Nasdaq-100

NASDAQ potential for bearish drop to overlap supportLooking at the H4 chart, my overall bias for NASDAQ is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a sell entry at 12456.1, where the overlap resistance and 38.2% Fibonacci line is. Stop loss will be at 12781.1, where the recent high is. Take profit will be at 11898.1, where the overlap support is and slightly above where the 50% Fibonacci line is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NASDAQ Potential For Bullish ContinuationLooking at the H4 chart, my overall bias for NASDAQ is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market.

Looking for a buy entry at 11921.1, where the overlap support is. Stop loss will be at 11546.9, where the 38.2% Fibonacci line and minor low is. Take profit will be at 12807.5, where the overlap resistance is.'

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

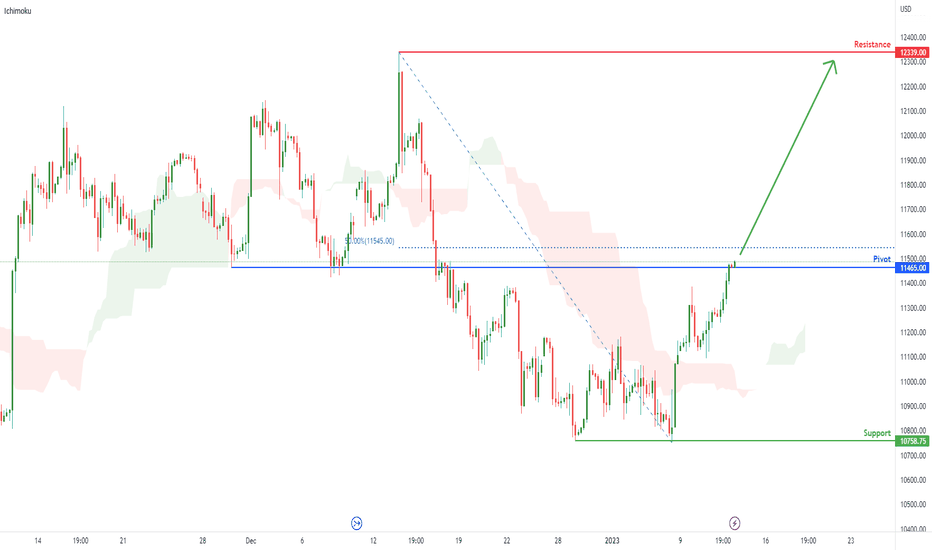

Nasdaq 100 Futures ( NQ1! ), H4 Potential for Bullish RiseTitle: Nasdaq 100 Futures ( NQ1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 12339.00

Pivot: 11465.00

Support: 10758.75

Preferred case: Looking at the H4 chart, my overall bias for CL1! is bullish due to the current price crossing above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to continue heading towards the resistance at 12339.00, where the previous swing high is.

Alternative scenario: Price may break the pivot at 11465.00, where the 50% Fibonacci line is, before heading towards the support 10758.75, where the previous swing low is.

Fundamentals: There are no major news.

NDX Potential for Bearish Momentum | 13th October 2022On the H4 chart, the overall bias for NDX is bearish. To add confluence to this, the price is below the Ichimoku cloud, indicating a bearish market.

Looking for a retracement sell entry at 11439.38 where the 23.6% Fibonacci line and -27.2% Fibonacci expansion line is located. Stop loss will be set at 12062.52, slightly above the 38.2% Fibonacci line. Take profit will be at 10408.41 where the 78.6% Fibonacci projection line and 127.2% Fibonacci extension line are located.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Nasdaq-100: Done correcting, or are we entering a bear market?Hey Trader,

please see my current idea on US-100. Price Action is currently trading above the 2.618 extension for our possible wave c. This point here will be crucial for the next days, since it decides from a purely technical perspective if the Nasdaq-100 is entering a bear market, or current panic is just hot air and we have a deep correction here. I'm speculating on a corrective pattern, because I think that rate hikes are now priced in already and the Dollar will become weaker again. Inflation may peak even more, so that investors don't have a reason to stay in their money just to see it vanish. I hope I am wrong, but I fear we will see a Hyper inflationary Environment this year.

This is no financial advice,

Your RT.

PayPal - Ready for new All-Time-Highs?Hey Investor,

please see my longterm idea on PayPal, where my counts suggests a possible bottom printed which will now lead to the next bullish cycle. What is important here is that we close above the 1.618 Fibonacci extension level in order for this analysis to be invalid. A break o the 1.618 level would lead to a bearish wave 3 which would change dramatically my count.

This is no financial advice, just my technical expertise.

RT

Palantir may have bottomed today! Start of THE next bullrun? Hello everyone,

please see my current video idea on the Palantir stock, where my count suggests a possible bottom with price target to around 220 $ area. This would be equal to a 1200% increase.

This is no financial advice, just my technical expertise.

RT

PayPal with possible 25% short-term returnHi Trader,

please see my current idea on the PayPal stock, which is giving us a perfect long entry in order to play this wave 4 retrace. If we hit target one it would give us a return of minimum 20%.

This is no financial advice, just my technical view of the stock market.

RT

NDX / NASDAQ 100 Technochasm Bull RunThe NASDAQ 100 (NDX) 'Technochasm' is still showing strong momentum on the monthly Heiken Ashi.

A correction will come; but only time will tell when that time is. I am still holding a long position until the market proves otherwise.

Some of the top Nasdaq holdings are over-valued in my humble opinion, with AMZN leading the way BUT, it certainly appears the Technochasm bull run is not over yet, as AMZN has broken out on the weekly/monthly chart after moving sideways for the past 11 months. Will it continue to push upwards? We will see over the coming weeks...

Twitter craving for new ATH!Right now everything is just right on Twitter.

In the past few weeks a wedge has formed that now seems to break out in the 3/4 range. We were also able to overcome the MA50 with high trading Volume . Compared to its direct competition from the tech sector, Twitter has a favorable price / earnings ratio of 15. The fact that the NASDAQ-100 has some catching up to do with the S&P and the Dow supports my thesis that Twitter will gain enormous momentum with the quarterly figures at the end of April.

I am very confident about this stock. My target price: $ 100

NQ 2 hour analysis - rising wedge - February 7, 2021NQ 2 hour analysis - The NQ (Nasdaq 100 futures) is at an interesting crossroads. Observe the rising wedge with bid line drawn from the January 31 low. Notice the negative (bear) divergence on the momentum indicator below.

Now look back to the previous rising wedge that topped out on January 26th. Notice the first (yellow arrow) top coinciding with the first negative (bear) divergence (yellow arrow). Observe that the NQ sold off for a day or so, then went back and tested the offer line again making a higher high (red arrow) on an even more negative divergence (red arrow) before selling off hard.

I think there are 3 possible scenarios:

1) The NQ sells off this week out of the rising wedge.

2) The NQ sells or consolidates a bit, then rallies up to test the fib extension (sideways red arrow), building an even bigger divergence like last time, before selling off hard.

3) The NQ melts higher up.

Let me know what you think will happen in the comments section below.

NASDAQ-100 Index futures finished higher: Downside Pressure June E-mini NASDAQ-100 Index futures finished higher on Friday after reversing earlier weakness. On Friday, June E-mini NASDAQ-100 Index futures settled at 7840.25, up 41.75 or +0.53%. The main trend is up according to the daily swing chart. A trade through 7879.50 will signal a resumption of the uptrend. The main trend will change to down on a move through 7276.00. This is highly unlikely, but there is room for a normal 50% to 61.8% correction if the minor trend changes to down.

NASDAQ-100 Index touch new higher 8000 Area That was best opportunity for sell, first target 7690 and finally 7200 level. NASDAQ-100 Index daily 200 ma Moving Average Area 7140 so this is best way for Buy NASDAQ-100 Index 7140 level target 7712 level.

Bullish Scenario:-

Taking out 7879.50 will indicate the buying is getting stronger. There is no resistance at this time, but buyers will have to watch for a closing price reversal top. This chart pattern will not change the trend, but it could lead to a short-term correction.

Bearish Scenario:-

The inability to overcome 7879.50 will signal the presence of sellers. This could drive the index back into the first short-term pivot at 7769.75. The next downside targets are Friday’s low at 7755.50, and a pair of pivots at 7739.00 and 7727.50.

The NASDAQ 100 - The Best Performing Index - By FarI have long known that the Nasdaq 100 out-performs all indices and benchmarks. In fact, during the completion of the liberatedstocktrader.com crash detector system which I refined over many years I have learned that the 20-year return of the NDX-100 is 604% (from 1998 to present), compare that to the S&P500 which netted only 200%.

If you are going to buy and hold any index, it has to be the Nasdaq 100 as the returns are superior. Don't just by any ETF or index tracking fund, buy the one that continually provides the best returns. No other broad market index has managed to beat 200% over the last 20 years.

Additionally, in the chart above we can see the last 16 weeks of Nasdaq 100 have brought us 15 up weeks with only 1 down week. But will that change?

The index is approaching again it's all-time high and we should expect some strong resistance coming up. Also, we have earnings season starting again and that will decide if we break-through to new highs or fade away. Ultimately right now there is no reason (technically) to expect a market turnaround. Resistance YES, bear market NO. There have been no shock alerts since December 2018, and the market is in a solid bull run.

Outlook:

Short-term Trend (Days to Weeks) - Up

Medium-term Trend (Weeks to Months) - Up

Long-term Trend (Months to Years) - Sideways

Good luck - like and follow if you want more analysis updates.

Barry

NAS100USD Approaching Support, Potential Bounce!NAS100USD is approaching its support at 6505 (100% Fibonacci extension, 76.4% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 6954 (38.2% Fibonacci retracement, horizontal overlap resistance).

Stochastic (89, 5, 3) is approaching its support at 7.09%.

NDX: Nasdaq 100 A good end to the week in storeNasdaq 100 NDX

Reading 2578 now - can come back to 7569 on the open but

should hold hold up here if the day is to remain a good

one....think it will be after a twitchy start. Marketmakers

need to try shaking the tree to get some stock on

board...don't think they will shake out much though - which

should bode well for the rest of the day if correct.

A potentially great end to the week in store...

*For fastest updates in real-time please see link, top-left of main page.

NDX Nasdaq 100 QQQ Possible Trading zoneI believe we may be near a market top, if you are like me you may be wondering where to sell. This is my attempt to analyze the current moves. I do think that the stock market is nearly in danger but that being said, it is definitely not a certainty that we have hit the top. I am not counting on any new highs though because in my opinion, we have already hit the high. I am looking for a bounce upwards from here which may occur over the next couple of weeks.

In this analysis I have put some potential buy and sell areas, please see the chart. This is a 1 hour candle chart.

I do think if we make a new short term low point it puts us in the danger zone. This does not mean I am advising you to sell - or to buy at that matter. It may still bounce back up. But if we are going that low, it is seriously concerning in my opinion. That being said, buying low is always safer than buying high, right? And if we just have a quick dip into the danger zone and it bounces above, it is not so worrisome as getting a 1 day candle close inside it.

My longer term outlook for stocks is negative though. Even if we bounce back, I expect sometime this year to have a real crash, if not now. Be very careful for long positions. This is all just my opinion.

What are your thoughts? I would love to hear from you.

If you liked the analysis, please show your support by clicking like.

This is not advice to buy or to sell. You should do your own research and make your own investment decisions.