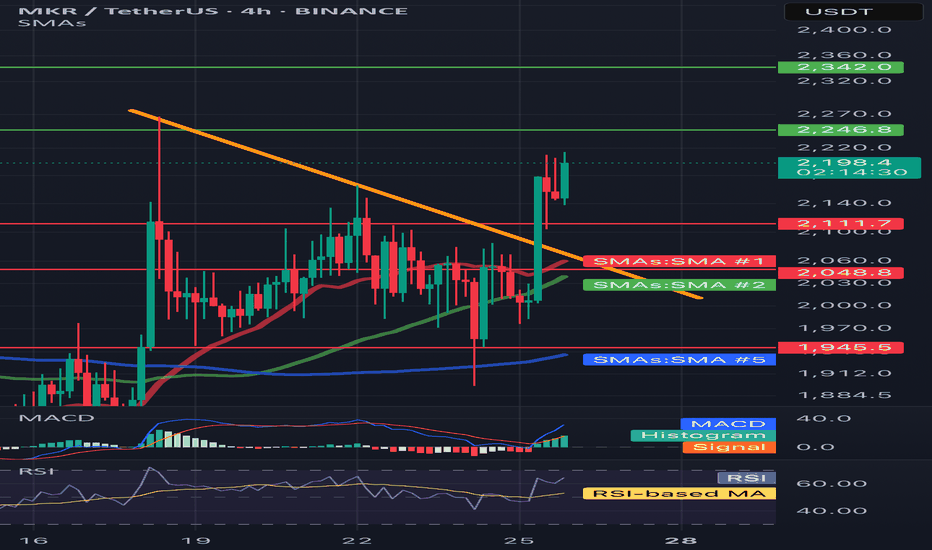

MKR/USDT 4H📈 Trend and price structure

• The price has just been above the downward trend line (yellow line), which suggests the potential reversal of the trend to the upward.

• Breaking was strong - a candle with a large growth volume and an increase +9.13%, which emphasizes the pressure of buyers.

⸻

🔍 levels of support and resistance

• resistance:

• ~ 2342 USDT - a clear level of resistance (green line) - may be the target for the next upward movement.

• 2246.8 USDT - first resistance to overcome.

• Support:

• 2111.7 USDT - level of local support after struggling (earlier resistance).

• 2048.8 USDT - SMA #1 (red medium), can be support at the back.

• 1945.5 USDT - strong support in the form of long -term SMA (blue line, SMA #5).

⸻

📊 Technical indicators

✅ MacD (below)

• The MacD line cut the signal line up - buy signal.

• The histogram is growing, which confirms the growth moment.

✅ RSI

• RSI has bounced from level 40 and is currently above 60 - it suggests upward momentum, but it is not yet purchased, so there may be room for further growth.

⸻

✅ Medium walking (SMAS)

• The price was pierced by SMA #1 (red) and SMA #2 (green) with impetus, which means a change in sentiment.

• If it stays above these medium - a bull signal.

• SMA 50 (green)> SMA 200 (blue) = potentially a golden cross is formed on a longer TF.

⸻

📌 Summary - technical scenario:

🐂 Bycza scenario:

• If the price lasts above 2111.7 USDT, it may continue to increase to USDTt and further up to $ 2,342.

• Confirmation will be the continuation of growth on MacD and RSI over 60-70.

🐻 Bear scenario (threats):

• If the price drops below 2048 USDT, possible correction up to 1945 USDT.

• RSI returning below 50 and Macd Cross down would be a reversal signal.

MKR

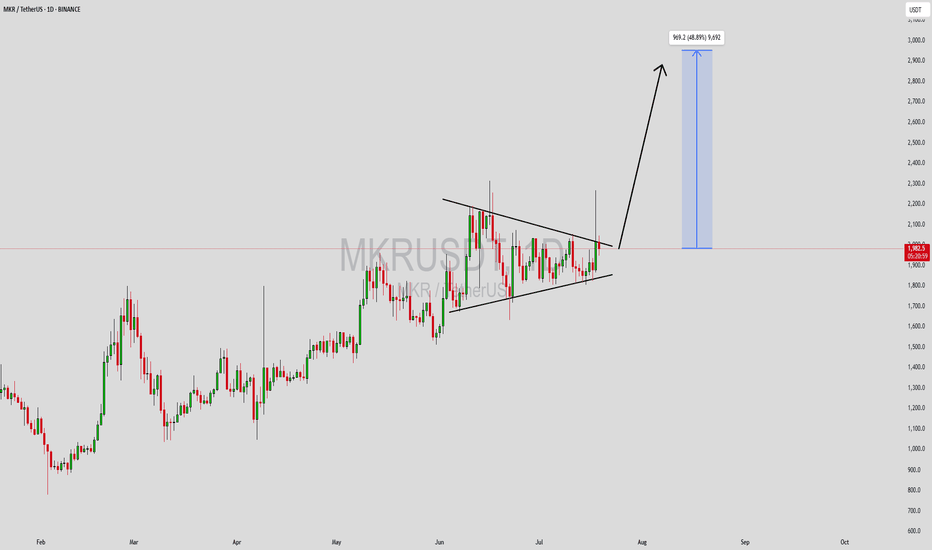

MKRUSDT Forming Symmetrical TriangleMKRUSDT has formed a textbook symmetrical triangle pattern on the daily chart, a classic consolidation structure that often precedes a strong breakout. The price is currently pressing against the upper resistance line, and a breakout above this range could trigger a bullish continuation toward the $2,900 level, suggesting a potential gain of 30% to 40%+. The rising volume on the recent candles confirms that traders are positioning themselves ahead of a possible move, making this setup highly watchable for swing traders.

Maker (MKR), being a major governance token in the DeFi ecosystem, continues to attract interest due to its role in the MakerDAO protocol and its connection to the DAI stablecoin. As DeFi fundamentals remain strong and institutional capital slowly returns to decentralized finance platforms, MKR is likely to benefit from renewed attention. This breakout could be a reflection of that growing confidence.

The bullish sentiment is further supported by strong fundamentals and technical indicators aligning in favor of upside momentum. With crypto market sentiment gradually improving and altcoins showing signs of strength, MKR could outperform many peers in the coming weeks. Watch for confirmation above the triangle resistance and monitor volume spikes to validate a strong entry.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

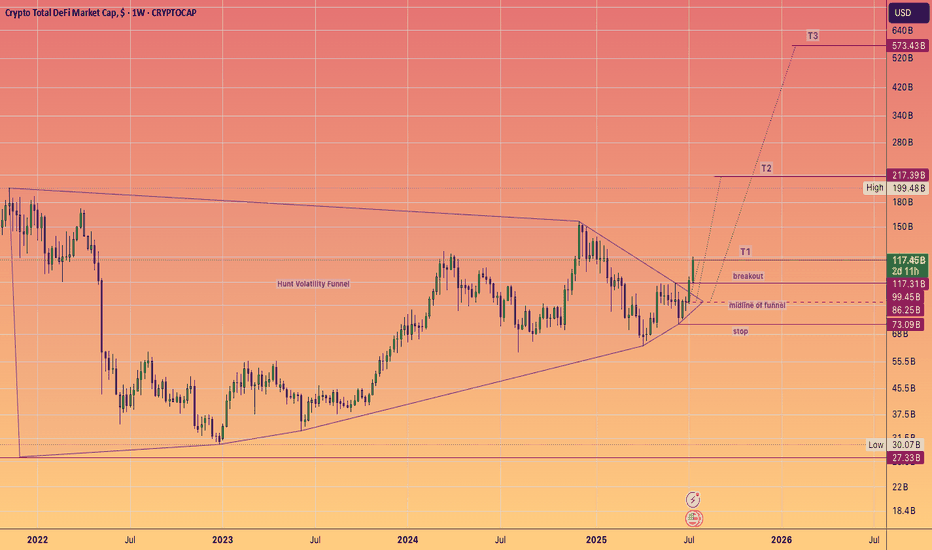

DeFi Moonshot! Moon mission to $573 Billion dollars!DEFI fuelled by Ethereum, built on proven protocols and stablecoin legislation is ready to keep cranking higher for the rest of the year. And instead of a Defi summer of emergence (2020), a multi season of adoption that takes it to half a trillion dollars, hitting these targets of a #HVF

@TheCryptoSniper

The components set to benefit are:

Uniswap #UNI ~ $12.3 Billion

Lido DAO #LDO ~ $9.1 Billion

Aave #AAVE ~ $7.5 Billion

MakerDAO #MKR ~ $4.6 Billion

GMX #GMX ~ $2.5 Billion

Curve #CRV ~ $1.9 Billion

Synthetix #SNX ~ $1.1 Billion

Pulsex #PLSX ~ $0.46 Billion

Key points:

The #TotalDefi index is currently at $117B aligning closely with the $123.6B of TVL

As we see hundreds of billions of dollars get digitized watch this index climb onwards and upwards... With $1 Trillion dollars and obvious milestone that is surely set to be met ... one day.

ATH Mode On => Request Your Altcoin Analysis NowThe bulls are back in action, and momentum is building fast! ⚡

To celebrate this major milestone, I’m opening the floor to YOU 👇

Request any altcoin in the comments, and I’ll personally share my technical analysis on it! 📊✅

Let’s make the most of this market together — it’s altcoin season waiting to happen! 🚀

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

MKR/USDT 4H Chart🔍 1. Technical Pattern:

The chart shows a descending wedge (orange lines) that has broken out upward.

The breakout occurred on increasing volume (a signal of bullish strength).

The price is currently trading above a resistance line, which is now acting as support (~1980 USDT).

📊 2. Support and Resistance Levels:

Support (red lines):

1903 USDT – local consolidation support.

1801 USDT – strong support at the previous bottom.

1727 and 1632 USDT – fallback zones in case of strong declines.

Resistance (green and blue lines):

2120 USDT – first target after the breakout.

2168 USDT – another strong resistance from the previous consolidation.

2312 USDT – high resistance, potential target if the uptrend continues.

📈 3. Indicators:

🔹 Stochastic RSI:

Close to the overbought zone, but not yet giving a sell signal.

A short consolidation or correction may occur in the coming hours.

🔹 MACD:

The MACD line is above the signal and the histogram is still rising – a buy signal.

No signs of weakening momentum.

🔹 RSI:

The RSI is rising, but not yet in the overbought zone (>70).

Shows the strength of the trend, but there is room for further upward movement.

🧠 Summary and scenarios:

✅ Bullish scenario:

If the price remains above 1980 USDT, the next targets are:

2120 USDT

2168 USDT

Potentially 2312 USDT with continued demand

⚠️ Bearish scenario (less likely at this time):

If the price returns below 1980 USDT and does not regain this level:

Possible return to 1903 or lower (1801 USDT).

MKR/USDT (MakerDAO) on the 4H time frame🔷 1. Trend and market structure

🔸 Upward channel:

The price is moving in a wide, ascending channel (orange lines).

The lower line of the channel was last tested on June 22, 2025, which ended with a dynamic upward bounce.

The upper limit of the channel reaches around 2,450 USDT.

🕸️ Market phase:

In the short term, the market was in a downward correction phase within the uptrend.

Currently, we see a strong rebound from support - a new uptrend is possible.

🔷 2. Key horizontal levels (support/resistance)

🟥 Support:

1,637 USDT - local support (the lowest level of the red zone), almost tested at the bottom.

1,717 USDT - very technical support, tested several times.

1,800 USDT – psychological level and local consolidation.

1,901 USDT – last support peak, currently broken upwards.

🟩 Resistances:

2,003 USDT – current price level, currently tested as new resistance.

2,129 USDT – strong resistance from previous peaks.

2,264 USDT – previous swing high.

2,433 USDT – upper boundary of the channel and technical level from historical peaks.

🔷 3. Price and candle behavior

Strong demand reaction at the lower boundary of the channel: long pin bar/bull's embrace at the lower boundary.

The upward movement was dynamic and uniform, which indicates high buyer activity.

If the price stays above 1,901 USDT – further increases are possible.

🔷 4. Technical indicators

🔁 Stochastic RSI (4H):

Currently in the overbought zone, just below the level of 100 - a temporary correction or consolidation may occur.

However, with a strong upward trend, Stoch RSI may "stick" to the upper band - it does not yet give a clear S/S signal.

🔷 5. Technical scenarios

🟢 Bullish scenario (continuation of growth):

Condition: maintaining the level above 1,901 USDT.

Targets:

TP1: 2,129 USDT

TP2: 2,264 USDT

TP3: 2,433 USDT (upper limit of the channel)

Stop-loss: below 1,800 USDT

🔴 Bearish scenario (rejection of resistance):

Condition: strong rejection of 2,003 USDT and return below 1,901

Targets:

TP1: 1,800 USDT

TP2: 1,717 USDT

TP3: 1,637 USDT

SL: return above 2,003 USDT

🔷 6. Final remarks

The current upward movement looks like a "V-shape reversal" reaction - a sharp turnaround with dynamic volume suggests strong buyer interest.

The key will be the reaction to 2,003 USDT - a breakout and retest can give a very good long entry.

Short positions are risky as long as the price is in the lower half of the ascending channel.

#MKR/USDT#MKR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 2008.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 2333

First target: 2201

Second target: 2097

Third target: 2333

#MKR/USDT Ready to launch upwards#MKR

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 1200

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1243

First target 1270

Second target 1311

Third target 1356

MKR 1W🔍1. Overall Trend:

In the long term, we can see that MKR was in a downtrend, as evidenced by the falling trendline (orange dashed line).

The last candles show that the price has broken this downtrend line - this could indicate a potential trend reversal or at least an attempted upside correction.

📊Support and resistance levels (horizontal chart):

Strong support (red) and resistance (green) levels are marked:

✅ Resistances:

~3,770 USDT – local top, very strong resistance.

~3,079 USDT – previous support, now acting as resistance.

~2,002 USDT – current growth barrier, price is currently struggling with this level.

🔻 Supports:

~1,574 USDT – current local support.

~1,248 USDT – next support, previously tested.

~800 USDT and ~400 USDT – historical accumulation zones, deep support levels.

Oscillators (bottom of the chart):

Stochastic RSI – currently in the upper zone, which may suggest that the market is approaching overbought. Possible correction.

RSI (classic) – oscillates around 50, i.e. neutral, but with a slight upward slope. There is no overbought signal yet.

🧠 Conclusions:

➕ Bullish signals (pro-growth):

Break of the downtrend line (may be the first signal of a trend change).

Formation of a higher low.

Oscillators are not yet in the extreme zone.

➖ Bearish signals (pro-fall):

The price has not yet managed to break the resistance at 2,002 USDT.

Stochastic RSI indicator close to the overbought zone - possible short correction.

📌 Scenarios:

1. Upside scenario:

If the price breaks through the 2,002 USDT level and stays above it, the next target will be the 3,079 USDT level.

Confirmation will be the rising RSI and staying above the trend line.

2. Downside scenario:

If the price fails to break through the 2,002 USDT level and falls below the 1,574 USDT level, a possible test of the 1,248 USDT level or even lower (800 USDT).

MKR/USDT 4h chart ReviewHello everyone, let's look at the 4H MKR chart to USDT, in this situation we can see how the price moves on the created upward trend line. Going further, let's check the places of potential target for the price:

T1 = $ 1576

T2 = 1657 $

Т3 = 1714 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = $ 1529

SL2 = $ 1499

SL3 = $ 1450

SL4 = 1372 $

Looking at the RSI indicator, we see

How slight relaxations give space for further increases by living in the upward trend of price.

MKR Looks Bearish (1D)The correction of MKR seems to have started from the point marked START on the chart.

This correction appears to be a diametric pattern, and we are now in the late stages of wave F, which has been a bullish wave.

It is expected that from the red zone, wave G a bearish wave will begin.

The closure of a daily candle above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Potentially a good time for LONG MKR/USDHello everyone, let's look at the 1W MKR to USD chart, in this situation we can see how the price created a lower low with the last drop, what is important is that now it goes up creating a new higher local high. What's more, we can see how the ema cross 50 and 200 approached each other, but the price exiting upwards should maintain a long-term upward trend. We can also see how the whole thing is moving in a descending triangle, but an exit from the yellow downward trend line upwards can give a new strong upward movement.

Let's start by defining the goals for the near future that it has to deal with, and here you can see how the price bounced off the first target:

T1 = 1631 USD

T2 = 2159 USD

Т3 = 3015 USD

Т4 = 3607 USD

As for support or potential stop-loss when opening a long, we need to consider a strong support zone from $1028 to $542, with the level around $790 being key, as it is our last lower low in declines.

The RSI and STOCH indicators show an attempt to break out of the local downtrend lines upwards, which may also have a positive impact on the next price movement.

#MKR Bears in Control: Is a Breakdown Inevitable or Not?Yello, Paradisers! Is #MKR setting up for another leg down, or will the Bulls finally step in? The structure is clear; this could get ugly unless something changes soon. Let’s break down the #Maker setup:

💎#MKRUSDT is forming a Descending Leading Diagonal, a classic bearish pattern within a larger zigzag correction. This structure suggests that sellers remain in control, with each bounce being met by renewed selling pressure.

💎Price is currently reacting off the descending support near $1,160. While a short-term bounce toward $1,250 - $1,300 is possible, it remains within the bearish framework. The critical resistance to watch is at $1,333—a breakout above this level would invalidate the bearish setup and signal a shift in momentum.

💎If the bearish structure holds, the next leg down could take us to the strong support zone at $1,000 - $950. This is where buyers will have their last real chance to defend the trend. A failure to hold this level could open the door to a deeper correction.

💎RSI remains weak, showing no strong bullish divergence, signaling that momentum is still in favor of the sellers. The volume is declining, meaning the recent price action lacks strong buying conviction.

Strive for consistency, not quick profits. The market rewards discipline and patience—trade smart, Paradisers!

MyCryptoParadise

iFeel the success 🌴

MKR, Ready for a short opportunity !!!Hello Traders, Hope you are doing great.

After a good upward movement that happened in last weeks, now it seems that bulls are going to lose their control and we'll probably see a downward correction after the price reaches to the specified supply zone, we also have regular divergences on 4H and Daily timeframes.

So for upcoming days I expect a slowly upward movement at first and after that Bears step in and cause a downward correction happen. Targets have determined by Blue dashed lines.

And finally Tell me What are your thoughts about MKR ? UP or DOWN ? comment your opinion below this post.

UniversOfSignals | MKRUSDT 70% Move?Let's analyze and review one of the best coins in the DAo area together and find another entry point together and update our previous triggers

🌐 Overview Bitcoin

Before starting today's altcoin analysis, let's look at Bitcoin on the 1-hour timeframe. Since yesterday, Bitcoin experienced a correction, which was necessary for the market, and it pulled back to the 102135 range. The next trigger for a long position will be a breakout above 104714.

Yesterday's correction, coupled with an increase in Bitcoin dominance, caused noticeable declines in some altcoins. This highlights the importance of monitoring BTC pairs in your checklist these days.

MakerDAO’s sharp increase in fees and growth in Total Value Locked (TVL) has fueled demand. On February 20, $156.77 million of MKR was burned, reducing supply. Growth in active addresses and trading volume has driven the price higher. Strong resistance at $1,800 may limit further growth. MakerDAO’s emergency offering has raised concerns about $3.1 billion USDC exposure.

📊 Weekly Timeframe

In the weekly timeframe, the token has seen a 95% gain on the coin, which is a good sign in these market conditions!

Also, in this timeframe, we are in an opening triangle, which is characterized by high volatility, and we are constantly moving towards the bottom and top of this triangle, regardless of the ceiling and floor or support and resistance, and the exit from this triangle will also be sharp.

In this timeframe, we did not have a trigger in advance to say that we could buy or anything else, and it moved very sharply. If you lose, it is normal and do not blame yourself and your strategy.

After exiting this triangle and breaking 2.182, we can have a good trigger to buy, and for now, if you bought and held during this fluctuation and are in profit above 50%, it is logical to save profit, but if you did FOMO and bought, it is better not to continue trading and be busy watching the tutorial for now.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends!

MKR/USDT: Accelerated Golden Cross & Strong Uptrend ConfirmationMKR is showing clear bullish momentum, forming higher lows and seeing increasing trading volume, both signs of a sustained uptrend. The price has reclaimed key moving averages and is now testing the 200 SMA ($1,517)—a critical level that, once broken, could trigger a strong upward move. Initially, the golden cross (50 SMA crossing above 200 SMA) was expected within 2-4 weeks, but given BTC’s renewed strength and rising market liquidity, this formation could now happen much sooner—potentially within 7-14 days if the current momentum continues.

With BTC stabilizing and likely resuming its uptrend toward $95K-$100K+, liquidity is expected to flow into strong altcoins like MKR. If MKR breaks and holds above $1,517, initial targets of $1,8 and $2,1 could be reached quickly. However, with higher volume and strong technical confirmation, a move toward $2,4 - $2,8 is highly probable. If momentum accelerates further, $3,0+ could be a mid-term target, supported by both technical and macro market conditions.

For traders, a confirmed breakout above $1,517 with strong volume would signal a breakout opportunity, while investors looking for accumulation zones might watch for pullbacks to $1,493 (100 SMA) or $1,223 (50 SMA) as potential re-entry points. With increasing volume, higher lows, and a likely golden cross arriving earlier than expected, MKR is positioned for a significant rally in the coming weeks.

MKR ANALYSIS (2D)Before anything, pay attention to the timeframe. This is a 2-day timeframe, so it will take time.

From the point where we placed the red arrow on the chart, it seems that MKR's correction has begun.

It now appears to be in wave C. Buy/long positions can be considered in the green zone.

The target could be the red box.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

MKR - USDT 1W chart Hello everyone, let's look at the 1W MKR chart to USDT, in this situation we can see how the price drops and lasts below the inheritance trend line. However, let's start by defining goals for the near future the price must face to return to a strong upward trend and here the level will be particularly important:

T1 = $ 1134

T2 = $ 1585

Т3 = $ 2070

Let's get to Stop-Loss in case of further declines, but here you can see how the price has affected the support that can also be taken into account as the first stop loss at the level:

SL1 = 771 $

SL2 = = $ 494

SL3 = $ 297

SL2 and SL3 can be considered as a range of a very strong support zone.

Next, we see RSI indicators where you can see how we are approaching the lower limit, which can help in stopping current relegations.

A Critical Buy Zone – This Could Be HUGE for Long-Term InvestorsA Critical Buy Zone – This Could Be HUGE for Long-Term Investors!

“MKRUSDT is at a massive buy zone, and let me tell you – this could be a game-changer for long-term investors. The setup is there, the potential is enormous. Are you paying attention?

I may add this position at 800$-700$-600$ areas”

Here’s Why This Could Be a Monster Opportunity:

Higher Time Frame CDV Looks Strong – Big money is positioning, and you want to be on the right side of the trade.

Explosive Entry Zones – If lower time frame breakouts, CDV, and volume profile confirm, these boxes could be some of the most profitable entries we’ve seen.

Precision Trading Wins – We don’t buy blindly. We wait for confirmation, then we strike with confidence. That’s how smart traders win.

Final Thoughts:

“This is setting up beautifully. I’m watching CDV, volume profile, and lower time frame structures like a hawk. No confirmation, no trade. But when the green light comes? We go BIG.”

The opportunity is there. The market is giving us signals. Now, let’s see if it delivers the big breakout we’re waiting for! 🚀🔥

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🎯 DEXEUSDT %180 Reaction with %9 Stop

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!