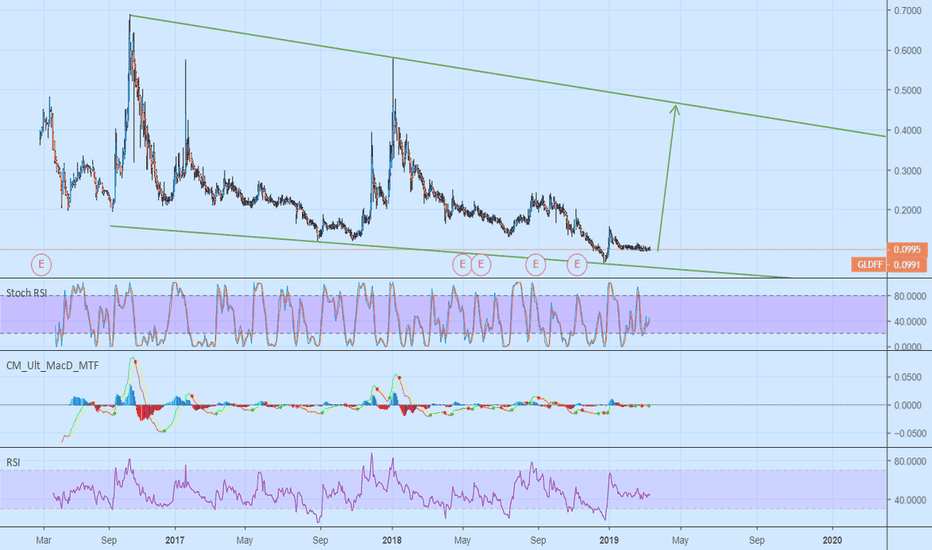

CGC continues to tighten in Equilibrium PatternCGC is currently in a very tight equilibrium pattern. Although these conditions are not ideal for active trades or anyone looking to trade short term, they are ideal for those of you whom are patient and are willing to wait for a break to enter a short/long position.

Equilibrium patterns are my favourite pattern to trade from upon breaking as there is generally very significant movement to whichever direction it breaks.

Please note, although not textbook due to amount of time, some may argue that this is a bull flag scenario.

I will keep everyone updated as to what positions I open for CGC.

Mjstocks

CGC just converging trendlines? Guess what...CGC has converging trend lines...but is an EW triangle...Possibly....is it 1 2,1 2, is it a running or symmetrical triangle!?!? STAY TUNED...the suspense is killing me.

PHOT - GrowLife breakout potential.Consolidated triangles ready for breakout. New trend reversal in place. This company sells growing products such as lights for cannabis industry. This whole sector is ready to breakout.

Information purposes only. Not advice or recommendation. This is my humble opinion. I have 20,000 shares at $0.00835.

CGC - looking for an entryCGC is looking strong in the longer term, but I'll be watching for a pulback to the trendline resistance hovering just above the 50-day EMA before making a move. We've dipped below both the 12 and 26. Stoch is picking up but RSI is neutral. Any move up would need to come with a significant increase in bullish volume to invalidate this set up. Breaking below trendline and 50 EMA resistance could spell a huge drop into the 30s before finding support again.

CRON - CRON looking pretty good here. Support at both the trendline and 12-day EMA around 19.60 ish. A little bit of resistance around 21.90, but RSI is above the 50-line. Positive Stoch cross. Keeping with this trend could have us seeing a new ATH soon. Volume will be the key thing to watch, as always.

This setup is invalidated if we break trendline support. The next support will be the 50-day EMA which is currently around 17.00. If that support holds, it would make a good entry price for a swing back into the 19-20 area.

CGC : Market Open TuesdayGoing out on a limb here, let me know what you think. I'm expecting to see a gap up in pre-market and continuation into the open. Especially since the price was pinned down at the previous close to burn the premium. Once we get past the initial 15 min algos going at it, I think retail will buy heavy sending the price upward through the remaining resistance levels and hopefully past the ATH. If we get to there we will break through the ATH as the RSI moves high into the oversold range and at this point retail will start to get skittish, volume will start to dry up, then most will sell for profit and we will retrace back down to around 51.98 towards the close. Otherwise it may go down a little.

Disclosure: Don't follow anyone into a trade, especially me as I do not normally know what the hell I'm doing.

SNN - Breakout Imminent, Bullish Pennant, Tightening Triangle After nearly a month long Consolidation following a +80% move off the bottom set christmas eve @$2.85 we have now settled at a 63% gain off the bottom. holding the 9DMA and 50DMA we could now be set for an advance to the 200DMA up near $6. Key support is 4.40, while we have not closed a trading day above $4.75 since Jan 21 which was rejected. A strong close at high of the day closing over 4.75 could be a strong signal of breakout. watching this week!

SNN - Sunniva Daily Bull Continuation after consolidation.My Take:

We formed an almost perfect "cup" (needing the handle) on the hourly topping at 4.88 on the day with the previous hourly high at 4.89 (double top) before closing lower at 4.76. This ramp could have been part due to the low float and having the equilibrium break up ward as well as the support hold at 4.18, continuation could have also been caused by a minor short squeeze after those indicators broke bullish.

Daily RSI levels have cooled of nicely for continuation daily upward but the hourly is a bit extended. Daily Moving averages all still look strong/bullish

My opinion for opening Monday, because US market is closed it typically results in less volume. I see a gap up on higher volume, close to $4.95 with a bit of selling pressure following, there was a big bid for 45K shares at $4.99 from Friday and I'll be watching that in the morning to see if it's there still. The selling will cool off the hourly RSI, support is between $4.50 and $4.65 (holding this will basically test the handle of the cup formation) with continuation afterwards. The other note was volume was still lower than average so any green days this week I'd be watching for the volume to increase.

Some nice healthy consolidation on the weekly chart, so I'm looking to see a close at or near the week near the high of the week, which would be ideal, and a break of $5.42 also. But that break of last weeks high could come the following week without any major red flags.

CSE:SNN .

ORGMFOne of the most financially sound looking holdings of the MJ etf.

Not as good as greenblatt would like, but perhaps the best the fledgling MJ industry has to offer atm.

gl hf

xoxo

snoop

SNN Daily consolidation under way. Good LONG entries are hereJan 9 SNN:

My take: So volume tapered right back today, declining bear volume. We had a big move up with almost 1 million shares in volume in 8 days and we have not had a big rush to take profits, bulls just needed a breather

Todays range was between $5.00 as the high and $4.75 as the low, with low coming at end of day thought there is a discrepancy in close price between exchanges, some posted 4.78 close

Our hourly pivot lows are technically $4.62, $4.65, $4.71 and $4.75 but we would need to not break $4.75 tomorrow to confirm hourly higher lows.

We are close to having a golden cross on the 9DMA and 50DMA which is a bullish indicator, and the RSI levels are cooling off enough that we could resume higher.

The 14 Period RSI: Hourly: 52

4-hour: 67

Daily: 65

Weekly: 45

On the daily chart a break of $5.00 with close near the high, will set us up good for Friday. however this doesn’t not necessarily need to happen for continuation as long as we hold today’s low of $4.75 and preferably above $4.78. On the hourly chart we are looking for first a break of $4.90 and then a break of $5.00 for a bullish signal. A close above $5.42 on Friday gives us a great weekly chart, with a strong set up for next week.

It’s hard to say given this set up how bulls will react to probably MJ majors and indices consolidating, but haven't been entirely correlated to them in recent times. Also fundmentaly we are still well undervalued to our Peers based on forecasted 2019 Revenue

Significant delays for New Age Beverages Corp.Technical Analysis:

- Support: 4.92; 5.47

- Resistance: 5.71; 5.96; 6.30

I would recommend a SL: 5.96 and a TP: 3.52

- MACD: Short

- RSI: Short

- Momentum: Short

- OBV: Short

Fundamental Analysis:

Head Line: "CBD-Infused Beverages, Delayed Indefinitely"

"It is unlawful under the FD&C Act to introduce food containing added CBD or THC into interstate commerce , or to market CBD or THC products as, or in, dietary supplements, regardless of whether the substances are hemp-derived. This is a requirement that we apply across the board to food products that contain substances that are active ingredients in any drug.”

FDA didn't changed its opinion after the Farm Bill at 20th December -> CBD infused products are still illegal

Consequences: "The company will face significant delays and reduce guidance in 2019"

SNN - Sunniva looking to change trend upon daily consolidationMy Take: Ideally I think we would see a push up to 4.80 and possibly love 5's on Monday and then consolidate over 2-3 days in mid to low 4's ($4.20 and 50 dma at ~$4.10) before pushing back above 5. The $5 price range is going to take support and conviction, along with a bunch of new buyers as we had the bought deal at $5.27. With psychological resistance at 5, bought deal price and then our recent top out as well at ~$5.55 thats a heavy zone. After getting through that zone we that could see a big break to the 200dma and into the 7's.

The daily chart is only at an RSI of 67, which is not over bought by any means and increasing bull volume is a good sign. scanners will have picked up the 17% gain and chart trend, which can be good for another push but will attract increase short pressure to consolidate.

The uptrend (up-sloping blue line) has lots of room to work with so a 2-3 day correction is not anything to worry, but $4.00 is key to stay above in my opinion (right in that intersection of the uptrend and downtrend) otherwise it would only be considered a lower high on the long term downtrend (down-sloping blue line) which we closed above for the first time and above the 50dma for first time since late August early September.

Sunniva is under valued Fundamentally based on near term revenue analysis, the stock was pumped early on with the MJ bull run back in january, but faded the entire year because of missed construction/ operation targets, things are looking good for 2019 and beyond and this stock is worth looking at upon confirmation of trend change. Do some digging and due diligence!

APHA looking for a daily higher low above 4.76Aphria is likely to form a tightening equilibrium, the break of which will likely be determined by how SPY breaks

CGC potential daily lower high on watchWatching CGC first thing Monday to see if the high of Friday or the low of Friday breaks to signal sort term direction