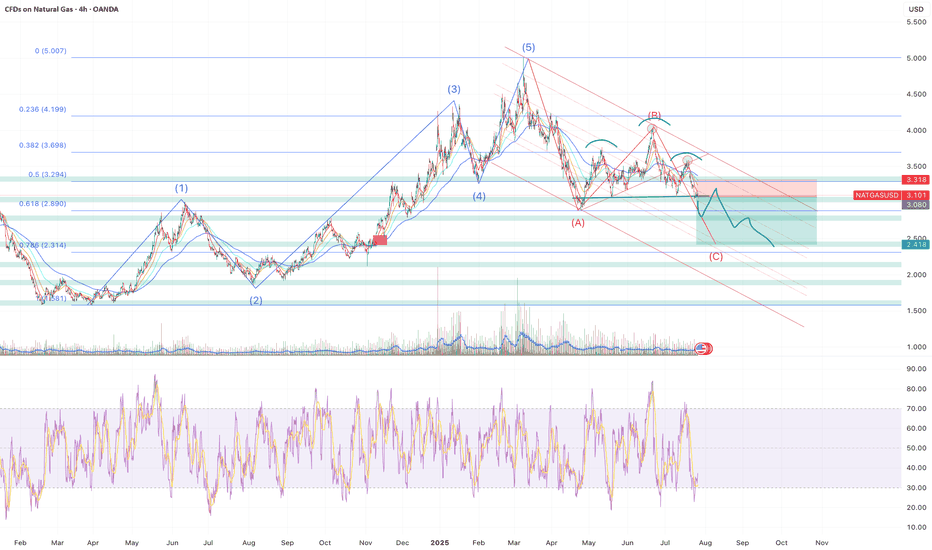

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

Natural

Crude Oil Spikes - Russia / Ukraine / USA sanction? Concerns about the possibility of tighter global oil supplies are supporting crude prices after President Trump warned of "secondary sanctions" if Russia fails to reach a ceasefire in Ukraine within 10 to 12 days.

These sanctions have absolutely burned the shorts in oil and can cause a 3 bar surge on the daily chart if crude breaks this channel.

Keep you eye on the daily 200 MA...if it holds above we should push higher on crude.

FOMC RATE DECISION TOMORROW - Tune into our live stream.

Navigating a Pullback in Natural GasNatural gas prices have been on a wild ride lately, with a recent pullback raising questions about the future of this energy source. This video provides insights into navigating this market volatility, offering actionable strategies for live trading in the midst of uncertainty.

Current weather forecasts for the U.S. show neither extreme heat nor cold—limiting heating or cooling demand. This typical spring-to-summer lull supports low prices .

Although rig counts in the U.S. are falling—the latest count shows an 8‑week decline—production remains ample. Storage levels remain healthy, and oversupply worries persist .

Natural gas rallied earlier today but faced resistance at the $4/mmBtu mark—a major psychological barrier. After hitting that ceiling, prices gave back gains, a typical sign of "rally exhaustion"

Bearish Forecast for the Dow Jones Starting May 15, 2025Bearish Forecast for the Dow Jones Starting May 15, 2025

The Dow Jones Industrial Average is poised to begin a significant decline, potentially as early as today, May 15, 2025, targeting a retest of the price low from April 7, 2025 (~36,611.78), and possibly lower. This movement is driven by renewed trade tensions, disappointing economic data, and bearish market sentiment.

1. Fundamental Factors Driving Potential Decline

Fundamental factors provide the macroeconomic and policy-driven rationale for the anticipated downturn in the Dow Jones.

1.1. Renewed Uncertainty in Trade Policy

The Dow’s rally on May 12–13, 2025, was fueled by optimism over a temporary U.S.-China tariff reduction agreement (90-day truce) announced after talks in Switzerland on May 11, 2025. However, as of May 15, 2025, investor confidence is faltering due to a lack of progress in ongoing U.S.-China trade negotiations.

Trigger for May 15: A Reuters report from May 14, 2025, notes that U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent are meeting with Chinese officials, but no new agreements have been confirmed. If today’s talks fail to deliver positive outcomes or if President Trump escalates tariff rhetoric, the Dow could plummet, as seen in early April when tariffs triggered a 5.5% single-day drop. The Dow, with its heavy weighting of multinational corporations, is particularly vulnerable to trade war fears, which could drive it toward the April 7 low as investors price in higher costs and slower global growth.

1.2. Disappointments in Economic Data

CPI Reaction: The April 2025 Consumer Price Index (CPI), released on May 14, 2025, showed inflation at 2.3% annually, below the expected 2.4%. However, the Dow’s decline (-0.6%) on May 14 suggests investors expected a lower figure to support Federal Reserve rate cuts, reflecting skepticism about inflation cooling further.

Producer Price Index (PPI) Release on May 15: The PPI for April 2025, due at 8:30 AM ET (2:30 PM CEST) on May 15, 2025, is critical. A higher-than-expected PPI, potentially driven by tariff-related cost pressures, could signal rising consumer prices, reducing hopes for Fed easing and triggering a sell-off. Consensus expects a 0.2% monthly increase; a reading above 0.3% could echo the April market reaction when GDP contraction fears pushed the Dow to 36,611.78.

Consumer Sentiment: The University of Michigan Consumer Sentiment Index for May 2025, released on May 14, likely showed continued weakness (April: 52.2, a multi-year low). A further decline could heighten concerns about reduced consumer spending, impacting Dow components like Walmart and Home Depot.

1.3. Concerns Over Federal Reserve Policy

On May 7, 2025, Fed Chair Jerome Powell cited “elevated uncertainty” due to trade policies, with markets expecting 75 basis points of rate cuts in 2025, starting in July. If today’s PPI or Initial Jobless Claims (8:30 AM ET) indicate persistent inflation or economic weakness, rate cut expectations could fade, increasing borrowing costs and pressuring Dow valuations, mirroring the April 7 recession fears.

2. Technical Analysis

The Dow’s initial decline in April was approximately -19.00%, with a second impulse of similar magnitude. Technical indicators suggest a bearish setup for May 15, 2025:

Current Level: The Dow closed at 42,051.06 on May 14, 2025, down 0.6%, testing support at 42,000.

Bearish Signals: A 12-hour timeframe analysis indicates alignment for a decline, with potential bearish candlestick patterns (e.g., bearish engulfing) and overbought RSI (70). A break below 42,000 could target the 200-day moving average (40,500) and the April 7 low of 36,611.78.

Price Targets:

Retest of April 7, 2025, low: ~36,611.78

Secondary target: ~35,970.70 (based on Fibonacci extensions and prior support zones).

3. Market Sentiment and Behavioral Factors

Fragile Optimism: The Dow’s 15% recovery from April lows was driven by trade truce hopes and select stock strength. Bloomberg’s May 14, 2025, report notes Wall Street’s rebound is “showing signs of exhaustion” due to trade risks. The Dow’s May 14 weakness, led by an 18% UnitedHealth drop, could spread if negative news emerges today.

Global Correlation: Mixed Asian market performance on May 14 (e.g., Nikkei up 1.43%, India’s Nifty 50 down 1.27%) suggests vulnerability. A lower Asian open on May 15, driven by U.S. declines or trade news, could amplify selling pressure on the Dow.

4. Evidence-Based Framework for the Forecast

4.1. Catalysts for Today’s Decline (May 15, 2025)

PPI Data (8:30 AM ET): A PPI reading above 0.3% could signal sticky inflation, reducing Fed rate cut odds and sparking a sell-off.

Trade Talk Updates: Negative U.S.-China trade comments (e.g., no Geneva deal) could reignite fears, mirroring April 7.

Initial Jobless Claims (8:30 AM ET): Claims above 220,000 (vs. prior 211,000) could signal labor market weakness, fueling recession concerns.

4.2. Dow Scenario

Expect a wave-like decline with corrections. The Dow could fall below 36,611.78, potentially reaching ~35,970.70 if trade and economic pressures intensify. Extreme caution is advised in 2025.

4.3. Global Scenario for S&P 500

I anticipate a wave-like decline with intermittent corrections. I wouldn’t be surprised if the S&P 500 falls below 4,700, potentially reaching 4,200. Extreme caution is warranted this year. There’s even a theory that, starting in 2025, the U.S. dollar could lose 50% of its purchasing power.

Idea:

New Screenshot:

4.4. Oil and Geopolitical Outlook

I expect oil (Brent) to decline to the $50+/- range, from which an upward trend may begin, potentially tied to future military conflicts:

· Europe vs. Russia

· India vs. Pakistan

· Iran vs. Israel

Brent (UKOIL):

Natural Gas:

E-cutieAll year EQT, an unloved natural gas producer has been a swing trader's paradise. I've harvested so many gains from these E-cutie trees I thought I'd make a thread just for it and post trading updates.

The macro technical picture is clear. Years of being battered by shorts ended with capitulation in 2020, followed by a swift rebound. Fundamentals are tightening. According to analysts, $25 is fair price for $2.50 NG price. Goldman Sachs has a $23ish target. Price action is showing signs of bottoming. It's lining up but this is much more profitable short term swings.

Currently, price is building a base at previous long term support around $18. More downside is certainly a possibility given that NG prices look overvalued. But, EQT is in a channel and fundamentally undervalued. Investors might front run this sector as demand picks up in later in the year, in which EQT will likely be closer to $25.

s3.tradingview.com

Long EQT

+200 @ 18.10

NATGAS REBOUND AHEAD|LONG|

✅NATGAS is approaching a demand level around 3.00$

So according to our strategy

We will be looking for the signs of the reversal in the trend

To jump onto the bearish bandwagon just on time to get the best

Risk reward ratio for us

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Will the Perfect Storm in Natural Gas Markets Lead to a New EnerIn an era of unprecedented global energy transformation, the natural gas market stands at a critical juncture where geopolitical tensions, technological advancement, and infrastructure development converge to create a potentially game-changing scenario. The ongoing Middle East crisis, particularly the Israel-Iran tensions threatening the Strait of Hormuz, could reshape energy flows and trigger a cascade of effects across interconnected global energy markets, potentially forcing a fundamental reassessment of natural gas's role in the global energy mix.

A seismic shift is approaching in North American markets with LNG Canada's anticipated 2025 launch, which promises to revolutionize Canadian gas pricing dynamics and global market access. This transformation coincides with an extraordinary surge in potential demand from AI and data centers, projected to consume between 3 and 30 billion cubic feet per day of additional North American gas. Such technological evolution, coupled with Asia's growing appetite for cleaner energy sources, suggests a structural reformation of traditional gas flow patterns and pricing mechanisms.

The convergence of these factors presents both challenges and opportunities for market participants. While weather patterns and storage dynamics continue to influence short-term price formation, longer-term strategic considerations are increasingly dominated by infrastructure development, market access, and geopolitical risk management. As the industry adapts through strategic hedging, infrastructure investment, and consolidation, the natural gas market appears poised for a period of dynamic evolution that could fundamentally alter its global value proposition and establish a new paradigm in energy markets.

UNG to $60 ...... is the idea...... UNG is the way to play Nat Gas.

Nat Gas traders fir under production costs at $6.5 to $7.5 per BTU - UNG at $6.5 per BTU will trade above $60

Nat Gas is cyclical, it moves in 4 year intervals, perfect to start the move Up now.

Please research my findings.

Cyclicality of the NAt Gas Market

Nat Gas is industry's energy

Nat Gas is the cleanest form of fossil fuel energy.

Nat Gas goes for $67 per BTU in Europe, the USA needs to be selling Nat Gas.

Many other positive things about NAT GAS and its required expansion.

We need Nat Gas and plenty of it.

NATTY down for a breather NATTY is extremely overextended and finds itself on the 0.5 Fib retracement after accumulating a substantial bearish divergence on the 4hr.

After breaking out of the cup & handle, it has yet retested those areas which it will IMHO.

NATTY often peaks in the middle of May which is often followed my strong consolidation into May, before it really gets going in June/July.

✅NATGAS SHORT FROM RESISTANCE🔥

✅NATGAS made a massive

Gap up from the support

But after the gap the price

Immediately hit a horizontal

Resistance level of 2.00$

From where we are already

Seeing a bearish reaction

And I think that we will see

A further move down next week

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

EXXON. EXOFF. EXXON. EXOFF. THE CLAPPER. The most important thing on the chart is the steep rejection trend that is also trending upwards. It is leading into another rejection trend, which should see some resistance, but with a potential move along the steep trend into the rejection and finally into a breakout, we could see the price around 118. There is potential to keep climbing from this point, and the top number I see is marked.

Earnings on the 26th is marked.

Short term indicators are showing bullish.

Price can keep pushing upwards.

When it falls, it could be fairly quick.

There are some really nice lines of support on the lower end.

Still undecided how this plays out, and I'll need more info before making a move.

Still, chart is worth watching.

NATURAL GAS accumulation idea realized since September 7We are currently hitting 50WMA and 200DMA.The price is located from the zone I set -78%(from this chart) from ATH. Of course if 1.7 is still in circulation.

All this requires the weekly candlestick to close above to receive one of the confirmations for further growth.

Of course if 1.7 is still in circulation.

Below you can see the analysis since September

NATURAL GAS Breakdown OpportunityHi!

NATGAS is pretty bearish, reading about a warm December, at least in the US, and overproduction. (reading headlines at naturalgasintel.com).

So, I'm expecting price to break down at the test of this trendline, which could be a good opportunity to SHORT on this one.

Have a great week ahead, and please comment if you have something good to add.

Best Regards,

ThomChris

NATURAL GAS BEARISH OUTLOOKThe recent surge of warm fronds impacting the United States, the largest consumer of natural gas, shows no signs of dissipating soon, exerting significant pressure on its market. This has led to a substantial decline in the price of the gas, plummeting for eight consecutive days from 2.841 to 2.375, marking a staggering drop of over 16%.

Technical indicators are not signaling an imminent reversal of this trend in the short term, as both the MACD and RSI exhibit robust Sell signals. Should the current trajectory persist, there's a possibility that the price could dip to support levels around 2.124.

A potential pivot point at 2.405 might be considered, potentially leading to a price rebound to 2.712.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.