MOODENG/USDT Technical Analysis – Massive Breakout Incoming?

🔍 Pattern Identified: Falling Wedge – A Classic Bullish Reversal Setup

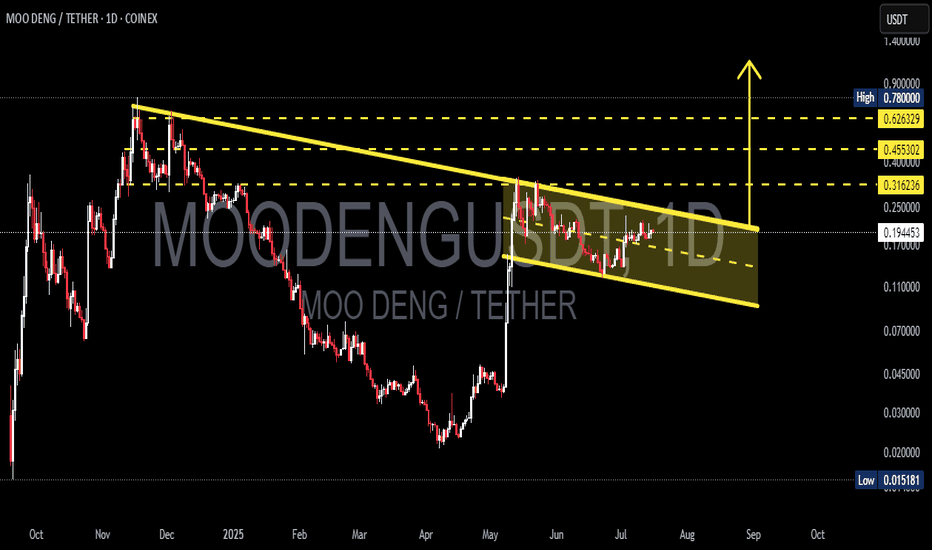

The MOODENG/USDT pair is currently forming a Falling Wedge pattern, a well-known structure that often appears at the end of a downtrend, signaling a potential bullish reversal.

Key characteristics of the Falling Wedge:

Down-sloping resistance and support lines converging toward each other.

Price action narrowing within the wedge as sellers weaken.

Often results in a powerful breakout to the upside, especially when accompanied by a volume surge.

📈 Bullish Scenario (Breakout Potential)

If the price successfully breaks out above the wedge resistance and closes above 0.25 USDT, this will confirm the breakout and open up potential upside targets:

🟡 Target 1: 0.316 USDT – Minor resistance zone and past consolidation level.

🟡 Target 2: 0.455 USDT – Major horizontal resistance and psychological level.

🟡 Target 3: 0.626 USDT – Golden Fibonacci zone and previous structure highs.

🟡 Ultimate Target: 0.78 – 0.90 USDT – The full wedge breakout projection and former top.

🔔 Ideal breakout confirmation includes:

A daily candle close above the wedge resistance.

Strong breakout volume.

RSI pushing above 60 and MACD crossing bullishly.

📉 Bearish Scenario (Breakdown Risk)

If the price fails to break out and instead falls below wedge support (especially under 0.17 USDT), it may revisit lower levels:

🔻 Support 1: 0.11 USDT – Historical bounce zone.

🔻 Support 2: 0.07 USDT – Last significant demand area before May’s breakout.

🔻 Final Support: 0.015 USDT – All-time low (high risk zone).

Still, current structure remains more bullish-biased as price consolidates near the upper wedge edge.

🧠 Market Sentiment & Narrative

This Falling Wedge is forming at the tail end of a long downtrend, with the asset showing early signs of accumulation.

If the broader crypto market sees renewed strength, altcoins like MOODENG could lead the next wave.

Smart traders spot these setups before the breakout — not after the crowd joins.

✅ Conclusion

This Falling Wedge is not just visually clean but strategically strong in terms of risk-to-reward. A confirmed breakout could trigger a massive rally with more than 200% upside potential from current levels.

Keep a close watch on the breakout level, volume confirmation, and daily candle structure. Patterns like this only appear a few times per market cycle — and they often mark the beginning of something big.

#MOODENG #AltcoinBreakout #FallingWedgePattern #CryptoAnalysis #USDT #TechnicalBreakout #ChartSetup #BullishAltcoins #CryptoReversal #TradingOpportunity

Moodengsignal

MOODENG – Wave 2 In Play, More Upside Ahead

Might be a bit bold here, but I see OKX:MOODENGUSDT pushing higher as long as it holds the 13c level.

It had a strong impulsive move, and this looks like wave 2 of the current momentum.

Daily downtrend signals from the local high have already expired, increasing the odds of continuation from here.

If momentum picks up, I’m eyeing 40–44c as a potential target zone.

MOODENG isn’t done yet!

Beginners Guide To Winning Memecoin Trades! Moo DengMeme coins have taken the cryptocurrency world by storm, often starting as jokes but evolving into high-volatility assets that attract crypto traders seeking quick gains. From Dogecoin to Shiba Inu and now Moo Deng, these so-called useless meme coins can offer trading opportunities—if you know where to look.

In this updated crypto analysis, I will build on our previous analysis where I identified a strong monthly supply zone for Moo Deng meme coin at $0.26. If you're wondering how to trade meme coins like Moo Deng, even with little experience, this supply and demand analysis breaks it down using simple supply and demand concepts on larger timeframes.

The sell-off is trying to happen.