HA-RSI + Stochastic Ribbon: The Hidden Gem for Trend & MomentumNavigating volatile markets requires more than just raw price action. The Heikin Ashi RSI Oscillator blends the power of smoothed candlesticks with momentum insights to give traders a clearer picture of trend strength and reversals.

At Xuantify , we use the Heikin Ashi RSI Oscillator as a hybrid momentum and trend tool. While the indicator calculations are based on Heikin Ashi values to smooth out noise and better capture trend dynamics, the chart itself displays standard candlesticks (real price data) . This ensures that all signals are aligned with actual market structure, making it easier to execute trades with confidence and clarity.

This dual-layer approach gives us the best of both worlds: clarity from smoothing and precision from real price action. MEXC:SOLUSDT.P

🧠 How We Use It at Xuantify

At Xuantify , we integrate the Heikin Ashi RSI Oscillator into our multi-layered strategy framework. It acts as a trend confirmation filter and a momentum divergence detector , helping us avoid false breakouts and time entries with greater precision. We pair it with volume and volatility metrics to validate signals and reduce noise. Note the Stochastic Ribbon Overlay as shown in the chart, very accurate for momentum.

⭐ Key Features

Heikin Ashi Smoothing : Filters out market noise for clearer trend visualization.

RSI-Based Oscillation : Measures momentum shifts with precision.

Color-Coded Bars : Instantly identify bullish/bearish momentum.

Dynamic Signal Zones : Customizable overbought/oversold thresholds.

Stochastic Ribbon Overlay : A powerful multi-line stochastic system that enhances momentum analysis and trend continuation signals.

💡 Benefits Compared to Other Indicators

Less Whipsaw : Heikin Ashi smoothing reduces false signals common in traditional RSI.

Dual Insight : Combines trend and momentum in one visual.

Better Divergence Detection : Easier to spot hidden and regular divergences.

Visual Simplicity : Clean, intuitive design for faster decision-making.

⚙️ Settings That Matter

RSI Length : Default is 14, but we often test 10 or 21 for different timeframes.

Smoothing Type : EMA vs. SMA – EMA reacts faster, SMA is smoother.

Overbought/Oversold Levels : 70/30 is standard, but 80/20 can reduce noise in trending markets.

📊 Enhancing Signal Accuracy

Combine with Volume Oscillators to confirm momentum strength.

Use Price Action Zones to validate oscillator signals.

Look for Divergences between price and oscillator for early reversal clues.

🧩 Best Combinations with This Indicator

MACD : For cross-confirmation of momentum shifts.

Bollinger Bands : To identify volatility squeezes and breakouts.

Support/Resistance Levels : For contextual trade entries and exits.

⚠️ What to Watch Out For

Lag in Strong Trends : Like all smoothed indicators, it may react slightly late.

Over-Optimization : Avoid curve-fitting settings to past data.

Standalone Use : Best used in conjunction with other tools, not in isolation.

🚀 Final Thoughts

The Heikin Ashi RSI Oscillator is a powerful hybrid tool that simplifies complex market behavior into actionable insights. At Xuantify, it’s a core part of our strategy toolkit, helping us stay ahead of the curve with clarity and confidence.

🔔 Follow us for more educational insights and strategy breakdowns!

We regularly share deep dives into indicators, trading psychology, and backtested strategies. Stay tuned and level up your trading game with us!

Momentum Oscillators

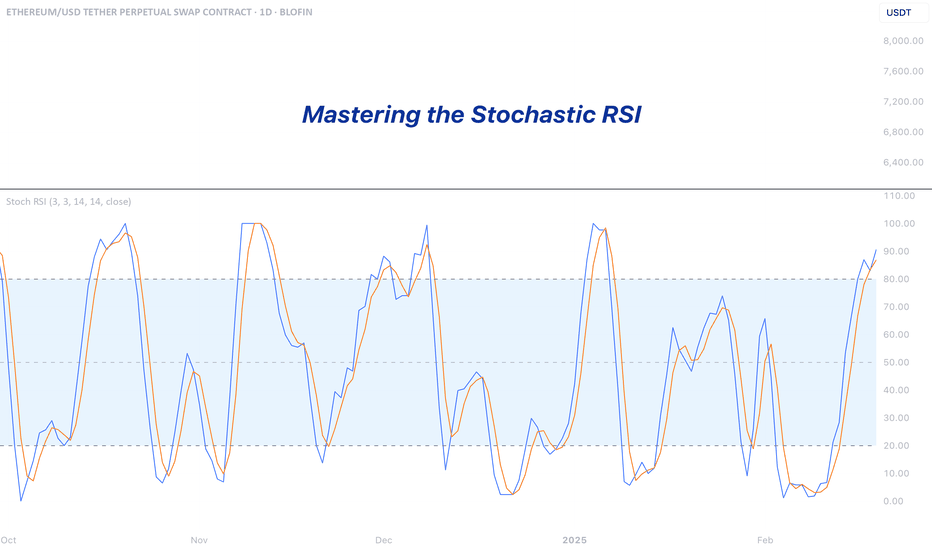

Mastering the Stochastic RSI - Guide to Spotting Momentum ShiftsIntroduction

In the world of technical analysis, momentum indicators are essential tools for understanding market sentiment and potential price movements. One such tool is the Stochastic RSI (Stoch RSI), a unique and highly sensitive variation of the traditional Relative Strength Index (RSI). While the standard RSI focuses on price, the Stoch RSI takes it a step further by measuring the momentum of the RSI itself. This makes it a faster-reacting and more dynamic indicator that many traders use to anticipate trend shifts and spot overbought or oversold conditions earlier.

What is the Stochastic RSI?

The Stochastic RSI (Stoch RSI) is a momentum oscillator that operates similarly to the RSI but with a twist — instead of measuring the price of an asset, it measures the movement of the RSI. Because of this, the Stoch RSI is typically more sensitive and quicker to respond to changes in market momentum.

It consists of two lines:

* The blue line: The primary line that reacts quickly and shows when the RSI is gaining or losing momentum.

* The orange line: A moving average of the blue line, which acts as a smoother version to help filter out noise and highlight potential turning points.

How to Read the Stoch RSI

The Stoch RSI moves between 0 and 100, and traders often focus on the 20 and 80 levels as key thresholds:

Above 80 (Overbought): Indicates that the RSI has been running hot compared to recent values. This suggests strong upward momentum that could be due for a slowdown or minor correction. However, it doesn’t necessarily mean the price will drop immediately, just that conditions are extended.

Below 20 (Oversold): Suggests the RSI has been suppressed, signaling weakening bearish momentum and a possible reversal upward. Again, this isn’t a guaranteed bounce but rather a situation where a shift may be more likely.

How to Trade with the Stoch RSI

While entering overbought or oversold zones can offer insight, trading solely based on those levels is risky. Instead, look for crossovers between the blue and orange lines:

Bearish signal: When the Stoch RSI is above 80 and the blue line crosses below the orange line, it can indicate that bullish momentum is fading — a potential short entry.

Bullish signal: When the Stoch RSI is below 20 and the blue line crosses above the orange line, it may suggest that bearish momentum is weakening — a potential long entry.

These crossover points provide more reliable signals than the levels alone, especially when confirmed by price action or other indicators.

What Timeframes to Use

The Stoch RSI can be applied to any timeframe, but its effectiveness varies. On lower timeframes (like 1-minute or 5-minute charts), it generates many signals, including plenty of false or weak ones. For stronger and more reliable signals, it’s best used on higher timeframes such as the 4-hour, daily, weekly, or monthly charts. Generally, the higher the timeframe, the more significant the signal becomes.

Conclusion

The Stochastic RSI is a powerful indicator that combines the strengths of the RSI and Stochastic Oscillator to deliver sharper, more responsive momentum signals. While it’s tempting to act on overbought or oversold readings alone, true effectiveness comes from understanding the behavior of the two lines and using it in conjunction with other analysis tools. Whether you're a short-term trader or a long-term investor, mastering the Stoch RSI can add depth to your strategy and help you make more informed decisions.

GOEV -Canoo reverses while TSLA slumps into earnings LONGGOEV was in the $ 4.50 to $5.50 range 1-2 months ago and on the 60 minute chart appears to

be in a round bottom or doble bottom reversal concurrently with TSLA continuing to fall on

the expectation of an earnings miss. GOEV's last earnings was a beat. It burned about half the

cash that the analysts forecasted. The relative trend index indicator suggests a trend up is

developing. A red flag is that volume is at or below the running mean. My plan is to watch

GOEV for a rise in trading volumes before entertaining a long trade here. The Price Volume

product Trend is helpful in that regard. While it currently has a positive slope it is minimal.

I will watch for something a bit steeper. I am expecting the Price Momentum Oscillator will

soon cross the horizontal zero and provide another entry signal.

Unveiling the Dynamic Range of The RSI for Precision Trading

In the image below you can see the differences we can arrive to when comparing the regular version of the Relative Strength Index and this new study.

What was once known to be OB or OS levels is actually the strength you need for breakouts, continuations, and larger movements.

Understanding the Dynamic Range

In the image below we can see the contrarian differences from the old and new version of the RSI. For example the standard range in the common RSI is a 40 - 60 area. However through more analysis we can see the range is actually a level of 39.6 as a low of the range and a 49.2 as the high part. This meaning we dont need to wait to cross above the RSI midline to start looking for long trades.

Scalping or Range Trading Within the Dynamic Range

In the image below we can see that using the new theory of the RSI, a range is created by the RSI entering down through the top of its previously created Range Bull Side. At the close of this candle we can determine this to be the top of the new range being created. As the RSI reaches a bottom of the new range within itself, we can also mark this value as the bottom of the price range. Once we drag this out forward, its easier to see when and were price will bounce off price levels.

We keep these price values until a new cross of the rsi over its range is found. If only one side is crossed we keep the old price value of the alternate side.

Introduction:

The Relative Strength Index (RSI) has long been a staple in the toolkit of traders, offering insights into overbought and oversold conditions in the market. Traditionally, traders have relied on static levels such as 30, 40, 50, 60, 70, and 80 to identify potential breakouts and reversals. However, a closer examination reveals that the RSI generates its own dynamic support and resistance levels, challenging the conventional wisdom that traders have adhered to for years.

Historical Perspective:

Before delving into the dynamic nature of the RSI, let's take a brief look at the historical information provided to traders. The traditional approach involved identifying specific RSI levels (e.g., 70 for overbought and 30 for oversold) as key points for making trading decisions. This static framework has been the cornerstone of RSI-based strategies for years.

The Dynamic Nature of RSI:

Contrary to popular belief, the RSI doesn't conform to fixed levels but rather establishes its own dynamic range. This range consists of a high part and a low part, both of which independently move within the oscillator. The intriguing aspect is that the high part can fluctuate irrespective of the position of the low part, leading to a constantly shifting dynamic range.

Understanding the Dynamic Range:

The dynamic range of the RSI introduces a paradigm shift in how traders interpret the oscillator. Unlike the traditional notion of range trading confined between 40 and 60, the dynamic range expands and contracts, creating a continuously evolving landscape. The upper and lower extremes of this range determine the prevailing market sentiment—bullish or bearish.

Implications for Trading:

Within this dynamic range, trading is not merely confined to buying at 40 and selling at 60. Instead, the goal is to identify the shifting bullish and bearish extremes. Breaking out of either extreme signifies a significant shift in market sentiment, eliminating resistance and presenting traders with clear opportunities to go long or short.

Trading Outside the Dynamic Range:

In instances when the RSI ventures outside its dynamic range, a different set of trading principles comes into play. Trading the RSI as it crosses above or below its own moving average provides valuable insights into potential market reversals and continuations. For instance, when trading on the bullish side above the dynamic range's bullish extreme, a trader should focus on taking long positions when the RSI dips below its previous low and subsequently crosses above this level or its moving average. This suggests a continuation of the upward momentum in the price.

Conversely, in a bearish scenario below the dynamic range's bearish extreme, traders can look for opportunities to enter short positions. This involves waiting for the RSI to make a high swing, followed by a cross below its previous low swing or its moving average. These conditions signify a resumption of the downtrend without encountering significant resistance. Additionally, observing the RSI moving up above its moving average and then crossing back down across it can further confirm the continuation of the downtrend.

It's crucial to note that these conditions are most effective when the RSI is operating outside its dynamic range. This underscores the idea that the RSI is not merely overbought or oversold at specific levels but rather indicates pullbacks and shifts in market sentiment. By interpreting the RSI's movements in relation to its moving average outside the dynamic range, traders can enhance their ability to identify key reversal and continuation points, contributing to a more nuanced and effective trading strategy.

Scalping Within the Dynamic Range:

Trading within the dynamic range involves scalping—capitalizing on short-term price fluctuations. The ever-changing nature of the range ensures that, even within the bounds of the oscillator, traders can engage in opportunistic long or short positions. This challenges the traditional notion that range trading is limited to a narrow band within the RSI.

Conclusion :

As we reassess the conventional wisdom surrounding RSI trading, it becomes evident that the dynamic range of the oscillator provides a nuanced perspective on market dynamics. Traders can benefit from embracing the ever-shifting nature of the RSI, adapting strategies to capitalize on the changing sentiment within this dynamic range. By understanding and leveraging the true potential of the RSI, traders can navigate markets with greater precision and agility.

VALE a junior miner can rise on the Gold bullrunNYSE:VALE as a junior miner could be reaosnably expected to follow spot gold.

The bottom line is quite simple. With fixed costs to mine gold, VALE can easily

expect to increase its margins when stop gold rises will above the breakeven

on a spreadsheet. The 2H chart shows price has descended into the support of

the long term anchored mean anchored VWAP line after a VWAP breakdown.

The PMO and ZL MACD are confirmatory for a consolidation sitting on dynamic

support.

Overall, the analysis is that of VALE setup to make a reversal for a bullish move

reflecting the gold run at large. I will take this trade long now.

EDUCATIONAL: MOMENTUM TRADING: THE POWER OF MULTIPLE TIMEFRAMESEDUCATIONAL: MOMENTUM TRADING: THE POWER OF MULTIPLE TIMEFRAMES

🔹Introduction: Momentum trading is a tactic that makes money off the continuation of current trends in the volatile world of financial markets. Identifying assets that have entered overbought or oversold circumstances is a crucial component of this strategy. Trades can be executed on lower periods to benefit from momentum shifts and traders can learn a lot about these areas by analyzing numerous timeframes. In this publication, we'll look at the importance of overbought and oversold zones, talk about how they apply to different timescales, and show how traders can place trades on shorter timeframes to profit from momentum changes.

🔹Understanding Overbought and Oversold Areas:: Technical indicators have zones known as overbought and oversold areas where the price of an item is thought to have drastically diverged from its average value. These regions frequently signal a possible trend reversal or correction in the price. These circumstances are crucial in momentum trading because they signal a change in market mood and present chances for traders to enter or exit positions.

🔹The Significance of Multiple Timeframes: For momentum traders, analyzing several periods is essential since it offers a thorough understanding of market dynamics. The numerous characteristics of price patterns shown by each timeframe enable traders to see overbought and oversold situations from a variety of angles. The precision of trade judgments is improved by this multi-timeframe study, which supports the strength of these areas.

🔹Lower timeframes, such as 15-minute or 1-hour charts, offer a detailed view of short-term price movements. Traders can identify overbought or oversold conditions on these lower timeframes, which often result in quick momentum shifts. By executing trades on lower timeframes, traders can capture these momentum shifts and generate timely profits.

🔹 Executing Trades.

1:Identify Overbought and Oversold Areas: Use oscillators like the Relative Strength Index (RSI) or Stochastics Oscillator to identify overbought (above 70) and oversold (below 30) areas. These indicators help gauge the speed and magnitude of price movements, providing valuable insights into potential market reversals.

2:Confirm Overbought or Oversold Conditions on Higher Timeframes: Before executing trades on lower timeframes, verify the presence of overbought or oversold conditions on higher timeframes, such as daily or weekly charts. This confirmation increases the probability of a successful trade.

3:Determine Entry and Exit Points: Once overbought or oversold areas are identified, pinpoint the optimal entry and exit points based on your trading strategy. This may involve waiting for a pullback or confirmation signal on the lower timeframe chart.

4:Manage Risk: Implement appropriate risk management techniques, such as setting stop-loss orders or trailing stops, to protect against adverse price movements. It is essential to define risk tolerance and adhere to it strictly.

🔹Key Indicators for Momentum Trading:

Moving Average Convergence Divergence (MACD): The MACD indicator helps identify changes in momentum by comparing two moving averages. Bullish or bearish crossovers between the fast line (MACD line) and the slow line (signal line) indicate potential buy or sell signals, respectively.

Relative Strength Index (RSI): The RSI measures the speed and change of price movements. This oscillator ranges from 0 to 100 and helps determine whether an asset is overbought (above 70) or oversold (below 30). Traders can take advantage of potential reversals by entering trades when the RSI crosses these key levels.

Stochastics Oscillator: The Stochastics oscillator compares the closing price of an asset to its price range over a specified period. It generates two lines, %K and %D, which fluctuate between 0 and 100. Traders look for bullish or bearish crossovers, as well as overbought and oversold conditions, to identify potential entry or exit points.

Bollinger Bands: Bollinger Bands consist of three lines plotted on a price chart. The middle line is the moving average, while the upper and lower bands represent the standard deviation of the price. When volatility increases, the bands expand, potentially signaling the start of a strong price trend.

🔹Below is a live chart example of how to apply this trading style.

The Use of Subjective Price Action Indicators and Individual Trade Techniques:

It's crucial to remember that individual traders' preferences for indicators and trading strategies can change when it comes to momentum trading. It's important to note that although indicators like the Relative Strength Index (RSI) and Stochastics Oscillator are frequently employed to pinpoint overbought and oversold areas, their interpretation and the execution of trades based on them are both arbitrary. The greatest trading strategies and indicators must be developed by each trader on their own. This entails learning to decipher the signals of each indication and researching and grasping its subtleties. Furthermore, some traders could opt to use price action patterns, trend lines, or other technical analysis techniques to spot overbought and oversold positions.

The capacity of a trader to consistently use a trading strategy or signal and make wise judgments ultimately determines how effective it is. It's crucial to rigorously test and hone trading methods while taking into account elements like risk appetite, individual preferences, and the particular market being traded.

Conclusion:

Momentum trading is a dynamic strategy that relies on the identification of overbought and oversold areas to capture profitable opportunities. While commonly used indicators like the RSI and Stochastics Oscillator provide valuable insights, traders should recognize that the choice of indicators and trading techniques is subjective. It is crucial for traders to develop their own strategies and refine them through testing and experience.

Furthermore, analyzing multiple timeframes plays a vital role in momentum trading. While the publication touched on executing trades on lower timeframes, it's important to emphasize the significance of using multiple timeframes to capture larger momentum shifts. By observing longer timeframes for trend identification and lower timeframes for precise entries and exits, traders can enhance their chances of success.

Overall, momentum trading requires a combination of technical analysis, risk management, and the ability to adapt to changing market conditions. By incorporating subjective price action indicators, personal trade techniques, and a multi-timeframe approach, traders can effectively navigate the complexities of momentum trading and potentially achieve consistent profitability.

Below you will find in related ideas my other publication on developing a framework for trading which covers a lot of the other aspects of a trading system.

MultiversX (EGLD) Showing Signs of RecoveryMultiversX (EGLD) has been showing signs of recovery after bouncing up from a support level of $40.00. In our last analysis, we identified this level as a key support level, and it has held the pullback so far. Currently, EGLD is on its way to the minor resistance level of $54.50.

What is EGLD? MultiversX is a blockchain protocol that offers fast transaction speeds through sharding. It rewards community and active participants with EGLD tokens, which act as a store of value currency to pay for network usage and a medium of exchange between platform users and validators. EGLD allows developers to deploy smart contracts, protocols, and dApps on the platform and empowers participants to perform any network action. EGLD also functions as a governance token, enabling holders to vote on network decisions. MultiversX was announced in August 2019, and its mainnet went live in July 2020.

EGLD's Bullish Momentum

While it's true that just bouncing up from a support level does not guarantee an uptrend, EGLD has been displaying strong volume in the past two days. This is a positive sign because in the past, every time EGLD had a bullish day with strong volume, it led to an uptrend. This indicates that we may see at least a limited uptrend in the coming days.

So far, EGLD has not shown strong bullish momentum compared to the rest of the market this year. This makes it difficult to estimate where the rally will stop. However, this also means that we can expect a stronger rally later on in 2024-2025 when the rest of the market should reach its all-time high. This makes EGLD a promising investment for the long term.

Bottom Line: In conclusion, MultiversX (EGLD) has been showing positive signs of recovery lately. The strong volume it displayed in the past two days indicates that we may see a limited uptrend soon. While EGLD has not shown strong bullish momentum so far this year, we can expect a stronger rally in the future. Investors who are looking for a promising investment for the long term may consider investing in EGLD.

GBPJPYGBPJPY has been examined in different dimensions:

1- Strong supply and demand levels that I identify with my own indicator and system.

2- The structure of recently formed waves

3- Current market momentum

4- The structure of classical and price patterns

In this idea, I identified the direction of the market in different ways and in the second step, I analyzed the potential of continuation or reversal. Usually, paying attention to the trend and strength of the trend can greatly increase the accuracy of the analysis.

In general, I tried to describe the continuation of the movement in the simplest possible way in the diagram.

⚠️ Disclaimer:

This is a personal opinion and you are responsible for any trading decisions.

SPX reversal after fall from double topSPX double topped last week and then proceeded to drop.

I see a rising trend line of higher lows ( green line),

SPX is nearly to the support trendline and is also touching

the lower Bollinger Band. VWAP is not shown but

price is below it. The Momentum Oscillator shows

a rapid decrease in negative momentum.

I see this as a reversal setup

worth watching.

Is software ever coming back? $DV is leading the recoveryDoubleverify Hldgs Inc help brands improve the effectiveness of their online advertising.

I bought half a position and so far the price hasn't under cut its support at $25, just were my stop is. For me this is a really good sign, considering what the SP:SPX is doing.

The bad thing is that the OBV and ROC is signaling a bearish divergence. If I had full position I'd have cut it in half.

So, as long as it doesn't break from the $25 support I'll hold my position.

If price goes above $29.50 I'll add more.

Bull Bear Volume Oscillator (Idea in the making)I want you guys and gals to add in your question and comments below.

There are certain things id like to new oscillator to do for you but i want to know in what ways it can be better like if it seems to be missing something.

However. That being said, if you think its good the way it is, then by all means, let it be done and ill release it ASAP.

This is the Bull Bear Power Volume Oscillator.

It shows you TREND DIRECTIONS.

A bullish trend is not defined until you have higher highs and higher lows of the same green color .

A bearish trend is not defined until you have lower lows and lower highs of the same red color .

There is also a CENTER area which is clouded called "The Void". Any action closing in this area is null and taken as

A) Market is ranging.

and or

B) There is not enough opposing volume to move the market either way.

it is not until you get a high or low OUTSIDE of this area, where you should consider a trade.

Also, any action taking place outside of the VOID is considered a higher volatity in the market. Anything INSIDE the void is an extremely LOW volati

SOURCE - You can choose the source to be anything else that exists on your chart, for example, the RSI from a different indicator or a particular moving average you have plotted on your chart.

For those who have trouble seeing a divergence between momentum (RSI) or (Stochastic RSI) and your price action on your chart, this should paint a more clearer picture for you.

A long red column is obviously a LOW

and a long green column is obviously a High but what you should be looking for is the end of the WICK and not the color of the candle.

Again this is an early set of information for this indicator. Id like to get your feedback on it.

WATCH $STEMBullish

- Round bottom

- Broke downtrend

- Broke neckline

- EPS +1

- Sales +1

- Funds accumulating

- Great fundamentals

Entry idea

- For members

Stop loss depending on entry and risk appetite. But always set meaningful stops.

“If you are depressed you are living in the past. If you are anxious you are living in the future. If you are at peace you are living in the present.”

Cheers and happy trading!

WATCH $3320Bullish

- Higher lows

- IHS formation

- Double bottoms

- Funds accumulating

- Great fundamentals

- Needs to break above downward trendline & neckline

Entry idea

- For members

Stop loss depending on entry and risk appetite. But always set meaningful stops.

“The gem cannot be polished without friction, nor man perfected without trials.”

Cheers and happy trading!

WATCH $AMPSBullish

- Higher lows / Higher highs

- IHS formation

- Funds accumulating

- Great fundamentals

- Hot theme

Entry idea

- For members

Stop loss depending on entry and risk appetite. But always set meaningful stops.

“A winner is just a loser who tried one more time.”

Cheers and happy trading!

WATCH $MAXNBullish

- Broke downward trend

- Broke neckline / major S/R

- Making Higher lows

- Funds accumulating

- Great value

- Good R/R trade

- Hot theme

Entry idea

- For members

Stop loss depending on entry and risk appetite. But always set meaningful stops.

“Our greatest glory is not in never falling, but in rising every time we fall.”

Cheers and happy trading!