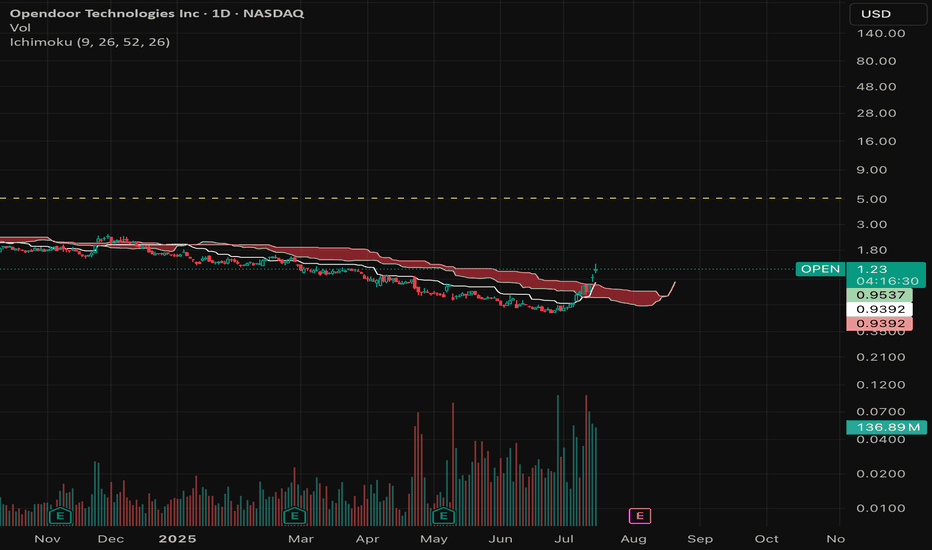

Trump firing Jerome is bullish for $OPEN - Trump firing Jerome is bullish for physical assets like real estate, gold, materials.

- Trump would most likely appoint a FED chair which will lead to lower interest rates.

- Lower Interest rates (Macro tailwinds) + Improving business model (fundamentals) + technical breakout = 🚀

Multibagger

$SEMR small cap multibagger top pick | 100-200% ROI- NYSE:SEMR is one of my topic for small caps.

- NYSE:SEMR is growing revenue in double digits 20%+

- High profit margin ~80%+

- Popular/Go-to tool for SEO Expert.

- With Agentic AI, Agents go and search results for the user. For example, all the foundational LLM have websearch option. SEO is more critical than ever before because a solid SEO strategy will help a foundation model to show your website in the search result.

- NYSE:SEMR is building AI tool capabilities as well which is an opportunity to upsell their offerings.

- Debt-free capital structure plus a cash-rich position (~$262 M, exceeding debt), and current ratio above 2× signal strong liquidity

Fundamentally,

Year | 2025 | 2026 | 2027 | 2028

EPS | 0.35 | 0.47 | 0.63 | 0.87

EPS growth% | 25.24% | 33.51% | 36.02% | 37.55%

For a company growing EPS close to 30s with a brand value deserves a forward p/e of 30

Base Case ( forward p/e = 30 )

Year | 2025 | 2026 | 2027 | 2028

Price | $10.5 | $14.1 | $18.9 | $26.1

Conservative Base Case ( forward p/e = 20 )

Year | 2025 | 2026 | 2027 | 2028

Price | $7 | $9.4 | $12.6 | $17.4

Bear Case ( forward p/e = 15 )

Year | 2025 | 2026 | 2027 | 2028

Price | $5.25 | $7.05 | $9.45 | $13.05

Bull Case ( forward p/e = 35 )

Year | 2025 | 2026 | 2027 | 2028

Price | $12.25 | $16.45 | $22.05 | $30.45

I expect the stock to return almost 100-200% in less than 3 years with a CAGR of 20-35% for the next 3 years through 2025-2028

Bullish Bet , UnionBankBanknifty at support.

UnionBank on recent high making sideways moves, which means consolidation.

Once Banknifty Bounce back, UnionBank will break the resistance on weekly and monthly Basis and will start moving higher.

It has higher targets on a short and long term investment.

Good to hold for short term.

+644% vertical $0.18 to $1.34 $TCTMHuge run from $0.18 to $1.34 🔥 in just a few hours NASDAQ:TCTM

It was first on my premarket watchlist which I posted everywhere as each morning.

At the time it was up just +130% now +644%

Massive HALF OF BILLION shares traded volume so far, it hits a billion volume today easily.

Buy Alert paid very well!

EdTech Unicorn Stride Surges: Strong Financials Fuel Rally!The EdTech revolution is progressing rapidly! As technology advances, internet access grows swiftly, and students seek innovative learning methods, the global EdTech market is flourishing.

North America currently holds a significant 37.3% share, but regions such as the Middle East and Africa, Europe, and Asia-Pacific are gaining ground, fueled by government support, digital literacy, and a burgeoning middle class. It's an exciting time for digital learning, and there's even more to look forward to!

◉ EdTech Market Growth Outlook

➖ Valuation projected to rise from $220.5 million in 2023 to $810.3 million by 2033.

➖ Compound Annual Growth Rate (CAGR) of 13.9%.

◉ Government Initiatives Supporting EdTech Sector

The US Department of Education has allocated $277 million in new grants through the Education Innovation and Research program to enhance educational equity and innovation, particularly in areas affected by the COVID-19 pandemic, specifically focusing on STEM education and rural regions.

Recognizing the enormous opportunity in EdTech, we're examining a stock that exhibits remarkable growth potential within the sector.

◉ Company Overview

Stride Inc. NYSE:LRN is a tech-driven education service provider offering proprietary and third-party online curricula, software, and services in the U.S. and globally. Their products support personalized learning for K-12 students through virtual and blended public schools, individual online courses, and supplemental materials in subjects like math, English, science, and history. Stride also emphasizes career learning in fields such as IT, healthcare, and business, and operates tuition-based private schools. Additionally, they provide post-secondary programs in software engineering and healthcare under brands like Galvanize and Tech Elevator, along with staffing services. Rebranded from K12 Inc. in December 2020, Stride has been incorporated since 1999 and is headquartered in Reston, Virginia.

Investent Advice by Naranj Capital

Buy Stride NYSE:LRN

● Buy Range- 77 - 80

● Target- 115 - 120

● Potential Return- 45% - 50%

● Invest Duration- 12-18 Months

◉ Market Capitalization - $3.31 B

◉ Peer Companies

➖ Graham Holdings NYSE:GHC - $3.23 B

➖ Adtalem Global Education NYSE:ATGE - $2.67 B

➖ Grand Canyon Education NASDAQ:LOPE - $4.04 B

➖ Laureate Education NASDAQ:LAUR - $2.25 B

◉ Technical Aspects

● Monthly

➖ The stock price initially faced resistance at $40 in 2011 but later found support at $17.

➖ Despite several attempts to break through resistance, the stock experienced significant declines.

➖ However, after a 12-year period, it finally broke out and rallied to a high of $84.

➖ Currently trading at $77.7, the stock is expected to continue rising in the near future

● Daily

➖ The daily chart indicates a clear uptrend in the price movement.

➖ An ascending triangle pattern has formed, and following the breakout, the price has retraced to the breakout level.

➖ At this moment, the price is attempting to find support at the 50 EMA.

➖ From a technical standpoint, the stock is resting at a support level, making it an attractive option for accumulation with a mid to long-term investment outlook.

◉ Relative Strength

➖ The chart clearly illustrates that Stride Inc. has greatly outperformed the US Smallcap 2000 index, achieving an impressive annual return of 82%, which is a notable achievement.

◉ Revenue & Profit Analysis

● Year-on-year

➖ In FY24, revenue surged by 11.3%, reaching $2,040 million, up from $1,837 million in FY23.

➖ EBITDA saw a substantial boost, climbing to $295.3 million in FY24 compared to $225.2 million the previous year.

➖ The EBITDA margin also experienced growth, rising to 14.47% from 12.26% in FY23.

➖ Additionally, diluted EPS witnessed an impressive increase of 57.91%, jumping to $4.69 in FY24 from $2.97 in FY23.

● Quarter-on-quarter

➖ In the latest June quarter, the company achieved a remarkable milestone with quarterly sales reaching an all-time high of $520.8 million. This marks a 3% increase from the $504.9 million recorded in the March quarter and a significant 10.75% rise compared to $470.3 million in the same quarter last year.

➖ EBITDA declined from $100.2 million to $82.3 million in the latest quarter, representing a 17.8% decrease.

◉ Valuation

◉ PE Ratio

● Current PE Ratio vs. Median PE Ratio

➖ The present price-to-earnings ratio for this stock is 16.2x, which is considerably below its four-year median price-to-earnings ratio of 18.9x times, indicating that the stock is currently undervalued.

● Current PE vs. Peer Average PE

➖ The stock presents a favorable valuation when considering its Price-To-Earnings Ratio of 16.2x, which is lower than the average of its peers at 18.3x.

● Current PE vs. Industry Average PE

➖ Stride appears to be offered at a more competitive price, featuring a Price-To-Earnings Ratio of 16.2x, which is significantly below the average of 19.2x for the US Consumer Services industry.

◉ PB Ratio

● Current PB vs. Peer Average PB

➖ The present PB ratio in relation to the average PB of peers indicates that the stock is somewhat higher, with a ratio of 2.8x in contrast to the peer average of 2.6x.

● Current PB vs. Industry Average PB

➖ When comparing the current PB ratio to the industry average, Stride appears to be considerably overvalued, exhibiting a PB ratio of 2.8x, while the industry average stands at 1.6x.

◉ Cash Flow Analysis

➖ The cash generated from operations has experienced substantial growth in fiscal year 2024, increasing to $278.8 million from $203.2 million in fiscal year 2023.

◉ Debt Analysis

➖ Stride has a total debt of $528.2 million, resulting in a debt-to-equity ratio of 0.44.

➖ The company generates sufficient interest income to exceed its interest expenses, indicating that interest payment coverage is not an issue.

◉ Top Shareholders

➖ BlackRock Inc. holds a significant ownership interest in this company, with a notable stake of 14.9%. This level of investment reflects BlackRock's confidence in the company's potential for growth and profitability.

➖ The Vanguard Group also maintains a considerable presence, owning 10.7% of the company's shares.

➖ Together, these two investment giants represent a substantial portion of the company's equity, indicating strong institutional support and interest in its future performance.

◉ Conclusion

Upon examining Stride Inc.'s financial performance, we focused on essential metrics such as revenue growth, profit margins, and the stability of cash flow. Additionally, we assessed the company's future growth potential by looking into industry trends and the competitive landscape.

As a result, we are confident that Stride Inc. is positioned to capitalize on new opportunities while effectively navigating challenges, making it an attractive option for both investors and stakeholders.

Reliance looks to be the BEAST amongst BEARS!!Reliance has been on a decline for a while and we have all wondered about when this beast of a bull will come to party!!.....May be the time has come!!

- MACD is positive

- Volume is high and RSI increasing over last few trading sessions

- Taken support 2 or 3 times in the 1205-1210 level

- Breaking out of a Falling Wedge pattern

- Taken support from 68.2 Retracement on Fibonacci and crossed 1260 - indicating an impulse pattern

Next stop 1290-1300 and eventually 1350!!

Fingers crossed

Swiss Military long consolidation breakoutIt has been consolidating for the last 16 years and is now giving a breakout on both weekly and monthly timeframes. Whenever a breakout occurs, it's often accompanied by changes in revenue, profits, and other fundamental ratios, indicating that the company is performing well.

I do use logarithmic charts, so the long position might look like 1:1 RR, but it's actually 1:5 RR.

Remember to do your own research before investing.

Prakash Ind Long Weekly BOIt has been consolidating for the last 16 years and is now giving a breakout on both weekly and monthly timeframes. Whenever a breakout occurs, it's often accompanied by changes in revenue, profits, and other fundamental ratios, indicating that the company is performing well.

Remember to do your own research before investing.

BITCOIN Holding the level - 98000Let's not discard the rally just yet. I see the buyers are still present but the overhead supply is a matter of concern.

So, here is my view:

Support level - 98000

As long as the price does not close below 97500 on the hourly chart, this is still a buyers' controlled setup.

Supply zone - All time high is the only and a very strong rejection zone. BTC will find it very hard to hold and break above ATH. So I am not very convinced about the upside momentum.

Possibility:

BTC could slowly further move up here and should form a base.

The consolidation around the drawn levels could be a nice place to play long or wait for the base breakout above ATH.

This is not a recommendation.

Corcept Therapeutics: A Shining Star in US BiotechCorcept Therapeutics is making waves in the booming U.S. biotech scene, with its stock surging 46.2% over the past six months. The company, known for its Cushing's syndrome drug, Korlym, reported a staggering 39.1% year-over-year sales increase, reaching $310.6 million in H1 2024. With a market cap of $4.42 billion, Corcept is actively developing new treatments like Relacorilant, which shows promise in clinical trials.

Despite a high PE ratio of 35.3x compared to the industry average of 19x, its strong revenue growth and commitment to R&D position it as a solid investment opportunity in the fast-growing biotech market projected to reach $1,786 billion by 2033.

◉ The US Biotech Industry Outlook

The biotech boom in the U.S. is hotter than a California summer! Fueled by groundbreaking tech and government cheerleading, the industry is soaring higher than a SpaceX rocket. According to Vision Research Reports, the market is projected to soar by 12.4% CAGR from 2024 to 2033. This rapid expansion is driven by advancements in areas like genomics, gene editing, and personalized medicine, positioning the U.S. as a global leader in healthcare innovation.

➖ The US biotechnology market size was valued at $552.43 billion in 2023 and is anticipated to hit around $1,786 billion by 2033.

➖ Key players like Abbvie Inc., Genentech Inc., and Amgen Inc. are leading the market.

Acknowledging the remarkable expansion of the biotech sector, we are taking a closer look at a stock that is showing considerable strength in its technical chart, complemented by robust financial performance.

◉ Company Overview

Corcept Therapeutics NASDAQ:CORT is a biopharmaceutical company dedicated to developing innovative treatments for severe endocrine, oncologic, and metabolic disorders. Their lead product, Korlym, is approved for Cushing's syndrome, a rare endocrine condition. Corcept is also advancing several pipeline candidates, including relacorilant for Cushing's syndrome, treatments for various cancers, and potential therapies for neurological conditions like amyotrophic lateral sclerosis and nonalcoholic steatohepatitis. Founded in 1998, Corcept is based in Menlo Park, California.

◉ Significant Stock Performance of Corcept Therapeutics

Corcept Therapeutics Incorporated's stock price has risen 46.2% in the past six months, despite a 2% industry decline. This surge is attributed to strong demand for Korlym, the company's sole marketed drug used to treat Cushing's syndrome, a condition that is primarily cured with mifepristone.

◉ The Economic Impact of Korlym

The primary source of revenue for Corcept emanates from the sales of Korlym. The drug has showcased remarkable growth, evidenced by a 39.1% year-over-year sales increase, culminating in $310.6 million during the first half of 2024. This growth is attributed to robust demand and an unprecedented number of patients being prescribed the medication.

◉ Corcept's Stock Growth Factors

● Potential of Relacorilant: Positive GRACE study results suggest relacorilant could be a valuable treatment for Cushing's syndrome, potentially driving revenue growth.

● Pipeline Diversification: Corcept's ongoing exploration of relacorilant in GRADIENT study demonstrates commitment to expanding pipeline.

● Regulatory Progress: Successful completion of GRACE study positions Corcept for a new drug application in late 2024.

● Market Need: Successful relacorilant could fill significant unmet medical need for Cushing's syndrome.

Investent Advice by Naranj Capital

Buy Corcept Therapeutics NASDAQ:CORT

● Buy Range- 38 - 40

● Target- 55 - 58

● Potential Return- 35% - 40%

● Invest Duration- 12-14 Months

◉ Market Capitalization - $4.42 B

◉ Peer Companies

● Prestige Consumer Healthcare NYSE:PBH - $3.644 B

● Jazz Pharmaceuticals NASDAQ:JAZZ - $6.766 B

● Amphastar Pharmaceuticals NASDAQ:AMPH - $2.423 B

● Organon NYSE:OGN - $5.142 B

◉ Relative Strength

➖ The chart distinctly demonstrates that NASDAQ:CORT has significantly surpassed the US Smallcap 2000 index, attaining an impressive annual return of 30%, marking a remarkable accomplishment.

◉ Technical Aspects

● Monthly Chart

➖ The historical chart shows that the stock price is trending upward, marked by a sequence of higher highs and higher lows.

➖ Having recently moved out of the parallel channel, the price is set for additional gains.

● Daily Chart

➖ After an extended period of consolidation, the stock price has formed an Inverted Head & Shoulders pattern.

➖ Post-breakout, the stock has stabilized above the breakout point and is now striving for new highs.

➖ A surge in trading volume suggests that buyers are currently showing significant interest.

◉ Revenue & Profit Analysis

● Year-on-year

➖ In the fiscal year 2023, revenue experienced a significant increase of 20.4%, amounting to $482.4 million, compared to $401.9 million in fiscal year 2022.

➖ However, EBITDA faced a downturn, decreasing to $108.3 million in FY23 from $113.9 million in FY22.

➖ The EBITDA margin also saw a reduction, falling to 22.46% from 28.34% in FY22.

➖ Moreover, diluted earnings per share (EPS) rose by 8% year-over-year, climbing to $0.94 in FY23, up from $0.87 in FY22.

**While the growth in EBITDA might raise some concerns, it's crucial to acknowledge that the company is heavily investing in its research and development sector, and this investment has seen substantial increases over the years.

● Quarter-on-quarter

➖ In the most recent June quarter, the company reached an impressive achievement, with quarterly sales hitting a record high of $163.8 million. This represents a 12% increase from the $146.8 million reported in the March quarter and a substantial 39% growth compared to $117.7 million in the corresponding quarter of the previous year.

➖ Additionally, EBITDA rose from $29.6 million to $36.2 million during the latest quarter.

◉ Valuation

◉ PE Ratio

● PE vs Median PE

➖ Corcept Therapeutics sustained a median price-to-earnings ratio of 19.7x from December 2019 to 2023.

➖ Presently, with a price-to-earnings ratio of 35.3x, the stock seems to be relatively expensive.

● PE vs. Peers PE

➖ CORT's Price-To-Earnings Ratio stands at 35.3x, making it quite pricey when compared to the average of its peers, which is only 13.6x.

● PE vs. Industry PE

➖ CORT's valuation seems high, as it has a Price-To-Earnings Ratio of 35.3x, which is considerably above the US Pharmaceuticals industry average of 19x.

◉ PB Ratio

● PB vs. Peers PB

➖ The current price-to-book (P/B) ratio suggests that the stock is slightly undervalued, sitting at 7.4x compared to the peer average of 10.8x.

➖ However, it's important to note that a P/B ratio of 7.4x is typically seen as significantly overvalued.

● PB vs. Industry PB

➖ When we analyze the P/B ratio against the industry standard, CORT stands out as being notably overvalued, with its P/B ratio of 7.4x far exceeding the industry average of just 1.7x.

● PEG Ratio

➖ The stock currently seems to present a compelling investment opportunity, featuring a PEG ratio of 0.84.

◉ Cash Flow Analysis

➖ In FY23, operating cash flow increased to $127 million, compared to $120.3 million in FY22. However, it's essential to recognize that when examining the overall trend from FY19 to FY23, there has been a decline in cash flow from operations.

◉ Debt Analysis

➖ CORT operates without any debt, showcasing the robust financial health of the company.

◉ Top Shareholders

➖ Blackrock presently possesses a significant 15.8% ownership in this stock, while The Vanguard Group maintains approximately 9.1% stakes.

◉ Conclusion

Following a comprehensive examination of technical and fundamental metrics, our assessment indicates that Corcept Therapeutics possesses substantial growth potential within the US biotechnology sector. Notwithstanding elevated valuations, the company's increasing research and development expenditures demonstrate a strong commitment to its future prospects. Consequently, we consider Corcept Therapeutics a prudent investment choice at this juncture.

HAL Swing trading Setup - Descending TriangleChart Analysis:

1. Descending Triangle Pattern:

• The chart shows a descending triangle with lower highs (LHs) forming resistance and a horizontal support zone. This pattern typically indicates a bearish continuation, though an upside breakout can happen.

• The trendline resistance appears well-respected, with a downtrend line pushing prices lower.

2. Resistance Levels:

• There is a resistance zone marked above current price levels.

• Resistance 1 and the trendline serve as a major area where a potential pullback could be seen.

3. Support Levels:

• A clear horizontal support level is visible, which has been tested multiple times, increasing the significance of a potential breakdown.

4. RSI Indicator:

• The RSI shows a downward trend but does not appear to be in oversold territory yet. This implies room for further downward movement but also warrants watching for a potential reversal signal.

Swing Trade Setup:

1. Bearish Scenario (Preferred based on the chart):

• Entry: Consider entering a short position if the price closes below the marked support zone with strong volume.

• Stop Loss: Place a stop loss above the descending trendline resistance to mitigate risk in case of a reversal or fake breakdown.

• Target 1: Use the measured move from the widest part of the triangle to estimate the potential target level for the downside move, aiming for key support levels below (e.g., 3,200-3,000).

• Target 2: If momentum is strong, trailing stops can help capture more of the move downwards.

2.Bullish Reversal Scenario:

• Entry: If the price breaks above the descending trendline with strong volume and closes in the resistance zone, it may invalidate the bearish pattern, indicating potential bullish momentum.

• Stop Loss: Set a stop loss below the breakout candle’s low to avoid potential false breakouts.

• Target 1: Aim for key resistance levels above, including previous swing highs.

• Target 2: Monitor RSI and volume for signs of overbought conditions.

Risk Management:

• Position Sizing: Ensure your position size aligns with your risk tolerance, ideally risking no more than 1-2% of your account balance per trade.

• Monitoring Volume: Increased volume on breakdown or breakout moves strengthens conviction in the trade direction.

• Adapting to Market Conditions: Be prepared to switch to the bullish scenario if the market sentiment shifts unexpectedly.

Caution:

• False breakdowns are possible, especially if volume is low or market sentiment shifts rapidly.

• Keep an eye on broader market trends and sector performance for additional cues on stock direction.

Disclaimer : This analysis is for informational purposes only and does not constitute financial advice or an investment recommendation. Trading in financial markets involves substantial risk, and you should be aware of your risk tolerance and investment objectives. Past performance is not indicative of future results. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. The author of this analysis is not responsible for any financial losses you may incur based on the information provided.

HCL Technologies Ltd Daily Chart Analysis

The daily chart of HCL Technologies Ltd illustrates an upward trend with strong support levels and clear resistance areas, showcasing both bullish momentum and potential pullback scenarios.

Key Observations:

1.Trend Analysis: The stock price is in an overall uptrend, consistently making higher highs and higher lows. It is supported by a well-defined ascending trendline and is trading above the 200 EMA, which is a bullish indicator.

2.EMA Levels: The 13, 48, and 200 EMAs are aligned in a bullish configuration, indicating continued strength. The price’s proximity to the EMAs will be a key indicator of short-term trends.

3.Volume Behavior: There is a healthy volume trend with spikes during up moves, suggesting interest and accumulation during bullish days.

4.Resistance and Support Zones:

• Resistance: The resistance zone around ₹1,888.50 - ₹1,889.30 represents a key hurdle. A sustained move above this level, accompanied by strong volume, could confirm a bullish breakout and indicate further upside potential.

• Support: The primary support level lies around ₹1,719.00. A breakdown below this level could lead to a more significant pullback, possibly retesting previous lows or consolidating around the 200 EMA.

5.RSI Indicator: The RSI is currently around 55.27, indicating mild bullish momentum without being overbought. An upward move in the RSI beyond 60 could further validate any price strength and potential for breakout scenarios.

Potential Scenarios:

• Bullish Scenario: A breakout above the ₹1,889 resistance zone with strong volume could propel the stock higher, targeting further resistance levels around ₹2,000 and beyond.

• Bearish Scenario: If the price is unable to break above resistance and reverses, it may test support around ₹1,719. A breakdown below this level could signal a potential trend reversal or consolidation phase.

Impact of Macro Events (e.g., US Elections):

The outcome of significant macroeconomic events, such as the US elections, could influence IT sector stocks, including HCL Technologies. Favorable policies, market stability, and global business sentiment may drive higher demand for IT services and lead to a bullish impact. Conversely, any policy uncertainty, geopolitical tensions, or economic disruptions could lead to increased volatility, potentially affecting the stock’s upward momentum.

Summary: HCL Technologies is currently at a key resistance level. A breakout above ₹1,889 may signal further bullishness, while a rejection and breakdown below ₹1,719 could prompt caution. Traders should watch volume and price action closely, along with any macroeconomic news that might impact the broader market sentiment.

Disclaimer: This analysis is for educational purposes only and should not be construed as financial advice. Always conduct your own research or consult with a financial advisor before making any trading or investment decisions.

Central Depository Services (I) Long positionCentral Depository Services (I) Ltd Daily Chart Analysis

This daily chart of Central Depository Services (I) Ltd (CDSL) reveals key market movements and a clear ascending trendline support that has provided a strong base for the stock’s recent upward movement.

Key Observations:

1.Ascending Triangle Pattern: The chart shows an ascending triangle pattern, characterized by higher lows connecting through a rising trendline and a relatively horizontal resistance zone near ₹1,660.20 - ₹1,664.40. This pattern typically suggests a continuation of the existing uptrend with a potential breakout.

2.EMA Levels: The stock price is above the 13, 48, and 200 EMA levels, which supports the bullish sentiment. The moving averages act as a dynamic support zone, indicating strong buying momentum.

3.Volume Trends: The volume shows periodic spikes, suggesting accumulation. A volume surge during an upward breakout above ₹1,660 - ₹1,664 could confirm the strength of the breakout.

4.Resistance and Support Zones:

• Resistance: The key resistance levels to watch are around ₹1,660.20 and ₹1,664.40. If the price breaks out above these levels with strong volume, it could lead to a significant upward move.

• Support: The immediate support level lies at ₹1,560.55, aligned with the ascending triangle’s support trendline. A break below this level may result in a corrective phase or consolidation around ₹1,486.65.

5.RSI Indicator: The RSI is around 58.93, indicating bullish momentum but not yet in overbought territory. A move above 60 would further strengthen the bullish sentiment.

Potential Scenarios:

• Bullish Scenario: A sustained breakout above ₹1,664 with strong volume may push the stock toward higher resistance zones, potentially targeting ₹1,750 and beyond.

• Bearish Scenario: A failure to break above the resistance levels and a drop below ₹1,560 could lead to a pullback toward the support levels around ₹1,486.

Impact of US Elections:

The outcome of the US elections can influence global market sentiments, including Indian equities. A favorable or market-friendly outcome (e.g., policies encouraging global trade, fiscal stimulus, or economic stability) could trigger bullish momentum in international markets, including CDSL, especially if investor sentiment turns risk-on. Conversely, market uncertainties or potential negative impacts on global trade and investments could weigh down sentiment, causing increased volatility and possibly stalling upward momentum for stocks like CDSL.

Summary: CDSL is currently showing a bullish pattern with an ascending triangle. The upcoming breakout or rejection from the resistance levels will likely set the direction for the stock. Traders should monitor volume, price action, and global macroeconomic influences, including the US election outcomes, to gauge market sentiment accurately.

Disclaimer: This analysis is for educational purposes only and should not be construed as financial advice. Always conduct your own research or consult with a financial advisor before making any trading or investment decisions.

KPGEL Diwali Pick 2024Stock Analysis and Trade Setup

This chart shows the stock breaking out of a long-term downward channel, suggesting a potential trend reversal:

• Bullish Setup : The price has broken above the descending channel, indicating bullish momentum. A strong consolidation above the support level around 631.1 could confirm this breakout. If the price maintains this upward trend, the next resistance at 716.75 would be the primary target, followed by further gains if momentum persists.

• Bearish Scenario : If the price fails to hold above 631.1, there could be a retest of lower levels. Watch for a potential short entry below the key support level at 525.9, as a breakdown could signal a continuation of the downtrend.

The RSI indicates room for further upside, and increasing volume supports the bullish breakout. Monitor these levels closely for entry and exit signals.

Disclaimer: This analysis is for educational purposes only. Please conduct your own research before making any trading decisions.

MULTIBAGGER Series - Stock 5Hello everyone!

I am back with 3rd company of the multibagger series.

The company is Gensol Engineering Ltd. Gensol Engineering Ltd is engaged in the business of Solar consulting & EPC. The company is among the top 10 EPC players in India and the top 5 in terms of independent EPC players. It has Solar Business, EV Lease Business, EV Manufacturing and Green Hydrogen Business. As of Q1 FY25, the company has a total order book of Rs. 5,025 Cr. The company has shown phenomenal rise in terms of revenue and profit.

Risk factors are that the company has very high debt, promoters are reducing their holding and the pledged shares by promoters stands at 79.8% which is not a good sign for the comapny. So investing in this company can be connsidered very risky due to these factors.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

MULTIBAGGER Series - Stock 4Hello everyone!

I am back with 3rd company of the multibagger series.

The company is Nirman Agri Genetics Ltd. NAGL is an agricultural input company that produces, processes, and markets premium hybrid seeds, organic fertilizers, and bio-organic seeds for a variety of crops, including corn, sunflower, cotton, rice, sorghum, and grain. Majorly they are processing corn. It has recently started producing micronutrients and bioproducts. In addition, it grows non-hybrid seeds. Company is working towards creating seeds with greater yield potential, drought resistance, pest and disease tolerance, etc. As drought is a great issue in Maharashtra where the company operates, these seeds are playing an important role during droughts because of their resistance. It is also working on research and development projects about better breeding techniques and biotechnology instruments, which allows it to create hybrid seeds, micronutrients, and bioproducts.

In FY24, company generated revenue from Sale of Products which was ~121% higher than FY23. In has shown a triple digit growth this June quarter. Company has an advance Order Book for the Rabi season for Rs. 120 Crores. Currently the revenue stands at more than 100 crores and profit at 14 crores. The market cap of the company is 242 crore making it a small cap company.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

MULTIBAGGER Series - Stock 3Hello everyone!

I am back with 3rd company of the multibagger series.

The company is Zaggle Prepaid Ocean Services Ltd. Zaggle builds world-class financial solutions and products to manage the business expenses of corporates, SMEs, & Startups through automated and innovative workflows. It is at an intersection of SaaS (Software as a service) and Fintech. It has made strategic alliances with many other companies. The company has an esteemed list of corporates like Tata Capital, Inox, NSDL, DBMS, Wockhardt, Yes Bank, Greenply, etc. It has also made an agreement with VISA and the deal is valued at approximately $20 million over the next five year.

The company has shown more than 10x growth in both sales and profit made in the past 4 years. Last year sales was 776 cr and profit was 44 cr. The quarterly sales and profit is also continuously increasing and the company is expected to grow at a good pace from here. They have made visionary targets for the year 2025. Ace investor Ashish Kacholia has also invested in this company.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

MULTIBAGGER Series - Stock 2Hello everyone!

I am back with 2nd company of the multibagger series.

The company name is Wise Travel India Ltd. with NSE code as WTICAB.

Wise Travel India Limited is a transport company that offers car rentals and transportation services across 130 cities in India. The company offers a range of services including car rental, employee transportation, end-to-end employee transport solutions (MSP), flexible fixed/monthly rental plans, airport counters, fleet management, mobility services for MICE, cutting-edge mobility tech solutions, sustainable mobility, project mobility solutions, strategic consulting and advisory on mobility, and community commute.

The company is currently available at a cheaper valuation than the stock 1 of multibagger series. The stock P/E is 27 which is lower than 30 of the previous company and the ROE and ROCE is higher and a good 26.4% and 22.4% respectively. Promoter holding is also at a higher side standing at 69.4%

Such companies earlier used to come under unorganized sector but after their listing and success of OLA and UBER and increasing urbanization, such companies have successfully entered organized sector and growing their market base and clientelle.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

Roivant Sciences (ROIV): A Multibagger Stock Opportunity

Roivant Sciences (ROIV) is poised for significant growth with a strong pipeline, including potential blockbusters like Batoclimab and Brepocitinib in the autoimmune space. Recent deals, including the $5.2B sale of Telavant, have strengthened their balance sheet and set the stage for future profitability. Upcoming Q4 catalysts, a $1.5B buyback program, and a solid focus on pulmonary hypertension therapies make ROIV an undervalued gem at its current price.

Personal Note: Hi, I'm sharing insights on stocks with strong catalysts like ROIV. Follow me for more deep dives and stock picks.

GNA Axles Limited Going Towards Its All TIME HIGH's NSE:GNA

GNA Axles is engaged in the Business of manufactures auto components for the four-wheeler industry, primary product being Rear Axles, Shafts, Spindles & other Automobiles Components for sale in domestic and foreign market.

..................................................................................................................

..................................................................................................................

..................................................................................................................

Key strengths

Extensive experience of promoters/management and long track record of operations

GNA was promoted by Late Rachhpall Singh and his brother Gursaran Singh, the latter being the company’s current managing

director with around five decades of industry experience. His son, Ranbir Singh, and other family members are also involved in

the company’s day-to-day business activities. The company directors are assisted by a team of professionals who are highly

experienced in their respective domains. Being established in 1946, the GNA group, which also includes GNA Gears Limited, has

a long track record of operations.

...............................................................................

Diversified revenue stream across product segments and geographies

The company supplies its products to varied segments of the automotive industry, including commercial vehicles (CV or the onhighway segment), tractors, farm equipment, and earth moving equipment (all three being part of the off-road segment). The

company derives significant income from export of its products to the US, Europe, Asia Pacific (Japan and China among others),

Mexico, Brazil, and so forth, with exports constituting around 53% of its total operating income (TOI) in FY23 (refers to April 1

to March 31) . The company is a Tier-1 vendor for its supplies in domestic off-road segment, while in the

exports markets, it supplies axles and spindles to larger and more established Tier-1 vendors.

................................................................................

Long and established relationship with customers

The GNA group has been operating in the auto component industry since 1946, thus having built time-tested relationship with

customers – with some ever since the commencement of its operations. Besides, it has been supplying to some of its export

customers since 2000. GNA markets its products through the common group marketing network catering a whole range of

products, including axles, gears, and shafts under one roof. The long and established relationship with customers provides revenue

stability to the company, subject to overall industry demand scenario.

....................................................................................

Reputed, though concentrated customer base

While GNA faces customer concentration with its top-5 and top-10 customers accounting for around 64% and around 80% of its

total gross sales in FY23, the risk is largely mitigated as the top revenue contributors are well-established players and enjoy strong

position in the industry. GNA is the main supplier of axle shafts to most of the original equipment manufacturers (OEMs) that it

supplies to, and by virtue of its long-standing relationships with the customers, the company has a strong market position. For

some of its export customers, the supplies are made by GNA for their plants in various countries, thereby mitigating the risk

arising from slowdown in one geographical location.

.........................................................................

Comfortable scale of operations with largely steady margins

In FY24, the company achieved TOI of ₹1,508.67 crore compared to a TOI of ₹1,582.93 crore in FY23 driven by moderation in

price realisations owing to weak tractor sales in the domestic market. The profit before interest, lease rentals, depreciation and

taxation (PBILDT) margin marginally declined to 13.24% in FY24 (PY: 14.70%). The profit after tax (PAT) margins declined to

6.63% in FY24 from 8.22% in FY23.

.......................................................................................

Comfortable financial risk profile

The company’s capital structure remained comfortable with long-term debt-to equity and overall gearing ratios of 0.04x and

0.24x, as on March 31, 2024, respectively (PY: 0.07x and 0.28x, respectively). The same improved mainly due to reduction in

debt and accretion of profits to the net worth. The company has low reliance on working capital borrowings as it only avails the

pre-shipment credit for exports and substantial portion of its inherently high working capital requirements are funded by internal

accruals. The interest coverage ratio remained healthy at 17.3x in FY24 (PY: 21.22x) due to healthy profitability and low interest

costs on foreign currency borrowings. The company’s total debt to PBILDT stood comfortable at 0.95 as on March 21, 2024 (PY:

0.87x).

NAM_INDIA A multibagger?Nippon Life India Asset Mgt. is engaged in managing mutual funds including exchange traded funds (ETFs); managed accounts, including portfolio management services, alternative investment funds and pension funds; and offshore funds and advisory mandates.

The AUM(Asset under management) is 435000 crores and the quarterly sip is 4700 crore which is increasing every quarter with the increasing interest of people in stock market and mutual fund. The company has increased its net profit by 3 times in 4 years and is performing better as compared to its peers. The company is also expected to give a good quarter.

It is an excellent buy for both short term and long term and it should be keep a definite place in portfolio.

I am not a SEBI registered analyst.

Please do your own analysis before investing.

Do like and follow and share among your friends and family.

Thank you.

SWSOLAR Getting Ready to Break its 2019's & All Time HighNSE:SWSOLAR

.................................................................................................................

.................................................................................................................

.................................................................................................................

| KEY HIGHLIGHTS FOR 1Q FY25

...............................................................................

• Unexecuted order value at ~INR 9,396 crore as of June 2024

compared to ~INR 8,084 crore as of Mar 2024

• Company has received new orders / LOI in three domestic

projects worth ~INR 1,016 crore during the quarter

• Company received two turnkey international orders from South

Africa amounting to ~USD 140 mn

• Commenced a pilot project for Solar plus BESS for Reliance

Industries at Jamnagar, Gujarat

• P&L of the company continues to improve

• Consol revenues up ~78% YoY in 1QFY25

• Gross margins at ~11%

• Second consecutive quarter of positive EBITDA, PBT and PAT

at a consolidated level

............................................................................................................

• The company’s balance sheet continues to de-leverage

............................................................................................................

• Total net debt of ~INR 97 crore as of Jun 2024, compared

to net debt of ~INR 116 crore in Mar 2024

• No upcoming debt repayments till 3QFY25

.................................................................................................................

.................................................................................................................

.................................................................................................................

Received order of 900 MW DC in 1QFY25

• Received a turnkey solar PV order from AMEA Power in South

Africa for a ~140 MW DC project

• Through this project, SWREL has achieved a key breakthrough in

the rapidly growing South African solar market.

• We have successfully executed a 90 MW DC order in South

Africa in 2016 previously, and continue to maintain O&M

operations there

• Bagged our second international order from South Africa with a

turnkey package for a 80 MW AC project from Energy Group

.................................................................................................................

.................................................................................................................

.................................................................................................................