KAVAUSD – Midpoint Retest with a Shot at a Daily Higher LowCOINBASE:KAVAUSD / COINBASE:KAVAUSDC

Watching KAVA here on the daily, and it’s at a key decision point that could define the next leg. We’ve got two sets of Fibonacci retracements drawn: the first from the March 2024 high to the August 2024 low, and the second from the August low to the December high. Right now, price is retesting the 50% level of the larger March–August move—aka the midpoint of the macro range—and it's still holding above the 50% retracement of the more recent August–December leg. We’re also sitting right on the 38.2% Fib of that second move, which tends to act as a key area for potential higher lows.

The idea here is simple: I’m playing for a daily higher low. We had a strong move off the December lows, followed by a healthy consolidation, and this is where bulls need to step in. Structure-wise, this is the ideal area for bulls to attempt a defense if the trend is going to continue. EMAs are curling up, and price is still holding above the 12 and 26 EMAs for now, which gives me confidence in a potential bounce.

If the Trade Goes as Planned (Bullish Case)

If buyers step in here and confirm a higher low—ideally somewhere between $0.48 and $0.50—we’d expect a continuation toward the recent high at $0.56. If that level breaks, then $0.64 becomes the next area of interest based on prior price structure and confluence with the upper Fib retracement levels. From there, we could even make a push toward the $0.74 area, where the last major rejection happened in late 2024.

A strong bounce here also sets up a potential inverse head and shoulders structure on the daily if we revisit that neckline around $0.56 again with momentum. In short, a higher low here gives the bulls the setup they need to retake trend control.

If the Trade Fails (Bearish Case)

If price fails to hold the $0.48–$0.50 region and breaks below the August–December 50% Fib level, then we’re likely heading back to the $0.44 zone. That’s where the 200-day SMA is sitting, and it’s also a major pivot from previous support. A loss of that zone opens the door to a full retrace toward $0.39 or even $0.37—last seen during the November-December basing structure.

In that case, the trend would flip neutral at best and would require a fresh base-building phase before bulls could even think about regaining momentum.

TL;DR

Thesis: Playing for a daily higher low above key Fib levels and EMAs.

Bullish Target: Reclaim $0.56 → push toward $0.64–$0.74 if momentum follows through.

Bearish Invalidator: Break below $0.48 = likely revisit of $0.44 or lower.

Not financial advice. Just sharing my thinking as I try to stack confluence and play the levels. Let’s see if this bounce gets legs.

Moving Averages

Direxion Midcap Bull 3x | MIDU | Long at $45.67Like my predictions for AMEX:TNA , I believe midcap stocks will likely rise as interest rates are lowered over the next few years (probably a little too early given the looming economic situation). While it may be a bumpy ride and everything truly depends no announcement of an "official" economic recession (by which all stock expectations would change to the negative), there could be significant room to run here before a top - but always stay cautious...

Thus, at $45.67 AMEX:MIDU is in a personal buy zone.

Targets:

$55.00

$75.00 (longer-term if the economic data/news hold up strong)

Potential Downtrend in AlcoaAlcoa has bounced this month, but some traders could think it’s due for a pullback.

The first pattern on today’s chart is the series of lower lows and lower highs since December. The aluminum company has climbed to the top of that falling channel, which may create potential resistance.

Second, prices stalled at the falling 50-day moving average (SMA) in February and seem to be peaking at the same SMA this month.

Speaking of the 50-day SMA, it recently had a “death cross” below the 200-day SMA.

Next, stochastics are dipping from an overbought condition.

Finally, the 52-week low is near $27 and last year’s low is under $25. Combined with the falling channel, those levels may provide space for potential moves to the downside.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

cup and handle pattern may be forming on the weekly chart HOOD"Potential Cup and Handle Pattern on NASDAQ:HOOD

A cup and handle pattern may be forming on the weekly chart of HOOD. The cup formation can be seen from August 2024 to February 2025, with a high point of around $55.00 and a low point of around $14.00. The handle formation started in late February 2025 and is currently ongoing.

Key levels to watch:

Resistance: $50.00

Support: $39.00

A breakout above the resistance level could confirm the pattern, potentially leading to a bullish trend. Keep a close eye on this stock! Weekly Daily and Monthly all look good.

#HOOD #cupandhandle #stockmarket #trading"

Pullback in Palantir Palantir Technologies had a dramatic rally in recent months, and now traders may see an opportunity in its latest pullback.

The first pattern on today’s chart is the 50-day simple moving average (SMA). While many other stocks, like Apple and Microsoft, have plunged below their 200-day SMAs, PLTR ended last week above its 50-day SMA. That may reflect relative strength versus the broader market.

Second, prices made a lower low and higher high on Friday. That kind of outside candle is a potentially bullish reversal pattern.

Third, the software company just had its highest weekly close since February 21.

Next, some short-term indicators may be positive: MACD is rising and the 8-day exponential moving average (EMA) is nearing a potential cross above the 21-day EMA.

Finally, PLTR is one of the top underliers in the options market. (Its 800,000 contracts per day in the last month ranks it fourth in the S&P 500, according to TradeStation data.) That could help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

What makes a good moving average?Four Core Qualities of Superior Moving Average

Accuracy (preserving large-scale structure):

Moving average should maintain the important underlying structure of price movements (like major trends and cycles) while filtering out all smaller fluctuations; it should faithfully represent the true price trajectory over longer timeframes.

Timeliness (minimal lag):

Most moving averages lag behind price action - they indicate changes way after they've already happened. A good moving average minimizes this lag, responding quickly to genuine price movements without sacrificing other qualities, providing more actionable signals and earlier entries/exits.

Minimal overshoot:

Overshoot occurs when a highly reactive moving average extends beyond the actual price extremes, creating false impressions of price levels never reached. TEMA, DEMA and HMA are examples of overshooting moving averages; good moving average should avoid this distortion, particularly during price reversals, preventing false triggers when used with threshold-based systems.

Smoothness (reduced noise):

A quality moving average filters out random price fluctuations (noise) that don't represent meaningful market activity, especially in steady non-volatile periods. This creates a clean, smooth line that clearly shows the underlying price direction without the jagged, erratic movements that could trigger false signals.

The Dynamic Adaptive Moving Average

Picture shows a study of Dynamic Adaptive Moving Average that employs a complex approach to price smoothing that continuously adjusts its behavior based on real-time market conditions. At its core, this indicator uses the ratio between short-term True Range and longer-term ATR to measure relative volatility changes in the market. This volatility assessment drives the automatic adjustment of critical smoothing parameters through calibrated sigmoid functions, allowing the indicator to become more responsive during volatile periods and more stable during consolidation.

Smoothing is achieved with three-stage filtering process: the first stage applies preliminary smoothing using self-adjusted adaptive exponential moving average. The second stage implements a Kalman filter that provides further smoothing while maintaining responsiveness to price spikes. The final stage applies another adaptive filter that balances smoothness and lag reduction.

The study shows comparison between HMA indicator and a working model of Dynamic Adaptive Moving Average.

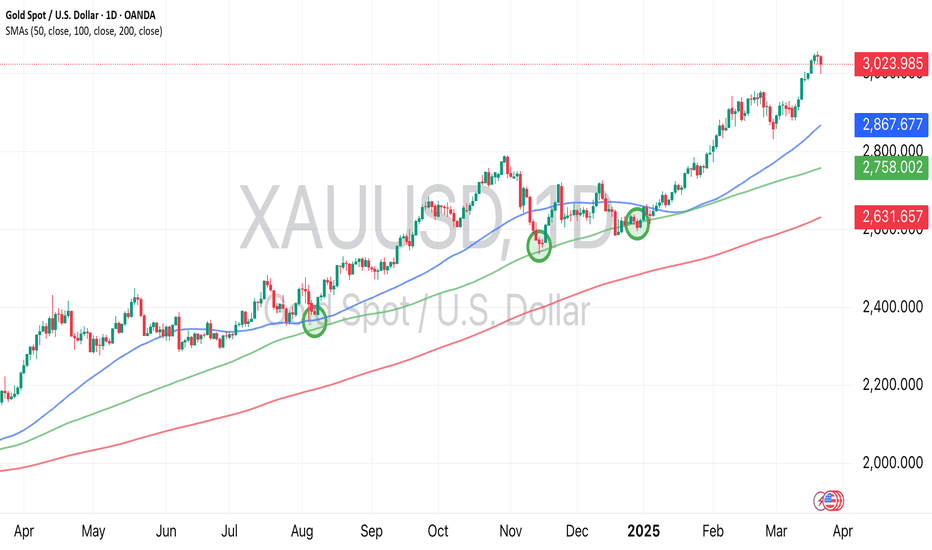

Gold | 100-Day SMAHistorically, gold's 100-day moving average has been a good entry-point for traders and buy-and-hold investors. As you can see from the chart, it's provided support on multiple occasions.

If gold is extended relative to its moving averages, you could wait for a pullback to go long. However, you might miss out on further upside, if the precious metal is in a strong bull market.

$SPY March 24, 2025AMEX:SPY March 24, 2025

15 Minutes.

Gap down open on 21st was not strong as gap was covered by close of day.

The fib move for downside was achieved by gap down hence no trade.

Now for the fall 570.57 to 558.03 566 is level to watch.

For the rise 558.72 to 564.89 561-562 is number to watch.

So, a short at 565-566 will have a target 562 -563 levels.

I will wait for Monday open before entering a trade.

Enhance Your Trading with Dual MACD OverlaysBy using two MACD overlays—one based on the current timeframe and another on a higher timeframe—you gain a more comprehensive view of market momentum. This approach helps identify short-term opportunities while aligning trades with the broader trend, reducing false signals. As seen in my chart, combining multiple MACD perspectives can improve decision-making and trade timing.

Try it out and refine your strategy with better trend confirmation!

The Election Was Support. Has it Become Resistance?Last year’s presidential election was a catalyst for stocks. Today’s idea considers its potentially shifting impact on sentiment.

The first pattern on today’s S&P 500 chart is the range between 5597 and 5783. Those prices are the low of November 4 and the high of November 5, the Monday and Tuesday of election week.

On January 13, SPX pulled back to find support at the top of the range. That bounce seemed to reflect ongoing optimism about the coming administration. (Inauguration was exactly a week later.)

The index remained above that zone through early March before sliding below it. Prices have now rebounded but appear to be stalling at the bottom of the price range. Does that show a newer anxiety about policy?

Next, Wilder’s relative strength index (RSI) made lower highs from early December -- despite SPX making incrementally higher highs. That kind of bearish divergence may be consistent with a longer-term trend fading.

Third, SPX is under its 200-day simple moving average (SMA). Staying here may confirm a break of its longer-term uptrend.

Finally, the 50-day SMA recently crossed below 100-day SMA. Both are falling. That may also suggest prices have stopped rising.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

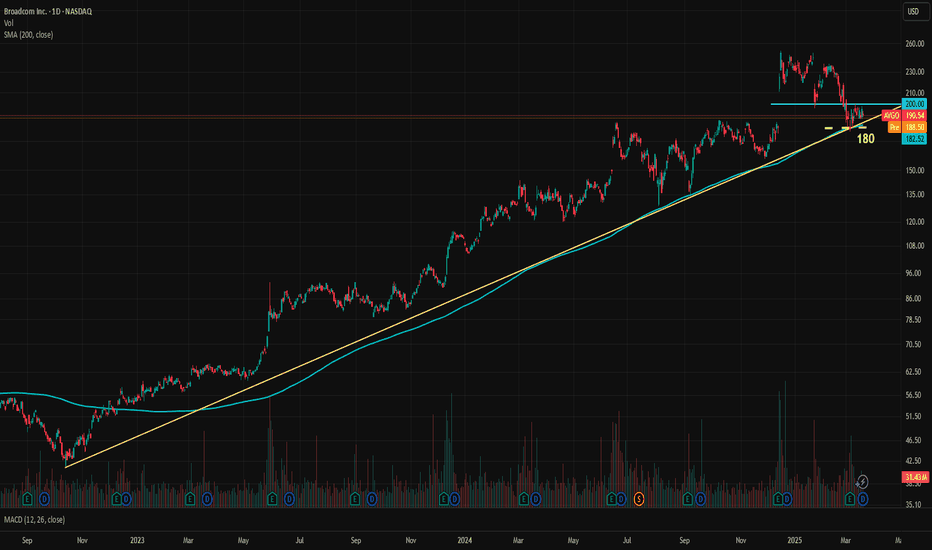

AVGO Stuck Between Key Levels, A Calm Before the Storm?Broadcom, one of the key favorites in the AI rally, is at a crossroads. AVGO has been in a steady logarithmic uptrend since October 2022, carrying the stock price from 41.51 to 251.88, marking an impressive 506% gain in about two and a half years. The company's EPS has been consistently increasing over the years and is expected to accelerate further this year. Although valuations are high, if Broadcom's performance in 2025 meets or exceeds expectations, the bullish case remains strong. The forward P/E for 2025 end is 28.7x.

Currently, the price is stuck between the trendline and the 200 resistance level. The uptrend is supported by the 200-day moving average. The trendline sits around 184, while the SMA is at 182.50. For a more cautious approach, 180 can be considered the key medium-term support level. If 180 holds and AVGO manages to break above the 200 resistance, there is significant upside potential for the bulls.

The current analyst consensus for the 12-month price target is 251, which also coincides with the stock's all-time high (ATH).

Navigating XRP Regulatory Winds and Technical TidesThe crypto sphere remains fixated on XRP, a digital asset perpetually caught between regulatory scrutiny and promising technological advancements. Recent developments, including the delayed decision on a potential XRP ETF, the nearing conclusion of the SEC vs. Ripple lawsuit, and the launch of CFTC-regulated XRP futures, have injected fresh volatility and speculation into XRP's price trajectory.

ETF Delay and SEC Lawsuit: A Tale of Two Catalysts

The anticipation surrounding a potential XRP Exchange-Traded Fund (ETF) has been palpable. However, the recent delay in the SEC's decision has tempered immediate expectations. While a positive verdict would undoubtedly trigger a massive price surge, the postponement underscores the regulatory hurdles still facing the cryptocurrency market.

Conversely, the long-standing legal battle between Ripple and the SEC is seemingly approaching its denouement. Reports suggest the SEC is considering dropping the case against Ripple, a development that has already spurred significant price appreciation. The dismissal of the lawsuit, even if partial, would provide much-needed regulatory clarity, significantly boosting investor confidence. This potential resolution drove XRP up 12+% to $2.50, indicating the market's sensitivity to legal outcomes.

Technical Analysis: Charting a Course to New Highs

From a technical standpoint, XRP's price action displays a complex interplay of support and resistance levels. A critical resistance zone lies between $2.60 and $2.89. Overcoming this barrier is crucial for XRP to unlock its full potential and embark on a sustained upward trend. However, XRP has shown resilience, maintaining support above the $2.0 mark, which suggests underlying strength.

Analyzing the Elliott Wave theory, some analysts suggest XRP is currently in a corrective Wave 4. Within this framework, the $2.66 level emerges as a pivotal point. Breaking above this level would signal the completion of Wave 4 and the initiation of Wave 5, potentially leading to new all-time highs. This wave count, while speculative, provides a valuable framework for understanding potential price movements.

Conversely, trading below the 100-day moving average (MA) presents a significant setback for XRP buyers. This would signal a potential shift in momentum and could lead to further downward pressure. Investors should closely monitor this MA as a key indicator of short-term price direction.

Bitnomial's XRP Futures: Bridging Traditional and Crypto Markets

The launch of Bitnomial's CFTC-regulated XRP futures marks a significant milestone for the asset. This development provides institutional investors with a regulated avenue to gain exposure to XRP, potentially increasing liquidity and market depth. This regulated futures market may also provide more price stability, while also providing a tool for shorting XRP.

How High Can XRP Price Go After a Ripple Victory?

The question on everyone's mind is: how high can XRP soar if Ripple secures a decisive victory against the SEC? Predicting exact price targets is inherently challenging, but several factors suggest a bullish outlook.

Firstly, regulatory clarity would remove a major overhang that has suppressed XRP's price for years. This newfound certainty would attract a wave of institutional and retail investors who have previously been hesitant to invest due to legal uncertainties.

Secondly, Ripple's continued expansion and adoption of its technology, particularly in the cross-border payments sector, positions XRP for long-term growth. The increasing demand for efficient and cost-effective payment solutions could further fuel XRP's price appreciation.

Thirdly, the psychological impact of a legal victory should not be underestimated. It would validate XRP's legitimacy as a digital asset and potentially trigger a FOMO (fear of missing out) rally.

Based on these factors, some analysts speculate that XRP could potentially retest and surpass its previous all-time high, potentially reaching double-digit valuations. However, the timing and magnitude of such a surge remain subject to market dynamics and regulatory developments.

Why Is XRP Surging? The Convergence of Catalysts

The recent surge in XRP's price can be attributed to a convergence of positive catalysts. The nearing conclusion of the SEC lawsuit, coupled with the launch of CFTC-regulated XRP futures, has created a perfect storm of bullish sentiment.

Furthermore, general market sentiment towards cryptocurrencies has been improving, with increasing institutional adoption and growing awareness of the technology's potential.

Navigating the Volatility: A Word of Caution

While the outlook for XRP appears promising, investors should remain cognizant of the inherent volatility of the cryptocurrency market. Regulatory developments, market sentiment, and technical factors can all significantly impact price movements.

Therefore, investors should conduct thorough research, manage their risk prudently, and avoid making impulsive decisions based on short-term price fluctuations.

In conclusion, XRP is navigating a complex landscape of regulatory headwinds and technological tailwinds. The nearing conclusion of the SEC lawsuit, coupled with the launch of regulated futures, presents a compelling case for a bullish outlook. However, investors should remain vigilant and exercise caution as they navigate the volatile crypto market. The interplay of legal outcomes, technical analysis, and market sentiment will ultimately determine XRP's future trajectory.

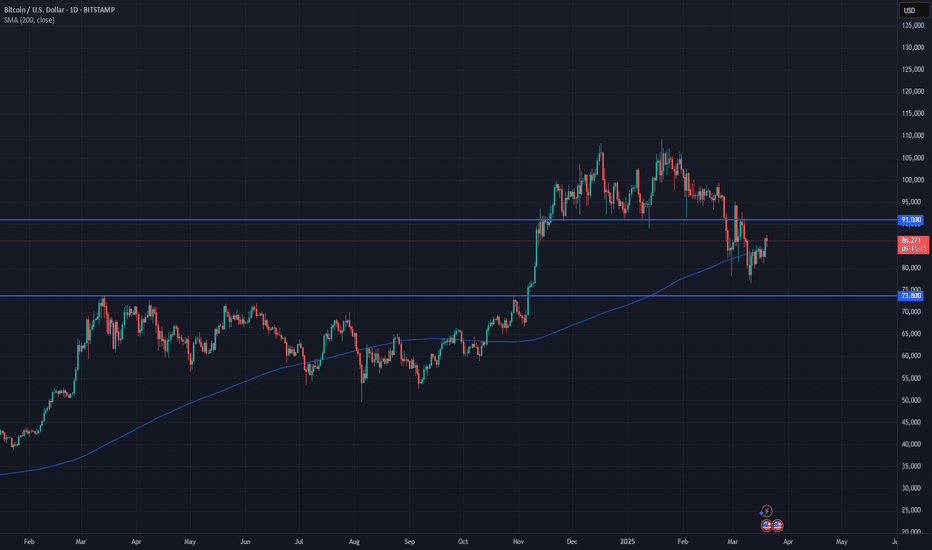

Unveiling Crypto Market Insights - Wen PumpGM, Bitstampers!

In today’s update, we’re diving into Bitcoin’s recent price action, analyzing its current trend, and identifying key support and resistance levels .

Bitcoin Market Commentary

Bitcoin reached a new all-time high (ATH) of $109.4K on January 20, 2025, on Bitstamp. Since then, the price has been in a sustained downtrend, marking 50 consecutive days without a meaningful trend reversal.

On March 9, BTC broke below the 200-day simple moving average (SMA) and had repeatedly failed to reclaim it—until yesterday, when it made a conclusive close above it, indicating a potential trend reversal.

We’re closely watching key support and resistance levels:

March 11 low – Bitcoin touched 76K, and established short-term support.

Next major support – Around 73K, aligning with the March 2024 high. A drop to this level would mark a >30% correction from ATH.

With Bitcoin reclaiming the 200-day SMA, indicating a potential trend reversal, levels around 90K could act as an important line of resistance.

If Bitcoin bottomed on March 11, that would mark an almost 30% correction lasting 50 days.

What’s next for Bitcoin? Has it bottomed, or is further downside in play? When do you think Bitcoin will trade above 100K again? Share your thoughts in the comments!

$SPY March 20, 2025AMEX:SPY March 20, 2025

15 Minutes.

For the extension 559.07 to 566.3 to 562.05 100% move is done yesterday making a high 570.95.

For the last rise 562.05 to 570.95 holding 565 is important else i expect a side moving average consolidation around 562 563 levels so that 50, 100 and 200 gets sorted out in order.

Is Chevron Attempting a Breakout?Chevron has gone nowhere for more than a year, but some traders may think that’s changing.

The first pattern on today’s chart is the $162.30 level, the highest weekly close since last May. The energy giant challenged that resistance a few times without success -- but yesterday may have broken it decisively.

CVX also apparently escaped a falling trendline that began in September 2023.

Next, you have the series of lower weekly lows, followed by higher weekly lows (marked with yellow arrows). That may be viewed as a long-term basing pattern.

Last, the 100-day simple moving average (SMA) recently crossed above the 200-day SMA. The 50-day SMA crossed above both. Such an alignment, with faster SMAs above slower ones, may be consistent with a longer-term uptrend.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Bearish Scenario If FOMC News Favors BearsFOMC interest rate news is due in less than 2hours .

I Stayed out of the market waiting since last Thursday just to wait for FOMC news because the market will almost always goes into consolidation days before this news due to its significant impact. So its usually a good idea to avoid getting chopped in the sideways action unless you like donating money to the market instead of waiting for a new trend to emerge or a continuation of the on-going trend.

After todays fomc news, we will know if we will resume dumping everything, or we'll evaluate potential short term bullish scenarios. For now, my recent BTC short analysis is still intact. I already took profit on all 8 short positions i was in on various coins i shorted along side BTC. If the FOMC news favors the bears, i'll be looking to re-enter shorts in the range 86.4k to 91k.

XRP Update | $5Similar accumulation pattern to what we've seen last year December. Price action is holding up nicely above the 150d SMA on a daily TF with bullish closes also sitting above the 8d SMA.

Volume is looking very good too with price sitting above the value area.

I'm using the fibonacci extension to get a local target of $5.