (resistance)

Points to consider,

- Bearish trend, consecutive lower highs

- Median line tested

- Structural support breached

- RSI recovering from oversold

- Stochastics in lower regions

- Volume climax evident

IIPR’s overall trend is bearish, putting in consecutive lower highs on the macro timeframe. Current resistance is being tested (Median line), it is important to break this level in order to test previous support.

The Structural support breached is a major level to close above; a retest and failure will confirm a bearish retest.

RSI is recovering from oversold conditions, this has lead price to an oversold bounce. Stochastics on the other hand is trading in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside.

Volume climax is evident, which puts emphasis on a temporary bottom, this will get taken out if a bearish retest is confirmed.

Overall, in my opinion, IIPR must break and close above structural resistance, failure will be very bearish.

What are your thoughts?

Please leave a like and comment,

And remember,

“You have power over how you'll respond to uncertainty.”

― Yvan Byeajee

CGC Bear Trend|Critical Weekly Support|MJ Sector Evening traders,

Today’s TA will focus on CGC which is in a brutal downtrend and is currently testing a critical support that if broken will send it to next local support situated at the $5 level.

Points to consider,

- Strong bear trend

- Critical support being tested

- Break of .236 Fibonacci (bullish case)

- RSI broke key trend line

- Stochastics projected downwards

- Noticeable bear volume nodes

CGC is in a strong bear trend with consecutive lower highs, this is evident across all stocks in the MJ industry. The critical support is currently being tested, due to the nature of the trend; it does have the probability of breaking.

For a bullish case, CGC needs to break above the .236 Fibonacci level, this will put in a higher high and negate the overall bearish structure.

The RSI broke its key trend line, this was coincided with the bear flag – the 200 MA also broke at this level.

Stochastics is projected downwards, still has stored momentum to the downside and has not yet flattened out.

CGC has noticeable bear volume on weekly nodes, a volume climax will send it breaking though support and put in a temporary bottom.

Overall, in my opinion, CGC must hold this critical support; a break will send it to penny stocks territory where it can stay down there for a while.

This is very similar to all stocks across the MJ sector.

What are your thoughts?

Please leave a like and comment,

And remember,

“Hope is bogus emotion that only costs you money.” – Jim Cramer

Liberty Health , my ideal small play and hope i am hoping small profitable players in the Mari-Jane field become profitable enough to survive

and the space become just another commodity that the big companies do not buy it out and price gauge us

its high 29.85

reverse stock splits

1 for 4 , AUG 31 2015

1 for 5 , JUN o3 2016

1 for 3 , JUL 26

so 60 shares became 1

29,85 / 60 = = 0.4975

the high price divided by splits = cost of share

price now 0.50 [ 50 cents

i will wait till it goes above the channel

which looks fairly priced

and then when it goes above this channel

i will watch for a bad reversal and exit !

if not , let the HI times begin

ACB goldgreenboiWork out where you want to buy and sell based on the info provided on the chart, make your own financial decisions . This is the treasure map . No X marks the spot however.

Hint:

Horizontal Lines are strong levels and solid targets.

Trend Lines are not as reliable or as solid as Horizontal Lines.

ACB Financials are growing exponentially, their sales and timing are impeccable with the markets.

Canada legalised Cannabis on 17th October 2018.

B uy the R umour, S ell the N ews.

1 May 2019 - Canada would introduce excise tax on all products containing THC, and introduce three new product classes for recreational sale: cannabis edibles, cannabis extracts, and cannabis topicals.

NYSE:ACB

TSX:ACB

FWB:21P

CRON Buy and HopeI rarely do Buy and Hope, but today, I am hoping for a bounce from yesterday's low, signalling that a weekly higher low is in. This seems to be a decent supply zone, but broader industry sentiments are still tough.

Averages signalling underlying weakness, but when sentiments change, this stock should be testing $8 again in the coming days or weeks. Still, trying to catch a bottom is generally a bad idea.

Trade with caution!

HEXO Bullish Divergence| Seller Exhaustion| Local Resistance Hello Traders!

Today’s chart update will be on HEXO CORP where we have a probable bullish divergence forming on the daily. Local resistance is a key level to break to show first signs of a possible trend change.

Points to consider,

- Clear bear trend intact

- Bullish divergence forming

- Local resistance to break

- Stochastics in upper regions

- RSI respecting trend

- Volume below average

HEXO’s current trend is bearish with consecutive lower highs in place, this current bullish divergence signals potential seller exhaustion on the daily.

Local resistance needs to break; this will further bring the bullish divergence to fruition as the trend attempts to put in a higher low. The stochastics is trading in the lower regions, can stay here for an extended period of time, however lots of stored momentum to the upside.

RSI is currently diverging from price by putting in higher lows whilst HEXO puts in consecutive lower lows, confirming a valid bullish divergence .

The current volume is well below average, it must increase when local resistance is broken to avoid the chances of a false break.

Overall, in my opinion, HEXO’s bullish divergence is the first sign of a potential trend reversal from such lows. Local resistance is the first key technical level to breach then structural resistance in order to change the current market structure.

What are your thoughts?

Please leave a like and comment,

And remember,

“Environmental distractions and boredom cause a lack of focus – All of us have limits to our attention span and these are easily taxed during quiet times in the market.” Brett Steenbarger

HUGE BEAR VOLUME! WATCH FOR MARKET CORRELATIONTICKER: $CRON

CRON is basically the same as CGC. Huge bear volume on Friday with a 10%+ pull back. Bull flag has been negated and we are looking for a daily higher low compared to 6.38.

Watch for $SPY correlation as it will have a factor in the timing of the bounce. Also watch correlation with CGC and other canadian MJ names. Remember, RSI levels could get to extremes if market pulls back hard.

$CGC potential buy opportunity coming upTicker: $CGC

CGC had a huge bear day, closing near the LOD on Friday. It was very correlated to $SPY on Friday and I won't be surprised that it will continue to be that way if the market dumps. Hourly time frame is in the oversold area, but I will be patient to enter if the market is dumping. I will look for a potential entry this coming Monday if we dump hard.

Anything over 19.02 is a daily HL and in the long term, the bulls still have complete control. Watch the volume this upcoming week as it will be a key indicator. Daily bull flag is negated due to Friday's bear action, but I will look for a equilibrium pattern with a HL above 19.02.

LABS Regression Trend| Higher Low| Key ResistanceHello Traders!

Today’s chart update will be on LABS – Canadian MJ – which has been trading in a clear regression trend, close to testing upper resistance, is a break imminent?

Points to consider,

- Clear bear trend

- Support provided by 50 MA

- Regression trend resistance to break

- Stochastics in lower regions

- RSI respecting trend

- Volume below average

LABS bear trend has been putting in consecutive lower highs, with a first higher low coming to fruition, a trend change may be probable.

Support is currently being provided by the 50 MA, all averages will eventually need to hold LABS when testing key resistance. The Regression trend resistance is a staunched area that LABS must close above to register for a probable trend change.

Stochastics are in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside. The RSI is respecting its trend line, currently neutral, not at extreme ends. LABS volume needs to stay above average for continued follow though when breaking levels.

Overall, in my opinion, a break and close above key structural resistance will confirm a trend change. LABS, does need to increase volume otherwise a rejection at currently trading level will become more probable.

What are your thoughts?

Please leave a like and comment,

And remember,

“Trading effectively is about assessing probabilities, not certainties.”

― Yvan Byeajee

CRON Key Level Broken| Increase In volume| EMA Cross Quick update on CRON, which has broken a key resistance level, now potential support upon retest

Points to consider,

- Trend change with Higher High

- Structural resistance broken

- RSI diverging

- Stochastics in upper regions

- EMA’s support

- Volume increasing

Higher high has come to fruition; this is the first time in CRON’s bear trend, signalling a potential reversal.

Structural resistance broken, now support upon a confirmed S/R flip retest. Stochastics in upper regions can stay here for an extended period of time, however lots of stored momentum to the downside.

RSI diverging, confirming a bullish divergence as CRON puts in lower lows. EMA’s cross bullish, first time this has happened in the downtrend for CRON.

Volume is visibly increasing confirming a technical level is being tested, this needs to sustain for a bullish continuation.

Overall, in my opinion, CRON has healthy volume coming at key resistance now potential support. A continuation is probable, confirming the macro trend change.

What are your thoughts?

Please leave a like and comment,

And remember

“There is a huge amount of freedom that is derived from not fighting the market.”

― Yvan Byeajee,

MJ volume not high enough...Cannabis stocks have been gaining from the start of this week.

Technical analysis

RSI has been trending upward, but OBV has not, creating a bearish divergence. /Bearish

We saw the same three candlesticks ending on November 21st, 2019, leading to a strong pullback. (Red circle drawn in chart). /Bearish

Fundamental analysis

Since May 2019, cannabis stocks have been shorted creating a downturn for the whole sector.

Many of the biggest companies are undervalued. But stocks can stay undervalued longer than we can accept our losses.

-----

Keeping on a close watchlist.

Bullish Daily Chart on $MJDaily Chart is looking like a great long-term buy down here. Watching for a move over the daily 50sma and a continuation higher above $20.

It's been a rough ride down since March of 2019, We trended all the way back down to 2017 support on the North American Cannabis Sector shown here -> charts.stocktwits.com

I'm anticipating for this to hit $50 in the 5 years

GLTA and Reinvest those dividends back into MJ :)

$SBES CEO Presents more Clues to Possible $10Bil MergerThe CEO of $SBES posted more tweets and clues as to the possible merger between $SBES and RockySaaS with S placements in various tweets and places.

The official website was also down for maintenance this weekend and updates with 3 new photos of three different cities, one of which is of Montreal Canada.

The quotes also left on the Panshi Group's Twitter page seems to allude to the merger as well.

There are breadcrumbs sprinkled everywhere across the platforms, shareholders are very excited for what is coming.

ACB Bullish Divergence| Trend Still Bearish Hello Traders!

Today’s chart update will be from the Canadian MJ sector – ACB which has recently had a bull reaction from local lows.

Will ACB have enough momentum to break key levels?

Points to consider,

- Trend Bearish – consecutive lower highs

- Local resistance to break (.382 Fibonacci level)

- Stochastics in lower regions

- RSI coming close to apex

- EMA’s holding as resistance

- Volume has increased

ACB’s overall trend has been bearish with consecutive lower highs in place; a market structure with higher lows is required to shift momentum for a bullish bias.

Local resistance for ACB is key to break; this will confirm the trend change as it will put in a new higher low, the bullish divergence suggests that the temporary low has been priced in.

The stochastics is in lower regions, can stay here for an extended period of time, however lots of stored momentum to the upside. The RSI is coming close to its apex; a break is imminent in either direction.

EMA’s are holding price as resistance, ACB could potentially be putting in another lower high, continuing the bear trend. Volume has however increased; ACB must sustain volume for follow through otherwise bears have an upper hand.

Overall, in my opinion, ACB needs to break EMA’s and key local resistance to confirm a trend change. For this to come to fruition, ACB needs sustained bull volume follow through.

What are your thoughts?

Please leave a like and comment

And remember,

It does not matter how slowly you go as long as you do not stop.”Confucius

$SBES Completes First Leg Consolidation And Readies for .02+ Brk$SBES Has completed its first major leg run and consolidation and is now gearing up for the breakout past .02 The company is in plans to merge with RockySaaS under its parent company Panshi a $10 Bil revenue generating company. All signs lead to this R/M taking place and filings are said to drop before the EOY into possibly January.

CGC 15 min chart and the AlphaBotSystem IndicatorsJust discovered these guys recently. They have built an impressive suite of indicators that cater to both equities and crypto traders. There is also a series of bots for trading crypto. The visual trend change blends in nicely with my charts and gives one confidence to take the trade after the trend change is indicated and then a technical setup presents itself.