Multi

Clinuvel (CUV) set up for the next 200-350% run-up!Chart pattern:

Since 2014 a regular chart-pattern can be observed in the Clinuvel ( CUV ) chart. After one year of a strong run-up (mostly starting in late February), the stock reaches a local peak (around Sept-Nov) and starts a correction (around -35% to -50%), followed by a longer sideways consolidation. Then the year after late Feb the next run-up starts. After the FDA approval in October 2019 the stock peaked, followed again by a strong and long correction and consolidation.

Currently, a new upmove started end of February 2021, bringing the stock from its recent correction low already up by 40% (20 AUD to 28 AUD).

Assuming the regluar pattern repeats, the new upmove has already started end of February and should bring the stock up to 60-86 AUD (200-330%) by autumn 2021.

Fundamental support of the coming run-up

Clinuvel is an innovative Biotech-Company, based in Melbourne Australia (ASX listed) and the world leader in Melanocortin-Hormones. Clinuvel offers the product "Scenesse" (Afamelanotide), which is approved in Europe since 2014, in USA since 2019 and in Australia and Israel since 2020. The company has no debts and is highly profitable.

There are several fundamental accelerators and good news to support a coming up-move:

- Continues expansion of the product in Europe (more and more countries are approved and reimbursed)

- Massive revenue growth expected in the USA, as the infrastructur for the distribution of Scenesse has been established now

- New Marketing and brand building initiatives

- New studies in place for label extension of the product

-> Vitiligo Phase 3 program to be started soon (Clinuvel is in final alignment with the FDA) (billon dollar market)

-> Ischemic stroke program: First study to be started shortly (billion dollar market)

-> XP study to proof DNA repair capabilities of Scenesse

-> Launch of OTC cosmetic products for mass market, with active ingredients for skin tanning (billion dollar market)

Overall, the management of the company is highly bullish to reach the set goals.

TSLA: The Channel GamesChannel 1:

> Lasted ~1 month and ended with bullish push. (1 Day Timeframe)

Channel 2:

> Lasted ~2 months and ended with bullish push. (1 Day Timeframe)

Channel 3:

> Lasted ~1 month and ended with bullish push. (1 Day Timeframe)

> Important channel, created support/resistance for channel 5.

Channel 4:

> Lasted ~1 month and ended with bearish pull. (1 Day Timeframe)

> Two price rejections, indicated by yellow circles.

> Two mini channels:

>> 1st mini channel ended with bullish push that was rejected. (2 Hour Timeframe)

>> 2nd mini channel ended with bearish pull. (2 Hour Timeframe)

Channel 5:

> Will last ~2 months. (1 Day Timeframe)

> Two mini channels:

>> 1st mini channel ended with strong bearish pull. (2 Hour Timeframe)

>> 2nd mini channel just started with huge impulse. (2 Hour Timeframe)

>>> 2nd mini channel also formed a head and shoulder. (5 Minute Timeframe)

Support/Resistance 1: $895

Support/Resistance 2: $686

White lines: 1 Day timeframe

Yellow lines: 1 Hour timeframe

Yellow Circles: Rejection

USDCAD Short opportunity could be in play by end of next weekHappy Weekend Traders,

Thank you for your likes and questions. If you have any queries feel free to message me.

I have had a few questions around how I build my analysis for the week. Here is one idea, I am looking at, I haven't placed a trade but is on my watchlist due to the below:

Bias: Short USDCAD

Type of idea: Swing

Please note: This chart is 4hr but the EMA is based off the Daily chart. I have used 4hr chart as a way to identify the price action so I can get into the trade early if it moves in my direction but not too early just in case it is noise.

Rationale:

1) Price has reacted between the Daily Chart 100EMA (Red line) & Daily Chart 50 EMA (Amber line) 2 times ( see pink circles)

2) Long term the pair is in a down trend

3) Near term the pair is in a down trend (Black line)

What am I waiting for:

1) USA news release next week (PMI, Non-Farm, Unemployment) I am not going to trade these releases but merely keep an eye on the release and see how positively or negatively it impacts the pair.

2) If news is negative for USD and price closes below Daily Chart 50EMA I will place a short

3) If news is positive for USD and price moves above Daily Chart 100EMA I will not place a trade

Point to note traders: Be careful of all USD pairs this coming week due to the news releases (that is only if your strategy doesn't include trading news releases).

If you like it give it a thumbs up and I will post a follow up should this pair move in favour of my bias.

Have a great weekend, Happy Hunting!

GOLD update Good day traders !!! On gold we are looking at a short setup because we got again into the descending channel again and it seems that we had some sort of fake breakout of the trend line. Also we just completed an "M" formation on the daylight timeframe and we retested the neckline and rejected it. We are looking for a short setup on the short term but be cautious with everything that is happening with the stock market because it has a big impact on commodities as well.

Now if you enjoyed this analysis like and share. If you have a different opinion comment below as I would love to have some more insights about this pair.

Trade safe !!1

GOLD to 1840, Buckle up !!!Good Day Traders !! On Gold as we expected the price dropped to the demand Zone and broke the trend line ! On the Monthly timeframe we have an overextended W formation and we just tested and rejected the neckline. Down on the weekly timeframe we have an "M" formation and we have confluence between the neckline of the weekly and Daily "M" formations. Also it happens that the neckline on the daily timeframe is exactly the 0.618 Fib retracement on the previous leg. With all of that being said we are looking at a potential opportunity for long in the short and mid term for gold. From an institutional perspective we have hedge funs and non commercials institutions adding a massive amount of long position on gold and this impulse to the downside could be considered as an accumulation of liquidity before the real launch.

Now if you enjoyed this analysis smash that like button and share. If you have a different opinion please leave a comment below as I would love to get more insights and ideas. I also linked my previous idea about this asset.

Trade safe !!!

USDCHF DAILY SHORT TRADE- double big up & down bar is mean the price is rejected the resistance + supply zone

- after breaks-out the head & shoulder pattern, the price is in the up trend

- short will small position to demand zone or long when price test demand zone + support level with clear price action

- if you look the volume, you will see it is increase around the head & shoulder pattern, specially the big bear bar with a large of volume. it's mean the shark started this long trade and they killed retailer investor tried long or short before. the momentum is too strong.

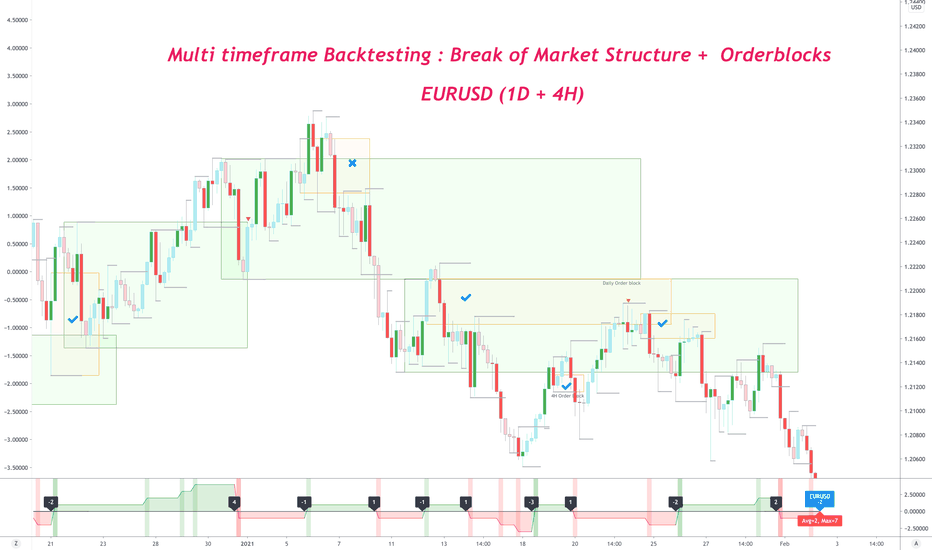

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

EURUSD is resting to do a big jumpEURUSD has broken its resistance of 1.2000 after a consolidation of 130days.

it also has broken major resistance of 1.21000 strongly.

to continue , this pair needed a rest, last week eurusd was in a bullish flag and one time tried to break that.

the zone of 1.21 is a key level i think. in this zone we have major SR zone , and as you see in 4H the EMA50 is waiting for price just close to 1.21

I personally will open a long position in this zone just in case i see a 4H signal .target can be 1.25000 but of curse we will face barriers near zone of 1.22.

just note, if price close lower than 1.2100 it can come to start from 1.2000....so wait for signals....

position will be long anyway but just keep an eye on zone of 1.21.

How to trade a Range / Real case on EUR/AUDGood morning traders! Today we detected a trade opportunity in the EUR / AUD pair and we want to share with you in detail how we perform a multi-timeframe analysis to develop a setup.

🔸The first step is to start on a high timeframe chart in order to see the long-term behavior, whether it is in an uptrend, downtrend, or range.

🔸What we see on the daily chart of this pair is that it has been moving within a range for several months without a clear main trend. Of course, inside this range, there are internal trends of less temporality, which is what we will use later to be able to develop the setup.

🔸Talking about the price situation at this time, we see that it is coming out of a support zone that was tested multiple times, and that each time it faced that zone it generated an upward movement. Because of this, we are now expecting the same behavior.

🔸Decreasing the timeframe to 4H, we are preparing to analyze the short-term behavior.

🔸Following the bounce in the support zone, the price broke to the upside the Descending Trendline, this was a strong bullish sign. The problem with this break is that there was a Resistance zone very close, so we needed this zone to be penetrated to the upside before looking for an opportunity.

🔸This is what happened a few days ago. The price generates a bullish breakout, and not only that, but also begins a corrective process in a throwback to the support zone (previous resistance).

🔸Due to all this confluence of factors, we consider this pair to be a good opportunity.

🔸Using the cloning of the first impulse as a movement objective, it offers us an excellent risk-benefit ratio.

Using My strategy to create High Profit backtests ConsistentlyI created a strategy and an alert system based on simple indicators that can produce very high results. I think I am going to start posting some of my results weekly, open for critique. I've actually been using my alerts in the live market, and with pretty good success, but I figure it is always better to have some constructive criticism. I have a ton of experience with my scripts, and I built in a ton of margins for error, so results in real life are actually better than posted.

Not sure if I have a talent, or it is just hours of experience, but I am able to create backtests similar to the one shown in a couple of minutes. The backtest shown is for the past year, from November 2019 to November 2020, and it's on BTC on a 2 hour time frame. Let me know your thoughts on it!

If anyone is interested, I have the strategy open source for everyone to use and to learn from,but my alert system that matches up perfectly with it took some time to build so I kindly ask for $10/month for anyone to use it, BUT I will also send you free configurations to use, similar to the one below, on any coin or any chart that you invest with. I can create great backtests on ANY CHART using my strategy and techniques. I always aim for a mixture of high percent profitability and obviously net profit.

Does anyone have any criticism/doubt/suggestions on my backtest? I'm always looking to learn on how to get better.