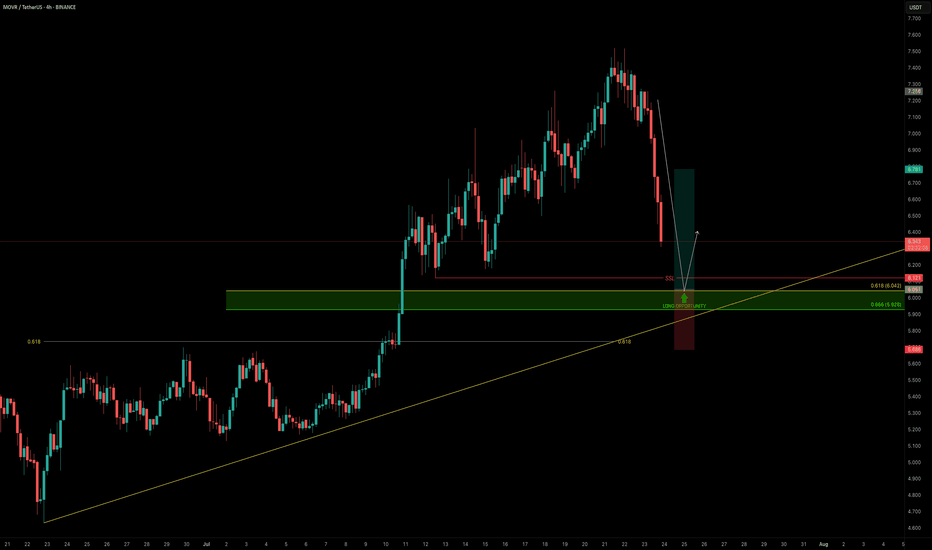

MOVR — Buying the Dip Into Confluence SupportAs the broader market pulls back, it’s the perfect time to scan for high-conviction long setups — and MOVR stands out.

Price is approaching a strong confluence support zone, offering a solid long opportunity.

🧩 Key Technicals

➡️ Liquidity Pool Below the Low:

There’s a visible liquidity pocket just beneath the swing low at $6.121 — an area where stop hunts and reversals are likely.

➡️ Fib & Speed Fan Confluence:

0.618 Fib retracement from the recent move aligns at $6.042

0.618 Speed Fan level also intersects the zone

Together, they form a technical floor right at the $6 psychological level

🟢 Long Trade Setup

Entry: $6.042

Stop-loss: $5.685 (below structure & liquidity sweep)

Target (TP): $6.78

R:R: ≈ 1:2+

Plan: Wait for price to fill into the zone and monitor for a bullish reaction (e.g., SFP, bullish structure reclaim)

💡 Why It Matters: Confluence Builds Confidence

When multiple tools — fib retracement, speed fan, liquidity pools, and psychological round numbers — all line up, it increases the probability of a strong reaction.

This is how smart money builds positions — not by chasing pumps, but by entering where others panic.

Final Thoughts

MOVR is approaching a clean, high-probability buy zone just below $6.00.

If the level holds and confirms with price action, this setup offers a solid R:R and a clear invalidation point.

📌 Mark the zone, set your alert, and let price come to you.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

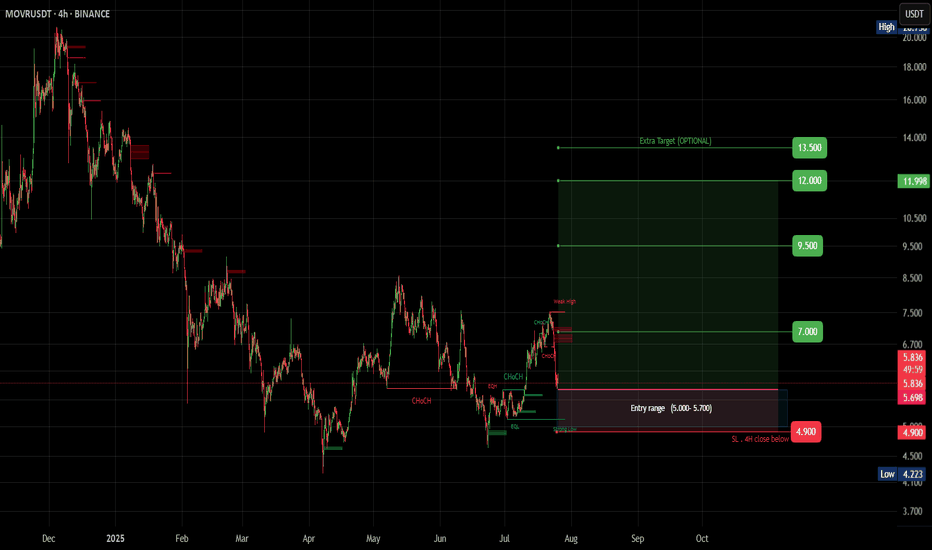

Movr

MOVR (SPOT)BINANCE:MOVRUSDT

#MOVR/ USDT

Entry (5.000- 5.700)

***** (Wait for the price to come to the entry range & price may come to the lowest entry point ) ******

SL 4H close below 4.900

T1 7.00

T2 9.50

T3 12.00

Extra Target

T4 13.50

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

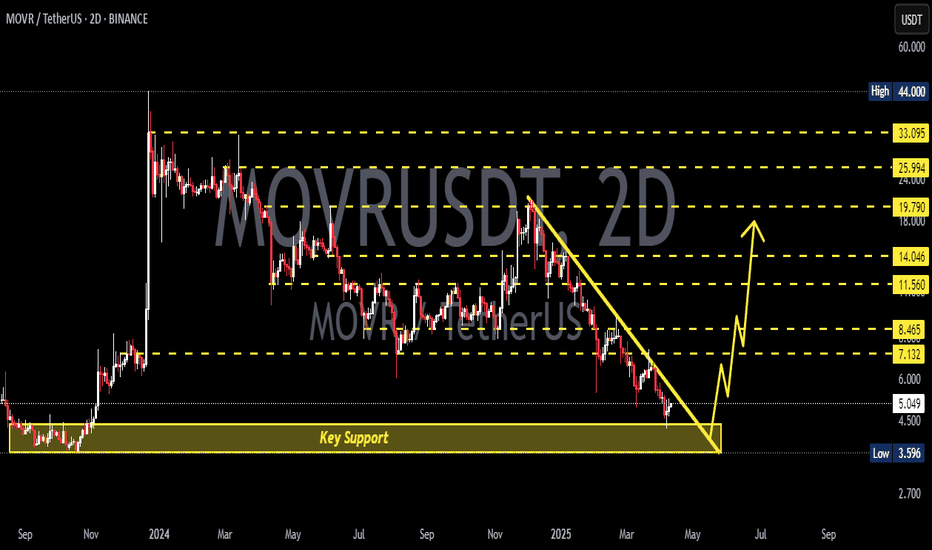

Moonriver 331% Profits Potential Target Mapped (Volume Breakout)Moonriver today produced the highest volume daily since December 2024. The big difference between now and then lies in the fact that in December MOVRUSDT was trading near a peak while today it is coming out of a higher low. Increasing volume in this situation means the start of something positive for the bulls.

For example, last year after some bearish action the first high volume candle came in October. After some choppy action, we experienced a strong bullish wave.

So now we have high volume today and this is only the start. We will see grow and more volume and bullish momentum building up... It will all accumulate and culminate in a massive bull run.

Thanks a lot for your continued support.

Namaste.

Moonriver Short-Term Boom 128% PP & 390% Mid-Term (You Choose)I am sharing Moonriver as a short-term trade setup but this doesn't invalidate the long-term potential. It will grow strong with the rest of the market but here is a fast target.

A "fast target" based on the fact that we have a bullish flag on the chart. The bull-flag is a continuation signal which means higher prices in the coming weeks and days.

Now, remember, the market can change course but if this happens the bullish bias is not invalidated rather we wait. If prices move down first before additional growth this is nothing other than some noise, a market shakeout before additional growth.

The bias is bullish, the signals are bullish and this means we are going up.

The main target for the short-term is a nice double-up. Whatever money you put in it can more than double if-when the target hits.

If there is a drop support will be found at the 3-Feb or 11-March low support. I am not betting on the low, but we need to be prepared.

Aim high, you got this. This is another easy chart. Remember Kaito?

Oh yes... We are bullish now and this is only the start.

The entire Cryptocurrency market will be extremely bullish by late May.

Prediction confirmed, success.

Thank you for reading.

Namaste.

#MOVR/USDT#MOVR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.70.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 4.80

First target: 4.90

Second target: 5.0

Third target: 5.12

Moonriver: Your Altcoin ChoiceHere Moonriver produced growth equaling 1,000% in a down year, 11X. Between late 2023 and early 2024. Surely, if this pair can produce this much growth as part of a bounce, a small move lasting two months within a bearish period, it can definitely grow more in a bull market. Any type of bull market.

Following this logic, a bull market year can produce a minimum of 2,000% or 3,000%, or maybe more, 5,000%, because the 1,000% was when the market was down and at its worst. And this all happened within 2 months.

So two months can produce 1,000% growth. Six months can surely produce so much more. This is logical thinking, makes sense and I believe you can agree.

Imagine the market going full blown bullish but producing the exact same amount of growth as in a neutral year, 1,000%. This would still be great but it doesn't make any sense.

Moonriver (MOVRUSDT) is trading at bottom prices with a long-term higher low (technical double-bottom), ready to grow. 2025 is the Cryptocurrency bull market year, we will see a minimum of 21X, but this pair can grow much more.

This another great Altcoin Choice.

Make sure to secure profits as your capital grows.

We are entering the 2025 bull market this or next month. The growth starts now, slowly, by next month everything will speed up. The wait is over. Rest easy, the pair you are holding is good with good potential for growth. Really strong. Your wise. You are smart.

Thanks a lot for your continued support.

Namaste.

MOVRUSDT – Simple Trade, No Need for Big Risk! “Sharp moves, unpredictable price action—this one screams ‘shitcoin vibes’ but we trade with a plan, not emotions.”

🔥 Key Insights:

✅ Clean Setup – If price reacts from my levels, it’s a straightforward trade. No need for overcomplication.

✅ Controlled Risk – No reckless sizing here. Calculated risk = long-term success.

✅ Sharp Movements = Caution – Sudden spikes, erratic price action—this is where patience beats impulsive trading.

💡 How I’m Approaching This Trade Like a Pro:

LTF Confirmation Required – I won’t just enter blindly. Volume profile, CDV & LTF structure must align.

If It Moves Too Wildly? I’ll step aside—choppy shitcoins eat accounts. Risk management comes first.

No Overexposure – This is just one trade, not a lottery ticket. Play smart, not desperate.

📉 Final Thought:

Shitcoins can be goldmines or traps. The difference? Smart execution & discipline. Follow me if you’re done with gambling and ready to trade like a pro. 🚀🔥

A tiny part of my runners;

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

j

A tiny part of my runners:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#MOVR/USDT#MOVR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 4.93.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 5.65

First target: 6.14

Second target: 6.60

Third target: 7.08

Alikze »» MOVR | Supercycle Bullish Wave 3 or C Scenario - 1D🔍 Technical analysis: Super cycle Bullish Wave 3 or C Scenario - 1D

📣 MEXC:MOVRUSDT currency has encountered demand after a zigzag correction in the 3.61 range, which has had a rapid upward rally

🟢 After that, the price has had a double complex zigzag correction to the origin of the third upward wave.

🟢 Again, in the origin of the third movement, with a three-wave movement, it has encountered demand again in the area of the bottom of the ascending channel.

🟢 Currently, selling pressure is also observed in the ceiling of the ascending channel and the supply area.

💎 If this correction is broken in the form of a zigzag to the minor ceiling, it can be extended to the minor ceiling. It can again encounter demand and an upward rally to the minor ceiling of the previous rally.

💎 Depending on the momentum, this cycle can be a super cycle wave 3 or C to touch the red box area.

⚠️In addition, if the area touches the bottom of the previous wave, the bullish scenario is invalidated and should be re-examined and updated.⚠️

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

🙏Thanks for your continued support.

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

Volume Spike, But Buyers Are Quiet Watching the Green Line!MOVRUSDT: Volume Spike, But Buyers Are Quiet—Watching the Green Line! 🚦📈

Key Points:

Volume Alert: Significant volume spike noted, signaling potential activity.

Buyer Status: No active buyers at the moment, so patience is key.

Entry Condition: Monitoring closely for opportunities as the price approaches the green line.

Why This Matters?

Volume spikes often precede market moves, but confirmation is crucial. I rely on tools like CDV, liquidity heatmaps, volume profiles, and volume footprints to pinpoint high-probability setups. The green line marks a potential inflection point, making it critical to observe market behavior as it gets tested.

Pro Tip: Always combine technical signals with market context—low time frame structure breaks and buyer presence are essential for validation.

Find this analysis useful? Don’t forget to boost, comment, and follow. Together, we’ll dominate the charts!

Let me tell you, folks, this is amazing. Nobody does analysis like I do. Believe me. If this helps you, don't forget to boost and comment! It’s a big deal, motivates me to share even more winning insights with you. Tremendous insights.

I keep my charts the best, clean, simple, and clear. You know it, I know it, clarity leads to better decisions. No question about it. My approach? Built on years of tremendous experience. Incredible track record. I don’t claim to know it all, but I spot high-probability setups like nobody else. Trust me.

Want to learn how to use the heatmap, cumulative volume delta, and volume footprint techniques I use to determine demand regions with stunning accuracy? Send me a private message—totally free, folks. That’s right. I help anyone who wants it, absolutely no charge. Unbelievable value.

Here’s the list, long list, great list, of some of my previous incredible analyses. Each one, a winner:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

And that’s just the start. The list goes on and on, folks. It’s a tremendous list, the best. I stopped adding because, frankly, it’s tiring. So many wins. People are amazed. You can check my profile and see for yourself, winning moves, all the time. Believe me, nobody does it better.

#MOVR/USDT Ready to go higher#MOVR

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 12.60

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 12.83

First target 13.26

Second target 14009

Third target 15.03

MOVR/USDT Technical Analysis: Potential Bearish Continuation

Based on the analysis of this chart, the most likely trend appears to be bearish in the short-to-medium term. The chart displays several indicators that point to a weakening of upward momentum and the potential for further downside.

Bearish Evidence:

Failed Breakout and Lower High:

The price attempted to break above $20 but failed to sustain the move, forming a lower high. This is a classic bearish signal indicating reduced buying pressure.

MACD Momentum Weakening:

The MACD is in a bearish crossover, with the signal line below the MACD line, and the histogram is trending negative. This suggests growing selling momentum.

RSI Deterioration:

The RSI has dropped below 50, indicating weakening bullish momentum and a shift toward bearish sentiment.

Bollinger Bands Contraction:

The Bollinger Bands are narrowing, signaling a period of lower volatility. The price is hovering around the middle band, leaning toward a downside breakout.

Trendline and Support Breakdown Risk:

The price is trading below the key support zone near $17.30, which was previously acting as a base. A close below this level could accelerate bearish momentum.

Key Levels to Watch:

Immediate Resistance:

$17.30: This former support now acts as immediate resistance. A failure to reclaim this level will keep the bearish trend intact.

Immediate Support:

$16.00: A psychological support level and a key area of recent consolidation.

$14.50: The next critical support level, aligning with previous price congestion zones.

Major Support:

$12.00: A significant area where buyers previously stepped in.

Trading Strategy:

Bearish Scenario:

Short Entry: Below $16.90 after a confirmed close below this level.

Take Profit:

First Target: $16.00

Second Target: $14.50

Final Target: $12.00

Stop Loss: Above $17.50 to minimize risk if the price reclaims resistance.

Risk Management Considerations:

Given the narrowing Bollinger Bands, a sudden spike in volatility is possible. Traders should use tight stop losses.

Monitor volume; a significant increase on a breakdown below support levels will confirm bearish momentum.

Conclusion:

The current price action suggests that MOVR/USDT is leaning bearish, with key indicators signaling further downside. A close below $16.90 will likely open the door to retesting lower support levels. However, a reclaim of $17.30 could negate the bearish outlook and shift the market back toward neutrality.

Moonriver (MOVR)Moonriver is an Ethereum-compatible, smart-contract parachain on Kusama. It is intended to be a companion network to Moonbeam, where it will provide a permanently incentivized canary network. The new code will ship to Moonriver first, where it can be tested and verified under real economic conditions. Once proven, the same code will ship to Moonbeam on Polkadot.

Anyway, MOVR has been in a downtrend, a long and deep one, almost since birth. Then, MOVR broke the curved downtrend line, and a new upward wave started. Correction unfolded in a descending channel, then MOVR broke the channel and the next upward wave started. Let's see how high MOVR can go.

#MOVR/USDT#MOVR

The price is moving in a descending channel on a 30-minute frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of

16.90

Entry price 17.02

First target 17.52

Second target 18.20

Third target 18.80

movr usdt"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

#MOVR (SPOT- INVESTING ) IN ( 8.200- 10.500)T.(64.000) SL(7.890)BINANCE:MOVRUSDT

entry range ( 8.200- 10.500)

Target1 (15.500) - Target2 (19.900)- Target3 (29.900)- Target4 (50.000)- Target5 (64.000)

3 Extra and Very Huge Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (7.890)

This trade notes..

_______________

* Keep your order in the entry range and wait for the order to be filled.

* All targets may take time to be achieved.

* This trade is for investors and big time frames traders.

______________________________________________________________

Golden Advices.

**********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

**********************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

********************************************************************************************************************** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT # IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR .

MOVR/USDT Approaching Key Resistance Levelshello guys!

Trend Breakout: The price broke above the long-term descending trendline, signaling a potential shift to bullish momentum.

Current Range: The asset is trading within an ascending channel, with the lower boundary around $10 and resistance near $16-$18.

Support Zone: A strong demand zone (S&D) around $7-$8 has acted as a launchpad for the recent upward movement.

Resistance Area: $16-$18 represents a significant supply zone, as highlighted. A breakout above this level could lead to a rally toward $20 and beyond.

Possible Scenarios:

A continuation within the channel with a potential retest of the $12-$13 area before another leg upward.

A breakout above $18, confirms bullish dominance.

Failure to hold within the channel could push the price back toward the $10 or $7-$8 support zones.

#MOVR/USDT#MOVR

The price is moving in a symmetrical head and shoulders pattern on the 4-hour frame

We are now in the right shoulder formation and a rebound is expected

We have a rebound from the lower limit of the pattern at 9.00

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.007459

First target 0.007980

Second target 0.008738

Third target 0.009700

MOVR Primed for a Massive Breakout: Potential 1026% Surge Ahead!hello guys.

let's analyze MOVR!

Current Trends:

- Downtrend and Descending Channel: The price of MOVR has been in a downtrend, moving within a descending channel since its previous high. This indicates a period of consolidation and potential accumulation.

Key Levels:

- Support and Resistance:

- Support: The internal trendline and the bottom of the descending channel are acting as significant support levels.

- Resistance: The upper boundary of the descending channel and the horizontal resistance around $22 are key resistance levels to watch.

Bullish Indicators:

- Engulfed Candlestick Pattern: Recently, there was a bullish engulfing pattern, suggesting a possible reversal in the downtrend.

- Quick Reaction and Internal Trendline: The price reacted quickly to the support levels and is now approaching the internal trendline, indicating growing bullish momentum.

Potential Breakout:

- Breakout Scenario: If the price breaks above the descending channel and surpasses the resistance around $22, it could initiate a strong upward move.

- Target: The projected target for this potential breakout is around $199, indicating a possible 1026% increase from the current levels.

Market Sentiment:

- Trader Sentiment: The current market sentiment seems optimistic, with traders potentially positioning themselves for a breakout, as indicated by the recent price movements and pattern formations.

Conclusion:

- Actionable Insights: Traders should watch for a confirmed breakout above the descending channel and the $22 resistance level. A sustained move above these levels could lead to significant gains, with a long-term target of around $199.

- Risk Management: It is essential to manage risks by setting stop-loss orders below the support levels to protect against potential downside moves.

This analysis highlights a promising setup for MOVR/USDT, emphasizing the importance of key support and resistance levels and the potential for a substantial bullish breakout.

___________________________

✓✓✓ Always do your research.

❒❒❒ If you have any questions, you can write them in the comments below, and I will answer them.

❤︎ ❤︎ ❤︎And please don't forget to support this idea with your likes and comment