Gold is Past Due for a PullbackReason #1: Gold reached $3000/oz and it has a strong tendency to pullback after reaching $1000 multiples for the first time as can be seen on the chart, specifically when it first reached $1000 and $2000. $1900 which is a whole number in the ballpark of $2000 was also stiff resistance in 2011.

Reason #2: Gold has been above the 52-week simple moving average for over 1 year. This alone is not reason enough to go short, as gold can stay above the 52-week average for 3 years like it did starting in 2008, but it is indicative of gold having rallied for an extended period of time without having any routine pullbacks. In the absence of routine pullbacks, gold can be said to be "past due" for a pullback the same way a person can be said to be "past due" for a dental appointment. A person being past due for a dental appointment isn't necessarily going to go to the dentist any time soon, but they will have to go eventually and the longer they put it off, the more cavities they'll have to have filled and possibly root canals once they do. This "number of days above moving average" metric is plotted at the bottom of the chart.

Reason #3: Gold tends to correct during stock market crashes. If the stock market keeps crashing, gold will likely follow, as it more often than not does.

Reason #4: Precious metals and industrial metals have dropped tremendously with the "Liberation Day" and retaliatory tariff announcements. Gold has been holding up like a champ in comparison. If other metals are rallying, it might not be a great time to short gold, but if they continue dumping or hold steady at or near current levels, gold may very well follow suit due to being in the same commodity family. Not a great reason, but a reason.

Reason #5: Gold is extended. Draw any trendline, look at any indicator, gold is flying high. This is similar to reason #2 but is less specific.

One might consider looking to catch downswings, particularly when price is below 3000. Gold is long-term bullish, but poised for downside price action in the near term.

Previous peak to troth moves with similar setups:

May 2006: -25.76% over 5 weeks

Mar 2008: -18.15% over 6 weeks

Sep 2011: -20.19% over 3 weeks

Aug 2020: -14.97% over 17 weeks

Current move: -4.8% over 1 week

2700 (-14.88%) before first week of August 2025 is a comparable move to the Aug 2020 move.

2530 (-20.12%) by April 25th 2025 is a comparable move to the Sep 2011 move.

Moving Averages

Bega Cheese Ltd Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Bega Cheese Ltd Stock Quote

- Double Formation

* (EMA Settings)) | Completed Survey

* 012345 Wave Feature | Subdivision 1

- Triple Formation

* (Consolidation Argument)) & 0.786 Area Retest | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 71.00 AUD

* Entry At 80.00 AUD

* Take Profit At 94.00 AUD

* (Ranging Argument)) & No Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

NZD/JPY DAILY TIMEFRAME CONTINUES TO DROP! POSITION FOR A SELLPrice dropped lower which further showed weakness In NZD against JPY .Coming week, I anticipate a retracement to 84.992 for a further sell. The OVERLALL market flow remains bearish coupled with the 200EMA showing bearish sentiment. A sell opportunity is envisaged once price retraces to 84.992

PL Dot Shapes (Detailed Summary)This idea shall focus on the behavior and structure of PL Dot Shapes, which are crucial in identifying market trends, congestion phases, and potential reversals. Let's deep dive on how to interpret PL Dot formations and recognize patterns that signal market movements.

1. Understanding PL Dot Behavior

- Trend:

PL Dots form a straight line, indicating a clear market direction. A trend stops when the market enters congestion.

- Congestion:

PL Dots move horizontally or “snake” sideways, signaling indecision or balance between buyers and sellers.

- Higher Time Period (HTP) Influence:

PL Dots from the HTP influence those in the Lower Time Period (LTP). Inconsistencies between them may indicate no clear pattern.

- Dot Distance:

Refers to the vertical price difference between consecutive PL Dots.

- Increasing Dot Distance: Indicates trend continuation or strength.

- Decreasing Dot Distance: Suggests trend exhaustion or potential reversal.

2. Key PL Dot Patterns

✅ Yes Pattern (Energy Termination Pattern)

Indicates the end of a trend and potential reversal. This pattern is characterized by signs of exhaustion:

1. PL Dot Pullback: PL Dot moves off the main trend channel, and the angle starts sloping down.

2. Decreasing Dot Distance: Dots get closer together, signaling waning momentum.

3. Exhaustion Signs: The dot pulls within range, with closes moving towards the PL Dot, causing congestion entrance.

4. Block Occurrence: Price likely returns to the area of 2-3 dots back.

5. Crest Formation: A PL Dot crest forms, indicating a potential market top.

6. Directional Shift: Dot directions begin turning downward.

7. Challenges: Be alert to price challenging PL Dot crests and valleys.

---

❌ No Pattern (Non-Termination Pattern)

Indicates that the trend is likely to continue without exhaustion:

1. Similar early behavior to the Yes Pattern but lacks signs of exhaustion.

2. No Significant Pullback: PL Dot may pull within range, but no congestion entrance signs appear (bullish).

3. Price Holds: Prices do not return to the 2-3 dots back area.

4. Weak Crests: No strong crest formation, or it's shallow.

5. Stable Direction: Dot direction struggles to turn down.

6. No Challenges: No challenges to PL Dot crests or valleys, confirming trend strength.

---

3. Trend Pattern (Trend Continuation Pattern)

Describes the start or continuation of a trend, especially in the LTP:

1. Dot Opening: PL Dot opens up, with increasing distance between dots, signaling strong momentum.

2. No Exhaustion: Continuation without signs of exhaustion.

3. Energy Refresh: If price reaches the area of 2-3 dots back, expect high energy on any PL Dot refresh.

4. Dots Out of Range: PL Dots move outside the prior bar’s range, confirming a strong trend.

5. Strong Challenges: Challenges to crests only add momentum to the trend.

6. Stable Direction: Dot direction maintains strength with minimal reversals.

---

4. PL Dot Shapes in Congestion

When the market is in congestion, expect the following:

1. Sideways Dots: PL Dots snake sideways, indicating market indecision.

2. Support/Resistance Holding: The 6-1 lines hold both sides of the congestion area.

3. Congestion Exit Signs: Look for signs indicating the market is ready to break out of congestion.

---

Key Takeaways:

- Trend Continuation: Increasing dot distance and out-of-range dots suggest a strong trend.

- Trend Exhaustion (Yes Pattern): Decreasing dot distance, dot pullbacks, and crest formation signal potential reversals.

- No Pattern: Indicates no exhaustion, suggesting the trend will continue.

- Congestion Behavior: PL Dots snake sideways with key support/resistance levels holding firm.

Understanding these patterns helps traders anticipate market behavior, identify trend reversals early, and manage trades effectively.

Is TAOUSDT About to Dump Hard? Yello, Paradisers! Are you paying close attention to this subtle shift on TAOUSDT? Because what we’re seeing right now could easily trap late bulls before the real drop even begins…

💎TAOUSDT is currently displaying clear signs of a potential bearish reversal. We’ve observed a bearish Change of Character (CHoCH) developing from the 1H Fair Value Gap (FVG), which is a strong early indication of weakening bullish momentum. To add to this, price has also broken down below the 50 EMA, a technical signal that increases the probability of further downside movement. When both of these elements align, it’s often a precursor to a more significant pullback.

💎If TAOUSDT revisits the recent Fair Value Gap, the trade setup becomes even more attractive, offering a stronger risk-to-reward ratio. That would be the optimal level for entry. However, even from current price levels, the trade still offers a 1:1 risk-to-reward opportunity. While not ideal, it remains viable for more aggressive traders.

💎That said, the entire bearish setup becomes invalid if the price breaks out and closes a candle above the current resistance zone. In such a scenario, it would be wise to step back and wait for more reliable price action to develop before making any further decisions.

Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

$540 incoming put trade expiring 4/4 or 4/11

AMEX:SPY

I start these Anchored VWAPs where the volume was the lowest before a major upside or downside.

When I entered this trade $540 expiring 4/4 was at $.5 on 3/27 on Thursday around 9.55am currently $2.06 closing week, however I want to highlight that the $540-$530 would be the major leg down and we might see the $570-$580 levels for first week of June imo.

Note: I am heavily comparing price actions for nowadays with 2022 first half drawdown.

Baker Hughes Company Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Baker Hughes Company Stock Quote

- Double Formation

* Diagonal & Wave Entry Set Up | Completed Survey

* Reversal Area At 49.00 USD| Subdivision 1

- Triple Formation

* (EMA Settings)) | Support & Resistance + Lower Band | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 133.00 USD

* Entry At 128.00 USD

* Take Profit At 120.00 USD

* (Downtrend Argument)) & No Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Navigating BTC Volatility Storm: Buy, Hold, or Flee?Bitcoin's recent price action has been reminiscent of a rollercoaster, leaving investors grappling with a whirlwind of conflicting signals. From sharp drops mirroring stock market turmoil to the looming "death cross," the cryptocurrency's trajectory is shrouded in uncertainty. Is this a prime buying opportunity, a warning to retreat, or simply another bout of the volatility that defines Bitcoin?

The past few days have been a stark reminder of Bitcoin's inherent volatility. Reports of an 8% drop, coupled with the US stock market shedding $2 trillion in value, sent ripples through the crypto sphere. The catalyst? Concerns surrounding potential US tariffs and their impact on the global economic outlook. This sudden shift in market sentiment triggered a sell-off, reminiscent of the COVID-19 crash in 2020, during which Bitcoin’s pre-pandemic gains evaporated.

Adding to the unease is the looming "death cross," a technical indicator that occurs when the 50-day moving average crosses below the 200-day moving average. Historically, this pattern has signaled bearish momentum. The 2022 death cross, for example, precipitated a significant price drop of nearly 20%. Conversely, "golden crosses," where the 50-day moving average crosses above the 200-day moving average, have historically signaled bullish momentum, triggering rallies of over 500% in 2020 and 2021.

Currently, Bitcoin's 50-day moving average is edging closer to this critical crossover, prompting widespread speculation. Is this a repeat of 2022, or will the market defy historical patterns? The answer, as always, is complex and contingent on a confluence of factors.

One significant factor is the strength of the US dollar. While the dollar's strength can often negatively impact Bitcoin, the current increase in the money supply could potentially counteract this effect, creating a bullish flag pattern. The dollar's inflation may become a catalyst for Bitcoin as a store of value. The global market dynamics are currently shrouded in uncertainty, making it difficult to predict the long-term impact of these factors.

The recent price drops have pushed Bitcoin towards the $80,000 mark, with some analysts predicting a potential fall to $71,000. However, this level could also represent a "sizeable bounce," acting as a strong support zone for Bitcoin. The concept of an "oversold bounce" also comes into play. After a period of intense selling pressure, markets often experience a relief rally as traders capitalize on discounted prices. Whether this materializes remains to be seen.

Is it a Good Time to Buy Bitcoin?

The decision to buy, hold, or sell Bitcoin depends on an individual's risk tolerance, investment strategy, and understanding of the market. Here's a breakdown to consider:

• For the Long-Term Investor:

o Bitcoin's long-term potential remains a compelling narrative. Its decentralized nature, limited supply, and growing adoption continue to attract institutional and retail investors.

o Price volatility is an inherent part of the Bitcoin journey. Historically, periods of sharp declines have been followed by significant rallies.

o Dollar-cost averaging (DCA) can mitigate the impact of volatility by investing a fixed amount at regular intervals, regardless of the price.1

o The strength of the US dollar may become a catalyst for Bitcoin as a store of value.

• For the Short-Term Trader:

o The current volatility presents opportunities for skilled traders to profit from price swings.

o Technical analysis, including monitoring moving averages and support/resistance levels, is crucial for identifying potential entry and exit points.

o However, short-term trading is inherently risky and requires a deep understanding of market dynamics.

o The "death cross" should be monitored carefully.

• For the Cautious Investor:

o The current market uncertainty may warrant a more conservative approach.

o Diversifying investments across different asset classes can help mitigate risk.

o Staying informed about market developments and avoiding emotional trading decisions is essential.

The Death Cross: A Warning or a False Alarm?

The "death cross" is a significant technical indicator, but it's not a foolproof predictor of future price action. Historical data show that while it can signal bearish trends, it's not always accurate. Market conditions, investor sentiment, and macroeconomic factors can all influence Bitcoin's trajectory.

Ultimately, the Bitcoin market remains highly speculative. The current volatility, driven by a confluence of factors, underscores the importance of careful research, risk management, and a long-term perspective. While the "death cross" and market fluctuations may cause short-term panic, the long-term potential of bitcoin, and it's reaction to the weakening dollar, may still produce long-term gains.

Is 5,700 the New 6,000?The S&P 500 has struggled recently, and some traders may see risk of further downside.

The first pattern on today’s chart is the three-day jump above 5,700 early last week. The move peaked around the January low of 5,773. It also represented a false breakout above the November low of 5,696.50.

In other words, two former support levels have emerged as new resistance.

It’s also reminiscent of the price action in January and February, when failure to hold 6,000 triggered selling.

Next, last week’s high occurred at the 200-day simple moving average. That may suggest the longer-term uptrend has ended.

Third, the 8-day exponential moving average (EMA) has remained below the 21-day EMA. That may indicate that a shorter-term downtrend has begun.

Finally, given the weakening momentum, traders may start eyeing longer-term levels for potential support. One potential spot could be the September low of 5,403, followed by the August trough of 5,119.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Understanding MACD In TradingThe Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that measures the relationship between two moving averages of an asset’s price. Developed by Gerald Appel in the late 1970s, MACD is designed to provide insights into both trend strength and momentum.

Unlike simple moving averages, which merely smooth price data over a specific period, MACD goes a step further by identifying when short-term momentum is shifting in relation to the long-term trend. This makes it a valuable tool for traders looking to enter or exit positions at optimal points.

1. Why is MACD important in trading?

Trend Confirmation: Identifies whether an asset is in an uptrend or downtrend.

Momentum Strength: Measures how strong a price movement is.

Reversal Signals: Detects potential changes in trend direction.

Entry and Exit Points: Helps traders determine when to buy and sell.

2. MACD Components

The MACD Line: Identifies whether an asset is in an uptrend or downtrend.

This line is derived by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA.

When the MACD Line is positive, it indicates bullish momentum; when negative, it suggests bearish momentum.

The Signal Line: Measures how strong a price movement is.

A 9-period EMA of the MACD Line.

It smooths out MACD fluctuations, making it easier to identify crossovers.

The Histogram: Detects potential changes in trend direction.

The difference between the MACD Line and the Signal Line.

A positive histogram suggests increasing bullish momentum, while a negative histogram suggests growing bearish momentum.

3. MACD Formula

The Moving Average Convergence Divergence (MACD) is one of the most widely used technical indicators in trading. It helps traders identify trends, momentum shifts, and potential buy or sell opportunities by analyzing the relationship between two moving averages.

By calculating the difference between a short-term and long-term exponential moving average (EMA), MACD provides insight into market direction and strength.

//@version=6

indicator("MACD Indicator", overlay=false)

// MACD parameters

shortLength = 12

longLength = 26

signalLength = 9

// Calculate MACD

macdLine = ta.ema(close, shortLength) - ta.ema(close, longLength)

signalLine = ta.ema(macdLine, signalLength)

histogram = macdLine - signalLine

// Plot MACD components

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.red, title="Signal Line")

plot(histogram, color=color.green, style=plot.style_columns, title="Histogram")

Explanation:

Short EMA (12-period) and Long EMA (26-period) are calculated.

The MACD Line is the difference between these EMAs.

A Signal Line (9-period EMA of MACD Line) is calculated.

The Histogram represents the difference between the MACD Line and the Signal Line.

4. Interpreting MACD signals

MACD Crossovers

A crossover occurs when the MACD Line and Signal Line intersect:

Bullish Crossover: When the MACD Line crosses above the Signal Line, it signals a potential uptrend and a buying opportunity.

Bearish Crossover: When the MACD Line crosses below the Signal Line, it suggests a potential downtrend and a selling opportunity.

MACD Divergences

Divergences occur when MACD moves in the opposite direction of the price, signaling a potential reversal:

Bullish Divergence: If price makes lower lows, but MACD makes higher lows, it suggests weakening downward momentum and a possible bullish reversal.

Bearish Divergence: If price makes higher highs, but MACD makes lower highs, it signals weakening upward momentum and a potential bearish reversal.

Histogram Interpretation

The MACD histogram visually represents momentum shifts:

When bars are increasing in height, momentum is strengthening.

When bars shrink, it suggests momentum is weakening.

Zero Line Crossings

The MACD crossing the zero line indicates momentum shifts:

MACD crossing above zero → Bullish trend initiation.

MACD crossing below zero → Bearish trend initiation.

5. Trend & Momentum Analysis

Traders use MACD to confirm trends and analyze market momentum:

If MACD Line is above the Signal Line, an uptrend is in place.

If MACD Line is below the Signal Line, a downtrend is dominant.

A widening histogram confirms strong momentum in the trend’s direction.

A narrowing histogram warns of potential trend weakening.

MACD works best in trending markets and should be used cautiously in sideways markets.

6. MACD Based Trading Strategies

Entry Strategies

Buy when MACD Line crosses above the Signal Line in an uptrend.

Sell when MACD Line crosses below the Signal Line in a downtrend.

Exit Strategies

Exit long trades when a bearish crossover occurs.

Close short positions when a bullish crossover occurs.

Position Management

If the histogram is expanding, traders can hold positions.

If the histogram is contracting, it may signal weakening momentum.

7. Limitations of MACD

While MACD is a powerful tool, traders must consider:

It lags behind price movements (since it is based on moving averages).

It can generate false signals in choppy markets.

Customization is required to suit different trading styles.

8. Optimization

Optimizing MACD for Different Market Conditions

Day Traders & Scalpers: Use faster settings like (5, 13, 6) for quick signals.

Swing Traders: Stick with the default (12, 26, 9) setting for balanced signals.

Long-Term Investors: Use slower settings like (24, 52, 18) for a broader market perspective.

9. Key Takeaways

MACD is a momentum and trend-following indicator that helps traders identify market direction, strength, and potential reversals.

Since MACD is a lagging indicator, it may generate false signals, especially in sideways markets.

Combining MACD with RSI, moving averages, and volume indicators improves accuracy and reduces risk.

MACD should be used alongside risk management strategies and other confirmation tools for best results.

MACD remains one of the most effective technical indicators, widely used across different markets. It helps traders identify trends, confirm momentum, and optimize trade entries and exits. However, it should always be used with additional tools to minimize false signals.

Stay sharp, stay ahead, and let’s make those moves. Until next time, happy trading!

GOLD - Day Trading with RSI 04/03/2025FX:XAUUSD

Daily Timeframe (D1): Still in a strong uptrend, with RSI and both moving averages are pointing upwards. The WMA45 is above 60.

4-Hour Timeframe (H4): RSI is positioned between the resistance created by WMA45 (current price around 3152) and the RSI 60 support level (current price around 3121).

1-Hour Timeframe (H1): The WMA45 is trending upward, supporting the bullish trend.

Trading Plan: BUY

Entry Zone:

When the RSI on the M15 timeframe is supported at the 50 or 60 levels.

Entry Confirmation:

When M5 completes a wave, or a divergence appears.

Or even when M1 shows divergence.

Stop Loss:

20–30 pips below the M5 low.

Take Profit:

100 pips or R:R ≥ 1:1.

Or when M5 completes its own uptrend.

But be careful when RSI on H4 reaches its own WMA45.

You can check out the indicators I use here: tradingview.com/u/dangtunglam14/

This 3 Step System Is Called The Rocket Booster StrategyIn this video i give you the full demonstration of the

3 step system called the rocket booster strategy

using the new and improved screener by

trading view

The rocket booster strategy is as follows:

-The price has to be above the 50 EMA

-The price has to be above the 200 EMA

-The price has to gap up

In this video you will see

how to do it right here on tradingview

no fluff just striaght to the point

Trade safe

Remember to rocket boost this

content to learn more.

Disclaimer: Trading is risky you will lose money whether

you like it or not

please learn risk management and profit taking strategies

and feel free to use a simulation trading account

before you trade with real money.

MASTERCARD: One more dip possible but long term target is $620.Mastercard is neutral on its 1D technical outlook (RSI = 52.317, MACD = -0.060, ADX = 29.709) having just recovered its 1D MA50 following the March 13th rebound. The pattern here is a Channel Up and March's bearish wave already hit the 0.382 Fibonacci retracement level much like the previous one did on May 1st 2024. That however went on to extend the decline to close to the 0.5 Fibonacci level and hit the 1D MA200. Consequently there is a chance of one more month of slow decline to the 1D MA200 but overall, this is a good enough level to buy again for the long term and aim for the -0.382 Fib extension (TP = 620.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

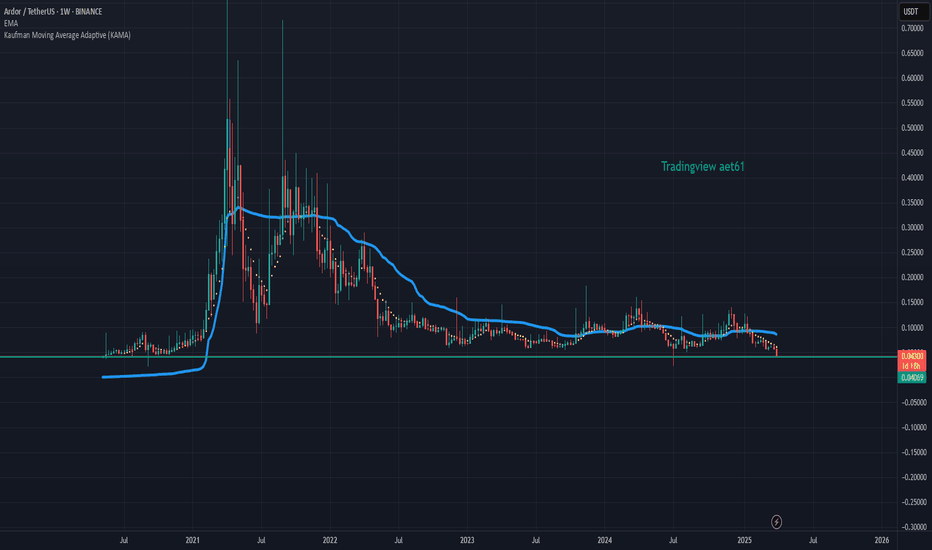

TIA | Next Altcoin to MOON ??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

In an earlier publication, I made an update about the ideal entry point for TIA:

A key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around. It is a bullish sign to see the gradual higher lows.

Moving Averages:

SNOW Finds Support at 200-Day SMASnowflake has been trading within a wide range between 108 and 240 over the past three years. During this period, revenue growth has remained steady, but operating and R&D expenses have consistently increased. This is a company that prioritizes growth and invests heavily in research, expanding its product offerings and business relationships.

However, the recent downturn, driven by tariffs and the broader selloff in AI and cloud-related stocks has exposed Snowflake's vulnerabilities.

The company reports reflect this caution. Recently, SNOW has received both downgrades and buy signals, highlighting analyst and market indecision. In such an environment, the stock’s performance will likely lean heavily on broader index movement. With a beta above 1.5, SNOW is expected to react more sharply to market swings. The consensus 12 month target still shows 38% upward potential.

Currently, Snowflake is finding support at the 200-day simple moving average. If the market manages to weather the impact of the April 2 tariffs and potential countermeasures, SNOW could stage a solid rebound. On the downside, the 130–135 zone stands out as a key support area just below the moving average.

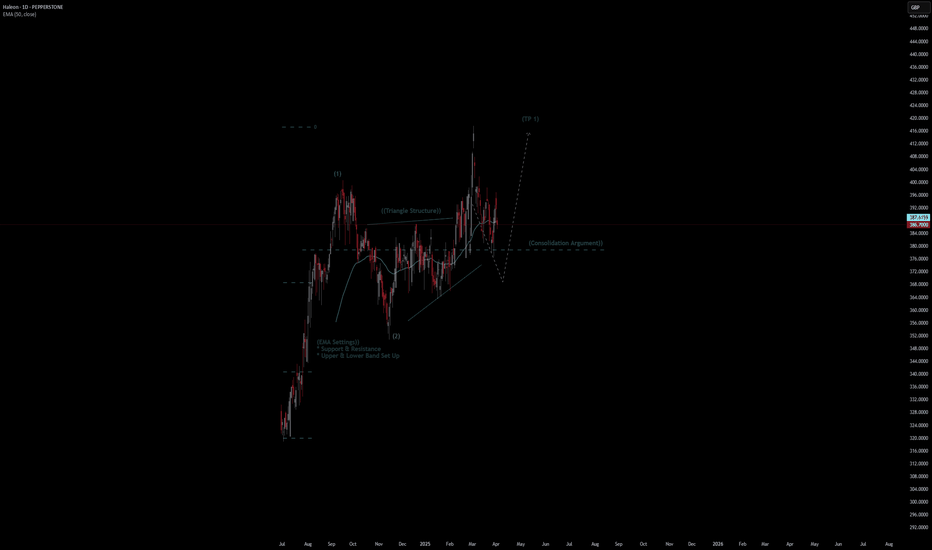

Haleon Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Haleon Stock Quote

- Double Formation

* (EMA Settings)) + Upper & Lower Band Set Up | Completed Survey

* (1) & (2) Wave Feature | Subdivision 1

- Triple Formation

* (Consolidation Argument)) | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 115.00 GBP

* Entry At 118.00 GBP

* Take Profit At 123.00 GBP

* (Uptrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

House of Cards - $585 before the crashHouse of Cards - $585 before the crash

I'm unable to update my previous idea that I originally posted in February when AMEX:SPY was at the top. Going to make this brief and will add screenshots and additional notes once the structure of Wave (B) is confirmed or invalidated.

On the 500R chart ($5), the price has risen in a distinct 3-wave pattern labelled A-B-C, with C reaching the 1.236 extension of A and finding resistance at the 100SMA (yellow). The low of Wave (A) respected the boundary of the lower line of the regression trend I have added to the chart. While this trend started prior to what I am considering Wave (A), I still think it provides a good target for the top of the retracement.

Wave (c) of A of (B) (still following me?) is not confirmed as complete yet. It could extend as far as $584 without pulling back, however I anticipate the market building more liquidity on the way up while burning options in the process. I bought 3/28 $570p at the end of the day in case we see a 50%-61.8% pullback to $560-$563 by the end of the week. If that happens, we should have enough room to reach the upper band at $585, which would be a little over a 50% retracement of Wave (A). This would also cause the price to touch the 200 SMA (green), which is common in the first major retracement of a bear market.

Lastly, from a psychological perspective, the market reached an overwhelmingly bearish consensus from mid-February to mid-March. Sentiment during Wave (a) was mostly bearish, but sentiment has shifted positive since the price entered Wave (c) and gapped up on Monday, resulting in a >+1% day. This sets the stage for a rug pull and subsequent bear trap for late sellers who will assume the downtrend has resumed prematurely.

We'll see how this plays out. I'll switch to calls if a higher high is made Wednesday 3/26. Good luck to all.

GOLD - Day Trading with RSI 04/02/2025

Weekly and Daily Timeframes (W & D):

GOLD is still in an uptrend, as the RSI's WMA45 is still hovering near the 70 level, and RSI remains above both of its moving averages.

H4 Timeframe:

This timeframe is currently showing a correction. However, it's not yet considered a downtrend because the WMA45 is still in the high region, close to the 70 level. But, RSI has dropped below the WMA45.

At present, the RSI on H4 is facing dynamic resistance from the WMA45 above and has support around the 4x level (43-48). The corresponding temporary price levels are approximately 3128 (resistance) and 3088 (support).

This end-of-uptrend correction on H4 could lead to high price volatility. GOLD may move within a 300–400 pip range (between the resistance from WMA45 and the RSI support around the 4x zone).

H1 Timeframe:

Currently in a downtrend, as RSI is moving below both of its MAs, and the WMA45 has a noticeable downward slope.

H1 also has RSI support at the 30 level (temporary price ~3086) and resistance at WMA45 above (temporary price ~3130).

Since we’re focusing on intraday trading, priority is given to the H1 trend.

Figure 1

Trading Plan: SELL

Entry Zone:

When RSI on M15 approaches upper resistance: levels 50–55 or 65–70.

Confirm Entry:

Conservative/Safe approach: when M5 ends its uptrend and reverses (see example in Figure 1 – M5 ends uptrend when RSI crosses below both MAs).

Or when bearish divergence appears on M5.

Or even earlier, when there’s divergence on M1 and M5's WMA45 flattens out.

Stoploss:

20–30 pips above M5’s recent peak.

Or if RSI on M5/M15 breaks through its previous high.

Take Profit:

100 pips or R:R >= 1:1.

Or when M5’s downtrend ends (when RSI crosses above both MAs).

You can check out the indicators I use here: www.tradingview.com

AAVE Longterm pickNot going to dive too deep, but I genuinely believe DEFI is set to explode in the future! AAVE is definitely one of my favorites, along with UNI and a couple of others that are on my radar. Anyway,

Looking at the long-term Fibonacci targets, they suggest (850-1300-1750) will happen eventually. I’m not sure how long it will take, but I’m all about keeping my eyes on the prize!

What are your thoughts? Let’s get a discussion going! Don’t forget to like and share! 🚀💥

To the moon? Hang on a second...I'm reluctant to jump to a conclusion on this count as yet, but it certainly looks like that centre line strike is as much as we get. I can't imagine there would be as big an announcement possible as American Bitcoin, with Eric T "all in ".

Well, seems like moon it is then, but nothing wrong with some skepticism nonetheless. I'm not convinced it can't still get down to that 41k ish level although it might be wishful thinking. Maybe more realistic is an accumulation around here plus or minus 5k or so, while it rolls around the converging daily moving averages, perhaps even with another spikey test of the 75k region. Losing that level would be great for a 41k superbuy, with 59 another potential barrier on the way to it.

If break outs to the upside happen, there will always be a back test to look for good buying opportunities.

41k though one time please thanks

Uber Quietly OutperformsStocks have been tumbling for more than a month, but Uber Technologies has quietly outperformed.

The first pattern on today’s chart is the series of higher lows since mid-December. They contrast sharply with the S&P 500, which has mostly experienced lower highs.

Second, the 50-day simple moving average (SMA) recently had a “golden cross” above the 200-day SMA. That may suggest a longer-term uptrend is trying to develop.

Third, relative strength in the lower study shows how the ride-sharing company has outperformed the broader market over the last three months.

Finally, UBER made an all-time high in October before pulling back. It then stabilized above its previous record high from 2021. That price action may be consistent with a longer-term breakout.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.