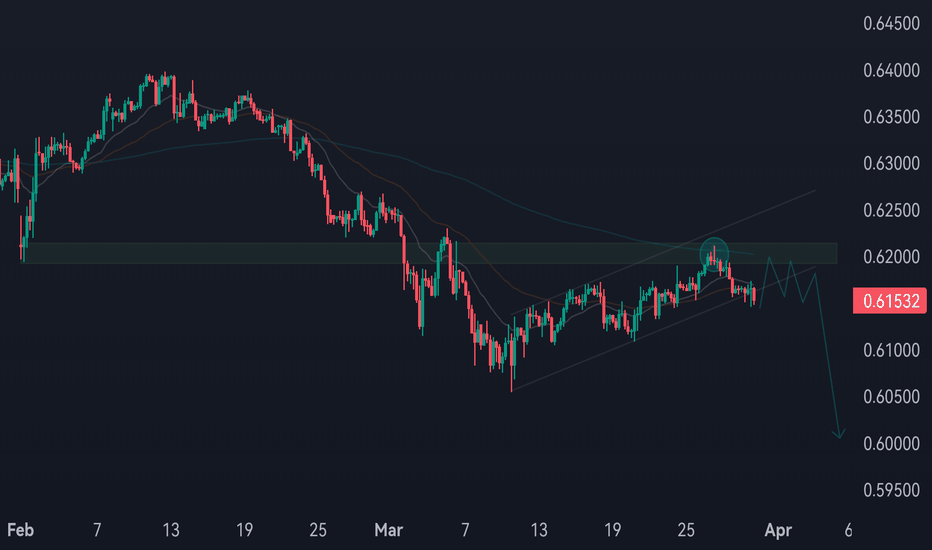

CADCHF Short Bias ! The pair attempted to break above the 0.6200 resistance zone but failed, forming a rejection. This suggests potential bearish momentum ahead.

Market Structure: Still bearish overall, despite a short-term ascending channel.

Bearish Scenario: If price respects the 0.6200 resistance and breaks below the ascending channel, it could head towards 0.6000 as the next major support.

Confirmation Factors:

Price rejection at resistance.

Moving averages acting as resistance.

Possible breakdown of the ascending channel.

Moving Averages

USDCHF Short Bias ! The pair is in a clear downtrend, trading below the moving averages and facing strong resistance around 0.8859. The price attempted to break this level but failed, reinforcing the likelihood of continued downside movement.

Expected Scenario: Further bearish continuation after this rejection, targeting 0.8660 as a potential support zone.

Bearish Confirmation Factors:

Price staying below key resistance.

Moving averages acting as dynamic resistance.

Overall bearish market structure.

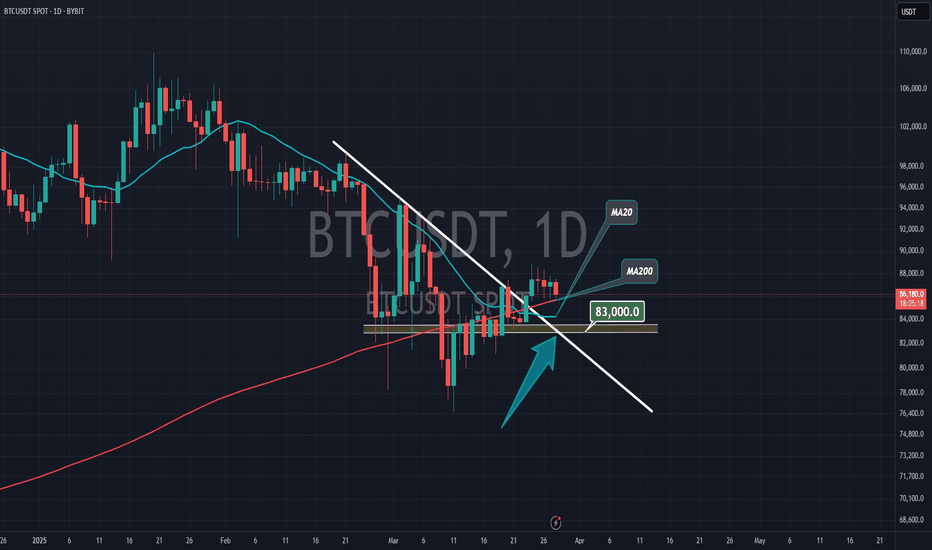

BTC/USDT: Strategic Entry Points for a Potential Bullish ReversaAnalysis of Key Positions in the BTC/USDT Chart

The chart provided shows a 30-minute timeframe for Bitcoin (BTC) against Tether (USDT) on Binance. The chart includes two labeled positions ("Position 1" and "Position 2") that highlight key areas of interest for traders. Below is a detailed breakdown of these positions:

---

1. Position 1

- Location: Near the horizontal green support line, around the $83,600 level.

- Significance:

- Support Zone: This area acts as a strong support level, where the price has previously bounced back after testing it. The horizontal green line indicates that this level has held firm multiple times, suggesting it is a critical zone for buyers.

- Potential Entry Point: Traders can consider entering long positions near this support level if they believe the price will reverse higher. This is a classic "buy the dip" strategy.

- Stop-Loss Placement: To manage risk, traders should place stop-loss orders slightly below this support level (e.g., $83,200–$83,400). If the price breaks below this level, it could signal a continuation of the downtrend.

2. Position 2

- Location: Near the descending blue trendline, around the $85,000–$86,000 range.

- Significance:

- Resistance Zone: The blue trendline acts as dynamic resistance, and the price has been bouncing off this level multiple times. A breakout above this trendline would be a strong bullish signal, indicating that buyers have overcome short-term selling pressure.

- Potential Entry Point: Traders can consider entering long positions after a confirmed breakout above the trendline. A breakout is typically confirmed when the price closes above the trendline on a candlestick.

- Stop-Loss Placement: For safety, traders should place stop-loss orders just below the trendline (e.g., $84,800–$85,000). This ensures that the trade is exited if the breakout fails and the price reverses lower.

---

Comparison Between Position 1 and Position 2

- Position 1 (Near Support):

- Risk Profile: Lower risk, as it is closer to a well-defined support level.

- Reward Potential: Moderate, as the upside target would likely be the next resistance level (e.g., the trendline or Fibonacci retracement levels).

- Strategy: Suitable for traders who want to enter at a cheaper price but are willing to take on some downside risk.

- Position 2 (Near Trendline Breakout):

- Risk Profile: Higher risk, as it requires waiting for a confirmed breakout.

- Reward Potential: Higher, as a successful breakout could lead to a stronger upward move.

- Strategy: Suitable for traders who prefer confirmation before entering long positions.

---

Actionable Insights

1. For Short-Term Traders:

- Entry Strategy: Look for pullbacks to the $83,600 support level to enter long positions. Use tight stop-loss orders below the support to manage risk.

- Exit Strategy: Set profit targets based on Fibonacci retracement levels or previous highs (e.g., $85,000–$86,000).

2. For Long-Term Traders:

- Entry Strategy: Wait for a confirmed breakout above the blue trendline ($85,000–$86,000) before entering long positions. This ensures that the bullish trend is sustainable.

- Exit Strategy: Use trailing stops or take profits at key resistance levels (e.g., $87,000–$88,000).

---

Risk Management

- Always use stop-loss orders to protect against unexpected price movements.

- Consider using position sizing to limit exposure to market volatility.

- Monitor volume and momentum indicators to confirm the strength of any breakout or reversal.

---

Conclusion

The two positions highlighted in the chart provide distinct trading opportunities:

1. Position 1 (Near Support): A potential entry point for aggressive traders looking to buy the dip near $83,600.

2. Position 2 (Near Trendline Breakout): A safer entry point for traders who prefer confirmation before entering long positions near $85,000–$86,000.

By combining these positions with proper risk management and technical analysis, traders can increase their chances of success in the BTC/USDT market.

---

Final Answer: The two positions indicate key trading opportunities:

- Position 1: Near the $83,600 support level, suitable for traders willing to buy the dip.

- Position 2: Near the $85,000–$86,000 trendline breakout, ideal for traders seeking confirmation before entering long positions.

APEUSDT: Will This Major Resistance Trigger a Sharp Rejection?Yello Paradisers, have you spotted what’s brewing on APEUSDT? We’re sitting at a critical zone—one that could either trigger a steep drop or trap late shorts before a breakout. Here's why this level demands your full attention.

💎APEUSDT is showing strong bearish potential, currently trading inside a rising wedge pattern accompanied by bearish divergence. What's even more crucial is that this price action is unfolding right at a key resistance zone, reinforced by both the 0.618 Fibonacci level and the 200 EMA. This confluence of technical factors significantly increases the probability of a bearish rejection from here.

💎If APEUSDT consolidates around this level and begins forming clear bearish structures—such as an M-pattern, a bearish CHoCH (Change of Character), a Head & Shoulders, or even an Inverse Cup & Handle—the bearish case strengthens further. This would also allow for a tighter risk setup, improving the risk-to-reward ratio for traders who are patient and precise.

💎On the flip side, if the price breaks and closes decisively above the invalidation level, this will invalidate the bearish setup entirely. In that scenario, the smart move would be to wait for a new structure or a clean retest before making any trading decisions.

🎖This is the only way you will make it far in your crypto trading journey. Be a professional—stick to your plan, reduce your risk, and never chase the market. Timing and discipline are what separate consistent traders from the rest. Stay sharp, Paradisers.

MyCryptoParadise

iFeel the success🌴

Free Report #2:The SImple Guide To Trading Stock OptionsThis is the 3 Step Strategy

Am going to show you in this video

to help you with trading stock options.

Watch it to learn more.

#1-Wait for Momentum/Rate Of Change/ Bull Power indicator

#2-Wait for a candlestick chart pattern confirmation

#3-Use the Rocket Booster Strategy

If you want to learn more check out the resources and rocket boost this content

Disclaimer: Trading is risky please learn

risk management and profit taking strategies.

Also feel free to use a simulation trading account.

Bitcoin’s Next Move – Another Attack to Heavy Resistance Zone!!!Bitcoin ( BINANCE:BTCUSDT ) was successful in three moves , as I expected in my previous post . I still think Bitcoin will NOT stop trying to break the Heavy Resistance zone($93,300_$89,200) .

Bitcoin is moving near the Support zone($87,100_$85,800) and Cumulative Long Liquidation Leverage($86,376_$85,411) .

Regarding the Elliott Wave theory , Bitcoin appears to be completing microwave C of the main wave 4 . The structure of the main wave 4 is a Zigzag Correction(ABC/5-3-5) .

If we look at the USDT.D% ( CRYPTOCAP:USDT.D ) chart on the 4-hour time frame , USDT.D% is pulling back to the Uptrend line and is currently in the Resistance zone(5.30%-5.15%) . There is a possibility of completing the Bearish Flag Pattern .👇

I expect Bitcoin to rise again in the coming hours and attack the Heavy Resistance zone($93,300_$89,200) , Potential Reversal Zone(PRZ) , Resistance lines , Monthly Pivot Point , and 50_SMA(Daily) .

Note: If Bitcoin falls below $85,400, we can expect more dumps.

Market Developments:

GameStop announced BTC adoption as a treasury asset, signaling growing corporate interest.

Trump Media partnered with Crypto to launch crypto ETFs, adding institutional momentum.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Super Micro Trade IdeaA risky trade, but with great risk comes great reward. We are at the trendline touching for the third time, and we have pivot off it in the pre market. A company who has demonstrated strong growth potential and the AI bubble starting to come together this will be a stock I will hold onto for sometime.

GBPAUD what's next ! GBPAUD is trading inside an ascending parallel channel, the price action shows a neutral short term trend, but the major trend is bullish, price is clearly trading above the 200 EMA, my setup is wait for price to touch resistance line of the channel to catch the next correction, let me know in the comments bellow what do you think for this pair, your thoughts is important, if you like my idea don't forget to boost it.

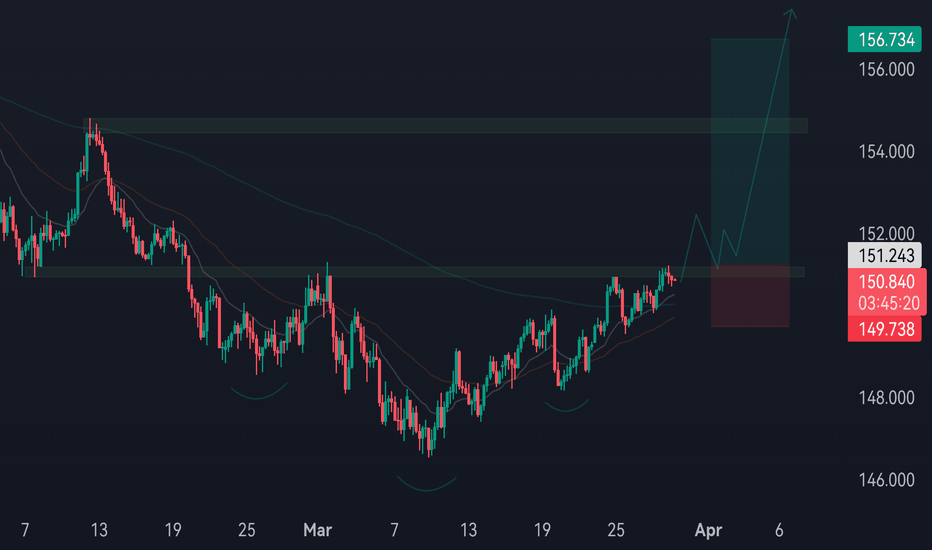

USDJPY Long BiasThe USDJPY pair on the 4H timeframe is forming a bullish structure, showing signs of continuation to the upside. The price is currently trading above key moving averages and consolidating near a resistance-turned-support zone, indicating potential bullish momentum.

Additionally, the formation resembles an inverse head and shoulders pattern, a strong bullish reversal signal. A successful break and retest of the 151.200 zone could confirm further upside movement, with the next key target around 156.700. However, failure to hold above the support zone may lead to a deeper retracement before resuming the uptrend.

EURNZD Long BiasThe EURNZD pair is currently breaking out of a descending trendline on the 4H timeframe, signaling a potential shift in momentum. The price has recently bounced from a key demand zone, aligning with the 38.2% Fibonacci retracement level, suggesting strong bullish interest.

Additionally, the price is now trading above key moving averages, reinforcing the bullish bias. A sustained break above the breakout level could confirm further upside potential, with the next target around the 1.92 zone. However, if the price fails to hold above the breakout level, a potential retest of the demand zone near 1.87 could be expected before resuming upward momentum.

Bollinger Bands Warning: Is Gold Losing Uptrend?Gold ( OANDA:XAUUSD ) has succeeded in creating a New All-Time High(ATH) as I expected in my previous post . Now, the question is whether Gold can continue its upward trend.

Gold is currently moving in the Resistance zone($3,058-$3,045) .

The upper and lower lines of the Bollinger Bands indicator also play the role of resistance and support well on the 1-hour time frame .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks( Bollinger Bands indicator and Price ).

Educational Note : A divergence forms when the price chart and the indicator behave in contrast to each other. Divergence sell signals mostly form at the end of an upward trend, where the price chart forms a peak above the Bollinger upper band and another peak after, below the upper band. These signals are considered negative Regular Divergences(RD-) , hinting at a potential market reversal and a downward trend.

In terms of Elliott Wave theory , I think the main wave 4 is NOT yet complete, and we can expect another corrective wave .

I expect Gold to bearish trend in the coming hours and drop to at least $3,036 , with the next target being an attack on the Support zone($3,032-$3,021 ) .

Note: If Gold goes above $3068.29, we should expect more Pumps.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GOLD: Short, Target 3041-3036After yesterday's rise, some gold indicators have formed a relatively obvious short position, so in today's trading, I personally recommend focusing on the short position.

During the trading process, we need to pay attention to the support points of 3046/3037/3032, the high point of resistance of 3060, and the possible new high of 3067.

From the overall situation, it is unlikely to break through 3067 today, but it is more likely to fall to around 3037.

Banxico Cuts Rates Aggressively In line with market expectations, the Bank of Mexico unanimously decided to implement another consecutive rate cut during its March 2025 monetary policy meeting. The 50-basis-point reduction brought the policy rate down to 9.00%, marking a forceful continuation of the monetary normalization cycle, one that remains behind its regional Latin American peers.

The central bank’s decision mainly reflects a relatively contained inflationary environment and growing concerns about downside economic risks, including the possibility of a technical recession following a visibly weak first quarter. Headline inflation stood at 3.67% in the first half of March, providing Banxico with the necessary room to ease its monetary stance without significantly compromising its 3% inflation target.

The Mexican economic outlook remains clouded by uncertainty surrounding U.S. trade policy. The recent tariff threats from the Trump administration, particularly those targeting imported vehicles and auto parts, could exacerbate Mexico’s economic fragility, given its high dependency on bilateral trade with the U.S. These tariffs, set to take effect in early April, pose a significant threat to the country's economic and monetary stability.

Previously, the foreign exchange market has responded favorably to reversals of initial U.S. tariff announcements, but the persistence and materialization of these threats would place further pressure on the Mexican peso. The automotive sector, a pillar of Mexico’s export structure, is already facing serious challenges, with a significant drop in exports in February, underscoring the country’s vulnerability to external trade restrictions.

Despite these internal and external pressures, Banxico has managed to strike a relative balance, cutting rates to help stimulate economic activity while maintaining a sufficiently tight monetary stance to guard against potential inflation risks. According to the Governing Board, this approach is consistent with the trajectory needed to ensure an orderly and sustained convergence of inflation toward the 3% target by the third quarter of 2026.

For now, one notion circulating in the markets is that the Mexican central bank may keep rates above the neutral level as a safeguard against tariff-related uncertainty and other potential external shocks. This reflects a strategic caution, aiming to balance economic stimulus with financial stability.

Looking ahead, the outlook remains complex. Banxico may continue making similar adjustments in upcoming meetings, always contingent on the evolution of inflation and both domestic and global economic activity. Ultimately, Mexico is facing a critical juncture where monetary policy decisions will play a key role in mitigating current uncertainty and supporting a more stable economic environment.

BTC DAILY - MA compression On the daily timeframe something very interesting is happening. A convergence of price around the blue KEY S/R is very interesting when you factor in what the moving averages are doing around this level also.

1D 200 EMA is completely flat having lost all of its momentum with the months of chop and then the sell-off into current levels. For a bullrun to be credible you want to see price above this level and a steady/steep slope up. Due to the lack of direction of this moving average price is able to climb above and drop below very easily and therefor it is neither support nor resistance until there is a trend.

1D 25 EMA is a different story, now that BTC has put in a local top and trending down, the 25 EMA is resistance but has been flipped in the last few days with price bouncing off the level 4 days in a row. This is good news for the bulls but the longer we linger here there is more chance dropping back under it.

Diagonal resistance as simple as it is has 4 points of contact and will be a big point of resistance and one many traders will be keeping an eye on.

On the lower timeframes we're seeing a bullish channel, a loss of this channel would be a huge red flag and a catalyst for a risk off event IMO, continuing the downtrend.

Dollar Weakens Amid Concerns Over New TariffsThe U.S. dollar traded weaker on Thursday, dropping 0.22% in the DXY index, despite the release of economic figures that slightly exceeded market expectations. This negative move becomes technically significant as it occurs near the 200-period moving average, a key level that was breached earlier in March, placing the greenback under greater short-term selling pressure.

The key economic data released was the Q4 2024 Gross Domestic Product (GDP), which showed an annualized growth rate of 2.4%, marginally above the expected 2.3%, though representing a notable slowdown from the previous quarter’s 3.1%. This growth was primarily driven by consumer spending, which rose 4%, its fastest pace since Q1 2023, and higher government expenditures (3.1%), partially offsetting declines in fixed investment and exports.

Despite the apparent economic optimism suggested by these figures, the underlying strength of the dollar remains questioned due to recent trade policy decisions by the Trump administration and the significant deterioration in consumer sentiment during Q1 2025. Particularly noteworthy is the announcement of new 25% tariffs on imported vehicles and auto parts, effective from April 3. Trump labeled this date as the "Liberation Day" for the U.S. automotive industry, asserting the primary goal is to stimulate local production and correct historically unfair trade practices.

However, substantial risks emerge from this policy, including potential disruptions to global supply chains, a significant increase in new vehicle prices (ranging from an additional $4,000 to $12,200 per unit), especially affecting electric vehicles highly dependent on imported components, and inflationary pressures that might compel the Federal Reserve to reconsider its current pause on restrictive monetary policy.

Additionally, the auto industry immediately reacted negatively, with shares of giants like General Motors, Ford, and Stellantis declining, while Canada and the European Union strongly opposed the measure, considering potential retaliatory actions that could escalate global trade tensions.

In this scenario, markets closely watch Friday’s release of the PCE inflation report and the University of Michigan's inflation expectations index, indicators that could provide crucial insights into the Federal Reserve's next moves. The Fed remains cautiously on the sidelines, evaluating the real impact of governmental trade policies on inflation and economic growth.

Ultimately, although today the dollar exhibited technical and fundamental weakness, its future outlook continues to hinge significantly on domestic and international political and economic dynamics, promising continued high operational volatility in the near term.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Keysight Technologies Inc Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Keysight Technologies Inc Stock Quote

- Double Formation

* A+ Set Up)) | Completed Survey

* EMA Settings & Lower Band | Channel & Retest Area | Subdivision 1

- Triple Formation

* (Reversal Argument)) | Short Set Up | Subdivision 2

* (TP1) | Subdivision 3

* 1 Hour Time Frame | Entry Settings Condition

- (Hypothesis On Entry Bias)) | Logarithmic Settings

- Position On A 1.5RR

* Stop Loss At 160.00 USD

* Entry At 150.00 USD

* Take Profit At 140.00 USD

* (Downtrend Argument)) & No Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

$SPY March 27, 2025AMEX:SPY March 27, 2025

15 Minutes.

AMEX:SPY struggling to move upwards as expected.

For the rise 561.48 to 576.42 it has retraced 61.8 levels to 567 levels.

Not it is taking support at 200 averages in 15 minutes

For the fall 576.33 to 567.92 570-571 is a good level to short for an initial target 565- 566 levels for the day.

Since below 200 in 5 minutes not a time to g long for the yet.