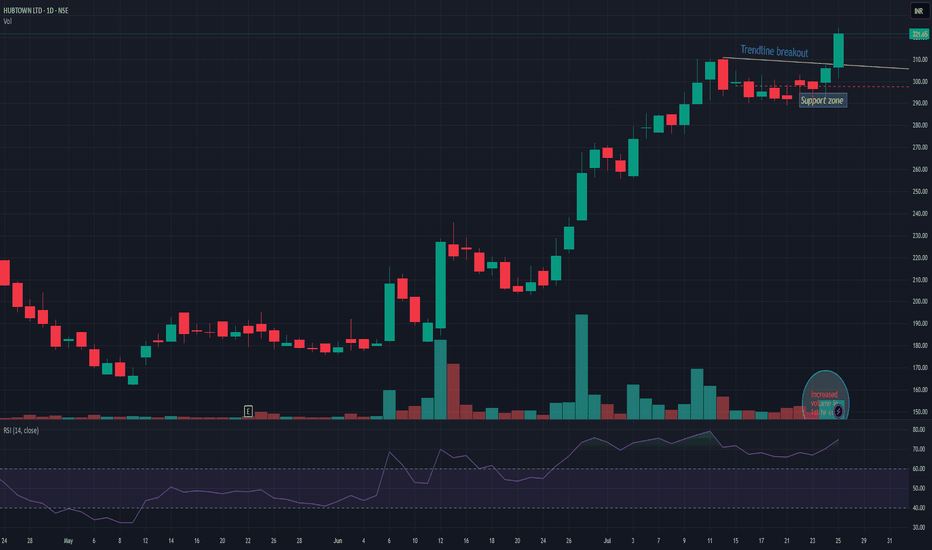

Momentumbreakout

MCLOUD : Post IPO Base Breakout#MCLOUD #IPOstock #breakout #momentumstock #patterntrading #cupandhandle

MCLOUD : Swing Trade

>> Post IPO Base Breakout

>> Cup & Handle Pattern

>> Trending Stock

>> Good Strength & Volume Building-up

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, Comment & Follow for more analysis

Disc : Charts shared are for Learning purpose not a Trade Recommendation, Take postions only after consulting your Financial Advisor or a SEBI Registered Advisor.

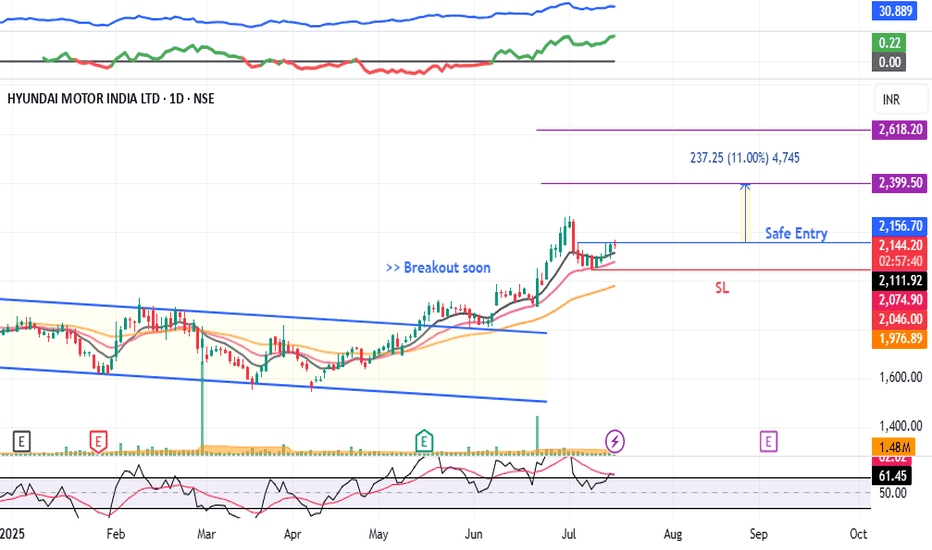

HYUNDAI - Swing Trade#HYUNDAI #swingtrade #trendingstock #momentumtrading #breakoutstock

HYUNDAI : Swing Trade

>> Breakout soon

>> Trending Stock

>> Volume Dried up

>> Good strength

>> Low Risk Trade ( RR - 1:2 or 1:3 )

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, like and comment if u like the analysis

Disc: Charts shared are for Learning purpose, Take position only after consulting ur Financial Advisor or a SEBI Registered Advisor

THELEELATHELEELA is giving resistance + cup and handle breakout above 414 level. Market participation has also increased in recent sessions. So if it sustains and closes above 414 then it looks very attractive and may start new momentum rally. 398 seems very good support. On upper side we may see momentum of 10-12%. Make sure that it sustain and closes above 414!

VALIANTLAB : Breakout Candidate (Swing Pick)#VALIANTLAB #swingtrading #breakoutstock #momentumstock

VALIANT LAB : Swing Trade

>> Cup & Handle Formation Visible

>> VCP Structure also Visible

>> Good Strength in stock

>> Volume Contraction seen, Expansion imminent

>> Potential Upside 23%

Swing Traders can lock 10% profit and keep trailing.

Disc : Stock chart shared for Learning Purpose and not a Trade recommendation.

HCCHCC is on the verge to give triangle breakout provided that it sustains and closes above 31.5. I observed increased market participation. It may face bit of resistance near 36 level and above that it has a potential to go up to 45 levels. But closes below 28.5 may change my view for the stock. Again I'm saying that sustaining above 31.5 is very crucial. Keep a closer watch on how it reacts near this levels.

ASST: Trade write-up / 07 MayDaily Time-Frame Context

1h Chart

ASST gapped up over 300% pre-market on news of transitioning to a crypto holding company (a strong hype theme).

Despite being in a long-term downtrend, ASST had a history of prior gap-ups in 2023–2025.

Highest daily trading volume (HDW) ever recorded, with 80M shares traded pre-market.

Low short interest (0.5 days) and a relatively small float of 10.9M.

5-Min Time-Frame Analysis

Pre-Market Action:

Gap-up to Jan’25 highs, followed by shallow consolidation to the rising 8 EMA and VWAP (1h 8 EMA)

Opening Price Action:

Price posted a failed breakdown setup, finding support at VWAP, Jan’25 highs, and the pre-market base.

Selling volume remained low, while reversal volume showed substantial buying interest, with most bars closing at the highs.

MACD signaled bearish posture during this reversal, hinting at potential upcoming consolidation.

Mid-Day Movement

Price reached a mid-day top with increased selling volume, reduced buying, bearish MACD, and flattening short-term EMAs.

Pullback Phase

Price pulled back for 4 hours to early morning support (Jan’25 highs, pre-market top, morning reversal), with gradually decreasing volume, indicating drying-up selling interest.

Pullback had a textbook three-wave structure with ideal Fibonacci proportions.

Consolidation and Breakout

Established a solid consolidation at the key support zone, featuring:

Several shake-outs

Buying volume dominating selling

Sequance of higher lows formation

Inside bars prior to breakout

MACD turning bullish

Possible Entries

Aggressive Entry:

Failed breakdown and V-shaped reversal with an 11% stop at LOD.

Ideal Entry/Aggressive add-on:

After the shake-out/inside bars sequence on low volume, breakout confirmed by bullish convergence of EMAs and VWAP. Full stop could be placed bellow higher low.

Active Uptrend Phase

Price respected the 8 EMA during the active advance phase, pausing only during halts.

(!) Gradually increasing buying volume without a sudden spike - a sign of steady buying rather than stop-loss coverage.

Noticeably lower selling volume compared to buying volume.

Price approached the next significant daily resistance zone at Jan’24 highs - a potential profit-trimming target.

Swing-Trading Thesis

Strong crypto-related hype (becoming a crypto holding company).

Crypto sector showing relative strength since the market top and recovery phase.

Price maintained above key short-term moving averages into the close and post-market, supporting the bullish case.

Bitcoin pullback and altcoin breakout setups further enhance the thesis.

S&P 500 Index Market Exposure and Sector Insights The S&P 500 Index is currently in a confirmed uptrend as of October 4th, maintaining support above its 21-Day Moving Average (DMA) . With 4 distribution days , market conditions suggest some caution, but the overall uptrend remains intact.

Our current market exposure is recommended at 100% , reflecting confidence in the strength of the broader market.

Key Points:

Market Condition: The S&P 500 remains above the critical 21-DMA level, indicating continued positive momentum. This key support should be monitored in the coming sessions for signs of potential changes in market direction.

Industry Strength: Strong sectors include Technology and Communication Services , with leading stocks showing resilience. Weaker sectors such as Utilities and Consumer Staples are underperforming, with multiple stocks trading below their 50-DMA and 200-DMA .

Opportunities: Leading stocks continue to demonstrate setups for potential gains, with key players in the Tech sector showing strong bases or breakout potential. We advise focusing on high-quality setups in stronger sectors while avoiding underperforming segments trading below critical moving averages.

The key takeaway here is to remain invested in leading areas while keeping an eye on market exposure and distribution day count for any shifts in sentiment.

Let us know—are you focusing on defensive sectors, or do you see opportunities in growth industries?

Disclaimer: The information provided here is for educational purposes only and should not be construed as financial advice. Trading involves significant risk, and you could lose some or all of your investment. Always do your own research and consult with a professional financial advisor before making any trading decisions. Past performance is not indicative of future results.

EURUSD Momentum Break: Trade Setup and Alternative ScenarioBased on this morning’s analysis, we’ve seen a break above the momentum high, signalling that buyers remain confident the EURUSD isn’t too overvalued.

As a straightforward principle, we trade what we observe. Buy above the momentum high, aiming for the next decision point at 1.1140 (H4 Structural Point).

Stop Loss:

What gets you in, gets you out!

Technically, if the price drops back below the momentum high (1.10899), it will be a negative signal for buyers. Therefore, we’ll set a conservative stop at 1.1085.

Profit Target:

1.1134 (Fibonacci Target)

1.1140 (Structural Target)

Alternative Scenario:

If the price breaks below 1.1085, buying is no longer advised. We will reverse the position for a trend reset trade towards the Fibonacci buy zone range of .

Happy Trading!

Sapphire (K.F.C & Pizza Hut) Showing Good Structural Breakout NSE:SAPPHIRE

.............................................

Company has delivered good profit growth of 26.0% CAGR over last 5 years.

.............................................

FY24 Highlights

• Sapphire has delivered the best all-round

performance in the QSR industry (all parameters considered):

Revenue scale & growth ,

Adj. EBITDA margin & growth

and New restaurant additions .

• Sapphire KFC delivered highest ever annual

restaurant EBITDA margin %: 19.7% .

• Sapphire KFC and Pizza Hut being recognized

as among the top 3 franchisees of Yum

globally on customer metrics and operating

standards.

• Sapphire Foods is ranked No.1 QSR in India

and at 95th percentile amongst QSR globally on

Dow Jones Sustainability Index (DJSI).

• We achieved our best ever employee

engagement score since inception and placed

at 88th percentile amongst all companies

surveyed worldwide by Gallup.

.............................................

PFOCUS is Focusing on 2008's Multi-Year Long Resistance BreakoutNSE:PFOCUS

.............................................................................................................................................

.............................................................................................................................................

Over Last 4 Years ... From Year 2020 to 2024 Promoter Holdings Have Been Increased by +34.93% ......

.............................................................................................................................................

.............................................................................................................................................

Customers

PFL caters to players across the entire media industry value chain and the product life cycle of media content. Its major clients include top Hollywood and Indian studios and media companies across the globe:

Studios – Warner Bros., Disney, Netflix, etc.

Broadcast networks – Bloomberg, Disney, Star, etc.

Others – ICC, BCCI, Amazon, etc.

.............................................................................................................................................

.............................................................................................................................................

Focus

In Creative Services, it aims to expand its global footprint and diversify the business across content formats. It also expects growth in cross-selling through bundled VFX, etc.

In Tech/Tech-Enabled Services it aims to sign more strategic deals and increase revenue from existing clients by offering new modules and analytics.

Working on top Hollywood projects

One of them is

Matrix 4

AVTNPL Showing Good MomentumNSE:AVTNPL

............................................................................................................................................................................................................................................

Products

The main products of the Co. are - Marigold Extracts for Eye Care, Food Coloring & Poultry Pigmentation; Spice oleoresin and Oils for Food Coloring and Flavoring; Value added Teas - Decaffeinated Teas and Instant Teas; Animal Nutrition Products; and Rosemary extract.

............................................................................................................................................................................................................................................

Subsidiaries

The Co. has 2 wholly owned subsidiaries, namely AVT Natural Europe Ltd. & AVT Natural S.A. De C.v., Mexico. AVT Natural Europe Ltd. is the marketing arm of the Company for decaffeinated tea and instant tea. AVT Natural SA DE C.V, Mexico has been established with an aim to capture the market for the Animal Nutritional products in the South American market and other markets.

............................................................................................................................................................................................................................................

SNOWMAN Increasing Cold Temperature & New WarehousesNSE:SNOWMAN

............................................................................................................................................................................................................................................

• Network Advantage - Ability to offer customers the largest Pan-India cold chain networkfor storage and distribution

• Expansion Plans – Planned expansion basis our customers’ requirements to reach new markets & to address the demand of the organised sector• Technology Driven - Snowman has developed customised software & apps for increasing efficiency of operations

• 25+ Years of Experience - Snowman has innovated best practices and is a knowledge leader in the industry

• Customer Trust & Satisfaction - Full visibility & transparency provided to customer using in-house tech platforms & many uninterrupted years of satisfactory customer service

............................................................................................................................................................................................................................................

Leading integrated temperature-controlled logistics

• Snowman Logistics Ltd was incorporated in 1993 and Gateway Distriparks acquired a majority stake in 2006• Pan India network of 45 warehouses across 20 cities

• Integrated service offering of warehousing services, transportation, and distribution bundled with value added services• Modern facilities with high quality infrastructure across the country

• Expansion plans to increase warehousing presence for catering to the fast-growing demand of the organised sector• Snowman is first Indian cold chain company to introduce 5PL services, which offer innovative and integrated solutions

............................................................................................................................................................................................................................................

Strengths:

Established market position in the temperature-controlled logistics industry: Snowman is the largest provider in the highly fragmented temperature-controlled warehousing, transportation and logistics industry in India. The company provides quality service and end-to-end solutions to customers in the temperature-controlled industry, thereby resulting in repeat orders and long-term contracts providing around 80% revenue visibility. As on March 31, 2023, the company had warehousing capacity of 1,35,552 pallets across 44 warehouses in 18 cities. It also had 239 refeer vehicles (refrigerated trucks) providing last-mile, inter-city distribution services through a consignment agency model. It caters to marquee customers in diversified end-user industries, such as seafood, pharmaceuticals, dairy, e-commerce and quick service restaurants (QSR). Under the dedicated warehouse segment, the company has opened 4 warehouses for e-commerce and pharmaceutical clients including Amazon, Fraazo, Impelpro, among others.

Adequate financial risk profile: Gearing was 0.25 times as on March 31, 2023, and is expected to remain low in the medium term. Debt protection metrics are adequate with interest coverage and net cash accrual to total debt ratios are ~4.3 times and 0.63 times, respectively, in fiscal 2023. Any higher-than-expected debt for funding capex could adversely impact the capital structure and debt protection metrics and will remain a key rating sensitivity factor.

Continued parentage of GDL: Post settlement of agreement between Snowman and Adani Logistics Ltd (ALL) in July 2020, GDL is the single largest owner with 40.25% stake in the company and substantial control on the board. The rating continues to benefit from moderate operational and strategic linkages with GDL, as both the companies offer complementary services in the logistics industry, thereby providing cross-selling opportunities to customers. GDL is one of the largest private players in the container freight station, railways and inland container depot businesses in India. Furthermore, Snowman is well established amongst the leading organised players, providing temperature-controlled services in India

KOPRAN Showed Breakout with Huge Volume at 52 Weeks High ZoneNSE:KOPRAN

The co. has set up a new API plant at Panoli, commercial production at this facility is expected to be started from Q3 FY25. In FY23, it completed upgradation and expansion of the multi-product plant at the Mahad facility for existing products and to manufacture new molecules.

An integrated Pharmaceutical Company, committed to supplying International

Quality Formulations and Active Pharmaceutical Ingredients (APIs) globally.

State-of-the-art manufacturing facilities and products with various accreditations

and approvals by major global regulatory authorities.

The formulations vertical is operated through Kopran Limited.

The API vertical is being operated under Kopran Research Laboratories Ltd.

(KRLL), a wholly owned subsidiary of Kopran Limited

EPL Just Have Broken 52 Week's HighNSE:EPL

Double digit revenue growth at 10.7%. All regions delivered strong growth.

Continued EBITDA margin improvement with Q1FY25 margin at 19.1%, an expansion of 160 bps YoY.

Absolute EBITDA grew by 20.8% YoY.

Adjusted PAT (excluding base year one off) has grown by 35.4% YoY. Reported PAT has grown by 18.2%.

Net Debt/EBITDA ratio improved to 0.67x vs 0.71x (YoY).

Return on Capital Employed (‘ROCE’) increased to 15.9% with YoY increase of 190 bp.

Company Profile

EPL manufactures multilayer plastic laminated collapsible tubes, providing specialty packaging solutions to the fast-moving consuming goods sector. EPL has 21 manufacturing plants in 11 countries across the world; the company commissioned a greenfield manufacturing unit in Brazil in FY23, with operations already getting ramped up at that unit.