USDCAD IS DRROPPING. DETAILED TECHNICAL AND FUNDAMENTALSUSDCAD is currently trading around 1.4200 after a clean retest of a previously broken support zone, which has now turned into a strong resistance level. Price action is confirming the bearish structure as we see a gradual yet consistent drop from the highs of 1.4540. With the rejection seen from the supply zone and recent lower high formation, momentum is shifting further in favor of the sellers. I am now targeting 1.3800 for the next key level, aligning with both technical confluence and fundamental sentiment.

Technically, the structure is clear: we had a failed breakout above 1.4450, followed by a decisive bearish engulfing move. The market then completed a textbook retest at the 1.4340–1.4450 supply zone before resuming the downside move. The current formation on the 12H chart shows a lower low and lower high sequence intact, signaling a trend continuation to the downside. The highlighted zones also provide ideal reward-to-risk setups for continuation traders.

From a fundamental perspective, the Canadian dollar is gaining strength due to rising oil prices, with WTI crude now climbing back above the $85 mark. This directly supports the loonie given Canada’s oil-export-driven economy. Meanwhile, US economic uncertainty around upcoming CPI data and shifting Fed rate cut expectations continue to weigh on the dollar’s upside momentum. Additionally, recent risk-on sentiment in global markets is pushing flows into commodity-linked currencies like CAD.

With technicals and fundamentals aligning, I remain firmly bearish on USDCAD. As long as price remains below the 1.4340 resistance, I’m looking for continuation toward the major demand zone near 1.3830–1.3800. This setup offers a clean 1:3+ risk-to-reward profile, and I will be scaling in further on bearish confirmations as the market progresses.

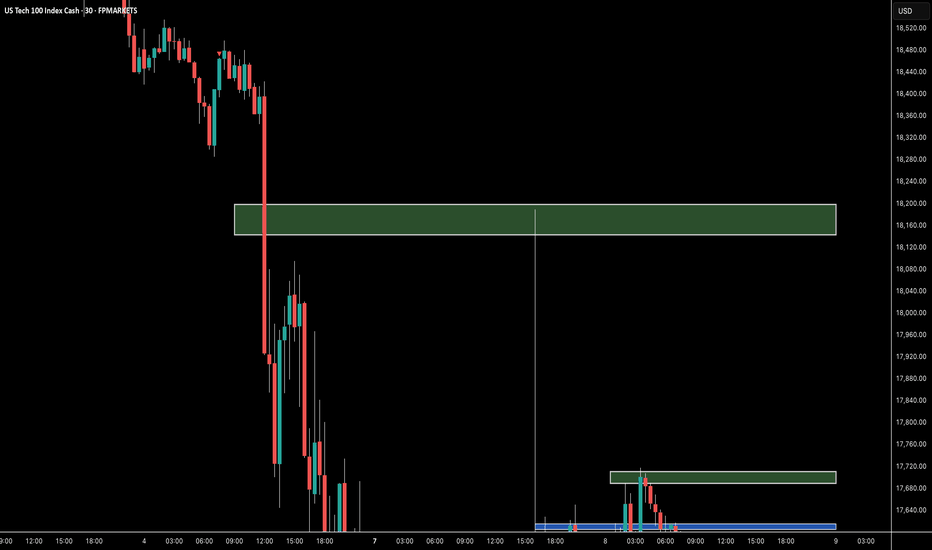

NASDAQ 100 CFD

Hanzo | Nas100 15 min Breaks – Will Confirm the Next Move🆚 Nas100

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bearish Setup After Break Out – 17550 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 16880

Key Level / Equal lows Formation - 16350

Strong Rejection from 16350 – The Ultimate Pivot

Strong Rejection from 16890 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 16890 – Liquidity Engineered

Twin Wicks @ 17000 – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 18 jan 2024 – Bearish Retest 16900

💯 11 jan 2024 – Bearish Retest 16900

💯 18 jan 2024 – Bullish Run After Break That level

👌 The Market Has Spoken – Are You Ready to Strike?

Nasdaq-100 H1 | Potential bullish bounceNasdaq-100 (NAS100) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 17,407.64 which is a swing-low support that aligns close to the 50.0% Fibonacci retracement.

Stop loss is at 17,000.00 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 18,238.84 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

WHY XAUUSD IS BULLISH ?? TECHNICAL AND FUNDAMENTALSXAUUSD is currently trading around the key psychological level of 3000, and as expected, price action has just completed a textbook retest of the previous breakout zone. The support level near 2960–2980 has held strongly, giving gold the momentum it needs for the next leg up. Price has reacted with a clear bullish bounce from this demand zone, confirming the structure and setting up for a potential continuation toward the 3100 target.

From a technical perspective, we’re seeing a classic bullish continuation move. The previous impulse to the upside was followed by a correction phase, which respected the support area now acting as a launchpad. This bounce, combined with strong candle formations on the 12H and daily charts, suggests bulls are regaining control. Volume is gradually increasing, aligning with the anticipated breakout from the recent consolidation.

On the fundamentals side, the gold market remains well-supported. Recent macroeconomic data shows inflationary pressures are still lingering, while expectations for Federal Reserve rate cuts later in the year continue to weigh on the US dollar. Geopolitical tensions and increased central bank gold accumulation are adding further demand for safe-haven assets like gold. These drivers remain bullish catalysts as long as uncertainty stays elevated and real yields remain low.

With price holding above 3000 and a strong structure in place, I expect continuation toward 3100 in the near term. This is a high-probability setup supported by both technicals and fundamentals. I’ll be closely watching for higher lows and continuation signals above 3020 for additional confirmation. Risk management remains key, but the market structure strongly favors further upside.

NQ volatility likely to persist until retest of 13k buy zonechart shows it all...expect more volatility this month, likely a retest of 61.8 fib level at 15k & 78.6 fib levels (based on lows from 2023) near 13k before we finally run to the highs again into 2026!

tariffs have similar impact as rate hikes...overall will be digested by markets just fine & we'll head back to the highs as fed sees more freedom to cut given those effects...very incentivized to prevent a "hard landing" economically without also boosting inflation too much, so this is all actually a good thing if you can see it :)

Hanzo | Nas100 15 min Breaks – Will Confirm the Next Move🆚 Nas100

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bullish Setup After Break Out – 17000 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 16880

Key Level / Equal lows Formation - 16350

Strong Rejection from 16350 – The Ultimate Pivot

Strong Rejection from 16890 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 16890 – Liquidity Engineered

Twin Wicks @ 17000 – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 18 jan 2024 – Bearish Retest 16900

💯 11 jan 2024 – Bearish Retest 16900

💯 18 jan 2024 – Bullish Run After Break That level

👌 The Market Has Spoken – Are You Ready to Strike?

Nasdaq 100 drops to its lowest level since January 2024Nasdaq 100 drops to its lowest level since January 2024

According to the chart of the Nasdaq 100 (US Tech 100 mini on FXOpen), the index opened this week around the 16,500 mark – a price level last seen in early 2024.

This suggests that the sharp sell-off in equities seen last Thursday and Friday may well continue today.

Stock indices respond to Trump’s tariffs

Treasury Secretary Scott Bessent said on NBC News’ Meet the Press that there is “no reason” to expect a recession.

However, equity charts reflect market sentiment described by CNN Business’s Fear & Greed Index as “extreme fear”. This wave of negativity followed President Trump’s announcement on 2 April of harsher-than-expected international trade tariffs. In response, China and other nations announced retaliatory measures.

As a result, the Nasdaq 100 (US Tech 100 mini on FXOpen) now trades roughly 25% below its 2025 peak – officially entering bear market territory.

Technical analysis of the Nasdaq 100 (US Tech 100 mini on FXOpen)

Back on 28 February, we drew an ascending trendline (line A). Bulls attempted a rebound from this support (as shown by the arrow), but their efforts were overwhelmed by the White House’s latest policy decisions.

Given the updated price action, we can now treat line A as the median of an ascending channel. From this perspective, the index is currently near the lower boundary of the channel.

Technically, this could indicate potential support. However, as long as the price remains below the bearish gap – which includes the key psychological level of 17,000 – talk of a meaningful recovery may be premature.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nas100 - Huge bear trap or further downside?The Nasdaq 100 has recently broken a critical rising trendline that has supported its bullish trajectory for an extended period. This break signifies a potential shift in market sentiment, suggesting that the prior uptrend may be losing steam. When an established trendline is breached, it often signals a change in the market's direction, indicating that buyers are losing control and sellers are starting to assert dominance.

In addition to the trendline break, the Nasdaq 100 has now fallen below all of its key moving averages—namely, the 50-day, 100-day, and 200-day moving averages. These moving averages are widely followed indicators of trend strength, and their loss is typically a bearish sign. When prices drop below these averages, it signals weakening momentum, and it becomes harder for the index to regain upward traction without strong buying pressure.

The weekly timeframe shows a beautiful support level if the bulls fail to reclaim all the key moving averages.

Together, the break of the rising trendline and the loss of key moving averages suggest that the Nasdaq 100 could be entering a phase of increased volatility and downward pressure. Traders should closely monitor the index for potential further declines or a failure to reclaim these key technical levels, as they could signal deeper market corrections.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

NQ! Short Idea (MXMM, Quarterly Theory)Hello, after 2 successful weeks I'm planning to continue this streak. Current WR is 75%.

After taking a quick Short on NQ, I'll be waiting for the NY Session for my next setup. I'm expecting a BSL Sweep at around 9:30 UTC-4, after that I will wait for the Macros 9:50 to enter Short.

Praise be to God

-T-

$SPX $NAS100 FILL THE GAP = "LEARNED BEHAVIOR" IN PLAY🏒🏒🏒🏒🏒FILL THE GAP! FILL THE GAP! FILL THE GAP!

Hopefully, institutions want to reach 7,000 from here, as the majority of them wrote in public New Year resolutions.

A great example of learned behavior.

Let’s watch.

FILL THE GAP! FILL THE GAP! FILL THE GAP!🏒🏒🏒🏒🏒

Market Review: Full Higher Time Frame Review of NASDAQ bear runI hope this get's featured 🎯

The simplest macroeconomic review of NASDAQ you may see this year.

It's all a fib retracement. That's all I have to say for now 🔪 Share this with someone looking for a good review 💰

**Video was cut short by a minute or two but the general idea was complete

NASDAQ New Week Gap will tell you everything you need to knowIf you watched my idea update from Friday, I was saying that the sellside monthly lows as well as the 2023 yearly high are being targeted.

Low and behold, we hit all targets on the weekly gap drop. Let's see how price approaches the new week opening gap mid level (dashed white). It will definitely hit that level before the end of the week.

If it does not, that means we have super easy sellside targets to hit after a clear rejection back below tested highs as always.

Share this with someone needing easy targets 🎯

Weekly Market Forecast: Short Term Buys, Then Sells! In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures for the week of April 7 - 11th.

The Stock Market Indices may find support at current levels for a Bear Market Rally. Wait for the market structure shift to the upside before taking any buys. Let the market confirm it's intended direction first, then look for valid buy setups for a short term countertrend play.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Market Update: NASDAQ 100 Analysis📈 The NASDAQ 100 is currently trading at 18,075.00, which represents a -22.6% decline from the all-time high of 22,425.75 . This marks a significant drop from its peak, entering into what could be classified as a bear market by traditional standards.

📊The previous decline from the high of 16,800.00 in November 2021 saw a decline of 37.47% , eventually bottoming out at the 61.8% Fibonacci retracement level (10,514.25), from which it staged a significant recovery to reach the all-time high of 22,425.75.

📊Current Demand Zones & Fibonacci Levels:

These zones represent potential reversal areas where buyers could regain control. The Fibonacci retracement levels align well with historical price action, reinforcing their significance as support zones.

DZ-1 (17,539.00-16,334.85): Approximately the 50% Fibonacci retracement of the recent bull rally

DZ-2 (16,334.85-15,384.25): Approximately the 61.8% Fibonacci retracement - Historically a strong support level

DZ-3 (15,384.25-14,557.00): Critical structural level with prior buyer interest

DZ-4 (14,557.00-14,140.25): Deep support level - key psychological zone

📈 Recovery Potential

To regain the all-time high of 22,425.7 5, the market would need to achieve the following percentage gains from each demand zone:

From DZ-1 (Top: 17,539.00, Base: 16,334.85): 📈 +37.3% to all-time high

From DZ-2 (Top: 16,334.85, Base: 15,384.25): 📈 +45.8% to all-time high

From DZ-3 (Top: 15,384.25, Base: 14,557.00): 📈 +54.0% to all-time high

From DZ-4 (Top: 14,557.00, Base: 14,140.25): 📈 +58.6% to all-time high

The DZ-2 to DZ-3 range provides the most likely region for a significant reversal based on confluence between historical support levels and Fibonacci retracements. While DZ-4 aligns with the 37% historical decline.

🔑 Key Takeaways

The NASDAQ 100 s is in a significant correction phase, down -22.6% from its peak.

Price is approaching critical Demand/support zones (DZ-1 to DZ-4), which may act as reversal points.

A return to all-time highs would require substantial gains, particularly if the market reaches the deeper demand zones.

Investors should closely monitor price action around the DZ-2 to DZ-3 range (15,384.25 - 14,557.00) for signs of a potential reversal.

Additionally, staying updated on developments related to the new tariffs is essential, as they may heavily influence market dynamics in the coming months.

Is This a Bear Market or a Golden Opportunity?The indices have plummeted sharply, and whether you believe this is due to Trump’s tariffs or would have happened anyway, regardless of the trigger, the reality remains the same.

Both the S&P 500 and Nasdaq 100 are officially in bear market territory— defined by a decline of more than 20% from their peaks . Meanwhile, the Dow Jones Industrial Average is down approximately 15%.

Given these facts, the big question is: Are we in a bear market, or is this a fantastic buying opportunity? 📉📈

Now, let's break down the key levels, potential scenarios, and how to approach the current market environment. 🚀

Dow Jones 30 (DJI): Navigating Key Support and Resistance Levels

On the weekly chart, DJI has been in an uptrend since the pandemic lows of 2020. The double top formation from 45k measured target has already been exceeded, and the index is now approaching a critical confluence support zone between 37k and 37,700.

📌 My Outlook:

• I believe this support will hold in the near future, presenting a buying opportunity.

• Resistances: 40k and 41,600 are important technical levels and potential targets for bulls.

💡 Alternative Scenario:

• If DJI starts rising without testing the long-term confluence support, I will focus on selling opportunities, particularly around the 41,500 zone, as we have 2 unfilled gaps from last week.

________________________________________

S&P 500 (SPX): Bear Market Territory, But Still Holding Uptrend (posted main chart)

According to classical theory, SPX is now officially in bear market territory. However, we are still above the ascending trend line established from the 2020 pandemic low, and approaching a confluence support zone around 4,820 - 4,900.

📌 My Outlook:

• I will be looking for buying opportunities if the index continues its decline towards the 4,820 - 4,900 zone next week.

• Target: Filling the first gap at 5,400.

💡 Alternative Scenario:

• If the week begins positively, and SPX doesn’t reach the 4,900 support zone, I will focus on shorting opportunities on gap filling, aiming for a return to 5,000.

________________________________________

Nasdaq 100 (Nas100): Hovering Above Key Support

Unlike DJI and SPX, Nas100 is still well above the ascending trend line from the 2020 pandemic low. However, it is nearing an important horizontal support defined by the 2021 ATH and the 2024 lows.

📌 My Outlook:

• Drops towards 17k or slightly lower could present good buying opportunities, anticipating a potential rise to fill the gaps.

💡 Alternative Scenario:

• If the price rises above 18.500k zone without dipping under 17k I will look for selling opportunities.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

ICPUSDT READY TO FLY AGAIN ?? ICPUSDT is currently forming a classic falling wedge pattern on the chart, which is widely recognized as a bullish reversal signal. The price has been compressing within this narrowing range and is now approaching a key point where a breakout is highly likely. With strong support being respected and buyers gradually stepping in, the setup is aligning well for a potential upside move.

Volume levels have been steadily increasing, confirming growing investor interest in Internet Computer (ICP). This increasing participation from traders and investors alike can often serve as a reliable indicator that a breakout may occur soon. Technical indicators such as RSI and MACD are also hinting at a momentum shift that aligns with a bullish scenario.

Given the strength of this chart formation and the positive volume dynamics, ICPUSDT could potentially see a price gain in the range of 90% to 100%+ from current levels. The risk-to-reward ratio is favorable, especially for those who are entering early before the breakout confirms with stronger candles above resistance. A retest of the wedge breakout, if it happens, could also provide a second opportunity to enter.

ICP is also gaining traction among long-term investors due to its unique blockchain technology aimed at decentralizing the internet. The ongoing development and community support around the project adds more fundamental strength to this setup. Keep an eye on it for confirmation of the breakout!

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

"NAS100 / US100" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "NAS100 / US100" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (20000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (19400) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 20800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"NAS100 / US100" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NAS100 Turn of the Month Strategy Meets Market Volatility!In this video, we dive into the Turn of the Month Strategy and explore how it could play out in the current market environment. Historically, mutual funds rebalance their portfolios at the end of the month, creating buying pressure that often leads to higher stock prices into the new month. Additionally, recurring financial inflows, such as monthly salary payments and pension contributions, tend to boost market demand during this period.

However, this month presents a unique challenge. The NASDAQ 100 has capitulated into the end of the month, driven by heightened volatility and uncertainty fueled by Donald Trump's rhetoric. With the market currently trading into a significant support zone and liquidity pool, we analyze whether the Turn of the Month effect can counteract the recent bearish momentum.

📊 Key Highlights in the Video:

Price Action Analysis: The NASDAQ 100 is deeply overextended, trading into a critical liquidity pool.

Trade Idea: A potential counter-trend rally could emerge as the market seeks to correct and rebalance.

Strategy: Look for a short-term rally into resistance, followed by a possible shorting opportunity as the market resumes its downward trend.

This video is perfect for traders looking to combine price action trading with seasonal strategies like the Turn of the Month effect. Will the market rally into the new month, or will bearish momentum prevail? Watch now to find out! 🚀

NAS100 Will Go Up From Support! Long!

Please, check our technical outlook for NAS100.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 18,411.4.

Considering the today's price action, probabilities will be high to see a movement to 18,773.6.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!