Stanmore Resources Ltd Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Stanmore Resources Ltd Stock Quote

- Double Formation

* A+ Set Up)) | Completed Survey

* 250 EMA| Entry & Retest Area | Subdivision 1

- Triple Formation

* Wave (3)) Ongoing Entry | Short Set Up | Subdivision 2

* (TP1) | Subdivision 3

* 1 Hour Time Frame | Entry Settings Condition

- (Hypothesis On Entry Bias)) | Logarithmic Settings

- Position On A 1.5RR

* Stop Loss At 2.400 AUD

* Entry At 2.150 AUD

* Take Profit At 1.800 AUD

* (Downtrend Argument)) & No Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Moving Averages

Gold Tests Trendline, 3000 Target Still in SightGold’s horizontal move ended on Friday with the breakdown of the short-term support at 3025. Since then, the critical 3000 level has been tested twice but is still holding for now. The short-term trend has turned bearish, leaving gold prices stuck between the downward pressure from above and key supports at 3000 and the 200-hour moving average.

Trump's recent softer messaging regarding the April 2 tariffs has temporarily eased upward pressure. Today's consumer confidence data will be significant, especially ahead of Friday's PCE release.

If the short-term downtrend channel holds, another attempt at the 3000 level could occur today, and a break below 3000 might intensify downward momentum.

On the upside, the immediate resistance levels to watch are the short-term downtrend line and 3030, both very close to the current price. A breakout above these levels could signal a continuation of flat move above 3000 until key economic data arrives later this week.

S&P 500 Correction Channel Keeps Bulls in Control, for NowThe S&P 500 has formed an uptrend channel after breaking out of the "tariff panic" downtrend, which had dragged the index down more than 10%. But is this new short-term uptrend merely a correction, or has the real direction changed? That’s the key question, one that will likely be answered in early April when the new tariffs take effect.

February consumer confidence data didn’t look promising, but much of the negativity had already been priced in during the earlier 10% sell-off. However, this week’s PCE report, combined with next week’s tariffs and jobs report, could become a catalyst for determining the short- to medium-term direction.

The 200-hour SMA has now reached the upper line of the trend channel. Together, they may create a strong resistance level. To the downside, 5700 is a key horizontal support level. By the end of this week, it will converge with the lower boundary of the channel, right as both the GDP and PCE data are released. Including the time factor, this confluence could mark the main short-term support.

As long as the trend channel holds, bulls remain in control.

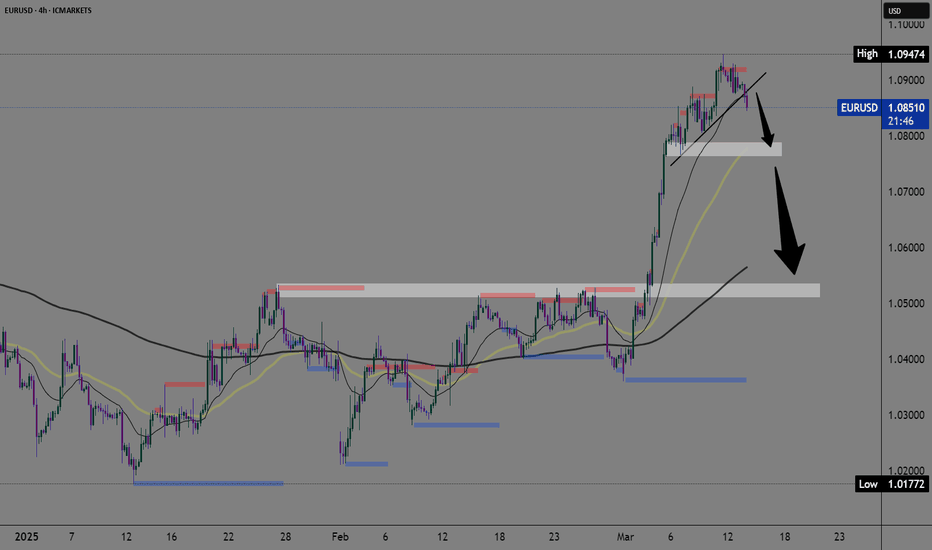

EURUSD bearish optionEURUSD loses bullish momentum. We see a deceleration of the bullish impulse and a transition to consolidation that led to a breakout of the trend line below 1.08500. The next important level is 1.08000 because below that we can expect a stronger pullback, maybe even a return to 1.05000.

Buy, hold, and let those sweet returns melt in your portfolio!Guys, we all know the sector rotational for consumer defensive is now rebounded

regardless the sector rotation or tariffs noise, agribusiness and sugar remains an essential commodity in our daily life.

There are strategies that Wilmar has taken for the past 3 years. We have seen the share price is being strongly supported at SG$3.03.

Given the essential nature of sugar, Wilmar’s strategic positioning, strong financials, and resilient consumer demand, this could be an opportune time to buy and hold for long-term gains.

🗝️ Key Investment Considerations:

Strong Technical Support – Wilmar’s share price has consistently held above SG$3.03, indicating a solid support level.

📙 Fundamental Strength – The company has a wide economic moat, benefiting from its integrated agribusiness model.

💰 High Insider Ownership – With a 74.7% stake held by major investors, management has significant “skin in the game.”

SGX:F34

📌 Investment Call: Buy & Hold (24-36 months)

🎯 Target Price: SG$4.46

💰 Potential Upside: 33%

📈 Dividend Yield: ~5.13% (TTM)

Wilmar International (stock symbol: F34.SI) dividend yield (TTM) as of March 27, 2025 : 5.13%

Average dividend yield, last 5 years: 4.1% (including 2024)

W Chart - crossing above zero line for MACD indicator

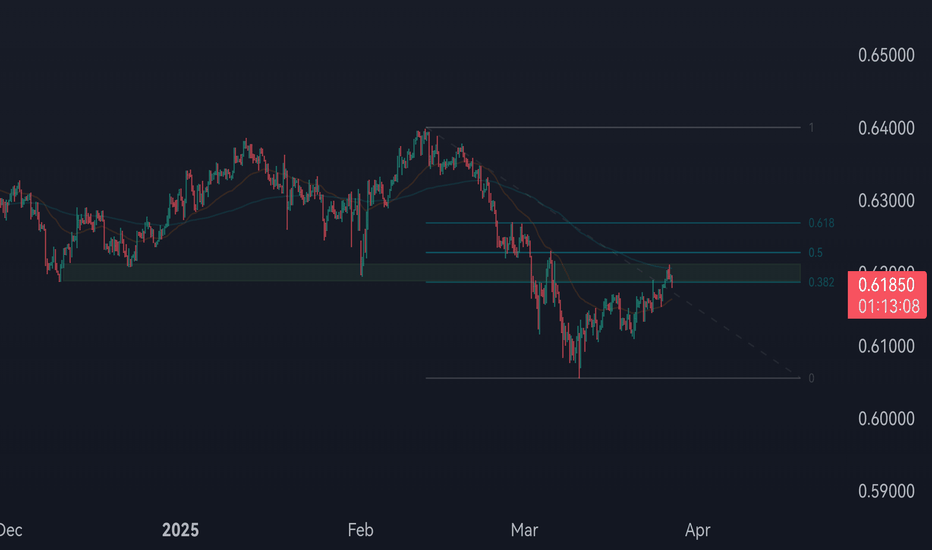

NZDUSD Short BiasThe New Zealand Dollar is consolidating, lacking clear directional momentum. However, the short-term outlook appears bearish following a confirmed closure below a key structure zone. A break below the 0.5710 level could serve as confirmation for further downside continuation, signaling potential bearish momentum ahead.

CADCHF Short BiasThe price is currently in a strong position, retesting a key resistance zone, which aligns with the 50% Fibonacci retracement level. Additionally, the 200 EMA is acting as dynamic resistance, reinforcing the bearish bias. Given these confluences, a downside move is anticipated, in line with the prevailing trend.

EURGBP, time to short ! price declined from a supply zone and made a made a clean break and retest on the structure zone, by looking at EMAs (21,50 and 200) we can clearly see that price has broke through them with a strong bearish candle, and currently price is trading below moving averages indicating a bearish control in the market, I expect price to continue down

NVA Triple EMA Buy SignalNASDAQ:NVA

Look for the break above $12 to hold for entry.

PT1 - 12.60

PT2 - 14.00

PT3 - 14.50

Stop loss at $10.80 for $12.00 entry

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Pfizer: Oh Buyer Where Art Thou?Pfizer has struggled for years, and some traders may see risk of further downside.

The first pattern on today’s chart is the slide to a new 12-year low in October and November. The drugmaker barely retraced half that move at subsequent highs. It also remained mostly below its October low of $26.87. That may suggest old support has become new resistance.

Second is PFE’s price action at its 100-day simple moving average (SMA). It fell sharply after breaking that SMA in October and now seems to be stalling at the same line. (See white arrows.) That may reflect a longer-term downtrend.

Third, $25.53 was the weekly close in mid-February. It provided support earlier this month, but yesterday the stock returned to the same level. Could that trigger a breakdown?

Next, the 50-day SMA had a “death cross” under the 200-day SMA in late November. The 100-day SMA followed in December. The resulting alignment, with faster SMAs under slower ones, is potentially consistent with a downtrend.

Finally, PFE is an active underlier in the options market. (TradeStation data shows it ranking 13th in the S&P 500 in the last month, averaging about 110,000 contacts per day.) That could make it easier to position for moves with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

$SPY March 26, 2025AMEX:SPY March 26, 2025

15 Minutes.

Sideways consolidation on for moving averages to catch up.

For the moment upside is capped 576-579 levels which is also top of channel.

576 - 578 is a good sell for 571-573 levels target for today.

Since 3 moving averages are nearby 9, 21 and 50.

I expect a one-sided movement.

So far, no trade for me for the week.

FART/USDTSEED_WANDERIN_JIMZIP900:FART Cup and Handle on 1D chart! 🔥

✅ The cup is nicely rounded - a sign of bullish accumulation.

✅ Neckline around 0.5561-0.6119 (V-WVWAP) - price is hitting resistance here.

✅ Volume is increasing during the breakout attempt - which is a positive signal.

✅ Possible "eye" - price may correct back to support before further growth.

Targets:

🔹 Cup height measurement: Bottom around 0.3194, neckline 0.5561, gap ~0.2367.

🔹 Target level: 0.5561 + 0.2367 = ~0.7928 (possible bull target on patterning confirmation).

🔹 Fib levels may help - I see first resistance around 0.6176.

How to play it?

📌 Ideal entry: after a pullback to neckline (retest) or during a confirmed breakout with volume.

📌 Stop-loss: Below the last low of the neckline or below the neckline if it becomes support.

📌 Confirmation.

Overall, the pattern looks very bullish, but the reaction to 0.5561-0.6119 will be important. If it fails there, the ears may go lower.

Surgery Partners Inc Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Surgery Partners Inc Stock Quote

- Double Formation

* ((Triangle Structure)) | Completed Survey

* (Uptrend Argument)) | Entry Area | Subdivision 1

- Triple Formation

* 100 EMA & Long Support Or Neutral Area | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Logarithmic

- Position On A 1.5RR

* Stop Loss At 23.00 USD

* Entry At 24.00 USD

* Take Profit At 26.00 USD

* (Uptrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Reddit Has Pulled BackReddit hit a record high early last month. Will some traders see an opportunity in the current pullback?

The first pattern on today’s chart is the bullish gap on October 30 after earnings beat estimates. RDDT approached the low of that session on March 10 and again last week. It bounced both times. That apparent double bottom may suggest new support has been established.

Next, the rebounds occurred around the 200-day simple moving average. Holding that line may suggest an uptrend is in place.

Finally, stochastics have turned up from an oversold condition. The stock also closed above its 8-day exponential moving average. Those patterns are potentially consistent with prices bottoming.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

$SPY Marcg 25, 2025AMEX:SPY Marcg 25, 2025

15 Minutes.

No trade for me yesterday as gap up and had no chance to enter.

For the rise 561.48 to 575.17 i am expecting a retrace to 566-568 levels as too far away from movoing averages.

On 60-minute time frame for the fall 597.37 to 549.68 4SPY has retraced between .5 to .618 levels.

So, at the moment I expect upside to be capped at 579-580 levels being .618 levels.

So, I will short around that levels or buy around 569 levels for the day.

EURUSD bearish scenarioEURUSD is in retreat after resistance in the 1.09500 zone. We are currently seeing a test of 1.08000 with pressure to continue on the bearish side. Around 1.07000, the pair will have a chance to look for support in the EMA200 moving average. If that is not enough, we continue down to the 1.05000-1.06000 support zone.