Important support and resistance zone: 0.18951-0.21409

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(DOGEUSDT 1D chart)

The M-Signal indicator on the 1M chart is passing the HA-Low indicator.

Therefore, the A section, that is, the area around 0.18951, is an important support and resistance zone.

-

However, since the HA-High indicator on the 1M chart is formed at the 0.21409 point, it is expected that the uptrend will begin only if the price rises above this point and maintains.

Therefore, we recommend buying when it shows support in the 0.18951-0.21409 range.

-

It is not visible on the current chart, but the HA-High indicator on the 1D chart is formed at the 0.42847 point.

Therefore, if it continues to rise like this, it is possible that it will touch the 0.42847 area.

If not, we should pay attention to whether the HA-High indicator on the 1D chart is newly created.

-

If it does not rise but falls, we should check whether it can rise with support near the M-Signal indicator on the 1D chart.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

MS

Check support near 2.2582

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(XRPUSDT 1D chart)

XRP's important support and resistance area is near 2.6013.

When this area breaks upward, it is the breakout trading period.

However, in order to feel more stable, buy when support is confirmed near 2.2582.

Therefore, XRP is still in an ambiguous position to consider it as a buying period.

It is not good to think that you can make more profit by buying in advance when there is not much left anyway.

The reason is that it is highly unlikely that a suitable countermeasure will be made.

Therefore, even if you buy at a slightly higher price, it is best to buy when it fits your own rules, that is, your trading strategy.

-

Like BTC, since the HA-Low indicator has been leveled off since it was created, if it rises above the HA-Low indicator this time, it is likely to lead to an additional rise.

If it does not rise and falls, it is highly likely that the price will continue to rise only if it maintains above the M-Signal indicator on the 1M chart.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

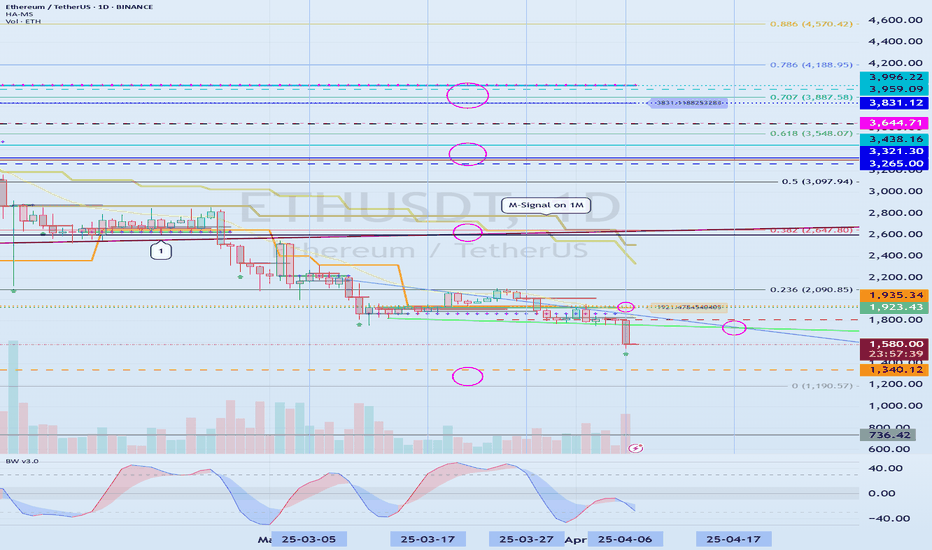

Short-term uptrend conversion point expected: 1647.06

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

The HA-Low indicator on the 1D chart is formed at the 1647.06 point.

Therefore, the key is whether it can receive support and rise near 1647.06.

-

However, since the M-Signal indicator on the 1M chart is falling near 2500, you should trade with a relaxed mind.

This is because in order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

-

Since the M-Signal indicator on the 1D chart is passing near the HA-Low indicator on the 1D chart, if it rises above 1647.06 and maintains the price, it is likely to turn into a short-term uptrend.

Since the trend line is showing a downward channel and the StochRSI indicator is above 50, the increase is likely to be limited.

Therefore, when the StochRSI indicator shows an upward trend below 50, it is a buying period when the price is maintained above the HA-Low indicator.

If it rises above 1647.06 and continues to rise further, it is expected to touch the Fibonacci ratio of 0.618 (1868.21).

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Next Volatility Period: Around April 25-29

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BTCUSDT 1W chart)

The key is whether it can receive support near the OBV Line indicator (84349.94) on the 1M chart and rise above the M-Signal indicator on the 1W chart.

-

(1D chart)

(Movement in a wide range)

If you look at the lines drawn with multiple lines, you can see that it is currently moving sideways within the section that the fingers are pointing to.

It may seem a bit complicated, but the key is in which direction the finger points out.

(Narrow range movement)

After the volatility period of around April 14-17, there is a possibility that the short-term trend will change.

The next volatility period is expected to be around April 25-29 (up to April 24-30).

Therefore, the point of interest is whether it will fall below the M-Signal indicator on the 1D chart and show a downward trend, or rise above the M-Signal indicator on the 1W chart and show an upward trend.

In other words, you need to look at whether it will rise along the trend line (2) or fall along the trend line (4).

-

As I said before, if the StochRSI indicator is above 50, it is better to focus on finding a selling point.

The reason is that even if it rises, the upward trend is likely to be limited.

If the trading volume increases explosively when it shows support at a certain support and resistance point or section, it is possible that it will lead to a large increase, but it is a rare case, so it is better to refrain from expecting it.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio section of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have maintained an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

Important Support and Resistance Zones: 582.20-595.0

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

(BNBUSDT 1D chart)

The HA-Low indicator on the 1D chart and the HA-High indicator on the 1W and 1M charts are formed in the 582.20-595.0 zone.

Therefore, whether there is support near this zone is an important key point.

The zone marked with a circle corresponds to the support and resistance zone.

-

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1W chart.

Therefore, we need to check if the price is maintained above the Fibonacci ratio of 0.786 (617.42).

-

If it falls below 583.54 and shows resistance,

1st: 551.61-554.60

2nd: 522.02

3rd: 496.02

We need to check if it is supported near the 1st-3rd above.

-

However, in order to continue the mid- to long-term uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

Therefore, it is especially important to check if there is support near 551.61-554.60 when falling.

-

The fact that the HA-Low indicator was created means that it rose from the low point range.

The fact that the HA-High indicator was created means that it fell from the high point range.

Since the HA-High indicator of the 1W and 1M charts is formed near the HA-Low indicator of the 1D chart, the 582.20-595.0 section corresponds to the high point section in the medium to long term.

Therefore, if it rises, it can be interpreted that it has risen to the high point section in the medium to long term.

A full-fledged upward trend, that is, a stepwise upward trend, is possible when the price is maintained above the HA-High indicator.

-

Since the HA-Low indicator of the 1D chart is formed, if it shows support near the HA-Low indicator, it is a short-term buying period.

Therefore, even if it rises above 582.20-595.0, it is expected that it will be advantageous to conduct a transaction with a short and quick response.

However, if it falls below the HA-Low indicator and maintains the price, there is a possibility that a stepwise downward trend will begin, so caution is required when trading.

-

To check if we have escaped this unstable situation, when the StochRSI indicator shows an upward trend below 50, it should show support near the HA-Low indicator.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

Relationship between trendline and StochRSI

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

I think that everything used in chart analysis should be objective so that everyone can understand it.

If not, I think that if we start complaining about the different interpretations used in chart analysis, the essence may be damaged.

Therefore, I am trying to present a method that anyone can understand and draw in the same way.

In that sense, I have talked about the method of drawing trendlines several times.

Today, I will explain additional parts that were not covered in the previous drawing methods.

To set it like the StochRSI indicator on this chart,

- Source value: ohlc4

- Setting value: 14, 7, 3, 3 (RSI, Stoch, K, D)

You can set it like this.

-

A trend line is literally a line drawn to find out the trend.

It can also be used to predict how the current trend will change in the future.

However, since a trend line is drawn for chart analysis, what we need to draw importantly is the support and resistance points on the 1M, 1W, and 1D charts.

-

The trend line currently drawn is as follows.

Trend line (1): Trend line between lows drawn on 1W chart

Trend line (2), (6): Trend line between lows drawn on 1D chart

Trend line (3), (4): Trend line between highs drawn on 1D chart

Trend line (5): Trend line drawn on 1M chart

Therefore, in order to continue the uptrend in the medium to long term, the price should be maintained above trend line (1).

Similarly, in order to continue the uptrend in the long term, the price should be maintained above trend line (5).

-

The trend line is drawn by connecting the points between the highs or lows of the StochRSI indicator.

The StochRSI indicator creates waves in any case.

However, when creating waves, you should consider that the points necessary for drawing the trend line have been formed by touching the overbought and oversold areas and draw them.

Therefore, the points of the A and B sections of the StochRSI indicator are ambiguous points for drawing trend lines.

The solution to these points is the same as the trend line drawn above.

That is, the trend line is operated by connecting the points of the A section or the B section based on the last point created by touching the overbought or oversold section.

At this time, the important thing is that it must have escaped the overbought or oversold section.

The trend line (3) and trend line (4) drawn in this way form an expansion channel.

Therefore, once the decline begins, you can see that there is a possibility of a large decline.

However, as I mentioned earlier, the trend line was drawn to analyze the chart.

Therefore, you need to check the importance of the support and resistance points drawn in the area to see if it will actually lead to a decline.

Currently, the important support and resistance range from a short-term perspective is 76322.42-78595.86.

And, from a medium- to long-term perspective, the important support and resistance range is 69000-73499.86.

Therefore, even if it falls below trend line (4) and shows a large decline, it is expected that it will not be easy to touch trend line (3).

-

Trend line (2) and trend line (6) are trend lines drawn between low points on the 1D chart.

Therefore, even if it falls, it is highly likely that the area around trend line (6) will be the maximum.

In other words, even if the decline begins, it is highly likely that it will re-confirm the support around 76322.42-78595.86.

-

In any case, this volatility period ended without any significant movement.

The next volatility period is around April 25-29.

Since the StochRSI indicator is clearly showing a downward trend in the overbought zone, the key is whether there is support around 83423.84-84591.59.

If the price is maintained above the 1D chart, there is a high possibility of maintaining a short-term uptrend.

However, from a trading perspective, it should show support near the HA-Low indicator on the 1D chart to be a trading period.

Therefore, whether there is support near 89294.25 is important.

-

Therefore, we are troubled.

Should we buy when it is supported in the current zone, 83423.84-84591.59, or should we buy when it is supported near 89294.25?

If the StochRSI indicator rises above the 50 point, it is better to focus on finding a time to sell, and if it falls below the 50 point, it is better to focus on finding a time to buy.

If you look at the chart again with this information, you can decide that it is better to wait a little longer rather than proceed with the current transaction.

-

In the previous idea, I said that if it rises to around 89294.25, there will be a psychological feeling that it will rise further, and you will try to make a breakout trade.

At this time, what we should be interested in is whether the trend line between the lows and the trend line between the highs are formed in the same direction.

And, whether the StochRSI indicator shows an upward trend below the 50 point.

If it does not show such a movement, it is highly likely that it will shake up and down with a large fluctuation range.

Therefore, it is absolutely necessary to check whether it is supported near 89294.25.

Checking support and resistance is a tedious and difficult task.

Checking support and resistance requires checking the movement for at least 1-3 days.

-

The fact that the HA-Low indicator was created means that it rose from the low point range.

Since it has currently fallen below the HA-Low indicator, it can be interpreted that it has fallen back to the low point.

Therefore, in order for an uptrend to begin, the trading volume must increase when confirming support near the HA-Low indicator.

If the trading volume does not increase and it rises, it may not rise much and turn into a downtrend, so you should think about a countermeasure for this.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

What to consider when trading...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

This is my personal opinion, so it may differ from yours.

Please keep this in mind.

-

So, how should I proceed with day trading?

When trading day trading, the first thing to consider is the trading volume.

Coins (tokens) with low trading volume should be avoided because volatility can occur in an instant, making it difficult to respond quickly and likely to result in losses.

Therefore, if possible, it is recommended to choose coins (tokens) with high trading volume.

The next thing to consider is the price of the coin (token).

If the price of the coin (token) becomes too high or too low, even if you sell it for profit, you may incur a loss.

Therefore, when trading a coin (token) with a very high price, you should trade with a longer time frame.

In other words, the increase should be high.

When trading a coin (token) with a very low price, you need to be persistent.

This is because the amount you want to trade is large, so the rise or fall may be slow.

The next thing to consider is the size of your trading funds.

If your trading funds are too small, you may not be able to enjoy trading because you will earn too little profit compared to the stress of trading.

If you lose the fun of trading like this, you will have difficulty continuing to trade or you will likely leave the investment market, so you need to be careful.

If you set the trading fund size too high, you can suffer a big loss with one mistake, so you must set a stop loss point and keep it.

You can find out how much trading fund size is right for you by looking at your psychological state when you trade.

If you think you are trading too boldly, it is better to think that the trading fund size is small and increase it little by little.

If you feel extremely anxious when you trade and incur a loss, it is better to reduce the trading fund size little by little.

-

(BTCUSDT 30m chart)

Considering the above considerations (trading volume, price, trading fund size), you should continuously observe the selected coin (token) chart to check the movement at the support and resistance points.

To do this, you need to check whether there is support at the support and resistance points drawn on the 1M, 1W, and 1D charts when you meet the HA-Low and HA-High indicators, which can be the basis for starting a transaction, or when you have a trading strategy.

Usually, when the Trend Cloud indicator shows an upward trend while receiving support near the HA-Low indicator and rising, there is a high possibility of rising.

Therefore, you should consider whether to buy when the HA-Low indicator shows support.

And, when the HA-High indicator touches and falls, there is a high possibility of falling when the Trend Cloud indicator shows a downward trend.

Therefore, the area near the HA-High indicator corresponds to the first selling section.

In this way, you can conduct transactions within the sideways section trading within the HA-Low ~ HA-High section.

Then, when there is a movement that falls below the HA-Low indicator or rises above the HA-High indicator, you can conduct a transaction according to the trend.

Therefore, split trading is essential.

The basics of split trading are to sell half when you make a profit and set the stop loss at the principal price for the remaining half.

-

This is something everyone knows, but it is not easy to follow.

Also, there are times when it is difficult to decide what to use as the standard for trading.

In such cases, as I mentioned, I recommend that you choose a coin (token) considering the trading volume, price, and trading fund size and continuously check the movement of the chart.

Even if you are not familiar with chart analysis, if you continuously look at the chart, there is a possibility that you will see movement.

However, you need prior knowledge on how to set the stop loss point.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Why the current section is important

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

It is not easy to explain everything with just chart analysis.

Therefore, it is true that interpretation of various issues is necessary.

However, I am only explaining the chart.

The reason is that interpretation of various issues other than the chart is not easy for individual investors.

-

(NAS100USD 1W chart)

In order to continue the uptrend, the price must be maintained above the M-Signal indicator of the 1M chart.

If not, there is a high possibility of continuing the downtrend.

Therefore, if the price is maintained above 18693.7, I think it is highly likely that the uptrend will continue.

However, this is a medium- to long-term perspective.

-

(1D chart)

In the short term, the price should be maintained above the M-Signal indicator on the 1D chart.

In that sense, we can see that the current price position is an important section.

However, in order to continue the short-term upward trend, it should rise above the M-Signal indicator on the 1W chart.

In that sense, the support around 19848.3 is an important key point.

-

Currently, the StochRSI indicator has entered the overbought section.

Therefore, even if it continues to rise further, it is expected to show a downward trend in the end.

Therefore, if it is not supported near 19848.3, I think you should prepare for a decline.

At this time, you should check whether it can be supported near 18428.8 and rise.

The reason is that the HA-Low indicator of the 1D chart is formed.

-

The HA-Low and HA-High indicators are indicators created for trading on the Heikin Ashi chart.

The fact that the HA-Low indicator was created means that it rose from the low point section.

Therefore, if it is supported near the HA-Low indicator, then that is the time to buy.

If it falls without being supported by the HA-Low indicator, there is a possibility of a stepwise decline, so you should think about a countermeasure for this.

However, there is a difference between a downward trend following the HA-Low indicator and a simple downward trend.

A stepwise decline following the HA-Low indicator is likely to eventually form a bottom section.

The next volatility period is expected to be around April 29th.

-

Thank you for reading to the end.

I hope you have a successful trading.

--------------------------------------------------

Breakout trading

(Title)

Breakout trading starts with finding support and resistance points

-------------------------------

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I will take the time to talk about breakout trading.

This is my opinion, so the content may be lacking.

The reason I did not explain what other people say with examples is because trading is a psychological battle.

Most of the content in books or on the Internet is explained with patterns.

However, it is not easy to find patterns when checking the movement of a real-time chart.

Therefore, I think it is more important to understand why such movements occur than to explain them with patterns.

Therefore, I think it is better to create a trading strategy by finding support and resistance points and checking whether or not they are supported by the support and resistance points rather than memorizing patterns.

Breakout trading refers to starting a transaction after checking whether there is support at a point or section when the price rises above a certain point or section, and there is a possibility of a larger rise.

If you do a breakout trade incorrectly, you may end up buying at a high point, which could result in a large loss, so it is recommended to always keep a stop loss point when trading.

In order to reduce the stop loss, you need to make an effort to lower the average purchase price by selling in installments when the price rises after purchasing and buying in installments when the price falls again.

Therefore, the stop loss point is when it is beyond the range you can handle.

-

Let's take the BTCUSDT 1D chart as an example.

It has fallen after renewing the ATH.

Looking at the current price position, it feels like it will fall further.

However, if the price rises to around the HA-Low indicator on the 1D chart, that is, around 89294.25, you will feel like it will turn into an uptrend.

Even if you think that you won't feel that way now, you will feel that way after it rises.

Therefore, the most important thing in breakout trading is to find important support and resistance points.

To find support and resistance points, you need to basically understand candles.

Any book or video about candles will do.

I recommend that you don't try to memorize the content in it, but read or watch it repeatedly several times.

In my case, after watching the video about candles about 3 times, my understanding of the chart became easier.

The reason for finding support and resistance points is to select a trading point.

What you need to find support and resistance is a horizontal line.

It is not easy to start trading with chart tools that are not horizontal lines but diagonal lines or curves.

The reason is that when you try to start a trade, you are more likely to miss the timing because your psychological state is added.

-

You can see that the uptrend started when it broke through the 73072.41 point.

Therefore, you can see that it is possible that the uptrend will start when it breaks through the 106133.74 point this time as well.

However, in this case, since it is rising while renewing the ATH, it is a point where it is thought to be difficult to actually start trading.

In other words, it is likely that you will be reluctant to trade because it is thought to be a high point.

Therefore, as I mentioned earlier, the actual breakout trade will be conducted when it breaks through the 89294.25 point.

Then, even if it rises to around the 106133.74 point, you will be more likely to respond stably without feeling much psychological anxiety.

-

However, there is one problem.

That is, the StochRSI indicator is currently in the overbought zone.

Therefore, when it rises near the 89294.25 point and confirms support, the StochRSI indicator should show a downward trend from the overbought zone.

Otherwise, the 89294.25 point is likely to act as a resistance point.

Even if the market is messy and difficult to predict, you should not be too busy finding support and resistance points.

After all, you need to have a standard for creating a trading strategy to start trading.

It is better to create a trading strategy and respond at the support and resistance points you have selected if possible.

Even if you suffer a loss, if you continue to trade, you will be able to better organize the support and resistance points.

For reference, the indicators that can create a trading strategy on my chart are the HA-Low and HA-High indicators.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

This volatility period is expected to last until April 18

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

I looked for cases where HA-Low > M-Signal on the 1W chart > M-Signal on the 1D chart in the entire range, but I could find similar movements, but I couldn't find anything like the current one.

I think it's difficult to understand the current movement.

-

HA-Low and HA-High indicators are paired indicators that show contraction and expansion like Bollinger Bands.

Currently, the HA-Low and HA-High indicators are in a contracted state.

Therefore, if it rises near the HA-Low indicator and maintains the price, it is likely to lead to an attempt to break through the HA-High indicator.

However, since the HA-Low and HA-High indicators are defined and used as indicators that serve as the basis for trading strategies, the most important thing is whether there is support near the HA-Low indicator.

When it rises near the HA-Low indicator and shows support, if the M-Signal of the 1D chart > M-Signal of the 1W chart, that is, if it maintains a proper arrangement, the possibility of an upward trend will increase.

Therefore, what we need to do is check whether there is support near the HA-Low indicator.

-

This volatility period is expected to last from April 13th to 18th.

At this time, the key is whether it can rise near 89294.25 and receive support.

If it touches the 89294.25 point and falls, we should see if the price can be maintained around the Fibonacci ratio 2.24 (83646.12) and rise along the rising trend line (2).

The maximum decline is expected to be around the left Fibonacci ratio 1.618 (76787.43) that the finger is pointing to.

If it fails to rise along the rising trend line (2), it is likely to fail to reverse the trend.

In any case, I think it is highly likely that the uptrend will be restricted because the StochRSI indicator is expected to enter the overbought zone.

-

The Fill HA Close 1W-1M indicator is an indicator that displays the Close of the 1W and 1M charts of the Heikin Ashi chart.

This was created for the purpose of identifying the point where an uptrend or downtrend turns from a mid- to long-term perspective.

The HA Close on 1W 1M Mid indicator is an indicator that displays the middle value of the Close of the 1W and 1M charts of the Heikin Ashi chart.

I think you can tell why the HA Close on 1W 1M Mid indicator was added by looking at the price movement.

In other words, it was added because it can act as a support and resistance point.

However, it is recommended that these indicators be used for analyzing charts.

In my chart, the only indicators used to create trading strategies are the HA-Low and HA-High indicators.

-

(30m chart)

If you bought (LONG) when the HA-Low indicator was created and showed support near it, you would be currently making a profit.

If the HA-Low indicator shows support and the price rises above the Trend Cloud (or M-Signal on the 1D chart) indicator and maintains, there is a high possibility that an uptrend will begin.

Then, if it shows resistance near the HA-High indicator and falls below the Trend Cloud (or M-Signal on the 1D chart) indicator and maintains the price, there is a high possibility that a downtrend will begin.

Therefore, if you bought near the HA-Low indicator, the first sell period will occur when you meet the HA-High indicator.

This movement will be conducted within the HA-Low ~ HA-High range.

Most of the time, you will trade within the HA-Low ~ HA-High range.

Otherwise, there will be cases where the price falls below the HA-Low indicator or rises above the HA-High indicator and shows a trend.

At this time, you will either gain a bigger profit or incur a bigger loss.

Therefore, it is important to stabilize your psychological state by guarding the first split sell section.

-

The body color of the candle indicates the status of the OBV indicator.

That is, dark green means that the OBV is located above the upper line.

Dark red means that the OBV is located below the lower line.

Therefore, when dark green or dark red appears, you can see that there is a high possibility that a change in trend will occur.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio section of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Support zone: 1340.12-1935.34

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(ETHUSDT 12M chart)

I can't get on the plane and it's falling.

The maximum decline zone is expected to be around the Fibonacci ratio 0 (1190.57).

-

(1M chart)

Since it has fallen below the support and resistance zones, I think it's a good idea to check the turn with a relaxed mind.

In order to continue the uptrend, it must rise above the M-Signal indicator on the 1M chart.

If it falls to around 736.47, it is better to buy without thinking from a long-term investment perspective.

The minimum holding period is 1 year.

-

(1W chart)

When looking at the 1W chart, the HA-Low indicator on the 1W chart is formed at the 1340.12 point.

Therefore, if it shows support around this area, it is a time to buy.

If it falls below 1340.12, it is a time to buy when it rises again and support is confirmed.

In the explanation of the 1M chart, I said to buy unconditionally if it falls to around 736.42.

This is a condition for holding for at least 1 year, so if not, it is recommended to buy when it is confirmed to be supported by rising near 1340.12.

-

(1D chart)

ETH's volatility period is from April 5 to 7.

ETH's next volatility period is around April 17 (April 16 to 18).

-

The most important thing on the ETH chart is the rising trend line (1).

Therefore, volatility is likely to occur when it passes the rising trend line (1).

-

Let's look at the chart from a short-term perspective.

Currently, the HA-Low indicator on the 1D chart is formed at the 1935.34 point.

Therefore, from a short-term perspective, when it is confirmed to be supported by rising near 1935.34, it is the time to buy.

Therefore, you should think about the average purchase price of the coins you currently own and think about how to respond.

-

The best method is to increase the number of coins (tokens) corresponding to the profit.

This method is most efficient when used during a downward trend.

You write down the purchase price and amount separately, and if the purchase price rises more than the purchase price and a profit is generated, you sell the purchase amount within the purchase amount range to leave the number of coins (tokens) corresponding to the profit.

The reason why this method is explained from a short-term perspective is because you have to conduct day trading or short-term trading.

If you continue to trade until the upward trend turns like this, you will make a large profit when the upward trend turns.

In addition, since the pressure on funds has decreased, you will also have the opportunity to seize the opportunity to make a full-fledged purchase.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

To check the entire range of BTC, I used TradingView's INDEX chart.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

The key to trading is finding support and resistance points

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

If the price is maintained above the M-Signal indicator on the 1D chart, there is a high possibility that it will turn into a short-term uptrend.

However, since the HA-High indicator on the 1D chart is formed at the 89294.25 point, it can be interpreted that it has not yet escaped the low point.

Therefore, it is recommended to trade with a short and quick response such as scalping or day trading until the price rises above 89294.25 and maintains.

I think the rising trend line (2) is an important trend line that changes the trend.

Therefore, we need to check whether it can rise along the rising trend line (2).

Therefore, it is important to see whether it rises above the rising trend line (2) after passing the next volatility period, around April 14 (April 13-15).

If it fails to rise, that is, fails to rise above the M-Signal indicator on the 1W chart, it is expected that it will eventually show a downward trend again.

Since the StochRSI indicator has risen above the midpoint, it is better to start focusing on finding a selling point rather than a buying point.

In summary, in order to rise above 89294.25, I think it is possible if the StochRSI indicator shows a wave that moves from the overbought zone to the oversold zone and from the oversold zone to the overbought zone, and it is supported near the M-Signal indicator on the 1W chart.

If not, and it goes up right away and touches the area around 89294.25, there is a possibility that the area around 89294.25 will act as resistance.

-

(30m chart)

I think the important thing is where to start and where to end the trade.

The indicators used to find the answer are the HA-Low and HA-High indicators.

When the HA-Low indicator is first created, if it receives support and rises and the Trend Cloud indicator shows an upward trend, it is a buying period.

In other words, when it shows support near the HA-Low indicator, it is an aggressive buying period.

Then, when it rises and meets the HA-High indicator, that is the first selling period.

The HA-High indicator, like the HA-Low indicator, also receives resistance and falls when the HA-High is newly created and the Trend Cloud indicator shows a downward trend, it is a selling period.

In other words, when it shows resistance near the HA-High indicator, it is the first selling period.

In the case of futures trading, it is the aggressive selling (SHORT) period.

Therefore, the HA-Low and HA-High indicators can be used as criteria for creating trading strategies.

Most of the trading is in the sideways and box sections within the HA-Low ~ HA-High indicator range.

If it falls below the HA-Low indicator or rises above the HA-High indicator, you should switch to a trading strategy in the trend.

Therefore, if you bought near the HA-Low indicator, you can sell first near the HA-High indicator and then respond according to the situation.

-

Rather than thinking about how far it will rise or fall before starting a trade, it is more important to find out which points are important support and resistance points.

Once you find that point, you can boldly start trading and respond to the rest according to the situation.

I use the HA-Low, HA-High indicators as the standard.

The most important indicators for creating a trading strategy are, of course, the HA-Low, HA-High indicators.

I use the Trend Cloud indicator and the M-Signal indicators on the 1D, 1W, and 1M charts as reference indicators for buying or selling from the HA-Low, HA-High indicators.

The remaining indicators are auxiliary indicators for conducting detailed corresponding transactions.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Support Zone: 106.19

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(NVDA Chart)

The HA-Low indicator on the 1D chart was formed at 106.19.

Therefore, the key is whether it can receive support and rise near 106.19.

-

(30m chart)

If it falls below 106.19,

1st: M-Signal indicator on 1M chart

2nd: HA-Low indicator on 30m chart

You need to check if it is supported near the 1st and 2nd above.

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

-

(1D chart)

Since the HA-Low indicator on the 1D chart has been newly created, the key is whether it can be supported near this area and rise above the M-Signal indicator on the 1D chart.

If so, it is expected to turn into a short-term uptrend.

If not, there is a possibility of a stepwise downtrend, so the current position is an important section.

-

Thank you for reading to the end.

I hope your transaction will be successful.

--------------------------------------------------

The key is whether it can rise after receiving support at 0.2349

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(MANAUSDT 1D chart)

It receives support near 0.2349

1st: 0.2636

2nd: 0.3136

The key is whether it can rise to the 1st and 2nd above.

An important volume profile section is formed in the 0.1066-0.1547 section.

Therefore, from a mid- to long-term perspective, the 0.1066-0.1547 range can be considered the last buying range.

-

In order to continue the upward trend, the price must be maintained above the M-Signal indicator of the 1M chart.

Therefore, a way to increase the number of coins (tokens) corresponding to profits with peace of mind is needed.

-

MANA coins are used for Collectibles & NFTs, Gaming, Play To Earn, and Payments.

In addition, it belongs to the Ethereum Ecosystem, Solana Ecosystem, Polygon Ecosystem, Gnosis Chain Ecosystem, and Fusion Network Ecosystem.

Therefore, it seems that it can be used in various ways.

I don't think the future outlook is that bad, but since it is currently being used for Gaming, I don't think there is much merit in terms of price.

This is because it is not easy for the Gaming business to continue to develop.

I think the business needs to expand a bit more.

-

(30m chart)

- HA-High indicator rises above,

- Trend Cloud indicator is rising,

- Rising near the M-Signal indicator on the 1D chart,

- StochRSI indicator enters the overbought zone,

Under the above conditions, there is a possibility that support will be confirmed near the HA-High indicator again.

Accordingly, the key is whether it will be supported near 0.2349, which is the M-Signal indicator point on the 1D chart.

It cannot be ruled out that it will rise to around 0.2636, but it is judged that there is not enough trading volume for that to happen.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Check support near the M-Signal indicator on the 1D chart

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BTCUSDT 1M chart)

-

(1W chart)

Indicators indicating lows on the 1M chart and 1W chart, i.e. BW(0), DOM(-60) indicators, are not created.

Therefore, caution is required when trading as it can fall at any time.

This movement is likely to occur until the trend line corresponding to the trend line (1) on the 1M chart is created as a solid line.

-

(1D chart)

There are several trend lines drawn, but the important thing to consider is whether there is support near the section marked with a circle.

Among them, the section that must be broken to create a trend is 89294.25 and 73499.86.

Therefore, the key is whether the price can be maintained near the M-Signal indicator on the 1D chart and rise above 89294.25.

Therefore, the next volatility period is from around April 14th to 17th, and we need to check whether the price can be maintained above the M-Signal indicator on the 1W chart.

If it fails to rise, there is a possibility of falling again to around 78595.86 and 73499.86.

The important thing to consider is whether there is support near the M-Signal indicator on the 1D chart.

-

(30m chart)

The following applies to all time frame charts.

Trading strategies can be created based on whether there is support near the HA-Low and HA-High indicators.

Here, we refer to the movements of the Trend Cloud and StochRSI indicators.

Currently, the HA-High indicator has risen above it and the Trend Cloud indicator is thick, so it can be interpreted that the upward trend is likely to continue.

However, since the StochRSI indicator has fallen in the overbought zone, the upward trend may be limited.

Therefore, it can be interpreted that the support near the M-Signal indicator on the 1D chart is important.

If it continues to rise further, it is expected to touch the M-Signal indicator on the 1W chart.

If it rises or moves sideways, the Trend Cloud indicator will eventually become thinner.

If the Trend Cloud indicator shows resistance while being thin, the possibility of a decline increases, so at that time, you should refer to the various indicators that are generated and respond according to whether there is support near those indicators.

-

If you predict the movement in advance and proceed with the transaction, you may be subject to psychological pressure and may proceed with the wrong transaction, so you should always be careful.

In the HA-Low ~ HA-High indicator section, a trading strategy in the sideways or box section is required.

If it falls below the HA-Low indicator or rises above the HA-High indicator, a trading strategy in the trend is required.

The current example chart is a 30m chart, so this chart requires a trading strategy in the trend.

Therefore, if it shows support above the HA-High indicator, you can create a trading strategy and proceed with the transaction.

Since it is currently located near the M-Signal indicator of the 1D chart, whether there is support near this area is the first trading strategy period.

-

For reference, HA-Low, HA-High indicators are indicators created to create trading strategies, and M-Signal indicators on 1M, 1W, and 1D charts are indicators created to identify trends.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

Important support and resistance zone: 0.6678-0.8033

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(EOSUSDT 1M chart)

In order to continue the uptrend, it must rise above the M-Signal indicator on the 1M chart.

Currently, the HA-Low indicator on the 1M chart is formed at the 2.8769 point, so if the HA-Low indicator is not newly created, it will rise to around 2.8769 and show support, which is the time to buy.

However, since it is far from the M-Signal indicator of the 1M chart, it is important to check whether the price is maintained above the M-Signal indicator of the 1M chart for now.

-

(1D chart)

The 0.6678-0.8033 section is an important support and resistance section.

Therefore, the key is whether it can be supported and rise near this section.

If it falls, you should check whether it is supported near 0.5255-0.5820.

If it starts to rise, it is likely to rise to the HA-Low indicator of the 1M chart.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain the details again when the downtrend begins.

------------------------------------------------------

The key is whether it can rise to around 136.74

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(SOLUSDT 1M chart)

In terms of Fibonacci ratio, the key is whether it can rise after receiving support near 0.5 (98.71).

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

Accordingly, we need to see whether it can rise above 136.92 and receive support.

If not, and it falls, you should go up again and check if it is supported near the Fibonacci ratio 0.5 (98.71) or if the HA-Low indicator on the 1M chart is generated, and then create a trading strategy.

-

(1D chart)

Therefore, if possible, it is more important to check if it is supported near the HA-Low indicator on the 1D chart, that is, near 136.74.

-

Fibonacci ratio 0.5 (98.71) should be interpreted as having an important meaning because it is in the middle of the overall chart.

Fibonacci ratio is a chart tool that helps with chart analysis, but it is not recommended to trade with it.

-

(30m chart)

The indicator that can create a trading strategy on my chart is the HA-Low, HA-High indicator.

Therefore, you can create a trading strategy by looking at the movement of the HA-Low, HA-High indicator formed on the time frame chart that you mainly view and trade.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902(101875.70) ~ 2(106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

NASDAQ, S&P 500 and CoinMarketCap movements, Bitcoin chart

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

We need to check the movement after a new candle is created.

USDT, USDC should gap up to know that funds have flowed into the coin market.

On the other hand, if there is a gap down, I think funds have flowed out of the coin market.

Therefore, I think USDT or USDC are showing the size and flow of funds in the coin market.

-

(BTC.D 1M chart)

If BTC dominance is maintained above 62.47 or continues to rise, altcoins are likely to show a large decline.

Therefore, in order for an altcoin bull market to begin, it must fall below 55.01 and remain there or continue to decline.

-

(USDT.D 1M chart)

USDT is a fund that has a large influence on the coin market.

Therefore, if USDT dominance rises, it means that the coin market is likely to show an overall decline.

On the other hand, if it falls, it can be interpreted that the coin market is likely to show an overall rise.

In order for the coin market to start an upward trend, it must fall below 4.97 and remain there or continue to decline.

In particular, if the Fibonacci ratio rises above 0.618, the coin market is likely to plummet.

If it remains above the Fibonacci ratio of 0.618, it is likely to rise to around 7.14.

-------------------------------------------

(NAS100USD 12M chart)

It has currently entered the most important support and resistance zone.

-

(1W chart)

Therefore, the maximum decline point is expected to be around 14922.2.

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

Therefore, the key is whether it can receive support near the most important support and resistance zone and rise above the M-Signal indicator on the 1M chart.

---------------------------------------------

(SPX500USD 1W chart)

The key is whether it can be supported around 4773.4-4846.1 and rise above the M-Signal indicator on the 1M chart.

If not, the maximum decline is expected to be around 3875.1-4116.0.

---------------------------------------------

(BTCUSDT 1M chart)

As I mentioned before, since the dotted trend line (1) is not acting as a clear trend line, there is a high possibility of volatility.

Therefore, when the StochRSI indicator creates a peak in the oversold zone and rises this time, there is a possibility that a trend will be formed as a trend line between lows is created.

However, the high-point trend line and the low-point trend line must be formed in the same direction.

In other words, since the current high-point trend line is creating an upward trend line, the low-point trend line that will be created this time must also create an upward trend line.

In that sense, the 69000-73199.86 section can be seen as an important support and resistance section.

If it falls below 69000, it is likely to touch the Fibonacci ratio section of 0.886 (56227.18) ~ 1 (61338.93), which was the previous high point section.

-

(1D chart)

On the last day of this volatility period, it fell below the upward trend line (2), showing a large decline.

Since it fell below the downward trend line, there is a possibility that it will continue to fall further.

At this time, the key is whether it can rise with support near 73499.86.

The next volatility period is around April 25 (April 24-26).

The point of interest is whether the price is maintained near 73499.86 or 89294.25 after the next volatility period.

-

The 73499.86 point is the HA-High indicator point on the 1M chart.

The M-Signal indicator on the 1M chart is rising to around 73499.86.

Therefore, if support is confirmed near the M-Signal indicator on the 1M chart, I think it is an aggressive buying period.

If it falls below the M-Signal indicator on the 1M chart, it is a buying period until it rises again and supports near the M-Signal indicator on the 1M chart.

The next time to buy is when it shows support near the Fibonacci ratio range of 0.886 (56227.18) ~ 1 (61338.93) that I mentioned in the 1M chart explanation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.