Bitcoin- 175-200k by year's endEvery major Bitcoin move over the last decade — whether a jaw-dropping bull run or a brutal crash — has shared one silent macro trigger.

It’s not the halving.

It’s not ETF hype.

It’s not Twitter sentiment or TikTok FOMO.

👉 It’s global liquidity.

And right now, this powerful force is expanding fast — the same setup that previously drove Bitcoin from $5K to $70K in under a year.

But here’s the twist: as of today, Bitcoin is already trading near $120,000, not $20K or 30k.

That means the engine is already roaring — and if this macro thesis holds, the next stop might just be $175,000-200.000 by year's end.

________________________________________

🧠 What Is Global Liquidity, Really?

Global liquidity = the total money sloshing around the financial system.

It’s often measured through M2 money supply, combining:

• Cash

• Checking/savings deposits

• Easily accessible liquid assets

The most comprehensive view comes from Global M2, which aggregates liquidity from 20 of the world’s largest central banks.

Right now, Global M2 is not just rising — it’s breaking to all-time highs.

And if history repeats itself, Bitcoin tends to follow this wave closely.

________________________________________

📅 Past Performance: Bitcoin and Liquidity Walk Hand in Hand

Let’s break it down:

• 2016–2017: Liquidity surges → BTC +5,000%

• 2020–2021: Post-COVID easing → BTC $5K to $69K

• 2018 & 2022: Liquidity dries up → BTC crashes ~70%

It’s a recurring pattern:

Liquidity drives the crypto cycle.

________________________________________

💡 Why Liquidity Moves: Interest Rates and Central Banks

Central banks control the tap.

• 🟢 Cut rates → Easier credit → More lending → More liquidity

• 🔴 Raise rates → Tighter credit → Less spending → Liquidity contraction

In 2022, the Fed tightened hard.

🧊 U.S. money supply shrank.

📉 Bitcoin fell from $70K to $15K.

But starting August 2023, the Fed paused, then pivoted.

Since then:

• 🟢 The U.S. M2 supply rebounded

• 🟢 Global M2 began expanding again

• 🟢 Over 64 global rate cuts were made in just six months — one of the fastest global easing cycles in history

The last time we saw this much cutting? 2020.

And we all know what happened to Bitcoin then.

U.S M2

________________________________________

🟢 Today’s Setup: The Engine Is Already Running

Fast forward to mid-July 2025:

Bitcoin is no longer at $30K — it’s already testing $120K.

Intraday highs have touched $123K, with a current consolidation zone between $117K–$120K.

This isn’t a "recovery rally" — we’re already in price discovery territory.

The question now becomes:

Is $150K and above next… or are we topping out?

________________________________________

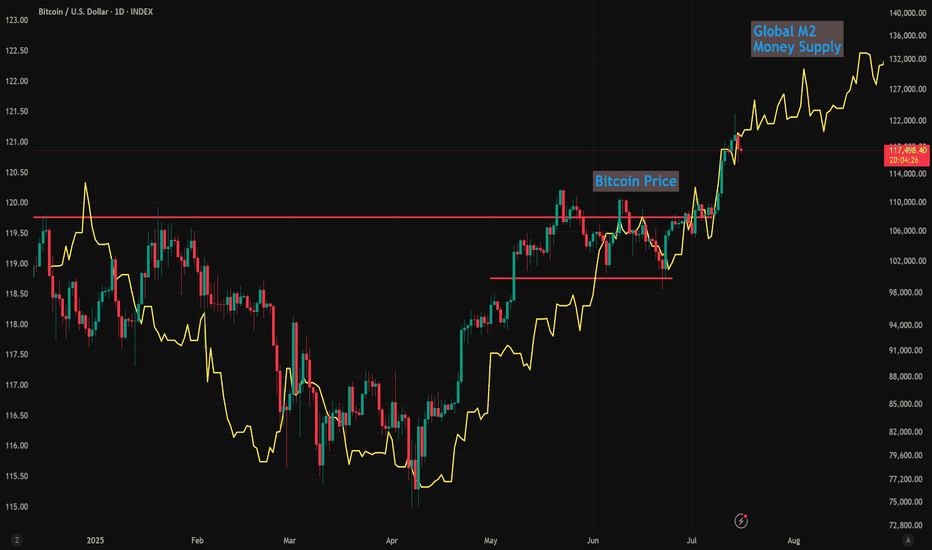

📈 Charting the Path: Bitcoin vs Global M2

When we overlay Bitcoin price over global liquidity trends, one thing becomes crystal clear:

📊 Bitcoin tracks liquidity direction.

• When money supply expands, Bitcoin rallies.

• When money dries up, Bitcoin tanks.

Given that global M2 is at record highs, and liquidity conditions are easing globally, the chart suggests there’s still plenty of fuel in the tank.

And if we follow the same growth, Bitcoin could realistically reach $175,000 before 2026 kicks in.

________________________________________

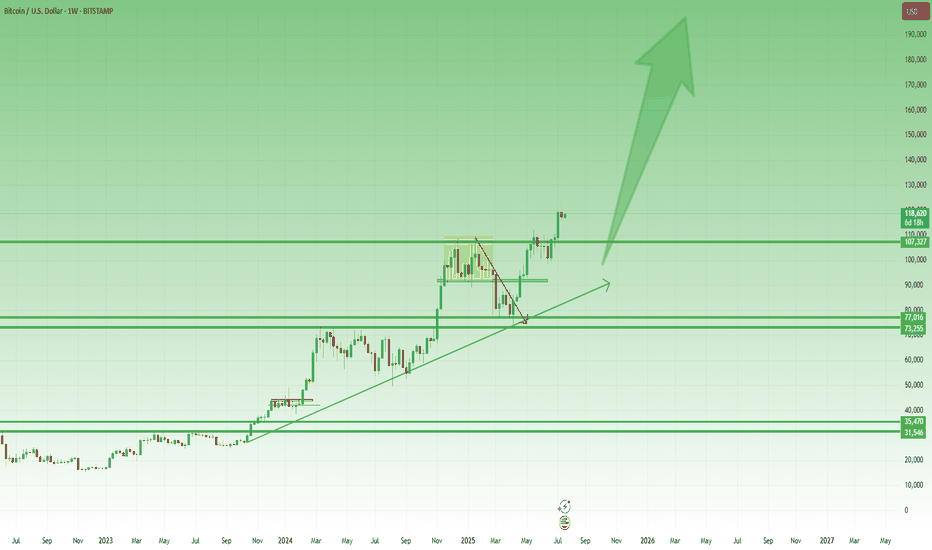

Technically:

As we can clearly see from the posted weekly chart, you don’t need to be an expert to recognize the strength of the current uptrend.

While last week printed a small bearish Pin Bar, this alone shouldn’t raise major concerns — especially considering the presence of multiple key support levels, starting from the 110K zone.

In the context of a strong and well-established trend, such candles often reflect normal short-term profit-taking, not a reversal.

🎯 Conclusion – Don’t Fight the Tide

This isn’t about hopium.

It’s not moon talk.

It’s about macro flows and monetary velocity.

Ignore the noise.

Watch what the central banks are doing.

Because Bitcoin moves not on wishful thinking, but on waves of liquidity — and the tide right now is rising fast.

Whether $175K comes by year-end, one thing is clear:

We are in the middle of a liquidity-driven expansion phase, and Bitcoin is already responding.

Stay focused, manage your risk, and don’t chase — ride the wave. 🌊

Moneysupply

Global M2 Money Supply (70/84/90 Day offset) and $150k BTCI'm using Global M2 slightlty different than most here, and showing it behaves differently during different periods of the cycle.

Many people say M2 leads Bitcoin by 10-12 weeks (70 - 84 Days) and I've seen periods where it does... But in this phase of the bull-run 90 days is working best.

We can see the dip in M2 around now coinciding with the drop in Bitcoin prices.

Of course, these are not directly correlated and can't be relied upon as predictive.

But it's following pretty close, and overall looks great for further upside!

I'll follow up with a video on this if anybody is interested.

Altcoins (Market Cap) - Excluding Top 10 Coins - Inverted H&SBullish setup on the daily chart. CRYPTOCAP:OTHERS have once again made a inverted head & shoulders pattern which is a bullish reversal pattern. With the yellow chart below showing the Global M2 Liquidity index breaking out aswell. With more money in circulation, the propabilty is that more money will enter the market over time. Although, there can be latency.

For now I will trust the patterns in the chart of Others and follow it to see IF we can confirm the Inverse H&S. We have to break the neckline which should be around 310-325 B for June and July. But still, after that we need a pullback to confirm that neckline and make it support for continueation.

It´s a very interesting world right now. And much can happen. But IF this break out. It would probably be one of the most explosive bull markets to remember for a long time.. I myself are holding quality coins and tokens. Im not in memecoins, whats so ever. With the adoption happening right now in crypto I don´t believe that is the right market to be in right now.

Nothing on this profile should be interpreted as financial advice. Always do your own research and investment decisions. Im only expressing my thoughts and beliefs. Nothing else. Crypto is a risky business but It also has a lot of reward If being right. I can´t find equal yield in any other markets for now. If you know any, plz comment below =)

BINANCE:BTCUSD

CRYPTOCAP:OTHERS

CRYPTOCAP:TOTAL

MARKETSCOM:ETHEREUM

BINANCE:SOLUSD

BINANCE:SUIUSD

ICEUS:DXY

73 days looks to be spot on73 Day Lag to the Global M2 Money Supply looks to be spot on for the last year. If it is, this is good news with the M2 still climbing.

If I am right, we will have a dip within 24 hours of May 28th, only to get another pump to the upside withing 24 hours of June 2nd.

(I tried inputting all this data to Grok in order for him to give me some price targets. They were close to where I think the price will be but using the M2 for price targets still needs some work.)

Global M2 MONEY SUPPLY VS GLOBAL LIQUIDITYWhich is the best to track ₿itcoin price action?

Lots of macro gurus have been arguing over the two.

For comparison, I have indexes for both metrics on a 12-Week Lead, tracking the 4 largest central banks:

The Federal Reserve (including TGA & RRP), People’s Bank of China, European Central Bank and Bank of Japan.

Let’s start by defining each.

Global M2 Money Supply covers physical cash in circulation and cash equivalents such as checking and savings deposits, as well as money market securities.

Global Liquidity covers a broader measure of liquid assets driven by central bank balance sheets, private sector financial activity (e.g., lending, corporate cash), and cross-border capital flows.

Historically, both move closely in lock-step and act as a great leading indicator for ₿itcoin, however we can see that Global Liquidity can have more drastic fluctuations.

We saw a large divergence in CRYPTOCAP:BTC PA with both metrics when the Blackrock iShares ₿itcoin ETF appeared on the DTCC list, a procedural step signaling progress toward potential approval.

When you look at the charts of all three, you can see there are points where either metric might follow CRYPTOCAP:BTC PA a bit closer, so in the end I would say it’s best to track both to find confluence in the signal.

The REAL Bull-Market Has Yet To Come: Here's Proof!In this analysis I want to talk about the M2 Global Money Supply indicator. This indicator basically shows how much money there is in circulation and how much is being printed.

The indicator itself is not that usefull since it's just going up (more money is printed over time). However, the rate at which money is printed is more interesting, hence I slapped an RSI indicator on top of it.

As seen on the chart, the RSI of the Global M2 shows that Bitcoin tops around the time that the RSI tops. It's not accurate enough for day-trading, but at least useful for to detect long-term moves.

The RSI of the Global M2 has always topped around the 70-75 points. It's currently sitting at 60.3, so there's quite some room left to grow (last time it took almost a year to go from 60 >75).

Furthermore, we can see that the "real" bull-market or Hype Phase starts once the RSI is above 65 and continues to climb.

In short, the "real" bull-market has not started yet and BTC has much more room to grow over the next 1-2 years.

Happy to hear your thoughts on this analysis.

Macro Monday 59~Japan Interest Rate Hikes Often Lead Recessions Macro Monday 59

Japan Interest Rate Hikes Often Lead Recessions

Apologies for the late release this week, I was ill yesterday and I am slowly making a recovery. This week I am keeping it brief however the chart really will speak for itself.

If you follow me on Trading view, you can revisit this chart at any time and press play to get the up to date data and see if we have hit any recessionary timeline trigger levels. They are very handy to have at a glance.

The chart illustrates the Japan central banks Interest rate history and overlays the last 7 recessions. A few key patterns and findings are evident from the chart which I will summarize below.

The Chart - ECONOMICS:JPINTR

SUBJECT CHART

◻️ 5 of the last 7 recessions were preceded directly by Japan Interest rate hikes.

- Arguably it is 6 out of 7 if you include the 1980 recession with the 1981 recession (which happened as rates were still declining from the original increase).

⌛️The average length of time from the initial hike to recession was 11.6 months.

- This would be Jan/Feb 2025 based on the initiation of Japan’s rate increases in Feb/Mar 2024. If you read my material you’ll know that the date of Jan 2025 has repeatedly arisen as a concerning date on multiple charts. This does not guarantee anything other than historical time patterns on multiple charts seem to point roughly towards Jan 2025 as a month of concern.

◻️ The minimum time frame from initial hike to recession was 8 months (Oct 2024) and the maximum time frame 18 months (Aug 2025). This can be our window of concern.

◻️ Its important to note that the rates have remained elevated or increasing for longer than the above timelines outset. In this chart we are only looking at the the first rate increase to recession initiation timeline. We are doing this establish a risk time frame. In the event rates remain elevated into month 11.6 (the average timeframe) we will know we are entering dangerous territory (Jan 2025). Likewise we could go a long as 18 months which is the maximum timeframe. This is all dependent on rates remaining elevated or increasing. A reduction in rates could deter or remove the risk timelines discussed.

What happens next is dependent on what the Japan Central bank does. History suggests when they start to increase rates its for a minimum of 6 - 8 months (Sept - Oct 2024), lets see if they pass these months and start to move towards Jan 2025 (the average time line from rate increase initiation to recession). This is a move into higher risk territory.

I want to add last week summary as a reminder that multiple other charts are lining up to suggest we may have volatility in the coming 6 months:

Macro Monday 58

Recession Charts Worth Watching

What to watch for in coming weeks and months?

▫️ If both the 10 - 2 year treasury yield spread and the U.S. Unemployment Rate continue in their upwards trajectory in coming weeks and months, this is a significant risk off signal and recession imminent warning.

▫️ Since 1999 the Federal reserve interest pauses have averaged at 11 months. July 2024 is the 11th month. This suggests rate cuts are imminent.

▫️ The 2 year bond yield which provides a lead on interest rate direction is suggesting that rates are set to decline in the immediate future and that the Fed might lagging in their rate cuts. Furthermore, rate cuts are anticipated in Sept 2024 by market participant's.

▫️ Finally, rate cuts should signal significant concern as most are followed immediately by recession or followed by a recession within 2 to 6 months of the initial cut. Yet the market appears to be calling out for this. This is high risk territory. Combine this with a treasury yield curve rising above the 0 level and an increasing U.S. unemployment rate and things look increasingly concerning.

(for all of the above charts see last weeks Macro Monday).

____________________________________

As always you can log onto my Trading View press play on the chart to see where we are, and get an visual update immediately on if we are at min, avg or max recessionary levels.

PUKA

Is Bitcoin broken? Why isn't it going up? A lot of folks are scratching their heads, wondering why Bitcoin isn't taking off like a rocket 🚀. Some even reckon it needs to take a nosedive before we see any action. But what's the deal with Bitcoin? Why does it seem like we're just going sideways? Let me break down a few things that, in my humble opinion, are affecting Bitcoin's price and what I think might go down.

**1️⃣ Miners Offloading Bitcoin**

Let's talk about mining. Miners are the backbone of the Bitcoin network. They validate transactions and keep the blockchain secure. But here's the kicker: Bitcoin's got this thing called "halving," where the rewards miners get are cut in half. In a few months, the cost of mining will double as the block reward drops from 6.25 to 3.125 BTC per block. So, miners are stocking up to cover their costs after the halving. Most of this selling happens on the down-low to avoid messing with the price, hence the sideways action.

**2️⃣ Big Picture Stuff**

Bitcoin was born in the ashes of the 2008 banking crisis, where Quantitative Easing (QE) was the name of the game, meaning cheap money galore. But now, we're in a period of Quantitative Tightening. Interest rates are sky-high, making money expensive. People are holding onto their cash, expecting a possible recession down the line. Geopolitical tensions and global shake-ups don't help either.

**3️⃣ It's All About the Cycles**

Take a look at the Bitcoin price chart, and you'll see cycles every four years. Bull run after the halving, hitting a peak, then dipping into bear territory. Rinse and repeat. BTC hasn't broken its all-time high before the next halving so far, and I don't see why it would now.

✅ So, what's the outlook, you ask?

📍 We're probably in for more sideways action, at least until we get close to the halving. Here's what's on my radar:

**1️⃣ BlackRock's ETF:** They wouldn't bother filing for an ETF if they didn't think it'd get the green light. The expected decision date is March 30th, 2024, right before the next BTC halving.

**2️⃣ Scarcity on Exchanges:** Unlike past halvings, there's hardly any BTC sitting on exchanges. This scarcity could lead to some wild price swings.

**3️⃣ The Halving:** As Satoshi said, "The price of any commodity tends to gravitate toward the production cost." After the halving, production costs double, so BTC's gotta climb to catch up. Miners will try to hold onto their BTC to turn a profit, making it even scarcer.

**4️⃣ End of QT:** When people stop spending, and the economy tanks, we'll likely see a shift from Quantitative Tightening (QT) back to Quantitative Easing (QE). That's a good sign for BTC and investment in general.

❓ When's all this gonna happen? My gut says not much until the second half of 2024, but if those four factors line up nicely, we might get a Bitcoin rally reminiscent of 2017, rolling into 2025. 🚀

🎙️Got thoughts? Share 'em in the comments and hit that like button if you found this overview useful. Don't forget to follow for more ideas.

Modeling a shift in SRAS and AD over the past year, I think. I used the U.S PCE YoY as the base, I then overlaid the M1 YoY and Real GDP YoY. I used the beginning of this years as a reference point as that is roughly when the fed began increasing interest rates.

As the price level declines demonstrated by a decline in the money supply and PCE YoY declining

Real GDP YoY is seen increasing

To my understanding this visualizes how SRAS and AD have shifted to the left over the past year

S&P500 Vulnerabilities: from Money Supply to Sectoral ImbalancesAs much as we try not to repeat ideas here, occasionally, an opportunity emerges to harp on the same point.

As we have previously laid out the bear case for the S&P 500 from a historical volatility behavior perspective, this week we will zoom in on other metrics showing why we think the S&P may struggle from here.

The first and most interesting measure, in our opinion, is the S&P 500 when adjusted by the money supply. Once again it appears to have peaked and is on the path of reversal now. The S&P500 / Money Supply has reached these levels not once, not twice but thrice, stopping at the same level before reversing. More importantly, overall, we see the S&P 500 clearly climbing up in line with the level of money supply.

Money supply has been on a decreasing trend since the start of the Federal Reserve hikes. While the downtrend has been paused momentarily with money supply slightly increasing in early 2023 it now seems to have resumed the downward path. This could spell bad news for equities given that the S&P has broadly followed money supply and the clear resistance observed on the S&P 500 / Money Supply chart.

As yields creep higher, investors will eventually second guess whether it still makes sense to put more into the equities when cash now yields more. The 6-month treasury yield is now higher than the S&P 500 earnings yield, a phenomenon not experienced since the turn of the millennium. A federal reserve resolute in keeping rates higher for longer might just be the kicker for investors to turn to these shorter dated treasuries while waiting out equity volatility.

With a series of better-than-expected economic data, the Federal Reserve once again gains greater headroom to maintain its higher for longer stance, which is causing discomfort in the equities market. All eyes will be on the Non-Farm Payrolls numbers coming out tomorrow for further confirmation if the US economy can indeed take this regime of higher rates.

Within the S&P 500, the Technology sector remains the significant outperformer compared to other sectors like Financial, Consumer Staples and Energy. With the Technology Sector / Financial Sector ratio extending far beyond the trend from 2017.

The combination of money supply metrics, yield comparisons, and sectoral imbalances, among other factors, makes a compelling case for a bearish outlook on the S&P 500. For investors seeking targeted strategies, CME E-MINI Select Sector Futures offers a refined approach, allowing for an overall bearish view on the S&P 500 while building positions in certain sectors through a relative value strategy. To express the bearish view on the technology sector relative to the financial sector, we can take a short position on the E-MINI Technology Select Sector Futures and a long position on the E-MINI Financial Select Sector Futures. Given the contract size differences, to roughly match the notional, we will need 3 E-MINI Financial Select Sector Futures at the current level of 405 to match 2 E-MINI Technology Select Sector Futures.

3 x E-MINI Financial Select Sector Futures Notional = 3 * 405 * 250 USD = $303,750

2 x E-MINI Technology Select Sector Futures Notional = 2 * 1678 * 100 USD = $335,600

Each 0.1 index point move in the E-MINI Technology Select Sector Futures is $10, while each 0.05 index point move in the E-MINI Financial Select Sector Futures is $12.5.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

www.cmegroup.com

S&P500 = PRICING IN THE MONEY SUPPLYIn today's chart, we look at the S&P500 divided by the WM2NS (money supply).

The upward trend of the S&P500 has been unstoppable since 2009 and has climbed to new heights since 2013.

> However, as soon as you divide the chart with the "MONEY QUANTITY", the unadulterated chart = the reluctant truth is revealed.

= Regardless of the rising price of the index, it has not changed in real value / hardly noticeable.

= The "stock rally" was accordingly only the pricing in of the rising money supply.

We have been in a sideways channel for about 30 years:

= this was broken by the "DOT COM BUBBLE" and the "FINANCIAL CRISIS".

= in the chart, you can clearly see that the channel serves as support and resistance.

Currently, we are on the way to the bottom of the channel = another 18% - Downside.

> at this bottom, there is a high probability that we will run again to the other side of the range = 64 % - upside.

Looking at the 18% - downside in the S&P500, we would end up at around 3,000 points.

> The 3,000 mark not only goes over one with Fibonacci and POI levels, but also represents a strong DEMAND zone on the monthly chart.

> Based on this, we can expect a reaction in this area on a further down-sale.

Looking at the range, a scenario of further down-sale is more than likely and goes along with the opinion of many.

If this idea and explanation has added value to you, I would greatly appreciate a review of the idea.

Thank you and a successful trading!

🔥 Bitcoin vs Money Supply: Massive Move On The Horizon?M1 Money Supply (M1SL): "M1 is the money supply that is composed of currency, demand deposits, other liquid deposits—which includes savings deposits. M1 includes the most liquid portions of the money supply because it contains currency and assets that either are or can be quickly converted to cash." - Investopedia

The M1SL amount is important since it tracks the amount of money in an economy that is able to be deployed quickly into the economy. If people have more to spend, they will generally spend more as a result of this.

When we take a look at the $ value of BTC divided by M1SL, the chart has been trading relatively flat since December of 2017. This means that Bitcoin has not gained substantially against the central banks' money printers.

On the other hand, it appears that BTC/M1 has been forming an inverse Head & Shoulders pattern over the last 5.5 years. Assuming this pattern will play out, BTC will continue to gain against M1 and break out of this 5.5 year consolidation pattern. Assuming that M1 will continue to increase (like it always does), this would mean that BTC will see another 2016-2017 scenario in the future where it will see exponential returns and potentially even do a 100x over the next few years.

This scenario is not the most likely scenario to play out, but it's definitely an interesting one. Hope to hear your thoughts in the comments 🙏

M2 Money Supply versus Global Net LiquidityM2 is getting a lot of attention, but is it really driving markets? M2 is the Federal Reserve's estimate of the total money supply including all cash hand, money deposited in checking accounts, savings accounts, and other short term savings. The rate of change for M2 over the past 3 years has been the steepest incline and decline in the M2 rate of change in history. However, global net liquidity, which is driven by fractional reserve banking and credit expansion from cycling credit between central banks and the private sector, as far greater impact on markets and is more strongly correlated than M2.

In the fall of 2021 the Federal Reserve announced the end of quantitative and monetary easing, marking the top of the market for risk assets. Other central banks followed suit and interest rates increases and liquidity tightening started in the beginning of 2022. This contraction is highlighted in the red box in the center of the chart. The white line in the center marks the liquidity bottom that we observed in the fall of 2022 which also marks the bottom for risk assets. The green box highlights the expansion in liquidity that begins immediately after with a correlated and coincident rise in risk assets. Note that M2 has continued to contract and interest rates hikes have continued during this time.

Michael Howell regularly tweets timely and insightful updates on global liquidity. I highly recommend following him @crossbordercap twitter.com Thank you to Codi0 and to dharmatech for their work on the liquidity indicators. These are fantastic editions to macroeconomic and monetary analysis.

Things are looking very ugly, day by dayRate hike will continue as Jerome has no way out now. 50 basis points is my projection. Experts cannot see any concrete signs that economy is under control, in which they are right.

Wall St banker's narrative are switching from soft landing, to crash landing.

US money supply has shrinked while yield curve remain heavily inverted. Uh ohh.

Congress voted to end emergency allotment. This means millions of Americans will lose $3 Billion a month food stamp benefits.

Debt levels across all segments & categories are at record high.

Layoffs are still on-going and is not stopping.

Stay liquid and conserve ammunition. The bottom is not in yet.

By Sifu Steve @ XeroAcademy