NASDAQ 100 CFD

🔝 Berkshire Hathaway. Grandpa Warren Breaks The TopLegendary investor Warren Buffett was on a trip to Tokyo, the capital of Japan, ten months earlier in mid-April 2023, and the titans of the country's giant energy and commodity conglomerates were there to make their presentations.

As usual, over glasses of Coca-Cola NYSE:KO - one of Buffett's most famous investments, they walked into Warren Buffett's suite at the luxury Four Seasons hotel and individually told the 92-year-old American investor the same thing: Japanese trading houses are cheap and should accelerate their move beyond commodities.

The support of the Oracle of Omaha is an important vote of confidence in the big five Japanese trading houses - Mitsubishi Corporations TSE:8058 , Mitsui TSE:8031 , Sumitomo TSE:8053 , Itochu TSE:8001 and Marubeni TSE:8002 .

It's also a broad endorsement of Japan, that is considered to have outlived its heyday 30-35 years ago, as well as considered less relevant than Asian counterparts such as China and India.

But there's one big question: Is Buffett betting on phasing out fossil fuels, the trading house products themselves, or a combination of the two? Or something else, like impact of the weak yen!?

Buffett's Berkshire Hathaway NYSE:BRK.B reported in August 2020 that it had acquired about 5% of the shares of five trading houses, that sent their stocks up and raised their total investment value above $6 billion. When the Covid-19 pandemic dampened demand for goods, it pushed down the value of company stocks, four of which traded below book value.

“They were selling, I thought, at a ridiculous price,” - 3 years later Buffett said to CNBC, in March 2023.

Three years after the Covid-19 pandemic (that is now hardly remembered) Warren Buffett's bets on Japan have nearly tripled to over $17 billion.

But even this Growth does not stop Buffett. Staying in Tokyo last spring, Buffett confirmed intentions to buy more shares, and participate in more big deals.

In addition, Berkshire recently unveiled plans to issue its own yen-denominated bonds, which can help hedge against the depreciation of the yen against the US dollar as well as depreciation of Japanese stocks in dollar terms.

In nowadays Japan Stock Index TSE:TOPIX ended 2023 on a positive note, adding more than 25 percent at the end of the year, that is, the maximum growth over the last 10 calendar years.

Early in 2024 TSE:TOPIX continues its growth path, as technology companies stocks are rallying.

In 2024 TSE:TOPIX hit the 2,500 yen mark - point that not been seen for more than 30 years - since the first half of 1990, while another one Japan stock index Nikkei225 INDEX:NKY hit its 36'000 Milestone - the level that was not seen also since early 1990s.

The main technical graph says Berkshire Hathaway Class B NYSE:BRK.B stocks are on the runway to break its key resistance - 6-month and all time highs, to further upside price action delver.

US100 D1 - Short Signal🇺🇸US100 D1

Another stock index markup here, for those that had a watch of the weekly watchlist video, you would have seen the detailed analysis on this, but we are simply waiting patience for a test of this 17k price, a huge psychological price with ATH’s, D1 resistance and supply.

A truly strong area of confluence, and a rejection here would be amazing, alerts set. Sitting patiently.

✨❄️🌟 The Tutorial How-To Find a Magic on TradingViewFinancial markets just finished its memorial 2023.

Whatever the numbers at the “Closing bell”, on your monitors and in your portfolios, there is no doubt that 2023 year’s Santa Rally will go down in history as one of the most outstanding in many years.

In November and December, 2023 the U.S. stock market was rallying for the 9th consecutive week in a row.

This was the longest ever upside streak in SP:SPX over the past 20 years, since the fourth quarter of 2003.

Well.. just try to answer what happened with the market the past one time.

Happy New 2024 Year!

✨❄️🌟🎅🎊🌲💫⛄️🌠✨❄️🌟🎅🎊🌲💫⛄️🌠

7 Dimension Trade idea For Nasdaq 😇 7 Dimension Analysis

Time Frame: H4

1️⃣ Swing Structure: Bullish

🟢 Structure Behavior: Break of Structure (BoS)

🟢 Swing Move: Corrective move, indicating a Point of Interest (POI) for potential reversal. Vigilance is required for a bullish reaction at this level.

🟢 Inducement: Not done yet; waiting for a proper internal bullish BoS.

🟢 Internal Structure: Currently bearish, anticipating a shift with a bullish BoS.

🟢 Decisional Order Block: About to be mitigated.

🟢 Demand Area: Identified via FVG, indicating a discounted area.

🟢 Time Frame Confluence: Daily and H4

2️⃣ Pattern

🟢 CHART PATTERNS: No significant chart patterns observed.

🟢 CANDLE PATTERNS: Various signals: Record Session count, Shrinking long wick, Change in guard with engulfing, Doji, Momentum, Inside bar, and a blended combo suggesting a potential reversal.

3️⃣ Volume

🟢 Fixed Range: Bullish dominance in these areas.

🟢 Volume during Correction: Comparatively less during correction than in impulsive moves.

4️⃣ Momentum RSI

🟢 Zone: Extremely Bearish

🟢 Range Shift: Waiting for a potential shift from bearish to sideways. Two strong bullish divergences indicate weakness in bearish momentum.

🟢 Loud Moves: Conventional RSI theory suggests an extremely oversold market, possibly signaling a reversal.

🟢 Grandfather Father Son Entries: A robust 7-star buy signal.

5️⃣ Volatility Bollinger Bands

🟢 Price is already under the Middle band.

🟢 After a strong expansion, the market is moving into contraction, indicating a potential bullish sideways move.

🟢 Squeeze breakout awaited.

🟢 Walking on the band not yet.

6️⃣ Strength According to ROC

🟢 Values: Nasdaq shows the highest rate of bullish sentiment compared to all other indices.

7️⃣ Sentiment

Price action signals a clear long entry, but other dimensions like momentum and volatility tell a different story. Waiting for final volatility and momentum confirmation for a long position.

✔️ Entry Time Frame: H4

✅ Entry TF Structure: Bullish

☑️ Current Move: Corrective

✔ Support Resistance Base: FVG demand area

☑️ Candles Behavior: Bullish signals intact - RSC, Long wicks, Doji, Inside, Momentum.

☑️ FIB Trigger Event: Occurred

☑️ Trend Line Breakout: Breached but not confirmed.

💡 Decision: It's prudent to wait until the price provides a proper internal structure breakout. Once a bullish BoS is confirmed, consider a buy. I will update entry, take profit, and stop levels when triggered.

🚀 Entry:

✋ Stop Loss:

🎯 Take Profit: 2nd Exit if Internal Structure changes, also Exit 3rd Trendline Breakout, FOMO.

😊 Risk to Reward Ratio:

🕛 Expected Duration:

SUMMARY: The analysis suggests a potential bullish reversal but advises caution until the price demonstrates a clear internal structure breakout. Various signals indicate a reversal, and a detailed plan will be updated upon market confirmation.

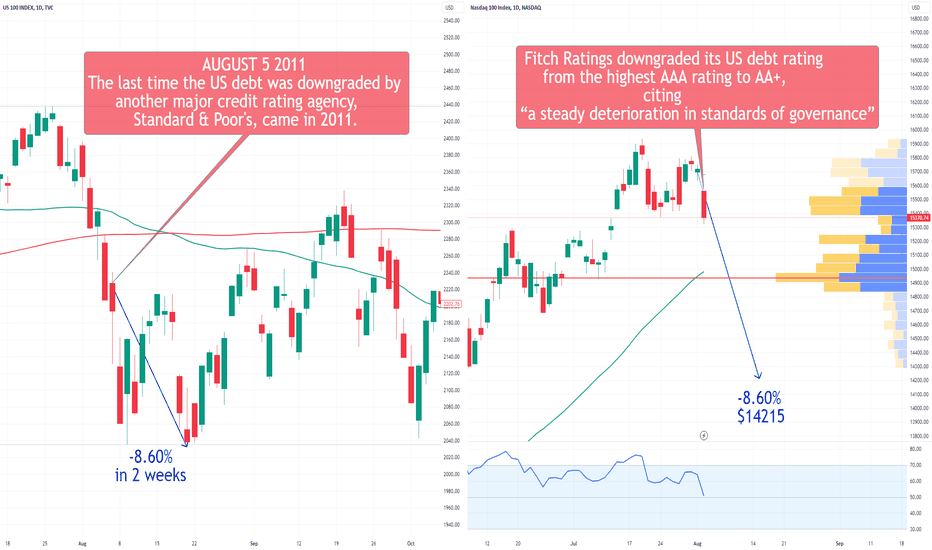

NDX Nasdaq100 Fell 8.60% After the Last U.S. Credit Downgradeitch Ratings downgraded the US debt rating on Tuesday, moving it from the highest AAA rating to AA+, citing concerns about "a steady deterioration in standards of governance."

This downgrade happened following last-minute negotiations among lawmakers to reach a debt ceiling deal earlier this year, raising the risk of the nation's first default.

In the past, a similar credit downgrade had a significant impact on the NDX, which fell 8.60% in just two weeks. Back in August 5, 2011, Standard & Poor's, one of the major credit rating firms, downgraded U.S. debt after another major debt ceiling battle.

Jim Reid, a strategist at Deutsche Bank, pointed out that while the news of Standard & Poor's being the first to downgrade 12 years ago was substantial, investors had already adjusted their perceptions of the world's most important bond market, recognizing that it was no longer a pure AAA. Nonetheless, Fitch's recent decision to downgrade is still significant.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, reaching its highest level since November 2022.

As for the price target for this year, it remains at $16650, as shown in the chart below:

Looking forward to read your opinion about it!

QQQ Nasdaq 100 ETF Price Prediction for 2024This was my price prediction for QQQ in 2023. I was bullish, but not enough:

Considerations about 2024:

In the July 2023 meeting, the FOMC chose to raise interest rates to a range of 5.25%–5.50%, marking the 11th rate hike in the current cycle aimed at mitigating heightened inflation. The prevailing consensus among market experts hints at a potential shift in strategy, suggesting that the Fed might commence rate cuts later in 2024 as inflation gradually aligns with the Fed's 2% target. Statistically, historical data indicates that approximately 11 months after the cessation of interest rate increases, a recession tends to manifest. This pattern places us around June 2024, aligning with my prediction of a dip in the QQQ to approximately $370.

Given that 2024 is an election year, there's an additional layer of complexity in predicting market behavior. Despite the anticipated mid-year dip, my inclination is that the QQQ will conclude the year on a bullish note. This optimistic outlook hints at the onset of a 3-5 year AI bubble cycle, with the QQQ boasting a year-end price target of $460.

The integration of artificial intelligence into various sectors is expected to catalyze market growth and innovation, propelling the QQQ to new heights by the close of 2024.

Light moves in Q4 for a possible santa rally Comment: 9/16

high 2yr yields with respect to the assumption that the fed starts cutting rates in the first two quarters of 24'. Earnings coming in October with strong economic data since july (pmi, manufacturing index, retail sales, etc.) along with big spending holiday seasons coming. Equities might be sideways or in a wedge til then and break out for a santa rally toward the end of the year towards 17k.

see updated chart

NDX Broke Double Bullish Pattern, 16600 SoonDear Traders,

NDX broke the falling channel (long purple trendlines) and then repeated a breakout from the falling wedge (short purple trendlines).

I believe NDX can continue its rally because MACD turned bullish, and I can see a confirmed bullish cross on the RSI. The price is above EMAs, and the volume is high enough for the continuation. I believe the target could be around 16600.

NDX is also overbought. While I expect further upside, traders without an existing position from lower target prices could wait for a corrective retracement to enter.

Kind regards,

Ely

US100 ~ Ho Ho Santa Rally or EOY Bah Humbug Bust? (4H)CAPITALCOM:US100 chart mapping/analysis.

Nasdaq 100 consolidating into key macro economic news, much like S&P 500.

Trading scenarios into EOY:

Bullish reaction to macro economic news = break above ~16167 trading range (yellow dashed) towards ascending trend-line (green) / red box confluence zone.

Bullish extension target(s) = new historical highs surpassing ~16770 November 2021 high.

Bearish reaction to macro economic news = break below ~15690 trading range (yellow dashed) + descending trend-line (light blue) towards 78.6% Fib / 200SMA dynamic support confluence zone.

Bearish extension target(s) = descending trend-line (white dotted) / ascending trend-line (green) / Golden Pocket confluence zone.

Nasdaq 100 Rally to All time HIghs - QQQNASDAQ:QQQ NASDAQ:NDX

Here's what I see shaping up in the Nasdaq 100

💡 Remember we do have two big news events this week . The inflation CPI # Tuesday and the FOMC rate decision on Wednesday.

These two events 📰will be huge market drivers. One or both could disappoint and cause a decent pullback.

Putting that aside for now I do see positioning and a technical target 🎯in the 430 range for QQQ.

Buckle up - it's going to be an interesting week

NDX100: Thoughts and Analysis Today's focus: NDX100 (NASDAQ)

Pattern – Continuation.

Support – 15,765

Resistance – 16,115, 16,085

Hi, and thanks for checking out today's update. Today, we are looking at NDX100 on the daily chart.

Today's video asks if NDX100 will continue to move higher after starting to break out of a range consolidation pattern. When these patterns are seen in uptrends, we tend to look at them as continuation patterns with a new breakout higher confirming the pattern.

We have run over what we are watching and things we want to see to confirm a new leg higher or things that could set some alarm bells for a potential fail or continued consolidation.

After Friday's higher-than-expected jobs data, the NDX100 started to confirm a breakout. Price is close but hasn't yet broken out, and resistance remains in play.

Will buyers shake off a weaker start to the week and push the price into a new up leg?

Good trading.

Nasdaq 100 ETF (QQQ) ~ December 4H SwingNASDAQ:QQQ chart analysis/mapping.

QQQ ETF in consolidation phase after strong November rally.

Trading scenarios:

Further consolidation = descending trend-line (light blue) / multiple EMA confluence zone.

Continuation rally #1 = top range of Fib / ascending trend-line (green) confluence zone.

Shallow pullback #1 = 78.6% Fib / 200MA confluence zone.

Shallow pullback #2 = descending trend-line (white dotted)\

Deeper pullback #1 = gap fill / ascending trend-line (green) / Golden Pocket confluence zone.

Capitulation #1 = 50% Fib

Capitulation #2 = 38.2% Fib / gap fill / ascending trend-line (light blue) confluence zone.

Capitulation #3 = 23.6% Fib

Strong Cup & Handle pattern on the weekly $IXIC chartToday witnessed a robust bullish surge in the Nasdaq with a cup and handle pattern (Very similar on the S&P500 too).

Introduced in 1988 by analyst William O’Neill, the cup and handle pattern signifies a bullish continuation pattern activated by consolidation following a robust upward trend. While the pattern requires time to evolve, its recognition and subsequent trading become relatively straightforward once it materializes. As with all chart patterns, trading volume and supplementary indicators should be employed to validate a breakout and the sustained bullish trajectory.

To validate the pattern, adherence to several rules is imperative:

- The cup with handle pattern must follow a significant bullish movement (Checked: +130% in 87 weeks).

- The lowest trough of the cup must be below 50% of the preceding bullish movement (Checked: -37%).

- The lowest trough of the handle must be below 50% of the cup’s height (checked: -13%).

Key statistics on cup with handle patterns, courtesy of CentralCharts, include:

In 79% of cases, the exit from a cup with handle pattern is bullish.

In 73% of cases, the cup with handle pattern’s price objective is reached (half the cup’s height), after breaking the neck line.

In 74% of cases, after exit, the price makes a pullback in support on the neck line.

In summary, the cup and handle pattern signifies a bullish continuation pattern, initiated by consolidation after a robust upward trend. While its development requires time, once formed, recognition and trading are relatively straightforward. Employing trading volume and additional indicators is crucial for confirming a breakout and sustaining the original bullish price movement.

PS: I think that a perfect cup and handle pattern would be form on the breakout of the 14300 neckline

Nasdaq100 Ahead Of Fed- The Nasdaq 100 index declined 2.60% last week, yet closed above the 14,000 major weekly support.

- Ahead of the Fed, quarterly bond sales plan and Apple's earnings; the mentioned support (represented in both: the 50-EMA and the downward channel's lower boundary) would play an important role in deciding the market's path on the short/medium-term.

- The technical indicators suggesting an upward rebound targeting: 14,520- 14,700 resistance levels.

USTECH Trade Plan Timeframe: 4HUSTECH Trade Plan Timeframe: 4H

#NDX100 #NASDAQ #USTECH #TradingwithBelieve #TradingOpportunity #Divergence #TradingSignal #USTECHtradingsignal #Forex

Hey traders! 👋 Let's dive into a potential trading opportunity on the USTECH pair using technical analysis. 📊

📉 Previously Bullish Trend:

Firstly, on the 4H- timeframe, we've been witnessing a Bullish trend in the USTECH pair. 🐻

🔄 Divergence on HH’s:

However, it's crucial to note that recently, we have started to observe a divergence pattern on the HH’s. This is an important signal that the Bullish momentum might be weakening. 📉🔄:

📊 Trade Opportunity:

Currently, we are looking at a potential trade opportunity with a Bearish bias.

📈 Entry Price: 15212

🎯 Stop Loss Level: 15407

🚀TP1: 15013

🚀TP2: 14824

💰 Investment Advice:

Please remember that trading carries risks, and it's essential to have a well-defined trading plan, proper risk management, and stop-loss orders in place. This analysis is for educational and informational purposes only and should not be considered as financial advice. Make sure to do your research and consider your risk tolerance before entering any trade.

Happy trading, and may the pips be in your favour! 🚀📈💰 #HappyTrading #ProfitOpportunity #TradeSmart #CryptoSignal #StockSignal #TradingwithBelieve