USD/CAD LONG SETUP DEVELOPING. DON'T MISS THIS CHANCETOP DOWN ANALYSIS

WEEKLY TIMEFRAME

----We see price is above the EMA indicating an uptrend in which the EMA Acts as dynamic support and resistance.we have seen price forming and higher low in the 50% fib level confirming as support

DAILY TIMEFRAME

-----EMA are pointing sideways indicating consolidation

-----Support is still being maintained while creating lower lows. still valid uptrend

H4 TIMEFRAME

----Price is below the EMA indicating a temporary retracement to collect liquidity

---- liquidity level i have identified by the red zone which come in confluence with the fib retracement level 61.8% and 78.6%

---we could see price retrace all the way to the zone btn 61.8 to 78.6%

H1 Timeframe

---- EMA crossover indicating price will drop in confluence with the H4 timeframe. and to those liquidity zone

update on COT DATA

--- we see institution are heavily buying dollar and selling canadian dollar. so this gives us and edge in the market.

TIPS

--- proper risk management

----confirmation from EMA crossover to upside in h1 and h4 timeframe

-- break of structure in M30 for perfect entry to upside

if you have any question comment below . like to help and support creation of more content. follow me to get notified on my analysis thank you

Mt4

BTCUSD Bybit Chart Analysis March 31th.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin BTCUSD Bybit Bitcoin Chart Analysis for March 31th .

This is a closed analysis yesterday.

30 minute chart, long position strategy.

Ignoring all the downtrends finger mark,

After entering $ 6204 long position,

It has risen to about $ 400.

Congratulations to the profitable people.

This is a daily chart.

The location of the day candle formation is advantageous.

However, the downtrend is still strong.

At the bottom, "I don't like"

Focus on the "Like" look at the top

I prepared a trading strategy.

Today's trading strategy.

It's a 30-minute chart.

and long position strategy.

Check the blue and red route, entry timing and price.

If you ignore the blue path,

If there is a strong uptrend,

Please pay attention to the "Like" expression on the top.

Yesterday, because the uptrend came out strongly

There is also the possibility of sideways.

If the final, red parallel line deviates from the support line,

End without additional entry.

Thank you.

BTCUSD Bybit Chart Analysis March 27th,

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin BTCUSD Bybit Bitcoin Chart Analysis for March 27th .

At the top, it is a 30-minute chart created yesterday.

In the middle of the route, it was changed to a sideway move.

In real-time broadcasting,

I checked the purple section.

After,

Exactly, a rebound occurred in the purple section below.

Congratulations to the profitable people.

This is a daily chart.

The location of additional day candle is not bad.

And Bollinger Band's support and resistance lines are narrowing.

Today, I make a Trading strategy focusing on this area.

It is a 30 minute chart.

One way, long position strategy.

And It's a long position strategy,

There is a possibility of sideways.

At the top and bottom,

Like, dislike mark section

Notice the red parallel line support , resistance.

When Breakaway the blue long position entry section,

Please check the red finger section at the bottom.

good luck.

Thank you.

March 26th NASDAQ US100 Chart Analysis.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin NASDAQ ZeroMarket US100 Chart Analysis for March 26th.

This is the Nasdaq 30 minute chart.

This is a long position strategy.

If bottom sad expression breake away.

stop loss.

And, please pay attention to the finger sections.

Good luck.

March 25th BTCUSD Bybit Chart Analysis.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin BTCUSD Bybit Bitcoin Chart Analysis for March 25th .

This is a 30-minute chart created yesterday.

Bitcoin has reached a new saction,

In the meantime, the pattern is broken.

The section we showed yesterday,

Within the red box , Sideway finished.

This is a daily chart.

It is still a dangerous section,

The downtrend is strong.

However, daily candle creation position not bad.

If there is no big movement,

For the time being, in the current section,

It is highly likely to continue sideways.

Focusing on this part,

I made a Trading strategy.

It is a 30 minute chart.

Neutral strategy,

Based on the green parallel line In the box,

it is a sideways strategy.

check a new pattern, It took a long time.

Two-way, daily trading, are advantageous

Pleade check to the fingers saction on the top and bottom.

If, At the top, touch the smile section Or,

touch the orange support at the bottom

If you do, the trading strategy will be invalidated,

All Position , breakway

support it, it is always good.

Good luck.

Thank you.

March 17 WTI CrudeOil Chart Analysis.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin WTI CrudeOil ZeroMarket Chart Analysis for March 17th .

WTI Crude oil 30 minutes chart.

All major index have similar positions.

It is in the middle of uptrend and downtrend.

A Blue section

B red section

Check the movement path and same color finger section.

Overall, the downtrend is strong.

Also ,

A saction moving ,

must reach the Smile section.

If it fails, it will strong downtrend.

Good luck.

March 16th BTCUSD Bybit Chart Analysis.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin BTCUSD Bybit Bitcoin Chart Analysis for March 16th .

This is an analysis written on last Friday.

It was a long position strategy,

Without much movement, it was finished with a sideaway.

This is a newly created weekly chart.

In one week, only one chart is generated week.

The plunge came out last week,

Because a strong downward movement came out,

It was necessary to check the bottom.

Today, an additional 4 hour / day / week chart was created,

focused on this part and have a Trading strategy.

Today's trading strategy. It is a 30 minute chart.

Overall, the downtrend is strong

It is dangerous if the Green Support line line section is brokeaway.

Check A and B paths and

A long position / B short position operation.

If there is a B path movement,

Short position operation is advantageous.

In addition, the blue finger section of the A path at the top

Please refer to the red finger section of the B path at the bottom.

Because the daily fluctuation is large,

day-Trading is advantageous.

It is better to run short,

Only the correct points are Entry and Finish.

The mid- to long-term downtrend can continue

Be careful,

For the time being,

securing the number of coins Please focus.

Thank you.

March 10th BTCUSD Bybit Chart Analysis.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin BTCUSD Bybit Bitcoin Chart Analysis for March 10th .

Yesterday's 30-minute salary chart.

It was a neutral strategy

In the long position entry position,

Vertical fall occurred.

In this section,

After entering the long position at the bottom, purple check section

After liquidation finished.

This is a capture before long position entering yesterday.

This is a daily chart.

The current position is very dangerous.

And There is no safe support line.

move up or down,

The rebound from the current position should come out.

Today I have a trading strategy focused on this part.

30 minutes chart.

That's a long position strategy.

Check the A and B movement route and the entry timing.

Also note the finger segments at each position.

Currently, the downtrend is very strong.

That's have to cannot Breakaway.

maybe , The big move seems to come after tomorrow.

good luck.

XAUUSD ZeroMarket Gold Chart Analysis for March 3th.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin XAUUSD ZeroMarket Gold Chart Analysis for March 3th .

XAUUSD Gold 30 Minutes Chart.

The overall downtrend is strong.

Today unconditionally, it must cross the yellow resistance line.

Also ,

If we breakaway the green parallel line,

Very dangerous.

Check the red expression below.

And Please check the finger section at the top , Short position.

Good luck.

Auto-delivering TradingView Alerts into MT4, MT5Check out TradingConnector (dot_com), an integration tool, which enables auto-delivery of TradingView Alerts in to MT4 and MT4, to trade Forex, commodities and indices!

Delivery time is below 1 second, so it can be even used for scalping, as well as higher timeframe trading.

Disclaimer: This is no financial advice nor any financial service. Remember – 95%+ traders lose money. You are trading at your own risk.

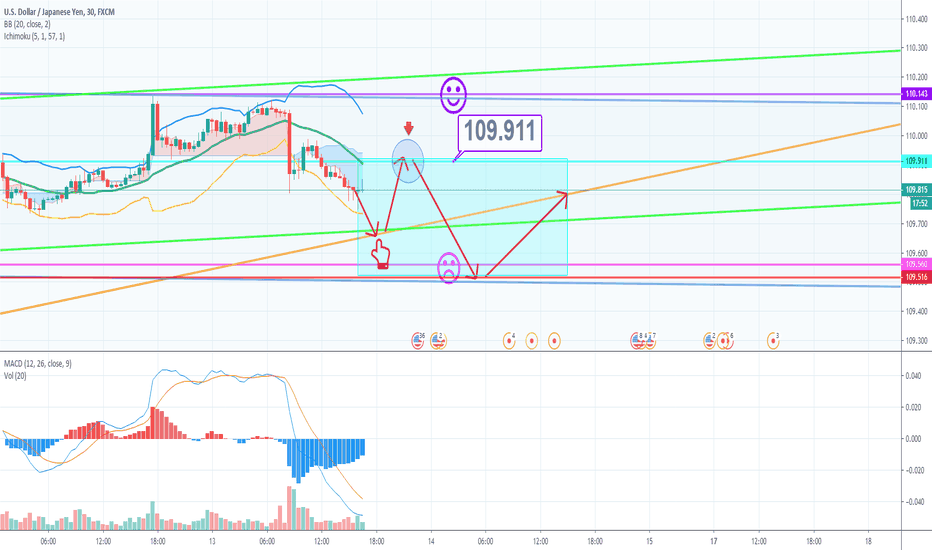

February 13th USDJPY Zeromarket FX Chart Analysis.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin USDJPY Zeromarket FX Chart Analysis for February 13th .

USDJPY 30 minute chart.

It's a short position strategy.

30 minutes parallel line resistance line should not touch.

uptrend is strong. When you touch the smile section at the top,

You can also switch in a long position.

The lower blue box section is

Short position waiting section.

At the bottom, check the red finger section.

Good Luck.

Thank you.

Daily Set & ForgetDear traders,

We spent the last 8 years Researching how Financial Derivatives behave. We built a financial model that applies Universal Equations to model any instrument into 9 states. Those states are the steady trend (1), the reversal (2), the strong trend (3), the super trend (4) and the flat market (0). We then calculated the second derivative of the model and used it with momentum to work out where price is heading next.

We wanted to avoid paying commission on our trades so we only review our portfolio at the end of the day or at a specific time each day. By minimising the commission costs we have become far more profitable. A strategy that makes 200% in 10 trades is better than a strategy that makes 200% in 200 if the commission cost on BitMEX is 0.4% all round trip.

Coming from an FX market background we have always preferred diversification - rather than only trading XBTUSD we opted to trade all 8 MEX contracts. For example if we have 10 BTC in our account we will allocate 10% for each trade as the initial margin. We use 10X leverage on our trades but only invest 10% of our account - some of our trades will be long and some will be short. Very rarely we are completeley long or completely short. 6/8 of the BitMEX contracts are relative to XBT so the movement is also not as much as the USD markets when levered.

We keep our stop losses at 5%. Typically once trades have gone into profit BitMEX automatically delevers them - so our trading margin on our whole account is usually 5X.

Our results from 2018 and 2019 show that we can generate about 10 to 35% per week on average. With some weeks in October 2018 generating substantially more depending on the volatility of the market. As a rule of thumb we make 10 to 35% every week.

I am 100% against 'drawn in' analysis - unless the author can create a Financial Model or a mathematical theory or proof that can be shown to generate abnormal returns from atleast 1990 to 2019 on the 4 main assetclasses (FX, Equities, Commodities and Bonds). TA strategies consisting of ( Trend Lines , Flags, Pennants Fib Retracements, Elliot Waves etc) can be coded into the TradingView platform. I do not believe trading is an 'art', I believe it is quant based with many Wall Street Hedge Funds running the show such as Two Sigma, Bridgewater Associates and Renaissance Technologies. The 'art' of technical analysis was something which was invented in the 1920's. We are now almost in the 2020's. Drawn lines on charts were first invented in the Roaring 20's - this was prior to the Digital Age. People would collect quotes and plot them by hand on paper back then. As Technology advances further and further the TA you are learning is will prove to be obsolete.

On our website we have two free downloads - Empowering Futures and Getting Started.

The first one is about our story and who we are, while the second one shows you where to begin and what you need to do.

If you have any questions don't hesitate to DM us. We only trade the 1440 for crypto and 770 timeframes for FX, Commodities and Stocks.

2018 to 2019 Results: 5927%

XBTUSD: +70%

ETHUSD: 363%

TRXXBT: 184%

LTCXBT: 15%

EOSXBT: 343%

BCHXBT: 496%

ADAXBT: 414%

XRPXBT: 120%

Best regards,

Grey Trading UK

February 6th XAUUSD ZeroMarket Gold FX Chart Analysis.

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin XAUUSD ZeroMarket Gold FX Chart Analysis for February 6th .

XAUUSD 30-minute chart.

It's a long position trading strategy.

Check the long position entry price and entry section.

At the bottom, if you leave the orange trend line

strategy is invalidat.

Thank you.

XAUUSD ZeroMarket Gold FX Chart Analysis for February 6th

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin XAUUSD ZeroMarket Gold FX Chart Analysis for February 6th .

XAUUSD 30-minute chart.

It's a long position trading strategy.

Check the long position entry price and entry section.

At the bottom, if you leave the orange trend line

strategy is invalidat.

Thank you.

BTCUSD Bybit Bitcoin Chart Analysis for February 5th.

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin BTCUSD Bybit Bitcoin Chart Analysis for February 5th.

30 minutes chart.

Yesterday exactly, in the red finger downward movement came out.

In addition, in real time, There was an explanation.

Congratulations on your profit.

This is a daily chart.

Daily Dead Cross came out,

It didn't fall much bigger than I thought.

Today I have a trading strategy.

30 minutes chart.

It's a long position strategy.

If you fail to raise the smile section at the top,

It will fall, to $ 8955 at the bottom.

Please be careful about short positions from today.

Check A and B route.

Entry timing, entry price confirmation

And note each finger segment.

good luck.

Thank you.

USDJPY ZeroMarket FX Chart Analysis for February 4th

Hello,

“Make it simple, make profit”

It’s BitcoinGuide.

Don’t forget to

“Follow” me and press “Likes”.

I will begin USDJPY ZeroMarket FX Chart Analysis for February 4th

USDJPY 30 minute chart.

It's a long position strategy.

Check the long Position entry timing and entry price.

If you leave the Support line,

Please finish short.

Smile section at the top,

If you can't touch it,

It becomes the short position entry position.

And Bonus Check your finger segment.

Thank you.

January 7th GBPUSD FX Chart Analysis

Make it simple, make profit.

It’s BitCoinGuide.

Recently, I’ve been concentrating on the FX margin trading.

If you get to know about characteristics and patterns for each item, it will be very helpful for your trading.

Don’t forget to press “Likes” and “Follow” me.

I will begin ZeroMarket FX Chart Analysis for GBPUSD on January 7th

This is AUDUSD for yesterday.

It didn’t show a wave pattern that I wanted.

But, the price fell right at the red timing above.

Then the price went down below parallel supporting line and danger zone with a drastic fall.

It was about $489 movement.

Congratulations.

I also checked USDCAD which has the opposite direction and made profits in both items.

Today we have GBPUSD 30m candle chart.

I will be brief.

Based on the parallel line,

First short position unless the price goes above the parallel resistance line.

Then finally long position at the bottom point.

Please check out red finger pointer at the middle part.

When breaking out parallel line, if the price reaches the smile face line above, we are at safe zone.

Furthermore, please check EURUSD which moves the same direction with GBPUSD.

And also check USDCHF which has the opposite direction.

Hope you all make profits.

I will come back to you tomorrow.

Thank you.

(Translation

Jae Ho Shin)

AUD/JPY NICE RISK TO REWARD FOR LONG SETUPTOP DOWN ANALYSIS

WEEKLY TIMEFRAME

There is 2 key level to pay attention at!!.weekly support level-74.900 at which the price is currently trading at. resistance level 78.500 at which we want price action to break for a continuation for upside

Daily Timeframe

we see market in an uptrend.also breaking the inner counter-trendline. moving to the outer counter- trendline. nice bounce of upward trendline and

H4 and H1 timeframe

We see price is respecting the 61.8% fib level and support level of previous higher low!

target 77.000