MSCI

MSCI Country Performance in 2020Here’s a chart of how some foreign equity markets around the world have performed relative to each other throughout 2020. Its based on iShares MSCI ETF performance.

This year’s correction and recovery have been unique from prior corrections in that the catalyst was a pandemic that impacted every country in the world, but at different times. Observing the chart, you can find where some countries underperform or outperform others as they go into and out of lockdowns and other measures that impacted the local markets.

There was an upturn in markets around October 28 (a bottom for US markets on 10/30). Around the same time several regions went back into lock downs early, with the United States refraining from further lock downs until some states pivoted heading into late November and asked for business to shut doors. It’s clear that the countries that locked down early have markets that are accelerating as investors see those economies likely to emerge from slowdowns faster.

Similarly, you can look at a comparison of currencies and see similar trends. Below is a currency comparison since the beginning of 2020.

Finally, below is world currencies since October 28.

It’s a curiosity, if not a pointer to what foreign countries to build some portfolio exposure. Most likely, the US market will emerge in relative strength once we clear the current pandemic wave and have a vaccine in place.

MSCI SINGAPORE INDEX ready for a new bullish run 🦐MSCI SINGAPORE futures after the nice impulse until the 333 level started a retracement move.

The market touches the 0.382 Fibonacci level over a support structure and started a consolidation move.

IF the price will break and close above the minor resistance structure, we can set a nice long order according to Plancton's strategy.

--––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

Leave a comment that is helpful or encouraging. Let's master the markets together.

EUR/MXN - Opportunities! Technical outlook towards EUR/MXN

We were messaged to analyse this pair, since we last looked at this pair was July - Great momentum it has had. It was 1hr chart this time, I am going through daily - Why?

***Higher time frame indicates shorter time frame of movement! ***

Technical outlook:

Pattern wise - we are being squeezed within price action of a triangle formation but within that we do have a smaller bullish flag occurring which if you go through 4 hr it hasn't broken towards upside yet and we are at support of this pattern.

Shorter Trade Plan: Going towards 4hr you could add Fibs retracement and the target for this bullish flag would be 26.52767 and that's the resistance of this formation as well as top of the range is has been for while. (Following the pattern and inner small flag pattern) For further confirmation a close above 50 EMA.

Longer term trade plan: You could play the shorter role of the 4hr and even 1hr following the channel down or break out- However, longer term looking at the daily you could wait for a break to either direction, adding alert to resistance and support areas of the pattern, which ever way it breaks from the yellow arrows draw, I have measured the pattern length. On patterns I like to make sure it's a real break of the range so I would wait for break out , get in on the pull back and then take the trade to whichever direction it goes towards.

Keep in mind - MXN is an EM currency, if you are interested to look more in depth an advanced view look at MSCI.

(Just a trade idea, not a recommendation)

All the best,

Trade Journal

💎 BTC and MSCI China ETF: reversal correlation of prices! Thumb UP👍 if you find this chart interesting!

👨🏻💻This chart shows a strong reversal correlation of prices between one of the famous classic financial instruments NYSE:MSCI and BTC. So you have one more indicator in your trading strategy! What do you guys think about it? Let's discuss in a comment!

________________________________________________________________________________________________________________________________________________________________________________________________

🚀Let me remind you that Bitcoin was created as a response to the crisis in the real estate market that broke out in 2008 and had serious consequences for the entire economy. Over time, the cryptocurrency managed to win the interest of traditional investors, who began to consider BTC as one of the hedging tools against geopolitical risks.

This is particularly evident during the escalation of the trade war between the US and China. Then the bitcoin exchange rate significantly strengthened, as many believed that it could offer them protection from shocks in the financial markets. It is noteworthy that this happened against the background of falling stock indexes.

It is no secret that the main players in the cryptocurrency market are Asians, especially Chinese. Historically, it can be traced that when panic sales of classic cyclical assets begin in China due to increased geopolitical or other risks, there is an increase in bitcoin. Thus, the Chinese population is trying to protect their assets. Therefore, it can be argued that the further growth of tensions in trade relations between the United States and the rest of the world, the Outbreak of the virus epidemic, is likely to fuel interest in "digital gold". And in General, classical markets need a correction, at least technical, the American stock market has been growing continuously for more than 10 years, the reason for this can be any, why not a Coronavirus?

✅ Investors need a reason to fix previously earned profits and then the fall can develop like a snowball. This situation can be a moment of truth for bitcoin. If the cryptocurrency manages to establish itself in the status of a protective asset, this can give a strong impetus to the further growth of the BTC.

Look at my other interesting charts below!

USDJPY tests the lower channel boundsThe USD is the worst performing G10 currency as we come to the final days of December and the end of the decade.

DXY broke below the 96.750 level (US dollar index) which is its lowest in 6 months.

The catalyst of the weaker dollar has likely been risk appetite holding up since both the US and China said that they were ready to sign a Phase 1 deal;

as well as the US Federal Reserve’s continued repo operations, which have recently been undersubscribed.

US Yields are expected to extend their grind higher in Q1 and a weaker USD should continue to support Commodity strength. Gold & Copper continue to be bullish and have established a base.

A weaker USD and stronger Commodities are expected to support Emerging Markets equity strength, with MSCI EM China crucially now also breaking higher.

EEM ETF: Lower long term Buy opportunity.The iShares MSCI Emerging Markets ETF (EEM) is on bearish 1W price action (RSI = 41.481, Highs/Lows = -1.8644), repeating a pattern last seen in April 2011 - May 2012. During that period the price was rejected at 44.90, crossed below the MA50 and MA200 and found support just over the 0.786 Fibonacci level before recovering 100%.

We expect a similar price behavior today as the price was rejected at 44.85 and has already crossed below the MA50. The crossing below the MA200 remains and the rebound above the 0.786 Fibonacci retracement level, which puts the support around 39.50 - 39.60. Our target is 44.80.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

MSCI World, S&P Global, The Global Dow - Count to three!I am going to count to three. There will not be a four.

MSCI World Index: Correction then 2.5% further Upside to 6015MSCI World Futures Index USD FMWO1!

An excellent day for bulls all over the world.

Now most markets are testing important resistance levels (Hang Seng, Sensex, SPX and Nasdaq)

and are vulnerable to fairly light profit taking in the very near term.

The MSCI World Index is also very close to resistance at 5873.

Has to break above here to confirm further strength back to the 6000-6015 range - about a 2.5% burst.

It looks likely to manage this sooner or later.

If it's to be later it should find good support on any retest of the rising dynamic at around the 5752 level.

Look for confirmation to buy a favored major market again either here - or if we don't get it then on a break above 5875 looking for an averaged rise of about 2.5%.

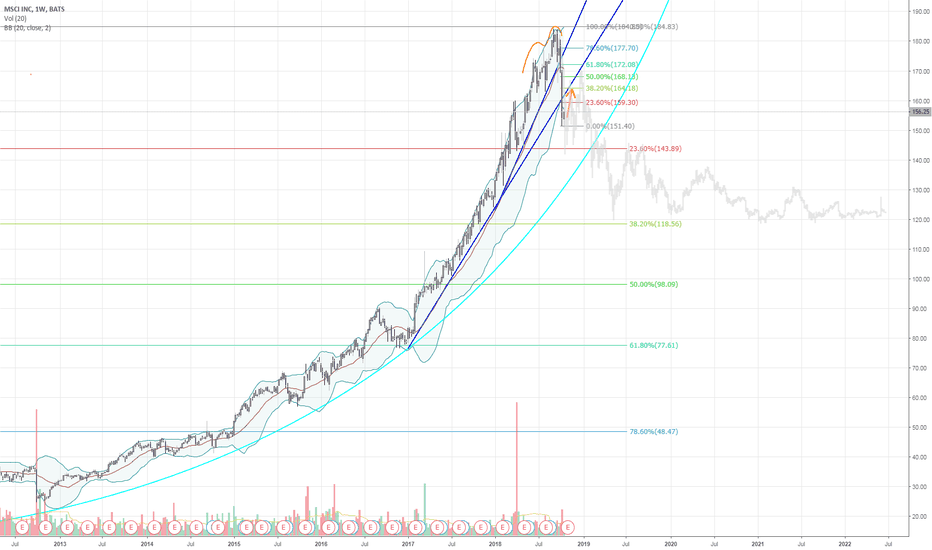

Parabolic Advance BrokenParabolic advance with a broken hypodermic trendline, much like whats been seen in Bitcoin, Gold, and other assets that have been through bubble cycles. Weekly Bollinger band M top, like the monthly ones we see on the DJI/S&P. Short above $160, expect a visit far lower maybe down to $120 first, the 38% macro bull retracement for starters. Good luck!

MSCI emerging markets Similar past, veryYou do not have to be a genius to see the huge similitures of the past charts of the emerging markets msci of exactly 10 years ago¡ , specifically in 2008, where you can clearly see an upturn in investment in these markets msci very, very strong up, reaching a summit to explosion and crach donw , it can practically be seen as a carbon copy 10 years later the same pattern almost yes,

well You may not remember it , but exactly 10 years ago it was the resection in North America.

Well coincidences, possibly.

but without a doubt the Charts are very similar to those of the past.

BUY STAWKS (Part 2)Global stocks bounced as expected. Higher highs on their way.

SPX - 2150 / 2160

DAX - 10380 / 1399