Natgas

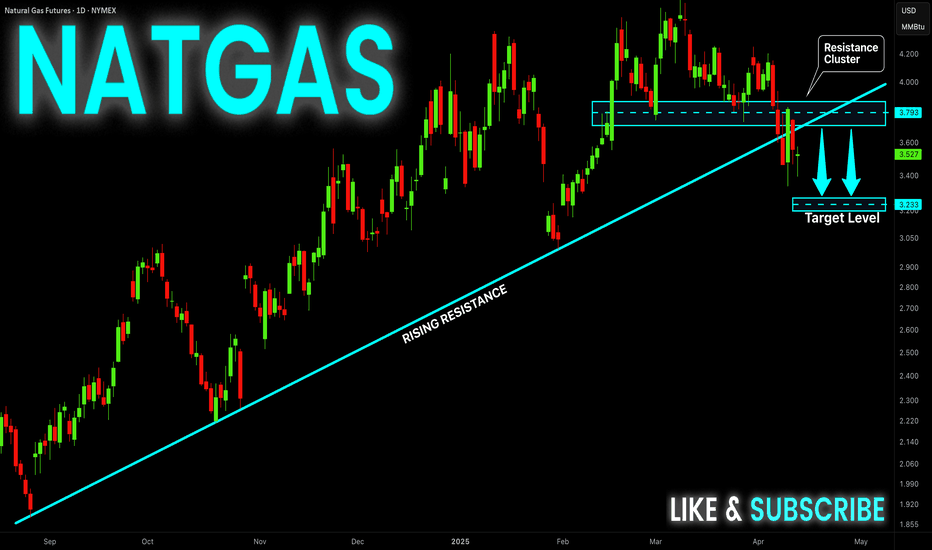

NATGAS Resistance Cluster Above! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the support

Cluster of the rising and

Horizontal support levels

Which is now a resistance

Cluster round 3.717$ then

Went down and made a local

Pullback on Thursday and

Friday but we are bearish

Biased mid-term so we

Will be expecting a further

Bearish move down this week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Natural Gas is in the Buy DirectionHello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

NATGAS: Long Trade Explained

NATGAS

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry - 3.541

Sl - 3.371

Tp - 3.841

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS Expected Growth! BUY!

My dear followers,

This is my opinion on the NATGAS next move:

The asset is approaching an important pivot point 3.541

Bias - Bullish

Safe Stop Loss - 3.373

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 3.834

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NATGAS Found Support at $3.43: Next Target Could be $3.084FenzoFx—NATGAS failed to stabilize below the $3.43 support, resulted in the prices to bounce. As of this writing, Natural Gas trades slighlty above the support.

From a technical perspective. The recent bounce in the price couldn't form a new higher high. Therefore, it is expected for the prices to fall. But, bears must close and stabilize below the $3.43 support for the downtrend to resume.

>>> Win $160.0 weekly by participating FenzoFx Forex Contest for free.

NATGAS Local Bearish Pullback Expected! Sell!

Hello,Traders!

NATGAS is about to hit

A strong horizontal resistance

Level of 3.880$ after a sharp

Push upwards by the bulls

So a local correction is needed

From the resistance with the

Expected target being the

Local level below at 3.655$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Bearish Breakout! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the key horizontal

Resistance of 3.626$ and the

Breakout is confirmed so we

Are bearish biased and we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS is Bearish amid Oversold SignalsFenzoFx—NATGAS is in a downtrend, broke below the $3.66 support. The primary trend is bearish, but a consolidation phase is expected.

In this scenario, Natural Gas may test the 50.0% Fibonacci retracement level at $3.866 before the downtrend resumes. Watch this level for bearish signals, like candlestick patterns.

>>> Trade NATGAS without swap at FenzoFx Decentralized Broker

NATGAS BEARISH BREAKOUT|SHORT|

✅NATGAS formed a head

And shoulders pattern then

Made a bearish breakout of

The neckline which is now

A resistance of 3.850$

And the breakout is confirmed

So we are bearish biased and

We will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Technical Analysis! BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.819 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.970

Recommended Stop Loss - 3.740

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS will soon retest a key support level of 3.728$

So I think that the pair will make a rebound

And go up to retest the supply level above at 3.887

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS: Bulls Will Push

The price of NATGAS will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS Free Signal! Buy!

Hello,Traders!

NATGAS went down again

But will soon hit a horizontal

Support level around 3.784$

So after the retest we can go

Long on Gas with the Take

Profit of 3.907$ and the

Stop Loss of 3.725$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Natural Gas is in the Buying DirectionHello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts