#Monero may Rally another 17% if XMR Bulls Break $120Past Performance of Monero

Monero prices are floating higher, rising with the crypto tide. It is up five percent in the last trading day, bottoming up from the 2022 lows. Technically, buyers are steady, and prices are consolidating within a $20 zone. The immediate support is $100, while resistance is $120. As prices edge higher, a break above this liquidation level at $120 may spark more demand, fast-tracking the expansion of XMR prices in subsequent sessions.

#Monero Technical Analysis

Traders appear confident, reading from the formation in the daily chart. Sellers remain in charge from a top-down analysis since resistance is at $120. If bulls build on gains of June 19, a close above $120 may draw in more buyers targeting $140. This is the 78.6 percent Fibonacci retracement level and May 2022 lows of the April to June 2022 trade range. Still, bears would be back in the picture if prices pullback from spot levels to below $100 with rising trading volumes.

What to Expect from #XMR?

Monero is rising as trading sentiment shifts. Gains above $120 may see the coin add more than 25 percent to a critical reaction point in the short term. Nonetheless, XMR sellers are in control from an Effort versus Results perspective.

Resistance level to watch out for: $120

Support level to watch out for: $100

Disclaimer: Opinions expressed are not investment advice. Do your research.

Moneroanalysis

#Monero adds 90% From Q1 2022 Lows, Will #XMR Rally to $300?

Past Performance of Monero

Monero is stable in the previous 24 hours but up eight percent versus the USDT in the previous trading week. Technically, buyers are in control, adding roughly 90 percent from Q1 2022 lows. #XMR remains bullish above April 18 lows and the support line marked by the flexible 20-day moving average from the daily chart.

Monero Technical Analysis

Overall, #Monero buyers have the upper hand reading from the candlestick arrangement in the daily chart. Even though the uptrend's momentum appears to be slowing down, the inability of sellers to completely unwind the gains of April 18 and break below the $230 signal strength. As a result, traders may find entries on dips above $230 with an immediate target at $300. On another approach, risk-averse buyers can wait for a clean break above $270 before trading with the primary trend. If sellers press lower, losses below April 18 lows and, most importantly, the middle BB may entail a bear breakout, possibly driving XMR towards $185.

What to Expect from XMR?

Monero is firm to the upside, finding support above the middle BB. Based on the formation in the daily chart, XMR may float higher to $300 provided buyers sustain prices above spot rates.

Resistance level to watch out for: $270

Support level to watch out for: $230

Disclaimer: Opinions expressed are not investment advice. Do your research.

Monero Daily TF Analysis 07/02/2021we can see XMR is in a bullish channel and it can continue in the same direction

we may have some retracement to its bullish Fibonacci retracement golden level and then start its rally

we can target the 27% of fib expansion as our 1 TP 235 and 127% of fib projection as our 2 TP 269

how do you think?

XMR (Monero) Coin Analysis 17/03/2021we had Analyzed the Monero Coin earlier and capitalized on it with two Targets:

Fundamentals:

Monero was launched in 2014, and its goal is simple: to allow transactions to take place privately and with anonymity. Even though it’s commonly thought that BTC can conceal a person’s identity, it’s often easy to trace payments back to their original source because blockchains are transparent. On the other hand, XMR is designed to obscure senders and recipients alike through the use of advanced cryptography.

The team behind Monero say privacy and security are their biggest priorities, with ease of use and efficiency coming second. It aims to provide protection to all users — irrespective of how technologically competent they are.

Overall, XMR aims to allow payments to be made quickly and inexpensively without fear of censorship.

There are several things that make Monero unique. One of the project’s biggest aims is achieving the greatest level of decentralization possible, meaning that a user doesn’t need to trust anyone else on the network.

Privacy is achieved through a few distinctive features. Whereas each Bitcoin in circulation has its own serial number, meaning that cryptocurrency usage can be monitored, XMR is completely fungible. By default, details about senders, recipients and the amount of crypto being transferred are obscured — and Monero advocates says this offers an upper hand over rival privacy coins such as Zcash, which are “selectively transparent.”

Obfuscation is achieved through the use of ring signatures. Here, past transaction outputs are picked from the blockchain and act as decoys, meaning that outside observers can’t tell who signed it. If Ian was sending 200 XMR to Susan, this amount could also be split into random chunks to add a further level of difficulty.

To ensure that transactions cannot be linked to one another, stealth addresses are created for every single transaction that are only used once.

All of these distinctive features have led to XMR being increasingly used for illicit transactions instead of Bitcoin — especially on darknet markets. Governments around the world, especially the U.S., have also offered hundreds of thousands of dollars to anyone who can crack Monero’s code.

Seven developers were initially involved in creating Monero — five of whom decided to remain anonymous. There have been rumors that XMR was also invented by Satoshi Nakamoto, the inventor of Bitcoin.

XMR’s origins can be traced back to Bytecoin, a privacy-focused and decentralized cryptocurrency that was launched in 2012. Two years later, a member of the Bitcointalk forum — only known as thankfulfortoday — forked BCN’s codebase, and Monero was born. They had suggested “controversial changes” to Bytecoin that others in the community disagreed with and decided to take matters into their own hands.

It’s believed that hundreds of developers have contributed to XMR over the years.

Technical Analysis:

As you can see the price has broken above the Ascending channel and made a new ATH, retested the TOP boundary of the same Parallels Chanel and is on the its Bullish Rally.

there exist a Hidden Bullish Divergence of Price with MACD histogram which is the sign of Bullish trend Continuation and it acts as an other confirmation for the Bull Run.

we have defined 3 New Targets with Fibonacci Projection where as ALL 3 are to be Achieved while the price may does Correction and Retracements in the Process.

MONERO LONG and LEVELSMonero has a nice setup for long positions. Just check the volume and be careful around strong SR.

Monero- Looking to buy for 500 targetThis coin held pretty well during the sell of, and looking on the chart we can see that, after reaching the last ATH's support, it reversed putting in a long tail on the daily candle.

More, yesterday the situation is similar, and we gain have a long tail on the daily candle and also a higher low.

These are clear indications for me that bulls are still in control and gains should accelerate.

As I said, 500usd is my target for Monero and only a decisive dive under 300 would change my bullish bias

I'm looking to buy dips

What about Monero? Huge gains or just another doomed altcoin?On this weekly log chart you can see XMR is now at a crucial point in it's next market cycle.

The red down arrow shows the current point XMR is at compared to the last bull cycle shown by the purple down arrow. As you can see they are at similar points when you compare them on the chart as well as on the LMACD where it rose above the level of 0.095 on the weekly chart and stayed above it till the next ATH.

On the RSI you can see where the lime green line is that if the RSI holds above this level it maintains it's bullish momentum upwards. Will it be the same from where XMR is currently till the next ATH?

The Fibonacci Retracement indicator shows that at the 0.618 level @ $96.52 there was resistance and now XMR has broken above it and heading up to the previous high of $132.27 where XMR should see some resistance again before heading up to the small lime green line @ $157 where some heavier resistance should be met.

XMR also broke above the thick red line @ $105 which had held as resistance since July 2019. The next major resistance is at the next red horizontal line @ $224 as well as the $200 level.

On the daily chart shown below you can see on the LMACD that the 0.095 on the daily time frame shows that XMR can be shorted when it hits this mark and you will make a profit every time if you know when to close the trade and not be greedy. On the RSI it also shows that when it hits 80 it is also a good time to short XMR.

So, XMR should hit the lime green line @ $157 and then retrace back to the red horizontal line @ $105 which should roughly be in line with the RSI and LMACD shorting opportunities when they hit their marks as indicated above on the daily time frame. This pullback should hit the weekly MA 21 or EMA 34 before then moving further up towards the next major red line @ $224.

As a long term stab in the complete dark, XMR may hit 30k if bull run takes till Dec 2023 to peak or 16.5k if the peak is Dec 2022. As it is one of the only true privacy coins going around I can't see XMR going anywhere as it is a useful tool for certain purposes.

Happy trading legends!

HTBB

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (79.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a uptrend and the Continuation of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 58.

Take Profits:

TP1= @ 145.90

TP2= @ 120.95

TP3= @ 96.90

SL= Break below S2

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (79.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a uptrend and the Continuation of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 58.

Take Profits:

TP1= @ 145.90

TP2= @ 120.95

TP3= @ 96.90

SL= Break below S2

Don't miss the great buy opportunity in XMRBTCTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (0.00825). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRBTC is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 71.

Take Profits:

TP1= @ 0.00939

TP2= @ 0.01030

TP3= @ 0.01140

SL= Break below S2

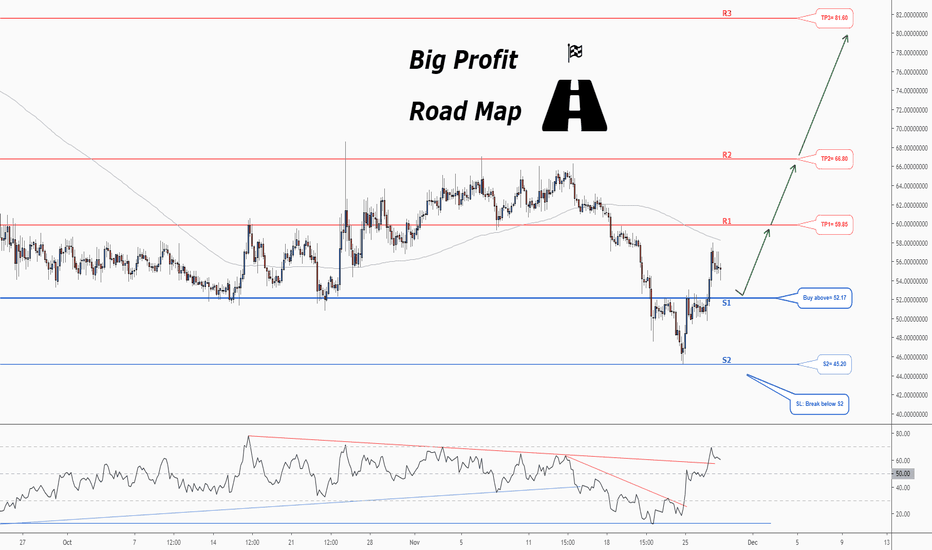

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (52.17). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 60.

Take Profits:

TP1= @ 59.85

TP2= @ 66.80

TP3= @ 81.60

SL= Break below S2

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (52.17). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 60.

Take Profits:

TP1= @ 59.85

TP2= @ 66.80

TP3= @ 81.60

SL= Break below S2

Monero Technical Analysis - XMRUSD - 31%-404% Profit ExpectedMonero - XMRUSD - Technical Analysis - 31%-404% Profit Expected

Don't Miss This Profitable Opportunity ... 4x - 5x Gains Expected.

Based on AB=CD pattern , Time Ratio & Gann Analysis, It's a potential long position with great returns :)

In a lower time-frame (4hrs) this long position has also been confirmed.

Target Profit Range - 51 - 169

(31%-404% Profit Expected)

TP - 1 - 51

TP - 2 - 74

TP - 3 - 100

TP - 4 - 124

TP - 5 - 147

TP - 6 - 169

Buying Zone! Long Position

Early Entry Trigger Point - 36 - 39

Ideal Entry Trigger Point - 32 - 35

***If you want to get in this trade from this point 60 you can still make 23% profit till TP2 is reached, however, there is a very high probability that price may continue to move down towards my ideal entry point., It is recommended to enter with a smaller lot size if you want to go long right away & manage your stop loss accordingly.

Good Luck.!

Disclaimer - This is not financial advice. This is my personal view and analysis of this chart.

If you follow this idea please plan your trade according to your lot size and account equity.

Don't forget to like, comment & follow , If you agree with my analysis :)

Monero Analysis: Intraday Timeframe Chart Patterns and Bullish BConclusion for today’s Monero Analysis: Price closing above ~65.518 implies bearish momentum slowing down and a potential change in the trend from bearish to bullish.

Monero analysis for today is presented on a 6 hour timeframe. Chart examination is provided from December 2018 to current date. Also included in today’s Monero Analysis is the 200 moving average and 50 moving average used to track price movement and/or trend changes.

The period from December 15, 2019 to June 23, 2019 produced an uptrend in Monero that has been followed ever since by down trending price action. Formation of a Head and shoulders top pattern between May 16, 2019 and August 14, 2019, as well as the downward sloping moving averages (200 and 50) provide further evidence for the current bearish trend in Monero.

A bearish price channel (not shown here) can also be plotted to capture price action from the June 23, 2019 price peak till date. A break above the upper boundary of the channel could therefore provide confirmation of bullish momentum in Monero.

Besides, ~65.518 is indicated on the chart as the price level to pay attention to as price recapturing the aforementioned level does suggest a slowing down of bearish momentum and/or change in the current trend from bearish to bullish.

Don't miss the great buy opportunity in MONEROTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (86.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 45.

Take Profits:

TP1= @ 97.00

TP2= @ 106.25

TP3= @ 120.87

SL= Break below S2

Monero Analysis (XMRBTC): Intraday Timeframe Chart PatternsConclusion for today’s Monero Analysis (XMRBTC): Price closing above ~0.01179518 implies resumption of the current bullish swing from May 13, 2019.

The 1 hour timeframe of Monero (XMRBTC) is presented using a log scale. Price action covered focuses on the bearish price channel to current date. A break out with XMRBTC closing above the upper boundary of the channel provides evidence for a termination of the current downtrend.

In addition, sideways price action has followed the channel with the formation of a symmetrical triangle (coil) reflecting a balance in power between XMRBTC bulls and bears. Of important note is the presence of a pennant structure inside of the symmetrical triangle. This is acceptable as a formation as chart patterns naturally can nest inside of one another.

The pennant is ideally a continuation pattern suggesting that the previous trend should resume upon completion (or confirmation) of the chart pattern, and in this case, bullish. Horizontal lines of support and resistance boundaries are also indicated on the 1 hour timeframe with a close below 0.01012464 indicating resumption and bearish strength.

The most conservative entry into a long position therefore involves buying Monero on a break above the uppermost boundary of intraday resistance at ~0.01179518. Buying on a break immediately after a break of the pennant to the upside is considered less conservative as it anticipates a break above resistance and therefore resumption of bullish momentum.