Musk

Cup & HANDLE + Mini Double Bottom: $TSLA to $610 ScenarioI maintain a bullish stance on Tesla ( NASDAQ:TSLA ), supported by a compelling combination of technical patterns and strong fundamental drivers. The current chart setup reveals a Cup and Handle formation complemented by a Mini Double Bottom, both of which are classic bullish continuation patterns. These suggest a potential breakout scenario that could drive NASDAQ:TSLA to $610 by year-end.

Technical Roadmap:

Gap Fill to $408: Anticipated earnings momentum, particularly from the Robotaxi segment, is likely to propel the stock to fill the previous gap at $408.

Consolidation at $450: Following the gap fill, I expect a consolidation phase forming a “box” around the $450 level.

Breakout to $610: A decisive breakout above $450 could trigger a strong rally toward the $610 target.

***Current Key Catalysts Supporting the Bullish Thesis:

Robotaxi Expansion: Tesla’s autonomous driving initiative is gaining traction, with Robotaxi developments expected to significantly boost revenue and margins.

India Market Entry: Tesla’s upcoming launch in India opens access to one of the world’s largest and fastest-growing EV markets.

In-House Chip Development & Dojo 2 Expansion: Continued investment in AI infrastructure and custom silicon enhances Tesla’s competitive edge in autonomy and robotics.

Tesla Diner Launch: The near-completion of Tesla’s themed diner adds to brand visibility and customer engagement.

Global EV Adoption: Tesla continues to benefit from rising EV demand across multiple international markets.

Optimus Robot Hype: Growing interest in Tesla’s humanoid robot project could unlock new revenue streams and investor enthusiasm.

Favorable Macro Trends: A declining interest rate environment supports higher valuations for growth stocks like Tesla.

Institutional Accumulation: Recent trading activity suggests that institutional investors are accumulating shares within the current range.

Grok AI Integration: The integration of Grok AI into Tesla vehicles could enhance user experience and differentiate Tesla’s infotainment ecosystem.

Investment Strategy:

I recommend initiating or increasing exposure to NASDAQ:TSLL (leveraged Tesla ETF) ahead of the upcoming earnings report. This could offer amplified returns if the bullish scenario plays out. Consider accumulating further on any dips, particularly during the consolidation phase around $450.

BUY NOW NASDAQ:TSLA NASDAQ:TSLL

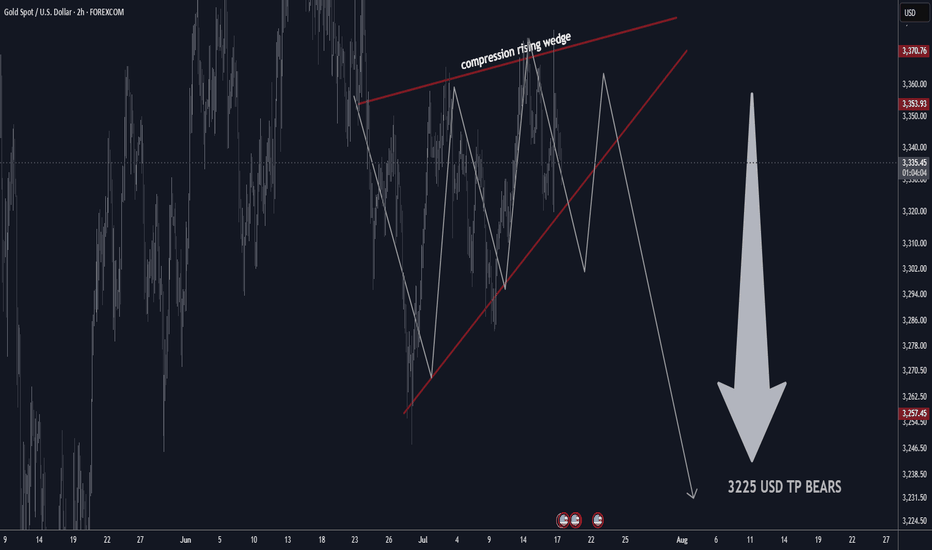

GOLD H2 Rising Wedge Expecting SellOFF TP BEARS 3225 USD📊 Gold Technical Outlook Update – H4 & 2H Chart

📰 Latest Summary Headlines

• Gold stalls near highs as technical compression signals possible breakdown

• Bearish rising wedge on 2-hour chart hints at sharp move lower

• Market volatility stays elevated amid global economic risks

• Short-term sellers targeting $3,225 if wedge pattern breaks

________________________________________

🏆 Market Overview

• Gold remains in a choppy range, struggling to clear key resistance.

• 2H Chart: Bearish rising wedge pattern identified, showing compression—expecting a potential breakdown soon.

• Overhead resistances: $3,410 / $3,460 USD will likely cap further upside.

• Major supports: $3,160 / $3,240 USD.

• If support fails, next key bear target is $3,225 USD.

• Range trading remains favored for now.

• Volatility likely to persist with no major bullish headlines on the horizon.

________________________________________

⭐️ Recommended Trade Strategy

• Bearish Setup (2H): Short sell gold at market on wedge breakdown.

o Stop loss: Above recent highs (set according to your risk tolerance and latest 2H swing high).

o Take profit: Target $3,225 USD.

• Continue to focus on selling near resistance, buying near support.

• Momentum: Watch for sharp moves as wedge resolves—be nimble!

• Always manage risk and adjust stop as price develops.

________________________________________

💡 Gold Market Highlights

• Safe-haven demand still strong due to tariffs, geopolitical tension, and U.S. fiscal concerns.

• Central banks & investors remain net buyers, but jewelry demand slides at high prices.

• Price action is dominated by institutional flows, with banks forecasting potential for gold above $4,000 next year—but short-term correction likely if wedge breaks.

• Current price: ~$3,358 per ounce. Compression suggests a larger move coming soon.

________________________________________

Summary:

Gold is at a crossroads, with a bearish wedge pattern building on the 2-hour chart. A breakdown could see a quick move to $3,225. Short sellers should act on confirmation, while bulls will look to reload at key support. Stay tactical!

TSLA bearish: Musk vs Trump! Subsidy Spotlight & Sentiment RisksIf you haven`t bought TSLA before the recent breakout:

Now you need to know that Tesla (TSLA) is sitting around $315, but the vibe is getting shakier. Elon Musk’s feud with Donald Trump — complete with jokes about “putting the DOGE on him” if deported — might feel like another meme moment, but it spotlights Tesla’s huge dependency on federal and state support.

Estimates show Tesla could face up to $48 billion in lost government contracts and incentives over the next decade if the political tide turns. With Trump’s base calling out “green subsidies” as wasteful, Tesla’s funding pipeline could get squeezed — just as competition ramps up and margins get tighter.

Key Bearish Points

1) Political Risk Is Real

Musk’s public fight with Trump is a double-edged sword: he risks losing goodwill on both sides of the aisle. If the next administration decides to gut EV credits, Tesla could take a huge hit — far more than its rivals who rely less on U.S. incentives.

2) Subsidy Dependence

Tesla’s success is partly built on a foundation of tax credits, carbon credits, and favorable policies. $48B in potential lost value is nothing to shrug off — especially when competitors like BYD are gaining ground.

3) Bearish Technical Setup

TSLA’s chart is rolling over inside a bearish channel. It recently failed to hold the $330 level and now sits around $315. A clean breakdown below $300 could open the door to your target zone at $262 — a major support area from earlier this year.

Catalysts:

Any new comments from Trump’s camp about EV subsidies

Weak delivery/margin numbers from Tesla

Broader tech/equity pullback

Musk’s crypto distractions no longer propping up sentiment

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The Trump & Musk Friends Again - Tesla RippingAnalysts attribute the recovery to cooling tensions between Elon Musk and President Donald Trump, which had previously weighed on investor sentiment.

Additionally, Tesla's upcoming robo-taxi launch on June 12 is generating excitement, with some analysts predicting it could be a major revenue driver. However, concerns remain about Tesla's valuation, as it trades at a price-to-earnings ratio of 192, significantly higher than traditional automakers.

$TSLA - Time to BUY (F to sellers)When weak hands sell in fear, we proudly buy.

Tesla is at the perfect spot for buying right now, both from fundamental and technical sides. The recent fight between Elon & Trump granted so much needed correction to the chart. The price is resting on the $260 - $280 support now - ideal spot for buying before the massive blast off will happen.

A few technical factors: there is a HUGE ascending triangle with horizontal resistance ($415), the 3rd approach of this resistance should be final before the breakout happens! Moreover, the price is steadily forming a bullish pennant that will help in breaking the resistance up.

The overall trend is strictly bullish according to Fibo. The target of this upward movement is located in the $900 - $1000 zone which is x4 from current points. Not very often in our century you get such an opportunity.

You may have different opinions about Elon Musk, but you can't deny the fact he is brilliant businessman and entrepreneur. You can already see that "Tesla owners are scrambling to remove their anti Elon stickers from their car now that he is feuding with Trump" . Elon is a good-guy for liberals again, while republicans didn't change their positive attire regarding his company as well.

I tend to believe that all those news we witnessed yesterday (mean Elon&Trump fight) was just a part of a bigger plan , the outcome of which we will see later this year or even next year.

TSLA SellOff ! Elon Musk vs Donald Trump ! Beginning of the End?If you haven`t bought the dip on TSLA:

Now you need to know that TSLA Tesla experienced a significant drop of 14% today, marking its worst single-day performance in over four years. This decline erased approximately $150 billion in market capitalization, bringing the stock down to $284.70.

The immediate cause of this downturn is the escalating feud between CEO Elon Musk and President Donald Trump. Musk's public criticism of Trump's tax legislation, labeling it a "repugnant abomination," prompted Trump to threaten the revocation of government contracts with Musk's companies. This political clash has introduced significant uncertainty regarding Tesla's future government support.

Beyond the political arena, Tesla's core business metrics are showing signs of strain. The company reported a 9% decline in quarterly revenues and a staggering 71% drop in profits. Additionally, Tesla has lost its leadership position in the electric vehicle market to China's BYD, indicating increased competitive pressure.

cincodias.elpais.com

Investor sentiment is also waning. A Morgan Stanley survey revealed that 85% of investors believe Musk's political activities are negatively impacting Tesla's business fundamentals. This perception is further exacerbated by declining sales in key markets, such as a 17% drop in Model Y registrations in California.

thestreet.com

Elon Musk and Donald Trump have publicly clashed, escalating a feud that has unraveled their once-close relationship. The dispute centers on several issues:

Republican Tax and Immigration Bill: Musk criticized a sweeping Republican domestic policy bill backed by Trump, calling it a "disgusting abomination" on X. Trump claimed Musk initially had no issue with the bill, accusing him of being upset over the removal of an electric vehicle tax credit.

Epstein Files Allegation: Musk alleged Trump's name appears in classified Jeffrey Epstein files, escalating tensions. Trump has not directly addressed this claim but responded by threatening to cut government contracts with Musk's companies.

Personal and Financial Accusations: Musk argued Trump would have lost the 2024 election without his financial support, accusing him of ingratitude. Trump countered, saying he was "disappointed" in Musk, claiming he asked Musk to leave the administration and accused him of "Trump Derangement Syndrome."

Government Contracts and Tariffs: Trump threatened to cancel "billions and billions" in government contracts with Musk's companies, like SpaceX, amid the feud. Separately, Musk reportedly made personal appeals to Trump on auto tariffs, which Trump noted might involve a conflict of interest.

Cabinet Clash: Reports indicate Musk clashed with Trump’s cabinet, including Marco Rubio, over spending cuts related to the Department of Government Efficiency (DOGE), with some describing Musk's behavior as disruptive.

Given these challenges, a price target of $215 for TSLA appears justified. The combination of political entanglements, deteriorating financial performance, and eroding investor confidence suggests that Tesla's stock may face continued downward pressure in the near term.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Elon Musk vs Trump: Who you betting on?Elon Musk and Donald Trump have recently had a public falling-out, with their feud playing out on social media and in political circles.

The dispute seems to have started over Trump's new budget bill, which Musk has criticized for increasing the national debt. Trump, in turn, accused Musk of being upset because the bill removes electric vehicle subsidies that benefit Tesla.

The tension escalated when Trump suggested that Musk had known about the bill beforehand and had no issue with it until after leaving his government role. Musk denied this, claiming he was never shown the bill and that it was passed too quickly for proper review. Trump then took things further by threatening to cut Musk’s government contracts and subsidies, which amount to billions of dollars. Musk responded defiantly on social media, calling Trump "ungrateful" and claiming that without his financial support, Trump would have lost the election.

TSLA violated key levels and will be looking for a sharp technical bounce off the $260-$257 zone

Everything we know about the Trump - Musk divorce (so far)

Elon Musk publicly criticised Trump’s “One Big Beautiful Bill” as a “disgusting abomination” that would explode the U.S. deficit and “bankrupt America.” The bill is projected to add $2.5 trillion to the U.S. deficit over 10 years.

Musk claimed Trump wouldn’t have won the 2024 election without his support, calling the backlash “such ingratitude.”

Musk then alleged on X that Trump appears in the Epstein files. This marks a serious escalation (but we all thought this before Musk confirmed it right?)

Trump followed up on Truth Social by calling Musk “crazy” and hinting at cancelling federal contracts with his companies. Trump wrote that cancelling subsidies for Musk’s companies “could save billions,”.

Tesla has wiped out ~$100 billion in market value. Tesla now politically exposed?

Musk floated the idea of creating a new centrist political party, criticising both Democrats and MAGA Republicans. “We need a party that actually represents the interests of the people. Not lobbyists. Not legacy donors. Not extremists.”

Gold H4 Technical update and key levels bulls/bears📊 Technical Outlook Update H4

🏆 Bull Market Overview

▪️stuck in range for now

▪️overhead resistances will limit upside

▪️Bears key S/R: 3410/3460 USD

▪️Bulls key S/R: 3160/3240 USD

▪️Expect range price action

▪️Focus on selling high / buying low

▪️volatility likely to remain low

▪️next few weeks as no major headlines

⭐️Recommended strategy

▪️short high and buy low

▪️detailed price levels above

▪️right now no trade recommended

Latest gold market updates:

📈 Gold surges as renewed tariff threats and geopolitical tensions drive safe-haven demand.

💳 Fiscal concerns escalate after the U.S. credit rating is downgraded, increasing investor interest in gold.

📊 Analysts identify $3,300 as a crucial support level, with strong buying interest keeping prices elevated.

🔮 Major banks project gold to surpass $4,000 per ounce within the next year, citing robust demand from both investors and central banks.

💍 Record gold prices prompt jewelry designers to shift toward 14-karat gold and alternative materials to control costs.

📉 Gold jewelry demand in India continues to decline due to high prices, while investment gold purchases rise.

🌍 Central banks, especially in emerging markets, sustain gold purchases to hedge against currency volatility and inflation.

🛡 Gold maintains key support above $3,200 despite market volatility and profit-taking pressures.

📈 Leading investment banks remain bullish, forecasting significant upside for gold through year-end.

💰 Gold is currently trading near $3,358 per ounce, reflecting ongoing volatility and global economic uncertainty.

TESLA | Monthly Analysis After NASDAQ:TSLA hitting its ATH target, 87% - 90% retracement is next target

start of 2027 = will be a buying signal for tesla unless there's some issues involving with Elon Musk, then tesla could experience under performance

Long term investors - prepare for down side inside buying channel

TSLA still bearish like I said. Why you should sue the board.This chart uses an unpublished modified turtle trader indicator / strategy combined with the unpublished TVMV framework using MFT candle sticks (published as separate indicator) and Bollinger bands. The max monthly position size is determined by seasonal probabilities, while the individual trade position sizes are determined by the turtle style volatility sizing based off the former's capital.

Nothing has changed about TSLA.

It has a work from home CEO who is who disconnected from reality and accountability that the stock will not recover. No amount of government contracts can over come the damage this man has done to the brand.

Sales and deliveries are down in every market and the car owners are afraid to drive their cars.

This recent pump had no basis. It lacked both fundamental value and technical value.

TSLA will break below 222 and may go as far as 109 by EOY if the board of directors does not fulfill their fiduciary obligations to share holder to remove Musk permanently .

Shareholders should seriously consider filing a class action law suit against the board of directors in collaboration with NY .

HOLY MOLY! ARE WE IN A RECESSION? $TSLA $120 BEAR FLAG PATTERNA bear flag trading pattern is a technical analysis formation that features a downward-sloping flagpole, followed by a consolidation phase forming a parallel channel. This pattern suggests a potential sharp decline or continuation of the downward trend

I also notice a head and shoulders pattern, as well as an inverse cup and handle.

Everything points to $120.

Sell/Short NASDAQ:TSLA right now with fact check:

+brand reputation risk, high competition, loss of EV market leadership, cyber truck/ product recalls, declining sales with lower margin, stock volatility concern, insider selling, investors buy it based on expected future earnings rather than its current profitability.

+ potential stagflation, tariff war, slow economic growth, inflation, rising public debt, geopolitical tensions, ai bubble, and more

My Technical Analysis for $TSLA (Tesla)📊 Technical Analysis: NASDAQ:TSLA (Tesla)

🗓️ Updated: March 24, 2025

🚨 Critical Zone Being Tested

After breaking out of a multi-year symmetrical triangle, NASDAQ:TSLA is now retesting the upper boundary of the pattern — perfectly aligned with the key ACTION ZONE (liquidity zone + long-term MAs).

🔵 ACTION ZONE ($245–265):

High-probability decision area. Holding this level could trigger a fresh bullish leg.

🟣 SWING BOX ($180–210):

If support fails, this is the next logical area for a potential bullish reaction.

🟡 FVG Daily ($75–115):

Unmitigated Fair Value Gap. Only relevant in case of a major breakdown.

📉 SMI (Stochastic Momentum Index):

Currently in negative territory, but nearing oversold — watch for a potential reversal.

🎯 Scenarios:

Bullish: Strong rejection from the Action Zone → potential move to $350–400 ✅

Bearish: Breakdown below the blue zone → eyes on Swing Box or FVG for reentry ⚠️

📌 Reminder: This is not financial advice. Always manage risk and wait for confirmation before entering a trade.

💬 What do you think? Is Tesla preparing for a bounce or heading lower?

👇 Share your thoughts in the comments!

TSLA ! You like money? You like money ?We're here to make money! I don't care about politics or idealists. If TSLA makes +20% in the next few weeks, I'll be very happy! End of story. I only do technical analysis. No emotions here.

hedge funds, YOUR pension funds and market makers have to pay themselves! They're buying the dip, while you're watching the stock collapse! Wake the hell up!

Some troll here haha

TSLA has bottomed. Great Rebound spot!!!TSLA ran up from 200 to 475/shr. On its way up it left to gaps in its price action, one gap up to 245 and another one right after to 275. Gaps in price action are eventually filled 90% of the time. During TSLA's recent decline, it pushed all the way down to close the gaps it had in its chart, with the bottom being 220, where the inital gap started.

Now that it has had its rundown and closed its gaps in price action, its likely this is the bottom for TSLA and it'll rebound from here.

EURUSD - PoVThe EUR/USD exchange rate is influenced by several economic and political factors, suggesting that the euro may continue to weaken in the coming weeks. On one side, the United States is implementing expansive fiscal policies that could strengthen the dollar, such as economic stimulus and increased public spending. These factors, along with potential protectionist measures like tariffs on Europe, could further weaken the euro by reducing the competitiveness of European exports. Additionally, the **Federal Reserve's** monetary policy, which has raised interest rates to combat inflation, makes the dollar more attractive to investors, increasing demand for the U.S. currency. The United States' energy independence, due to increased domestic production of gas and oil, has also reduced its reliance on imports, which further strengthens the dollar compared to the euro.

On the other hand, the Eurozone is facing a series of economic and political challenges that are putting pressure on the single currency. High inflation is eroding purchasing power across the Eurozone, and despite the European Central Bank (ECB) raising interest rates to combat it, economic growth remains slow. This divergence from the United States, where growth has been more dynamic, amplifies the euro's weakness. Moreover, the ongoing energy crisis in Europe, worsened by the war in Ukraine and reduced gas supplies from Russia, has increased costs and slowed the competitiveness of European businesses. In this context, political uncertainties in some Eurozone countries and the ECB’s less aggressive economic management compared to the Fed further contribute to the euro's weakness.

Therefore, the strengthening of the dollar, driven by U.S. policies and growing energy independence, and the structural weakness of the Eurozone, are likely to continue pushing the EUR/USD lower in the coming weeks.

MUSKIT Wild Run – 2300% Surge Followed by a 92% Drop– What Next?The Solana-based meme coin, Musk It ($MUSKIT), which draws inspiration from Elon Musk and his ventures, experienced an explosive 2300% surge before suffering a 92% crash in value. This extreme price fluctuation has left investors questioning whether $MUSKIT has the potential for a strong rebound or if it’s merely another short-lived pump-and-dump scheme.

Market Sentiment and Recent Trends

$MUSKIT's drastic price movement coincided with a broader crypto market shake-up. Bitcoin (BTC) dipped to $91K before rebounding to $101K, while Ethereum (ETH) fell to $2K before recovering. This reflects the volatile nature of the crypto space, where sudden price swings are common.

Despite its steep decline, $MUSKIT maintains a market cap of $27,585,727.43. The coin remains largely unlisted on major centralized exchanges (CEXs), which means that future exchange listings could act as a catalyst for another price surge. Additionally, with a 24-hour trading volume of $3,985,854, market activity remains significant despite a 58.3% decline in trading volume.

Technical Analysis

From a technical standpoint, $MUSKIT is currently down 3.4% but showing signs of a potential reversal. The Relative Strength Index (RSI) stands at 46, indicating that the coin is neither overbought nor oversold. This suggests that the bears are not in complete control, and a recovery to the upside remains a possibility.

A key pivot level to watch is $0.07278, the coin’s all-time high recorded just four days ago. If $MUSKIT can regain momentum and break resistance levels, it could reclaim previous highs and continue its upward trajectory. However, failure to hold support could lead to a further decline toward $0.008864, its all-time low recorded two weeks ago.

Is There Hope for a Rebound?

1. Strong Market Performance Compared to Peers

In the last 7 days, $MUSKIT has risen 148.4%, outperforming the overall crypto market (down 6.4%) and similar meme cryptocurrencies (down 23.6%). This relative strength suggests that investor interest remains high.

2. Potential for More Exchange Listings

Currently, $MUSKIT is primarily traded on Raydium (DEX) and MEXC (CEX). Additional CEX listings could boost liquidity and attract new investors, potentially fueling another rally.

3. Market Sentiment and Meme Coin Hype

Meme coins thrive on community engagement and speculative hype. If Elon Musk acknowledges $MUSKIT in any form (as has happened with Dogecoin), it could significantly impact the coin’s trajectory.

Conclusion

While $MUSKIT’s massive pump and subsequent crash raise concerns, its relative strength against the broader market, decent liquidity, and upcoming catalysts suggest that it is not entirely doomed. However, traders should exercise caution, monitor key resistance/support levels, and watch for major exchange listings that could reignite momentum.

As always, investing in meme coins carries high risks and high rewards, making risk management crucial for those considering a position in $MUSKIT.

Dogecoin(DOGE)Price Action Potential in 2025 $0.82, $1.11or $24?As of January 22, 2025, Dogecoin (DOGE) is trading around $0.38, showing signs of strong market interest. The recent price action reflects DOGE's resilience in the current market environment. Let's analyze its potential:

Key Highlights:

(1) Current Price Movement:

🟢 Trading Range: $0.3368 (low) - $0.3969 (high)

🟢 Daily Change: +2.67%

(2) Recent Developments: Elon Musk’s involvement as head of the Department of Government Efficiency (DOGE) has significantly boosted investor confidence, resulting in an 88% price increase post-announcement.

Price Predictions:

🟢 Short-Term Potential (Ali Martinez Analysis): If DOGE holds above $0.37, it could rally to $0.82, a 120% upside.

🟢 Mid-Term Projections (CoinCodex): Machine-learning models estimate DOGE could hit $1.11 by April 2025, marking a potential 200% gain.

🟢 Long-Term Speculation (Social Media Analyst): Some projections, though highly speculative, suggest DOGE could reach $24, contingent on significant market shifts.

Market Sentiment & Risks:

While optimism is high, the cryptocurrency market is inherently volatile. Key factors to watch include:

🟢 Regulatory changes impacting broader crypto adoption.

🟢 Macroeconomic trends like inflation and monetary policies.

🟢 Technological developments influencing DOGE’s utility and scalability.

Conclusion: Dogecoin’s price action remains promising, but caution is advised. Always research thoroughly and assess your risk tolerance before making investment decisions.

Study Source URLs:

(1) Elon Musk's Appointment Impact: The Times - Will Dogecoin Price Be Boosted by Elon Musk’s New Job?

(2) Ali Martinez Analysis: Blockonomi - DOGE Price Analysis: Key Indicators Point to Possible 120% Upside for Dogecoin

(3) Mid-Term CoinCodex Prediction: The Tribune - Bullish Signals Indicate Dogecoin Could Hit $5, Say Crypto Experts

(4) Long-Term Speculation: The Financial Analyst - Analyst Predicts Dogecoin Could Soar to $24, Sparking Community Buzz

Feel free to share your thoughts and charts in the comments! 🚀

Tesla - A Bright Future For Elon!Tesla ( NASDAQ:TSLA ) is creating a textbook break and retest:

Click chart above to see the detailed analysis👆🏻

Over the past couple of months we saw a rally of more than +100% on Tesla, perfectly following the bullish triangle breakout. Therefore it is quite anticipated that we will see a rejection at the previous all time high and a retest of the next support, creating a bullish break and retest.

Levels to watch: $400, $300

Keep your long term vision,

Philip (BasicTrading)

ETF500 Coin Set for a 250% Surge Amidst Neck & Shoulder PatternThe Elon Trump Fart (ETF500) token has been making waves in the meme coin market, driven by its unique blend of political satire and community-driven momentum. This token, inspired by the Fartcoin deployer narrative, has been through significant market fluctuations but is now showing signs of a potential bullish reversal.

Meme Coin Narrative:

ETF500 stands out by merging two influential figures, Elon Musk and Donald Trump, into a politically charged meme token. This strategy taps into a broad audience that finds humor and engagement in the politifi narrative.

From its inception, ETF500 has been a community-driven project. The CTO has been pivotal in shaping the token’s direction, fostering transparency and inclusivity.

Market Metrics

- Current Price: 61.09% below its all-time high of $0.01462 (recorded on January 10, 2025).

- All-Time Low: $0.002335 (recorded on January 8, 2025), with the current price up by 143.57%.

- Market Cap: $5,684,503, ranking #2246 on CoinGecko.

Where to Buy ETF500

ETF500 tokens can be traded on decentralized exchanges like MEXC, Raydium and Meteora. The most active trading pair, ETF500/SOL, indicates strong liquidity and accessibility for traders.

Technical Analysis

As of this writing, ETF500USDT is down 19%, trading within a falling wedge pattern. This bearish setup often precedes a bullish breakout, signaling potential opportunities for traders.

Neck and Shoulder Pattern:

A developing neck and shoulder pattern hints at a bullish reversal. However, the preceding shoulder formation is incomplete, placing ETF500 in a strategic buy zone for early investors. Similarly, the Relative Strength Index (RSI) indicates oversold conditions, suggesting that ETF500 has the potential to break new highs as buying momentum builds.

- Key Levels:

Resistance: The token faces resistance near the $0.0095 level, which aligns with the neckline of the pattern.

Support: Strong support is observed at $0.0052, providing a safety net for traders.

Potential for Growth

The combination of community engagement, unique narrative appeal, and favorable technical patterns positions ETF500 for significant growth. If the bullish reversal materializes, the token could see a surge of up to 250%, capturing the attention of meme coin enthusiasts and seasoned traders alike.

Conclusion

Elon Trump Fart (ETF500) represents the fusion of humor, community, and market strategy in the crypto space. While its price trajectory has been volatile, the current technical and fundamental indicators point to a promising future. As always, investors should conduct their own research and consider the inherent risks before diving in.

Is This $1B Tech Deal the Dawn of a New AI Infrastructure Era?In a move that redefines the landscape of enterprise AI infrastructure, Hewlett Packard Enterprise has emerged victorious in securing a transformative $1 billion deal with X, Elon Musk's social media platform. This landmark agreement represents one of the largest AI server contracts to date and signals a pivotal shift in how major tech companies approach their AI computing needs.

The implications of this deal extend far beyond its monetary value. By outmaneuvering industry titans Dell Technologies and Super Micro Computer in a competitive bidding process, HPE has demonstrated that traditional leaders no longer dominate the AI hardware market. This disruption suggests a new era where technological innovation and cooling efficiency may prove more crucial than established market positions.

The timing of this partnership is particularly significant as it coincides with a dramatic surge in data center infrastructure spending, which reached $282 billion in 2024. HPE's success in securing this contract, despite being considered a relative newcomer in the AI server space, challenges conventional wisdom and opens up intriguing possibilities for future market dynamics. As enterprises worldwide grapple with their AI infrastructure needs, this deal may serve as a blueprint for the next wave of major tech investments, marking the beginning of a new chapter in the evolution of AI computing infrastructure.