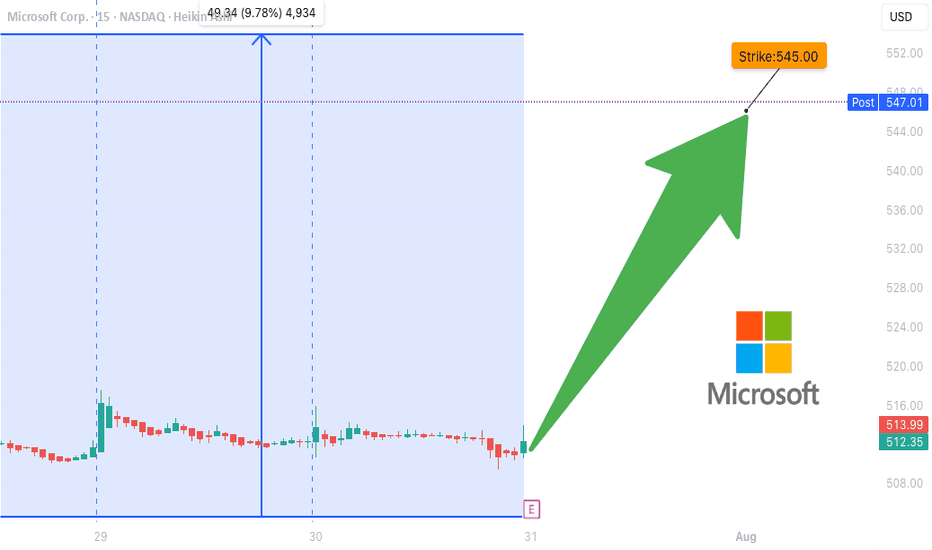

MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP

**🚨 MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP 🚨**

**Microsoft \ NASDAQ:MSFT Pre-Earnings Trade Idea — 545C (Aug 1)**

---

### 🧠 **Earnings Thesis (🔥 80% Conviction)**

MSFT is set to report **BMO July 31**, and all signs point *bullish*:

📈 **Revenue Growth**: +13.3% YoY, driven by **AI + Cloud** momentum

💰 **Margins**: Profit 35.8%, Op 45.7%, Gross 69.1% — textbook pricing power

📊 **Guidance**: 100% beat history, avg. +5.8% surprise

📌 **Analyst Consensus**: 💪 Strong Buy | Target: \$549.90

📊 **Sector Tailwinds**: Tech favored in current macro with Fed on hold

➡️ **Score: 9/10 Fundamentals | Bullish Momentum Across the Board**

---

### 🔍 **Options Flow & Technicals**

🔥 **Implied Move**: \~6.3% by Aug 1

📉 **IV Rank**: 0.75 (Room to expand post-earnings)

💸 **Call Flow**: Strong OI in 540–550 zone, gamma buildup may fuel squeeze

📊 **RSI**: 70.14 → Bullish, close to overbought

📈 **Support**: \$505 | **Resistance**: \$518.29

➡️ **Score: 8/10 Options | 8/10 Technicals**

---

### 🧨 Trade Setup: 545 CALL (Aug 1 Exp)

🎯 **Entry Price**: \$0.90

📅 **Expiry**: 2025-08-01

📈 **Profit Target**: \$1.80 (⚡️+100%)

🛑 **Stop Loss**: \$0.45

📐 **Size**: 2 contracts (2% portfolio risk)

💡 **Timing**: Enter **EOD July 30 (Pre-earnings)**

⚠️ **IV Crush Alert** → Exit within 2 hours *post-earnings*

---

### ✅ RISK PLAN

* Position: Max 2–3% of portfolio

* IV crush & gap protection: Tight stop and quick post-earnings exit

* Exit Plan: \$1.80 or Stop \$0.45, OR close manually after earnings move

---

📊 **Trade JSON Snapshot**

```json

{

"ticker": "MSFT",

"direction": "CALL",

"strike": 545,

"entry": 0.90,

"target": 1.80,

"stop": 0.45,

"expiry": "2025-08-01",

"entry_time": "EOD Jul 30",

"earnings_date": "2025-07-31 BMO",

"confidence": "80%",

"expected_move": "6.3%",

"iv_rank": "0.75"

}

```

---

🧠 **Summary**

MSFT is poised for a **clean earnings beat** with bullish fundamentals, strong options flow, and upside momentum. This is a **high-conviction, short-dated trade** with defined risk.

🎯 **Watchlist it. Size smart. Exit fast.**

Msftidea

MSFT Weekly Chart Signals a $100 Move — Don’t Miss This BreakoutMicrosoft continues to show strong bullish behavior on the weekly chart. Historically, the stock has respected a well-defined upward channel, and the recent price action has further reinforced this trend. Notably, MSFT has broken through a key resistance level that had previously capped its upside for months. This breakout is significant as it suggests a shift in market structure, from consolidation to a potential new leg up.

The breakout area around $474–$479 has now turned into a short-term support zone. This region will play a critical role in maintaining bullish sentiment; any successful retest that holds above this zone confirms strength and invites further accumulation. The chart highlights a projected move toward $580, which lies near the upper red trendline—this aligns well with the historical resistance trajectory.

A bullish trade setup can be considered from the current levels around $478, with a stop-loss just below the $447–$435 zone. This range marks a previous congestion area and aligns with the lower side of the risk-reward box illustrated on the chart. The potential upside move is about 20.99%, offering a solid risk-reward ratio of approximately 2.27, assuming the price continues to hold above the breakout level.

While the trend remains firmly bullish, a weekly close below $447.50 would warrant caution. It could indicate a deeper retracement, potentially back into the broader green trend channel extending toward $400 or below. However, current momentum favors continuation to the upside, especially after clearing such a pivotal resistance.

In conclusion, Microsoft’s long-term chart structure, combined with the recent breakout and favorable price action, supports a bullish outlook. If price action remains above $474–$479, the stock is well-positioned to challenge the $580 resistance level in the coming weeks.

MSFT Setup After EarningsEarnings season is heating up and Microsoft (MSFT) is once again in the spotlight. With its dominance in cloud and AI, the next move could be explosive.

Here’s how pro Im thinking my setting up:

🔹 $390 – A bold speculative entry for breakout hunters.

🔹 $365 – A defensive entry on post-earnings pullback to support.

🔹 $345 – The opportunity zone if a sharp drop offers value.

🎯 Profit Targets:

TP1: $410 – Psychological and technical resistance.

TP2: $426 – Momentum continuation level.

TP3: $445–$450 – Ambitious upside for long-term riders.

Whether you’re playing momentum or patiently buying dips, MSFT is offering clear levels. Stay sharp.

Disclaimer: This is not financial advice. All trading involves risk. Do your own research or consult a professional advisor before investing.

Microsoft - H&S Fake Out to Make Out! 16% Upside🖐️ H5 TRADE - NASDAQ:MSFT

There was to much going on to call out my exact entry on this at the retest area but to be fair I put it on everyone's watchlist a few weeks ago and said a retest would be a perfect entry. This will be different once the H5 Community is up and running as I will have a whole trade alerts channel were I post my trades and buy/sell notis right as after execution!

With this trade we still have over 16% to run upward from here. So, up to you friends! Them and other Mag7 names held up really well during that flash crash and that is very bullish to me! Also, to throw in a learning lesson for all: Just because a charting pattern forms (H&S on MSFT) doesn't mean it's a trade you should enter! Always wait for breakouts and retest! If you struggle with that then you better beat it into your head and tape you hands underneath your desk!

-H5 indicator is GREEN

-Symmetrical Triangle pattern breakout and retest

-Launching off Volume shelf back to ATH and beyond

-Bottom of the two year rising channel

-Williams CB forming and believe we create support next week

I consolidated the account yesterday into the best trades and saw this OLD SAFE n RELIABLE trade and chose to buy some options!

🔜🎯$466

🎯$512

⏲️Before 05May2025

2 Contracts -$420 Calls for May 16th 2025

CB: $40.03 - Currently $43.75

Not financial advice.

Microsoft Update: Key Levels to WatchMicrosoft ( NASDAQ:MSFT ) is at an important point right now, and here’s what to look out for:

If we close above $442: There’s a good chance we’ll see targets at $453 or even $478 as buyers take control.

If the price breaks down out of the current range: A correction to $422 or $415 becomes a strong possibility.

Stay focused on these levels and let the market show you the way forward. No need to force it—patience pays.

Kris/Mindbloome Exchange

Trade What You See

Microsoft (MSFT): What’s Next? Will It Break $455.34 Morning, Trading Family! Let’s Talk About Microsoft (MSFT): Will It Break $455.34 or Head Lower?

Microsoft’s stock is at a key level, and the next move could set the tone for what’s ahead. The magic number right now is $455.34. Will we see a breakout to new highs, or could the price dip lower before bouncing back? Let’s break it down step by step so everyone’s ready!

If Microsoft Breaks Above $455.34

If the stock moves above $455.34 and holds steady, it could signal that buyers are in control.

What could happen?

The price might head up toward $460 or even $465. These levels could be the next spots where the stock takes a breather.

What should we watch?

Look for strong movement above $455.34 with good trading volume (lots of action). If the price quickly dips back below, it could mean the breakout isn’t real yet.

How can we trade it?

If the price holds above $455.34, it might be a good time to think about buying with a target around $460. Just make sure to use a stop-loss in case the trade doesn’t go as planned.

If Microsoft Drops Below $455.34

If the stock struggles to stay above $455.34, we could see a pullback.

The first key level:

Watch $449. This is the next area where buyers might step in to stop the price from falling.

If $449 doesn’t hold:

The price could drop further, landing somewhere in the $443–$438 range, where stronger support is likely.

How can we trade it?

Be patient! If the price dips, wait for signs that it’s stabilizing at a support level before making any moves.

What If the Price Drops Below $438?

If MSFT falls below $438, it could mean the stock is turning more bearish. At that point, we’ll need to step back and reassess the trend.

Tips for Today’s Trading

If you’re bullish: Wait for the price to break and hold above $455.34 before jumping in.

If you’re bearish: Watch for a clean break below $449 for potential short opportunities.

Always: Use stop-losses to protect yourself and trade with a plan!

Bottom Line:

The $455.34 level is the line in the sand. If we break above, it’s good news for the bulls. If not, we could see a dip to $449 or lower.

Kris/ Mindbloome Exchange

Trade What You See

Microsoft $MSFT - About to go on another run? 19% UpsideMicrosoft - NASDAQ:MSFT 🖥️

Microsoft with a big statement today for themselves and the MAG7! The runs not over! All MAG7 names are moving higher today and carrying the market.

Is this the beginning of the next leg up for BIG TECH?

Microsoft was forming a nasty H&S on the charts but has formed a Symmetrical Triangle pattern at then same time and is currently breaking out. They also broke out of the WR% downtrend and are launching off the AVP shelf to make a push back to ATH's.

Finally the H5 indicator is pointing upward and working on flipping back to GREEN.

🎯$466 📏$512 ⏳ May2025

NFA

IS THIS MAG7 DARLING ABOUT TO CRASH?!NASDAQ:MSFT

🔥 IS NASDAQ:MSFT ABOUT TO FALL OVER 21%?! 🔥

Let's not panic yet, but Microsoft's weekly charts are flashing some intriguing signals. Here’s the lowdown:

As long as NASDAQ:MSFT stays within its symmetrical pattern, we’re in the clear. But if it breaks downward, we’re looking at a potential 6% drop from the Volume profile shelf and possibly a dangerous 22% plunge, breaking the 2024 Head & Shoulders pattern. Enter the "Low Five Setup"—the bearish counterpart to my "High Five Setup."

Key factors to watch:

- Williams %R: Lower High

- MACD: Dangerously close to crossing below the zero line (BEARISH)

- RSI: Below RSI MA with lower highs, at 46—lots of room before oversold

- Trend: Lower high, red through yellow downward move indicating a downtrend on the weekly chart

Microsoft has been Wall Street’s golden goose, untouched by the FUD that hit the MAG7 stocks. Apple had China FUD, Tesla faced the ELON BAD FUD, Google with AI SEARCH FUD, Amazon with spending and margins FUD, Meta with metaverse spending FUD, and Nvidia with growth concerns FUD.

But as Willy Wonka taught us, every golden goose lays a bad egg sometimes. This is a weekly chart setup, so it will take time to play out. No one's immune to Wall Street’s FUD wrath, not even Microsoft. We shall see what happens...

P.S. I’m not in this name yet—just putting it on your radar. We’re early to the party, just like I always am with my setups. If you’re still here, you value solid, well-thought-out market analysis. Props to you!

Have a great Sunday, friends! 👊

Not Financial Advice #HighFiveSetup #LowFiveSetup

Microsoft Soars on Cloud Momentum, Fueled by AIMicrosoft is experiencing a period of robust growth, driven by the accelerating adoption of its cloud computing services. The company's recent fiscal third-quarter results surpassed analyst expectations on both revenue and earnings, solidifying its position as a major player in the cloud wars. However, a slightly weaker-than-expected revenue guidance for the next quarter has injected a note of caution.

The cloud division, Azure, continues to be the crown jewel of Microsoft's growth strategy. Azure is experiencing significant momentum, capturing a growing share of the ever-expanding cloud market. This success can be attributed in part to Microsoft's strategic push towards artificial intelligence (AI).

The company is heavily investing in AI research and development, recognizing its transformative potential across various industries. Microsoft's Azure platform provides a comprehensive suite of AI tools and services, allowing businesses to leverage AI capabilities for tasks like data analysis, machine learning, and intelligent automation. This focus on AI is proving to be a significant differentiator for Microsoft, attracting customers seeking to integrate cutting-edge AI solutions into their operations.

One key indicator of Microsoft's commitment to AI is its increasing capital expenditures on securing Nvidia graphics processing units (GPUs). GPUs are essential hardware components for training and running complex AI models, requiring immense processing power. By investing in this technology, Microsoft ensures it has the necessary infrastructure to support the ever-growing demand for AI services on its Azure platform.

While Microsoft's financial performance is impressive, a slight concern arises from the company's guidance for the next quarter. Revenue for the fiscal fourth quarter is projected to be around $64 billion, falling short of the $64.5 billion analysts anticipated. This could potentially indicate a temporary slowdown in the overall growth trajectory. However, it's important to consider the broader market climate and potential external factors impacting revenue generation, such as fluctuations in global economic conditions.

Despite this minor setback, Microsoft's long-term prospects remain positive. The company boasts a strong and diversified business model. Beyond the cloud, Microsoft continues to generate significant revenue from its traditional software products like the Office suite and Windows operating system. This diversification provides a safety net, mitigating risks associated with any potential fluctuations in a single market segment.

Furthermore, Microsoft's commitment to innovation extends beyond just the cloud and AI. The company actively explores other high-growth areas like cybersecurity, gaming (Xbox), and mixed reality (HoloLens). These ventures have the potential to unlock new revenue streams and solidify Microsoft's position as a technological leader across diverse sectors.

However, Microsoft faces challenges on its path to continued dominance. The cloud market is fiercely competitive, with Amazon Web Services (AWS) holding a significant market share. Microsoft must persistently innovate and improve its cloud services to maintain its competitive edge. Additionally, regulatory scrutiny regarding data privacy and antitrust concerns could pose obstacles for Microsoft's growth strategies.

In conclusion, Microsoft is in a strong position, propelled by its flourishing cloud business and strategic investments in AI. While a slightly weaker-than-expected revenue guidance for the next quarter introduces some caution, Microsoft's diversified business model and commitment to innovation position it well for long-term success. The company's ability to navigate the competitive landscape and address potential regulatory hurdles will be crucial in determining its continued dominance in the years to come.

MSFT Soars with the Arrival of Sam Altman from OpenAII wanted to share the latest development that has the potential to spark a remarkable surge in Microsoft's stock value.

Imagine the possibilities that await as MSFT makes a strategic move by hiring none other than Sam Altman, the renowned technology visionary behind OpenAI. Altman's groundbreaking expertise in artificial intelligence (AI) and his impressive track record in shaping the future of technology make this an exhilarating moment for all MSFT investors.

With Altman on board, MSFT is set to revolutionize the tech industry and solidify its position as a leading force in innovation. The integration of his visionary mindset, coupled with Microsoft's already sterling reputation and enduring commitment to evolving technology, heralds a significant opportunity for continued growth and groundbreaking achievements.

In light of this momentous news, I invite you to join me in seizing the potential for substantial gains as MSFT aims to hit unprecedented highs. Now is the time to act and position ourselves for a profitable long-term investment opportunity. I strongly encourage you to consider taking a long position in MSFT, as this could be a game-changing move for your portfolio.

Let's ride the wave of this incredible development and harness the power of Altman's expertise and Microsoft's unwavering dedication to reshaping the tech landscape. By investing in MSFT today, we have the chance to participate in a remarkable journey towards new horizons of success.

Don't miss out on this investment opportunity; the potential for incredible returns is within our grasp. Position yourself for success by joining me in going long on MSFT and embarking on this exciting venture together.

Microsoft 23/10 MovePair : Microsoft Corp

Description :

Symmetrical Triangle as an Corrective Pattern in Short Time Frame , Rejecting from the Upper Trend Line and Demand Zone. Completed Impulsive Waves and Corrective Waves " abc " , If it Breaks the Lower Trend Line and Retest then it will Short

Entry Precaution :

Wait for the Proper Rejection with Strong Price Action

Microsoft Challenges Fib 3.618 levelMicrosoft - NASDAQ:MSFT

Expectations were beat across the board today but what does the long term monthly chart tell us? All is revealed in the chart. This is a key moment for NASDAQ:MSFT and a pull back or break through to established new highs wouldn't surprise. I'm happy to wait for the confirmations outlined in the chart. That MACD cross though looks appealing.

Earnings Summary

- Profits jumped 20% to 20.1 b

- EPS: $2.69 / Exp $2.56

- Revenue: $56.19B / Exp $55.49B

- Azure (cloud) revenue up 26% / Exp 27%

FTC Appeals to Block Microsoft Activision MergerI am providing a crucial update regarding the recent news of the Federal Trade Commission's (FTC) decision to appeal against the proposed merger between Microsoft and Activision. This development has significant implications for the tech industry, particularly for those who have invested or are considering investing in Microsoft stock.

The FTC's decision to appeal the merger indicates that regulatory authorities are scrutinizing the potential consequences of this consolidation. While mergers and acquisitions can often lead to positive outcomes, such as improved products and services, it is essential to approach this situation cautiously, considering the potential risks and uncertainties ahead.

As tech traders, it is crucial to carefully evaluate the potential impact of this appeal on Microsoft's stock performance. The uncertainty surrounding the outcome of the appeal, coupled with potential delays or even the possibility of the merger being blocked, could significantly influence the company's stock value in the short to medium term.

Therefore, I strongly advise you to exercise prudence and consider holding off on buying Microsoft stock until further clarity emerges regarding the outcome of the FTC's appeal. By doing so, you can better protect your investment and mitigate potential risks associated with this merger.

It is important to understand this is not financial advice but rather an alert to the potential implications of the FTC's appeal on Microsoft's stock performance. As always, I encourage you to consult your financial advisor or conduct thorough research before making investment decisions.

In conclusion, the FTC's decision to appeal the Microsoft-Activision merger has introduced an element of uncertainty into the market. By adopting a cautious approach and refraining from immediate stock purchases, you can better position yourself to make informed investment choices once more clarity on the situation emerges.

MSFT Swing Short updateWe have hit our entry perfectly and have started to move down. Since we have already moved 2% Its good enough for moving stop loss slightly lower, but I would keep it above the recent high atleast couple of point higher.

Once we breach the while horizontal line and stay under it for a day or two I will move the Stop loss to breakeven after taking small tp and let the rest ride.

If you like my content then please boost and share this post. I have over 6 years of trading and investing experience and have learned a lot in this time. I like to share what I have learned. If you would like to learn from my experience then follow me on trading view to get notified on my trade, market projections and several upcoming technical analysis and in-depth tutorials on technical Indicators. You can also leave a comment and let me know if you want me to look at any specific asset or want to learn about any specific topic in the world of Technical Analysis. I Will do my best to create a post for it.

Keep learning and Happy trading All.

Microsoft A Great Selling Opportunity 🤨👌Trade Proposal:

There is a probability of first tp to the proposed ( 200,00 ) Direction line. So, Traders can set orders based on Price Action and expect to reach short-term goals.

Technical analysis:

Microsoft is in Downtrend and It is Expected to Continue Downtrend.

Microsoft -> It's Now Or NeverHello Traders,

welcome to this free and educational multi-timeframe technical analysis .

On the weekly timeframe Microsoft stock just recently created an awesome double bottom and also already broke above the neckline confirming the weekly pattern.

As we are speaking the market is retesting the neckline of the double bottom which is now turned support so from a weekly perspective I just do expect the continuation towards the upside from here.

On the daily timeframe however the market is currently massively bearish and I definitely don't want to catch a falling knife so I am now just waiting for some bullish structure on the daily timeframe before I will look to enter longs to capitalize on the continuation towards the upside.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis of this asset:

Microsoft -> All Timeframes Are BullishHello Traders,

welcome to this free and educational multi-timeframe technical analysis .

Microsoft is looking extremely juicy right now. From a weekly perspective we just created a long term double bottom and we also broke above a long term downtrend line.

There is definitely the possibility that after a short term pullback, we will start the next bullrun from here, creating new all-time-highs in the process.

From a daily perspective I am just waiting for a short term retest of the weekly neckline of the double bottom and then there is a very high chance that we will also see the daily continuation to the upside from here.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis of this asset:

Microsoft -> Very Bullish Inverted Head And ShouldersHello Traders,

welcome to this free and educational multi-timeframe technical analysis.

Microsoft just recently perfectly tested and rejected a quite strong and obvious previous support/resistance zone towards the upside. It also seems like Microsoft is about to create a double bottom from a weekly perspective, which is generally speaking a very bullish pattern, leading to more upside potential.

On the daily timeframe we actually have a quite interesting situation. You can see that the market is currently crating an inverted head and shoulders and just yesterday and today broke above and retested the neckline, which again is simply previous resistance which is now turned support.

Now from here I do expect further continuation towards the upside, confirming the bullish inverted head and shoulders pattern.

Thank you for watching and I will see you tomorrow!

Microsoft Analysis 01.12.2022Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!