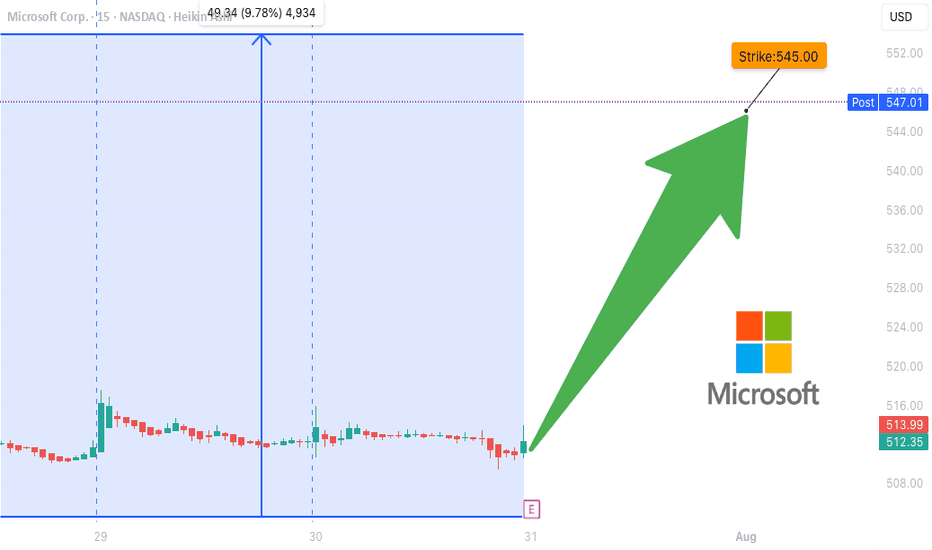

MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP

**🚨 MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP 🚨**

**Microsoft \ NASDAQ:MSFT Pre-Earnings Trade Idea — 545C (Aug 1)**

---

### 🧠 **Earnings Thesis (🔥 80% Conviction)**

MSFT is set to report **BMO July 31**, and all signs point *bullish*:

📈 **Revenue Growth**: +13.3% YoY, driven by **AI + Cloud** momentum

💰 **Margins**: Profit 35.8%, Op 45.7%, Gross 69.1% — textbook pricing power

📊 **Guidance**: 100% beat history, avg. +5.8% surprise

📌 **Analyst Consensus**: 💪 Strong Buy | Target: \$549.90

📊 **Sector Tailwinds**: Tech favored in current macro with Fed on hold

➡️ **Score: 9/10 Fundamentals | Bullish Momentum Across the Board**

---

### 🔍 **Options Flow & Technicals**

🔥 **Implied Move**: \~6.3% by Aug 1

📉 **IV Rank**: 0.75 (Room to expand post-earnings)

💸 **Call Flow**: Strong OI in 540–550 zone, gamma buildup may fuel squeeze

📊 **RSI**: 70.14 → Bullish, close to overbought

📈 **Support**: \$505 | **Resistance**: \$518.29

➡️ **Score: 8/10 Options | 8/10 Technicals**

---

### 🧨 Trade Setup: 545 CALL (Aug 1 Exp)

🎯 **Entry Price**: \$0.90

📅 **Expiry**: 2025-08-01

📈 **Profit Target**: \$1.80 (⚡️+100%)

🛑 **Stop Loss**: \$0.45

📐 **Size**: 2 contracts (2% portfolio risk)

💡 **Timing**: Enter **EOD July 30 (Pre-earnings)**

⚠️ **IV Crush Alert** → Exit within 2 hours *post-earnings*

---

### ✅ RISK PLAN

* Position: Max 2–3% of portfolio

* IV crush & gap protection: Tight stop and quick post-earnings exit

* Exit Plan: \$1.80 or Stop \$0.45, OR close manually after earnings move

---

📊 **Trade JSON Snapshot**

```json

{

"ticker": "MSFT",

"direction": "CALL",

"strike": 545,

"entry": 0.90,

"target": 1.80,

"stop": 0.45,

"expiry": "2025-08-01",

"entry_time": "EOD Jul 30",

"earnings_date": "2025-07-31 BMO",

"confidence": "80%",

"expected_move": "6.3%",

"iv_rank": "0.75"

}

```

---

🧠 **Summary**

MSFT is poised for a **clean earnings beat** with bullish fundamentals, strong options flow, and upside momentum. This is a **high-conviction, short-dated trade** with defined risk.

🎯 **Watchlist it. Size smart. Exit fast.**

Msftlong

$MSFT: A Teflon stock turning hot, will it catch fire? Before you wonder why we call it a Teflon stock please check my blog on 27 April 2025.

NASDAQ:MSFT : A 'Teflon' stock refusing to budge under pressure for NASDAQ:MSFT by RabishankarBiswal

I pointed out the reason why this stock refused to go down below critical levels and held onto some impressive gains. And since then, we have rallied 33% from the lows of 360 and reached an ATH of 480 $. The buying pressure on the stock has pushed it above our upward sloping parallel channel which we have been following for more than 2 quarters. We always argued that the stock has support around 350 $ and is unlikely to break the support. We bounced back exactly 350 $ with 25 RSI indicating oversold conditions.

Currently with stock price above 480 $ the RSI looks over bought at 73. But in my opinion the bull run can continue for some more time unless we see a double top in the RSI just like in 2022 and 2024. Double tops usually result in breakdown. But until then there is a lot of runway ahead of us. If we plot the Fib extension levels from the top before Liberation Day to the bottom after the liberation day, then we see that the next level on the chart is 1.612 Fib level with a price of 542 $. NASDAQ:MSFT is a Teflon stock which is hot but might not catch fire and go to the moon. 😊

Verdict: More potential upside in $MSFT. Near term target 542 $.

MSFT Weekly Chart Signals a $100 Move — Don’t Miss This BreakoutMicrosoft continues to show strong bullish behavior on the weekly chart. Historically, the stock has respected a well-defined upward channel, and the recent price action has further reinforced this trend. Notably, MSFT has broken through a key resistance level that had previously capped its upside for months. This breakout is significant as it suggests a shift in market structure, from consolidation to a potential new leg up.

The breakout area around $474–$479 has now turned into a short-term support zone. This region will play a critical role in maintaining bullish sentiment; any successful retest that holds above this zone confirms strength and invites further accumulation. The chart highlights a projected move toward $580, which lies near the upper red trendline—this aligns well with the historical resistance trajectory.

A bullish trade setup can be considered from the current levels around $478, with a stop-loss just below the $447–$435 zone. This range marks a previous congestion area and aligns with the lower side of the risk-reward box illustrated on the chart. The potential upside move is about 20.99%, offering a solid risk-reward ratio of approximately 2.27, assuming the price continues to hold above the breakout level.

While the trend remains firmly bullish, a weekly close below $447.50 would warrant caution. It could indicate a deeper retracement, potentially back into the broader green trend channel extending toward $400 or below. However, current momentum favors continuation to the upside, especially after clearing such a pivotal resistance.

In conclusion, Microsoft’s long-term chart structure, combined with the recent breakout and favorable price action, supports a bullish outlook. If price action remains above $474–$479, the stock is well-positioned to challenge the $580 resistance level in the coming weeks.

MSFT weekly cup and handleMSFT staying strong during all of the volatility and chop shows relative strength would like to see the market push to all time highs with MSFT and some other mega caps leading the way this could pan out in time and looks like a great set up to test the highs reset and push higher. Not financial advice

Microsoft’s Big Moves This Quarter | From Activision to AI AgentMicrosoft’s Revenue Surge: The Power of AI, Gaming, and Strategic Investments

Microsoft has released its Q1 FY25 earnings for the quarter ending in September

The stock saw a 6% drop, indicating the results fell short of investors' high hopes. Trading at over 30 times projected earnings for next year, expectations for Microsoft were significant.

CEO Satya Nadella stated

“Our AI business is set to exceed an annual revenue run rate of $10 billion next quarter, making it the fastest business in our history to reach this milestone.”

This means that AI will soon account for about 4% of Microsoft's total revenue in under three years a remarkable feat for a global giant.

If you need a quick summary, here are three main points:

1. ☁️ Azure’s growth is slowing. As Microsoft’s key player in the AI competition, Azure grew 34%, down slightly from 35% in the prior quarter (after adjustments). This comes as Google Cloud raised the bar, with its growth accelerating from 29% to 35% during the same period.

2. 🤖 AI growth is limited by hardware supply, as capacity struggles to meet demand. Data center expansion is a long-term process, and Microsoft is investing heavily in infrastructure, aiming for a growth boost by 2025.

3. 👨👩👧👦 Consumer-focused products like Gaming and Devices are underperforming. Although not essential to Microsoft's core business, their poor performance has impacted overall results.

Here’s a breakdown of the insights from the quarter.

Overview of today’s insights:

- New segmentation.

- Microsoft’s Q1 FY25 overview.

- Key earnings call highlights.

- Future areas to monitor.

1. New Segmentation

Revised Business Segments

In August, Microsoft announced a reorganization of its business segments, effective this quarter. The purpose? To better align financial reporting with the current business structure and strategic management.

Summary of the main changes

- Microsoft 365 Commercial revenue consolidation: All M365 commercial revenue, including mobility and security services, now falls under the Productivity and Business Processes segment.

-Copilot Pro revenue shift: Revenue from the Copilot Pro tool was moved from Productivity and Business Processes to the More Personal Computing segment under Search and news advertising.

-Nuance Enterprise reallocation: Revenue from Nuance, previously part of Intelligent Cloud, is now included in Productivity and Business Processes.

-Windows and Devices reporting combination: Microsoft now reports Windows and Devices revenue together.

Impact of These Changes:

Core Segments Overview:

In summary:

- The Productivity and Business Processes segment has grown significantly.

- The Intelligent Cloud segment has decreased due to the reallocation of Nuance and other revenue.

Products and Services Overview:

- M365 Commercial now includes Nuance, shifted from the Server products category, along with integrated mobility and security services.

- Windows & Devices have been merged into a single, slower-growth category.

Additional Insights:

- Azure, Microsoft's cloud platform, is reported within 'Server products and cloud services.' Although its growth rate is shared by management, exact revenue figures remain undisclosed.

Azure’s past growth figures have been adjusted for consistency, with the last quarter’s constant currency growth recast from 30% to 35%, setting a higher benchmark. Tracking these metrics is challenging due to limited revenue disclosure, but this recast indicates Azure's raised growth expectations.

2. Microsoft’s Q1 FY25 Performance

Financial Summary:

-Revenue: Up 16% year-over-year, reaching $65.6 billion (exceeding estimates by $1 billion). Post-Activision Blizzard acquisition in October 2023, the growth was 13% excluding the merger.

New Product and Services Segmentation Results

- Server products & cloud services: $22.2 billion (+23% Y/Y).

- M365 Commercial: $20.4 billion (+13% Y/Y).

- Gaming: $5.6 billion (+43% Y/Y), influenced by Activision.

- Windows & Devices: $4.3 billion (flat Y/Y).

- LinkedIn: $4.3 billion (+10% Y/Y).

- Search & news advertising: $3.2 billion (+7% Y/Y).

- Enterprise & partner services: $1.9 billion (flat Y/Y).

- Dynamics: $1.8 billion (+14% Y/Y).

- M365 Consumer products: $1.7 billion (+5% Y/Y).

Core Business Segments Breakdown:

- Productivity and Business Processes: Increased 12% Y/Y to $28.3 billion, supported by M365 Commercial, especially Copilot adoption.

- Intelligent Cloud: Grew 20% Y/Y to $24.1 billion, with Azure AI driving growth.

- More Personal Computing: Grew 17% Y/Y to $13.2 billion, including a 15-point boost from Activision. Devices fell, but search and ad performance improved under new segmentation.

Key Observations:

- Microsoft Cloud revenue climbed 22% Y/Y to $39 billion, making up 59% of total revenue (+3 percentage points Y/Y).

- Azure continues to drive cloud services and server products' growth.

- Xbox growth has surged due to the Activision acquisition since Q2 FY24, expected to stabilize by Q2 FY25.

- Windows OEM and devices combined, showing a 2% decline in Q1 FY25.

- Office rebranded to Microsoft 365; updated naming will be used starting next quarter.

- Margins: Gross margin at 69% (down 2pp Y/Y, 1pp Q/Q); operating margin at 47% (down 1pp Y/Y, up 4pp Q/Q).

- EPS: Increased 10% to $3.30, beating by $0.19.

Cash Flow and Balance Sheet:

- Operating cash flow: $34 billion (52% margin, down 2pp Y/Y).

- Cash**: $78 billion; Long-term debt**: $43 billion.

Q2 FY25 Outlook:

- Productivity and Business Processes: Anticipated 10%-11% Y/Y growth, steady due to M365, Copilot inclusion, and expected LinkedIn growth of ~10%. Dynamics set to grow mid-to-high teens.

- Intelligent Cloud: Projected 18%-20% Y/Y growth, slightly slowing, with Azure growth expected between 28%-29%.

- More Personal Computing: Forecasted ~$14 billion revenue, declines in Windows, Devices, and Gaming anticipated, with some offset from Copilot Pro.

Main Takeaways:

- Azure's growth slowed to 34% Y/Y in constant currency, with AI services contributing 12pp, up from 11pp last quarter. This marks a dip from the recast 35% prior and included an accounting boost.

- Capacity limitations in AI persist; more infrastructure investments are planned, with reacceleration expected in H2 FY25.

- Commercial performance obligations grew 21% to $259 billion, up from 20% in Q4.

- Margins were pressured by AI infrastructure investments; Activision reduced the operating margin by 2 points.

- Capital expenditures increased by 50% to $15 billion, half dedicated to infrastructure, with further Capex growth expected.

- Shareholder returns included $9.0 billion through buybacks and dividends, matching Q4 repurchases.

Earnings Call Highlights:

Azure AI saw a doubling of usage over six months, positioning it as a foundation for services like Cosmos DB and SQL DB. Microsoft Fabric adoption grew 14% sequentially, signaling rapid uptake.

AI Expansion: GitHub Copilot enterprise use surged 55% Q/Q, with AI-powered capabilities used by nearly 600,000 organizations, a 4x increase Y/Y.

M365 Copilot has achieved a 70% adoption rate among Fortune 500 companies and continues to grow rapidly.

LinkedIn saw accelerated growth in markets like India and Brazil and a 6x quarterly increase in video views, aligning with broader social media trends.

Search and Gaming: Bing’s revenue growth surpassed the market, while Game Pass hit a new revenue record, propelled by Black Ops 6

Capital Expenditures: CFO Amy Hood highlighted that half of cloud and AI investments are for long-term infrastructure, positioning the company for sustained growth.

4. Future Outlook

Energy Needs: Microsoft, facing higher power demands, plans to revive a reactor at Three Mile Island with Constellation Energy by 2028 to power its AI data centers sustainably.

Autonomous AI Agents: Coming in November, these agents will perform tasks with minimal human input, enhancing efficiency. Copilot Studio will allow businesses to customize these agents, with 10 pre-built options to start.

Industry Impact: Salesforce has launched Agentforce, signaling increased competition. CEO Mark Benioff recently compared Microsoft’s Copilot to the nostalgic Clippy, stoking rivalry.

For further analysis stay tuned

MSFT Setup After EarningsEarnings season is heating up and Microsoft (MSFT) is once again in the spotlight. With its dominance in cloud and AI, the next move could be explosive.

Here’s how pro Im thinking my setting up:

🔹 $390 – A bold speculative entry for breakout hunters.

🔹 $365 – A defensive entry on post-earnings pullback to support.

🔹 $345 – The opportunity zone if a sharp drop offers value.

🎯 Profit Targets:

TP1: $410 – Psychological and technical resistance.

TP2: $426 – Momentum continuation level.

TP3: $445–$450 – Ambitious upside for long-term riders.

Whether you’re playing momentum or patiently buying dips, MSFT is offering clear levels. Stay sharp.

Disclaimer: This is not financial advice. All trading involves risk. Do your own research or consult a professional advisor before investing.

$MSFT : A 'Teflon' stock refusing to budge under pressureI promised multiple times that a detailed analysis of NASDAQ:MSFT will be published. Its time, today we analyze the levels to watch for and the future price points in this stock.

A large cap stock like NASDAQ:MSFT is a difficult ship to navigate. During the recent turbulence the stock lost almost 33% of its value. Even during these times, it never broke below the prior cycle highs of 345 $ in contrast to other MAG7 stocks like NASDAQ:TSLA which then led to more than 50% downturn in the stock. But as the headline says NASDAQ:MSFT is Teflon stock with resistance to go down. In the weekly chart we see that the stock never broke below the midpoint of the upward sloping regression band channel which is @ 375 $.

Now where does the stock go from here? If we plot the Fib levels on NASDAQ:MSFT we see that it is firmly at 0.382 which lies at 392 $. Next level is at 415 $, and we have an earning catalyst upcoming for NASDAQ:MSFT and if the stock closes above 425 $ then we can easily touch 422 $.

Verdict : NASDAQ:MSFT keep on DCAing. Earnings quality with low volatility.

$MSFT $SNOW sympathy play, $390-$400 SupportNASDAQ:MSFT NYSE:SNOW — Microsoft is like a snail in this AI/ Tech race but I suppose that shows strength because no major drops and holding zones well. Bottoms after bottoms. I’m looking for short term calls here. As of today, ending week 2/28, I may try $405c. But can see this retest the $420s weeks to come.

WallStreetLoser

$MSFT short term consolidation within a upward trending channelNASDAQ:MSFT stock price has stagnated since Aug 2024. Since hitting a peak of $ 468 in July 2024 the NASDAQ:MSFT stock has been consolidating sideways. But the stock is still within the upward sloping channel in a weekly price chart. We are bullish if the price is above the midpoint of the upward sloping regression channel which lies $380.

We should remember from Louis Yamada that ‘The bigger the base, the higher in space’. So, the consolidation in NASDAQ:MSFT can result in a major breakout. The daily Fib retracement of 0.236 lies $ 406. Accumulate NASDAQ:MSFT between $406 and $380.

MSFT : Going long for about 0.625% of the net capitalTechnical Overview

Took a position for about 0.625% of the net capital from the lower trendline of the parallel channel. As of now, the target considered is the high of the parallel channel, to where there is a potential move of about 10% from the entry level.

Will consider adding on to the position if the price falls to the, low of the ascending channel as marked in the charts.

Fundmental Overview

In the fiscal quarter ending January 29, 2025, Microsoft reported a 12% increase in revenue, totaling $69.6 billion, and a 10% rise in net income to $24.1 billion. The Intelligent Cloud segment, which includes Azure, saw a 19% revenue growth. However, Azure's growth rate decelerated to 31%, down from 34% in the previous quarter.

The company is significantly investing in artificial intelligence (AI), with plans to allocate $80 billion in capital expenditures for the fiscal year, primarily aimed at enhancing AI infrastructure.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer: The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

Microsoft preparing for Q4 earnings - positive outcome?Hi guys , we are looking into one of the Magnificent 7 - and one of the biggest TECH giants - MSFT.

Microsoft had a fantastic 2024 growth wise and stability / expansion wise.

The stock remains a strong investment choice due to its diversified business model, consistent revenue growth, and leadership in key sectors like cloud computing (Azure), enterprise software, and AI innovation. With its robust balance sheet, steady dividend payouts, and adaptability in evolving markets, Microsoft is well-positioned for long-term growth, appealing to both growth and income-focused investors.

I am expecting some great numbers from their Q4 earnings which would lead towards us reaching our targets.

Entry: 429

Target: 456

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my community so you can follow up with me in private!

Microsoft - We Will See A Correction!Microsoft ( NASDAQ:MSFT ) can actually create a correction:

Click chart above to see the detailed analysis👆🏻

Microsoft is one of the strongest stocks over the past decade and also over the past couple of months, there was no clear sign of weakness. Therefore, it is actually not extremely likely that a correction will happen, but if it does, this will offer a long term texbook trading opportunity.

Levels to watch: $420, $350

Keep your long term vision,

Philip (BasicTrading)

Microsoft - H&S Fake Out to Make Out! 16% Upside🖐️ H5 TRADE - NASDAQ:MSFT

There was to much going on to call out my exact entry on this at the retest area but to be fair I put it on everyone's watchlist a few weeks ago and said a retest would be a perfect entry. This will be different once the H5 Community is up and running as I will have a whole trade alerts channel were I post my trades and buy/sell notis right as after execution!

With this trade we still have over 16% to run upward from here. So, up to you friends! Them and other Mag7 names held up really well during that flash crash and that is very bullish to me! Also, to throw in a learning lesson for all: Just because a charting pattern forms (H&S on MSFT) doesn't mean it's a trade you should enter! Always wait for breakouts and retest! If you struggle with that then you better beat it into your head and tape you hands underneath your desk!

-H5 indicator is GREEN

-Symmetrical Triangle pattern breakout and retest

-Launching off Volume shelf back to ATH and beyond

-Bottom of the two year rising channel

-Williams CB forming and believe we create support next week

I consolidated the account yesterday into the best trades and saw this OLD SAFE n RELIABLE trade and chose to buy some options!

🔜🎯$466

🎯$512

⏲️Before 05May2025

2 Contracts -$420 Calls for May 16th 2025

CB: $40.03 - Currently $43.75

Not financial advice.

Microsoft $MSFT - About to go on another run? 19% UpsideMicrosoft - NASDAQ:MSFT 🖥️

Microsoft with a big statement today for themselves and the MAG7! The runs not over! All MAG7 names are moving higher today and carrying the market.

Is this the beginning of the next leg up for BIG TECH?

Microsoft was forming a nasty H&S on the charts but has formed a Symmetrical Triangle pattern at then same time and is currently breaking out. They also broke out of the WR% downtrend and are launching off the AVP shelf to make a push back to ATH's.

Finally the H5 indicator is pointing upward and working on flipping back to GREEN.

🎯$466 📏$512 ⏳ May2025

NFA

IS THIS MAG7 DARLING ABOUT TO CRASH?!NASDAQ:MSFT

🔥 IS NASDAQ:MSFT ABOUT TO FALL OVER 21%?! 🔥

Let's not panic yet, but Microsoft's weekly charts are flashing some intriguing signals. Here’s the lowdown:

As long as NASDAQ:MSFT stays within its symmetrical pattern, we’re in the clear. But if it breaks downward, we’re looking at a potential 6% drop from the Volume profile shelf and possibly a dangerous 22% plunge, breaking the 2024 Head & Shoulders pattern. Enter the "Low Five Setup"—the bearish counterpart to my "High Five Setup."

Key factors to watch:

- Williams %R: Lower High

- MACD: Dangerously close to crossing below the zero line (BEARISH)

- RSI: Below RSI MA with lower highs, at 46—lots of room before oversold

- Trend: Lower high, red through yellow downward move indicating a downtrend on the weekly chart

Microsoft has been Wall Street’s golden goose, untouched by the FUD that hit the MAG7 stocks. Apple had China FUD, Tesla faced the ELON BAD FUD, Google with AI SEARCH FUD, Amazon with spending and margins FUD, Meta with metaverse spending FUD, and Nvidia with growth concerns FUD.

But as Willy Wonka taught us, every golden goose lays a bad egg sometimes. This is a weekly chart setup, so it will take time to play out. No one's immune to Wall Street’s FUD wrath, not even Microsoft. We shall see what happens...

P.S. I’m not in this name yet—just putting it on your radar. We’re early to the party, just like I always am with my setups. If you’re still here, you value solid, well-thought-out market analysis. Props to you!

Have a great Sunday, friends! 👊

Not Financial Advice #HighFiveSetup #LowFiveSetup

Microsoft MSFT: Volume + Momentum today & a retest of High soon

Microsoft came up in stock scans today on increased momentum so I took a look and I took a Long position.

MSFT you may remember back in July of this year sold off quite deeply from a bearish head n shoulders pattern. But since then it's price has reformed with good market structure & following its steamy movement today, I think a reclaim of the high price will occur before end of the year.

MSFT Setting up for a Long trade**Microsoft Value Correlation to USD and Interest Rates

>We are approaching oversold region for both correlations

**Election Year Seasonality forecast

>Setting up for a Bullish move on October 10

Technical Analysis:

1. Price could reach the highlighted Demand Zone and bounce.

2. Price could also reach the Gap Below the Demand zone. Price Gaps are like magnets because this is a market imbalance.

OTHERS:

>Scalpers can ride the Bearish trend until price reaches Demand Zone

>Long term traders can position for a Long trade at Demand Zone or at the Gap area.

***As always, manage your own trades, trade safe and make sure to do your due diligence when analyzing the charts.***

Microsoft - Correction Is Not Over Yet!Microsoft ( NASDAQ:MSFT ) can still drop a little lower:

Click chart above to see the detailed analysis👆🏻

It seems like the correction on Microsoft is not over yet and following previous price action and market structure, a move back to the previous triangle breakout level seems to be quite likely. However Microsoft still remains in an overall bullish market so looking for long setups is best.

Levels to watch: $350

Keep your long term vision,

Philip (BasicTrading)

MSFT has room to the daily 50 SMA.NASDAQ:MSFT daily chart shows consolidation just below the daily 50 and 65 EMAs. If MSFT can confirm this daily supply to the upside, there is significant space on the chart up to the daily 50 SMA, which gives this trade a large measured potential. Many NASDAQ:QQQ names have reclaimed their daily 50 SMAs, and as long as the index continues to build above its daily 50 SMA, MSFT is likely to catch up. As MSFT is a thinner name, this trade will be more likely to work during the morning trading session when liquidity is higher.