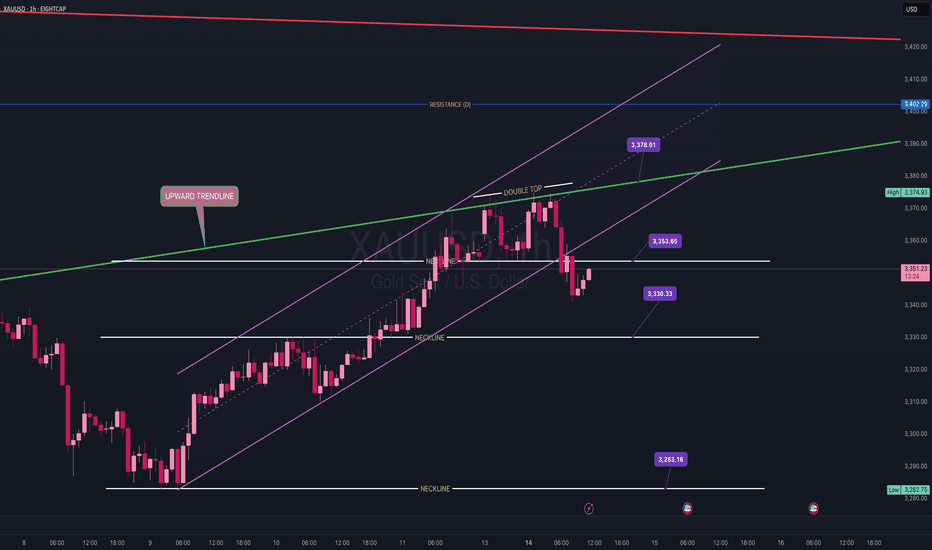

Gold Outlook – Monday Session BreakdownOn the Monthly timeframe, gold has shown a triple wick rejection, which continues to signal potential downside movement. After several failed attempts to break above the $3,400 level, we’ve begun to see a retracement take shape.

On the Daily chart, a Head and Shoulders pattern appears to be forming — further reinforcing the bearish narrative.

During Monday’s session, price action retested the upward trendline from Friday, before sharply reversing down to the $3,353 zone, where it consolidated and formed a neckline. During the London session, gold once again tested the trendline, met sharp resistance, and formed a double top. The neckline and ascending channel were then broken at $3,353 during the New York session.

At present, gold is trading between the two key neckline levels: $3,353 and $3,330.

• A break and close above $3,353 could signal renewed bullish sentiment, with targets at the $3,378 trendline and potentially the $3,402 resistance.

• A break and close below $3,330 would point to continued bearish momentum, with a downside target at $3,312.

CPI data is scheduled for tomorrow, which may bring increased volatility and key level breaks.

Key Levels to Watch:

• Resistance: $3,402, $3,378, $3,353

• Support: $3,330, $3,312, $3,300, $3,283

Trade Zones:

• Buy entries: $3,330 – $3,328

• Sell entries: $3,353 – $3,355

Stay sharp this week, and remember to manage your risk wisely — 1–2% per trade.

Let the market come to you — patience pays.

Monday

EURAUD BUY SETUP1️⃣ Demand Zone Reaction

The price is currently in a clearly defined demand zone, where we’ve seen strong buying interest in the past. This zone has already shown signs of holding support, making it an ideal area to look for a long position.

2️⃣ Volume Profile Confirmation

The volume profile shows increased activity near the demand zone, indicating significant interest from buyers in this area.

3️⃣ Fibonacci Confluence

The demand zone aligns with the golden pocket area (61.8%–78.6%) of a Fibonacci retracement, adding strength to this level.

4️⃣ Bullish Momentum Potential

There are signs of rejection from lower levels, with wicks and candles showing hesitation in breaking lower, suggesting bullish momentum may build from here.

5️⃣ Liquidity Grab

The price recently swept the lows, grabbing liquidity from weak hands before a potential move to the upside.

Trade Plan:

Entry: 1.61900 (current demand zone).

Stop Loss: 1.61600 (below the demand zone and liquidity sweep).

Take Profit Levels:

TP1: 1.62500 (local resistance).

TP2: 1.63000 (higher timeframe resistance zone).

Bias:

The overall market structure remains bullish, with price expected to continue upward after this retracement.

Reminder:

Always manage your risk. Use proper position sizing and wait for confirmations if needed.

USDCAD Bullish setup.Above this high we wait for a solid BOS , the nature

of a candle close will dictate if we commit to the

setup

We are looking for a candle that fully breaks above the structure With the body close above the structure .

This will be an impulsive move.

We identify a market structure that formed prior the

break , and that will be our entry position.

Be sure to use your hard learnt skills to look for an

entry around this area. Which will be our POI.

GBPUSDThe beginning of the week looks like a very calm day without much volatility, but the scenario looks very good to take advantage of sales for the opening of London and purchases to our psychological point in NY as long as when Frankfurt breaks upwards at its opening, I will be on the lookout and I will make a decision based on what the price presents to me. Remember that a trader is not a fortune teller but an interpreter of the language of price.

Greetings from yours truly and have a good day.

NAS100: First red dayHi everyone and welcome to my channel, please don’t forget to support all my work subscribing and liking my post, and for any question leave me a comment, I will be more than happy to help you!

“Trade setups, not movements”

1. DAY OF THE WEEK (Failed Breakout, False Break, Range Expansion)

Monday DAY 1 Opening Range ✅ day 2 cycle

Tuesday DAY 2 Initial Balance

Wednesday DAY 3 (reset DAY 1) Mid Point Week

Thursday DAY 2

Friday DAY 3 Closing Range

2. SIGNAL DAY

First Red Day ✅

First Green Day

3 Days Long Breakout

3 Days Short Breakout

Inside Day

3. WEEKLY TEMPLATE

Pump&Dump ✅

Dump&Pump

Frontside

Backside ✅

4. THESIS:

Long: secondary, not my main setup, however I could scalp long if after 10am, the market will consolidate at the current level (Friday LOD) for at least 30/45 minutes for a reversal trade back to the current HOD

Short: primary, possibility to see down continuation, going to completed during the upcoming days the weekly pump and dump scenario. I will be looking for a pump and dump in my session (NY) after all the news will be release.

Please note that the purpose of my analysis is to help me and you hunting the best trade setup for the day, none of my technical aspects are a way to forecast any directional market movement.

Gianni

ICP: MONDAY FAKEOUT AND BULLISH PUMP ! Internet Computer (ICP) has once again demonstrated its resilience by bouncing off a critical support level at $11. This price action suggests that ICP may be poised for a rebound and a potential continuation of its upward trajectory.

Key Support Level and Reaction:

ICP has consistently shown strong support at the $11 level, bouncing back from this zone on several occasions. This repeated reaction highlights the significance of this support level and the potential for ICP to find footing there.

Anticipated Price Movement:

While ICP has bounced off the $11 support, I anticipate a further downward move to retest the psychological round number of $10. This retest is a common occurrence in the market, as traders often pay attention to round numbers.

Bullish Continuation Setup:

The potential retest of $10, followed by a reversal, could set the stage for a significant bullish continuation. This price action would create a classic "bullish flag" pattern, indicating potential upside momentum.

Abundant Liquidity Above Trendline:

A crucial factor supporting the bullish outlook is the presence of significant liquidity above the downward trendline. This liquidity pool could act as fuel for a strong upward move once ICP breaks through the trendline.

Conclusion:

ICP's recent price action at the $11 support level suggests a potential rebound and continuation of its upward trend. The anticipated retest of $10, followed by a bullish flag pattern formation, could pave the way for a substantial price surge. The abundant liquidity above the trendline further strengthens the bullish case.

Black Monday all over again on October 19 and Where SQ may drop The weekly chart of SQ showed a strong rejection of higher prices at Vwap with an increase in volume and if history is to repeat itself and we have a huge move down like we did on October 19, 1987 then I see prices going all the way down to $10 next week. Its possible for a move of this size because SQ did drop this much on the week of May 9, 2022. The $10 target is based on a measured move of the sideways range.

With so much turmoil going on around the world and with the bond market tanking, I think the equity market has a lot to catch up to in a short amount of time. Tlt 20 year tbond etf had a No Demand up day on Friday on very low volume so its very likely to continue dropping. With interest yields rising, something has to break and I think it will the equity markets.

Decoding Bitcoin's Latest CME Gap: An Insightful AnalysisOver the past weekend, Bitcoin experienced a significant sell-off, causing a price discrepancy to form, commonly referred to as a 'gap'. This gap is discernible between the present Bitcoin market price and the closing price from last Friday (as per New York time). Notably, these gaps, often identified in futures markets such as the Chicago Mercantile Exchange (CME), can serve as potential signals for traders. It's currently anticipated that this gap could be filled in the near future. The phenomenon of 'filling the gap' refers to the price retracing its steps back to the level before the gap was formed, thus restoring market equilibrium. The market's response to this development will be closely watched by traders and investors alike.

MONDAY approaching the top of the Channel Up.Monday.com Ltd (MNDY) is testing today the 1W MA100 (red trend-line) for the first time, being just below Resistance 1 (192.50) and the top (Higher Highs trend-line) of the 8-month Channel Up. This is a strong medium-term Resistance cluster and as the 1D RSI is about to hit its Higher Highs trend-line of its own, we will be looking to sell and target 135.00, on a potential contact with the 1D MA200 (orange trend-line), near the bottom of the Channel Up.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURJPY TRADEWell here i used Fib tool to get another confirmation to enter a trade,we have fib 0.618+retest of daily zone+bullish engulfing,so triple confirmation,if u go to daily and u pull a fib from the low to the hi,0.618 alignes with my zone 144.287-always look as a zone not a LINE,i put the lines because if not my chart looks messy,and daily is retesting ,i only enter when 0.618 or 0.5 alignes,and only using fib sometimes to get multiple confirmation,here a bullish engulfing and a retest would be enough for me,didnt manage to publish the trade before i entered,if someone is interested i can do it most of the time,always glad to help and to share the knowledge

Monday FOMC Weeks QQQ for 12/12This is a 5 minute moving weighted average pattern looking at the Mondays for the past year falling on the weeks of the FOMC meetings. I used a straight average for the first five Mondays, then weighted the last 3 Mondays falling on FOMC at 15% consecutively (7/25/22, 9/19/22, 10/31,22).

Historically, the high clocks in at the 9:40-9:45 interval, followed with a steady decline until 12:10 PM. Look for choppy boxable action from 12:25 to 2:25 with low opportunity for scalping (You should take a walk here, go to the gym, sing a song, or read a book during this time).

Finally we have a good historical liftoff with steady rise starting at 2:45PM until close.

Monday BTC LongI decided to place this small BTC long to see if this Monday move was a fake move.

The last 4 hourly contraction value line was plotted on the chart and an expansion below has happened, perhaps an uptrend to the value line can happen?

TP1: 16150

TP2: 16349

TP3: 16530

TP4: 16700

SL: 15788

═════════════════════════════════════════════════════════════════════════

Contraction Plotter Indicator and Expansion Index:

═════════════════════════════════════════════════════════════════════════

GBPJPY BUYHello traders.

GBPJPY has performed a quite bullish price action. But the market makers' game is usually trapping the retailers on Mondays and reverse the trend later during week. So, I am sceptical.

The pair definitely needs corrections and that is not only an opinion of mine.

It is overbought so many big players will close their profits pretty soon. However, it remains bullish in technical analysis and GBP is bouncing from the lows while JPY keeps loosing value.

Drawing Fib levels from the Swing Low to Swing High, based of the last 4H impulse move, I consider the below Fib retracement area as a great long opportunity.

163.585 - 166.057

Note: it is at a weekly Supply level but I see the potential to break it and aim for Multiyear highs.

good luck

GBPJPY Monday Manipulation GBPJPY Outlook for Nov 7th- Nov 11th

LONG if Closes Bearish

Top-Down Analysis: Starting with a Top-Down analysis POV. In the Daily I will wait and watch for how Monday will Close. Remembering that Monday is huge day for manipulation we need to wait patiently. We do not always need to be in the market. A successful trader is a patient trader.

Trend Analysis: Last week GJ broke out of its channel. This could be a fake out to reel in orders. But, again, we will wait to see how tomorrow closes to adjust how we will attack this pair this week. I expect the pair to close bearish tomorrow.

Fib Retracement: Looking at the Latest Move and applying the Fib tool, we can see that GJ reacted to it’s .5 retracement. Also in this region you will see that GJ is reactionary to 165.000.

50/100/200EMA: Looking at the EMAs, you can see the GJ is currently reacting to the 100day (yellow) EMA. I expect GJ to stay above the 100day, and react to it, as I have placed the LONG entry zone. If everything plays out to this action, one could take advantage of another 300-500pip impulse.

If orders start to flood in, the price action will NOT move with a straight impulse as One would like, and it would invalidate this theory. An influx of orders will cause a volatile week, where we can see spreads reaching to sweep S/L’s, if that is the case.

SHORT if Closes Bullish

IF GJ closes bearish tomorrow, I expect to GJ to react to 168.000 before another move to the downside. If price moves to the downside this will, validate the Fake-Out, which I previously mentioned, and stay within the channel that it has been moving in the past week or so.

What are YOUR Thoughts? I’d Love to hear from you!

This is not financial advice! This is my Own Outlook on GJ’s price movement at this given time.

Thanks and I hope you enjoyed the read… Have a great Week!

US30 - 10 SEPTEMBER 2022Monday we expect a retracement of the market before pulling down again, the big entry is the sell which can hold for a 1000 pips.

US30 3rd of OctoberThe first 2 weeks of October we are going to see a retracement, The market has been bearish the whole of September we saw a 10% drop. But in October only 2 weeks would be bullish and on the 17th Of October (The third week), market will continue to go bearish I dont know for how long But maybe till December(But I will still check it) Analysis not yet full proof, Monday we give us an idea. We should look at the 27000 price level if it can hold analysis is full proof.

BTC Monday Price PredictionBTC Market is open 24H a week and seven days a week. What does that mean for traders? I need to be on point while trading! More Hours are put into analysis and following Trends. More work and hours following Movements of the market. It is all over the place. Hard to believe one idea, but you can learn and Backtest an idea until you get it correctly.

BTC Low Volatility today.

It's great to keep track of these data for future trading Strategies and more illuminated entry and exit points.

Todays #CryptoWhale100Billion Analysis:

If BTC goes bearish. The next bear will be around $17000

I am more bullish due week sales the past few days and a large buyback to the $19300, and we may see it run around up to $21000

Shoot me a message with your Technical Analysis would like to see what your thoughts are and trading strategies.

Gbp/nzdHello Traders, here is the full analysis for this pair, let me know in the comment

section below if you have any questions, the entry will be taken only if all rules of

the strategies will be satisfied. I suggest you keep this pair on your watchlist and

see if the rules of

your strategy are satisfied. Please also refer to the Important

Risk What you can afford to lose