Silver Breakout, Tech Resistance & TRY Rotation 📊🔥 Silver Breakout, Tech Resistance & TRY Rotation – Structure Meets Reality 🌍📉

Hey traders, FXPROFESSOR here 👨🏫

Today’s charts show how technical structure and real-world capital behavior can tell one powerful story. We’re watching Silver surge, Tech stall, and the Turkish Lira react to local capital flows — all aligning with clean market levels.

Let’s break it down:

🔍 Silver (XAG/USD)

Price exploded into $39.30, reaching the top of a well-defined ascending channel.

Now stalling — pullbacks toward $35.38 or even $32.17 would be natural.

🧠 Structurally strong, fundamentally backed by industrial demand, inflation hedging, and tight supply dynamics. Just not a good timing to 'ape it' today.

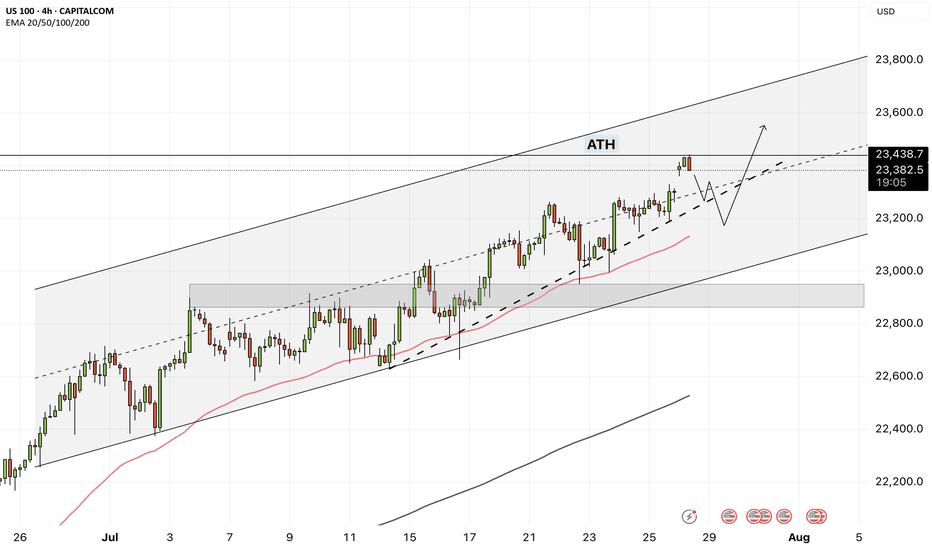

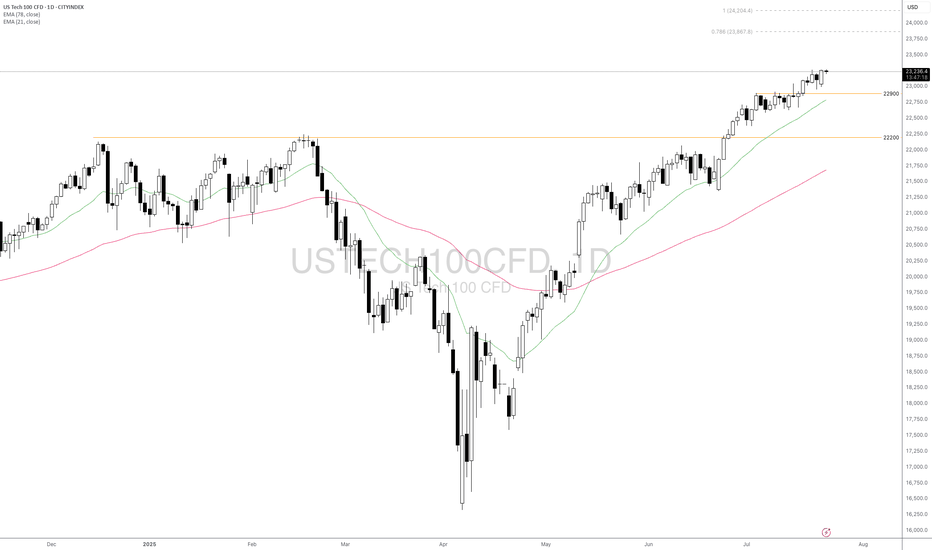

📉 US Tech 100 (USTEC)

Testing resistance around 23,434.

RSI and OBV show signs of exhaustion, suggesting potential pause or pullback.

In a stretched macro environment, tech is vulnerable to rotation — especially if yields shift or inflation expectations change.

💱 EUR/TRY – Turkish Lira Rotation

We just saw a sharp rejection at 47.78, a key round-number resistance.

On the ground, there’s a notable shift — My Turkish brother says 'FX profits being converted into real estate and hard assets, especially by locals and returning expats'. And I trust a good Turk as much as i trust my Greek family! (yes, we can be friends when there is respect and no hatred! common interests work best in this troubled world)

The chart reflects this move: potential drop toward 46.00 → 45.45 → 43.79 if momentum fades.

🧩 What These Charts Teach Us

This is a perfect storm where technical resistance, macro rotation, and local capital behavior all align:

🔹 Silver rising = hard assets in favor

🔹 Tech pausing = overextension risk

🔹 TRY dropping = profit-taking & capital redeployment

Trade what you see — but understand why it’s happening.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Nasdaq

NAS100 - How will the stock market react to the FOMC meeting?!The index is trading above the EMA200 and EMA50 on the four-hour timeframe and is trading in its ascending channel. The target for this move will be the ceiling of the channel, but if it corrects towards the indicated support area, you can buy Nasdaq with better reward-risk.

As signs of easing global trade tensions begin to emerge, the Federal Open Market Committee (FOMC) is scheduled to meet this week. Analysts widely expect the Fed to hold interest rates steady for a fifth consecutive time. This anticipated decision comes as the U.S. President continues to push for rate cuts, persistently pressuring the Fed to adopt a more accommodative monetary stance.

So far, the Federal Reserve has kept its benchmark rate within a range of 4.25% to 4.5%. While some officials project two cuts by the end of the year, markets are waiting for the Fed’s patience to run out. According to the CME Group’s FedWatch tool, investors have priced in a 62% chance of a rate cut in the September meeting. By then, the Fed will have access to the July and August employment reports—key indicators of whether the labor market is weakening or remains resilient.

The upcoming week marks the peak of Q2 earnings season, with 37% of S&P 500 companies reporting results, including four major tech firms. In parallel, the August 1st tariff deadline for the EU and other countries is approaching, while legal challenges over existing tariffs remain ongoing.

According to a report by The Wall Street Journal, many large U.S. corporations have so far absorbed the bulk of tariff-related costs without passing them on to consumers. This strategy aims to maintain market share and avoid drawing criticism from President Trump. However, the question remains—how long can this continue?

Examples from the report include:

• General Motors paid over $1 billion in tariffs in Q2 alone without announcing any price hikes.

• Nike expects a $1 billion hit from tariffs this fiscal year and is planning price increases.

• Hasbro is working on a combination of price hikes and cost cuts to offset $60 million in tariff impacts.

• Walmart has made slight pricing adjustments (e.g., bananas rising from $0.50 to $0.54) and managed pressure through inventory reductions.

This week is shaping up to be one of the busiest on the economic calendar in recent months. A flood of key data on growth, inflation, and employment, alongside three major interest rate decisions, has markets on high alert.

On Tuesday, attention will turn to two significant reports: the Job Openings and Labor Turnover Survey (JOLTS) and the U.S. Consumer Confidence Index for July. These metrics will offer a clearer view of labor market dynamics and household sentiment heading into critical monetary policy decisions.

The most anticipated day is Wednesday. That day brings the ADP private payrolls report, the first estimate of Q2 GDP, and pending home sales data. Additionally, both the Bank of Canada and the Federal Reserve will announce rate decisions—events with the potential to simultaneously steer global market trajectories.

On Thursday, the July Personal Consumption Expenditures (PCE) price index will be released—a key inflation gauge closely monitored by the Fed. Weekly jobless claims data will also be published that day.

The week concludes Friday with two heavyweight economic indicators: July’s Non-Farm Payrolls (NFP) report, a crucial input for Fed policy decisions, and the ISM Manufacturing PMI, which offers insights into the health of the real economy.

Some economists argue that a September rate cut may be premature, and even suggest that no rate changes might occur in 2025. Analysts expect Fed Chair Jerome Powell to reiterate a data-dependent stance, consistent with previous meetings.

Still, beyond political dynamics, the July meeting holds independent significance.The Fed’s internal policy tone is gradually leaning more dovish, and subtle signals of this shift may emerge in the final statement. Given that only one meeting remains before September, if policymakers are leaning toward a rate cut then, it’s critical that the groundwork for such communication be laid now.

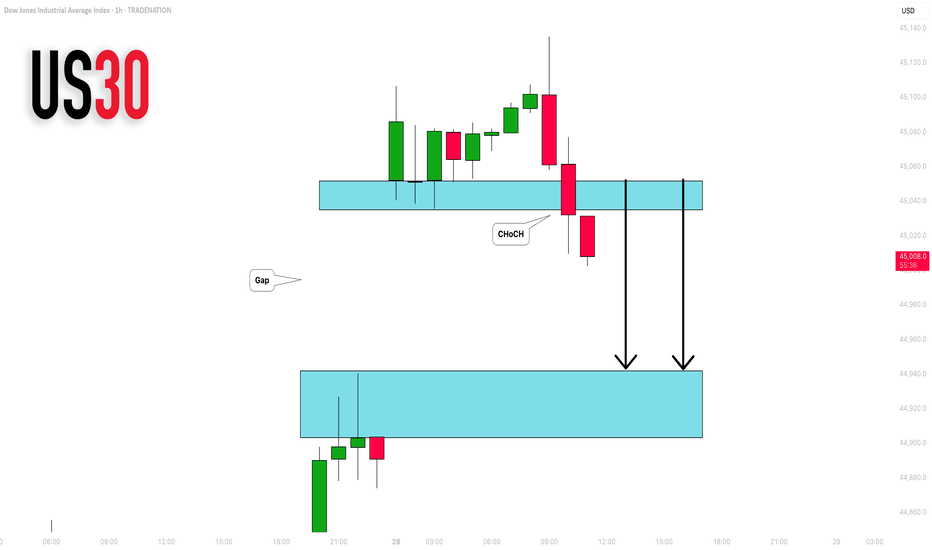

DOW JONES INDEX (US30): Another Gap For Today?

I see another gap up opening on US30 Index.

I think it will be filled today. A formation of an intraday

bearish CHoCH on an hourly time frame suggests

a highly probable bearish continuation.

Goal - 44943

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

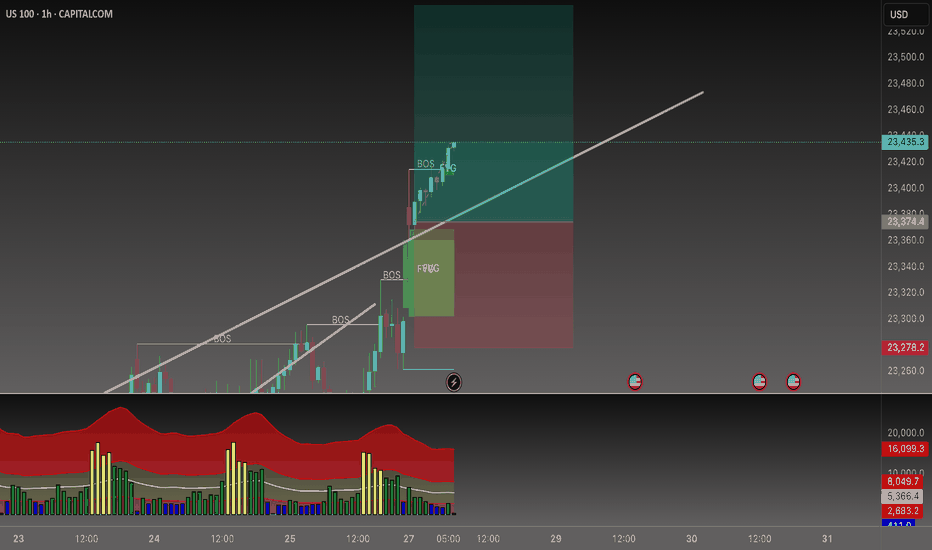

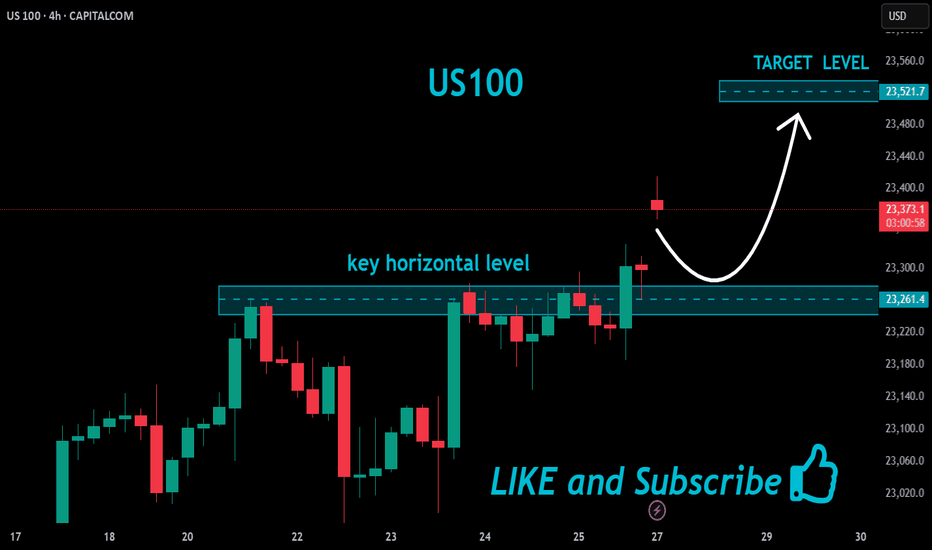

Beyond the Chart – NAS100 Through Technicals & Fundamentals📊 CAPITALCOM:US100 Analysis

Today, NAS100 opened with a huge gap up following former President Trump’s announcement that the U.S. has officially reached a trade agreement with the European Union.

🕳️ After price rejected the gap zone, and volume gets low low. I’m now looking for a potential test of the 23,540 level.

💼 With Q2 earnings season kicking off, stock-moving news will be hitting fast. While retail traders might scramble to catch up, smart money is already positioning for surprise earnings beats.

Stay sharp, this week could set the tone for the next major move.

NDAQ #001 ( Say Goodbye to Nasdaq Market !!! ) Hello dear traders.

Good days.

First of all thanks for your comment and support.

------------ ---------------- --------------

Today I want to analysis Nasdaq Market which on monthly Gann Square which is grown up highly close to the 0.75 Monthly Gann Box price level .

I can see sharp rises to fill 0.75 Gann Box ( which is about 102.2 ) befor collaps .

In other words you can see a rising wedge formed which is a sign of correction .

Analysis and road map is plotted with Gann Square.

Good luck and safe trades.

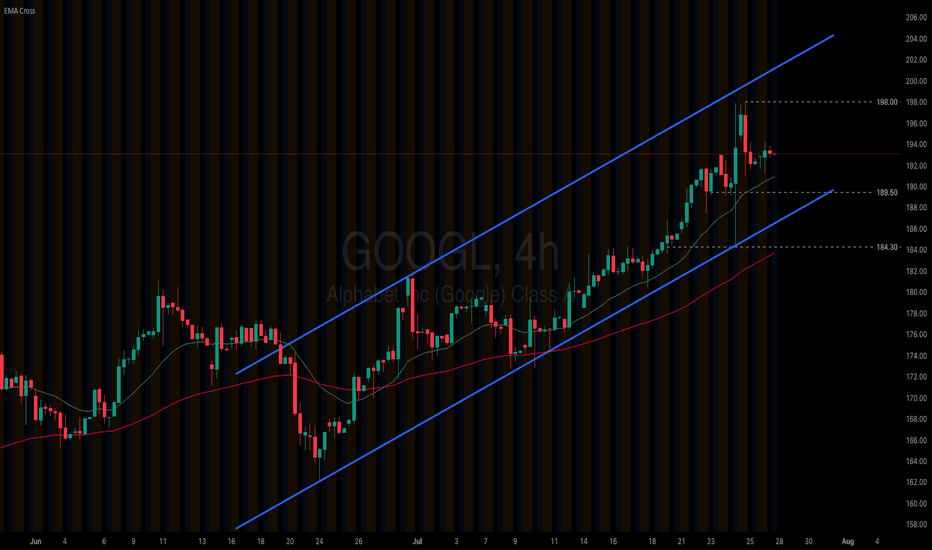

Alphabet (GOOGL) extends its rally on upbeat 2Q earnings

US equities continue to post record highs, driven by stronger-than-expected 2Q earnings and optimism over ongoing trade agreements. Alphabet’s (GOOGL) Q2 results reaffirmed the accelerating pace of AI-led growth. The company’s cloud revenue surged 32% YoY, up from 28% in 1Q, and it raised its full-year capex guidance from $75B to $85B.

Alphabet (GOOGL) remains firm within its ascending channel. The price solidly holds above both EMAs, indicating the potential extension of bullish momentum. If Alphabet (GOOGL) holds above EMA21, the price may gain upside traction toward the previous high at 198.00. Conversely, if Alphabet (GOOGL) breaks below the support at 189.50, the price could retreat to the next support at 184.30.

NASDAQ (Nas 100): Buyers Are In Control. Wait For LongsWelcome back to the Weekly Forex Forecast for the week of July 28 - Aug 1st.

In this video, we will analyze the following FX market:

NASDAQ (NQ1!) NAS100

The Nasdaq rose Friday to fresh highs, following a busy week of tariff updates and earnings. The index is showing no signs of bearishness.

Wait for pullbacks to FVGs to buys.

FOMC and NFP warrant caution with new entries. Wait until the news before new entries.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

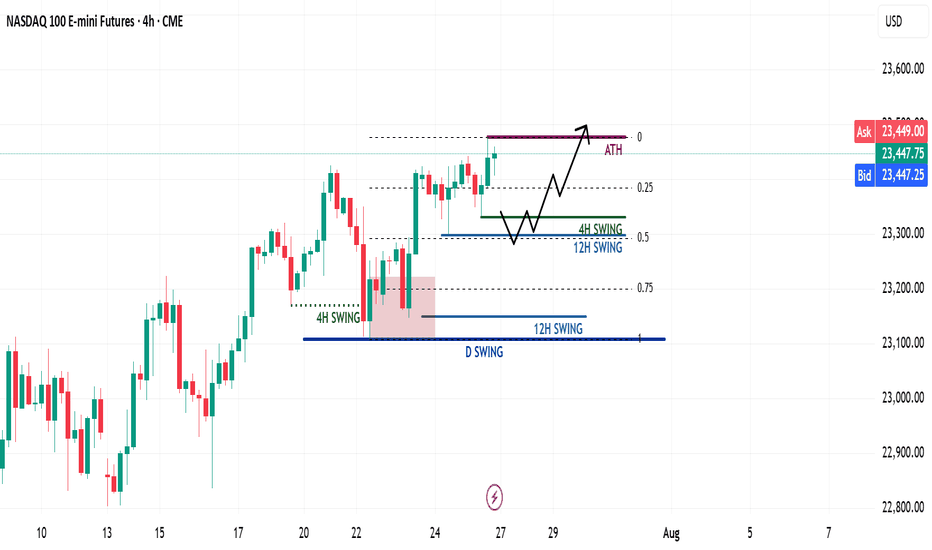

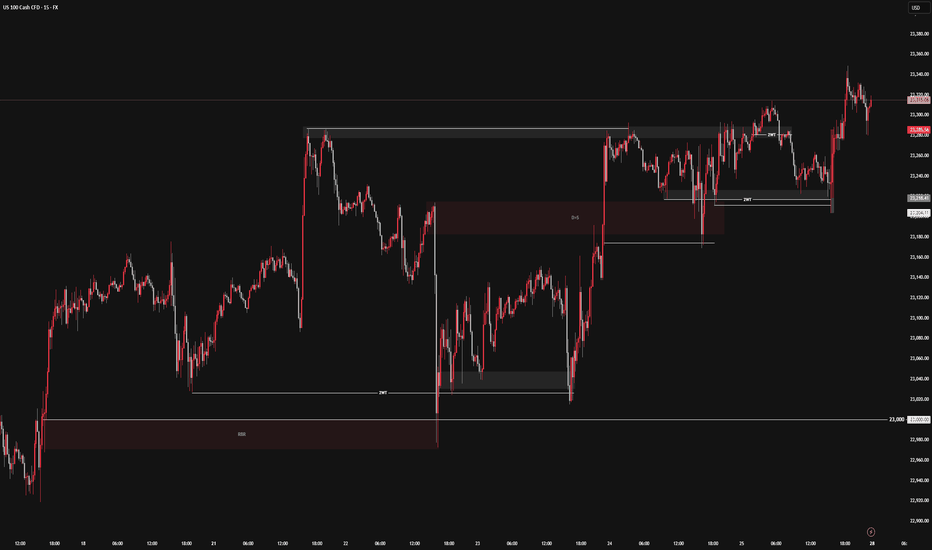

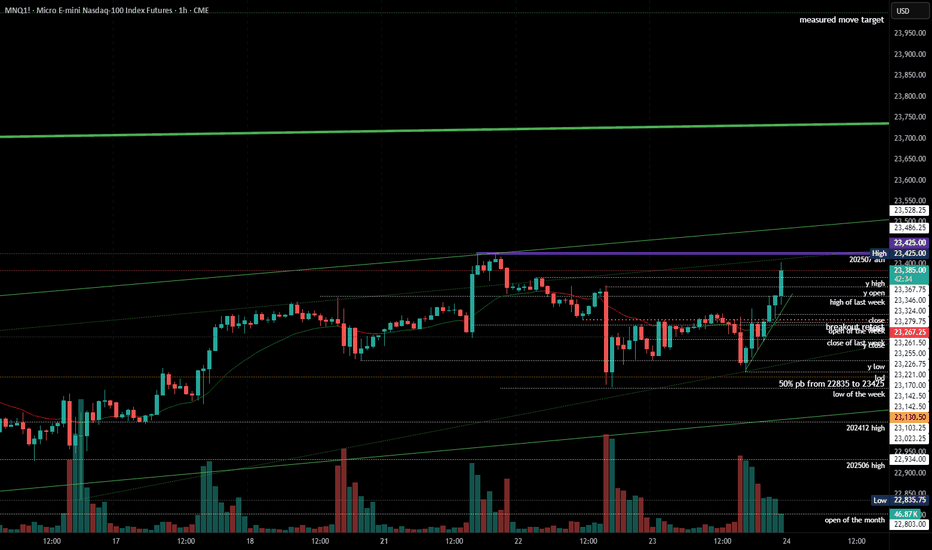

NQ Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Lower inflation data

• Trump’s policy shift toward aggressive rate cuts

This creates a strong risk-on environment across U.S. indices.

🔙 Previous Week Recap

• NQ continued its price discovery phase

• Price swept 4H swing liquidity and triggered a market structure shift

• A new 1H demand zone was formed after MSS

• Price revisited the 1H demand and launched toward new all-time highs (ATH)

• While I anticipated a deeper retracement, ES provided the cleaner pullback

• I executed longs on both ES and NQ using SMT divergence (ICT SMT concept)

📊 Technical Analysis

My bias remains bullish as long as the higher timeframe structure holds.

For the upcoming week:

• Watching for either the 4H or 12H swing high to get swept

• Ideally, a retracement toward the 0.5 Fib level, which aligns with my bullish discount zone

• A clean liquidity sweep into this zone could act as a launchpad for the next leg higher

⚙️ Trade Setup & Execution Plan

Entry Strategy:

• Wait for a new 1H–4H Market Structure Shift

• Identify the new demand zone post-MSS

• Look for price to return to the zone for a long opportunity with LTF confirmation

Trade Management:

🎯 Target: New ATH

⛔ Stoploss: Swing low of the 1H–4H demand zone

📌 Chart will include Fib levels, MSS zones, and execution trigger areas.

Let me know your thoughts or share your plan below.

Happy trading!

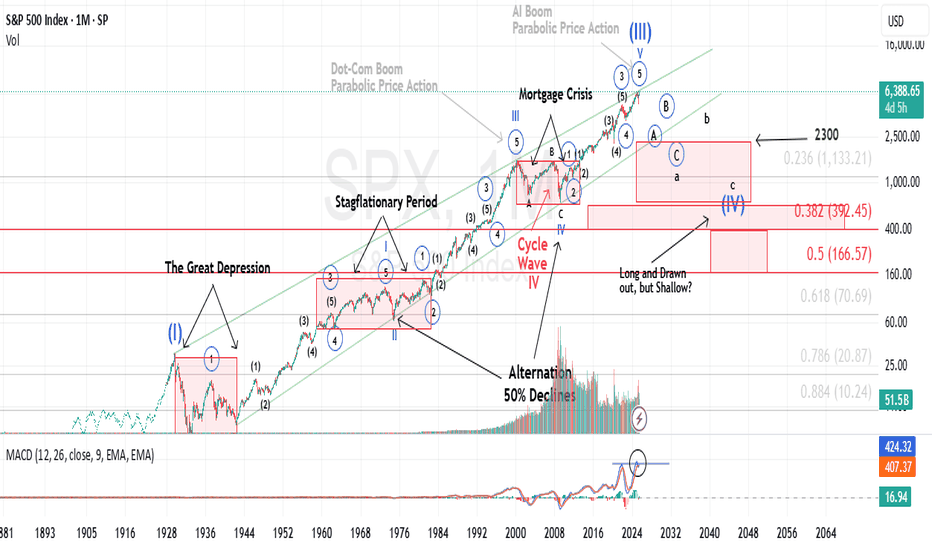

History does not repeat itself, however it tends to rhymeIt’s widely accepted that Mark Twain once said (or wrote) that “history does not repeat itself, however it tends to rhyme”.

Historical Parallels to a Super Cycle Wave (I) Top in U.S. Equities

The road to a major market top is often paved with echoing patterns from the past, and today's landscape bears an uncanny resemblance to pivotal historical events that preceded economic upheaval.

The 1918 Spanish Flu—though less economically damaging in the U.S. than elsewhere, still triggered a 1.5% drop in GDP and a 2.1% decline in consumer spending. The resulting economic weakness, paired with rising inflation, eroded real returns on equities and short-term government bonds for years.

Then came the 1929 stock market crash, the spark that ignited the Great Depression. Driven by a perfect storm of extreme speculation, sky-high valuations, and a regulatory vacuum, the collapse revealed the systemic fragility beneath the euphoria.

Adding fuel to the fire, the Smoot-Hawley Tariff Act of 1930 slammed the brakes on global trade. By sharply raising tariffs on imports, it invited swift retaliatory measures from abroad. The result: a devastating plunge in both U.S. exports and imports, deepening the economic crisis and worsening unemployment. Smoot-Hawley has since become a textbook example of how protectionist policy can magnify economic damage.

Modern Echoes: A Cycle Repeating?

Fast forward to the present and we see unsettling similarities.

The Covid-19 pandemic serves as a modern analog to the 1918 flu, disrupting global supply chains and triggering a steep drop in GDP and consumer spending. Unlike the post-WWI period, however, inflation didn’t precede the crisis, it exploded afterward, fueled by pent-up demand and fiscal stimulus, giving rise to persistent “sticky” inflation....and NOT TRANSITORY.

In a similar inversion of sequence, the Trump-era tariffs—modern-day echoes of Smoot-Hawley, were enacted before any major equity downturn, not after. Still, their long-term impact on global trade and supply chain reliability remains a pressure point for the economy.

Most critically, speculation and valuation excess are again center stage. Just as the roaring ’20s were characterized by euphoric risk-taking, today’s U.S. equity market is trading at record-high P/E ratios, despite rising macroeconomic uncertainty and deteriorating breadth.

These historical and contemporary markers suggest we may be approaching the apex of a Super Cycle Wave (III), a turning point that, like its predecessors, may only be fully recognized in hindsight.

It is my contention, that history is currently rhyming.

Best to all,

Chris

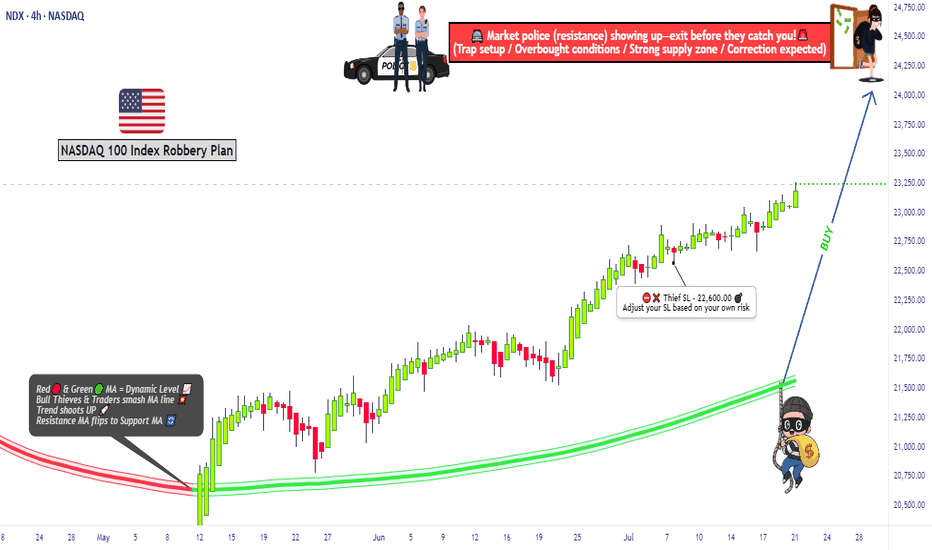

"NASDAQ 100 Heist – Scalp, Swing, or Hold? (Full Plan)🔥 NASDAQ 100 HEIST PLAN – BULLISH LOOT AWAITS! 🔥

🚨 Attention Market Robbers & Money Makers! 🚨

(Swing/Day Trade Strategy – High-Risk, High-Reward Play)

🎯 Mission Objective: Loot the NDX100/US100 (NASDAQ 100) Like a Pro!

Based on Thief Trading’s ruthless technical & fundamental analysis, we’re executing a bullish heist—targeting the Red Zone (high-risk, high-reward area).

⚠️ WARNING: Overbought market, consolidation zone, potential bear traps—weak bears may get slaughtered! Strong hands only!

🔐 ENTRY: The Vault is OPEN!

"SWIPE THE BULLISH LOOT!" – Any price is a steal, but smart thieves use:

Buy Limit Orders (15m-30m TF) near recent swing lows/highs.

DCA/Layering Strategy – Multiple limit orders for max loot.

Breakout Confirmation – Don’t jump in early; wait for the real move!

🛑 STOP LOSS: Protect Your Stash!

Thief’s SL Rule: Nearest 4H swing low (22,600) – WICK LEVEL ONLY!

DO NOT place SL before breakout! (Patience = Profit.)

Adjust SL based on risk, lot size, and number of orders.

🎯 TARGETS: Escape Before the Cops Arrive!

Main Take-Profit: 24,400 (or exit early if momentum fades).

Scalpers: Longs ONLY! Use trailing SL to lock in profits.

Swing Traders: Ride the wave like a true market pirate!

📰 FUNDAMENTAL BACKUP: Why This Heist Will Work

Bullish momentum in NDX100 driven by:

Macro trends (Fed, inflation, tech earnings).

COT Report & Institutional positioning.

Geopolitical & Sentiment Shifts.

Intermarket correlations (USD, Bonds, Tech Sector).

(Stay updated—markets change FAST!)

⚠️ TRADING ALERT: News = Danger Zone!

Avoid new trades during high-impact news.

Trailing SL = Your best friend.

Lock profits early if volatility spikes!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to strengthen our robbery crew!

🚀 More heists coming soon—stay tuned, thieves! 🚀

SoFi's Surge: Unveiling 2023 and What Lies Ahead in 2024Technical Analysis Overview

Current Price : $10.34, a 3.77% increase.

Weekly Trend : Showing a positive trend with a 5.35% increase over the last five days.

1-Month Trend : A significant increase of 51.96%, indicating strong bullish sentiment.

6-Month and Yearly Trends : A 17.04% increase over the last six months and a 124.51% increase year to date, highlighting a robust bullish trend.

Advanced Technical Indicators

Relative Strength Index (RSI) : 70.41 - Indicating that SOFI is nearing overbought territory, which could lead to a potential reversal or consolidation in the short term.

Moving Average Convergence Divergence (MACD) : 0.63 - Suggesting bullish momentum, indicating a strong buying trend.

Other Indicators : STOCH (83.28), STOCHRSI (84.02), ADX (37.09), Williams %R (-8.57), CCI (104.63), ATR (0.46), Ultimate Oscillator (54.76), and ROC (24.66) all contribute to a picture of current bullish momentum but with potential for short-term volatility or pullback.

Market Sentiment and External Factors

Market Capitalization : $9.904B USD.

Trading Volume Analysis : A high trading volume of 35,199,288, suggesting active market participation and interest in the stock.

Recent News Coverage Impacting SOFI

Bullish Outlook for 2024 : Analysts predict SOFI stock could continue its rally in the new year, benefiting from expected interest-rate cuts. A notable analyst has set a high price target of $14 for SOFI stock, implying significant upside potential ( InvestorPlace ).

Focus on Non-Lending Businesses : Analysts appreciate SoFi's shift towards non-lending businesses, improving earnings quality despite a higher-for-longer interest-rate policy.

Central Bank Policy Changes : Potential interest rate cuts in 2024 could benefit SoFi's lending business, as lower rates tend to spur borrowing and lending activity.

Conclusion

SOFI's stock shows strong bullish signs in the medium to long term, but the current overbought condition warrants caution for short-term traders.

The recent news and analyst predictions provide a positive outlook for 2024, making SOFI an interesting stock for both traders and long-term investors.

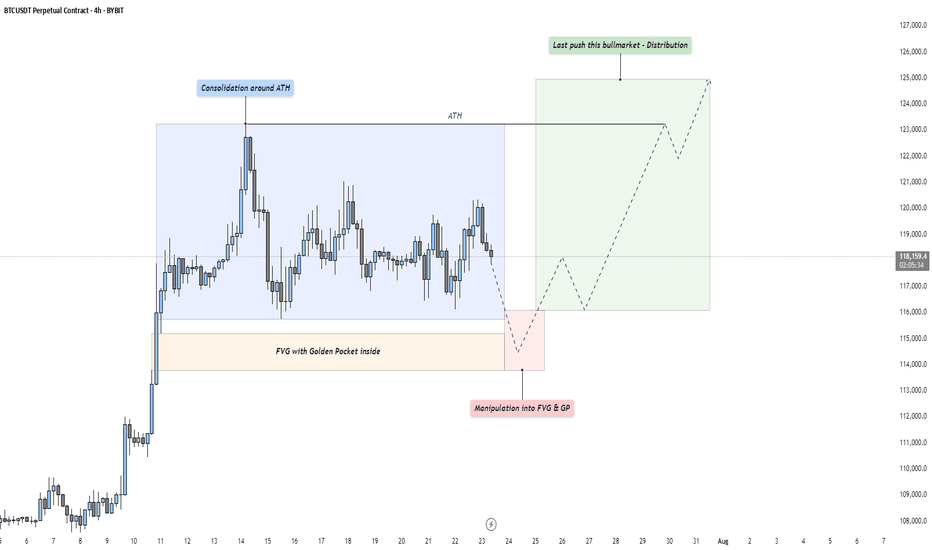

BTC - Last Push: Consolidation, Manipulation & DistributionMarket Context

After a strong upward impulse, Bitcoin has entered a mid-term consolidation phase just below its all-time high. This kind of price action is typical as the market digests recent gains and larger participants prepare for the next move. These pauses in momentum often precede either trend continuation or a reversal — and the structure here suggests we might be witnessing the former, but not without a final shakeout.

Phase 1: Consolidation Around the All-Time High

The first phase is defined by a tight range just beneath the all-time high, where price moves sideways in a balanced struggle between buyers and sellers. This is often where retail participants become overly bullish, anticipating a breakout. However, the lack of a sustained move higher indicates that smart money may be waiting for better entries — or preparing to engineer liquidity to fuel the next move.

Phase 2: Manipulation Into the Fair Value Gap and Golden Pocket

Directly below the range lies a clean Fair Value Gap, with a Golden Pocket retracement nestled inside it. This zone represents a strong area of interest. A sharp move into this area would likely sweep late long positions and trigger stop-losses from range traders — a classic manipulation pattern. This phase serves two purposes: collect liquidity and offer favorable pricing for larger players looking to position themselves before expansion. Watch for signs of absorption or reversal as price enters this zone.

Phase 3: Expansion – The Last Push of the Bull Market?

Following the liquidity sweep and reaction from the Fair Value Gap and Golden Pocket zone, we could see a renewed expansion toward higher highs. This is the phase where volume returns, sentiment shifts, and price accelerates. If this plays out, it could mark the final leg of this bull cycle — potentially driving Bitcoin to new all-time highs with strength.

Execution Thoughts

If you're looking to participate, it's wise to wait for a confirmation signal on a lower timeframe — like the 5-minute or 15-minute chart — once price enters the Fair Value Gap and Golden Pocket zone. Watch for a strong bullish reaction, break of structure, or shift in order flow to signal that buyers are stepping back in.

Final Thoughts

Let the market come to your level and don’t chase moves without context. These three phases — consolidation, manipulation, and expansion — are timeless patterns seen across all markets. Stay patient, stay objective, and react with clarity.

If this breakdown helped you see the setup more clearly, a like would mean a lot — and I’d love to hear your thoughts in the comments! Are you watching the same zone, or do you see something different?

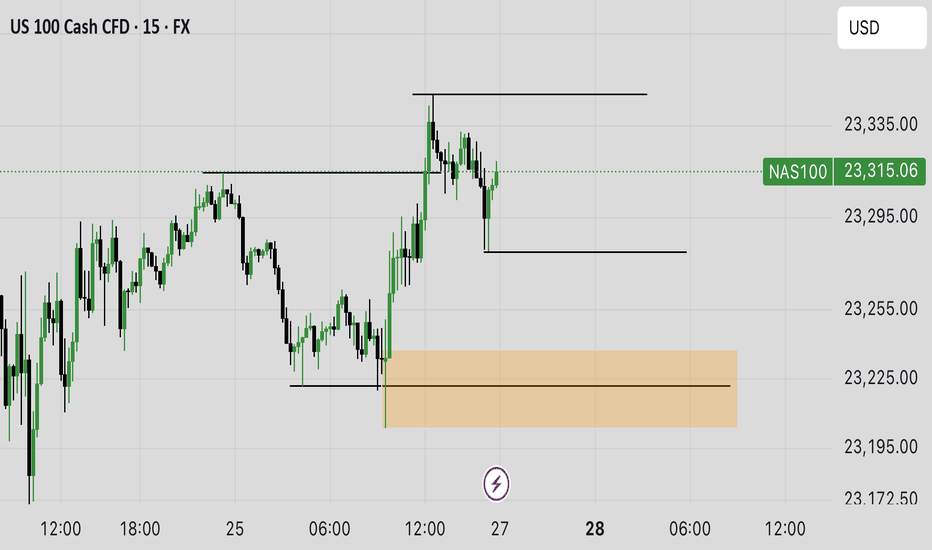

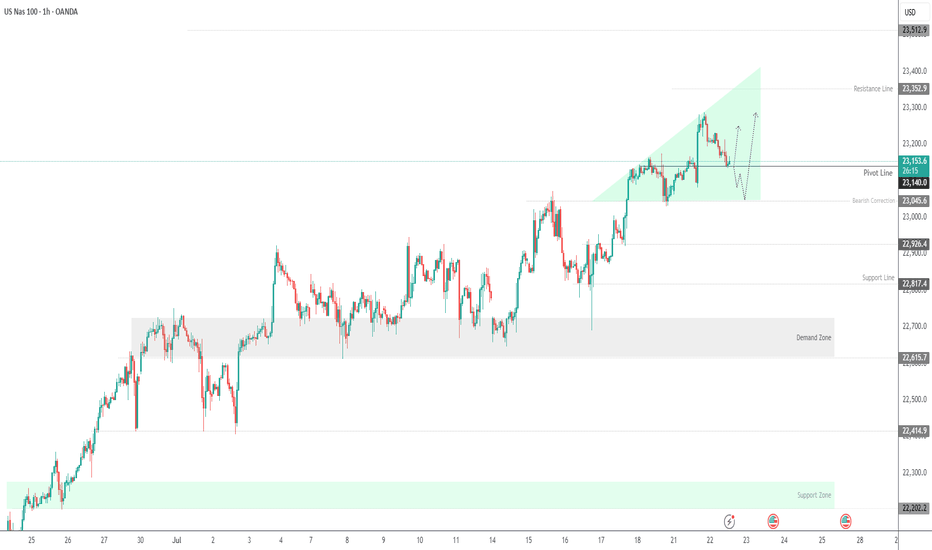

USNAS100 - Tech Index Pulls Back After Testing 23,295USNAS100 | OVERVIEW

The index came close to registering a new ATH at 23,295 before pulling back slightly.

Today, it appears to be in a bearish correction phase toward 23,200 and 23,150, as long as the price trades below 23,270.

Market sentiment may remain cautious, especially with no major earnings reports scheduled before the open, although Intel’s report after the close could have a notable impact.

A 1H close above 23,290 would invalidate the correction and open the way toward 23,350 and 23,500.

Key Levels:

Support: 23,200 · 23,150 · 23,050

Resistance: 23,350 · 23,520

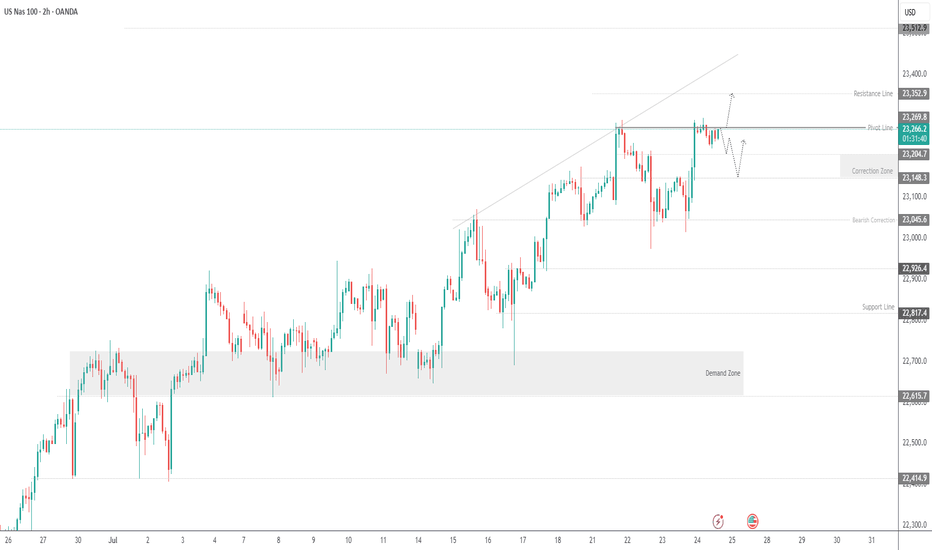

Will USTEC Continue Its Rallies Amid Better Market Sentiment?Macro approach:

- USTEC advanced modestly this week, supported by upbeat corporate earnings and resilience in economic data amid ongoing policy uncertainty.

- The index benefited from strong expected results in major tech firms such as Microsoft (MSFT) and Nvidia (NVDA), as top giant AI leadership, helping to bolster sentiment despite lingering concerns about tariffs and Fed policy direction.

- US macro data showed sticky inflation in key categories, robust retail sales, and falling jobless claims. This prompted the Fed to retain its cautious stance on rate cuts while markets reassessed policy expectations. Policy-related headlines and manufacturing sector developments also partly drove market volatility.

- USTEC could remain sensitive to incoming tech earnings, the 29-30 Jul Fed meeting, and potential US tariff announcements in early Aug. Persistent inflation and any surprises in central bank communication may drive volatility in the sessions ahead.

Technical approach:

- USTEC trended higher and created a new record high. The price is above both EMAs, indicating a strong bullish momentum.

- If USTEC stays above the support at 22900, the price may continue toward the 78.6% Fibonacci Extension at around 23867.

- On the contrary, breaking below the support at 22900 and EMA21 may prompt a deeper correction to retest the following support at 22000.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

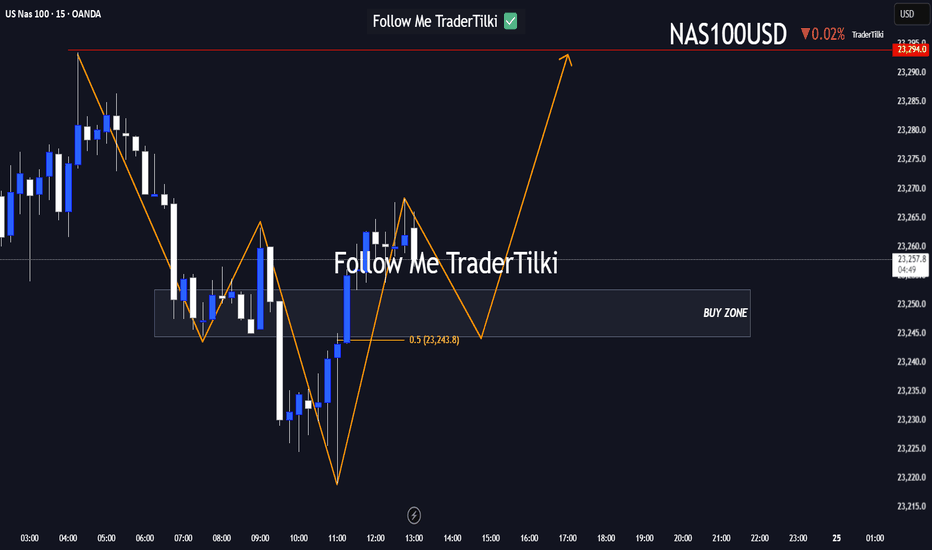

Here’s a fresh Nasdaq100 analysis I’ve put together for you.Hey Guys,

Here’s a fresh Nasdaq100 analysis I’ve put together for you.

I’ve marked the buy zone between 23,252 and 23,240. If price dips into that range, I’m anticipating a potential move upward toward 23,294.

Your likes and support are my biggest source of motivation to keep sharing these insights.

Huge thanks to everyone backing me with a thumbs-up!

Nasdaq Ascending Trend has been broken.Good night traders.

With Tuesday & today's move. NQ has broken the ascending trend, and retested the highs.

A total of 107 daily candles, 7,000pips move.

Reasons for taking this trade:

Current monthly candle has 2.9m volume, compared to a 6m & 7million from last 2 months. With only 8 days missing to end the month, how to fill all that pending volume?

Ascending trend has been broken and retested.

Expect a deep correction, around 2000-2400-2600 pips. There is correlation between 38.2 Fibo level.

Last week there was a manipulation with Powell dismiss rumor on Wednesday, next day on Thursday NQ rallied to the upside. Today being also Wednesday we saw a huge rejection to the upside, but there is no continuation.

DXY reaching bottom, + has a deeper short trend initiation, starting on January 13.

Trade will be validated if NQ creates a LL followed by a LH within the next 2 days.

What do you think of this analysis?

Thank you.

Enjoy

2025-07-23 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: Very tight channel up from 23142 but only 1 bear bar since then and in the absence of bear bars, we can only assume sideways to up movement.

current market cycle: bull trend

key levels: 23000 - 24000

bull case: Bulls want to print more higher highs. We are in this bull channel for the whole July now without breaking it and bulls now confirmed the breakout above 23100ish - 3 times. That is the 50% retracement of the last big leg up and very important. A measured move for this leg gives us 24000. Bears have tried with two decent legs to get down to 23000 and failed. I think many will give up on this after hours buying and we can have more meltup into the weekend. Anything bearish would be a big surprise.

Invalidation is below 23250ish.

bear case: Bears tried and failed again. Everything is bought. 1h close below 23250 would certainly stop the max bullishness but bears are really not doing much. We are almost printing daily new ath. Focus on longing pullbacks until the bull channel is broken.

Invalidation is above 24000.

short term: Bullish on any pullback until it stops working.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Long 23200 has been profitable since Friday.

USNAS100 Eyes 23350 Ahead of Powell & Earnings StormUSNAS100

The price maintains bullish momentum, as outlined in the previous idea, with a clean rejection from the 23280 zone. Today, volatility is expected to increase ahead of Jerome Powell’s speech and a wave of key earnings reports.

As long as price holds above 23140, the outlook remains bullish toward 23230 and 23350.

A short-term correction toward 23045 is possible if we get a 1H close below 23140.

Resistance: 23230 · 23350 · 23510

Support: 23045 · 22920